Statistik Asas

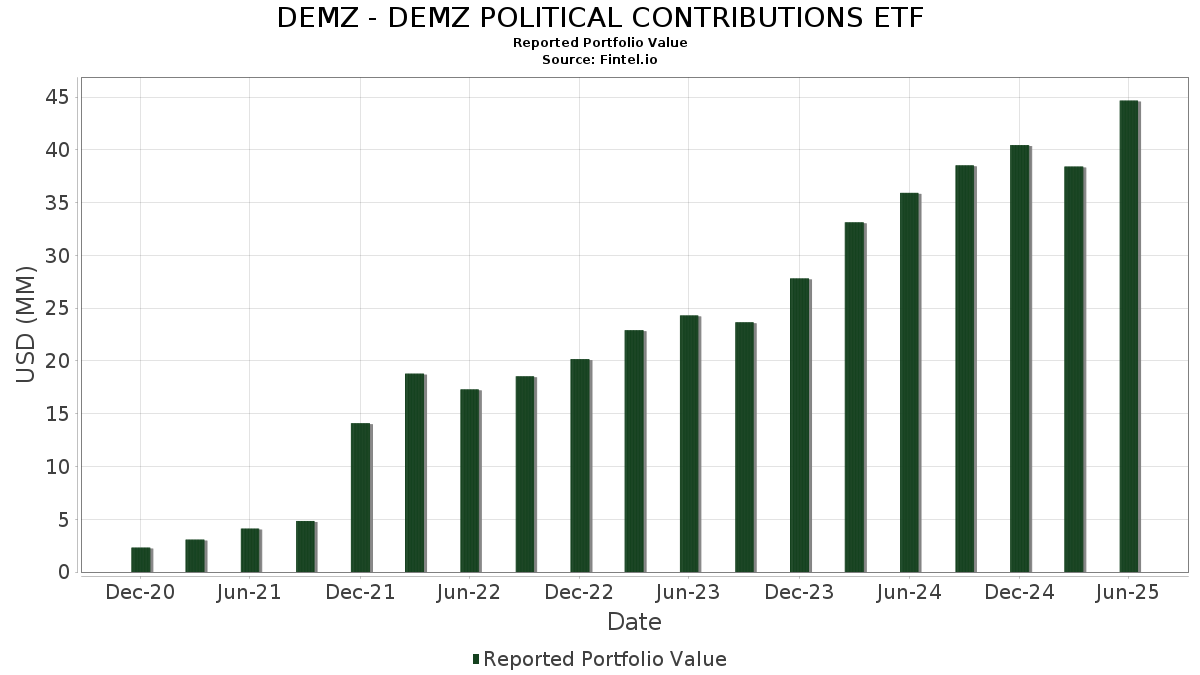

| Nilai Portfolio | $ 44,669,117 |

| Kedudukan Semasa | 48 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

DEMZ - DEMZ POLITICAL CONTRIBUTIONS ETF telah mendedahkan 48 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 44,669,117 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas DEMZ - DEMZ POLITICAL CONTRIBUTIONS ETF ialah NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Meta Platforms, Inc. (US:META) , and Loews Corporation (US:L) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 1.27 | 2.8316 | 0.9420 | |

| 0.00 | 1.11 | 2.4743 | 0.7952 | |

| 0.01 | 0.91 | 2.0319 | 0.7516 | |

| 0.00 | 0.79 | 1.7627 | 0.7419 | |

| 0.01 | 2.37 | 5.2823 | 0.6964 | |

| 0.00 | 0.85 | 1.9067 | 0.6859 | |

| 0.00 | 1.47 | 3.2856 | 0.6850 | |

| 0.00 | 2.20 | 4.9023 | 0.6074 | |

| 0.01 | 1.09 | 2.4297 | 0.5744 | |

| 0.01 | 0.91 | 2.0274 | 0.5326 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 1.50 | 3.3505 | -1.3243 | |

| 0.00 | 1.30 | 2.8959 | -1.2179 | |

| 0.00 | 0.21 | 0.4733 | -1.0454 | |

| 0.00 | 0.21 | 0.4668 | -1.0222 | |

| 0.01 | 1.47 | 3.2895 | -0.8749 | |

| 0.02 | 1.79 | 3.9863 | -0.7870 | |

| 0.00 | 1.24 | 2.7726 | -0.7313 | |

| 0.00 | 0.23 | 0.5025 | -0.5345 | |

| 0.00 | 0.10 | 0.2263 | -0.5178 | |

| 0.01 | 0.46 | 1.0359 | -0.4460 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-28 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.01 | -8.07 | 2.37 | 34.05 | 5.2823 | 0.6964 | |||

| MSFT / Microsoft Corporation | 0.00 | -8.77 | 2.26 | 20.85 | 5.0361 | 0.1893 | |||

| AAPL / Apple Inc. | 0.01 | 21.39 | 2.24 | 12.14 | 4.9932 | -0.1878 | |||

| META / Meta Platforms, Inc. | 0.00 | 3.69 | 2.20 | 32.79 | 4.9023 | 0.6074 | |||

| L / Loews Corporation | 0.02 | -2.58 | 1.79 | -2.83 | 3.9863 | -0.7870 | |||

| COST / Costco Wholesale Corporation | 0.00 | -20.34 | 1.50 | -16.62 | 3.3505 | -1.3243 | |||

| APH / Amphenol Corporation | 0.01 | -38.96 | 1.47 | -8.11 | 3.2895 | -0.8749 | |||

| MCO / Moody's Corporation | 0.00 | 36.47 | 1.47 | 46.95 | 3.2856 | 0.6850 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | -18.87 | 1.30 | -18.07 | 2.8959 | -1.2179 | |||

| LRCX / Lam Research Corporation | 0.01 | 30.21 | 1.27 | 74.42 | 2.8316 | 0.9420 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.88 | 1.25 | 19.58 | 2.7970 | 0.0760 | |||

| SYK / Stryker Corporation | 0.00 | -13.38 | 1.24 | -8.01 | 2.7726 | -0.7313 | |||

| KLAC / KLA Corporation | 0.00 | -1.16 | 1.22 | 30.28 | 2.7297 | 0.2913 | |||

| GOOGL / Alphabet Inc. | 0.01 | 6.84 | 1.20 | 21.87 | 2.6746 | 0.1189 | |||

| NOW / ServiceNow, Inc. | 0.00 | 32.76 | 1.11 | 71.52 | 2.4743 | 0.7952 | |||

| GOOG / Alphabet Inc. | 0.01 | 34.19 | 1.09 | 52.38 | 2.4297 | 0.5744 | |||

| EG / Everest Group, Ltd. | 0.00 | 31.81 | 1.09 | 23.30 | 2.4241 | 0.1366 | |||

| KIM / Kimco Realty Corporation | 0.05 | 0.41 | 1.09 | -0.64 | 2.4241 | -0.4140 | |||

| NFLX / Netflix, Inc. | 0.00 | -4.96 | 1.08 | 36.55 | 2.4037 | 0.3546 | |||

| XYL / Xylem Inc. | 0.01 | 9.63 | 0.99 | 18.66 | 2.2168 | 0.0443 | |||

| PAYX / Paychex, Inc. | 0.01 | 21.37 | 0.93 | 14.46 | 2.0677 | -0.0345 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 33.68 | 0.91 | 84.96 | 2.0319 | 0.7516 | |||

| DIS / The Walt Disney Company | 0.01 | 25.59 | 0.91 | 57.91 | 2.0274 | 0.5326 | |||

| CRM / Salesforce, Inc. | 0.00 | 34.19 | 0.89 | 36.46 | 1.9810 | 0.2907 | |||

| NDSN / Nordson Corporation | 0.00 | 70.99 | 0.85 | 81.70 | 1.9067 | 0.6859 | |||

| DHR / Danaher Corporation | 0.00 | 31.16 | 0.84 | 26.48 | 1.8677 | 0.1484 | |||

| MSCI / MSCI Inc. | 0.00 | 96.98 | 0.79 | 100.76 | 1.7627 | 0.7419 | |||

| VLTO / Veralto Corporation | 0.01 | 30.44 | 0.78 | 35.13 | 1.7347 | 0.2411 | |||

| AMT / American Tower Corporation | 0.00 | -3.70 | 0.77 | -2.16 | 1.7226 | -0.3262 | |||

| AVY / Avery Dennison Corporation | 0.00 | 13.10 | 0.74 | 11.56 | 1.6602 | -0.0718 | |||

| ANET / Arista Networks Inc | 0.01 | -3.49 | 0.70 | 27.29 | 1.5537 | 0.1353 | |||

| RL / Ralph Lauren Corporation | 0.00 | -6.48 | 0.67 | 16.17 | 1.4929 | -0.0018 | |||

| ROST / Ross Stores, Inc. | 0.00 | 59.82 | 0.62 | 59.49 | 1.3902 | 0.3766 | |||

| SNPS / Synopsys, Inc. | 0.00 | 66.46 | 0.56 | 99.29 | 1.2556 | 0.5216 | |||

| OMC / Omnicom Group Inc. | 0.01 | 60.95 | 0.55 | 39.80 | 1.2248 | 0.2045 | |||

| CDNS / Cadence Design Systems, Inc. | 0.00 | 50.81 | 0.54 | 82.83 | 1.2129 | 0.4407 | |||

| TPR / Tapestry, Inc. | 0.01 | -34.79 | 0.46 | -18.77 | 1.0359 | -0.4460 | |||

| HSIC / Henry Schein, Inc. | 0.01 | -9.39 | 0.45 | -3.25 | 0.9965 | -0.2031 | |||

| KMX / CarMax, Inc. | 0.01 | 20.82 | 0.44 | 4.26 | 0.9858 | -0.1147 | |||

| A / Agilent Technologies, Inc. | 0.00 | 13.77 | 0.43 | 14.67 | 0.9622 | -0.0132 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | 17.53 | 0.33 | 50.23 | 0.7353 | 0.1650 | |||

| EA / Electronic Arts Inc. | 0.00 | 5.85 | 0.23 | 17.26 | 0.5159 | 0.0028 | |||

| ADSK / Autodesk, Inc. | 0.00 | -52.33 | 0.23 | -43.61 | 0.5025 | -0.5345 | |||

| CDW / CDW Corporation | 0.00 | 7.90 | 0.22 | 20.11 | 0.4956 | 0.0161 | |||

| CL / Colgate-Palmolive Company | 0.00 | -62.63 | 0.21 | -63.87 | 0.4733 | -1.0454 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | -59.76 | 0.21 | -63.53 | 0.4668 | -1.0222 | |||

| IT / Gartner, Inc. | 0.00 | -57.92 | 0.11 | -59.54 | 0.2373 | -0.4440 | |||

| ADBE / Adobe Inc. | 0.00 | -64.93 | 0.10 | -64.69 | 0.2263 | -0.5178 |