Statistik Asas

| Nilai Portfolio | $ 82,794,000 |

| Kedudukan Semasa | 89 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

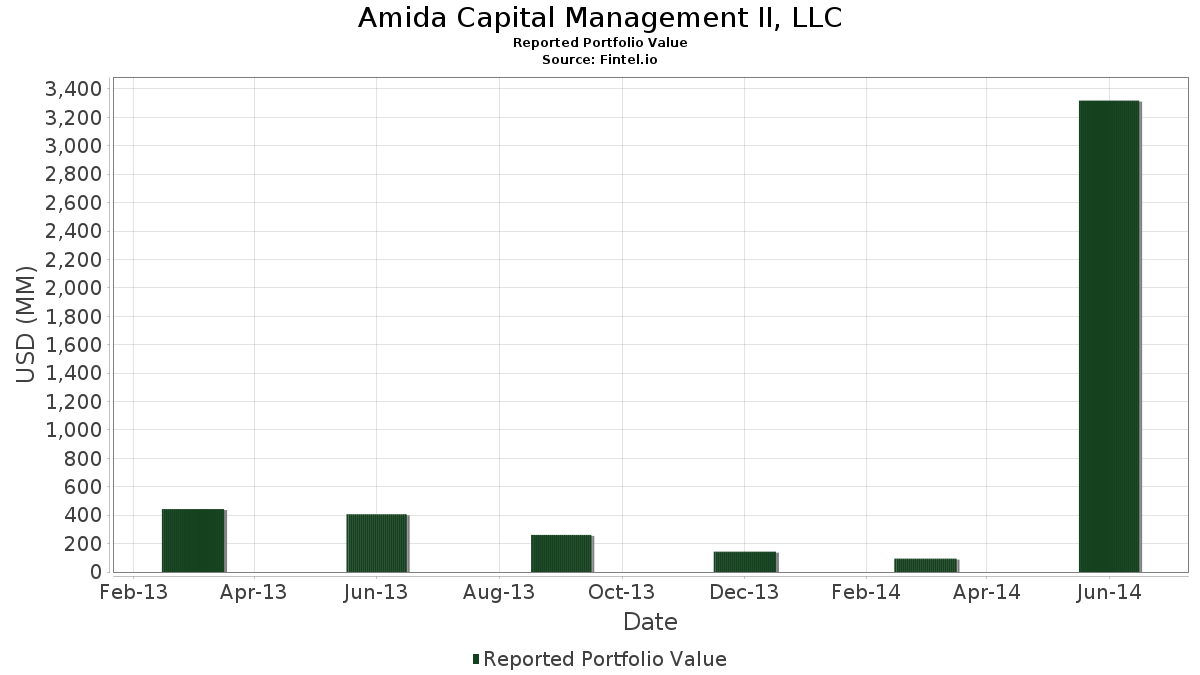

Amida Capital Management II, LLC telah mendedahkan 89 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 82,794,000 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Amida Capital Management II, LLC ialah SPDR S&P 500 ETF (US:SPY) , Microchip Technology Inc. 2.125% Convertible Bond due 2037-12-15 (US:595017AB0) , International Business Machines Corporation (US:IBM) , Apple Inc. (US:AAPL) , and Apple Inc. (US:AAPL) . Kedudukan baharu Amida Capital Management II, LLC termasuk International Business Machines Corporation (US:IBM) , International Business Machines Corporation (US:IBM) , JX Luxventure Limited (US:LLL) , (US:ARCP) , and j2 Global, Inc Bond (US:US48123VAC63) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.09 | 17.34 | 20.9435 | 7.0597 | |

| 0.02 | 3.63 | 4.3795 | 4.3795 | |

| 0.03 | 3.06 | 3.6923 | 3.6923 | |

| 0.04 | 3.25 | 3.9290 | 3.1795 | |

| 0.03 | 1.91 | 2.3021 | 2.3021 | |

| 0.01 | 1.81 | 2.1898 | 2.1898 | |

| 5.00 | 9.55 | 11.5383 | 1.7008 | |

| 0.01 | 1.51 | 1.8226 | 1.5224 | |

| 0.01 | 1.24 | 1.5013 | 1.5013 | |

| 0.07 | 1.27 | 1.5363 | 1.3306 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 0.42 | 0.5037 | -0.8922 | |

| 0.01 | 0.42 | 0.5037 | -0.8741 | |

| 0.00 | 0.08 | 0.0942 | -0.5502 | |

| 0.16 | 0.42 | 0.5073 | -0.3052 | |

| 0.00 | 0.21 | 0.2561 | -0.2764 | |

| 0.02 | 0.41 | 0.4904 | -0.1631 | |

| 0.01 | 0.21 | 0.2573 | -0.1547 | |

| 0.01 | 0.78 | 0.9385 | -0.1466 | |

| 0.01 | 0.10 | 0.1184 | -0.1415 | |

| 0.01 | 0.48 | 0.5773 | -0.1386 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2014-08-12 untuk tempoh pelaporan 2014-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Call | 0.09 | 26.57 | 17.34 | 32.47 | 20.9435 | 7.0597 | ||

| 595017AB0 / Microchip Technology Inc. 2.125% Convertible Bond due 2037-12-15 | 5.00 | 0.00 | 9.55 | 3.00 | 11.5383 | 1.7008 | |||

| IBM / International Business Machines Corporation | Put | 0.02 | 3.63 | 4.3795 | 4.3795 | ||||

| AAPL / Apple Inc. | Call | 0.04 | 366.67 | 3.25 | -2.02 | 3.9290 | 3.1795 | ||

| AAPL / Apple Inc. | Put | 0.03 | 558.00 | 3.06 | 54.16 | 3.6923 | 3.6923 | ||

| BKNG / Booking Holdings Inc. | Put | 0.00 | -44.44 | 3.01 | -42.50 | 3.6331 | -0.0191 | ||

| LRCX / Lam Research Corporation | Call | 0.03 | 25.33 | 1.91 | 65.45 | 2.3021 | 2.3021 | ||

| IBM / International Business Machines Corporation | 0.01 | 1.81 | 2.1898 | 2.1898 | |||||

| HOS / Hornbeck Offshore Services Inc | 0.04 | -24.32 | 1.69 | -15.06 | 2.0364 | -0.0690 | |||

| AMZN / Amazon.com, Inc. | Put | 0.01 | -33.33 | 1.62 | -45.70 | 1.9615 | -0.1268 | ||

| APA / APA Corporation | Call | 0.01 | 200.00 | 1.51 | 250.93 | 1.8226 | 1.5224 | ||

| INTC / Intel Corporation | Call | 0.04 | 10.25 | 1.36 | 32.07 | 1.6463 | 0.5517 | ||

| GLD / SPDR Gold Trust | Call | 0.01 | 25.00 | 1.28 | 37.78 | 1.5460 | 0.8974 | ||

| NFLX / Netflix, Inc. | Put | 0.00 | 16.00 | 1.28 | 45.23 | 1.5436 | 0.6102 | ||

| NRF / NorthStar Realty Finance Corp. | Put | 0.07 | 510.00 | 1.27 | 555.67 | 1.5363 | 1.3306 | ||

| LLL / JX Luxventure Limited | Put | 0.01 | 1.24 | 1.5013 | 1.5013 | ||||

| HOS / Hornbeck Offshore Services Inc | Put | 0.02 | 427.66 | 1.16 | 490.36 | 1.4047 | 1.1957 | ||

| ARCP / | 1.02 | 0.0000 | |||||||

| US48123VAC63 / j2 Global, Inc Bond | 1.01 | -99.90 | 0.0000 | ||||||

| LRCX / Lam Research Corporation | Put | 0.01 | 16.28 | 1.01 | 77.27 | 1.2247 | 1.2247 | ||

| VZ / Verizon Communications Inc. | Call | 0.02 | 0.98 | 1.1812 | 1.1812 | ||||

| NUAN / Nuance Communications Inc | Call | 0.05 | 34.48 | 0.95 | 46.76 | 1.1486 | 0.4613 | ||

| INTC / Intel Corporation | Put | 0.03 | 334.78 | 0.93 | 420.79 | 1.1196 | 0.9309 | ||

| HOS / Hornbeck Offshore Services Inc | Call | 0.02 | 38.52 | 0.88 | 55.67 | 1.0605 | 0.4623 | ||

| GS / The Goldman Sachs Group, Inc. | Call | 0.01 | -50.00 | 0.84 | -43.14 | 1.0109 | 0.6786 | ||

| AMZN / Amazon.com, Inc. | Call | 0.00 | 0.81 | 0.9807 | 0.9807 | ||||

| LRCX / Lam Research Corporation | 0.01 | -38.17 | 0.78 | -24.05 | 0.9385 | -0.1466 | |||

| FCX / Freeport-McMoRan Inc. | Call | 0.02 | 85.19 | 0.73 | 104.48 | 0.8817 | 0.5031 | ||

| T / AT&T Inc. | Put | 0.02 | 0.71 | 0.8539 | 0.8539 | ||||

| GPI / Group 1 Automotive, Inc. | Call | 0.01 | 64.00 | 0.69 | 110.98 | 0.8358 | 0.4879 | ||

| EWW / iShares, Inc. - iShares MSCI Mexico ETF | 0.01 | 100.00 | 0.68 | 111.88 | 0.8189 | 0.4795 | |||

| MU / Micron Technology, Inc. | Call | 0.02 | 100.00 | 0.66 | 178.48 | 0.7972 | 0.5458 | ||

| KRC / Kilroy Realty Corporation | 0.01 | 0.61 | 0.7331 | 0.7331 | |||||

| CAG / Conagra Brands, Inc. | Put | 0.02 | 0.54 | 0.6522 | 0.6522 | ||||

| TPR / Tapestry, Inc. | Put | 0.01 | 0.00 | 0.51 | -40.07 | 0.6196 | 0.6196 | ||

| EWZ / iShares, Inc. - iShares MSCI Brazil ETF | Call | 0.01 | -33.33 | 0.48 | -29.19 | 0.5773 | -0.1386 | ||

| CSCO / Cisco Systems, Inc. | Put | 0.02 | -23.60 | 0.47 | -21.87 | 0.5737 | 0.5737 | ||

| C / Citigroup Inc. | Call | 0.01 | -6.00 | 0.44 | -14.97 | 0.5351 | 0.1713 | ||

| MCP / | 0.16 | 0.00 | 0.42 | -45.17 | 0.5073 | -0.3052 | |||

| MSFT / Microsoft Corporation | Put | 0.01 | -68.85 | 0.42 | -68.31 | 0.5037 | -0.8922 | ||

| MSFT / Microsoft Corporation | Call | 0.01 | -68.45 | 0.42 | -67.90 | 0.5037 | -0.8741 | ||

| NFLX / Netflix, Inc. | 0.00 | 844.00 | 0.42 | 1,088.57 | 0.5025 | 0.4653 | |||

| NRF / NorthStar Realty Finance Corp. | Call | 0.02 | 135.00 | 0.41 | 154.04 | 0.4940 | 0.3232 | ||

| SLV / iShares Silver Trust | Put | 0.02 | -60.00 | 0.41 | -56.62 | 0.4904 | -0.1631 | ||

| TWTR / Twitter Inc | Put | 0.01 | 26.67 | 0.39 | -18.45 | 0.4698 | 0.4698 | ||

| CLF / Cleveland-Cliffs Inc. | Put | 0.03 | 365.45 | 0.39 | 241.59 | 0.4662 | 0.3464 | ||

| POT / Potash Corp. of Saskatchewan, Inc. | Put | 0.01 | -60.00 | 0.38 | -61.26 | 0.4590 | 0.2375 | ||

| HPQ / HP Inc. | Put | 0.01 | 0.37 | 0.4469 | 0.4469 | ||||

| GM / General Motors Company | Call | 0.01 | 0.00 | 0.36 | 0.83 | 0.4384 | 0.4384 | ||

| CAG / Conagra Brands, Inc. | 0.01 | 0.36 | 0.4336 | 0.4336 | |||||

| AABA / Altaba Inc | Put | 0.01 | -52.20 | 0.34 | -58.45 | 0.4155 | 0.4155 | ||

| TPR / Tapestry, Inc. | Call | 0.01 | -33.33 | 0.34 | -54.40 | 0.4131 | 0.2438 | ||

| GPI / Group 1 Automotive, Inc. | 0.00 | 0.34 | 0.4070 | 0.4070 | |||||

| HRI / Herc Holdings Inc. | Put | 0.01 | -20.53 | 0.34 | -10.16 | 0.4058 | 0.4058 | ||

| MS / Morgan Stanley | Call | 0.01 | -50.00 | 0.32 | -40.07 | 0.3901 | 0.3901 | ||

| SPLS / Staples, Inc. | Put | 0.03 | 0.28 | 0.3442 | 0.3442 | ||||

| T / AT&T Inc. | 0.01 | 81.82 | 0.28 | 82.58 | 0.3418 | 0.2336 | |||

| HRI / Herc Holdings Inc. | Call | 0.01 | -50.00 | 0.28 | -43.55 | 0.3382 | 0.3382 | ||

| BAC / Bank of America Corporation | Call | 0.02 | 13.21 | 0.28 | 1.47 | 0.3346 | 0.0450 | ||

| LLL / JX Luxventure Limited | Call | 0.00 | 0.27 | 0.3213 | 0.3213 | ||||

| CSCO / Cisco Systems, Inc. | Call | 0.01 | -50.00 | 0.25 | -48.87 | 0.3007 | 0.3007 | ||

| PHH / Park Ha Biological Technology Co., Ltd. | 0.01 | -81.63 | 0.24 | -80.77 | 0.2887 | 0.2887 | |||

| PHH / Park Ha Biological Technology Co., Ltd. | Put | 0.01 | -36.30 | 0.21 | -33.33 | 0.2585 | 0.2585 | ||

| IGT / International Game Technology PLC | Put | 0.01 | -58.77 | 0.21 | -63.90 | 0.2573 | -0.1547 | ||

| C / Citigroup Inc. | 0.00 | -57.35 | 0.21 | -57.77 | 0.2561 | -0.2764 | |||

| CLF / Cleveland-Cliffs Inc. | Call | 0.01 | 84.00 | 0.21 | 35.95 | 0.2512 | 0.0889 | ||

| KING / King Digital Entertainment plc | Put | 0.01 | 0.21 | 0.2488 | 0.2488 | ||||

| UAL / United Airlines Holdings, Inc. | Call | 0.01 | 0.20 | 0.2476 | 0.2476 | ||||

| POT / Potash Corp. of Saskatchewan, Inc. | Call | 0.01 | -73.68 | 0.19 | -73.76 | 0.2295 | 0.2295 | ||

| META / Meta Platforms, Inc. | Call | 0.00 | -91.67 | 0.17 | -88.84 | 0.2029 | 0.2029 | ||

| IGT / International Game Technology PLC | 0.01 | 1,509.05 | 0.13 | 1,714.29 | 0.1534 | 0.1460 | |||

| BTU / Peabody Energy Corporation | 0.01 | -51.19 | 0.12 | -50.99 | 0.1498 | -0.1186 | |||

| MBI / MBIA Inc. | 0.01 | 341.82 | 0.11 | 314.81 | 0.1353 | 0.1164 | |||

| AABA / Altaba Inc | 0.00 | 44.09 | 0.10 | 25.00 | 0.1268 | 0.1268 | |||

| BTU / Peabody Energy Corporation | Put | 0.01 | -60.00 | 0.10 | -60.00 | 0.1184 | -0.1415 | ||

| GPI / Group 1 Automotive, Inc. | Put | 0.00 | 0.09 | 0.1123 | 0.1123 | ||||

| CLF / Cleveland-Cliffs Inc. | 0.01 | 57.14 | 0.08 | 23.88 | 0.1002 | 0.0851 | |||

| ELX / Emulex Corp | Call | 0.01 | 0.08 | 0.1002 | 0.1002 | ||||

| SPY / SPDR S&P 500 ETF | 0.00 | -92.00 | 0.08 | -91.55 | 0.0942 | -0.5502 | |||

| SLV / iShares Silver Trust | 0.00 | -80.65 | 0.06 | -78.97 | 0.0737 | -0.1288 | |||

| LLL / JX Luxventure Limited | 0.00 | 0.06 | 0.0725 | 0.0725 | |||||

| HRI / Herc Holdings Inc. | 0.00 | 0.04 | 0.0507 | 0.0507 | |||||

| ELOS / Syneron Medical Ltd. | 0.00 | 0.03 | 0.0411 | 0.0411 | |||||

| CSCO / Cisco Systems, Inc. | 0.00 | 0.03 | 0.0302 | 0.0302 | |||||

| PRKR / ParkerVision, Inc. | 0.01 | -85.54 | 0.02 | -93.62 | 0.0254 | 0.0254 | |||

| GM / General Motors Company | 0.00 | -86.38 | 0.02 | -85.71 | 0.0217 | -0.1119 | |||

| MS / Morgan Stanley | 0.00 | 0.01 | 0.0121 | 0.0121 | |||||

| TWTR / Twitter Inc | 0.00 | -70.00 | 0.01 | -81.25 | 0.0072 | 0.0072 | |||

| GEVO / Gevo, Inc. | 0.01 | 0.00 | 0.00 | -33.33 | 0.0048 | -0.0015 |