Statistik Asas

| Nilai Portfolio | $ 135,573,486 |

| Kedudukan Semasa | 117 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

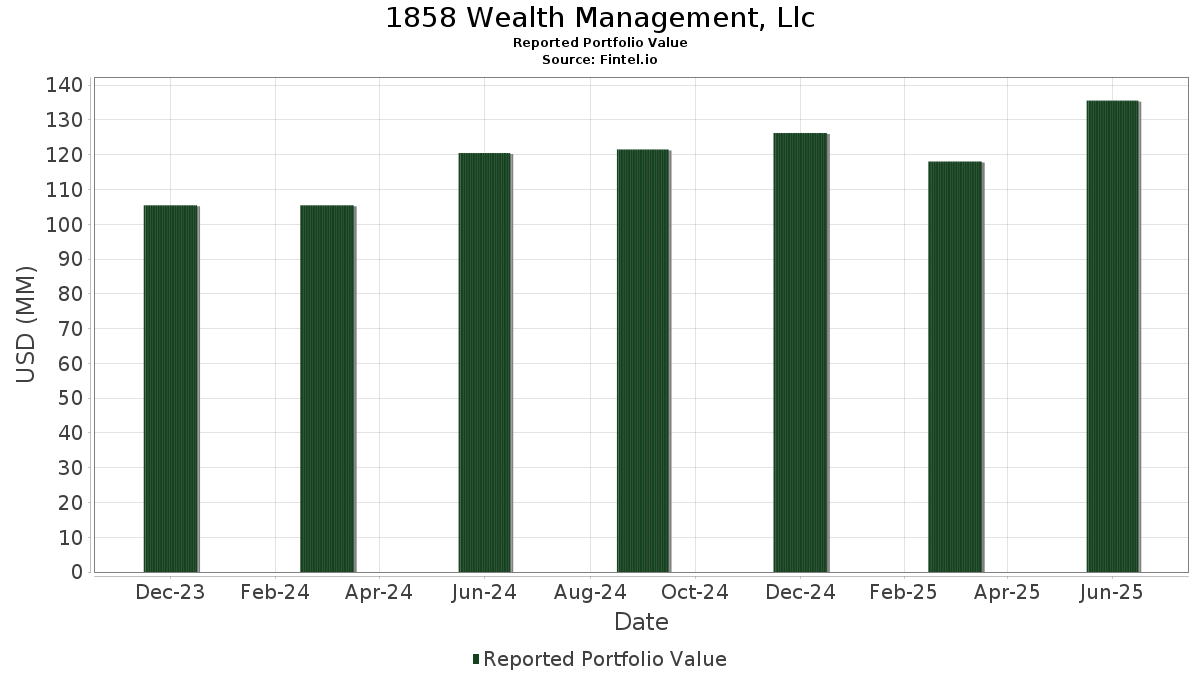

1858 Wealth Management, Llc telah mendedahkan 117 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 135,573,486 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas 1858 Wealth Management, Llc ialah Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , iShares Trust - iShares Short Treasury Bond ETF (US:SHV) , and Meta Platforms, Inc. (US:META) . Kedudukan baharu 1858 Wealth Management, Llc termasuk iShares Trust - iShares Short Treasury Bond ETF (US:SHV) , WisdomTree Trust - WisdomTree Floating Rate Treasury Fund (US:USFR) , Palantir Technologies Inc. (US:PLTR) , Carlyle Secured Lending, Inc. (US:CGBD) , and The Walt Disney Company (US:DIS) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 5.81 | 4.2872 | 4.2872 | |

| 0.06 | 3.06 | 2.2587 | 2.2587 | |

| 0.01 | 5.05 | 3.7227 | 1.3514 | |

| 0.01 | 1.33 | 0.9830 | 0.9830 | |

| 0.04 | 6.16 | 4.5447 | 0.9811 | |

| 0.01 | 1.32 | 0.9761 | 0.9761 | |

| 0.03 | 3.43 | 2.5319 | 0.9341 | |

| 0.02 | 8.27 | 6.1011 | 0.8985 | |

| 0.12 | 1.65 | 1.2150 | 0.8465 | |

| 0.01 | 5.48 | 4.0407 | 0.7042 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 6.08 | 4.4822 | -1.1760 | |

| 0.00 | 0.34 | 0.2492 | -0.7204 | |

| 0.01 | 2.92 | 2.1509 | -0.6407 | |

| 0.01 | 2.23 | 1.6429 | -0.4080 | |

| 0.02 | 5.04 | 3.7204 | -0.3920 | |

| 0.00 | 1.10 | 0.8088 | -0.3567 | |

| 0.02 | 4.00 | 2.9480 | -0.2960 | |

| 0.01 | 1.74 | 1.2855 | -0.2547 | |

| 0.01 | 0.54 | 0.3994 | -0.2462 | |

| 0.06 | 2.28 | 1.6804 | -0.1991 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-25 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.02 | 1.64 | 8.27 | 34.68 | 6.1011 | 0.8985 | |||

| NVDA / NVIDIA Corporation | 0.04 | 0.47 | 6.16 | 46.48 | 4.5447 | 0.9811 | |||

| AAPL / Apple Inc. | 0.03 | -1.51 | 6.08 | -9.03 | 4.4822 | -1.1760 | |||

| SHV / iShares Trust - iShares Short Treasury Bond ETF | 0.05 | 5.81 | 4.2872 | 4.2872 | |||||

| META / Meta Platforms, Inc. | 0.01 | 8.60 | 5.48 | 39.11 | 4.0407 | 0.7042 | |||

| GEV / GE Vernova Inc. | 0.01 | 4.01 | 5.05 | 80.31 | 3.7227 | 1.3514 | |||

| CME / CME Group Inc. | 0.02 | 0.00 | 5.04 | 3.89 | 3.7204 | -0.3920 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 5.98 | 4.20 | 22.19 | 3.0957 | 0.1866 | |||

| AME / AMETEK, Inc. | 0.02 | -0.72 | 4.00 | 4.36 | 2.9480 | -0.2960 | |||

| VRT / Vertiv Holdings Co | 0.03 | 2.32 | 3.43 | 81.97 | 2.5319 | 0.9341 | |||

| PANW / Palo Alto Networks, Inc. | 0.02 | -0.01 | 3.32 | 19.91 | 2.4479 | 0.1036 | |||

| USFR / WisdomTree Trust - WisdomTree Floating Rate Treasury Fund | 0.06 | 3.06 | 2.2587 | 2.2587 | |||||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -2.99 | 2.92 | -11.50 | 2.1509 | -0.6407 | |||

| UBER / Uber Technologies, Inc. | 0.03 | -6.38 | 2.92 | 19.91 | 2.1504 | 0.0904 | |||

| CSCO / Cisco Systems, Inc. | 0.03 | 3.02 | 2.42 | 15.80 | 1.7848 | 0.0151 | |||

| GE / General Electric Company | 0.01 | -3.26 | 2.35 | 24.43 | 1.7320 | 0.1332 | |||

| ANET / Arista Networks Inc | 0.02 | -1.12 | 2.28 | 30.59 | 1.6848 | 0.2030 | |||

| GCOW / Pacer Funds Trust - Pacer Global Cash Cows Dividend ETF | 0.06 | 0.00 | 2.28 | 2.71 | 1.6804 | -0.1991 | |||

| NOW / ServiceNow, Inc. | 0.00 | 3.65 | 2.25 | 33.83 | 1.6577 | 0.2354 | |||

| GOOGL / Alphabet Inc. | 0.01 | -18.98 | 2.23 | -8.01 | 1.6429 | -0.4080 | |||

| NFLX / Netflix, Inc. | 0.00 | -5.14 | 2.23 | 36.25 | 1.6416 | 0.2577 | |||

| GRID / First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund | 0.01 | 15.22 | 2.02 | 41.57 | 1.4924 | 0.2819 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 2.79 | 1.96 | 12.75 | 1.4486 | -0.0265 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | -5.04 | 1.74 | -4.18 | 1.2855 | -0.2547 | |||

| NU / Nu Holdings Ltd. | 0.12 | 182.57 | 1.65 | 278.62 | 1.2150 | 0.8465 | |||

| CAT / Caterpillar Inc. | 0.00 | -0.27 | 1.45 | 17.38 | 1.0712 | 0.0233 | |||

| AVGO / Broadcom Inc. | 0.00 | -7.18 | 1.35 | 52.82 | 0.9993 | 0.2484 | |||

| PLTR / Palantir Technologies Inc. | 0.01 | 1.33 | 0.9830 | 0.9830 | |||||

| BA / The Boeing Company | 0.01 | 1.32 | 0.9761 | 0.9761 | |||||

| V / Visa Inc. | 0.00 | 7.70 | 1.28 | 9.11 | 0.9452 | -0.0497 | |||

| RTX / RTX Corporation | 0.01 | -0.50 | 1.17 | 9.74 | 0.8648 | -0.0406 | |||

| LDOS / Leidos Holdings, Inc. | 0.01 | 3.64 | 1.15 | 21.24 | 0.8507 | 0.0444 | |||

| CARR / Carrier Global Corporation | 0.02 | 0.07 | 1.12 | 15.53 | 0.8234 | 0.0049 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -13.21 | 1.10 | -20.29 | 0.8088 | -0.3567 | |||

| LLY / Eli Lilly and Company | 0.00 | 9.31 | 1.09 | 3.22 | 0.8033 | -0.0908 | |||

| FXO / First Trust Exchange-Traded AlphaDEX Fund - First Trust Financials AlphaDEX Fund | 0.02 | 5.21 | 1.08 | 11.33 | 0.7974 | -0.0255 | |||

| ADBE / Adobe Inc. | 0.00 | 21.74 | 1.07 | 22.74 | 0.7927 | 0.0514 | |||

| COWZ / Pacer Funds Trust - Pacer US Cash Cows 100 ETF | 0.02 | -1.60 | 1.02 | -0.97 | 0.7519 | -0.1202 | |||

| IVRA / Invesco Actively Managed Exchange-Traded Fund Trust - Invesco Real Assets ESG ETF | 0.06 | 1.79 | 0.97 | 2.00 | 0.7168 | -0.0901 | |||

| GD / General Dynamics Corporation | 0.00 | 0.99 | 0.95 | 8.09 | 0.7005 | -0.0439 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -4.14 | 0.95 | 13.29 | 0.6982 | -0.0095 | |||

| KIE / SPDR Series Trust - SPDR S&P Insurance ETF | 0.02 | 0.72 | 0.92 | -0.54 | 0.6819 | -0.1059 | |||

| ABT / Abbott Laboratories | 0.01 | 0.00 | 0.87 | 2.58 | 0.6448 | -0.0774 | |||

| GOOGL / Alphabet Inc. | 0.00 | 31.92 | 0.65 | 50.34 | 0.4829 | 0.1140 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.65 | 31.44 | 0.4784 | 0.0601 | |||

| BSX / Boston Scientific Corporation | 0.01 | -4.31 | 0.63 | 1.77 | 0.4660 | -0.0593 | |||

| ABBV / AbbVie Inc. | 0.00 | -8.28 | 0.63 | -18.79 | 0.4658 | -0.1925 | |||

| SNPS / Synopsys, Inc. | 0.00 | 12.20 | 0.58 | 34.25 | 0.4311 | 0.0620 | |||

| SNOW / Snowflake Inc. | 0.00 | 16.32 | 0.58 | 77.91 | 0.4283 | 0.1521 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.06 | 0.57 | 0.17 | 0.4235 | -0.0623 | |||

| CGBD / Carlyle Secured Lending, Inc. | 0.04 | 0.57 | 0.4172 | 0.4172 | |||||

| DELL / Dell Technologies Inc. | 0.00 | 53.90 | 0.56 | 107.01 | 0.4139 | 0.1843 | |||

| TMUS / T-Mobile US, Inc. | 0.00 | 6.50 | 0.56 | -4.94 | 0.4119 | -0.0853 | |||

| DIS / The Walt Disney Company | 0.00 | 0.54 | 0.4001 | 0.4001 | |||||

| AXP / American Express Company | 0.00 | 1.55 | 0.54 | 20.22 | 0.3997 | 0.0185 | |||

| MRK / Merck & Co., Inc. | 0.01 | -19.44 | 0.54 | -29.00 | 0.3994 | -0.2462 | |||

| AMT / American Tower Corporation | 0.00 | 4.47 | 0.53 | 5.99 | 0.3924 | -0.0323 | |||

| CDNS / Cadence Design Systems, Inc. | 0.00 | 0.00 | 0.53 | 21.05 | 0.3907 | 0.0204 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | 4.79 | 0.52 | 44.69 | 0.3828 | 0.0790 | |||

| KO / The Coca-Cola Company | 0.01 | 0.00 | 0.51 | -1.17 | 0.3748 | -0.0609 | |||

| LRCX / Lam Research Corporation | 0.01 | 52.39 | 0.50 | 104.08 | 0.3688 | 0.1612 | |||

| DASH / DoorDash, Inc. | 0.00 | 30.72 | 0.50 | 76.60 | 0.3675 | 0.1281 | |||

| FITB / Fifth Third Bancorp | 0.01 | 0.00 | 0.46 | 5.01 | 0.3402 | -0.0322 | |||

| NEE / NextEra Energy, Inc. | 0.01 | 16.02 | 0.44 | 13.73 | 0.3241 | -0.0035 | |||

| PG / The Procter & Gamble Company | 0.00 | -2.63 | 0.41 | -8.85 | 0.3040 | -0.0796 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.00 | -1.52 | 0.39 | -1.26 | 0.2897 | -0.0473 | |||

| BK / The Bank of New York Mellon Corporation | 0.00 | -5.04 | 0.37 | 3.11 | 0.2697 | -0.0305 | |||

| GWW / W.W. Grainger, Inc. | 0.00 | 0.00 | 0.34 | 5.54 | 0.2532 | -0.0229 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | -18.05 | 0.34 | -15.00 | 0.2513 | -0.0883 | |||

| MGNI / Magnite, Inc. | 0.01 | 11.62 | 0.34 | 137.06 | 0.2503 | 0.1285 | |||

| EOG / EOG Resources, Inc. | 0.00 | -68.35 | 0.34 | -70.54 | 0.2492 | -0.7204 | |||

| TPR / Tapestry, Inc. | 0.00 | 2.54 | 0.34 | 27.76 | 0.2484 | 0.0253 | |||

| ORCL / Oracle Corporation | 0.00 | -21.81 | 0.33 | 21.98 | 0.2462 | 0.0150 | |||

| TXN / Texas Instruments Incorporated | 0.00 | 0.00 | 0.33 | 15.49 | 0.2426 | 0.0015 | |||

| ZTS / Zoetis Inc. | 0.00 | -6.04 | 0.33 | -11.14 | 0.2417 | -0.0702 | |||

| TOST / Toast, Inc. | 0.01 | 0.00 | 0.33 | 33.61 | 0.2411 | 0.0337 | |||

| QTUM / ETF Series Solutions - Defiance Quantum ETF | 0.00 | 0.00 | 0.32 | 23.46 | 0.2370 | 0.0161 | |||

| DIVO / Amplify ETF Trust - Amplify CWP Enhanced Dividend Income ETF | 0.01 | 0.00 | 0.31 | 4.42 | 0.2266 | -0.0227 | |||

| BAC / Bank of America Corporation | 0.01 | 4.71 | 0.30 | 18.75 | 0.2243 | 0.0074 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | 0.00 | 0.30 | 44.98 | 0.2235 | 0.0458 | |||

| PHM / PulteGroup, Inc. | 0.00 | -2.81 | 0.30 | -0.33 | 0.2207 | -0.0335 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.00 | 0.75 | 0.29 | 1.74 | 0.2155 | -0.0283 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | -3.44 | 0.29 | -26.85 | 0.2117 | -0.1200 | |||

| PKW / Invesco Exchange-Traded Fund Trust - Invesco BuyBack Achievers ETF | 0.00 | 0.00 | 0.28 | 9.69 | 0.2092 | -0.0098 | |||

| JCI / Johnson Controls International plc | 0.00 | -5.83 | 0.28 | 24.67 | 0.2088 | 0.0157 | |||

| GIS / General Mills, Inc. | 0.01 | 0.00 | 0.28 | -13.23 | 0.2083 | -0.0678 | |||

| HWM / Howmet Aerospace Inc. | 0.00 | -27.78 | 0.28 | 3.68 | 0.2081 | -0.0225 | |||

| SGOV / iShares Trust - iShares 0-3 Month Treasury Bond ETF | 0.00 | -17.95 | 0.28 | -18.05 | 0.2047 | -0.0818 | |||

| PAVE / Global X Funds - Global X U.S. Infrastructure Development ETF | 0.01 | 0.00 | 0.27 | 15.68 | 0.2015 | 0.0012 | |||

| XOM / Exxon Mobil Corporation | 0.00 | -19.20 | 0.27 | -26.70 | 0.1985 | -0.1127 | |||

| MCD / McDonald's Corporation | 0.00 | -1.81 | 0.27 | -8.22 | 0.1983 | -0.0497 | |||

| SPGI / S&P Global Inc. | 0.00 | 24.75 | 0.27 | 29.27 | 0.1960 | 0.0221 | |||

| VRSK / Verisk Analytics, Inc. | 0.00 | -8.97 | 0.27 | -4.68 | 0.1958 | -0.0402 | |||

| KR / The Kroger Co. | 0.00 | -2.26 | 0.26 | 3.59 | 0.1923 | -0.0209 | |||

| AFL / Aflac Incorporated | 0.00 | 0.00 | 0.26 | -5.11 | 0.1922 | -0.0405 | |||

| FTNT / Fortinet, Inc. | 0.00 | 0.26 | 0.1895 | 0.1895 | |||||

| FE / FirstEnergy Corp. | 0.01 | 17.95 | 0.26 | 17.51 | 0.1885 | 0.0042 | |||

| BLK / BlackRock, Inc. | 0.00 | 0.00 | 0.25 | 10.48 | 0.1873 | -0.0067 | |||

| EMR / Emerson Electric Co. | 0.00 | 0.00 | 0.25 | 21.63 | 0.1871 | 0.0104 | |||

| WCN / Waste Connections, Inc. | 0.00 | 0.00 | 0.25 | -4.18 | 0.1861 | -0.0373 | |||

| LIN / Linde plc | 0.00 | -6.62 | 0.25 | -5.99 | 0.1855 | -0.0409 | |||

| TJX / The TJX Companies, Inc. | 0.00 | -2.84 | 0.25 | -1.19 | 0.1838 | -0.0305 | |||

| SYY / Sysco Corporation | 0.00 | -3.45 | 0.25 | -2.78 | 0.1813 | -0.0324 | |||

| SYK / Stryker Corporation | 0.00 | 7.24 | 0.23 | 14.00 | 0.1687 | -0.0013 | |||

| WDAY / Workday, Inc. | 0.00 | 0.00 | 0.23 | 2.70 | 0.1685 | -0.0198 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | 3.17 | 0.23 | -6.61 | 0.1673 | -0.0381 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 0.22 | 0.1657 | 0.1657 | |||||

| ALV / Autoliv, Inc. | 0.00 | 0.22 | 0.1643 | 0.1643 | |||||

| CP / Canadian Pacific Kansas City Limited | 0.00 | 0.22 | 0.1631 | 0.1631 | |||||

| WFRD / Weatherford International plc | 0.00 | 0.22 | 0.1600 | 0.1600 | |||||

| FI / Fiserv, Inc. | 0.00 | -2.68 | 0.21 | -23.93 | 0.1572 | -0.0804 | |||

| SPHB / Invesco Exchange-Traded Fund Trust II - Invesco S&P 500 High Beta ETF | 0.00 | 0.21 | 0.1568 | 0.1568 | |||||

| CLH / Clean Harbors, Inc. | 0.00 | 0.21 | 0.1555 | 0.1555 | |||||

| SCI / Service Corporation International | 0.00 | 0.00 | 0.21 | 1.48 | 0.1524 | -0.0200 | |||

| JNJ / Johnson & Johnson | 0.00 | -8.92 | 0.21 | -16.33 | 0.1518 | -0.0560 | |||

| FANG / Diamondback Energy, Inc. | 0.00 | 3.19 | 0.20 | -11.30 | 0.1508 | -0.0445 | |||

| BX / Blackstone Inc. | 0.00 | 0.20 | 0.1506 | 0.1506 | |||||

| 2U3 / Alcon Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IBTF / iShares Trust - iShares iBonds Dec 2025 Term Treasury ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| URTY / ProShares Trust - ProShares UltraPro Russell2000 | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GS / The Goldman Sachs Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NOC / Northrop Grumman Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KRE / SPDR Series Trust - SPDR S&P Regional Banking ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CRM / Salesforce, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SMMV / iShares Trust - iShares MSCI USA Small-Cap Min Vol Factor ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GPC / Genuine Parts Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IBTJ / iShares Trust - iShares iBonds Dec 2029 Term Treasury ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CVX / Chevron Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IBTH / iShares Trust - iShares iBonds Dec 2027 Term Treasury ETF | 0.00 | -100.00 | 0.00 | 0.0000 |