Statistik Asas

| Nilai Portfolio | $ 236,302,000 |

| Kedudukan Semasa | 60 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

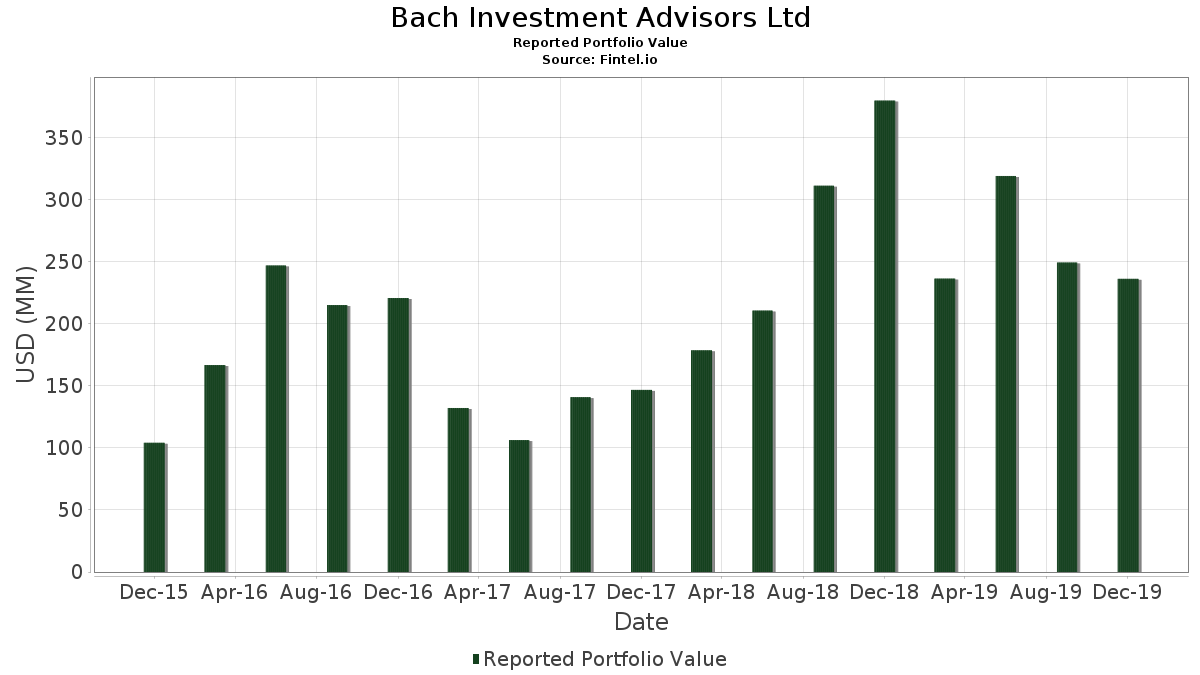

Bach Investment Advisors Ltd telah mendedahkan 60 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 236,302,000 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Bach Investment Advisors Ltd ialah SPDR S&P 500 ETF (US:SPY) , SPDR S&P 500 ETF (US:SPY) , SPDR Gold Trust (US:GLD) , iShares Trust - iShares 20+ Year Treasury Bond ETF (US:TLT) , and iShares Silver Trust (US:SLV) . Kedudukan baharu Bach Investment Advisors Ltd termasuk Southwest Airlines Co. (US:LUV) , Southwest Airlines Co. (US:LUV) , VanEck ETF Trust - VanEck Oil Services ETF (US:OIH) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 7.24 | 3.0639 | 3.0639 | |

| 0.21 | 29.59 | 12.5242 | 3.0108 | |

| 0.12 | 40.19 | 17.0058 | 2.8140 | |

| 0.03 | 5.48 | 2.3174 | 1.2539 | |

| 0.04 | 5.24 | 2.2188 | 1.1978 | |

| 0.03 | 4.21 | 1.7808 | 0.8023 | |

| 0.03 | 1.77 | 0.7495 | 0.7495 | |

| 0.01 | 3.40 | 1.4388 | 0.6516 | |

| 0.01 | 1.53 | 0.6462 | 0.6462 | |

| 0.02 | 2.92 | 1.2357 | 0.6280 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 3.57 | 1.5120 | -3.7928 | |

| 0.00 | 0.00 | -3.2990 | ||

| 0.16 | 51.04 | 21.6012 | -2.2503 | |

| 0.03 | 2.40 | 1.0161 | -1.7374 | |

| 0.11 | 15.27 | 6.4616 | -1.0687 | |

| 0.00 | 0.00 | -0.9119 | ||

| 0.00 | 0.00 | -0.6081 | ||

| 0.00 | 0.00 | -0.6061 | ||

| 0.06 | 1.68 | 0.7126 | -0.5721 | |

| 0.00 | 0.00 | -0.5251 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2020-01-29 untuk tempoh pelaporan 2019-12-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Call | 0.16 | -20.80 | 51.04 | -14.21 | 21.6012 | -2.2503 | ||

| SPY / SPDR S&P 500 ETF | Put | 0.12 | 4.79 | 40.19 | 13.50 | 17.0058 | 2.8140 | ||

| GLD / SPDR Gold Trust | Call | 0.21 | 21.18 | 29.59 | 24.70 | 12.5242 | 3.0108 | ||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | Put | 0.11 | -14.17 | 15.27 | -18.72 | 6.4616 | -1.0687 | ||

| SLV / iShares Silver Trust | Call | 0.48 | -1.69 | 8.04 | 3.00 | 3.4007 | 0.2733 | ||

| BL / BlackLine, Inc. | Put | 0.03 | 21.43 | 7.24 | 36.68 | 3.0639 | 3.0639 | ||

| IWM / iShares Trust - iShares Russell 2000 ETF | Call | 0.03 | 88.57 | 5.48 | 106.41 | 2.3174 | 1.2539 | ||

| AAPL / Apple Inc. | Put | 0.02 | -5.26 | 5.29 | 24.23 | 2.2370 | 0.5313 | ||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | Call | 0.04 | 117.42 | 5.24 | 105.85 | 2.2188 | 1.1978 | ||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | Call | 0.10 | 0.97 | 4.66 | 10.84 | 1.9725 | 0.2869 | ||

| GLD / SPDR Gold Trust | 0.03 | 67.58 | 4.21 | 72.39 | 1.7808 | 0.8023 | |||

| ADBE / Adobe Inc. | Put | 0.01 | 10.00 | 3.63 | 31.31 | 1.5353 | 0.4278 | ||

| GLD / SPDR Gold Trust | Put | 0.03 | -73.77 | 3.57 | -73.00 | 1.5120 | -3.7928 | ||

| SPY / SPDR S&P 500 ETF | 0.01 | 59.81 | 3.40 | 73.12 | 1.4388 | 0.6516 | |||

| CRM / Salesforce, Inc. | Put | 0.02 | 5.41 | 3.17 | 15.48 | 1.3419 | 0.2412 | ||

| IWM / iShares Trust - iShares Russell 2000 ETF | Put | 0.02 | 76.00 | 2.92 | 92.61 | 1.2357 | 0.6280 | ||

| FXI / iShares Trust - iShares China Large-Cap ETF | Put | 0.06 | 52.02 | 2.79 | 66.59 | 1.1815 | 0.5097 | ||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | Put | 0.03 | -65.36 | 2.40 | -65.05 | 1.0161 | -1.7374 | ||

| MSFT / Microsoft Corporation | Put | 0.01 | -33.33 | 2.37 | -24.36 | 1.0013 | -0.2526 | ||

| MSFT / Microsoft Corporation | Call | 0.01 | -25.00 | 2.37 | -14.92 | 1.0013 | -0.1135 | ||

| EFA / iShares Trust - iShares MSCI EAFE ETF | Call | 0.03 | 1.77 | 0.7495 | 0.7495 | ||||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | Put | 0.04 | -34.01 | 1.74 | -27.57 | 0.7372 | -0.2269 | ||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | Call | 0.06 | -52.08 | 1.68 | -47.46 | 0.7126 | -0.5721 | ||

| PRU / Prudential Financial, Inc. | Call | 0.02 | 25.53 | 1.66 | 30.84 | 0.7021 | 0.1938 | ||

| AAPL / Apple Inc. | Call | 0.01 | 1.53 | 0.6462 | 0.6462 | ||||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | 0.01 | 181.54 | 1.36 | 166.80 | 0.5747 | 0.3707 | |||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | Put | 0.01 | 0.00 | 1.33 | -1.98 | 0.5645 | 0.0190 | ||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | Call | 0.01 | 0.00 | 1.33 | -1.98 | 0.5645 | 0.0190 | ||

| FXI / iShares Trust - iShares China Large-Cap ETF | Call | 0.03 | 1.78 | 1.25 | 11.63 | 0.5281 | 0.0800 | ||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | Call | 0.02 | 1.20 | 0.5082 | 0.5082 | ||||

| GDXJ / VanEck ETF Trust - VanEck Junior Gold Miners ETF | Call | 0.03 | 0.00 | 1.16 | 16.63 | 0.4926 | 0.0925 | ||

| NEM / Newmont Corporation | Call | 0.03 | 0.00 | 1.11 | 14.52 | 0.4706 | 0.0814 | ||

| XOM / Exxon Mobil Corporation | Call | 0.01 | 1.05 | 0.4431 | 0.4431 | ||||

| NUE / Nucor Corporation | Call | 0.02 | 10.71 | 0.87 | 22.30 | 0.3690 | 0.3690 | ||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.87 | 0.3686 | 0.3686 | |||||

| EFA / iShares Trust - iShares MSCI EAFE ETF | Put | 0.01 | 0.87 | 0.3673 | 0.3673 | ||||

| GDXJ / VanEck ETF Trust - VanEck Junior Gold Miners ETF | Put | 0.02 | 0.00 | 0.85 | 16.53 | 0.3580 | 0.0670 | ||

| BAC / Bank of America Corporation | Call | 0.02 | -20.00 | 0.84 | -3.43 | 0.3576 | 0.0068 | ||

| BAC / Bank of America Corporation | Put | 0.02 | 20.00 | 0.84 | 44.94 | 0.3576 | 0.1239 | ||

| BMY / Bristol-Myers Squibb Company | Put | 0.01 | 23.81 | 0.83 | 56.77 | 0.3529 | 0.1397 | ||

| SU / Suncor Energy Inc. | Call | 0.02 | 0.77 | 0.3250 | 0.3250 | ||||

| COP / ConocoPhillips | Call | 0.01 | -35.00 | 0.76 | -25.83 | 0.3220 | -0.0892 | ||

| MS / Morgan Stanley | Call | 0.01 | 37.74 | 0.75 | 65.04 | 0.3157 | 0.1345 | ||

| MS / Morgan Stanley | Put | 0.01 | 37.74 | 0.75 | 65.04 | 0.3157 | 0.1345 | ||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | Put | 0.01 | 0.64 | 0.2704 | 0.2704 | ||||

| LUV / Southwest Airlines Co. | Call | 0.01 | 0.55 | 0.2332 | 0.2332 | ||||

| LUV / Southwest Airlines Co. | Put | 0.01 | 0.55 | 0.2332 | 0.2332 | ||||

| BIDU / Baidu, Inc. - Depositary Receipt (Common Stock) | 0.00 | 0.41 | 0.47 | 23.48 | 0.1981 | 0.0461 | |||

| SU / Suncor Energy Inc. | Put | 0.01 | 0.44 | 0.1862 | 0.1862 | ||||

| GM / General Motors Company | Call | 0.01 | -31.25 | 0.40 | -32.83 | 0.1705 | -0.0700 | ||

| AAPL / Apple Inc. | 0.00 | 0.40 | 0.1672 | 0.1672 | |||||

| FAST / Fastenal Company | Put | 0.01 | 0.00 | 0.37 | 13.15 | 0.1566 | 0.0255 | ||

| FAST / Fastenal Company | Call | 0.01 | 0.00 | 0.37 | 13.15 | 0.1566 | 0.0255 | ||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -63.36 | 0.35 | -59.86 | 0.1498 | -0.2037 | |||

| CRM / Salesforce, Inc. | 0.00 | -33.24 | 0.31 | -26.81 | 0.1329 | -0.0391 | |||

| WY / Weyerhaeuser Company | Call | 0.01 | 0.00 | 0.30 | 9.03 | 0.1278 | 0.0168 | ||

| WY / Weyerhaeuser Company | Put | 0.01 | 0.00 | 0.30 | 9.03 | 0.1278 | 0.0168 | ||

| OIH / VanEck ETF Trust - VanEck Oil Services ETF | Call | 0.02 | 0.30 | 0.1261 | 0.1261 | ||||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | Put | 0.01 | 0.29 | 0.1240 | 0.1240 | ||||

| LNC / Lincoln National Corporation | 0.00 | 0.21 | 0.0884 | 0.0884 | |||||

| MU / Micron Technology, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.1720 | |||

| HUM / Humana Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| LNC / Lincoln National Corporation | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.3359 | |||

| NFLX / Netflix, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2614 | ||||

| NFLX / Netflix, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.9119 | |||

| QQQ / Invesco QQQ Trust, Series 1 | Call | 0.00 | -100.00 | 0.00 | -100.00 | -3.2990 | |||

| BEN / Franklin Resources, Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.1158 | |||

| IRM / Iron Mountain Incorporated | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.2545 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.4514 | |||

| CMCSA / Comcast Corporation | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.1808 | |||

| AMZN / Amazon.com, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2157 | ||||

| IRM / Iron Mountain Incorporated | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.2806 | |||

| SLV / iShares Silver Trust | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.6061 | |||

| GM / General Motors Company | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.1503 | |||

| FXI / iShares Trust - iShares China Large-Cap ETF | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| MRK / Merck & Co., Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.3712 | |||

| PPG / PPG Industries, Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.6081 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.1503 | ||||

| CAT / Caterpillar Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0866 | ||||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| ABBV / AbbVie Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.3187 | |||

| SMH / VanEck ETF Trust - VanEck Semiconductor ETF | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.5251 |