Statistik Asas

| Nilai Portfolio | $ 110,463,312 |

| Kedudukan Semasa | 67 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

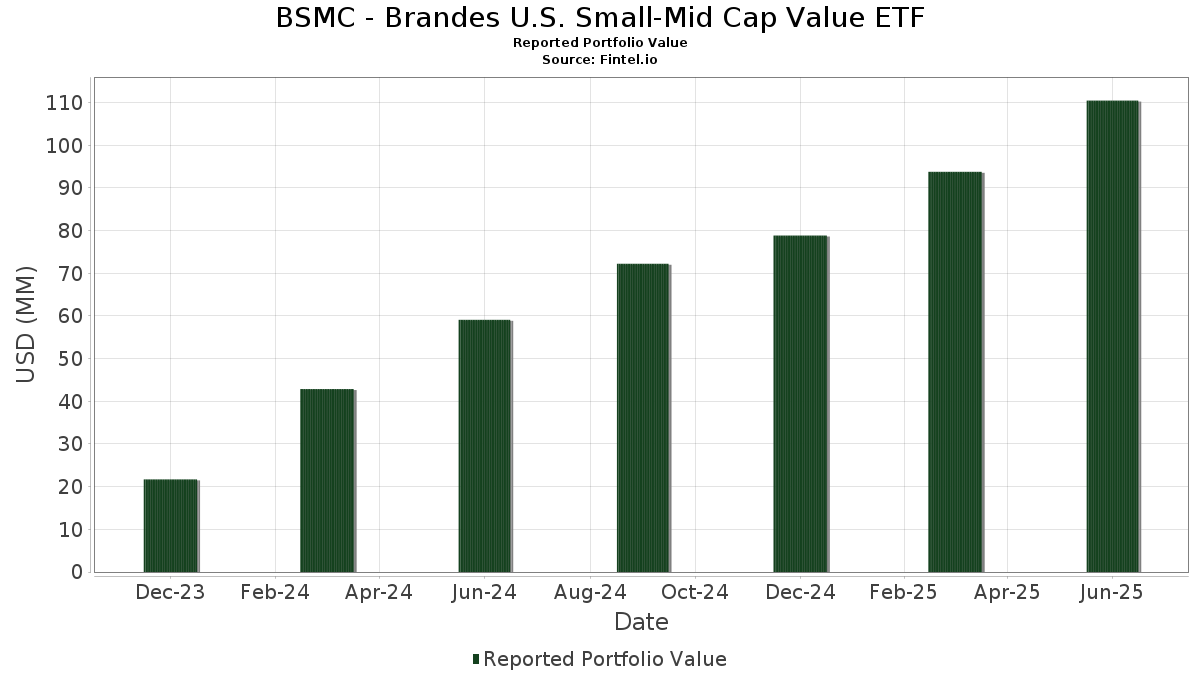

BSMC - Brandes U.S. Small-Mid Cap Value ETF telah mendedahkan 67 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 110,463,312 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas BSMC - Brandes U.S. Small-Mid Cap Value ETF ialah JPMorgan US Treasury Plus Money Market Fund (US:US4812C22399) , Premier, Inc. (US:PINC) , Amdocs Limited (DE:AOS) , NETGEAR, Inc. (US:NTGR) , and IPG Photonics Corporation (US:IPGP) . Kedudukan baharu BSMC - Brandes U.S. Small-Mid Cap Value ETF termasuk Halliburton Company (US:HAL) , EPAM Systems, Inc. (US:EPAM) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.07 | 1.44 | 1.3032 | 1.3032 | |

| 0.01 | 1.16 | 1.0477 | 1.0477 | |

| 0.05 | 3.15 | 2.8500 | 0.9691 | |

| 0.16 | 2.31 | 2.0877 | 0.8720 | |

| 0.14 | 2.29 | 2.0745 | 0.7905 | |

| 0.08 | 1.74 | 1.5716 | 0.7775 | |

| 0.04 | 2.49 | 2.2566 | 0.7465 | |

| 0.03 | 1.91 | 1.7295 | 0.7144 | |

| 0.02 | 1.72 | 1.5607 | 0.5657 | |

| 0.03 | 2.30 | 2.0854 | 0.5070 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 1.08 | 0.9781 | -0.8752 | |

| 0.01 | 1.64 | 1.4864 | -0.7757 | |

| 4.11 | 4.11 | 3.7175 | -0.7056 | |

| 0.04 | 1.90 | 1.7199 | -0.6090 | |

| 0.16 | 2.46 | 2.2292 | -0.5582 | |

| 0.02 | 0.79 | 0.7155 | -0.5465 | |

| 0.08 | 0.77 | 0.6976 | -0.4111 | |

| 0.08 | 1.87 | 1.6924 | -0.3226 | |

| 0.05 | 2.96 | 2.6755 | -0.3084 | |

| 0.12 | 3.37 | 3.0470 | -0.2780 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-26 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US4812C22399 / JPMorgan US Treasury Plus Money Market Fund | 4.11 | -0.97 | 4.11 | -0.99 | 3.7175 | -0.7056 | |||

| PINC / Premier, Inc. | 0.17 | 9.75 | 3.63 | 24.87 | 3.2845 | 0.1845 | |||

| AOS / Amdocs Limited | 0.04 | 9.00 | 3.49 | 8.71 | 3.1607 | -0.2655 | |||

| NTGR / NETGEAR, Inc. | 0.12 | -9.15 | 3.37 | 7.99 | 3.0470 | -0.2780 | |||

| IPGP / IPG Photonics Corporation | 0.05 | 64.21 | 3.15 | 78.51 | 2.8500 | 0.9691 | |||

| ERJ / Embraer S.A. - Depositary Receipt (Common Stock) | 0.05 | -14.23 | 2.96 | 5.64 | 2.6755 | -0.3084 | |||

| NPK / National Presto Industries, Inc. | 0.03 | 8.29 | 2.65 | 20.65 | 2.3955 | 0.0565 | |||

| EPC / Edgewell Personal Care Company | 0.11 | 43.74 | 2.53 | 7.85 | 2.2884 | -0.2125 | |||

| IMKTA / Ingles Markets, Incorporated | 0.04 | 80.94 | 2.49 | 76.13 | 2.2566 | 0.7465 | |||

| INVX / Innovex International, Inc. | 0.16 | 8.35 | 2.46 | -5.78 | 2.2292 | -0.5582 | |||

| ELAN / Elanco Animal Health Incorporated | 0.16 | 48.78 | 2.31 | 102.37 | 2.0877 | 0.8720 | |||

| TXT / Textron Inc. | 0.03 | 40.08 | 2.30 | 55.68 | 2.0854 | 0.5070 | |||

| UNF / UniFirst Corporation | 0.01 | 10.28 | 2.30 | 19.29 | 2.0810 | 0.0256 | |||

| XRAY / DENTSPLY SIRONA Inc. | 0.14 | 79.10 | 2.29 | 90.37 | 2.0745 | 0.7905 | |||

| CFG / Citizens Financial Group, Inc. | 0.05 | 9.06 | 2.24 | 19.15 | 2.0272 | 0.0221 | |||

| HCSG / Healthcare Services Group, Inc. | 0.14 | -16.37 | 2.16 | 24.74 | 1.9570 | 0.1078 | |||

| GRFS / Grifols, S.A. - Depositary Receipt (Common Stock) | 0.22 | 9.82 | 2.01 | 39.69 | 1.8215 | 0.2844 | |||

| MD / Pediatrix Medical Group, Inc. | 0.14 | 7.49 | 2.01 | 6.46 | 1.8206 | -0.1946 | |||

| SEIC / SEI Investments Company | 0.02 | 9.65 | 1.99 | 26.88 | 1.7986 | 0.1289 | |||

| HOLX / Hologic, Inc. | 0.03 | 90.31 | 1.91 | 100.74 | 1.7295 | 0.7144 | |||

| OMF / OneMain Holdings, Inc. | 0.03 | 10.06 | 1.90 | 28.32 | 1.7223 | 0.1412 | |||

| TAP / Molson Coors Beverage Company | 0.04 | 10.14 | 1.90 | -13.00 | 1.7199 | -0.6090 | |||

| IPG / The Interpublic Group of Companies, Inc. | 0.08 | 9.80 | 1.87 | -1.06 | 1.6924 | -0.3226 | |||

| QRVO / Qorvo, Inc. | 0.02 | 10.22 | 1.85 | 29.29 | 1.6698 | 0.1476 | |||

| SCHL / Scholastic Corporation | 0.08 | 109.84 | 1.74 | 133.47 | 1.5716 | 0.7775 | |||

| INGR / Ingredion Incorporated | 0.01 | 7.89 | 1.73 | 8.21 | 1.5634 | -0.1388 | |||

| WHR / Whirlpool Corporation | 0.02 | 64.23 | 1.72 | 84.78 | 1.5607 | 0.5657 | |||

| PAHC / Phibro Animal Health Corporation | 0.07 | 8.24 | 1.72 | 29.42 | 1.5570 | 0.1395 | |||

| IFF / International Flavors & Fragrances Inc. | 0.02 | 12.71 | 1.66 | 6.83 | 1.5009 | -0.1547 | |||

| EXE / Expand Energy Corporation | 0.01 | -26.30 | 1.64 | -22.58 | 1.4864 | -0.7757 | |||

| BIH / Balfour Beatty plc | 0.23 | 8.57 | 1.63 | 38.62 | 1.4782 | 0.2219 | |||

| WIPKF / Winpak Ltd. | 0.05 | 11.48 | 1.62 | 33.88 | 1.4665 | 0.1760 | |||

| KMT / Kennametal Inc. | 0.07 | 11.79 | 1.49 | 20.48 | 1.3523 | 0.0300 | |||

| HAL / Halliburton Company | 0.07 | 1.44 | 1.3032 | 1.3032 | |||||

| ARLO / Arlo Technologies, Inc. | 0.08 | 9.59 | 1.43 | 88.39 | 1.2924 | 0.4838 | |||

| MOGA / Moog, Inc. - Class A | 0.01 | 8.97 | 1.41 | 13.72 | 1.2753 | -0.0456 | |||

| STT / State Street Corporation | 0.01 | 9.43 | 1.40 | 30.00 | 1.2711 | 0.1188 | |||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.03 | 69.08 | 1.39 | 72.10 | 1.2613 | 0.3971 | |||

| LEVI / Levi Strauss & Co. | 0.07 | 9.69 | 1.31 | 30.12 | 1.1844 | 0.1117 | |||

| WTY / Willis Towers Watson Public Limited Company | 0.00 | 9.54 | 1.28 | -0.62 | 1.1586 | -0.2155 | |||

| SMG / The Scotts Miracle-Gro Company | 0.02 | 10.43 | 1.21 | 32.68 | 1.0992 | 0.1232 | |||

| PBH / Prestige Consumer Healthcare Inc. | 0.02 | 9.52 | 1.21 | 1.68 | 1.0934 | -0.1730 | |||

| HTLD / Heartland Express, Inc. | 0.14 | 57.43 | 1.21 | 47.56 | 1.0922 | 0.2199 | |||

| AGCO / AGCO Corporation | 0.01 | 13.40 | 1.21 | 26.44 | 1.0903 | 0.0737 | |||

| EPAM / EPAM Systems, Inc. | 0.01 | 1.16 | 1.0477 | 1.0477 | |||||

| PHG / Koninklijke Philips N.V. - Depositary Receipt (Common Stock) | 0.05 | 15.04 | 1.15 | 8.60 | 1.0401 | -0.0883 | |||

| WKC / World Kinect Corporation | 0.04 | 10.59 | 1.13 | 10.57 | 1.0229 | -0.0673 | |||

| SEB / Seaboard Corporation | 0.00 | 9.44 | 1.13 | 16.19 | 1.0200 | -0.0151 | |||

| TKR / The Timken Company | 0.02 | 14.33 | 1.11 | 15.34 | 1.0004 | -0.0209 | |||

| FFIV / F5, Inc. | 0.00 | -43.74 | 1.08 | -37.80 | 0.9781 | -0.8752 | |||

| DGX / Quest Diagnostics Incorporated | 0.01 | 3.73 | 1.08 | 10.11 | 0.9756 | -0.0682 | |||

| SHC / Sotera Health Company | 0.09 | 10.79 | 0.99 | 5.66 | 0.8955 | -0.1031 | |||

| AVT / Avnet, Inc. | 0.02 | 11.81 | 0.97 | 23.41 | 0.8785 | 0.0398 | |||

| SON / Sonoco Products Company | 0.02 | 11.30 | 0.96 | 2.56 | 0.8720 | -0.1291 | |||

| WTM / White Mountains Insurance Group, Ltd. | 0.00 | 11.53 | 0.96 | 4.03 | 0.8644 | -0.1149 | |||

| MZTI / The Marzetti Company | 0.01 | 11.82 | 0.95 | 10.34 | 0.8604 | -0.0579 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.01 | 11.71 | 0.93 | -10.03 | 0.8448 | -0.2609 | |||

| ARW / Arrow Electronics, Inc. | 0.01 | 12.44 | 0.91 | 38.09 | 0.8236 | 0.1204 | |||

| HSIC / Henry Schein, Inc. | 0.01 | 12.55 | 0.89 | 20.03 | 0.8034 | 0.0148 | |||

| CNA / CNA Financial Corporation | 0.02 | 3.78 | 0.85 | -4.93 | 0.7689 | -0.1839 | |||

| SEE / Sealed Air Corporation | 0.03 | 12.59 | 0.84 | 20.95 | 0.7633 | 0.0194 | |||

| ORI / Old Republic International Corporation | 0.02 | -31.84 | 0.79 | -33.22 | 0.7155 | -0.5465 | |||

| OGN / Organon & Co. | 0.08 | 14.04 | 0.77 | -25.87 | 0.6976 | -0.4111 | |||

| CPB / The Campbell's Company | 0.02 | 23.69 | 0.76 | -5.09 | 0.6920 | -0.1666 | |||

| FTRE / Fortrea Holdings Inc. | 0.15 | 66.88 | 0.74 | 9.20 | 0.6660 | -0.0527 | |||

| UTHR / United Therapeutics Corporation | 0.00 | 17.15 | 0.55 | 9.15 | 0.4974 | -0.0393 | |||

| LSTR / Landstar System, Inc. | 0.00 | 30.55 | 0.40 | 20.66 | 0.3655 | 0.0091 |