Statistik Asas

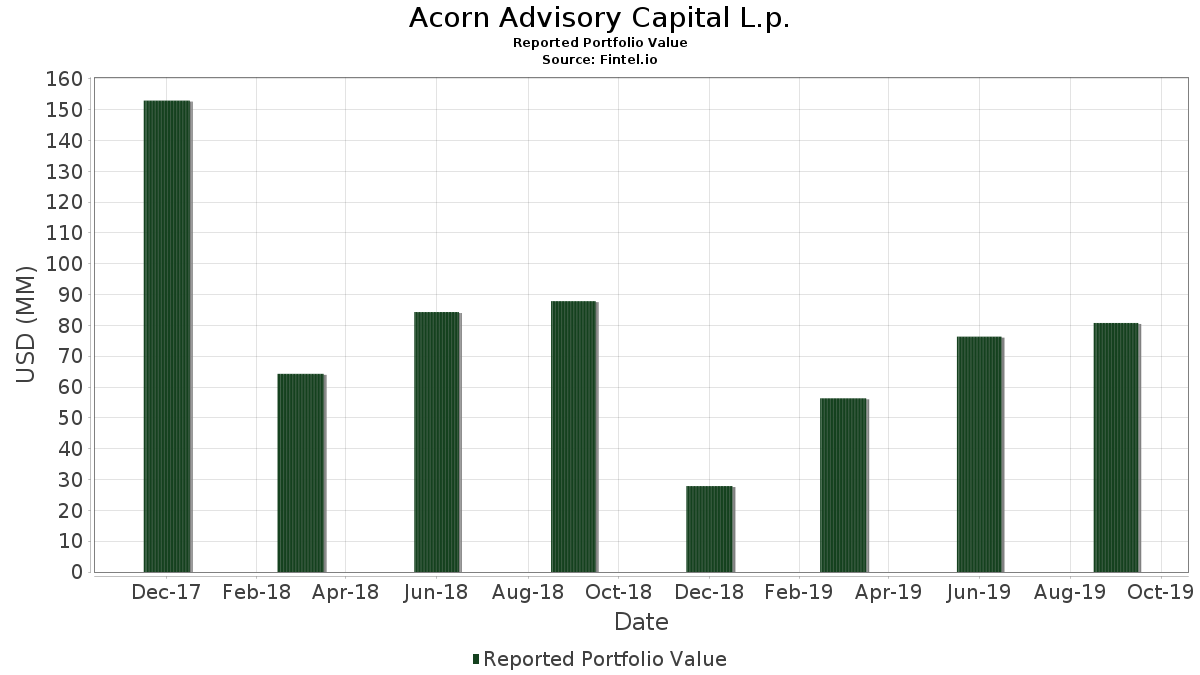

| Nilai Portfolio | $ 80,780,000 |

| Kedudukan Semasa | 25 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Acorn Advisory Capital L.p. telah mendedahkan 25 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 80,780,000 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Acorn Advisory Capital L.p. ialah Exacttarget, Inc. (US:30064K105) , Two Harbors Investment Corp. (US:TWO) , Alphabet Inc. (US:GOOGL) , MPLX LP - Limited Partnership (US:MPLX) , and Amazon.com, Inc. (US:AMZN) . Kedudukan baharu Acorn Advisory Capital L.p. termasuk iShares Trust - iShares U.S. Home Construction ETF (US:ITB) , iShares Trust - iShares U.S. Transportation ETF (US:IYT) , M.D.C. Holdings, Inc. (US:MDC) , lululemon athletica inc. (US:LULU) , and Global X Funds - Global X MSCI Greece ETF (US:GREK) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.12 | 5.02 | 6.2194 | 6.2194 | |

| 0.02 | 2.91 | 3.5974 | 3.5974 | |

| 0.07 | 1.97 | 2.4362 | 2.4362 | |

| 0.01 | 1.95 | 2.4189 | 2.4189 | |

| 0.01 | 1.46 | 1.8099 | 1.8099 | |

| 0.03 | 1.38 | 1.7022 | 1.7022 | |

| 0.01 | 0.98 | 1.2156 | 1.2156 | |

| 0.10 | 0.98 | 1.2095 | 1.2095 | |

| 0.01 | 0.98 | 1.2095 | 1.2095 | |

| 0.29 | 8.00 | 9.8997 | 0.7167 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.9935 | ||

| 0.00 | 0.00 | -1.8324 | ||

| 0.00 | 0.00 | -1.6988 | ||

| 0.00 | 0.00 | -1.6360 | ||

| 0.00 | 0.00 | -1.6333 | ||

| 0.00 | 0.00 | -1.5521 | ||

| 0.00 | 0.00 | -1.5390 | ||

| 0.00 | 7.72 | 9.5630 | -1.4748 | |

| 0.00 | 0.00 | -1.4054 | ||

| 0.00 | 0.00 | -1.3753 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2019-11-06 untuk tempoh pelaporan 2019-09-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 30064K105 / Exacttarget, Inc. | 0.92 | 8.80 | 12.09 | 1.08 | 14.9703 | -0.7003 | |||

| TWO / Two Harbors Investment Corp. | 0.75 | 0.00 | 9.81 | 3.63 | 12.1441 | -0.2546 | |||

| GOOGL / Alphabet Inc. | 0.01 | -8.07 | 9.74 | 3.68 | 12.0574 | -0.2469 | |||

| MPLX / MPLX LP - Limited Partnership | 0.29 | 31.08 | 8.00 | 14.06 | 9.8997 | 0.7167 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.00 | 7.72 | -8.33 | 9.5630 | -1.4748 | |||

| ITB / iShares Trust - iShares U.S. Home Construction ETF | Call | 0.12 | 5.02 | 6.2194 | 6.2194 | ||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 4.98 | -1.33 | 6.1686 | -0.4459 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.02 | 2.91 | 3.5974 | 3.5974 | |||||

| I / Intelsat SA | 0.10 | 0.00 | 2.20 | 17.19 | 2.7259 | 0.2648 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.07 | 1.97 | 2.4362 | 2.4362 | |||||

| IYT / iShares Trust - iShares U.S. Transportation ETF | 0.01 | 1.95 | 2.4189 | 2.4189 | |||||

| TDG / TransDigm Group Incorporated | 0.00 | 13.79 | 1.72 | 22.45 | 2.1268 | 0.2891 | |||

| NVDA / NVIDIA Corporation | 0.01 | 1.46 | 1.8099 | 1.8099 | |||||

| MDC / M.D.C. Holdings, Inc. | 0.03 | 1.38 | 1.7022 | 1.7022 | |||||

| LNG / Cheniere Energy, Inc. | 0.02 | 29.09 | 1.34 | 18.95 | 1.6625 | 0.1838 | |||

| LULU / lululemon athletica inc. | 0.01 | 0.98 | 1.2156 | 1.2156 | |||||

| ULTA / Ulta Beauty, Inc. | 0.00 | 143.75 | 0.98 | 76.22 | 1.2107 | 0.4838 | |||

| GREK / Global X Funds - Global X MSCI Greece ETF | 0.10 | 0.98 | 1.2095 | 1.2095 | |||||

| SMH / VanEck ETF Trust - VanEck Semiconductor ETF | 0.01 | 0.98 | 1.2095 | 1.2095 | |||||

| MRVL / Marvell Technology, Inc. | 0.04 | 0.00 | 0.96 | 4.60 | 1.1835 | -0.0137 | |||

| DIS / The Walt Disney Company | 0.01 | 0.00 | 0.95 | -6.67 | 1.1773 | -0.1574 | |||

| ZTS / Zoetis Inc. | 0.01 | 35.71 | 0.95 | 48.90 | 1.1723 | 0.3393 | |||

| UAL / United Airlines Holdings, Inc. | 0.01 | 0.00 | 0.95 | 0.96 | 1.1711 | -0.0562 | |||

| PVH / PVH Corp. | 0.00 | 0.40 | 0.4915 | 0.4915 | |||||

| ROAN / Roan Resources, Inc. | 0.30 | -12.10 | 0.37 | -37.88 | 0.4568 | -0.3212 | |||

| US20605P1012 / Concho Resources, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.4054 | ||||

| TPIC / TPI Composites, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| ILMN / Illumina, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2895 | ||||

| TTWO / Take-Two Interactive Software, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.6360 | ||||

| FANG / Diamondback Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.6988 | ||||

| EA / Electronic Arts Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5390 | ||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.4794 | ||||

| URI / United Rentals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.6333 | ||||

| PXD / Pioneer Natural Resources Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.1893 | ||||

| RDS.A / Shell Plc - ADR (Representing Ordinary Shares - Class A) | 0.00 | -100.00 | 0.00 | -100.00 | -1.8324 | ||||

| T / AT&T Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5265 | ||||

| ATVI / Activision Blizzard Inc | 0.00 | -100.00 | 0.00 | -100.00 | -1.5521 | ||||

| 19041P105 / CBS Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1500 | ||||

| QD / Qudian Inc. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -1.3753 | ||||

| PCG / PG&E Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.2993 | ||||

| AES / The AES Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.4375 | ||||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -1.9935 | ||||

| PYPL / PayPal Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5554 |