Statistik Asas

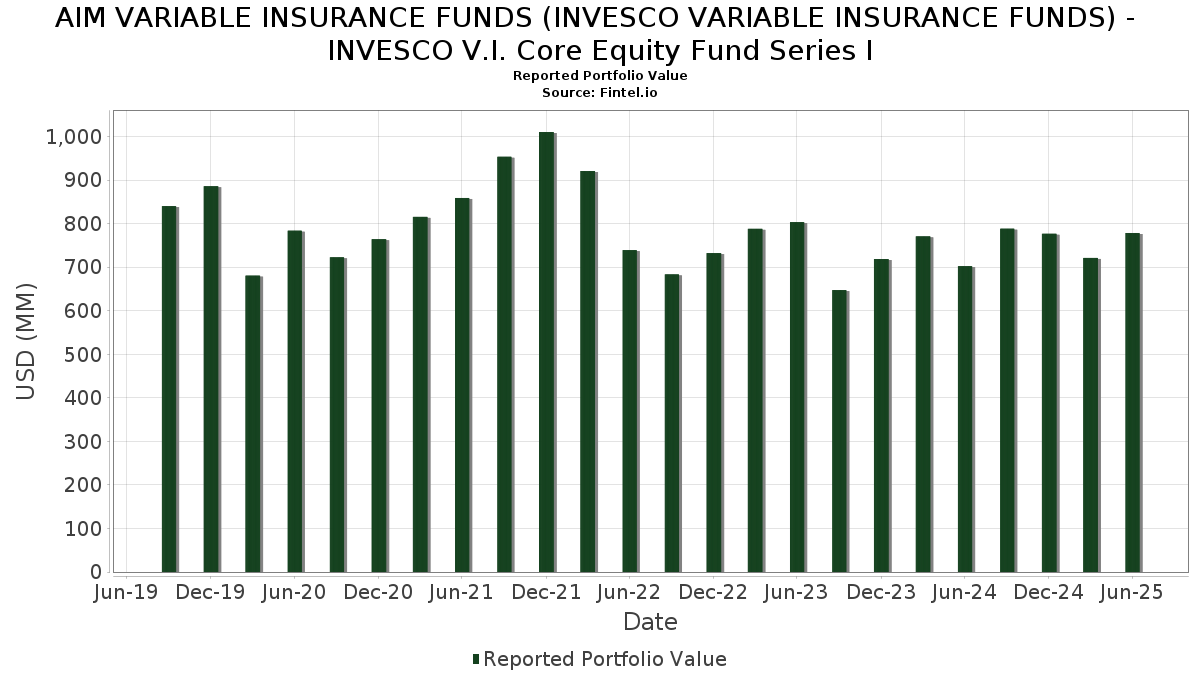

| Nilai Portfolio | $ 778,585,133 |

| Kedudukan Semasa | 72 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

AIM VARIABLE INSURANCE FUNDS (INVESCO VARIABLE INSURANCE FUNDS) - INVESCO V.I. Core Equity Fund Series I telah mendedahkan 72 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 778,585,133 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas AIM VARIABLE INSURANCE FUNDS (INVESCO VARIABLE INSURANCE FUNDS) - INVESCO V.I. Core Equity Fund Series I ialah Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Alphabet Inc. (US:GOOGL) . Kedudukan baharu AIM VARIABLE INSURANCE FUNDS (INVESCO VARIABLE INSURANCE FUNDS) - INVESCO V.I. Core Equity Fund Series I termasuk Oracle Corporation (US:ORCL) , The Trade Desk, Inc. (US:TTD) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 15.75 | 15.75 | 2.0805 | 2.0805 | |

| 0.34 | 54.29 | 7.1730 | 1.8151 | |

| 0.17 | 29.14 | 3.8493 | 1.5726 | |

| 0.05 | 11.87 | 1.5681 | 1.5681 | |

| 0.12 | 60.15 | 7.9467 | 1.1719 | |

| 0.08 | 20.70 | 2.7351 | 1.0128 | |

| 6.07 | 6.07 | 0.8019 | 0.8019 | |

| 0.03 | 25.13 | 3.3200 | 0.6983 | |

| 0.05 | 3.70 | 0.4887 | 0.4887 | |

| 0.11 | 10.62 | 1.4031 | 0.4556 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.17 | 34.52 | 4.5609 | -1.3468 | |

| 0.02 | 7.46 | 0.9850 | -1.1729 | |

| 0.04 | 8.02 | 1.0599 | -1.1274 | |

| 0.02 | 6.50 | 0.8583 | -0.6076 | |

| 0.03 | 7.34 | 0.9693 | -0.5601 | |

| 0.02 | 3.45 | 0.4556 | -0.4902 | |

| 0.08 | 7.40 | 0.9777 | -0.4830 | |

| 0.04 | 3.93 | 0.5193 | -0.4430 | |

| 3.54 | 3.54 | 0.4676 | -0.4369 | |

| 0.08 | 11.02 | 1.4565 | -0.3964 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-27 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.12 | -6.30 | 60.15 | 24.15 | 7.9467 | 1.1719 | |||

| NVDA / NVIDIA Corporation | 0.34 | -2.79 | 54.29 | 41.70 | 7.1730 | 1.8151 | |||

| AAPL / Apple Inc. | 0.17 | -11.53 | 34.52 | -18.29 | 4.5609 | -1.3468 | |||

| AMZN / Amazon.com, Inc. | 0.16 | -2.80 | 34.52 | 12.09 | 4.5600 | 0.2540 | |||

| GOOGL / Alphabet Inc. | 0.17 | 57.03 | 29.14 | 78.96 | 3.8493 | 1.5726 | |||

| META / Meta Platforms, Inc. | 0.03 | 4.66 | 25.13 | 34.04 | 3.3200 | 0.6983 | |||

| JPM / JPMorgan Chase & Co. | 0.08 | -2.80 | 24.30 | 14.88 | 3.2101 | 0.2526 | |||

| AVGO / Broadcom Inc. | 0.08 | 2.10 | 20.70 | 68.09 | 2.7351 | 1.0128 | |||

| Invesco Private Prime Fund / STIV (N/A) | 15.75 | 15.75 | 2.0805 | 2.0805 | |||||

| WMT / Walmart Inc. | 0.15 | 1.41 | 14.20 | 12.95 | 1.8754 | 0.1180 | |||

| PG / The Procter & Gamble Company | 0.08 | -2.80 | 13.53 | -9.13 | 1.7879 | -0.2945 | |||

| SCHW / The Charles Schwab Corporation | 0.14 | -2.80 | 12.76 | 13.30 | 1.6861 | 0.1109 | |||

| LLY / Eli Lilly and Company | 0.02 | -7.69 | 12.29 | -12.88 | 1.6240 | -0.3489 | |||

| ORCL / Oracle Corporation | 0.05 | 11.87 | 1.5681 | 1.5681 | |||||

| PM / Philip Morris International Inc. | 0.06 | -14.62 | 11.25 | -2.03 | 1.4859 | -0.1195 | |||

| CVX / Chevron Corporation | 0.08 | -2.80 | 11.02 | -16.81 | 1.4565 | -0.3964 | |||

| BSX / Boston Scientific Corporation | 0.10 | -2.80 | 10.99 | 3.49 | 1.4523 | -0.0329 | |||

| WFC / Wells Fargo & Company | 0.13 | -2.80 | 10.75 | 8.48 | 1.4202 | 0.0346 | |||

| UBER / Uber Technologies, Inc. | 0.11 | 22.40 | 10.62 | 56.75 | 1.4031 | 0.4556 | |||

| TXN / Texas Instruments Incorporated | 0.05 | -2.80 | 10.60 | 12.31 | 1.4010 | 0.0806 | |||

| MCK / McKesson Corporation | 0.01 | -2.79 | 9.78 | 5.84 | 1.2927 | 0.0001 | |||

| MA / Mastercard Incorporated | 0.02 | -2.79 | 9.78 | -0.34 | 1.2918 | -0.0801 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.03 | -5.41 | 9.68 | 44.16 | 1.2792 | 0.3401 | |||

| EMR / Emerson Electric Co. | 0.07 | -2.80 | 9.55 | 18.20 | 1.2620 | 0.1320 | |||

| INTU / Intuit Inc. | 0.01 | -2.78 | 9.52 | 24.71 | 1.2576 | 0.1903 | |||

| AIG / American International Group, Inc. | 0.11 | -2.80 | 9.48 | -4.31 | 1.2521 | -0.1328 | |||

| CSCO / Cisco Systems, Inc. | 0.14 | -2.80 | 9.45 | 9.28 | 1.2491 | 0.0394 | |||

| LOW / Lowe's Companies, Inc. | 0.04 | -2.80 | 9.13 | -7.53 | 1.2068 | -0.1746 | |||

| CBOE / Cboe Global Markets, Inc. | 0.04 | 30.74 | 8.85 | 34.74 | 1.1689 | 0.2506 | |||

| AIR / Airbus SE | 0.04 | -11.21 | 8.70 | 5.48 | 1.1492 | -0.0039 | |||

| AJG / Arthur J. Gallagher & Co. | 0.03 | -2.80 | 8.63 | -9.86 | 1.1396 | -0.1987 | |||

| PLD / Prologis, Inc. | 0.08 | -2.80 | 8.27 | -8.60 | 1.0923 | -0.1725 | |||

| HWM / Howmet Aerospace Inc. | 0.04 | -19.02 | 8.08 | 16.18 | 1.0670 | 0.0950 | |||

| ROK / Rockwell Automation, Inc. | 0.02 | 18.18 | 8.03 | 51.93 | 1.0611 | 0.3219 | |||

| COF / Capital One Financial Corporation | 0.04 | -68.02 | 8.02 | -56.02 | 1.0599 | -1.1274 | |||

| AXP / American Express Company | 0.02 | -2.80 | 7.85 | 15.24 | 1.0373 | 0.0846 | |||

| BLK / BlackRock, Inc. | 0.01 | -2.79 | 7.72 | 7.77 | 1.0202 | 0.0182 | |||

| LONN / Lonza Group AG | 0.01 | -2.79 | 7.70 | 12.54 | 1.0172 | 0.0605 | |||

| JCI / Johnson Controls International plc | 0.07 | -2.80 | 7.48 | 28.16 | 0.9887 | 0.1721 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | -18.89 | 7.46 | -51.68 | 0.9850 | -1.1729 | |||

| CEG / Constellation Energy Corporation | 0.02 | -2.80 | 7.45 | 55.59 | 0.9845 | 0.3148 | |||

| PPL / PPL Corporation | 0.22 | -2.80 | 7.42 | -8.78 | 0.9801 | -0.1570 | |||

| COP / ConocoPhillips | 0.08 | -17.09 | 7.40 | -29.16 | 0.9777 | -0.4830 | |||

| LNG / Cheniere Energy, Inc. | 0.03 | 7.31 | 7.37 | 12.94 | 0.9733 | 0.0611 | |||

| NOW / ServiceNow, Inc. | 0.01 | -2.78 | 7.36 | 25.54 | 0.9728 | 0.1526 | |||

| MCD / McDonald's Corporation | 0.03 | -28.28 | 7.34 | -32.92 | 0.9693 | -0.5601 | |||

| CRH / CRH plc | 0.08 | -2.80 | 7.25 | 1.44 | 0.9577 | -0.0416 | |||

| MAR / Marriott International, Inc. | 0.03 | -12.28 | 6.94 | 0.61 | 0.9164 | -0.0477 | |||

| FI / Fiserv, Inc. | 0.04 | -2.80 | 6.82 | -24.11 | 0.9016 | -0.3559 | |||

| CRM / Salesforce, Inc. | 0.02 | -39.01 | 6.50 | -38.03 | 0.8583 | -0.6076 | |||

| THC / Tenet Healthcare Corporation | 0.04 | -2.80 | 6.39 | 27.19 | 0.8441 | 0.1417 | |||

| ACN / Accenture plc | 0.02 | -20.25 | 6.29 | -23.61 | 0.8314 | -0.3206 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.05 | -2.80 | 6.28 | -0.32 | 0.8294 | -0.0514 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.01 | 12.46 | 6.16 | 36.00 | 0.8142 | 0.1806 | |||

| MDT / Medtronic plc | 0.07 | -21.73 | 6.14 | -24.08 | 0.8108 | -0.3194 | |||

| Invesco Private Government Fund / STIV (N/A) | 6.07 | 6.07 | 0.8019 | 0.8019 | |||||

| AEE / Ameren Corporation | 0.06 | -2.80 | 5.93 | -7.01 | 0.7829 | -0.1083 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.12 | -20.08 | 5.73 | -30.39 | 0.7569 | -0.3938 | |||

| DLR / Digital Realty Trust, Inc. | 0.03 | -2.80 | 5.51 | 18.28 | 0.7285 | 0.0765 | |||

| NOC / Northrop Grumman Corporation | 0.01 | -2.79 | 5.36 | -5.07 | 0.7077 | -0.0814 | |||

| EL / The Estée Lauder Companies Inc. | 0.06 | -2.80 | 5.14 | 19.00 | 0.6786 | 0.0750 | |||

| HUBB / Hubbell Incorporated | 0.01 | -25.84 | 4.78 | -8.48 | 0.6318 | -0.0988 | |||

| BRBR / BellRing Brands, Inc. | 0.08 | -2.80 | 4.60 | -24.37 | 0.6076 | -0.2428 | |||

| RJF / Raymond James Financial, Inc. | 0.03 | -27.71 | 4.47 | -20.19 | 0.5912 | -0.1928 | |||

| COO / The Cooper Companies, Inc. | 0.06 | -2.80 | 4.25 | -18.00 | 0.5616 | -0.1632 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.04 | -29.12 | 3.93 | -42.89 | 0.5193 | -0.4430 | |||

| STZ / Constellation Brands, Inc. | 0.02 | -2.80 | 3.76 | -13.83 | 0.4964 | -0.1134 | |||

| TTD / The Trade Desk, Inc. | 0.05 | 3.70 | 0.4887 | 0.4887 | |||||

| US8252524066 / Invesco Treasury Portfolio, Institutional Class | 3.54 | -45.28 | 3.54 | -45.28 | 0.4676 | -0.4369 | |||

| PCTY / Paylocity Holding Corporation | 0.02 | -47.28 | 3.45 | -49.02 | 0.4556 | -0.4902 | |||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 1.91 | -45.28 | 1.91 | -45.31 | 0.2518 | -0.2353 | |||

| TSLA / Tesla, Inc. | 0.01 | -2.81 | 1.80 | 19.13 | 0.2378 | 0.0265 |