Statistik Asas

| Pengurus | David Tepper |

| Profil Orang Dalam | APPALOOSA MANAGEMENT LP |

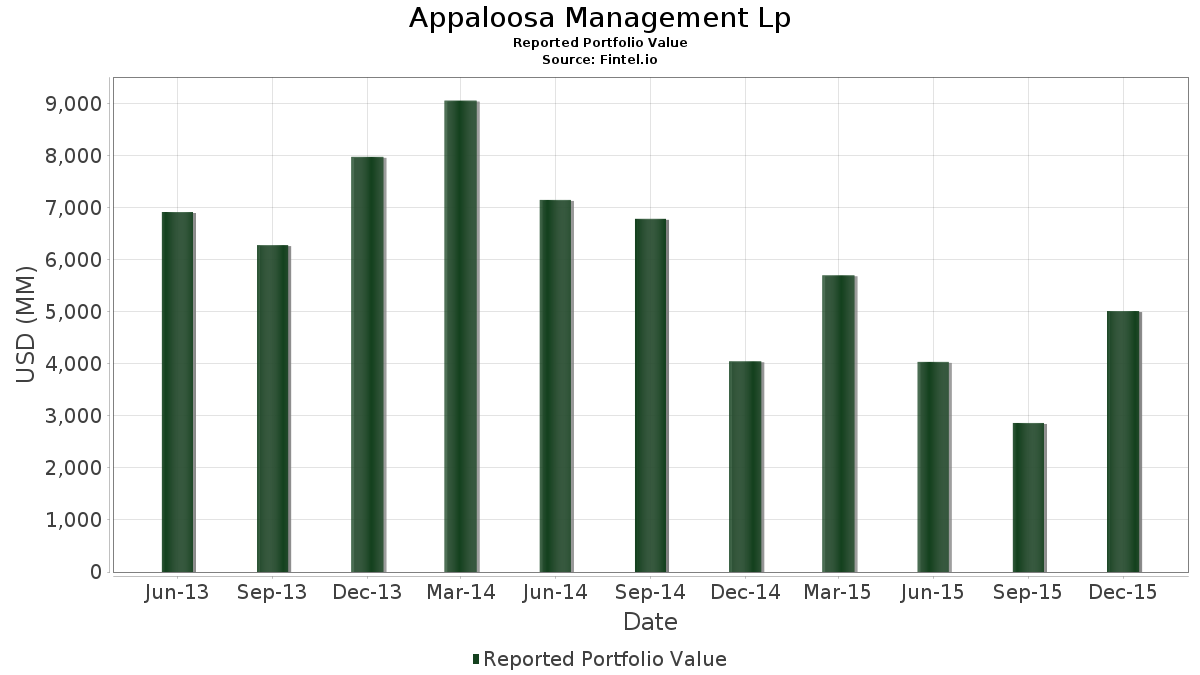

| Nilai Portfolio | $ 5,014,293,000 |

| Kedudukan Semasa | 52 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Appaloosa Management Lp telah mendedahkan 52 jumlah pegangan dalam pemfailan SEC terkini mereka. Pengurus portfolio disenaraikan sebagai David Tepper. Nilai portfolio terkini dikira sebagai $ 5,014,293,000 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Appaloosa Management Lp ialah SPDR S&P 500 ETF (US:SPY) , General Motors Company (US:GM) , Alphabet Inc. (US:GOOG) , Delta Air Lines, Inc. (US:DAL) , and HCA Healthcare, Inc. (US:HCA) . Kedudukan baharu Appaloosa Management Lp termasuk Sunoco Logistics Partners L.P. (US:SXL) , Kinder Morgan, Inc. (US:KMI) , Atlantica Sustainable Infrastructure plc (US:AY) , TerraForm Power Inc. (US:US88104R2094) , and Pfizer Inc. (US:PFE) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 3.00 | 611.67 | 12.1985 | 12.1985 | |

| 0.54 | 406.87 | 8.1143 | 4.1488 | |

| 5.14 | 173.48 | 3.4596 | 3.4596 | |

| 9.45 | 140.92 | 2.8104 | 2.8104 | |

| 6.30 | 121.60 | 2.4250 | 2.4250 | |

| 2.92 | 181.36 | 3.6169 | 2.3457 | |

| 7.60 | 95.61 | 1.9067 | 1.9067 | |

| 2.41 | 77.87 | 1.5529 | 1.5529 | |

| 4.29 | 184.83 | 3.6861 | 1.5126 | |

| 0.75 | 74.23 | 1.4803 | 1.4803 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.80 | 67.40 | 1.3442 | -5.6309 | |

| 12.59 | 428.03 | 8.5361 | -4.9713 | |

| 2.14 | 69.88 | 1.3937 | -4.6788 | |

| 0.00 | 0.00 | -4.0447 | ||

| 4.54 | 306.84 | 6.1193 | -3.4801 | |

| 1.26 | 133.05 | 2.6534 | -2.3884 | |

| 7.32 | 371.22 | 7.4033 | -2.1184 | |

| 3.36 | 158.01 | 3.1512 | -1.7657 | |

| 0.22 | 13.00 | 0.2593 | -1.5915 | |

| 0.00 | 0.00 | -1.5437 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2016-02-12 untuk tempoh pelaporan 2015-12-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Call | 3.00 | 0.00 | 611.67 | 12.1985 | 12.1985 | |||

| GM / General Motors Company | 12.59 | -2.33 | 428.03 | 10.65 | 8.5361 | -4.9713 | |||

| GOOG / Alphabet Inc. | 0.54 | 187.25 | 406.87 | 258.28 | 8.1143 | 4.1488 | |||

| DAL / Delta Air Lines, Inc. | 7.32 | 20.51 | 371.22 | 36.14 | 7.4033 | -2.1184 | |||

| HCA / HCA Healthcare, Inc. | 4.54 | 27.68 | 306.84 | 11.62 | 6.1193 | -3.4801 | |||

| WHR / Whirlpool Corporation | 1.61 | 42.45 | 237.18 | 42.07 | 4.7301 | -1.0996 | |||

| LUV / Southwest Airlines Co. | 4.29 | 162.33 | 184.83 | 196.95 | 3.6861 | 1.5126 | |||

| ALL / The Allstate Corporation | 2.92 | 367.30 | 181.36 | 398.18 | 3.6169 | 2.3457 | |||

| SXL / Sunoco Logistics Partners L.P. | 5.14 | 173.48 | 3.4596 | 3.4596 | |||||

| OC / Owens Corning | 3.36 | 0.00 | 158.01 | 12.22 | 3.1512 | -1.7657 | |||

| KMI / Kinder Morgan, Inc. | 9.45 | 140.92 | 2.8104 | 2.8104 | |||||

| BKNG / Booking Holdings Inc. | 0.11 | 12.26 | 140.26 | 15.71 | 2.7971 | -1.4355 | |||

| AAPL / Apple Inc. | 1.26 | -3.44 | 133.05 | -7.85 | 2.6534 | -2.3884 | |||

| AY / Atlantica Sustainable Infrastructure plc | 6.30 | 121.60 | 2.4250 | 2.4250 | |||||

| US40416M1053 / Hd Supply Inc. | 3.20 | 41.14 | 96.14 | 48.09 | 1.9174 | -0.3496 | |||

| US88104R2094 / TerraForm Power Inc. | 7.60 | 95.61 | 1.9067 | 1.9067 | |||||

| HUN / Huntsman Corporation | 8.04 | 0.00 | 91.39 | 17.34 | 1.8226 | -0.8972 | |||

| PFE / Pfizer Inc. | 2.41 | 77.87 | 1.5529 | 1.5529 | |||||

| PPG / PPG Industries, Inc. | 0.75 | 74.23 | 1.4803 | 1.4803 | |||||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 5.93 | 71.41 | 1.4240 | 1.4240 | |||||

| GT / The Goodyear Tire & Rubber Company | 2.14 | -63.92 | 69.88 | -59.81 | 1.3937 | -4.6788 | |||

| NXPI / NXP Semiconductors N.V. | 0.80 | -65.13 | 67.40 | -66.26 | 1.3442 | -5.6309 | |||

| WPZ / Access Midstream Partners, L.P | 2.37 | 66.06 | 1.3175 | 1.3175 | |||||

| IR / Ingersoll Rand Inc. | 1.04 | 51.39 | 57.72 | 64.87 | 1.1511 | -0.0714 | |||

| HPE / Hewlett Packard Enterprise Company | 3.66 | 55.64 | 1.1097 | 1.1097 | |||||

| URI / United Rentals, Inc. | 0.77 | -8.15 | 55.57 | 10.95 | 1.1082 | -0.6407 | |||

| CBI / Chicago Bridge & Iron Co., N.V. | 1.39 | 10.89 | 54.24 | 9.02 | 1.0817 | -0.6556 | |||

| EMN / Eastman Chemical Company | 0.70 | -10.53 | 47.28 | -6.67 | 0.9429 | -0.8261 | |||

| 018490100 / Allergan plc | 0.15 | 46.88 | 0.9348 | 0.9348 | |||||

| US00C4U1L353 / Mylan N.V. | 0.85 | 81.62 | 46.16 | 143.92 | 0.9206 | 0.2598 | |||

| COOP / Mr. Cooper Group Inc. | 16.90 | 0.00 | 43.78 | 0.39 | 0.8730 | -0.6497 | |||

| RRC / Range Resources Corporation | 1.61 | 39.53 | 0.7884 | 0.7884 | |||||

| TGI / Triumph Group, Inc. | 0.90 | 6.60 | 35.66 | 0.70 | 0.7111 | -0.5254 | |||

| UAL / United Airlines Holdings, Inc. | 0.60 | 27.53 | 34.44 | 37.75 | 0.6868 | -0.1862 | |||

| SWN / Southwestern Energy Company | 4.38 | 31.17 | 0.6216 | 0.6216 | |||||

| CYH / Community Health Systems, Inc. | 1.00 | 49.53 | 26.53 | 1.02 | 0.5291 | 0.1999 | |||

| COG / Cabot Oil & Gas Corp. | 1.39 | 24.56 | 0.4898 | 0.4898 | |||||

| FCX / Freeport-McMoRan Inc. | 3.56 | 215.36 | 24.08 | -43.43 | 0.4803 | -0.0534 | |||

| KYN / Kayne Anderson Energy Infrastructure Fund, Inc. | 1.01 | 17.46 | 0.3483 | 0.3483 | |||||

| EQT / EQT Corporation | 0.32 | 16.67 | 0.3325 | 0.3325 | |||||

| EXP / Eagle Materials Inc. | 0.22 | -72.23 | 13.00 | -75.47 | 0.2593 | -1.5915 | |||

| AR / Antero Resources Corporation | 0.56 | 12.15 | 0.2424 | 0.2424 | |||||

| TOO / Teekay Offshore Partners L.P. | 1.00 | 6.48 | 0.1292 | 0.1292 | |||||

| SPY / SPDR S&P 500 ETF | 0.02 | 0.00 | 4.66 | 6.39 | 0.0929 | -0.0600 | |||

| GM.WS.A / General Motors Company | 0.19 | 0.00 | 4.63 | 19.63 | 0.0924 | -0.0428 | |||

| TGP / Teekay LNG Partners LP - Unit | 0.25 | 3.29 | 0.0656 | 0.0656 | |||||

| GM.WS.B / General Motors Company - Warrants 07/10/2019 | 0.19 | 0.00 | 3.11 | 23.77 | 0.0620 | -0.0257 | |||

| TYG / Tortoise Energy Infrastructure Corporation | 0.05 | 1.31 | 0.0261 | 0.0261 | |||||

| XCEMX / Clearbridge Energy MLP Fund Inc | 0.08 | 1.19 | 0.0237 | 0.0237 | |||||

| NYLD.A / NRG Yield, Inc | 0.07 | 0.92 | 0.0184 | 0.0184 | |||||

| CWEN / Clearway Energy, Inc. | 0.05 | 0.77 | 0.0153 | 0.0153 | |||||

| KMI.WS / Kinder Morgan, Inc. Warrants | 1.50 | 0.09 | 0.0018 | 0.0018 | |||||

| BAC / Bank of America Corporation | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| TEX / Terex Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.0357 | ||||

| JBLU / JetBlue Airways Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -4.0447 | ||||

| KBR / KBR, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3065 | ||||

| LEN / Lennar Corporation | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| MHK / Mohawk Industries, Inc. | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| AXLL / Axiall Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1188 | ||||

| USG / USCF ETF Trust - USCF Gold Strategy Plus Income Fund | 0.00 | -100.00 | 0.00 | -100.00 | -1.0096 | ||||

| MAS / Masco Corporation | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| DHI / D.R. Horton, Inc. | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| RF / Regions Financial Corporation | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| NKE / NIKE, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -1.5437 | |||

| RYL / Ryland Group Inc | 0.00 | -100.00 | 0.00 | -100.00 | -0.8495 |