Statistik Asas

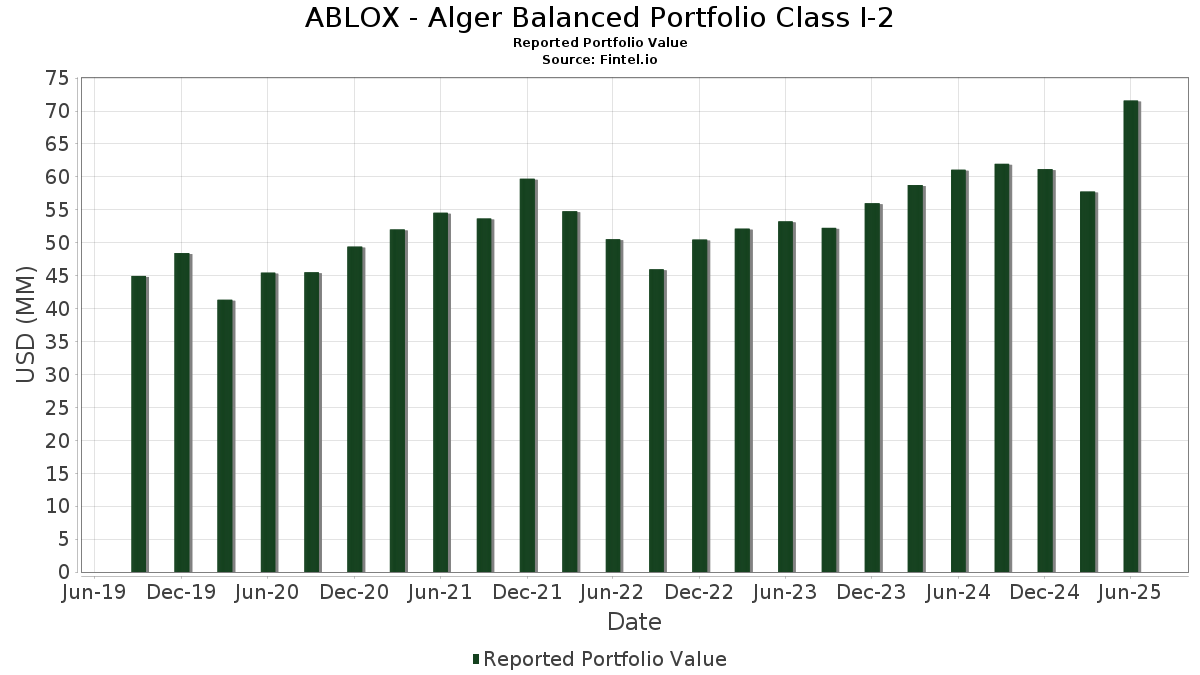

| Nilai Portfolio | $ 71,585,372 |

| Kedudukan Semasa | 129 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

ABLOX - Alger Balanced Portfolio Class I-2 telah mendedahkan 129 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 71,585,372 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas ABLOX - Alger Balanced Portfolio Class I-2 ialah Microsoft Corporation (US:MSFT) , Broadcom Inc. (US:AVGO) , Apple Inc. (US:AAPL) , JPMorgan Chase & Co. (US:JPM) , and KLA Corporation (US:KLAC) . Kedudukan baharu ABLOX - Alger Balanced Portfolio Class I-2 termasuk UNITEDHEALTH GROUP INC REGD 3.70000000 (US:US91324PEG37) , American Express Company (US:US025816DB21) , ECOLAB INC (US:US278865BP48) , McDonald's Corp (US:US58013MFU36) , and PepsiCo Inc (US:US713448FR44) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 3.19 | 5.1388 | 1.7249 | |

| 0.01 | 4.77 | 7.6828 | 1.4560 | |

| 0.52 | 0.8314 | 0.8314 | ||

| 0.51 | 0.8173 | 0.8173 | ||

| 0.51 | 0.8173 | 0.8173 | ||

| 0.51 | 0.8151 | 0.8151 | ||

| 0.51 | 0.8151 | 0.8151 | ||

| 0.50 | 0.8124 | 0.8124 | ||

| 0.50 | 0.8124 | 0.8124 | ||

| 0.50 | 0.8112 | 0.8112 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.43 | 0.6947 | -1.0481 | |

| 0.01 | 2.88 | 4.6447 | -0.7606 | |

| 0.00 | 0.64 | 1.0357 | -0.6212 | |

| 0.00 | 0.56 | 0.8968 | -0.2758 | |

| 0.01 | 0.69 | 1.1179 | -0.1997 | |

| 0.00 | 0.21 | 0.3404 | -0.1870 | |

| 0.49 | 0.49 | 0.7889 | -0.1770 | |

| 0.00 | 0.56 | 0.9018 | -0.1508 | |

| 0.00 | 0.65 | 1.0400 | -0.1372 | |

| 0.00 | 0.13 | 0.2028 | -0.1237 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-28 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.01 | -0.52 | 4.77 | 31.82 | 7.6828 | 1.4560 | |||

| AVGO / Broadcom Inc. | 0.01 | -2.32 | 3.19 | 60.82 | 5.1388 | 1.7249 | |||

| AAPL / Apple Inc. | 0.01 | -0.61 | 2.88 | -8.22 | 4.6447 | -0.7606 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 0.00 | 1.84 | 18.15 | 2.9695 | 0.2852 | |||

| KLAC / KLA Corporation | 0.00 | 0.00 | 1.68 | 31.79 | 2.7119 | 0.5131 | |||

| GOOGL / Alphabet Inc. | 0.01 | 0.00 | 1.40 | 14.00 | 2.2574 | 0.1412 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 0.00 | 1.37 | 15.37 | 2.2139 | 0.1627 | |||

| MS / Morgan Stanley | 0.01 | 0.00 | 1.16 | 20.77 | 1.8654 | 0.2147 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 1.13 | 28.14 | 1.8279 | 0.3030 | |||

| GOOG / Alphabet Inc. | 0.01 | -1.53 | 1.09 | 11.76 | 1.7621 | 0.0783 | |||

| US91324PEG37 / UNITEDHEALTH GROUP INC REGD 3.70000000 | 0.99 | 0.30 | 1.5973 | -0.1040 | |||||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.95 | 31.35 | 1.5329 | 0.2859 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.81 | 1.25 | 1.3066 | -0.0713 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.78 | 0.13 | 1.2524 | -0.0851 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 0.00 | 0.69 | -9.41 | 1.1179 | -0.1997 | |||

| BLK / BlackRock, Inc. | 0.00 | -1.96 | 0.68 | 8.77 | 1.0989 | 0.0187 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.65 | -5.56 | 1.0400 | -0.1372 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | 0.00 | 0.64 | 3.71 | 1.0372 | -0.0316 | |||

| ABBV / AbbVie Inc. | 0.00 | -24.62 | 0.64 | -33.26 | 1.0357 | -0.6212 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.61 | 36.30 | 0.9872 | 0.2142 | |||

| HON / Honeywell International Inc. | 0.00 | 0.00 | 0.60 | 10.05 | 0.9707 | 0.0277 | |||

| WMT / Walmart Inc. | 0.01 | 0.00 | 0.58 | 11.54 | 0.9347 | 0.0381 | |||

| PG / The Procter & Gamble Company | 0.00 | -2.09 | 0.56 | -8.51 | 0.9018 | -0.1508 | |||

| BAC / Bank of America Corporation | 0.01 | 0.00 | 0.56 | 13.41 | 0.9006 | 0.0521 | |||

| CVX / Chevron Corporation | 0.00 | -4.54 | 0.56 | -18.36 | 0.8968 | -0.2758 | |||

| BX / Blackstone Inc. | 0.00 | 0.00 | 0.55 | 7.03 | 0.8833 | 0.0015 | |||

| United States Treasury Note/Bond / DBT (US91282CLP40) | 0.55 | 0.18 | 0.8818 | -0.0588 | |||||

| United States Treasury Note/Bond / DBT (US91282CLP40) | 0.55 | 0.18 | 0.8818 | -0.0588 | |||||

| US025816DB21 / American Express Company | 0.52 | 0.00 | 0.8352 | -0.0565 | |||||

| United States Treasury Note/Bond / DBT (US91282CMM00) | 0.52 | 0.8314 | 0.8314 | ||||||

| US278865BP48 / ECOLAB INC | 0.52 | 0.19 | 0.8302 | -0.0550 | |||||

| DJNJ3 / Johnson & Johnson - Depositary Receipt (Common Stock) | 0.51 | 0.59 | 0.8280 | -0.0505 | |||||

| DJNJ3 / Johnson & Johnson - Depositary Receipt (Common Stock) | 0.51 | 0.59 | 0.8280 | -0.0505 | |||||

| Astrazeneca Finance LLC / DBT (US04636NAL73) | 0.51 | 0.79 | 0.8241 | -0.0495 | |||||

| Astrazeneca Finance LLC / DBT (US04636NAL73) | 0.51 | 0.79 | 0.8241 | -0.0495 | |||||

| T-Mobile USA Inc / DBT (US87264ADS15) | 0.51 | 1.39 | 0.8219 | -0.0446 | |||||

| T-Mobile USA Inc / DBT (US87264ADS15) | 0.51 | 1.39 | 0.8219 | -0.0446 | |||||

| CAH / Cardinal Health, Inc. - Depositary Receipt (Common Stock) | 0.51 | 0.99 | 0.8215 | -0.0466 | |||||

| CAH / Cardinal Health, Inc. - Depositary Receipt (Common Stock) | 0.51 | 0.99 | 0.8215 | -0.0466 | |||||

| R1SG34 / Republic Services, Inc. - Depositary Receipt (Common Stock) | 0.51 | 1.39 | 0.8211 | -0.0441 | |||||

| R1SG34 / Republic Services, Inc. - Depositary Receipt (Common Stock) | 0.51 | 1.39 | 0.8211 | -0.0441 | |||||

| US58013MFU36 / McDonald's Corp | 0.51 | 0.79 | 0.8211 | -0.0497 | |||||

| US713448FR44 / PepsiCo Inc | 0.51 | 0.80 | 0.8183 | -0.0492 | |||||

| HON / Honeywell International Inc. - Depositary Receipt (Common Stock) | 0.51 | 1.00 | 0.8179 | -0.0477 | |||||

| HON / Honeywell International Inc. - Depositary Receipt (Common Stock) | 0.51 | 1.00 | 0.8179 | -0.0477 | |||||

| United States Treasury Note/Bond / DBT (US91282CLR06) | 0.51 | 0.80 | 0.8173 | -0.0498 | |||||

| United States Treasury Note/Bond / DBT (US91282CLR06) | 0.51 | 0.80 | 0.8173 | -0.0498 | |||||

| W1AB34 / Westinghouse Air Brake Technologies Corporation - Depositary Receipt (Common Stock) | 0.51 | 0.8173 | 0.8173 | ||||||

| W1AB34 / Westinghouse Air Brake Technologies Corporation - Depositary Receipt (Common Stock) | 0.51 | 0.8173 | 0.8173 | ||||||

| ConocoPhillips Co / DBT (US20826FBJ49) | 0.51 | 0.80 | 0.8172 | -0.0490 | |||||

| ConocoPhillips Co / DBT (US20826FBJ49) | 0.51 | 0.80 | 0.8172 | -0.0490 | |||||

| US023135CP90 / Amazon.com Inc | 0.51 | 0.20 | 0.8166 | -0.0534 | |||||

| US48125LRU88 / JPMorgan Chase Bank NA | 0.51 | 0.00 | 0.8161 | -0.0560 | |||||

| WMT / Walmart Inc. - Depositary Receipt (Common Stock) | 0.51 | 0.8151 | 0.8151 | ||||||

| WMT / Walmart Inc. - Depositary Receipt (Common Stock) | 0.51 | 0.8151 | 0.8151 | ||||||

| US816851BQ16 / Sempra Energy | 0.50 | 0.00 | 0.8136 | -0.0541 | |||||

| M1CK34 / McKesson Corporation - Depositary Receipt (Common Stock) | 0.50 | 0.8124 | 0.8124 | ||||||

| M1CK34 / McKesson Corporation - Depositary Receipt (Common Stock) | 0.50 | 0.8124 | 0.8124 | ||||||

| Citibank NA / DBT (US17325FBJ66) | 0.50 | 0.00 | 0.8113 | -0.0552 | |||||

| Citibank NA / DBT (US17325FBJ66) | 0.50 | 0.00 | 0.8113 | -0.0552 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 0.50 | 0.8112 | 0.8112 | ||||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 0.50 | 0.8112 | 0.8112 | ||||||

| W1EL34 / Welltower Inc. - Depositary Receipt (Common Stock) | 0.50 | 0.8098 | 0.8098 | ||||||

| W1EL34 / Welltower Inc. - Depositary Receipt (Common Stock) | 0.50 | 0.8098 | 0.8098 | ||||||

| AAPL / Apple Inc. - Depositary Receipt (Common Stock) | 0.50 | 0.8095 | 0.8095 | ||||||

| AAPL / Apple Inc. - Depositary Receipt (Common Stock) | 0.50 | 0.8095 | 0.8095 | ||||||

| US68389XCF06 / Oracle Corp | 0.50 | -0.20 | 0.8089 | -0.0585 | |||||

| C1DN34 / Cadence Design Systems, Inc. - Depositary Receipt (Common Stock) | 0.50 | 1.01 | 0.8060 | -0.0464 | |||||

| C1DN34 / Cadence Design Systems, Inc. - Depositary Receipt (Common Stock) | 0.50 | 1.01 | 0.8060 | -0.0464 | |||||

| US931142EW94 / Walmart, Inc. | 0.50 | 0.00 | 0.8049 | -0.0546 | |||||

| MA / Mastercard Incorporated - Depositary Receipt (Common Stock) | 0.50 | 1.43 | 0.8025 | -0.0433 | |||||

| MA / Mastercard Incorporated - Depositary Receipt (Common Stock) | 0.50 | 1.43 | 0.8025 | -0.0433 | |||||

| T-Mobile USA Inc / DBT (US87264ADL61) | 0.50 | 1.02 | 0.8003 | -0.0452 | |||||

| T-Mobile USA Inc / DBT (US87264ADL61) | 0.50 | 1.02 | 0.8003 | -0.0452 | |||||

| Novartis Capital Corp / DBT (US66989HAT59) | 0.50 | 1.23 | 0.7990 | -0.0441 | |||||

| US2619081076 / DREYFUS TREASURY PRIME CASH MANAGEMENT/ CLASS A | 0.49 | -12.74 | 0.49 | -12.83 | 0.7889 | -0.1770 | |||

| US37045XDK90 / General Motors Financial Co Inc | 0.49 | 1.04 | 0.7823 | -0.0455 | |||||

| TDG / TransDigm Group Incorporated | 0.00 | 0.00 | 0.47 | 9.77 | 0.7620 | 0.0214 | |||

| CME / CME Group Inc. | 0.00 | 0.00 | 0.46 | 4.12 | 0.7332 | -0.0208 | |||

| KO / The Coca-Cola Company | 0.01 | -2.81 | 0.45 | -3.85 | 0.7254 | -0.0818 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 0.00 | 0.44 | 12.53 | 0.7092 | 0.0353 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -28.50 | 0.43 | -57.41 | 0.6947 | -1.0481 | |||

| WELL / Welltower Inc. | 0.00 | 0.00 | 0.43 | 0.23 | 0.6891 | -0.0446 | |||

| JNJ / Johnson & Johnson | 0.00 | 0.00 | 0.41 | -7.81 | 0.6660 | -0.1065 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 0.00 | 0.41 | -4.23 | 0.6576 | -0.0770 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.36 | 14.92 | 0.5840 | 0.0402 | |||

| CAH / Cardinal Health, Inc. | 0.00 | 9.75 | 0.35 | 33.97 | 0.5668 | 0.1143 | |||

| PEP / PepsiCo, Inc. | 0.00 | 0.00 | 0.35 | -11.99 | 0.5566 | -0.1186 | |||

| UNP / Union Pacific Corporation | 0.00 | 12.10 | 0.35 | 9.18 | 0.5565 | 0.0119 | |||

| VZ / Verizon Communications Inc. | 0.01 | 0.00 | 0.34 | -4.75 | 0.5506 | -0.0661 | |||

| ABT / Abbott Laboratories | 0.00 | 50.42 | 0.34 | 54.79 | 0.5466 | 0.1680 | |||

| SPG / Simon Property Group, Inc. | 0.00 | 0.00 | 0.32 | -3.04 | 0.5142 | -0.0533 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.32 | -6.47 | 0.5131 | -0.0730 | |||

| TYIA / Johnson Controls International plc | 0.00 | 0.00 | 0.31 | 31.78 | 0.5015 | 0.0951 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.00 | 0.00 | 0.30 | 2.38 | 0.4861 | -0.0204 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.30 | -5.10 | 0.4813 | -0.0605 | |||

| ADBE / Adobe Inc. | 0.00 | 0.00 | 0.30 | 1.02 | 0.4775 | -0.0282 | |||

| SCCO / Southern Copper Corporation | 0.00 | 0.97 | 0.30 | 9.63 | 0.4770 | 0.0107 | |||

| ORCL / Oracle Corporation | 0.00 | 0.00 | 0.29 | 55.91 | 0.4689 | 0.1485 | |||

| MO / Altria Group, Inc. | 0.00 | 0.00 | 0.29 | -2.39 | 0.4624 | -0.0433 | |||

| CMCSA / Comcast Corporation | 0.01 | 0.00 | 0.28 | -3.12 | 0.4497 | -0.0470 | |||

| FERG / Ferguson Enterprises Inc. | 0.00 | 0.00 | 0.27 | 35.82 | 0.4414 | 0.0944 | |||

| GRMN / Garmin Ltd. | 0.00 | 0.00 | 0.27 | -3.89 | 0.4385 | -0.0489 | |||

| DELL / Dell Technologies Inc. | 0.00 | 0.00 | 0.27 | 34.17 | 0.4314 | 0.0887 | |||

| SBUX / Starbucks Corporation | 0.00 | 0.00 | 0.25 | -6.37 | 0.4031 | -0.0579 | |||

| NEE / NextEra Energy, Inc. | 0.00 | 0.00 | 0.25 | -1.99 | 0.3973 | -0.0361 | |||

| LAMR / Lamar Advertising Company | 0.00 | 0.00 | 0.25 | 6.52 | 0.3964 | -0.0006 | |||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 0.24 | -10.49 | 0.3864 | -0.0742 | |||

| GLW / Corning Incorporated | 0.00 | 0.00 | 0.24 | 15.12 | 0.3809 | 0.0267 | |||

| CCI / Crown Castle Inc. | 0.00 | 0.00 | 0.23 | -1.28 | 0.3744 | -0.0314 | |||

| OWL / Blue Owl Capital Inc. | 0.01 | 0.00 | 0.22 | -4.33 | 0.3571 | -0.0409 | |||

| SRE / Sempra | 0.00 | 0.00 | 0.22 | 6.40 | 0.3483 | -0.0021 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.22 | 8.59 | 0.3471 | 0.0055 | |||

| ED / Consolidated Edison, Inc. | 0.00 | 0.00 | 0.21 | -9.32 | 0.3452 | -0.0612 | |||

| MDT / Medtronic plc | 0.00 | 0.00 | 0.21 | -3.18 | 0.3445 | -0.0349 | |||

| FITB / Fifth Third Bancorp | 0.01 | 24.80 | 0.21 | 31.48 | 0.3438 | 0.0633 | |||

| SYY / Sysco Corporation | 0.00 | 0.00 | 0.21 | 0.95 | 0.3437 | -0.0201 | |||

| OKE / ONEOK, Inc. | 0.00 | 0.00 | 0.21 | -17.90 | 0.3413 | -0.1019 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.00 | -27.47 | 0.21 | -31.05 | 0.3404 | -0.1870 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | 0.00 | 0.21 | -1.42 | 0.3367 | -0.0268 | |||

| MRK / Merck & Co., Inc. | 0.00 | 0.00 | 0.19 | -11.63 | 0.3066 | -0.0648 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.00 | 0.19 | 18.35 | 0.3026 | 0.0299 | |||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 0.00 | 0.00 | 0.18 | -15.42 | 0.2932 | -0.0759 | |||

| BMY / Bristol-Myers Squibb Company | 0.00 | 0.00 | 0.18 | -24.24 | 0.2827 | -0.1152 | |||

| PFE / Pfizer Inc. | 0.01 | 0.00 | 0.16 | -4.22 | 0.2568 | -0.0300 | |||

| PLD / Prologis, Inc. | 0.00 | 0.00 | 0.13 | -6.43 | 0.2122 | -0.0289 | |||

| BBY / Best Buy Co., Inc. | 0.00 | -27.24 | 0.13 | -33.86 | 0.2028 | -0.1237 | |||

| GAP / The Gap, Inc. | 0.00 | 0.00 | 0.11 | 5.94 | 0.1725 | -0.0017 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.00 | 0.00 | 0.10 | -2.00 | 0.1587 | -0.0141 |