Statistik Asas

| Nilai Portfolio | $ 965,132,770 |

| Kedudukan Semasa | 48 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

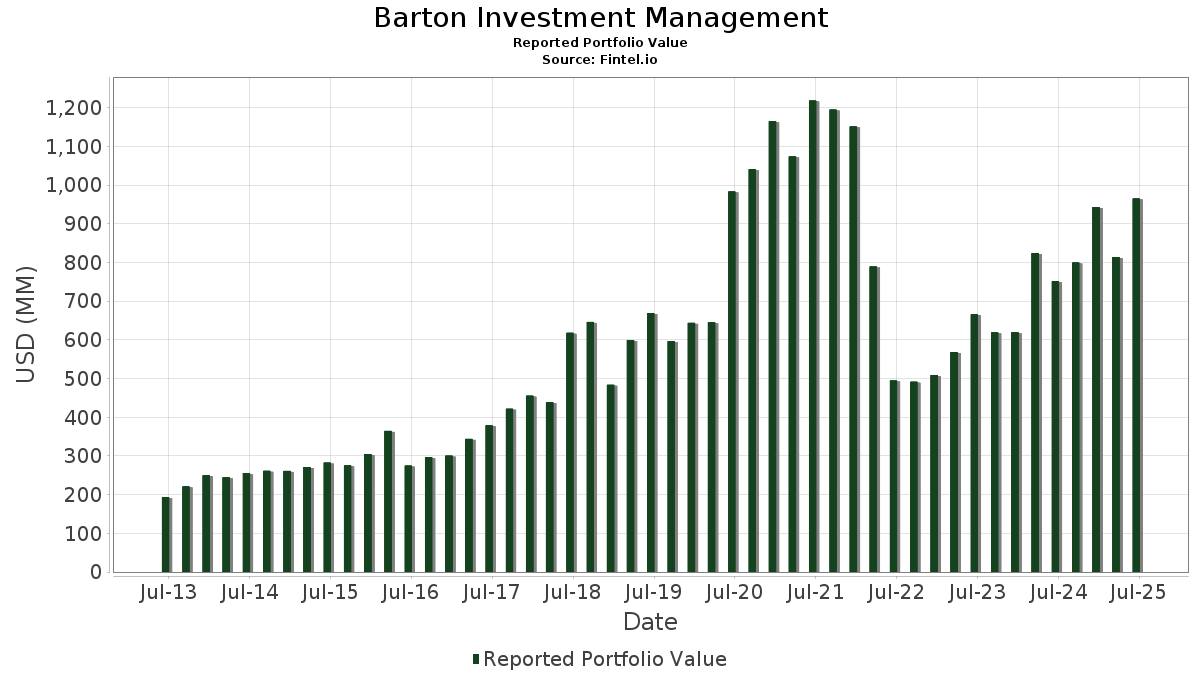

Barton Investment Management telah mendedahkan 48 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 965,132,770 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Barton Investment Management ialah Netflix, Inc. (US:NFLX) , Shopify Inc. (US:SHOP) , Amazon.com, Inc. (US:AMZN) , Blue Owl Capital Inc. (US:OWL) , and Global-E Online Ltd. (US:GLBE) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.25 | 328.87 | 34.0755 | 5.4914 | |

| 1.72 | 198.21 | 20.5374 | 0.2659 | |

| 0.03 | 12.82 | 1.3284 | 0.1398 | |

| 0.56 | 25.45 | 2.6370 | 0.1010 | |

| 0.01 | 1.44 | 0.1492 | 0.0361 | |

| 0.00 | 0.30 | 0.0306 | 0.0306 | |

| 0.00 | 0.29 | 0.0297 | 0.0297 | |

| 0.01 | 1.48 | 0.1532 | 0.0185 | |

| 0.00 | 0.62 | 0.0642 | 0.0120 | |

| 0.01 | 0.78 | 0.0808 | 0.0046 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.91 | 36.63 | 3.7952 | -0.8988 | |

| 1.08 | 36.20 | 3.7510 | -0.7892 | |

| 0.25 | 25.20 | 2.6109 | -0.7322 | |

| 0.04 | 29.96 | 3.1041 | -0.6646 | |

| 0.52 | 113.30 | 11.7396 | -0.4111 | |

| 0.08 | 18.26 | 1.8923 | -0.3921 | |

| 0.60 | 34.80 | 3.6060 | -0.3606 | |

| 0.17 | 9.85 | 1.0209 | -0.3055 | |

| 0.42 | 21.18 | 2.1942 | -0.2856 | |

| 0.00 | 7.29 | 0.7551 | -0.2257 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-21 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NFLX / Netflix, Inc. | 0.25 | -1.58 | 328.87 | 41.33 | 34.0755 | 5.4914 | |||

| SHOP / Shopify Inc. | 1.72 | -0.58 | 198.21 | 20.11 | 20.5374 | 0.2659 | |||

| AMZN / Amazon.com, Inc. | 0.52 | -0.66 | 113.30 | 14.54 | 11.7396 | -0.4111 | |||

| OWL / Blue Owl Capital Inc. | 1.91 | -0.00 | 36.63 | -4.15 | 3.7952 | -0.8988 | |||

| GLBE / Global-E Online Ltd. | 1.08 | 4.11 | 36.20 | -2.05 | 3.7510 | -0.7892 | |||

| AL / Air Lease Corporation | 0.60 | -10.98 | 34.80 | 7.78 | 3.6060 | -0.3606 | |||

| EQIX / Equinix, Inc. | 0.04 | 0.09 | 29.96 | -2.35 | 3.1041 | -0.6646 | |||

| GTLB / GitLab Inc. | 0.56 | 28.44 | 25.45 | 23.28 | 2.6370 | 0.1010 | |||

| OKTA / Okta, Inc. | 0.25 | -2.55 | 25.20 | -7.41 | 2.6109 | -0.7322 | |||

| GFL / GFL Environmental Inc. | 0.42 | 0.43 | 21.18 | 4.90 | 2.1942 | -0.2856 | |||

| AMT / American Tower Corporation | 0.08 | -3.31 | 18.26 | -1.79 | 1.8923 | -0.3921 | |||

| MSFT / Microsoft Corporation | 0.03 | 0.00 | 12.82 | 32.51 | 1.3284 | 0.1398 | |||

| BL / BlackLine, Inc. | 0.17 | -21.96 | 9.85 | -8.75 | 1.0209 | -0.3055 | |||

| PYPL / PayPal Holdings, Inc. | 0.13 | -1.17 | 9.76 | 12.57 | 1.0108 | -0.0537 | |||

| EA / Electronic Arts Inc. | 0.05 | -7.01 | 8.01 | 2.74 | 0.8303 | -0.1277 | |||

| QCOM / QUALCOMM Incorporated | 0.05 | -2.75 | 7.55 | 0.84 | 0.7820 | -0.1375 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 7.29 | -8.72 | 0.7551 | -0.2257 | |||

| AAPL / Apple Inc. | 0.03 | -1.40 | 5.91 | -8.93 | 0.6119 | -0.1847 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 0.00 | 5.08 | -8.79 | 0.5260 | -0.1577 | |||

| GOOGL / Alphabet Inc. | 0.02 | 0.00 | 3.40 | 13.96 | 0.3528 | -0.0142 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.01 | -5.68 | 3.36 | 4.32 | 0.3480 | -0.0475 | |||

| JNJ / Johnson & Johnson | 0.01 | 0.00 | 2.28 | -7.91 | 0.2365 | -0.0679 | |||

| GOOG / Alphabet Inc. | 0.01 | -1.76 | 1.89 | 11.53 | 0.1955 | -0.0123 | |||

| ABBV / AbbVie Inc. | 0.01 | 0.00 | 1.78 | -11.42 | 0.1849 | -0.0625 | |||

| VGSH / Vanguard Scottsdale Funds - Vanguard Short-Term Treasury ETF | 0.03 | 9.91 | 1.61 | 10.05 | 0.1668 | -0.0128 | |||

| TROW / T. Rowe Price Group, Inc. | 0.02 | -4.25 | 1.59 | 0.57 | 0.1644 | -0.0294 | |||

| DASH / DoorDash, Inc. | 0.01 | 0.00 | 1.48 | 34.95 | 0.1532 | 0.0185 | |||

| ORCL / Oracle Corporation | 0.01 | 0.00 | 1.44 | 56.41 | 0.1492 | 0.0361 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 0.00 | 1.35 | -9.38 | 0.1402 | -0.0432 | |||

| ABT / Abbott Laboratories | 0.01 | 0.00 | 1.35 | 2.52 | 0.1394 | -0.0218 | |||

| ADBE / Adobe Inc. | 0.00 | 0.00 | 1.24 | 0.90 | 0.1283 | -0.0225 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 1.01 | 4.65 | 0.1050 | -0.0139 | |||

| DIS / The Walt Disney Company | 0.01 | 0.00 | 0.78 | 25.65 | 0.0808 | 0.0046 | |||

| BILL / BILL Holdings, Inc. | 0.01 | 6.17 | 0.68 | 7.08 | 0.0706 | -0.0076 | |||

| MRK / Merck & Co., Inc. | 0.01 | 0.00 | 0.65 | -11.89 | 0.0669 | -0.0230 | |||

| NVDA / NVIDIA Corporation | 0.00 | 0.00 | 0.62 | 45.99 | 0.0642 | 0.0120 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.56 | 28.18 | 0.0585 | 0.0043 | |||

| AXP / American Express Company | 0.00 | 0.00 | 0.55 | 18.67 | 0.0573 | 0.0000 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.52 | 10.45 | 0.0537 | -0.0039 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.43 | 0.94 | 0.0447 | -0.0078 | |||

| CI / The Cigna Group | 0.00 | 0.00 | 0.36 | 0.56 | 0.0370 | -0.0067 | |||

| CSCO / Cisco Systems, Inc. | 0.00 | 0.00 | 0.30 | 12.17 | 0.0307 | -0.0017 | |||

| VRT / Vertiv Holdings Co | 0.00 | 0.30 | 0.0306 | 0.0306 | |||||

| AVGO / Broadcom Inc. | 0.00 | 0.29 | 0.0297 | 0.0297 | |||||

| NTRS / Northern Trust Corporation | 0.00 | 0.00 | 0.29 | 28.96 | 0.0296 | 0.0023 | |||

| WMT / Walmart Inc. | 0.00 | 0.00 | 0.25 | 11.26 | 0.0257 | -0.0017 | |||

| PFE / Pfizer Inc. | 0.01 | 0.18 | 0.24 | -4.45 | 0.0245 | -0.0058 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.00 | 0.00 | 0.22 | 2.35 | 0.0226 | -0.0036 |