Statistik Asas

| Nilai Portfolio | $ 35,784,366 |

| Kedudukan Semasa | 39 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

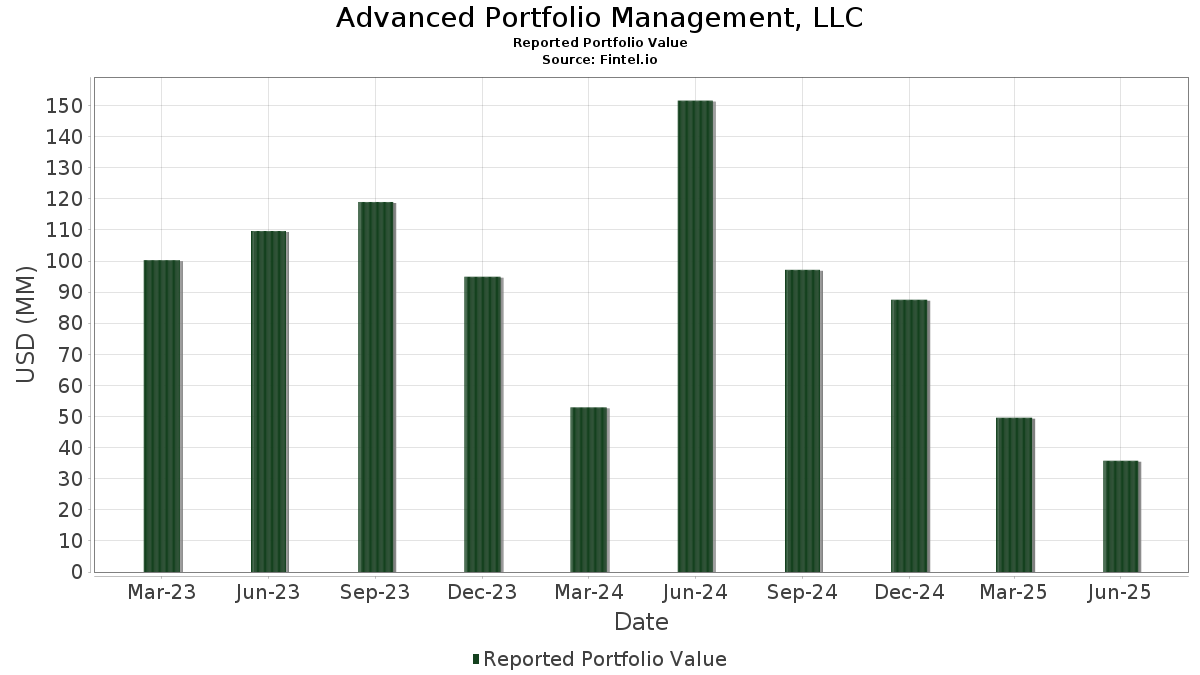

Advanced Portfolio Management, LLC telah mendedahkan 39 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 35,784,366 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Advanced Portfolio Management, LLC ialah NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Wells Fargo & Company (US:WFC) , Waste Management, Inc. (US:WM) , and The Boeing Company (US:BA) . Kedudukan baharu Advanced Portfolio Management, LLC termasuk Waste Management, Inc. (US:WM) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 1.72 | 4.7958 | 4.7958 | |

| 0.00 | 1.57 | 4.3823 | 4.3823 | |

| 0.02 | 1.56 | 4.3720 | 4.3720 | |

| 0.01 | 1.56 | 4.3590 | 4.3590 | |

| 0.03 | 1.55 | 4.3435 | 4.3435 | |

| 0.02 | 1.81 | 5.0480 | 4.3180 | |

| 0.04 | 1.43 | 3.9895 | 3.9895 | |

| 0.01 | 1.15 | 3.2067 | 3.2067 | |

| 0.00 | 2.41 | 6.7235 | 3.0644 | |

| 0.02 | 3.18 | 8.8875 | 2.8529 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.70 | 1.9423 | -1.3811 | |

| 0.03 | 1.31 | 3.6741 | -0.9387 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-13 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.02 | -27.14 | 3.18 | 6.21 | 8.8875 | 2.8529 | |||

| MSFT / Microsoft Corporation | 0.00 | 0.00 | 2.41 | 32.51 | 6.7235 | 3.0644 | |||

| WFC / Wells Fargo & Company | 0.02 | 346.81 | 1.81 | 398.90 | 5.0480 | 4.3180 | |||

| WM / Waste Management, Inc. | 0.01 | 1.72 | 4.7958 | 4.7958 | |||||

| BA / The Boeing Company | 0.01 | -27.27 | 1.68 | -10.66 | 4.6843 | 0.9037 | |||

| MELI / MercadoLibre, Inc. | 0.00 | 1.57 | 4.3823 | 4.3823 | |||||

| WMT / Walmart Inc. | 0.02 | 1.56 | 4.3720 | 4.3720 | |||||

| UNH / UnitedHealth Group Incorporated | 0.01 | 1.56 | 4.3590 | 4.3590 | |||||

| D / Dominion Energy, Inc. | 0.03 | 1.55 | 4.3435 | 4.3435 | |||||

| CMCSA / Comcast Corporation | 0.04 | 1.43 | 3.9895 | 3.9895 | |||||

| GLW / Corning Incorporated | 0.03 | -50.00 | 1.31 | -42.60 | 3.6741 | -0.9387 | |||

| AAPL / Apple Inc. | 0.01 | 0.00 | 1.25 | -7.66 | 3.5066 | 0.7689 | |||

| CRH / CRH plc | 0.01 | 1.15 | 3.2067 | 3.2067 | |||||

| GOOGL / Alphabet Inc. | 0.01 | 0.00 | 0.89 | 13.97 | 2.4860 | 0.9129 | |||

| K / Kellanova | 0.01 | 0.00 | 0.87 | -3.55 | 2.4314 | 0.6128 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 0.87 | 43.69 | 2.4175 | 1.2035 | |||

| UPS / United Parcel Service, Inc. | 0.01 | 0.00 | 0.83 | -8.23 | 2.3063 | 0.4941 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.82 | -8.77 | 2.2982 | 0.4812 | |||

| PPG / PPG Industries, Inc. | 0.01 | 0.00 | 0.70 | 3.99 | 1.9664 | 0.6032 | |||

| AMZN / Amazon.com, Inc. | 0.00 | -63.45 | 0.70 | -57.85 | 1.9423 | -1.3811 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.00 | 0.60 | 64.66 | 1.6808 | 0.9446 | |||

| ED / Consolidated Edison, Inc. | 0.01 | 0.00 | 0.60 | -9.30 | 1.6641 | 0.3416 | |||

| MCK / McKesson Corporation | 0.00 | 0.00 | 0.60 | 8.97 | 1.6628 | 0.5615 | |||

| IFF / International Flavors & Fragrances Inc. | 0.01 | 0.00 | 0.57 | -5.33 | 1.5890 | 0.3799 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 0.00 | 0.49 | -18.53 | 1.3642 | 0.1569 | |||

| TT / Trane Technologies plc | 0.00 | 0.00 | 0.47 | 29.92 | 1.3128 | 0.5836 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.00 | 0.43 | 18.23 | 1.1974 | 0.4668 | |||

| TXN / Texas Instruments Incorporated | 0.00 | 0.00 | 0.42 | 15.47 | 1.1697 | 0.4396 | |||

| WDAY / Workday, Inc. | 0.00 | 0.00 | 0.37 | 3.05 | 1.0396 | 0.3101 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.37 | 2.49 | 1.0349 | 0.3069 | |||

| ADBE / Adobe Inc. | 0.00 | 0.00 | 0.36 | 0.83 | 1.0195 | 0.2907 | |||

| ZTS / Zoetis Inc. | 0.00 | 0.00 | 0.34 | -5.26 | 0.9579 | 0.2286 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.34 | -5.52 | 0.9563 | 0.2257 | |||

| EXC / Exelon Corporation | 0.01 | 0.00 | 0.34 | -5.56 | 0.9502 | 0.2230 | |||

| PG / The Procter & Gamble Company | 0.00 | 0.00 | 0.34 | -6.67 | 0.9416 | 0.2153 | |||

| JNJ / Johnson & Johnson | 0.00 | 0.00 | 0.33 | -7.78 | 0.9280 | 0.2015 | |||

| BIIB / Biogen Inc. | 0.00 | 0.00 | 0.33 | -8.31 | 0.9269 | 0.1986 | |||

| HPQ / HP Inc. | 0.01 | 0.00 | 0.32 | -11.88 | 0.8940 | 0.1642 | |||

| MRK / Merck & Co., Inc. | 0.00 | 0.00 | 0.32 | -11.67 | 0.8895 | 0.1622 | |||

| NU / Nu Holdings Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ASHR / DBX ETF Trust - Xtrackers Harvest CSI 300 China A-Shares ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CCL / Carnival Corporation & plc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IEUR / iShares Trust - iShares Core MSCI Europe ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| C / Citigroup Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UBS / UBS Group AG | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NUE / Nucor Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VALE / Vale S.A. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| COHR / Coherent Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GOOG / Alphabet Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CPNG / Coupang, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |