Statistik Asas

| Nilai Portfolio | $ 146,538,559 |

| Kedudukan Semasa | 50 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

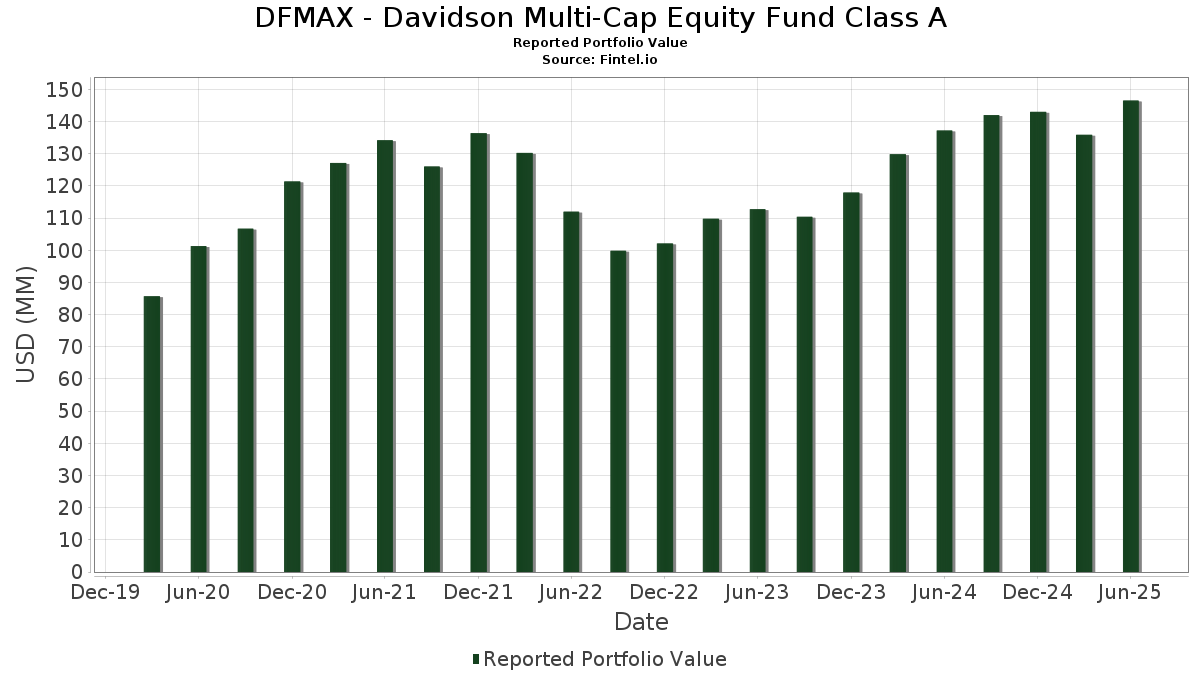

DFMAX - Davidson Multi-Cap Equity Fund Class A telah mendedahkan 50 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 146,538,559 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas DFMAX - Davidson Multi-Cap Equity Fund Class A ialah Microsoft Corporation (US:MSFT) , Amazon.com, Inc. (US:AMZN) , Alphabet Inc. (US:GOOG) , Apple Inc. (US:AAPL) , and Broadcom Inc. (US:AVGO) . Kedudukan baharu DFMAX - Davidson Multi-Cap Equity Fund Class A termasuk BellRing Brands, Inc. (US:BRBR) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 2.07 | 1.4153 | 1.4153 | |

| 0.02 | 4.42 | 3.0141 | 1.0077 | |

| 0.01 | 7.43 | 5.0695 | 0.8767 | |

| 0.01 | 3.04 | 2.0757 | 0.8579 | |

| 0.00 | 3.26 | 2.2280 | 0.7307 | |

| 0.02 | 3.87 | 2.6422 | 0.6558 | |

| 0.01 | 4.22 | 2.8834 | 0.4444 | |

| 0.03 | 3.44 | 2.3505 | 0.3997 | |

| 0.00 | 3.81 | 2.5985 | 0.3786 | |

| 0.01 | 3.31 | 2.2622 | 0.3745 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 2.91 | 1.9885 | -0.9629 | |

| 0.03 | 5.41 | 3.6948 | -0.6891 | |

| 0.01 | 2.20 | 1.5033 | -0.6876 | |

| 0.79 | 0.79 | 0.5383 | -0.5100 | |

| 0.03 | 1.59 | 1.0839 | -0.4812 | |

| 0.01 | 3.23 | 2.2043 | -0.4265 | |

| 0.02 | 2.20 | 1.5005 | -0.4207 | |

| 0.01 | 2.68 | 1.8296 | -0.4150 | |

| 0.01 | 2.52 | 1.7229 | -0.3020 | |

| 0.01 | 2.60 | 1.7720 | -0.2874 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-14 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.01 | -1.57 | 7.43 | 30.44 | 5.0695 | 0.8767 | |||

| AMZN / Amazon.com, Inc. | 0.03 | -1.57 | 6.41 | 13.49 | 4.3778 | 0.2171 | |||

| GOOG / Alphabet Inc. | 0.03 | -1.57 | 5.76 | 11.75 | 3.9338 | 0.1369 | |||

| AAPL / Apple Inc. | 0.03 | -1.57 | 5.41 | -9.09 | 3.6948 | -0.6891 | |||

| AVGO / Broadcom Inc. | 0.02 | -1.57 | 4.42 | 62.08 | 3.0141 | 1.0077 | |||

| C / Citigroup Inc. | 0.05 | -1.57 | 4.28 | 18.01 | 2.9216 | 0.2513 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | -1.57 | 4.22 | 27.51 | 2.8834 | 0.4444 | |||

| NFLX / Netflix, Inc. | 0.00 | -18.01 | 4.07 | 17.75 | 2.7808 | 0.2332 | |||

| NVDA / NVIDIA Corporation | 0.02 | -1.57 | 3.87 | 43.49 | 2.6422 | 0.6558 | |||

| INTU / Intuit Inc. | 0.00 | -1.57 | 3.81 | 26.28 | 2.5985 | 0.3786 | |||

| V / Visa Inc. | 0.01 | -1.57 | 3.58 | -0.28 | 2.4433 | -0.1998 | |||

| RTX / RTX Corporation | 0.02 | -1.57 | 3.55 | 8.51 | 2.4205 | 0.0141 | |||

| ANET / Arista Networks Inc | 0.03 | -1.57 | 3.44 | 29.97 | 2.3505 | 0.3997 | |||

| ETN / Eaton Corporation plc | 0.01 | -1.57 | 3.31 | 29.26 | 2.2622 | 0.3745 | |||

| FTNT / Fortinet, Inc. | 0.03 | -1.57 | 3.28 | 8.10 | 2.2413 | 0.0048 | |||

| META / Meta Platforms, Inc. | 0.00 | 25.34 | 3.26 | 60.50 | 2.2280 | 0.7307 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | -1.57 | 3.23 | -9.60 | 2.2043 | -0.4265 | |||

| HON / Honeywell International Inc. | 0.01 | -1.57 | 3.07 | 8.26 | 2.0938 | 0.0074 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | 34.76 | 3.04 | 83.91 | 2.0757 | 0.8579 | |||

| WMT / Walmart Inc. | 0.03 | -34.75 | 2.91 | -27.35 | 1.9885 | -0.9629 | |||

| LH / Labcorp Holdings Inc. | 0.01 | -1.57 | 2.85 | 10.99 | 1.9440 | 0.0552 | |||

| DT / Dynatrace, Inc. | 0.05 | -1.57 | 2.81 | 15.26 | 1.9188 | 0.1229 | |||

| HD / The Home Depot, Inc. | 0.01 | -1.57 | 2.78 | -1.52 | 1.8981 | -0.1812 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | -1.57 | 2.68 | -12.07 | 1.8296 | -0.4150 | |||

| CRM / Salesforce, Inc. | 0.01 | -1.57 | 2.63 | 0.00 | 1.7960 | -0.1410 | |||

| PGR / The Progressive Corporation | 0.01 | -1.57 | 2.60 | -7.19 | 1.7720 | -0.2874 | |||

| GIL / Gildan Activewear Inc. | 0.05 | -1.57 | 2.55 | 9.59 | 1.7400 | 0.0275 | |||

| FDX / FedEx Corporation | 0.01 | -1.57 | 2.52 | -8.22 | 1.7229 | -0.3020 | |||

| CI / The Cigna Group | 0.01 | -1.57 | 2.49 | -1.11 | 1.6970 | -0.1539 | |||

| SLAB / Silicon Laboratories Inc. | 0.02 | -1.57 | 2.40 | 28.89 | 1.6360 | 0.2663 | |||

| AGNC / AGNC Investment Corp. | 0.26 | -1.57 | 2.38 | -5.56 | 1.6222 | -0.2311 | |||

| EOG / EOG Resources, Inc. | 0.02 | -1.57 | 2.35 | -8.20 | 1.6054 | -0.2809 | |||

| PYPL / PayPal Holdings, Inc. | 0.03 | -1.57 | 2.30 | 12.13 | 1.5717 | 0.0594 | |||

| STZ / Constellation Brands, Inc. | 0.01 | 29.31 | 2.27 | 14.62 | 1.5471 | 0.0912 | |||

| MDT / Medtronic plc | 0.03 | -1.57 | 2.23 | -4.54 | 1.5214 | -0.1974 | |||

| BDX / Becton, Dickinson and Company | 0.01 | -1.57 | 2.20 | -25.98 | 1.5033 | -0.6876 | |||

| CVX / Chevron Corporation | 0.02 | -1.57 | 2.20 | -15.75 | 1.5005 | -0.4207 | |||

| CTVA / Corteva, Inc. | 0.03 | -1.57 | 2.10 | 16.57 | 1.4315 | 0.1069 | |||

| BRBR / BellRing Brands, Inc. | 0.04 | 2.07 | 1.4153 | 1.4153 | |||||

| CPT / Camden Property Trust | 0.02 | -1.57 | 2.06 | -9.31 | 1.4036 | -0.2658 | |||

| OTIS / Otis Worldwide Corporation | 0.02 | -1.57 | 1.98 | -5.53 | 1.3517 | -0.1922 | |||

| EXC / Exelon Corporation | 0.04 | -1.57 | 1.88 | -7.27 | 1.2802 | -0.2088 | |||

| Aptiv PLC / EC (JE00BTDN8H13) | 0.03 | -1.57 | 1.87 | 12.85 | 1.2773 | 0.0564 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.03 | -1.57 | 1.79 | -6.42 | 1.2236 | -0.1869 | |||

| SRE / Sempra | 0.02 | -1.57 | 1.78 | 4.53 | 1.2140 | -0.0390 | |||

| CUBE / CubeSmart | 0.04 | -1.57 | 1.66 | -2.07 | 1.1303 | -0.1145 | |||

| BMY / Bristol-Myers Squibb Company | 0.03 | -1.57 | 1.59 | -25.32 | 1.0839 | -0.4812 | |||

| FUL / H.B. Fuller Company | 0.02 | -1.57 | 1.40 | 5.52 | 0.9523 | -0.0214 | |||

| WAFD / WaFd, Inc | 0.03 | -1.57 | 1.00 | 0.81 | 0.6803 | -0.0474 | |||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 0.79 | -44.61 | 0.79 | -44.62 | 0.5383 | -0.5100 |