Statistik Asas

| Nilai Portfolio | $ 2,449,871,177 |

| Kedudukan Semasa | 196 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

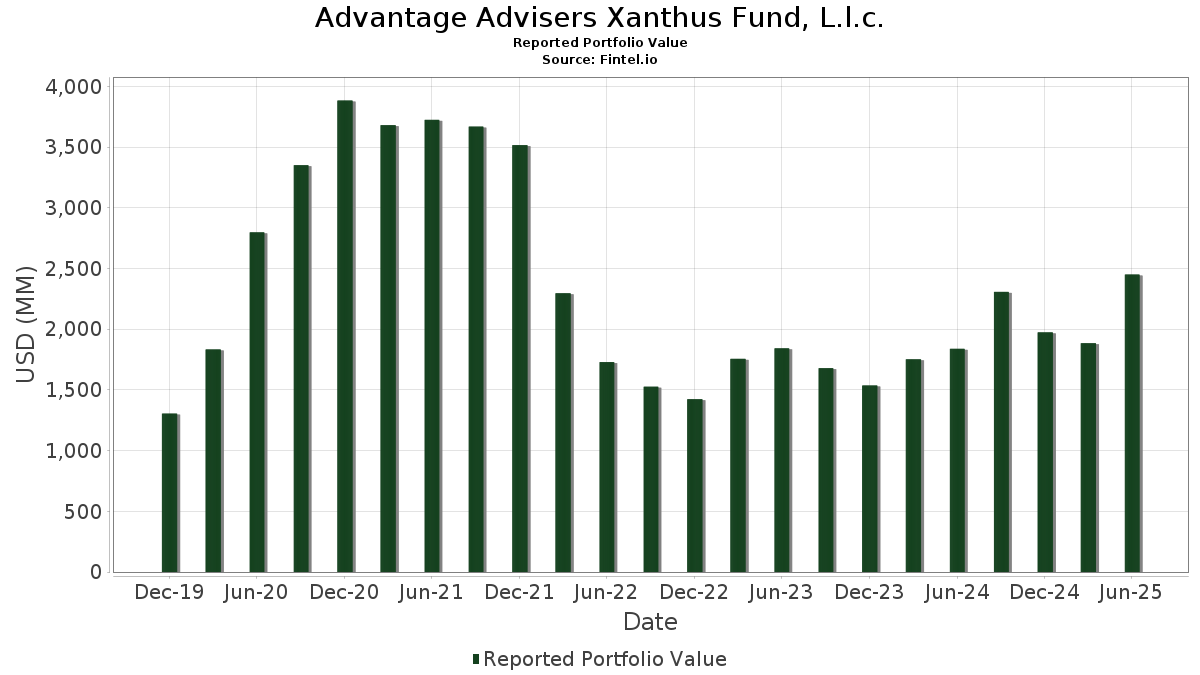

Advantage Advisers Xanthus Fund, L.l.c. telah mendedahkan 196 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 2,449,871,177 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Advantage Advisers Xanthus Fund, L.l.c. ialah Siemens Energy AG (IT:ENR) , Meta Platforms, Inc. (US:META) , Safran SA (FR:SAF) , Amazon.com, Inc. (US:AMZN) , and Airbus SE (FR:AIR) . Kedudukan baharu Advantage Advisers Xanthus Fund, L.l.c. termasuk BWX Technologies, Inc. (US:BWXT) , Insmed Incorporated (US:INSM) , Toast, Inc. (MX:TOST) , Open Text Corporation (US:OTEX) , and GitLab Inc. (US:GTLB) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.31 | 68.22 | 2.3598 | 3.6060 | |

| 91.57 | 3.1675 | 3.1675 | ||

| 1.72 | 198.28 | 6.8584 | 2.8133 | |

| 0.00 | 0.00 | 2.0828 | ||

| 38.26 | 1.3235 | 1.3235 | ||

| 0.19 | 37.64 | 1.3018 | 1.0530 | |

| 0.00 | 0.00 | 1.0112 | ||

| 26.98 | 0.9333 | 0.9333 | ||

| 0.23 | 26.42 | 0.9140 | 0.9140 | |

| 26.02 | 0.9001 | 0.9001 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| -0.09 | -70.70 | -2.4456 | -2.4456 | |

| 0.80 | 174.48 | 6.0353 | -1.6850 | |

| -0.04 | -17.19 | -0.5947 | -1.6583 | |

| -0.39 | -123.08 | -4.2573 | -1.1712 | |

| 0.00 | 0.00 | -1.1388 | ||

| 0.27 | 195.84 | 6.7739 | -1.0399 | |

| 0.05 | 5.45 | 0.1884 | -1.0020 | |

| -0.06 | -26.35 | -0.9115 | -0.9115 | |

| -0.20 | -32.46 | -1.1229 | -0.8643 | |

| 0.03 | 26.61 | 0.9205 | -0.8206 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-18 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ENR / Siemens Energy AG | 1.72 | 4.33 | 198.28 | 106.49 | 6.8584 | 2.8133 | |||

| META / Meta Platforms, Inc. | 0.27 | -17.56 | 195.84 | 5.58 | 6.7739 | -1.0399 | |||

| SAF / Safran SA | 0.54 | 0.00 | 176.12 | 23.89 | 6.0920 | 0.1035 | |||

| AMZN / Amazon.com, Inc. | 0.80 | -17.43 | 174.48 | -4.79 | 6.0353 | -1.6850 | |||

| AIR / Airbus SE | 0.82 | 6.97 | 170.13 | 26.59 | 5.8849 | 0.2231 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.71 | -9.50 | 161.00 | 23.48 | 5.5688 | 0.0763 | |||

| KLAC / KLA Corporation | 0.13 | -2.71 | 119.10 | 28.20 | 4.1196 | 0.2061 | |||

| LRCX / Lam Research Corporation | 1.18 | 8.41 | 114.86 | 45.15 | 3.9730 | 0.6395 | |||

| MSFT / Microsoft Corporation | 0.23 | 0.00 | 114.85 | 32.51 | 3.9726 | 0.3213 | |||

| SNEJF / Sony Group Corporation | 4.08 | 0.00 | 105.38 | 2.56 | 3.6452 | -0.6832 | |||

| ADI / Analog Devices, Inc. | 0.39 | 20.32 | 93.16 | 42.01 | 3.2225 | 0.4588 | |||

| Total Return Swap / DE (N/A) | 91.57 | 3.1675 | 3.1675 | ||||||

| MELI / MercadoLibre, Inc. | 0.03 | 11.09 | 86.86 | 48.83 | 3.0046 | 0.5460 | |||

| V / Visa Inc. | 0.20 | 0.00 | 70.60 | 1.31 | 2.4419 | -0.4936 | |||

| ORCL / Oracle Corporation | 0.31 | -247.48 | 68.22 | -330.63 | 2.3598 | 3.6060 | |||

| CDNS / Cadence Design Systems, Inc. | 0.22 | 0.00 | 66.52 | 21.16 | 2.3009 | -0.0119 | |||

| MLM / Martin Marietta Materials, Inc. | 0.11 | 4.08 | 63.02 | 19.50 | 2.1800 | -0.0418 | |||

| MA / Mastercard Incorporated | 0.11 | 0.00 | 59.09 | 2.52 | 2.0439 | -0.3841 | |||

| EXPE / Expedia Group, Inc. | 0.34 | 5.75 | 57.70 | 6.11 | 1.9958 | -0.2949 | |||

| TJX / The TJX Companies, Inc. | 0.46 | 0.00 | 57.00 | 1.39 | 1.9717 | -0.3967 | |||

| VMC / Vulcan Materials Company | 0.20 | 8.31 | 53.40 | 21.09 | 1.8470 | -0.0107 | |||

| CEG / Constellation Energy Corporation | 0.16 | 29.87 | 52.71 | 107.90 | 1.8231 | 0.7551 | |||

| MTX / MTU Aero Engines AG | 0.11 | 1.67 | 48.19 | 30.11 | 1.6667 | 0.1066 | |||

| SNPS / Synopsys, Inc. | 0.09 | 0.00 | 46.30 | 19.55 | 1.6014 | -0.0300 | |||

| ICE / Intercontinental Exchange, Inc. | 0.25 | 0.00 | 45.58 | 6.36 | 1.5765 | -0.2287 | |||

| DELL / Dell Technologies Inc. | 0.37 | -18.33 | 44.99 | 9.85 | 1.5561 | -0.1690 | |||

| TDG / TransDigm Group Incorporated | 0.03 | -20.35 | 40.87 | -12.44 | 1.4135 | -0.5525 | |||

| Total Return Swap / DE (N/A) | 38.26 | 1.3235 | 1.3235 | ||||||

| PWR / Quanta Services, Inc. | 0.10 | 0.00 | 38.04 | 48.74 | 1.3157 | 0.2385 | |||

| APH / Amphenol Corporation | 0.38 | 6.12 | 37.85 | 59.77 | 1.3092 | 0.3112 | |||

| VST / Vistra Corp. | 0.19 | 286.03 | 37.64 | 537.14 | 1.3018 | 1.0530 | |||

| UBER / Uber Technologies, Inc. | 0.40 | -14.44 | 37.55 | 9.56 | 1.2990 | -0.1449 | |||

| ETR / Entergy Corporation | 0.37 | 16.14 | 30.97 | 12.92 | 1.0713 | -0.0841 | |||

| Equity Option / DE (N/A) | 26.98 | 0.9333 | 0.9333 | ||||||

| ADS / adidas AG | 0.11 | 0.00 | 26.63 | -0.73 | 0.9213 | -0.2090 | |||

| EQIX / Equinix, Inc. | 0.03 | -34.00 | 26.61 | -35.61 | 0.9205 | -0.8206 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.23 | 26.42 | 0.9140 | 0.9140 | |||||

| Equity Option / DE (N/A) | 26.02 | 0.9001 | 0.9001 | ||||||

| GE / General Electric Company | 0.10 | 0.00 | 25.85 | 28.60 | 0.8942 | 0.0474 | |||

| Equity Option / DE (N/A) | 25.63 | 0.8867 | 0.8867 | ||||||

| YMM / Full Truck Alliance Co. Ltd. - Depositary Receipt (Common Stock) | 2.10 | 5.86 | 24.85 | -2.10 | 0.8597 | -0.2098 | |||

| TER / Teradyne, Inc. | 0.28 | 30.33 | 24.85 | 41.87 | 0.8596 | 0.1217 | |||

| BY6 / BYD Company Limited | 1.57 | 110.32 | 24.48 | -34.99 | 0.8469 | -0.7397 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.28 | 0.00 | 23.29 | -0.87 | 0.8057 | -0.1842 | |||

| CP / Canadian Pacific Kansas City Limited | 0.29 | 84.82 | 22.73 | 108.68 | 0.7863 | 0.3274 | |||

| Equity Option / DE (N/A) | 22.00 | 0.7608 | 0.7608 | ||||||

| Equity Option / DE (N/A) | 21.29 | 0.7363 | 0.7363 | ||||||

| Equity Option / DE (N/A) | 20.83 | 0.7204 | 0.7204 | ||||||

| LOW / Lowe's Companies, Inc. | 0.09 | 0.00 | 20.32 | -4.87 | 0.7030 | -0.1970 | |||

| Equity Option / DE (N/A) | 19.22 | 0.6648 | 0.6648 | ||||||

| Equity Option / DE (N/A) | 19.08 | 0.6600 | 0.6600 | ||||||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 0.58 | -9.77 | 18.78 | -28.38 | 0.6496 | -0.4550 | |||

| JCI / Johnson Controls International plc | 0.17 | -11.71 | 18.48 | 16.40 | 0.6391 | -0.0296 | |||

| Total Return Swap / DE (N/A) | 18.36 | 0.6351 | 0.6351 | ||||||

| Equity Option / DE (N/A) | 17.75 | 0.6139 | 0.6139 | ||||||

| EDU / New Oriental Education & Technology Group Inc. - Depositary Receipt (Common Stock) | 0.31 | 103.83 | 16.92 | 130.03 | 0.5854 | 0.2754 | |||

| Equity Option / DE (N/A) | 16.92 | 0.5853 | 0.5853 | ||||||

| CG / The Carlyle Group Inc. | 0.32 | 79.76 | 16.50 | 111.99 | 0.5707 | 0.2428 | |||

| SHW / The Sherwin-Williams Company | 0.04 | 0.00 | 15.26 | -1.67 | 0.5277 | -0.1259 | |||

| HIA1 / Hitachi, Ltd. | 0.52 | -34.23 | 15.22 | -17.20 | 0.5263 | -0.2478 | |||

| NI / NiSource Inc. | 0.36 | 4.12 | 14.63 | 4.77 | 0.5061 | -0.0822 | |||

| SPGI / S&P Global Inc. | 0.03 | 0.00 | 14.18 | 3.78 | 0.4903 | -0.0851 | |||

| AMT / American Tower Corporation | 0.06 | 0.00 | 13.72 | 1.58 | 0.4746 | -0.0945 | |||

| AKRO / Akero Therapeutics, Inc. | 0.26 | 21.07 | 13.69 | 59.59 | 0.4737 | 0.1122 | |||

| ROST / Ross Stores, Inc. | 0.10 | 0.00 | 13.02 | -0.17 | 0.4502 | -0.0990 | |||

| Equity Option / DE (N/A) | 12.65 | 0.4375 | 0.4375 | ||||||

| BWXT / BWX Technologies, Inc. | 0.09 | 12.39 | 0.4286 | 0.4286 | |||||

| 27 / Galaxy Entertainment Group Limited | 2.79 | -20.52 | 12.38 | -9.70 | 0.4281 | -0.1493 | |||

| BURL / Burlington Stores, Inc. | 0.05 | 18.35 | 11.67 | 15.53 | 0.4038 | -0.0219 | |||

| YUM / Yum! Brands, Inc. | 0.07 | 0.00 | 10.09 | -5.84 | 0.3490 | -0.1024 | |||

| RYTM / Rhythm Pharmaceuticals, Inc. | 0.15 | 26.23 | 9.24 | 50.60 | 0.3194 | 0.0611 | |||

| SARO / StandardAero, Inc. | 0.28 | 10.92 | 8.86 | 31.78 | 0.3064 | 0.0232 | |||

| RARE / Ultragenyx Pharmaceutical Inc. | 0.24 | 0.00 | 8.77 | 0.41 | 0.3034 | -0.0646 | |||

| XYZ / Block, Inc. | 0.12 | 0.00 | 8.44 | 25.03 | 0.2920 | 0.0076 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.14 | 0.00 | 7.89 | 11.83 | 0.2731 | -0.0243 | |||

| Equity Option / DE (N/A) | 7.82 | 0.2704 | 0.2704 | ||||||

| CTAS / Cintas Corporation | 0.03 | 0.00 | 7.41 | 8.43 | 0.2563 | -0.0316 | |||

| BCRX / BioCryst Pharmaceuticals, Inc. | 0.82 | -21.14 | 7.32 | -5.79 | 0.2533 | -0.0741 | |||

| INSM / Insmed Incorporated | 0.07 | 7.21 | 0.2495 | 0.2495 | |||||

| Equity Option / DE (N/A) | 7.10 | 0.2456 | 0.2456 | ||||||

| BEKE / KE Holdings Inc. - Depositary Receipt (Common Stock) | 0.40 | -34.17 | 7.04 | -41.87 | 0.2434 | -0.2665 | |||

| Equity Option / DE (N/A) | 6.74 | 0.2331 | 0.2331 | ||||||

| Equity Option / DE (N/A) | 6.69 | 0.2313 | 0.2313 | ||||||

| ORIC / ORIC Pharmaceuticals, Inc. | 0.65 | 13.97 | 6.56 | 107.31 | 0.2267 | 0.0935 | |||

| ARGX / argenx SE - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 5.93 | -6.87 | 0.2050 | -0.0631 | |||

| Total Return Swap / DE (N/A) | 5.72 | 0.1977 | 0.1977 | ||||||

| Total Return Swap / DE (N/A) | 5.58 | 0.1929 | 0.1929 | ||||||

| OKTA / Okta, Inc. | 0.05 | -79.72 | 5.45 | -80.73 | 0.1884 | -1.0020 | |||

| MPNGY / Meituan - Depositary Receipt (Common Stock) | 0.31 | 0.00 | 4.93 | -20.28 | 0.1706 | -0.0901 | |||

| Equity Option / DE (N/A) | 4.52 | 0.1563 | 0.1563 | ||||||

| Equity Option / DE (N/A) | 4.35 | 0.1505 | 0.1505 | ||||||

| Total Return Swap / DE (N/A) | 3.20 | 0.1108 | 0.1108 | ||||||

| TOST / Toast, Inc. | 0.06 | 2.54 | 0.0880 | 0.0880 | |||||

| Equity Option / DE (N/A) | 2.23 | 0.0772 | 0.0772 | ||||||

| Equity Option / DE (N/A) | 1.65 | 0.0571 | 0.0571 | ||||||

| KROS / Keros Therapeutics, Inc. | 0.12 | 0.00 | 1.60 | 31.05 | 0.0555 | 0.0039 | |||

| Currency Option / DFE (N/A) | 1.52 | 0.0525 | 0.0525 | ||||||

| Total Return Swap / DE (N/A) | 1.18 | 0.0409 | 0.0409 | ||||||

| Total Return Swap / DE (N/A) | 0.48 | 0.0168 | 0.0168 | ||||||

| PMVP / PMV Pharmaceuticals, Inc. | 0.33 | 0.00 | 0.35 | -2.79 | 0.0121 | -0.0031 | |||

| Total Return Swap / DE (N/A) | 0.34 | 0.0116 | 0.0116 | ||||||

| Total Return Swap / DE (N/A) | 0.26 | 0.0089 | 0.0089 | ||||||

| Currency Option / DFE (N/A) | 0.11 | 0.0040 | 0.0040 | ||||||

| FDX / FedEx Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.4156 | ||||

| CATY / Cathay General Bancorp | 0.00 | -100.00 | 0.00 | -100.00 | 0.2092 | ||||

| JWN / Nordstrom, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.5303 | ||||

| FN / Fabrinet | 0.00 | -100.00 | 0.00 | -100.00 | 0.7641 | ||||

| NOW / ServiceNow, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 2.0828 | ||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.3857 | ||||

| CLS / Celestica Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4910 | ||||

| 700 / Tencent Holdings Limited | 0.00 | -100.00 | 0.00 | -100.00 | -1.1388 | ||||

| MPWR / Monolithic Power Systems, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.0112 | ||||

| TTC / The Toro Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.1762 | ||||

| 1VLY / Valley National Bancorp | 0.00 | -100.00 | 0.00 | -100.00 | 0.2687 | ||||

| 1VLY / Valley National Bancorp | 0.00 | -100.00 | 0.00 | -100.00 | 0.2687 | ||||

| Total Return Swap / DE (N/A) | -0.01 | -0.0002 | -0.0002 | ||||||

| CGC / Canopy Growth Corporation | Short | -0.01 | -0.00 | -0.01 | 50.00 | -0.0002 | -0.0000 | ||

| 1333 / Breton Technology Co., Ltd. | Short | -0.67 | -0.00 | -0.14 | -0.69 | -0.0049 | 0.0011 | ||

| HPP / Hudson Pacific Properties, Inc. | Short | -0.10 | -0.00 | -0.28 | -6.98 | -0.0097 | 0.0030 | ||

| Total Return Swap / DE (N/A) | -0.42 | -0.0146 | -0.0146 | ||||||

| BDN / Brandywine Realty Trust | Short | -0.13 | -0.00 | -0.54 | -3.91 | -0.0187 | 0.0050 | ||

| HOUS / Anywhere Real Estate Inc. | Short | -0.15 | -0.00 | -0.55 | 8.66 | -0.0191 | 0.0023 | ||

| 1833 / Ping An Healthcare and Technology Company Limited | Short | -0.66 | -0.00 | -0.74 | 24.29 | -0.0257 | -0.0005 | ||

| Total Return Swap / DE (N/A) | -1.27 | -0.0438 | -0.0438 | ||||||

| Total Return Swap / DE (N/A) | -1.50 | -0.0519 | -0.0519 | ||||||

| TDC / Teradata Corporation | Short | -0.08 | -0.00 | -1.77 | -0.78 | -0.0613 | 0.0139 | ||

| Total Return Swap / DE (N/A) | -1.80 | -0.0622 | -0.0622 | ||||||

| Total Return Swap / DE (N/A) | -2.07 | -0.0717 | -0.0717 | ||||||

| RPD / Rapid7, Inc. | Short | -0.09 | -0.00 | -2.08 | -12.73 | -0.0719 | 0.0284 | ||

| WBD / Warner Bros. Discovery, Inc. | Short | -0.18 | -0.00 | -2.09 | 6.84 | -0.0724 | 0.0102 | ||

| NIO / NIO Inc. - Depositary Receipt (Common Stock) | Short | -0.64 | -0.00 | -2.19 | -9.96 | -0.0757 | 0.0267 | ||

| HBI / Hanesbrands Inc. | Short | -0.50 | -0.00 | -2.27 | -20.63 | -0.0787 | 0.0420 | ||

| Total Return Swap / DE (N/A) | -2.33 | -0.0806 | -0.0806 | ||||||

| Total Return Swap / DE (N/A) | -2.33 | -0.0807 | -0.0807 | ||||||

| 6 / Power Assets Holdings Limited | Short | -0.39 | -0.00 | -2.47 | 7.33 | -0.0856 | 0.0116 | ||

| SBH / Sally Beauty Holdings, Inc. | Short | -0.28 | -0.00 | -2.58 | 2.55 | -0.0891 | 0.0167 | ||

| OTEX / Open Text Corporation | Short | -0.11 | -3.35 | -0.1159 | -0.1159 | ||||

| SLG / SL Green Realty Corp. | Short | -0.06 | -35.01 | -3.46 | -30.28 | -0.1197 | 0.0894 | ||

| KSS / Kohl's Corporation | Short | -0.41 | -0.00 | -3.47 | 3.68 | -0.1199 | 0.0210 | ||

| CFLT / Confluent, Inc. | Short | -0.16 | -3.97 | -0.1372 | -0.1372 | ||||

| INFY / Infosys Limited - Depositary Receipt (Common Stock) | Short | -0.22 | -3.99 | -0.1380 | -0.1380 | ||||

| G / Genpact Limited | Short | -0.09 | 163.35 | -4.10 | 130.08 | -0.1418 | -0.0668 | ||

| CAG / Conagra Brands, Inc. | Short | -0.22 | -10.18 | -4.42 | -31.06 | -0.1529 | 0.1172 | ||

| M / Macy's, Inc. | Short | -0.41 | -0.00 | -4.80 | -7.16 | -0.1660 | 0.0518 | ||

| TENB / Tenable Holdings, Inc. | Short | -0.14 | 32.64 | -4.88 | 28.09 | -0.1688 | -0.0083 | ||

| XIACF / Xiaomi Corporation | Short | -0.65 | -23.94 | -4.93 | -8.15 | -0.1704 | 0.0555 | ||

| BMW / Bayerische Motoren Werke Aktiengesellschaft | Short | -0.06 | -49.17 | -5.08 | -43.42 | -0.1757 | 0.2025 | ||

| PINS / Pinterest, Inc. | Short | -0.14 | -5.14 | -0.1778 | -0.1778 | ||||

| ETSY / Etsy, Inc. | Short | -0.11 | 102.84 | -5.75 | 115.67 | -0.1990 | -0.0866 | ||

| GTLB / GitLab Inc. | Short | -0.13 | -5.82 | -0.2013 | -0.2013 | ||||

| Total Return Swap / DE (N/A) | -6.02 | -0.2081 | -0.2081 | ||||||

| BEN / Franklin Resources, Inc. | Short | -0.30 | 17.66 | -7.25 | 45.79 | -0.2507 | -0.0413 | ||

| VZ / Verizon Communications Inc. | Short | -0.17 | -57.44 | -7.37 | -59.40 | -0.2548 | 0.5096 | ||

| DBX / Dropbox, Inc. | Short | -0.27 | 15.24 | -7.79 | 23.40 | -0.2694 | -0.0035 | ||

| DEI / Douglas Emmett, Inc. | Short | -0.54 | -0.00 | -8.10 | -6.00 | -0.2801 | 0.0828 | ||

| MBLY / Mobileye Global Inc. | Short | -0.45 | -19.89 | -8.16 | 0.06 | -0.2822 | 0.0613 | ||

| AMD / Advanced Micro Devices, Inc. | Short | -0.06 | -68.07 | -8.17 | -55.91 | -0.2825 | 0.4977 | ||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | Short | -0.07 | -0.00 | -8.36 | 8.55 | -0.2891 | 0.0353 | ||

| KRC / Kilroy Realty Corporation | Short | -0.25 | 22.85 | -8.42 | 28.68 | -0.2912 | -0.0156 | ||

| PYPL / PayPal Holdings, Inc. | Short | -0.11 | -8.53 | -0.2949 | -0.2949 | ||||

| VEEV / Veeva Systems Inc. | Short | -0.03 | -30.97 | -8.69 | -14.17 | -0.3006 | 0.1260 | ||

| 0T3W / Bilibili Inc. - Depositary Receipt (Common Stock) | Short | -0.41 | -0.00 | -8.80 | 12.24 | -0.3045 | 0.0259 | ||

| XPEV / XPeng Inc. - Depositary Receipt (Common Stock) | Short | -0.50 | -11.26 | -8.97 | -23.42 | -0.3103 | 0.1832 | ||

| BXP / Boston Properties, Inc. | Short | -0.13 | -32.28 | -8.97 | -32.00 | -0.3103 | 0.2454 | ||

| Total Return Swap / DE (N/A) | -9.06 | -0.3135 | -0.3135 | ||||||

| GFS / GLOBALFOUNDRIES Inc. | Short | -0.24 | -0.00 | -9.19 | 3.49 | -0.3180 | 0.0562 | ||

| ARES / Ares Management Corporation | Short | -0.06 | -9.93 | -0.3436 | -0.3436 | ||||

| MCHP / Microchip Technology Incorporated | Short | -0.15 | 33.32 | -10.52 | 93.83 | -0.3639 | -0.1352 | ||

| RF / Regions Financial Corporation | Short | -0.46 | 33.35 | -10.79 | 44.34 | -0.3733 | -0.0583 | ||

| QLYS / Qualys, Inc. | Short | -0.08 | -0.00 | -11.14 | 13.46 | -0.3853 | 0.0283 | ||

| CTSH / Cognizant Technology Solutions Corporation | Short | -0.15 | -0.00 | -11.61 | 2.00 | -0.4016 | 0.0779 | ||

| CPB / The Campbell's Company | Short | -0.39 | -0.00 | -11.99 | -23.22 | -0.4146 | 0.2430 | ||

| MTLA / Motorola Solutions, Inc. | Short | -0.03 | 1.45 | -12.06 | -2.58 | -0.4171 | 0.1043 | ||

| WIX / Wix.com Ltd. | Short | -0.09 | -13.64 | -0.4719 | -0.4719 | ||||

| 1024 / Kuaishou Technology | Short | -1.72 | -18.83 | -13.88 | -6.30 | -0.4802 | 0.1439 | ||

| GIS / General Mills, Inc. | Short | -0.27 | -14.13 | -14.11 | -25.59 | -0.4881 | 0.3108 | ||

| 1IPG / The Interpublic Group of Companies, Inc. | Short | -0.59 | 13.58 | -14.40 | 2.37 | -0.4982 | 0.0945 | ||

| KHC / The Kraft Heinz Company | Short | -0.56 | -0.00 | -14.55 | -15.15 | -0.5034 | 0.2191 | ||

| PSA / Public Storage | Short | -0.05 | -0.00 | -14.59 | -1.96 | -0.5047 | 0.1223 | ||

| CAP / Capgemini SE | Short | -0.09 | -0.00 | -14.78 | 14.18 | -0.5114 | 0.0341 | ||

| T / AT&T Inc. | Short | -0.51 | -25.82 | -14.90 | -24.09 | -0.5153 | 0.3114 | ||

| ULTA / Ulta Beauty, Inc. | Short | -0.03 | -8.82 | -15.13 | 16.38 | -0.5234 | 0.0244 | ||

| GPN / Global Payments Inc. | Short | -0.19 | 31.16 | -15.21 | 7.21 | -0.5261 | 0.0715 | ||

| JNJ_KZ / Johnson & Johnson | Short | -0.10 | -11.08 | -15.56 | -18.10 | -0.5382 | 0.2621 | ||

| CSGP / CoStar Group, Inc. | Short | -0.20 | -0.00 | -16.00 | 1.48 | -0.5536 | 0.1108 | ||

| AMGN / Amgen Inc. | Short | -0.06 | -0.00 | -16.05 | -10.38 | -0.5553 | 0.1993 | ||

| URW / Unibail-Rodamco-Westfield SE | Short | -0.17 | 51.75 | -16.39 | 71.78 | -0.5669 | -0.1649 | ||

| 1F / Ford Motor Company | Short | -1.53 | -0.00 | -16.58 | 8.17 | -0.5735 | 0.0722 | ||

| NVT / nVent Electric plc | Short | -0.23 | 102.58 | -16.80 | 183.11 | -0.5811 | -0.3311 | ||

| ADBE / Adobe Inc. | Short | -0.04 | -205.49 | -17.19 | -180.04 | -0.5947 | -1.6583 | ||

| WDAY / Workday, Inc. | Short | -0.07 | -17.20 | -0.5950 | -0.5950 | ||||

| TROW / T. Rowe Price Group, Inc. | Short | -0.20 | -22.84 | -19.08 | -18.95 | -0.6600 | 0.3318 | ||

| OMC / Omnicom Group Inc. | Short | -0.27 | 48.00 | -19.60 | 28.41 | -0.6778 | -0.0350 | ||

| HRB / H&R Block, Inc. | Short | -0.39 | 44.48 | -21.68 | 44.43 | -0.7498 | -0.1176 | ||

| MNST / Monster Beverage Corporation | Short | -0.37 | 12.50 | -23.35 | 20.42 | -0.8076 | 0.0092 | ||

| CHH / Choice Hotels International, Inc. | Short | -0.18 | -0.00 | -23.42 | -4.45 | -0.8103 | 0.2224 | ||

| DASH / DoorDash, Inc. | Short | -0.10 | 254.98 | -24.68 | 378.77 | -0.8536 | -0.6364 | ||

| HUBB / Hubbell Incorporated | Short | -0.06 | -26.35 | -0.9115 | -0.9115 | ||||

| IT / Gartner, Inc. | Short | -0.07 | 73.75 | -27.81 | 67.33 | -0.9618 | -0.2618 | ||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | Short | -0.36 | 1.61 | -28.96 | 3.87 | -1.0016 | 0.1727 | ||

| CQD / Charter Communications, Inc. | Short | -0.08 | -10.53 | -31.09 | -0.75 | -1.0754 | 0.2443 | ||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | Short | -0.20 | 249.15 | -32.46 | 428.89 | -1.1229 | -0.8643 | ||

| FICO / Fair Isaac Corporation | Short | -0.02 | 35.43 | -34.99 | 34.24 | -1.2103 | -0.1123 | ||

| ACN / Accenture plc | Short | -0.12 | 187.07 | -36.38 | 174.97 | -1.2584 | -0.7011 | ||

| TMUS / T-Mobile US, Inc. | Short | -0.16 | 42.78 | -38.73 | 27.56 | -1.3396 | -0.0605 | ||

| CRM / Salesforce, Inc. | Short | -0.19 | 45.19 | -53.16 | 47.53 | -1.8389 | -0.3209 | ||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | Short | -0.09 | -70.70 | -2.4456 | -2.4456 | ||||

| TSLA / Tesla, Inc. | Short | -0.39 | 37.07 | -123.08 | 68.01 | -4.2573 | -1.1712 |