Statistik Asas

| Nilai Portfolio | $ 226,197,944 |

| Kedudukan Semasa | 99 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

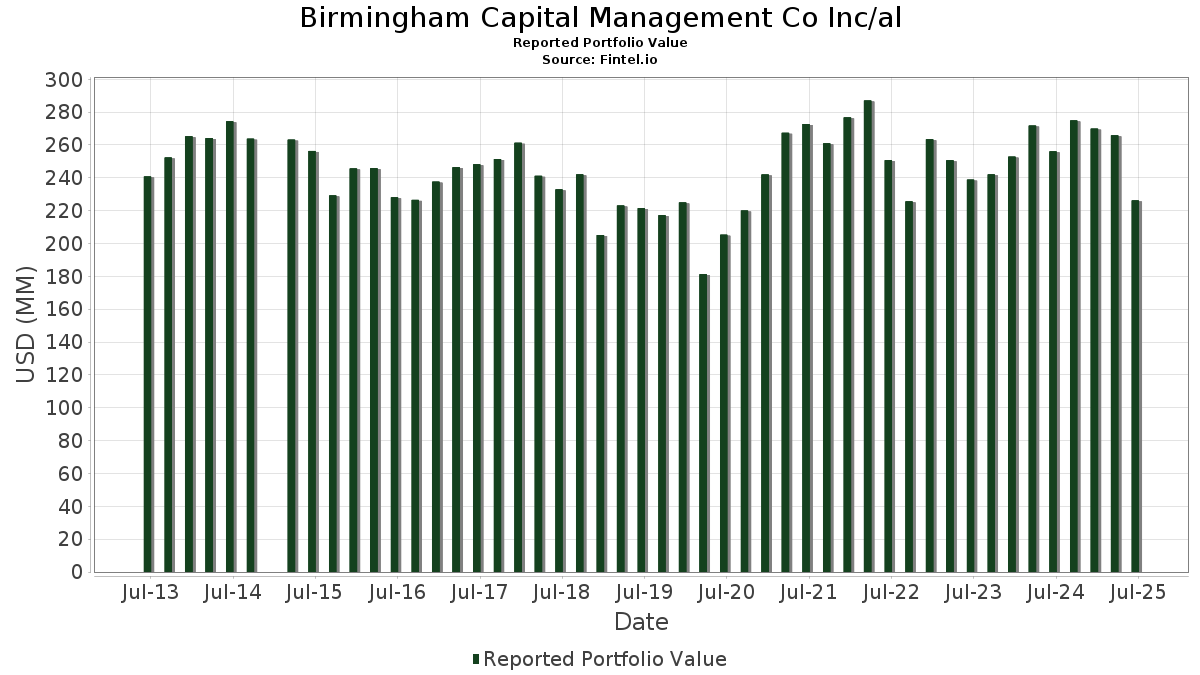

Birmingham Capital Management Co Inc/al telah mendedahkan 99 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 226,197,944 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Birmingham Capital Management Co Inc/al ialah Deere & Company (US:DE) , Caterpillar Inc. (US:CAT) , The Allstate Corporation (US:ALL) , McDonald's Corporation (US:MCD) , and Eli Lilly and Company (US:LLY) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 15.52 | 6.8615 | 1.7096 | |

| 0.03 | 16.43 | 7.2632 | 1.4321 | |

| 0.05 | 7.20 | 3.1815 | 0.6336 | |

| 0.06 | 7.53 | 3.3289 | 0.5554 | |

| 0.01 | 6.07 | 2.6853 | 0.4704 | |

| 0.02 | 2.88 | 1.2747 | 0.3777 | |

| 0.01 | 4.37 | 1.9319 | 0.3768 | |

| 0.01 | 2.54 | 1.1238 | 0.3613 | |

| 0.01 | 4.81 | 2.1283 | 0.3525 | |

| 0.00 | 2.96 | 1.3088 | 0.3009 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 5.63 | 2.4887 | -0.5227 | |

| 0.06 | 3.72 | 1.6438 | -0.4963 | |

| 0.01 | 0.64 | 0.2836 | -0.4516 | |

| 0.03 | 2.22 | 0.9809 | -0.4336 | |

| 0.04 | 4.38 | 1.9360 | -0.3666 | |

| 0.02 | 1.31 | 0.5796 | -0.3155 | |

| 0.02 | 1.10 | 0.4880 | -0.3151 | |

| 0.02 | 3.49 | 1.5444 | -0.3142 | |

| 0.00 | 1.34 | 0.5915 | -0.3004 | |

| 0.03 | 4.79 | 2.1163 | -0.2914 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-29 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| DE / Deere & Company | 0.03 | -2.17 | 16.43 | 5.99 | 7.2632 | 1.4321 | |||

| CAT / Caterpillar Inc. | 0.04 | -3.72 | 15.52 | 13.33 | 6.8615 | 1.7096 | |||

| ALL / The Allstate Corporation | 0.05 | -7.81 | 9.47 | -10.38 | 4.1878 | 0.2115 | |||

| MCD / McDonald's Corporation | 0.03 | -10.36 | 9.31 | -16.16 | 4.1162 | -0.0615 | |||

| LLY / Eli Lilly and Company | 0.01 | -7.15 | 8.05 | -12.36 | 3.5600 | 0.1034 | |||

| EMR / Emerson Electric Co. | 0.06 | -16.01 | 7.53 | 2.13 | 3.3289 | 0.5554 | |||

| RTX / RTX Corporation | 0.05 | -3.61 | 7.20 | 6.26 | 3.1815 | 0.6336 | |||

| IBM / International Business Machines Corporation | 0.02 | -27.33 | 6.19 | -13.85 | 2.7385 | 0.0334 | |||

| LMT / Lockheed Martin Corporation | 0.01 | -0.49 | 6.07 | 3.18 | 2.6853 | 0.4704 | |||

| PG / The Procter & Gamble Company | 0.04 | -14.68 | 5.86 | -20.24 | 2.5913 | -0.1733 | |||

| CVX / Chevron Corporation | 0.04 | -17.84 | 5.63 | -29.67 | 2.4887 | -0.5227 | |||

| JNJ / Johnson & Johnson | 0.03 | -18.13 | 4.85 | -24.59 | 2.1439 | -0.2753 | |||

| CMI / Cummins Inc. | 0.01 | -2.39 | 4.81 | 1.99 | 2.1283 | 0.3525 | |||

| ABBV / AbbVie Inc. | 0.03 | -15.57 | 4.79 | -25.20 | 2.1163 | -0.2914 | |||

| MMM / 3M Company | 0.03 | -17.98 | 4.74 | -14.97 | 2.0965 | -0.0016 | |||

| KO / The Coca-Cola Company | 0.06 | -15.77 | 4.40 | -16.78 | 1.9467 | -0.0441 | |||

| XOM / Exxon Mobil Corporation | 0.04 | -21.07 | 4.38 | -28.45 | 1.9360 | -0.3666 | |||

| AXP / American Express Company | 0.01 | -10.84 | 4.37 | 5.73 | 1.9319 | 0.3768 | |||

| SPBO / SPDR Series Trust - SPDR Portfolio Corporate Bond ETF | 0.15 | -21.54 | 4.31 | -21.04 | 1.9054 | -0.1477 | |||

| HSY / The Hershey Company | 0.02 | -7.20 | 3.95 | -9.94 | 1.7468 | 0.0961 | |||

| SCHQ / Schwab Strategic Trust - Schwab Long-Term U.S. Treasury ETF | 0.12 | -19.22 | 3.81 | -21.37 | 1.6854 | -0.1385 | |||

| EDV / Vanguard World Fund - Vanguard Extended Duration Treasury ETF | 0.06 | -30.94 | 3.72 | -34.63 | 1.6438 | -0.4963 | |||

| SO / The Southern Company | 0.04 | -17.66 | 3.51 | -17.76 | 1.5518 | -0.0541 | |||

| AAPL / Apple Inc. | 0.02 | -23.45 | 3.49 | -29.29 | 1.5444 | -0.3142 | |||

| PFE / Pfizer Inc. | 0.13 | -18.99 | 3.21 | -22.51 | 1.4172 | -0.1389 | |||

| ABT / Abbott Laboratories | 0.02 | -7.62 | 3.05 | -5.28 | 1.3487 | 0.1371 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.00 | 2.96 | 10.49 | 1.3088 | 0.3009 | |||

| NVDA / NVIDIA Corporation | 0.02 | -17.05 | 2.88 | 20.93 | 1.2747 | 0.3777 | |||

| DUK / Duke Energy Corporation | 0.02 | -19.16 | 2.61 | -21.79 | 1.1536 | -0.1015 | |||

| GE / General Electric Company | 0.01 | -2.47 | 2.54 | 25.42 | 1.1238 | 0.3613 | |||

| FDX / FedEx Corporation | 0.01 | -12.29 | 2.35 | -18.22 | 1.0401 | -0.0421 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -30.97 | 2.24 | -18.41 | 0.9914 | -0.0426 | |||

| MRK / Merck & Co., Inc. | 0.03 | -33.09 | 2.22 | -41.01 | 0.9809 | -0.4336 | |||

| DG / Dollar General Corporation | 0.02 | -48.66 | 2.10 | -33.21 | 0.9276 | -0.2543 | |||

| BAC / Bank of America Corporation | 0.04 | -21.75 | 1.94 | -11.27 | 0.8561 | 0.0351 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 1.91 | 4.66 | 0.8447 | 0.1580 | |||

| SCHO / Schwab Strategic Trust - Schwab Short-Term U.S. Treasury ETF | 0.07 | -29.13 | 1.78 | -29.04 | 0.7868 | -0.1563 | |||

| BMY / Bristol-Myers Squibb Company | 0.04 | -15.22 | 1.68 | -35.64 | 0.7441 | -0.2400 | |||

| BA / The Boeing Company | 0.01 | -1.24 | 1.52 | 21.31 | 0.6721 | 0.2007 | |||

| INTC / Intel Corporation | 0.06 | -3.15 | 1.43 | -4.47 | 0.6327 | 0.0691 | |||

| GWW / W.W. Grainger, Inc. | 0.00 | -46.42 | 1.34 | -43.57 | 0.5915 | -0.3004 | |||

| MET / MetLife, Inc. | 0.02 | -44.99 | 1.31 | -44.89 | 0.5796 | -0.3155 | |||

| TXN / Texas Instruments Incorporated | 0.01 | -40.23 | 1.30 | -30.98 | 0.5755 | -0.1336 | |||

| C / Citigroup Inc. | 0.01 | -24.35 | 1.26 | -9.29 | 0.5569 | 0.0344 | |||

| DD / DuPont de Nemours, Inc. | 0.02 | -43.71 | 1.10 | -48.31 | 0.4880 | -0.3151 | |||

| GEV / GE Vernova Inc. | 0.00 | -2.90 | 1.10 | 68.56 | 0.4859 | 0.2402 | |||

| LNC / Lincoln National Corporation | 0.03 | 0.00 | 1.09 | -3.62 | 0.4834 | 0.0565 | |||

| CAH / Cardinal Health, Inc. | 0.01 | 0.00 | 1.09 | 22.01 | 0.4828 | 0.1459 | |||

| SLB / Schlumberger Limited | 0.03 | -12.76 | 1.09 | -29.48 | 0.4826 | -0.0996 | |||

| JCI / Johnson Controls International plc | 0.01 | -2.88 | 1.07 | 28.09 | 0.4719 | 0.1583 | |||

| SCHW / The Charles Schwab Corporation | 0.01 | -29.24 | 1.04 | -17.57 | 0.4588 | -0.0146 | |||

| HAL / Halliburton Company | 0.05 | -30.48 | 1.01 | -44.14 | 0.4470 | -0.2341 | |||

| ITA / iShares Trust - iShares U.S. Aerospace & Defense ETF | 0.01 | 0.00 | 0.96 | 23.32 | 0.4232 | 0.1309 | |||

| KHC / The Kraft Heinz Company | 0.04 | -38.89 | 0.93 | -48.15 | 0.4092 | -0.2623 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | -1.98 | 0.92 | -2.35 | 0.4052 | 0.0523 | |||

| MSFT / Microsoft Corporation | 0.00 | -44.89 | 0.91 | -26.97 | 0.4011 | -0.0663 | |||

| KMI / Kinder Morgan, Inc. | 0.03 | -41.00 | 0.90 | -39.25 | 0.4000 | -0.1598 | |||

| CLX / The Clorox Company | 0.01 | -10.82 | 0.79 | -27.30 | 0.3499 | -0.0596 | |||

| HD / The Home Depot, Inc. | 0.00 | -20.57 | 0.76 | -20.58 | 0.3380 | -0.0240 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | -49.07 | 0.76 | -42.76 | 0.3359 | -0.1632 | |||

| GT / The Goodyear Tire & Rubber Company | 0.07 | -1.69 | 0.72 | 10.37 | 0.3203 | 0.0733 | |||

| ROK / Rockwell Automation, Inc. | 0.00 | 0.00 | 0.70 | 28.60 | 0.3084 | 0.1043 | |||

| BKR / Baker Hughes Company | 0.02 | 0.00 | 0.67 | -12.87 | 0.2966 | 0.0073 | |||

| WMT / Walmart Inc. | 0.01 | -70.53 | 0.64 | -67.20 | 0.2836 | -0.4516 | |||

| VZ / Verizon Communications Inc. | 0.01 | -42.93 | 0.63 | -45.56 | 0.2791 | -0.1571 | |||

| WY / Weyerhaeuser Company | 0.02 | -38.46 | 0.63 | -46.05 | 0.2780 | -0.1601 | |||

| DIS / The Walt Disney Company | 0.01 | -34.13 | 0.62 | -17.26 | 0.2758 | -0.0078 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | -29.68 | 0.59 | -33.14 | 0.2614 | -0.0711 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | 0.00 | 0.59 | -3.93 | 0.2597 | 0.0296 | |||

| GL / Globe Life Inc. | 0.00 | 0.00 | 0.55 | -5.70 | 0.2418 | 0.0237 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | 0.00 | 0.55 | 5.01 | 0.2410 | 0.0455 | |||

| MO / Altria Group, Inc. | 0.01 | 0.00 | 0.49 | -2.20 | 0.2168 | 0.0279 | |||

| WHR / Whirlpool Corporation | 0.00 | 0.00 | 0.49 | 12.67 | 0.2163 | 0.0527 | |||

| EBAY / eBay Inc. | 0.01 | 0.00 | 0.48 | 9.77 | 0.2140 | 0.0483 | |||

| DAL / Delta Air Lines, Inc. | 0.01 | 0.00 | 0.48 | 12.65 | 0.2131 | 0.0523 | |||

| CCL / Carnival Corporation & plc | 0.02 | 0.00 | 0.47 | 43.83 | 0.2064 | 0.0844 | |||

| T / AT&T Inc. | 0.02 | -36.19 | 0.45 | -34.74 | 0.1978 | -0.0600 | |||

| CTVA / Corteva, Inc. | 0.01 | -11.18 | 0.44 | 5.04 | 0.1940 | 0.0371 | |||

| PYPL / PayPal Holdings, Inc. | 0.01 | 0.00 | 0.43 | 13.91 | 0.1922 | 0.0486 | |||

| PEP / PepsiCo, Inc. | 0.00 | 0.00 | 0.42 | -11.97 | 0.1854 | 0.0062 | |||

| ED / Consolidated Edison, Inc. | 0.00 | -16.67 | 0.41 | -24.45 | 0.1819 | -0.0228 | |||

| PCAR / PACCAR Inc | 0.00 | 0.00 | 0.40 | -2.47 | 0.1749 | 0.0225 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.01 | -30.70 | 0.38 | -38.66 | 0.1700 | -0.0657 | |||

| PSX / Phillips 66 | 0.00 | -52.80 | 0.38 | -54.46 | 0.1673 | -0.1450 | |||

| VMC / Vulcan Materials Company | 0.00 | 0.00 | 0.37 | 11.75 | 0.1642 | 0.0392 | |||

| ENB / Enbridge Inc. | 0.01 | -19.76 | 0.37 | -17.98 | 0.1617 | -0.0060 | |||

| COP / ConocoPhillips | 0.00 | -26.88 | 0.35 | -37.52 | 0.1540 | -0.0557 | |||

| TFC / Truist Financial Corporation | 0.01 | -4.33 | 0.32 | 0.00 | 0.1406 | 0.0209 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | -5.91 | 0.30 | 12.83 | 0.1323 | 0.0325 | |||

| GLW / Corning Incorporated | 0.01 | 0.00 | 0.30 | 15.12 | 0.1314 | 0.0341 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 0.00 | 0.27 | 8.10 | 0.1183 | 0.0252 | |||

| A / Agilent Technologies, Inc. | 0.00 | -31.54 | 0.26 | -31.05 | 0.1161 | -0.0269 | |||

| BAX / Baxter International Inc. | 0.01 | -4.49 | 0.26 | -15.46 | 0.1138 | -0.0008 | |||

| DOW / Dow Inc. | 0.01 | 0.00 | 0.24 | -24.20 | 0.1054 | -0.0129 | |||

| GIS / General Mills, Inc. | 0.00 | -67.90 | 0.23 | -72.19 | 0.1017 | -0.2094 | |||

| FLR / Fluor Corporation | 0.00 | 0.22 | 0.0958 | 0.0958 | |||||

| BSX / Boston Scientific Corporation | 0.00 | 0.00 | 0.21 | 6.47 | 0.0950 | 0.0191 | |||

| NOC / Northrop Grumman Corporation | 0.00 | 0.00 | 0.21 | -2.30 | 0.0939 | 0.0121 | |||

| CLF / Cleveland-Cliffs Inc. | 0.01 | 0.00 | 0.11 | -7.38 | 0.0500 | 0.0040 | |||

| CL / Colgate-Palmolive Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GLD / SPDR Gold Trust | 0.00 | -100.00 | 0.00 | -100.00 | -0.1355 | ||||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FI / Fiserv, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PARAA / Paramount Global | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PNW / Pinnacle West Capital Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NEM / Newmont Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| OKE / ONEOK, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AEP / American Electric Power Company, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WPM / Wheaton Precious Metals Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GOLD / Barrick Mining Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |