Statistik Asas

| Nilai Portfolio | $ 203,587,987 |

| Kedudukan Semasa | 154 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

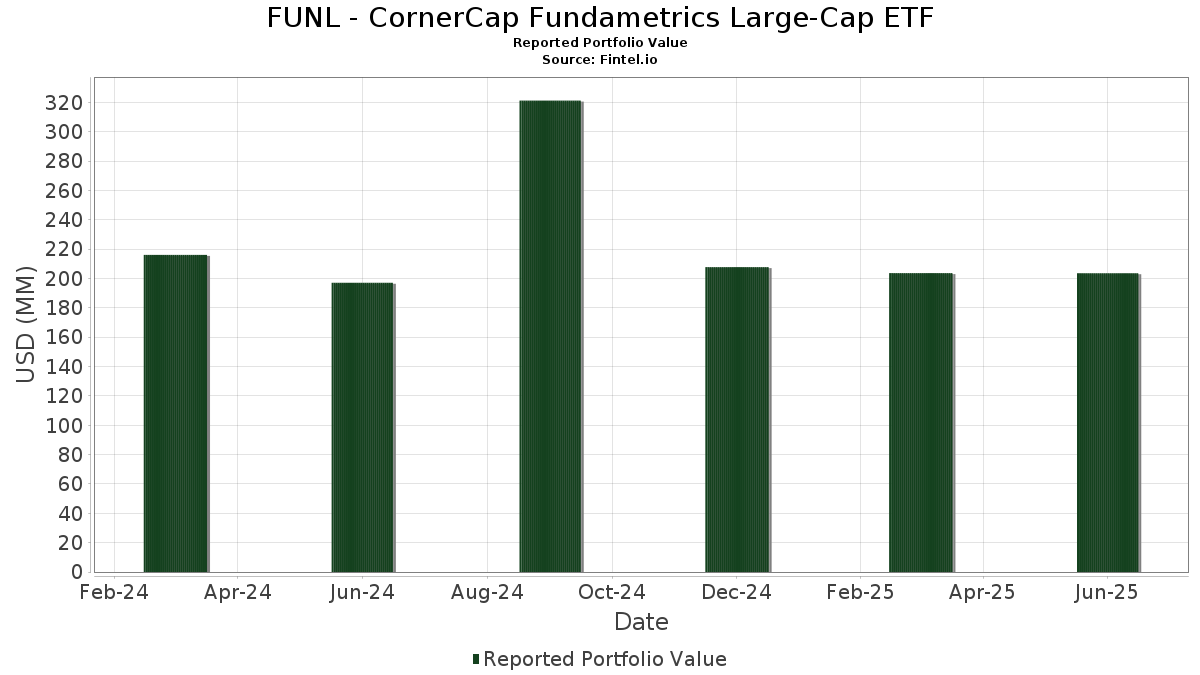

FUNL - CornerCap Fundametrics Large-Cap ETF telah mendedahkan 154 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 203,587,987 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas FUNL - CornerCap Fundametrics Large-Cap ETF ialah Johnson & Johnson (US:JNJ) , First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , Wells Fargo & Company (US:WFC) , Cisco Systems, Inc. (US:CSCO) , and The Walt Disney Company (US:DIS) . Kedudukan baharu FUNL - CornerCap Fundametrics Large-Cap ETF termasuk GE HealthCare Technologies Inc. (US:GEHC) , PPL Corporation (US:PPL) , PepsiCo, Inc. (US:PEP) , Lennar Corporation (US:LEN) , and Xcel Energy Inc. (US:XEL) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 7.88 | 7.88 | 4.0202 | 4.0202 | |

| 3.69 | 3.69 | 1.8838 | 1.6086 | |

| 0.02 | 1.59 | 0.8093 | 0.8093 | |

| 0.04 | 1.51 | 0.7688 | 0.7688 | |

| 0.01 | 1.49 | 0.7581 | 0.7581 | |

| 0.01 | 1.44 | 0.7366 | 0.7366 | |

| 0.02 | 1.38 | 0.7031 | 0.7031 | |

| 0.00 | 1.00 | 0.5084 | 0.5084 | |

| 0.00 | 0.91 | 0.4656 | 0.4656 | |

| 0.01 | 1.74 | 0.8867 | 0.4285 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.75 | 0.3838 | -0.4329 | |

| 0.00 | 2.40 | 1.2231 | -0.3482 | |

| 0.04 | 1.78 | 0.9061 | -0.3443 | |

| 0.02 | 1.41 | 0.7191 | -0.3083 | |

| 0.03 | 2.35 | 1.1971 | -0.2696 | |

| 0.03 | 1.33 | 0.6803 | -0.2667 | |

| 0.02 | 3.73 | 1.9011 | -0.2582 | |

| 0.02 | 1.03 | 0.5234 | -0.2461 | |

| 0.01 | 1.92 | 0.9815 | -0.2193 | |

| 0.02 | 1.93 | 0.9825 | -0.1843 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-29 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Mount Vernon Liquid Assets Portfolio, LLC / STIV (N/A) | 7.88 | 7.88 | 4.0202 | 4.0202 | |||||

| JNJ / Johnson & Johnson | 0.02 | -2.22 | 3.73 | -9.94 | 1.9011 | -0.2582 | |||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 3.69 | 589.67 | 3.69 | 589.91 | 1.8838 | 1.6086 | |||

| WFC / Wells Fargo & Company | 0.04 | -13.85 | 3.50 | -3.85 | 1.7844 | -0.1142 | |||

| CSCO / Cisco Systems, Inc. | 0.05 | -2.26 | 3.45 | 9.87 | 1.7611 | 0.1217 | |||

| DIS / The Walt Disney Company | 0.02 | -2.30 | 2.85 | 22.76 | 1.4560 | 0.2426 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -20.62 | 2.48 | -6.21 | 1.2635 | -0.1143 | |||

| META / Meta Platforms, Inc. | 0.00 | -37.82 | 2.40 | -20.37 | 1.2231 | -0.3482 | |||

| COP / ConocoPhillips | 0.03 | -2.29 | 2.35 | -16.52 | 1.1971 | -0.2696 | |||

| C / Citigroup Inc. | 0.03 | -13.09 | 2.31 | 4.19 | 1.1803 | 0.0217 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -1.55 | 2.20 | 23.68 | 1.1227 | 0.1943 | |||

| SCHW / The Charles Schwab Corporation | 0.02 | -2.10 | 2.10 | 14.11 | 1.0696 | 0.1107 | |||

| ABBV / AbbVie Inc. | 0.01 | 21.67 | 2.01 | 7.82 | 1.0281 | 0.0524 | |||

| CVS / CVS Health Corporation | 0.03 | -2.00 | 2.01 | -0.25 | 1.0242 | -0.0259 | |||

| VST / Vistra Corp. | 0.01 | -32.81 | 1.97 | 10.87 | 1.0051 | 0.0778 | |||

| MRK / Merck & Co., Inc. | 0.02 | -2.33 | 1.93 | -13.83 | 0.9825 | -0.1843 | |||

| CVX / Chevron Corporation | 0.01 | -2.31 | 1.92 | -16.39 | 0.9815 | -0.2193 | |||

| CMCSA / Comcast Corporation | 0.05 | -2.45 | 1.85 | -5.65 | 0.9460 | -0.0796 | |||

| HCA / HCA Healthcare, Inc. | 0.00 | -2.13 | 1.78 | 8.48 | 0.9083 | 0.0520 | |||

| BMY / Bristol-Myers Squibb Company | 0.04 | -2.33 | 1.78 | -25.89 | 0.9061 | -0.3443 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 43.33 | 1.74 | 98.06 | 0.8867 | 0.4285 | |||

| MA / Mastercard Incorporated | 0.00 | -0.87 | 1.74 | 1.64 | 0.8856 | -0.0058 | |||

| NTRS / Northern Trust Corporation | 0.01 | -17.63 | 1.72 | 5.83 | 0.8803 | 0.0297 | |||

| V / Visa Inc. | 0.00 | -2.12 | 1.72 | -0.86 | 0.8781 | -0.0278 | |||

| NEM / Newmont Corporation | 0.03 | -2.24 | 1.71 | 18.00 | 0.8733 | 0.1160 | |||

| RF / Regions Financial Corporation | 0.07 | -2.27 | 1.70 | 5.78 | 0.8685 | 0.0286 | |||

| TFC / Truist Financial Corporation | 0.04 | -2.25 | 1.67 | 2.08 | 0.8526 | -0.0015 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.01 | -2.14 | 1.67 | 0.36 | 0.8513 | -0.0166 | |||

| MSFT / Microsoft Corporation | 0.00 | -2.37 | 1.66 | 29.34 | 0.8486 | 0.1776 | |||

| LDOS / Leidos Holdings, Inc. | 0.01 | -2.22 | 1.65 | 14.32 | 0.8437 | 0.0887 | |||

| MO / Altria Group, Inc. | 0.03 | -2.18 | 1.62 | -4.42 | 0.8284 | -0.0584 | |||

| GOOGL / Alphabet Inc. | 0.01 | -2.28 | 1.60 | 11.40 | 0.8176 | 0.0666 | |||

| BAC / Bank of America Corporation | 0.03 | -2.39 | 1.60 | 10.71 | 0.8176 | 0.0620 | |||

| SPGI / S&P Global Inc. | 0.00 | -2.23 | 1.60 | 1.46 | 0.8148 | -0.0067 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | -2.35 | 1.59 | 24.63 | 0.8136 | 0.1458 | |||

| FNF / Fidelity National Financial, Inc. | 0.03 | -2.07 | 1.59 | -15.61 | 0.8110 | -0.1725 | |||

| PM / Philip Morris International Inc. | 0.01 | -24.79 | 1.59 | -13.71 | 0.8096 | -0.1501 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.02 | 1.59 | 0.8093 | 0.8093 | |||||

| LRCX / Lam Research Corporation | 0.02 | -2.54 | 1.58 | 30.50 | 0.8079 | 0.1746 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | -2.09 | 1.58 | -12.54 | 0.8046 | -0.1364 | |||

| EA / Electronic Arts Inc. | 0.01 | -2.25 | 1.57 | 8.04 | 0.8025 | 0.0425 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | -2.19 | 1.57 | -3.21 | 0.8005 | -0.0457 | |||

| MCO / Moody's Corporation | 0.00 | 89.34 | 1.57 | 104.04 | 0.8002 | 0.3988 | |||

| SYY / Sysco Corporation | 0.02 | -2.22 | 1.55 | -1.34 | 0.7903 | -0.0289 | |||

| MMM / 3M Company | 0.01 | -18.16 | 1.54 | -15.19 | 0.7867 | -0.1619 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.02 | 71.22 | 1.54 | 69.72 | 0.7843 | 0.3116 | |||

| CAT / Caterpillar Inc. | 0.00 | -2.40 | 1.53 | 14.88 | 0.7806 | 0.0855 | |||

| ELV / Elevance Health, Inc. | 0.00 | -2.10 | 1.53 | -12.45 | 0.7791 | -0.1312 | |||

| TRV / The Travelers Companies, Inc. | 0.01 | -17.90 | 1.52 | -16.94 | 0.7759 | -0.1798 | |||

| RTX / RTX Corporation | 0.01 | -21.08 | 1.51 | -12.98 | 0.7703 | -0.1355 | |||

| PPL / PPL Corporation | 0.04 | 1.51 | 0.7688 | 0.7688 | |||||

| MET / MetLife, Inc. | 0.02 | -2.28 | 1.50 | -2.09 | 0.7656 | -0.0346 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.01 | 85.98 | 1.49 | 86.50 | 0.7616 | 0.3437 | |||

| PEP / PepsiCo, Inc. | 0.01 | 1.49 | 0.7581 | 0.7581 | |||||

| DUK / Duke Energy Corporation | 0.01 | -2.19 | 1.48 | -5.36 | 0.7568 | -0.0614 | |||

| ADBE / Adobe Inc. | 0.00 | -2.23 | 1.48 | -1.40 | 0.7546 | -0.0281 | |||

| WDAY / Workday, Inc. | 0.01 | 124.33 | 1.47 | 130.61 | 0.7498 | 0.4171 | |||

| PFE / Pfizer Inc. | 0.06 | -2.28 | 1.46 | -6.53 | 0.7457 | -0.0704 | |||

| WTY / Willis Towers Watson Public Limited Company | 0.00 | -2.08 | 1.45 | -11.18 | 0.7422 | -0.1128 | |||

| CSA / Accenture plc | 0.00 | -2.24 | 1.45 | -6.40 | 0.7399 | -0.0684 | |||

| LEN / Lennar Corporation | 0.01 | 1.44 | 0.7366 | 0.7366 | |||||

| EXPE / Expedia Group, Inc. | 0.01 | -10.60 | 1.43 | -10.33 | 0.7317 | -0.1027 | |||

| CTRA / Coterra Energy Inc. | 0.06 | -2.22 | 1.43 | -14.15 | 0.7313 | -0.1399 | |||

| SLB / Schlumberger Limited | 0.04 | 10.56 | 1.43 | -10.58 | 0.7289 | -0.1052 | |||

| DVN / Devon Energy Corporation | 0.04 | 44.28 | 1.42 | 22.69 | 0.7260 | 0.1208 | |||

| ZM / Zoom Communications Inc. | 0.02 | -2.36 | 1.42 | 3.27 | 0.7247 | 0.0064 | |||

| USB / U.S. Bancorp | 0.03 | -2.42 | 1.41 | 4.59 | 0.7215 | 0.0157 | |||

| EBAY / eBay Inc. | 0.02 | -34.87 | 1.41 | -28.37 | 0.7191 | -0.3083 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -2.13 | 1.38 | 1.47 | 0.7058 | -0.0058 | |||

| XEL / Xcel Energy Inc. | 0.02 | 1.38 | 0.7031 | 0.7031 | |||||

| TXT / Textron Inc. | 0.02 | -2.49 | 1.37 | 8.37 | 0.7008 | 0.0392 | |||

| MSCI / MSCI Inc. | 0.00 | -2.22 | 1.37 | -0.29 | 0.6990 | -0.0181 | |||

| TEAM / Atlassian Corporation | 0.01 | -2.30 | 1.36 | -6.52 | 0.6955 | -0.0654 | |||

| CSX / CSX Corporation | 0.04 | -2.49 | 1.34 | 8.06 | 0.6842 | 0.0368 | |||

| VZ / Verizon Communications Inc. | 0.03 | -22.96 | 1.33 | -26.52 | 0.6803 | -0.2667 | |||

| CI / The Cigna Group | 0.00 | -2.30 | 1.32 | -1.86 | 0.6742 | -0.0283 | |||

| TROW / T. Rowe Price Group, Inc. | 0.01 | -2.47 | 1.30 | 2.52 | 0.6650 | 0.0010 | |||

| EOG / EOG Resources, Inc. | 0.01 | -2.39 | 1.30 | -8.97 | 0.6633 | -0.0820 | |||

| NTAP / NetApp, Inc. | 0.01 | -2.64 | 1.30 | 18.16 | 0.6611 | 0.0884 | |||

| OXY / Occidental Petroleum Corporation | 0.03 | -2.35 | 1.29 | -16.90 | 0.6600 | -0.1524 | |||

| KHC / The Kraft Heinz Company | 0.05 | -2.22 | 1.29 | -17.05 | 0.6583 | -0.1534 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | -2.50 | 1.27 | 1.12 | 0.6463 | -0.0078 | |||

| GIS / General Mills, Inc. | 0.02 | -2.25 | 1.26 | -15.35 | 0.6419 | -0.1334 | |||

| PFG / Principal Financial Group, Inc. | 0.02 | -2.41 | 1.25 | -8.14 | 0.6397 | -0.0726 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | -2.30 | 1.22 | -11.43 | 0.6213 | -0.0963 | |||

| CRM / Salesforce, Inc. | 0.00 | -2.43 | 1.21 | -0.90 | 0.6200 | -0.0197 | |||

| MAS / Masco Corporation | 0.02 | -2.46 | 1.21 | -9.72 | 0.6160 | -0.0820 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -2.19 | 1.19 | -20.35 | 0.6098 | -0.1729 | |||

| FDX / FedEx Corporation | 0.01 | -2.49 | 1.15 | -9.11 | 0.5862 | -0.0733 | |||

| AVY / Avery Dennison Corporation | 0.01 | -2.51 | 1.13 | -3.91 | 0.5774 | -0.0371 | |||

| UPS / United Parcel Service, Inc. | 0.01 | -2.60 | 1.03 | -10.69 | 0.5251 | -0.0758 | |||

| FTV / Fortive Corporation | 0.02 | -2.33 | 1.03 | -30.46 | 0.5234 | -0.2461 | |||

| HOLX / Hologic, Inc. | 0.02 | -2.79 | 1.02 | 2.51 | 0.5218 | 0.0013 | |||

| ETR / Entergy Corporation | 0.01 | -1.96 | 1.01 | -4.62 | 0.5161 | -0.0378 | |||

| AMAT / Applied Materials, Inc. | 0.01 | -3.04 | 1.01 | 22.28 | 0.5156 | 0.0844 | |||

| CEG / Constellation Energy Corporation | 0.00 | -2.35 | 1.01 | 56.45 | 0.5134 | 0.1774 | |||

| Aptiv PLC / EC (JE00BTDN8H13) | 0.01 | -2.15 | 1.00 | 12.09 | 0.5113 | 0.0451 | |||

| COF / Capital One Financial Corporation | 0.00 | 1.00 | 0.5084 | 0.5084 | |||||

| BIIB / Biogen Inc. | 0.01 | -2.68 | 0.99 | -10.64 | 0.5060 | -0.0735 | |||

| VEEV / Veeva Systems Inc. | 0.00 | -2.21 | 0.97 | 21.64 | 0.4938 | 0.0783 | |||

| CTVA / Corteva, Inc. | 0.01 | -2.17 | 0.95 | 15.94 | 0.4865 | 0.0570 | |||

| KR / The Kroger Co. | 0.01 | -2.03 | 0.94 | 3.85 | 0.4820 | 0.0071 | |||

| TGT / Target Corporation | 0.01 | -2.80 | 0.94 | -8.08 | 0.4818 | -0.0546 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.00 | -2.12 | 0.92 | 13.05 | 0.4687 | 0.0444 | |||

| ZBRA / Zebra Technologies Corporation | 0.00 | 0.91 | 0.4656 | 0.4656 | |||||

| MS / Morgan Stanley | 0.01 | -2.27 | 0.90 | 18.05 | 0.4574 | 0.0608 | |||

| TJX / The TJX Companies, Inc. | 0.01 | -2.04 | 0.87 | -0.68 | 0.4448 | -0.0133 | |||

| PNR / Pentair plc | 0.01 | -2.28 | 0.85 | 14.61 | 0.4327 | 0.0467 | |||

| TER / Teradyne, Inc. | 0.01 | 60.85 | 0.82 | 75.21 | 0.4190 | 0.1742 | |||

| NI / NiSource Inc. | 0.02 | -2.18 | 0.81 | -1.58 | 0.4140 | -0.0163 | |||

| NOW / ServiceNow, Inc. | 0.00 | -2.11 | 0.81 | 26.41 | 0.4129 | 0.0787 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | 0.81 | 0.4109 | 0.4109 | |||||

| TE Connectivity PLC / EC (IE000IVNQZ81) | 0.00 | -2.32 | 0.80 | 16.59 | 0.4089 | 0.0501 | |||

| CRBG / Corebridge Financial, Inc. | 0.02 | -2.36 | 0.80 | 9.92 | 0.4073 | 0.0278 | |||

| HON / Honeywell International Inc. | 0.00 | -2.21 | 0.80 | 7.58 | 0.4059 | 0.0198 | |||

| D / Dominion Energy, Inc. | 0.01 | -2.21 | 0.78 | -1.39 | 0.3987 | -0.0150 | |||

| DD / DuPont de Nemours, Inc. | 0.01 | 27.97 | 0.77 | 17.50 | 0.3943 | 0.0511 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.77 | 0.3912 | 0.3912 | |||||

| EVRG / Evergy, Inc. | 0.01 | -2.19 | 0.76 | -2.31 | 0.3893 | -0.0180 | |||

| FI / Fiserv, Inc. | 0.00 | 0.76 | 0.3872 | 0.3872 | |||||

| CMI / Cummins Inc. | 0.00 | -2.20 | 0.76 | 2.30 | 0.3864 | -0.0004 | |||

| DOV / Dover Corporation | 0.00 | -53.91 | 0.75 | -51.98 | 0.3838 | -0.4329 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.01 | -2.29 | 0.74 | -0.27 | 0.3769 | -0.0100 | |||

| APP / AppLovin Corporation | 0.00 | -31.32 | 0.74 | -9.25 | 0.3757 | -0.0478 | |||

| LAMR / Lamar Advertising Company | 0.01 | -2.25 | 0.72 | 4.34 | 0.3681 | 0.0069 | |||

| WPC / W. P. Carey Inc. | 0.01 | -2.25 | 0.72 | -3.38 | 0.3652 | -0.0215 | |||

| AIG / American International Group, Inc. | 0.01 | -2.24 | 0.71 | -3.78 | 0.3642 | -0.0229 | |||

| LYB / LyondellBasell Industries N.V. | 0.01 | -3.09 | 0.71 | -20.41 | 0.3606 | -0.1025 | |||

| FR / First Industrial Realty Trust, Inc. | 0.01 | -2.24 | 0.68 | -12.80 | 0.3478 | -0.0602 | |||

| NNN / NNN REIT, Inc. | 0.02 | -2.32 | 0.68 | -1.02 | 0.3456 | -0.0119 | |||

| TSN / Tyson Foods, Inc. | 0.01 | -2.21 | 0.67 | -14.36 | 0.3443 | -0.0666 | |||

| O / Realty Income Corporation | 0.01 | -2.30 | 0.66 | -3.07 | 0.3382 | -0.0184 | |||

| HD / The Home Depot, Inc. | 0.00 | -2.38 | 0.66 | -2.36 | 0.3381 | -0.0160 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.00 | -2.20 | 0.65 | -13.65 | 0.3296 | -0.0607 | |||

| MDT / Medtronic plc | 0.01 | -2.38 | 0.63 | -5.40 | 0.3224 | -0.0259 | |||

| ELS / Equity LifeStyle Properties, Inc. | 0.01 | -2.26 | 0.63 | -9.74 | 0.3219 | -0.0425 | |||

| MPC / Marathon Petroleum Corporation | 0.00 | -2.70 | 0.61 | 10.91 | 0.3117 | 0.0243 | |||

| NBIX / Neurocrine Biosciences, Inc. | 0.00 | -2.68 | 0.61 | 10.51 | 0.3117 | 0.0234 | |||

| PINS / Pinterest, Inc. | 0.02 | -2.81 | 0.60 | 12.50 | 0.3081 | 0.0278 | |||

| GLPI / Gaming and Leisure Properties, Inc. | 0.01 | -2.31 | 0.60 | -10.43 | 0.3070 | -0.0435 | |||

| CUBE / CubeSmart | 0.01 | -2.45 | 0.60 | -2.93 | 0.3046 | -0.0164 | |||

| VNX / NXP Semiconductors N.V. | 0.00 | -2.60 | 0.58 | 11.95 | 0.2967 | 0.0256 | |||

| SBAC / SBA Communications Corporation | 0.00 | -2.42 | 0.58 | 4.15 | 0.2947 | 0.0053 | |||

| HST / Host Hotels & Resorts, Inc. | 0.04 | -2.63 | 0.56 | 5.25 | 0.2864 | 0.0080 | |||

| OC / Owens Corning | 0.00 | -2.56 | 0.52 | -6.27 | 0.2674 | -0.0241 | |||

| BBY / Best Buy Co., Inc. | 0.01 | -2.65 | 0.52 | -11.22 | 0.2664 | -0.0406 | |||

| AKAM / Akamai Technologies, Inc. | 0.01 | -2.79 | 0.46 | -3.77 | 0.2351 | -0.0146 | |||

| CAG / Conagra Brands, Inc. | 0.02 | -2.50 | 0.44 | -25.08 | 0.2256 | -0.0828 | |||

| AMT / American Tower Corporation | 0.00 | 0.38 | 0.1929 | 0.1929 | |||||

| VICI / VICI Properties Inc. | 0.01 | -2.21 | 0.37 | -2.14 | 0.1870 | -0.0087 | |||

| EQIX / Equinix, Inc. | 0.00 | 0.32 | 0.1640 | 0.1640 | |||||

| ADC / Agree Realty Corporation | 0.00 | -2.23 | 0.32 | -7.25 | 0.1633 | -0.0172 | |||

| RAL / Ralliant Corporation | 0.01 | 0.32 | 0.1623 | 0.1623 | |||||

| KIM / Kimco Realty Corporation | 0.01 | -2.39 | 0.31 | -3.38 | 0.1604 | -0.0095 |