Statistik Asas

| Nilai Portfolio | $ 246,180,412 |

| Kedudukan Semasa | 1,392 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

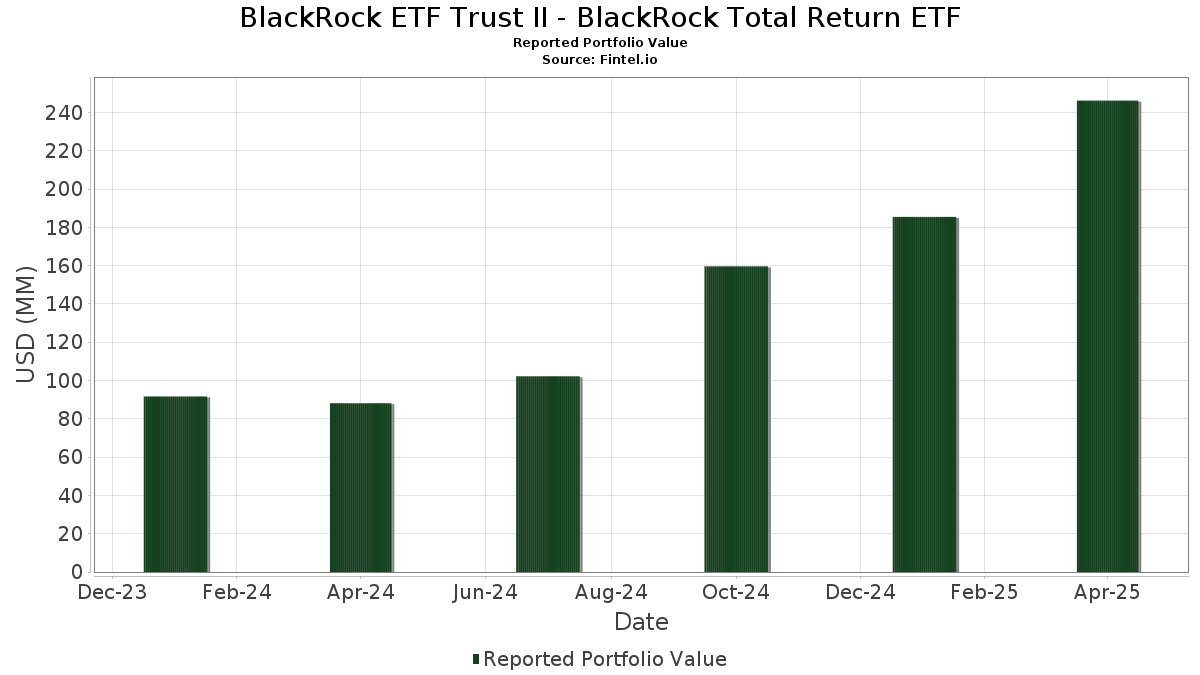

BlackRock ETF Trust II - BlackRock Total Return ETF telah mendedahkan 1,392 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 246,180,412 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas BlackRock ETF Trust II - BlackRock Total Return ETF ialah Uniform Mortgage-Backed Security, TBA (US:US01F0606594) , FNMA TBA 30 YR 5.5 SINGLE FAMILY MORTGAGE (US:US01F0526560) , BlackRock Cash Funds: Treasury, SL Agency Shares (US:US0669224778) , Uniform Mortgage-Backed Security, TBA (US:US01F0206536) , and Uniform Mortgage-Backed Security, TBA (US:US01F0506505) . Kedudukan baharu BlackRock ETF Trust II - BlackRock Total Return ETF termasuk Uniform Mortgage-Backed Security, TBA (US:US01F0606594) , FNMA TBA 30 YR 5.5 SINGLE FAMILY MORTGAGE (US:US01F0526560) , Uniform Mortgage-Backed Security, TBA (US:US01F0206536) , Uniform Mortgage-Backed Security, TBA (US:US01F0506505) , and United States Treasury Note/Bond (US:US91282CHE49) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 15.14 | 7.7535 | 7.7535 | ||

| 14.81 | 7.5850 | 5.8752 | ||

| 2.02 | 1.0372 | 1.0372 | ||

| 1.74 | 0.8904 | 0.8904 | ||

| 1.67 | 0.8560 | 0.8560 | ||

| 1.49 | 0.7653 | 0.7653 | ||

| 1.48 | 0.7573 | 0.7573 | ||

| 1.35 | 0.6931 | 0.6931 | ||

| 1.21 | 0.6220 | 0.6220 | ||

| 2.85 | 1.4618 | 0.5873 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 0.10 | 0.0512 | -2.6972 | |

| 0.31 | 0.1564 | -0.7579 | ||

| 0.15 | 0.0775 | -0.4884 | ||

| 0.56 | 0.2848 | -0.3291 | ||

| 0.15 | 0.0783 | -0.3115 | ||

| 0.05 | 0.0243 | -0.2756 | ||

| 0.03 | 0.0130 | -0.2545 | ||

| 0.94 | 0.4798 | -0.2336 | ||

| 1.13 | 0.5785 | -0.2160 | ||

| 1.66 | 0.8505 | -0.2075 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-06-26 untuk tempoh pelaporan 2025-04-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US01F0606594 / Uniform Mortgage-Backed Security, TBA | 15.14 | 7.7535 | 7.7535 | ||||||

| US01F0526560 / FNMA TBA 30 YR 5.5 SINGLE FAMILY MORTGAGE | 14.81 | 1,001.79 | 7.5850 | 5.8752 | |||||

| US0669224778 / BlackRock Cash Funds: Treasury, SL Agency Shares | 5.36 | 44.04 | 5.37 | 44.03 | 2.7484 | 0.3248 | |||

| US01F0206536 / Uniform Mortgage-Backed Security, TBA | 2.85 | 315.28 | 1.4618 | 0.5873 | |||||

| US01F0506505 / Uniform Mortgage-Backed Security, TBA | 2.26 | 123.56 | 1.1567 | -0.1281 | |||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CLV18) | 2.02 | 1.0372 | 1.0372 | ||||||

| U.S. Treasury Notes / DBT (US91282CLR06) | 1.74 | 0.8904 | 0.8904 | ||||||

| U.S. Treasury Notes / DBT (US91282CKJ98) | 1.67 | 0.8560 | 0.8560 | ||||||

| US91282CHE49 / United States Treasury Note/Bond | 1.66 | 2.09 | 0.8505 | -0.2075 | |||||

| US21H0206597 / GNMA II 30 YR TBA 2% MAY 21 TO BE ANNOUNCED 2.00000000 | 1.51 | 152.68 | 0.7741 | 0.0126 | |||||

| U.S. Treasury Notes / DBT (US91282CMM00) | 1.49 | 0.7653 | 0.7653 | ||||||

| U.S. Treasury Notes / DBT (US91282CMP31) | 1.48 | 0.7573 | 0.7573 | ||||||

| US01F0326581 / Uniform Mortgage-Backed Security, TBA | 1.39 | 302.90 | 0.7123 | 0.2727 | |||||

| US21H0226553 / Ginnie Mae | 1.36 | 170.86 | 0.6953 | 0.0572 | |||||

| U.S. Treasury Notes / DBT (US91282CMK44) | 1.35 | 0.6931 | 0.6931 | ||||||

| US3132DWDC47 / Freddie Mac Pool | 1.35 | 0.22 | 0.6894 | -0.1838 | |||||

| US01F0406516 / Uniform Mortgage-Backed Security, TBA | 1.32 | 814.58 | 0.6749 | 0.4912 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1.28 | 124.39 | 0.6554 | 0.2843 | |||||

| EU000A3K4DY4 / European Union | 1.28 | 30.51 | 0.6552 | 0.0174 | |||||

| FNCI / UMBS 15YR TBA(REG B) 2.0 UMBS TBA 05-01-35 | 1.28 | 504.74 | 0.6541 | 0.3857 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.21 | 0.6220 | 0.6220 | ||||||

| US21H0306587 / G2SF 3 5/16 | 1.16 | 146.71 | 0.5953 | -0.0041 | |||||

| US21H0526523 / Ginnie Mae | 1.15 | 299.31 | 0.5893 | 0.2226 | |||||

| U.S. Treasury Notes / DBT (US91282CKF76) | 1.13 | -7.53 | 0.5785 | -0.2160 | |||||

| US21H0506566 / Ginnie Mae | 1.10 | 247.47 | 0.5627 | 0.1597 | |||||

| U.S. Treasury Notes / DBT (US91282CLM19) | 1.08 | 0.5514 | 0.5514 | ||||||

| US91282CDL28 / UNITED STATES TREASURY NOTE 1.50000000 | 1.06 | 2.91 | 0.5443 | -0.1271 | |||||

| US91282CEV90 / United States Treasury Note/Bond | 1.03 | 335.02 | 0.5283 | 0.3736 | |||||

| US01F0306526 / FNMA TBA 30YR 3.0% MAY 20 TO BE ANNOUNCED 3.00000000 | 1.02 | 0.5227 | 0.5227 | ||||||

| US91282CHM64 / U.S. Treasury Notes | 0.99 | 350.45 | 0.5077 | 0.3640 | |||||

| US91282CFC01 / U.S. Treasury Notes | 0.97 | 2.96 | 0.4990 | -0.1164 | |||||

| US55903VBA08 / Warnermedia Holdings Inc | 0.95 | 0.4860 | 0.4860 | ||||||

| US01F0226591 / FNMA 30YR TBA 2.5% 4/25/50 TO BE ANNOUNCED 2.50000000 | 0.94 | 67.14 | 0.4798 | -0.2336 | |||||

| US91282CCJ80 / United States Treasury Note/Bond | 0.92 | 1.21 | 0.4733 | -0.1205 | |||||

| US91282CFZ95 / TREASURY NOTE | 0.92 | 1.66 | 0.4714 | -0.1175 | |||||

| US91282CHF14 / United States Treasury Note/Bond | 0.91 | 168.53 | 0.4678 | 0.0514 | |||||

| U.S. Treasury Notes / DBT (US91282CJZ59) | 0.91 | 585.71 | 0.4672 | 0.3803 | |||||

| US91282CJG78 / U.S. Treasury Notes | 0.91 | 0.4643 | 0.4639 | ||||||

| US91282CET45 / U.S. Treasury Notes | 0.90 | 0.4620 | 0.4620 | ||||||

| US912810SZ21 / United States Treasury Note/Bond | 0.90 | 22,425.00 | 0.4620 | 0.4590 | |||||

| U.S. Treasury Notes / DBT (US91282CMC28) | 0.90 | 0.4595 | 0.4595 | ||||||

| US01F0426571 / Uniform Mortgage-Backed Security, TBA | 0.89 | 80.08 | 0.4541 | -0.1730 | |||||

| US91282CCP41 / United States Treasury Note/Bond - When Issued | 0.85 | 1.31 | 0.4361 | -0.1104 | |||||

| US21H0426534 / Ginnie Mae | 0.80 | 236.71 | 0.4089 | 0.1068 | |||||

| US91282CJP77 / United States Treasury Note/Bond | 0.79 | 0.4064 | 0.4064 | ||||||

| US91282CFJ53 / United States Treasury Note/Bond | 0.78 | 0.4006 | 0.4006 | ||||||

| U.S. Treasury Notes / DBT (US91282CMW81) | 0.78 | 0.3998 | 0.3998 | ||||||

| US912828ZS21 / UST NOTES 0.5% 05/31/2027 | 0.77 | 2.12 | 0.3957 | -0.0964 | |||||

| U.S. Treasury Bonds / DBT (US912810UD80) | 0.77 | 2.14 | 0.3920 | -0.0953 | |||||

| US91282CGJ45 / United States Treasury Note/Bond | 0.76 | 0.3891 | 0.3891 | ||||||

| US21H0606556 / Ginnie Mae | 0.75 | 0.3859 | 0.3859 | ||||||

| US912810ST60 / TREASURY BOND | 0.74 | 2,525.00 | 0.3768 | 0.3581 | |||||

| US31418EB908 / FNMA UMBS, 30 Year | 0.73 | 0.3745 | 0.3745 | ||||||

| US91282CJR34 / United States Treasury Note/Bond - When Issued | 0.72 | 2.41 | 0.3706 | -0.0891 | |||||

| US912810RK60 / United States Treas Bds Bond | 0.71 | 2.01 | 0.3652 | -0.0889 | |||||

| US912810SQ22 / United States Treasury Note/Bond | 0.71 | 2,525.93 | 0.3634 | 0.3453 | |||||

| Cross 2025-H1 Mortgage Trust / ABS-MBS (US22758NAA54) | 0.70 | 52.29 | 0.3581 | 0.0592 | |||||

| US91087BAM28 / Mexico Government International Bond | 0.70 | 36.81 | 0.3565 | 0.0254 | |||||

| US3140QMHX52 / Fannie Mae Pool | 0.69 | 0.29 | 0.3517 | -0.0933 | |||||

| US91282CGA36 / United States Treasury Note/Bond | 0.67 | 0.15 | 0.3457 | -0.0926 | |||||

| US3132DWBP77 / UMBS | 0.67 | 0.30 | 0.3443 | -0.0916 | |||||

| U.S. Treasury Notes / DBT (US91282CKW00) | 0.67 | 9,485.71 | 0.3441 | 0.3389 | |||||

| US3132DWAW38 / Freddie Mac Pool | 0.64 | 0.31 | 0.3301 | -0.0879 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.64 | -10.97 | 0.3284 | -0.1402 | |||||

| U.S. Treasury Bonds / DBT (US912810UG12) | 0.64 | 0.3274 | 0.3274 | ||||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0.63 | 291.30 | 0.3228 | 0.2177 | |||||

| US91282CFY21 / TREASURY NOTE | 0.63 | 2.78 | 0.3219 | -0.0758 | |||||

| US91282CFF32 / United States Treasury Note/Bond | 0.63 | 3.64 | 0.3207 | -0.0722 | |||||

| US91282CGP05 / United States Treasury Note/Bond | 0.62 | 0.3184 | 0.3184 | ||||||

| US91282CAH43 / United States Treasury Note/Bond | 0.61 | 2.34 | 0.3144 | -0.0758 | |||||

| US912810TQ13 / United States Treasury Note/Bond | 0.61 | 149.80 | 0.3138 | 0.1544 | |||||

| US912828U246 / United States Treasury Note/Bond | 0.61 | 1.34 | 0.3110 | -0.0790 | |||||

| US91282CFU09 / United States Treasury Note/Bond - When Issued | 0.60 | 1.52 | 0.3092 | -0.0776 | |||||

| U.S. Treasury Notes / DBT (US91282CKH33) | 0.60 | 0.33 | 0.3089 | -0.0826 | |||||

| US912810TJ79 / United States Treasury Note/Bond | 0.60 | 313.10 | 0.3070 | 0.2126 | |||||

| US01F0626634 / Uniform Mortgage-Backed Security, TBA | 0.60 | 0.3057 | 0.3057 | ||||||

| US26884LAG41 / EQT Corp | 0.59 | 304.08 | 0.3043 | 0.2084 | |||||

| US718286CC97 / Philippine Government International Bond | 0.58 | 52.91 | 0.2962 | 0.0497 | |||||

| US912828ZN34 / United States Treasury Note/Bond | 0.57 | 2.14 | 0.2938 | -0.0717 | |||||

| US91282CEE75 / United States Treasury Note/Bond | 0.57 | 3.06 | 0.2936 | -0.0687 | |||||

| US21H0406577 / Ginnie Mae | 0.56 | 103.28 | 0.2855 | -0.0637 | |||||

| US01F0124523 / FNCI 1.5 UMBS TBA 05-01-36 | 0.56 | 15.15 | 0.2848 | -0.3291 | |||||

| US912810SF66 / Us Treasury Bond | 0.55 | 2.05 | 0.2810 | -0.0689 | |||||

| U.S. Treasury Notes / DBT (US91282CKK61) | 0.54 | 0.00 | 0.2766 | -0.0741 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.53 | 0.2719 | 0.2719 | ||||||

| US31418D4X74 / Fannie Mae Pool | 0.53 | 0.00 | 0.2695 | -0.0727 | |||||

| US31418ES431 / UMBS, 30 Year | 0.52 | 0.2686 | 0.2686 | ||||||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 0.01 | -16.73 | 0.52 | -17.87 | 0.2685 | -0.1469 | |||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.52 | 348.70 | 0.2644 | 0.1180 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.51 | 0.2631 | 0.2631 | ||||||

| US91282CGR60 / United States Treasury Note/Bond | 0.50 | 0.00 | 0.2565 | -0.0688 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 0.50 | 0.2565 | 0.2565 | ||||||

| US91282CEM91 / United States Treasury Note/Bond - When Issued | 0.50 | 2.89 | 0.2557 | -0.0602 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 0.50 | -22.29 | 0.2536 | -0.1612 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.49 | -0.40 | 0.2525 | -0.0689 | |||||

| US31418EDC12 / Fannie Mae Pool | 0.49 | 0.62 | 0.2507 | -0.0658 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.49 | -0.61 | 0.2507 | -0.0695 | |||||

| SHYG / iShares Trust - iShares 0-5 Year High Yield Corporate Bond ETF | 0.01 | 31.20 | 0.48 | 28.76 | 0.2457 | 0.0031 | |||

| U.S. Treasury Notes / DBT (US91282CKE02) | 0.48 | 1.06 | 0.2447 | -0.0629 | |||||

| U.S. Treasury Notes / DBT (US91282CJT99) | 0.48 | 1.06 | 0.2433 | -0.0628 | |||||

| US69331CAJ71 / PG&E Corp | 0.47 | 58.50 | 0.2389 | 0.0474 | |||||

| US91282CJA09 / United States Treasury Note/Bond | 0.46 | 2.22 | 0.2358 | -0.0576 | |||||

| US91087BAV27 / United Mexican States | 0.46 | 130.65 | 0.2354 | 0.1058 | |||||

| US91282CCE93 / United States Treasury Note/Bond | 0.46 | 2.71 | 0.2334 | -0.0552 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.44 | 0.45 | 0.2266 | -0.0599 | |||||

| Bank of America Corp / DBT (US06051GML04) | 0.44 | 121.00 | 0.2264 | 0.0959 | |||||

| US21H0626513 / Ginnie Mae | 0.44 | 289.38 | 0.2257 | 0.0814 | |||||

| US91282CGQ87 / United States Treasury Note/Bond | 0.44 | 0.2252 | 0.2251 | ||||||

| US3132DNF819 / FR SD1091 | 0.43 | 0.46 | 0.2225 | -0.0589 | |||||

| US31418EV807 / FN MA5138 | 0.43 | 0.2215 | 0.2215 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | 0.43 | 0.2214 | 0.2214 | ||||||

| US6174468L62 / Morgan Stanley | 0.43 | 298.15 | 0.2204 | 0.1500 | |||||

| Vistra Operations Co LLC / DBT (US92840VAU61) | 0.42 | 120.83 | 0.2172 | 0.0919 | |||||

| US91282CAL54 / United States Treasury Note/Bond | 0.42 | 2.44 | 0.2152 | -0.0516 | |||||

| US3132DWDS98 / Freddie Mac Pool | 0.42 | 0.48 | 0.2137 | -0.0565 | |||||

| US3132DWDJ99 / Freddie Mac Pool | 0.42 | 0.24 | 0.2134 | -0.0570 | |||||

| BE0000358672 / BELGIUM KINGDOM EUR 144A LIFE/REG S 3.3% 06-22-54 | 0.42 | 23.15 | 0.2130 | -0.0066 | |||||

| US01F0224513 / Fannie Mae or Freddie Mac | 0.41 | 270.27 | 0.2108 | 0.0689 | |||||

| US26884LAN91 / EQT CORP 3.625% 05/15/2031 144A | 0.41 | 15.58 | 0.2092 | -0.0208 | |||||

| OCP CLO 2025-40 Ltd / ABS-CBDO (US67570FAA30) | 0.40 | 0.2070 | 0.2070 | ||||||

| EXEEZ / Expand Energy Corporation - Equity Warrant | 0.40 | 153.46 | 0.2067 | 0.1027 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.40 | 0.25 | 0.2056 | -0.0551 | |||||

| US3132DVL943 / Uniform Mortgage-Backed Securities | 0.40 | 0.25 | 0.2024 | -0.0541 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.39 | -20.08 | 0.2003 | -0.1172 | |||||

| VICI / VICI Properties Inc. | 0.39 | 28.29 | 0.2000 | 0.0022 | |||||

| US3140XTBW04 / FNMA 30YR 2% 11/01/2050#FP0052 | 0.39 | 0.52 | 0.1982 | -0.0525 | |||||

| LNG / Cheniere Energy, Inc. | 0.39 | 77.06 | 0.1979 | 0.0555 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.38 | 1.05 | 0.1970 | -0.0507 | |||||

| US629377CT71 / NRG Energy Inc | 0.38 | 39.93 | 0.1959 | 0.0183 | |||||

| US698299BF03 / Panama Government International Bond | 0.38 | 104.28 | 0.1958 | 0.0740 | |||||

| Fontainebleau Miami Beach Mortgage Trust 2024-FBLU / ABS-MBS (US34461WAA80) | 0.38 | 65.65 | 0.1956 | 0.0455 | |||||

| US25179MBD48 / Devon Energy Corp | 0.38 | -34.54 | 0.1944 | -0.1828 | |||||

| US912810SA79 / United States Treas Bds Bond | 0.38 | 1.89 | 0.1934 | -0.0474 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.38 | -0.27 | 0.1927 | -0.0530 | |||||

| US25278XAM11 / Diamondback Energy Inc. | 0.37 | 32.38 | 0.1908 | 0.0076 | |||||

| US78449RAA32 / SLG Office Trust 2021-OVA | 0.37 | 3.06 | 0.1901 | -0.0444 | |||||

| US87264ABF12 / CORP. NOTE | 0.37 | 100.00 | 0.1898 | 0.0693 | |||||

| US912810SX72 / UNITED STATES TREASURY BOND 2.375% 05/15/2051 | 0.37 | 2,542.86 | 0.1897 | 0.1800 | |||||

| US455780CQ75 / Indonesia Government International Bond | 0.37 | 2.50 | 0.1891 | -0.0455 | |||||

| US36179XHW92 / Ginnie Mae II Pool | 0.37 | 0.1881 | 0.1881 | ||||||

| HCA Inc / DBT (US404119CT49) | 0.36 | -28.12 | 0.1864 | -0.1425 | |||||

| US912810RZ30 / United States Treas Bds Bond | 0.36 | 2.25 | 0.1860 | -0.0455 | |||||

| US3132DWDR16 / UMBS | 0.36 | 0.1831 | 0.1831 | ||||||

| Angel Oak Mortgage Trust 2025-1 / ABS-MBS (US034934AA73) | 0.36 | -1.93 | 0.1826 | -0.0537 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.36 | 0.1821 | 0.1821 | ||||||

| EFMT 2025-NQM1 / ABS-MBS (US26846CAN65) | 0.36 | 1.14 | 0.1819 | -0.0466 | |||||

| STAR 2025-SFR5 Trust / ABS-O (US85520CAG06) | 0.35 | 0.57 | 0.1812 | -0.0474 | |||||

| Cross 2025-H1 Mortgage Trust / ABS-MBS (US22758NAF42) | 0.35 | 0.29 | 0.1800 | -0.0480 | |||||

| Diameter Capital CLO 8 Ltd / ABS-CBDO (US25256JAA43) | 0.35 | -0.28 | 0.1793 | -0.0491 | |||||

| US25278XAR08 / Diamondback Energy Inc | 0.35 | 1.16 | 0.1792 | -0.0456 | |||||

| US87165BAU70 / Synchrony Financial | 0.35 | 38.49 | 0.1792 | 0.0151 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0.35 | 52.40 | 0.1789 | 0.0293 | |||||

| U.S. Treasury Notes / DBT (US91282CJV46) | 0.35 | 0.29 | 0.1770 | -0.0474 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.34 | -0.29 | 0.1762 | -0.0477 | |||||

| US3140XL5C80 / FN FS5342 | 0.34 | -1.15 | 0.1761 | -0.0497 | |||||

| US3140XTAZ44 / FNMA 30YR 3.5% 03/01/2050#FP0023 | 0.34 | -0.29 | 0.1747 | -0.0481 | |||||

| US694308KH99 / Pacific Gas and Electric Co | 0.34 | 20.71 | 0.1733 | -0.0091 | |||||

| US03674XAS53 / ANTERO RESOURCES CORP 5.375% 03/01/2030 144A | 0.34 | 20.07 | 0.1720 | -0.0101 | |||||

| US00206RLV23 / AT&T Inc | 0.32 | 32.79 | 0.1663 | 0.0071 | |||||

| KSL Commercial Mortgage Trust 2024-HT2 / ABS-MBS (US500937AA54) | 0.32 | 970.00 | 0.1649 | 0.1453 | |||||

| AREIT 2025-CRE10 Ltd / ABS-CBDO (US00193DAA63) | 0.32 | 54.85 | 0.1638 | 0.0295 | |||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 0.32 | 22.22 | 0.1636 | -0.0063 | |||||

| BRSTNCNTF1Q6 / Brazil Notas do Tesouro Nacional Serie F | 0.32 | 329.73 | 0.1630 | 0.1146 | |||||

| US91282CCV19 / UNITED STATES TREASURY NOTE 1.12500000 | 0.32 | 2.93 | 0.1621 | -0.0379 | |||||

| US36179W5D62 / Ginnie Mae II Pool | 0.32 | 0.1618 | 0.1618 | ||||||

| US43789XAE40 / Homeward Opportunities Fund I Trust, Series 2020-2, Class B1 | 0.31 | 5.72 | 0.1612 | -0.0326 | |||||

| US366651AG25 / Gartner Inc | 0.31 | 53.92 | 0.1609 | 0.0282 | |||||

| US3132DNWL36 / UMBS, 30 Year | 0.31 | -1.26 | 0.1606 | -0.0457 | |||||

| US46647PBX33 / JPMorgan Chase & Co | 0.31 | 345.71 | 0.1601 | 0.1143 | |||||

| S1YF34 / Synchrony Financial - Depositary Receipt (Common Stock) | 0.31 | 0.1594 | 0.1594 | ||||||

| US785592AX43 / Sabine Pass Liquefaction LLC | 0.31 | 44.86 | 0.1591 | 0.0196 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.31 | 0.65 | 0.1588 | -0.0421 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0.31 | 777.14 | 0.1576 | 0.1345 | |||||

| EQT / EQT Corporation | 0.31 | 92.45 | 0.1572 | 0.0537 | |||||

| U.S. Treasury Notes / DBT (US91282CLW90) | 0.31 | -78.29 | 0.1564 | -0.7579 | |||||

| US912810TN81 / United States Treasury Note/Bond | 0.31 | 2.01 | 0.1563 | -0.0388 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.30 | 0.1538 | 0.1538 | ||||||

| US38141GXR00 / Goldman Sachs Group Inc/The | 0.30 | 57.37 | 0.1532 | 0.0290 | |||||

| US3140X8ZF79 / Fannie Mae Pool | 0.30 | -1.65 | 0.1530 | -0.0441 | |||||

| US785592AS57 / SABINE PASS LIQUEFACTION LLC SR SECURED 03/27 5 | 0.30 | 40.57 | 0.1527 | 0.0143 | |||||

| US12482NAN12 / CBAM 2019-10 Ltd | 0.30 | -17.04 | 0.1523 | -0.0812 | |||||

| US91282CCF68 / United States Treasury Note/Bond | 0.30 | 1.03 | 0.1516 | -0.0387 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.29 | 0.1511 | 0.1511 | ||||||

| ARES Commercial Mortgage Trust 2024-IND / ABS-MBS (US03990DAA54) | 0.29 | -0.34 | 0.1501 | -0.0412 | |||||

| US92916WAA71 / VOYA CLO LTD FRN 04/25/2031 2013-2A A1R 144A | 0.29 | -23.56 | 0.1499 | -0.0988 | |||||

| LEX 2024-BBG Mortgage Trust / ABS-MBS (US52885AAA60) | 0.29 | 1.40 | 0.1486 | -0.0375 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.29 | 0.1481 | 0.1481 | ||||||

| US12669MAB46 / CHL Mortgage Pass-Through Trust 2007-J1 | 0.29 | 0.1477 | 0.1477 | ||||||

| US92763MAA36 / Viper Energy Partners LP 5.375% 11/01/2027 144A | 0.29 | 0.1467 | 0.1467 | ||||||

| EQT / EQT Corporation | 0.29 | 0.1464 | 0.1464 | ||||||

| US31418ES506 / Fannie Mae Pool | 0.28 | -1.06 | 0.1441 | -0.0412 | |||||

| US845467AT68 / Southwestern Energy Co | 0.28 | 1,455.56 | 0.1437 | 0.1316 | |||||

| BX Trust 2025-VLT6 / ABS-MBS (US12433KAA51) | 0.28 | 0.1425 | 0.1425 | ||||||

| Nelnet Student Loan Trust 2025-A / ABS-O (US64033XAE40) | 0.27 | 0.1395 | 0.1395 | ||||||

| BX Commercial Mortgage Trust 2024-MDHS / ABS-MBS (US12433BAA52) | 0.27 | 114.17 | 0.1395 | 0.0568 | |||||

| Morgan Stanley Bank NA / DBT (US61690U8A11) | 0.27 | 0.1394 | 0.1394 | ||||||

| US36242DJQ79 / GSMPS Mortgage Loan Trust, Series 2004-4, Class 1AF | 0.27 | -2.16 | 0.1393 | -0.0419 | |||||

| Morgan Stanley Capital I 2017-HR2 / ABS-MBS (US61691NAJ46) | 0.27 | 0.1387 | 0.1387 | ||||||

| US91282CBQ33 / United States Treasury Note/Bond | 0.27 | 1.13 | 0.1383 | -0.0354 | |||||

| US542514TQ74 / Long Beach Mortgage Loan Trust 2006-2 | 0.27 | -1.85 | 0.1365 | -0.0403 | |||||

| US06051GKK49 / Bank of America Corp | 0.27 | 205.75 | 0.1364 | 0.0796 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0.27 | 85.31 | 0.1362 | 0.0427 | |||||

| US01F0424592 / Uniform Mortgage-Backed Security, TBA | 0.27 | 314.06 | 0.1357 | 0.0533 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.26 | 158.82 | 0.1354 | 0.0689 | |||||

| HLTN Commercial Mortgage Trust 2024-DPLO / ABS-MBS (US40424UAA51) | 0.26 | 130.97 | 0.1339 | 0.0601 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.26 | 81.12 | 0.1329 | 0.0395 | |||||

| EQT / EQT Corporation | 0.26 | 0.1326 | 0.1326 | ||||||

| US25278XAN93 / Diamondback Energy Inc | 0.26 | 21.80 | 0.1318 | -0.0055 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.26 | 0.1315 | 0.1315 | ||||||

| US01F0304547 / Fannie Mae or Freddie Mac | 0.26 | 232.47 | 0.1313 | 0.0332 | |||||

| US361841AR08 / GLP Capital LP / GLP Financing II Inc | 0.26 | 7.59 | 0.1311 | -0.0236 | |||||

| US29444UBS42 / EQUINIX INC 2.5% 05/15/2031 | 0.25 | 117.09 | 0.1305 | 0.0540 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.25 | 0.79 | 0.1303 | -0.0342 | |||||

| JP Morgan Mortgage Trust 2025-VIS1 / ABS-MBS (US46659BAF94) | 0.25 | 0.1298 | 0.1298 | ||||||

| US054989AD07 / BAT CAPITAL CORP 7.081000% 08/02/2053 | 0.25 | -8.03 | 0.1291 | -0.0496 | |||||

| US11135FBK66 / BROADCOM INC 3.419% 04/15/2033 144A | 0.25 | 1,468.75 | 0.1288 | 0.1084 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.25 | 0.80 | 0.1288 | -0.0337 | |||||

| US06051GGL77 / BANK OF AMERICA CORP SR UNSECURED 04/28 VAR | 0.25 | 0.1287 | 0.1287 | ||||||

| US12551YAG89 / CIFC Funding 2018-III Ltd | 0.25 | -0.40 | 0.1284 | -0.0353 | |||||

| AGL Core CLO 2 Ltd / ABS-CBDO (US001200AJ39) | 0.25 | -0.40 | 0.1282 | -0.0355 | |||||

| OHA Loan Funding 2016-1 Ltd / ABS-CBDO (US67110UAW99) | 0.25 | -0.40 | 0.1282 | -0.0357 | |||||

| OHA Credit Funding 6 Ltd / ABS-CBDO (US67098UAY10) | 0.25 | -0.40 | 0.1281 | -0.0358 | |||||

| US749752AE14 / RRAM 2021-18A A2 | 0.25 | 0.00 | 0.1281 | -0.0350 | |||||

| Silver Point Clo 5 Ltd / ABS-CBDO (US82809BAA44) | 0.25 | 0.00 | 0.1281 | -0.0351 | |||||

| Creeksource 2024-1 Dunes Creek Clo Ltd / ABS-CBDO (US225914AA89) | 0.25 | -0.79 | 0.1281 | -0.0359 | |||||

| CIFC Funding 2019-VI Ltd / ABS-CBDO (US12555XAN12) | 0.25 | -0.40 | 0.1281 | -0.0356 | |||||

| Owl Rock CLO VII LLC / ABS-CBDO (US69121BAQ77) | 0.25 | 0.1281 | 0.1281 | ||||||

| OHA Credit Funding 5 Ltd / ABS-CBDO (US67113GAS66) | 0.25 | -0.40 | 0.1281 | -0.0356 | |||||

| MidOcean Credit CLO XII Ltd / ABS-CBDO (US59803TAQ40) | 0.25 | 0.00 | 0.1281 | -0.0348 | |||||

| Benefit Street Partners CLO XXVII Ltd / ABS-CBDO (US08179PAQ54) | 0.25 | -0.40 | 0.1281 | -0.0358 | |||||

| Silver Point CLO 7 LTD / ABS-CBDO (US82808UAA34) | 0.25 | 0.1280 | 0.1280 | ||||||

| Orchard Park Clo Ltd / ABS-CBDO (US68563JAA25) | 0.25 | -0.80 | 0.1280 | -0.0356 | |||||

| RR 32 LTD /old / ABS-CBDO (US74988CAA27) | 0.25 | -1.19 | 0.1280 | -0.0359 | |||||

| Park Blue CLO 2024-VI Ltd / ABS-CBDO (US70019KAA51) | 0.25 | -0.80 | 0.1280 | -0.0356 | |||||

| Symphony CLO 39 Ltd / ABS-CBDO (US87169TAL44) | 0.25 | 0.1280 | 0.1280 | ||||||

| Diameter Capital Clo 3 Ltd / ABS-CBDO (US25255JAL17) | 0.25 | 0.1280 | 0.1280 | ||||||

| US74971CAC73 / RR 16 Ltd | 0.25 | -0.40 | 0.1280 | -0.0351 | |||||

| OCP CLO 2024-38 Ltd / ABS-CBDO (US67120KAA79) | 0.25 | 0.1279 | 0.1279 | ||||||

| US69700GAJ13 / Palmer Square CLO 2019-1 Ltd | 0.25 | -0.40 | 0.1279 | -0.0351 | |||||

| New Mountain CLO 3 Ltd / ABS-CBDO (US647550AG79) | 0.25 | -0.40 | 0.1279 | -0.0350 | |||||

| US03768WAL90 / Apidos CLO XXXIV, Series 2020-34A, Class A1R | 0.25 | -0.40 | 0.1278 | -0.0351 | |||||

| Whitebox CLO III Ltd / ABS-CBDO (US96467HAL06) | 0.25 | -0.40 | 0.1278 | -0.0351 | |||||

| US91282CFW64 / United States Treasury Note/Bond | 0.25 | 0.00 | 0.1278 | -0.0345 | |||||

| Galaxy XX CLO Ltd / ABS-CBDO (US36320MAN83) | 0.25 | -0.40 | 0.1277 | -0.0351 | |||||

| Benefit Street Partners CLO IV Ltd / ABS-CBDO (US08180FBW05) | 0.25 | -0.80 | 0.1277 | -0.0357 | |||||

| US12564DAC83 / CIFC 2021-3A B | 0.25 | 0.1276 | 0.1276 | ||||||

| Regatta IX Funding Ltd / ABS-CBDO (US75887VAN10) | 0.25 | -1.19 | 0.1276 | -0.0369 | |||||

| DBGS 2024-SBL / ABS-MBS (US23306QAA31) | 0.25 | 79.71 | 0.1275 | 0.0373 | |||||

| Generate CLO 20 Ltd / ABS-CBDO (US370912AC18) | 0.25 | -0.80 | 0.1275 | -0.0352 | |||||

| Regatta XVIII Funding Ltd / ABS-CBDO (US75884EAN22) | 0.25 | 0.1274 | 0.1274 | ||||||

| Sagard-Halseypoint Clo 8 Ltd / ABS-CBDO (US78662AAA07) | 0.25 | 0.1273 | 0.1273 | ||||||

| Clover CLO 2021-3 LLC / ABS-CBDO (US18915FAA03) | 0.25 | -0.80 | 0.1273 | -0.0358 | |||||

| Silver Point Clo 8 Ltd / ABS-CBDO (US827918AA13) | 0.25 | 0.1273 | 0.1273 | ||||||

| Barclays Mortgage Loan Trust 2025-NQM1 / ABS-MBS (US06744WAA53) | 0.25 | -0.40 | 0.1272 | -0.0354 | |||||

| Madison Park Funding LXXI Ltd / ABS-CBDO (US55817DAA63) | 0.25 | 0.1272 | 0.1272 | ||||||

| CIFC Funding 2025-II Ltd / ABS-CBDO (US17181DAA46) | 0.25 | 0.1272 | 0.1272 | ||||||

| Anchorage Capital Clo 17 Ltd / ABS-CBDO (US03332PAN78) | 0.25 | 0.1272 | 0.1272 | ||||||

| US3140XFLU34 / FANNIE MAE POOL FN FS0338 | 0.25 | 1.64 | 0.1271 | -0.0321 | |||||

| Generate CLO 20 Ltd / ABS-CBDO (US370912AA51) | 0.25 | -0.80 | 0.1271 | -0.0355 | |||||

| Benefit Street Partners CLO XXIX / ABS-CBDO (US08186EAL20) | 0.25 | -0.80 | 0.1271 | -0.0355 | |||||

| Milford Park CLO Ltd / ABS-CBDO (US59966PAN24) | 0.25 | 0.1271 | 0.1271 | ||||||

| Regatta XX Funding Ltd / ABS-CBDO (US75884YAK47) | 0.25 | 0.1270 | 0.1270 | ||||||

| MidOcean Credit CLO XI Ltd / ABS-CBDO (US59801ABA16) | 0.25 | -1.20 | 0.1270 | -0.0361 | |||||

| OCP CLO 2023-26 Ltd / ABS-CBDO (US67116HAJ14) | 0.25 | 0.1267 | 0.1267 | ||||||

| Buckhorn Park CLO Ltd / ABS-CBDO (US118382BC37) | 0.25 | -1.20 | 0.1267 | -0.0360 | |||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAA34) | 0.25 | 252.86 | 0.1266 | 0.0808 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0.25 | 425.53 | 0.1266 | 0.0954 | |||||

| Creeksource 2024-1 Dunes Creek Clo Ltd / ABS-CBDO (US225914AE02) | 0.25 | -1.99 | 0.1265 | -0.0371 | |||||

| US337932AM94 / FIRSTENERGY CORP 3.4% 03/01/2050 | 0.25 | 51.85 | 0.1265 | 0.0205 | |||||

| BBAM US CLO I Ltd / ABS-CBDO (US054978AL59) | 0.25 | 0.1264 | 0.1264 | ||||||

| Z1IO34 / Zions Bancorporation, National Association - Depositary Receipt (Common Stock) | 0.25 | 0.1263 | 0.1263 | ||||||

| Park Blue CLO 2025-VII Ltd / ABS-CBDO (US70019HAA23) | 0.25 | 0.1263 | 0.1263 | ||||||

| VICI / VICI Properties Inc. | 0.25 | -37.18 | 0.1257 | -0.0743 | |||||

| US912810SN90 / UNITED STATES TREASURY BOND 1.25% 05/15/2050 | 0.24 | 2.53 | 0.1246 | -0.0298 | |||||

| FCT / Fincantieri S.p.A. | 0.24 | 0.1245 | 0.1245 | ||||||

| US36179W7L60 / Ginnie Mae II Pool | 0.24 | 0.1244 | 0.1244 | ||||||

| US49327M3H53 / KeyBank NA | 0.24 | -0.41 | 0.1233 | -0.0336 | |||||

| US91282CBS98 / United States Treasury Note/Bond | 0.24 | 2.56 | 0.1233 | -0.0294 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.24 | -2.05 | 0.1227 | -0.0366 | |||||

| S1YF34 / Synchrony Financial - Depositary Receipt (Common Stock) | 0.24 | 63.70 | 0.1224 | 0.0269 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0.24 | 6.73 | 0.1224 | -0.0229 | |||||

| GreenSky Home Improvement Issuer Trust 2024-2 / ABS-O (US39571XAB01) | 0.24 | 0.1216 | 0.1216 | ||||||

| US61744YAP34 / Morgan Stanley | 0.23 | -14.29 | 0.1202 | -0.0575 | |||||

| US64134JAA16 / Neuberger Berman Loan Advisers Clo 40 Ltd | 0.23 | -4.12 | 0.1199 | -0.0387 | |||||

| SoFi Consumer Loan Program 2025-1 Trust / ABS-O (US83406YAA91) | 0.23 | 0.1198 | 0.1198 | ||||||

| US06051GJF72 / Bank of America Corp. | 0.23 | 703.45 | 0.1195 | 0.1002 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.23 | -1.70 | 0.1187 | -0.0346 | |||||

| US034863BD17 / Anglo American Capital PLC | 0.23 | 0.44 | 0.1176 | -0.0312 | |||||

| Foundry JV Holdco LLC / DBT (US350930AG89) | 0.23 | 0.1175 | 0.1175 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.23 | 165.12 | 0.1171 | 0.0410 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0.23 | 83.87 | 0.1169 | 0.0358 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.23 | 0.00 | 0.1164 | -0.0317 | |||||

| US3133KRMR20 / FREDDIE MAC POOL UMBS P#RA9368 5.00000000 | 0.23 | -1.74 | 0.1159 | -0.0338 | |||||

| Wells Fargo Commercial Mortgage Trust 2024-BPRC / ABS-MBS (US95004AAE38) | 0.23 | 1,084.21 | 0.1157 | 0.1032 | |||||

| US912810SW99 / United States Treasury Note/Bond | 0.23 | 2.74 | 0.1156 | -0.0271 | |||||

| US925650AD55 / VICI Properties LP | 0.23 | 3.21 | 0.1153 | -0.0270 | |||||

| US40390MAA36 / HONO 2021-LULU Mortgage Trust | 0.22 | 0.00 | 0.1149 | -0.0310 | |||||

| US87612BBU52 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 0.22 | 95.58 | 0.1135 | 0.0395 | |||||

| PRPM 2025-NQM1 Trust / ABS-MBS (US74391EAA91) | 0.22 | 0.1133 | 0.1133 | ||||||

| US36179WLN64 / GNII II 2% 08/20/2051#MA7533 | 0.22 | -0.45 | 0.1124 | -0.0307 | |||||

| US30225VAR87 / Extra Space Storage LP | 0.22 | 280.70 | 0.1112 | 0.0735 | |||||

| BAHA Trust 2024-MAR / ABS-MBS (US05493XAA81) | 0.22 | 1.41 | 0.1110 | -0.0279 | |||||

| OBDC / Blue Owl Capital Corporation | 0.22 | 16.76 | 0.1108 | -0.0096 | |||||

| VICI Properties LP / DBT (US925650AH69) | 0.22 | 41.45 | 0.1105 | 0.0113 | |||||

| Gaea Mortgage Loan Trust 2025-A / ABS-MBS (US362928AA19) | 0.22 | 0.1103 | 0.1103 | ||||||

| Glencore Funding LLC / DBT (US378272BZ09) | 0.21 | 0.1099 | 0.1099 | ||||||

| US87165BAR42 / Synchrony Financial | 0.21 | 62.12 | 0.1098 | 0.0234 | |||||

| US912828Z948 / United States Treasury Note/Bond | 0.21 | 3.90 | 0.1092 | -0.0247 | |||||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 0.21 | 0.1083 | 0.1083 | ||||||

| US19033EAA82 / COAST Commercial Mortgage Trust 2023-2HTL | 0.21 | -0.48 | 0.1073 | -0.0297 | |||||

| US232422AF28 / CWL 2006-7 M1 | 0.21 | -5.00 | 0.1072 | -0.0366 | |||||

| US31418EU999 / Fannie Mae Pool | 0.21 | -0.95 | 0.1066 | -0.0303 | |||||

| Foundry JV Holdco LLC / DBT (US350930AC75) | 0.21 | 0.1064 | 0.1064 | ||||||

| US87190GAC50 / Symphony CLO XXVI Ltd | 0.21 | 0.1056 | 0.1056 | ||||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.20 | 36.00 | 0.1049 | 0.0071 | |||||

| US3140XL3X46 / FNMA 30YR 3.5% 01/01/2050#FS5313 | 0.20 | 0.00 | 0.1048 | -0.0282 | |||||

| US46630LAH78 / JP MORGAN MORTGAGE ACQUISITION JPMAC 2007 CH1 MF1 | 0.20 | 3.05 | 0.1041 | -0.0242 | |||||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 0.20 | 348.89 | 0.1035 | 0.0736 | |||||

| FLOURISHING TRADE + INVT LTD / DBT (US343427AA80) | 0.20 | 0.1035 | 0.1035 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.20 | 0.1027 | 0.1027 | ||||||

| US37045XEF96 / General Motors Financial Co Inc | 0.20 | -0.50 | 0.1027 | -0.0283 | |||||

| HOMES 2025-AFC1 Trust / ABS-MBS (US403969AF57) | 0.20 | 0.50 | 0.1026 | -0.0275 | |||||

| JW Trust 2024-BERY / ABS-MBS (US46676AAA16) | 0.20 | -0.50 | 0.1019 | -0.0284 | |||||

| US912828X885 / United States Treasury Note/Bond | 0.20 | 1.54 | 0.1016 | -0.0254 | |||||

| US05609BCD91 / BX Trust, Series 2021-LBA, Class AJV | 0.20 | -0.50 | 0.1015 | -0.0284 | |||||

| US9128282R06 / United States Treasury Note/Bond | 0.20 | 2.07 | 0.1011 | -0.0250 | |||||

| BX Commercial Mortgage Trust 2024-KING / ABS-MBS (US05612RAA77) | 0.20 | -0.51 | 0.1010 | -0.0278 | |||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 0.20 | 250.00 | 0.1006 | 0.0641 | |||||

| U.S. Treasury Notes / DBT (US91282CMR96) | 0.20 | 0.1006 | 0.1006 | ||||||

| US36179W2U15 / Ginnie Mae II Pool | 0.20 | -0.51 | 0.1005 | -0.0277 | |||||

| PETROLEOS MEXICANOS / DBT (XS2966423472) | 0.20 | -2.00 | 0.1004 | -0.0300 | |||||

| AREIT 2024-CRE9 Ltd / ABS-CBDO (US00193AAA25) | 0.20 | -0.51 | 0.1002 | -0.0279 | |||||

| T1OW34 / American Tower Corporation - Depositary Receipt (Common Stock) | 0.20 | 14.71 | 0.0999 | -0.0109 | |||||

| US761713BB19 / Reynolds American Inc | 0.19 | 21.25 | 0.0998 | -0.0048 | |||||

| US366651AC11 / Gartner Inc | 0.19 | -21.46 | 0.0995 | -0.0612 | |||||

| Angel Oak Mortgage Trust 2025-2 / ABS-MBS (US03466QAA13) | 0.19 | 0.0990 | 0.0990 | ||||||

| US172967NN71 / C 3.785 03/17/33 | 0.19 | 44.03 | 0.0989 | 0.0114 | |||||

| SCE.PRK / SCE Trust V - Preferred Security | 0.19 | 0.0988 | 0.0988 | ||||||

| US78448YAD31 / SMB Private Education Loan Trust 2021-A | 0.19 | -11.52 | 0.0986 | -0.0428 | |||||

| US912810RD28 / United States Treas Bds Bond | 0.19 | 2.14 | 0.0983 | -0.0238 | |||||

| US337932AH00 / FirstEnergy Corp | 0.19 | 1.06 | 0.0982 | -0.0251 | |||||

| US912810QL52 / United States Treas Bds Bond | 0.19 | 2.16 | 0.0971 | -0.0233 | |||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0.19 | 384.62 | 0.0971 | 0.0713 | |||||

| BX Commercial Mortgage Trust 2025-SPOT / ABS-MBS (US12433FAA66) | 0.19 | 0.0970 | 0.0970 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.19 | -2.07 | 0.0969 | -0.0288 | |||||

| EQT / EQT Corporation | 0.19 | 0.0969 | 0.0969 | ||||||

| US912810RC45 / United States Treas Bds Bond | 0.19 | 2.17 | 0.0967 | -0.0235 | |||||

| US452151LF83 / ILLINOIS ST | 0.19 | 1.08 | 0.0964 | -0.0246 | |||||

| US64035DAC02 / Nelnet Student Loan Trust 2021-A | 0.19 | -1.57 | 0.0963 | -0.0280 | |||||

| US760942BB71 / Uruguay Government International Bond | 0.19 | 1.09 | 0.0954 | -0.0246 | |||||

| US3140QFNX38 / FANNIE MAE POOL UMBS P#CA7605 3.00000000 | 0.19 | 0.54 | 0.0950 | -0.0250 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.18 | -2.65 | 0.0943 | -0.0288 | |||||

| US26884LAL36 / EQT Corporation | 0.18 | 26.03 | 0.0943 | -0.0008 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.18 | -27.67 | 0.0942 | -0.0707 | |||||

| GreenSky Home Improvement Issuer Trust 2024-2 / ABS-O (US39571XAE40) | 0.18 | 0.0939 | 0.0939 | ||||||

| FirstEnergy Transmission LLC / DBT (US33767BAH24) | 0.18 | 2.26 | 0.0929 | -0.0227 | |||||

| EFMT 2025-INV1 / ABS-MBS (US26846XAA81) | 0.18 | 0.0925 | 0.0925 | ||||||

| US33767BAC37 / FIRSTENERGY TRANSMISSION SR UNSECURED 144A 04/49 4.55 | 0.18 | 54.31 | 0.0917 | 0.0159 | |||||

| US126694S412 / COUNTRYWIDE ALTERNATIVE LOAN TRUST | 0.18 | -1.66 | 0.0915 | -0.0266 | |||||

| US33768EAL65 / FirstKey Homes 2022-SFR3 Trust | 0.18 | 1.71 | 0.0912 | -0.0231 | |||||

| EU000A3K4DT4 / European Union | 0.18 | 19.59 | 0.0907 | -0.0057 | |||||

| US93935YAB65 / Washington Mutual Mortgage Pass-Through Certificates WMALT Ser 2006-AR10 Trust | 0.18 | -2.23 | 0.0899 | -0.0269 | |||||

| PRPM 2025-NQM1 Trust / ABS-MBS (US74391EAD31) | 0.17 | 0.0896 | 0.0896 | ||||||

| US912810RH32 / United States Treas Bds Bond | 0.17 | 2.35 | 0.0892 | -0.0217 | |||||

| US912810TW80 / United States Treasury Note/Bond | 0.17 | 1.78 | 0.0885 | -0.0217 | |||||

| BX 2024-PALM / ABS-MBS (US05612UAA07) | 0.17 | -0.58 | 0.0884 | -0.0243 | |||||

| US912810SJ88 / United States Treas Bds Bond | 0.17 | 2.38 | 0.0881 | -0.0216 | |||||

| Angel Oak Mortgage Trust 2024-1 / ABS-MBS (US03465XAA72) | 0.17 | -2.84 | 0.0879 | -0.0272 | |||||

| US845467AR03 / CORP. NOTE | 0.17 | 0.0877 | 0.0877 | ||||||

| US16411QAK76 / CORP. NOTE | 0.17 | 1.18 | 0.0876 | -0.0226 | |||||

| BXMT 2025-FL5 Ltd / ABS-CBDO (US05613YAA10) | 0.17 | 0.0876 | 0.0876 | ||||||

| US912810RX81 / United States Treas Bds Bond | 0.17 | 1.80 | 0.0874 | -0.0214 | |||||

| LBA Trust 2024-BOLT / ABS-MBS (US50177BAA52) | 0.17 | 0.00 | 0.0871 | -0.0235 | |||||

| US87264ACX19 / T-Mobile USA Inc | 0.17 | 74.23 | 0.0869 | 0.0235 | |||||

| BX Commercial Mortgage Trust 2024-GPA3 / ABS-MBS (US123910AC54) | 0.17 | 0.0867 | 0.0867 | ||||||

| ELFI Graduate Loan Program 2024-A LLC / ABS-O (US28627LAA52) | 0.17 | 0.0864 | 0.0864 | ||||||

| US74922NAB55 / RALI Series 2006-QA10 Trust | 0.17 | -0.59 | 0.0862 | -0.0241 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 0.17 | 0.0862 | 0.0862 | ||||||

| US33768NAL64 / FirstKey Homes 2022-SFR1 Trust | 0.17 | 1.21 | 0.0858 | -0.0220 | |||||

| INV 2024-IND Mortgage Trust / ABS-MBS (US45000DAA46) | 0.17 | -0.60 | 0.0858 | -0.0238 | |||||

| US12433UAG04 / BX Trust 2018-GW | 0.17 | 0.0857 | 0.0857 | ||||||

| US576436AT67 / MASTR Reperforming Loan Trust 2005-1 | 0.17 | -2.34 | 0.0856 | -0.0259 | |||||

| US361841AL38 / GLP Capital LP / GLP Financing II Inc | 0.17 | 140.58 | 0.0855 | 0.0402 | |||||

| US23243VAD29 / Alternative Loan Trust 2006-OC7 | 0.17 | -1.79 | 0.0850 | -0.0246 | |||||

| US19424WAB37 / COLLEGE AVE STUDENT LOANS 2021-C LLC CASL 2021-C A2 | 0.17 | -2.37 | 0.0848 | -0.0253 | |||||

| US91087BAR15 / Mexican Government International Bond | 0.16 | 2.52 | 0.0839 | -0.0199 | |||||

| US92564RAE53 / VICI PROPERTIES / NOTE 4.125% 08/15/2030 144A | 0.16 | 1.88 | 0.0836 | -0.0209 | |||||

| US912810QS06 / United States Treas Bds Bond | 0.16 | 0.0828 | 0.0828 | ||||||

| US3132A5HR91 / Freddie Mac Pool | 0.16 | -0.62 | 0.0828 | -0.0228 | |||||

| US36179WR263 / GINNIE MAE II POOL G2 MA7705 | 0.16 | 0.00 | 0.0827 | -0.0227 | |||||

| GS Mortgage Securities Corp Trust 2025-800D / ABS-MBS (US36273XAA90) | 0.16 | 0.0827 | 0.0827 | ||||||

| US91282CCY57 / UNITED STATES TREASURY NOTE 1.25000000 | 0.16 | 3.21 | 0.0825 | -0.0193 | |||||

| BAY 2025-LIVN Mortgage Trust / ABS-MBS (US072925AA82) | 0.16 | 0.0825 | 0.0825 | ||||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0.16 | 0.0821 | 0.0821 | ||||||

| US378272BE79 / Glencore Funding LLC | 0.16 | -0.62 | 0.0820 | -0.0229 | |||||

| US46627MCU99 / J.P. Morgan Alternative Loan Trust | 0.16 | -3.05 | 0.0817 | -0.0253 | |||||

| US3133L74L80 / Freddie Mac Pool | 0.16 | 0.00 | 0.0815 | -0.0222 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.16 | 0.00 | 0.0814 | -0.0216 | |||||

| US36168XAA72 / GCAT 2022-HX1 TRUST SER 2022-HX1 CL A1 V/R REGD 144A P/P 2.88500000 | 0.16 | -1.26 | 0.0805 | -0.0233 | |||||

| US03882LAJ98 / ARBOR MULTIFAMILY MORTGAGE SECURITIES TRUS SER 2022-MF4 CL A5 V/R REGD 144A P/P 3.29340000 | 0.16 | 1.31 | 0.0799 | -0.0197 | |||||

| US31418EAN04 / FN MA4512 | 0.16 | 0.00 | 0.0797 | -0.0213 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.16 | 106.67 | 0.0795 | 0.0304 | |||||

| US912810TR95 / United States Treasury Note/Bond | 0.15 | -74.62 | 0.0783 | -0.3115 | |||||

| Onemain Financial Issuance Trust 2024-1 / ABS-O (US68269NAB82) | 0.15 | 0.66 | 0.0780 | -0.0202 | |||||

| US12559QAH56 / CIT Mortgage Loan Trust 2007-1 | 0.15 | 0.00 | 0.0780 | -0.0215 | |||||

| CIM Trust 2025-I1 / ABS-MBS (US12571DAD75) | 0.15 | 1.34 | 0.0777 | -0.0199 | |||||

| US36262MAA62 / GSMS 2021-IP A 1ML+105 10/15/2036 144A | 0.15 | -0.66 | 0.0776 | -0.0214 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.15 | -82.62 | 0.0775 | -0.4884 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.15 | 316.67 | 0.0769 | 0.0450 | |||||

| GLP Capital LP / GLP Financing II Inc / DBT (US361841AU37) | 0.15 | -9.15 | 0.0768 | -0.0301 | |||||

| US12433EAA91 / BX Trust, Series 2022-LBA6, Class A | 0.15 | 0.00 | 0.0764 | -0.0211 | |||||

| US05609TAA88 / BX Trust, Series 2022-VAMF, Class A | 0.15 | 0.00 | 0.0764 | -0.0208 | |||||

| US16412XAJ46 / Cheniere Corpus Christi Holdings LLC | 0.15 | 104.11 | 0.0764 | 0.0287 | |||||

| US05526DBF15 / BAT Capital Corp | 0.15 | 34.55 | 0.0762 | 0.0046 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.15 | 0.0761 | 0.0761 | ||||||

| New Residential Mortgage Loan Trust 2025-NQM1 / ABS-MBS (US64832DAC56) | 0.15 | -1.99 | 0.0761 | -0.0228 | |||||

| US95000LBB80 / Wells Fargo Commercial Mortgage Trust | 0.15 | 0.00 | 0.0756 | -0.0203 | |||||

| Vistra Operations Co LLC / DBT (US92840VAS16) | 0.15 | 0.00 | 0.0754 | -0.0205 | |||||

| US912810SC36 / United States Treas Bds Bond | 0.15 | 2.08 | 0.0754 | -0.0185 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.15 | -4.58 | 0.0752 | -0.0244 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.15 | 0.69 | 0.0747 | -0.0195 | |||||

| US26884LAF67 / EQT Corp. | 0.14 | -24.61 | 0.0739 | -0.0509 | |||||

| US92735LAA08 / Vine Energy Holdings, LLC | 0.14 | 0.0738 | 0.0738 | ||||||

| ACRA Trust 2024-NQM1 / ABS-MBS (US00112EAA29) | 0.14 | -2.72 | 0.0735 | -0.0227 | |||||

| BRAVO Residential Funding Trust 2025-NQM2 / ABS-MBS (US10569NAC56) | 0.14 | 0.0735 | 0.0735 | ||||||

| US226373AT56 / Crestwood Midstream Partners LP | 0.14 | 0.00 | 0.0734 | -0.0199 | |||||

| BlueMountain CLO 2016-3 Ltd / ABS-CBDO (US09628VAW46) | 0.14 | 0.0730 | 0.0730 | ||||||

| US13063DGE22 / California (State of), Series 2018, Ref. GO Bonds | 0.14 | 8.40 | 0.0729 | -0.0125 | |||||

| US040104RW38 / ARSI 2006-W2 A2C | 0.14 | 0.71 | 0.0728 | -0.0194 | |||||

| CIM Trust 2025-I1 / ABS-MBS (US12571DAA37) | 0.14 | -5.37 | 0.0726 | -0.0250 | |||||

| US92343VCQ59 / Verizon Communications Inc | 0.14 | 1,310.00 | 0.0725 | 0.0586 | |||||

| SCG 2024-MSP Mortgage Trust / ABS-MBS (US78436EAA73) | 0.14 | -0.70 | 0.0725 | -0.0201 | |||||

| US05526DBV64 / BAT Capital Corp | 0.14 | -2.08 | 0.0724 | -0.0218 | |||||

| US05610DAA00 / BX_23-DELC | 0.14 | -0.70 | 0.0724 | -0.0200 | |||||

| HCA Inc / DBT (US404119DB22) | 0.14 | 0.0723 | 0.0723 | ||||||

| BlueMountain CLO 2018-3 Ltd / ABS-CBDO (US09630AAN63) | 0.14 | -12.42 | 0.0723 | -0.0328 | |||||

| PRET 2024-NPL5 LLC / ABS-O (US74143QAA31) | 0.14 | -1.40 | 0.0723 | -0.0214 | |||||

| SELF Commercial Mortgage Trust 2024-STRG / ABS-MBS (US81631WAA45) | 0.14 | 0.00 | 0.0719 | -0.0194 | |||||

| US912810SH23 / United States Treas Bds Bond | 0.14 | 2.21 | 0.0713 | -0.0175 | |||||

| US83612QAE89 / Soundview Home Loan Trust 2007-NS1 | 0.14 | 0.00 | 0.0711 | -0.0193 | |||||

| BRAVO Residential Funding Trust 2024-CES2 / ABS-MBS (US10570PAA12) | 0.14 | -4.17 | 0.0711 | -0.0227 | |||||

| US16412XAL91 / Cheniere Corpus Christi Holdings LLC | 0.14 | 11.29 | 0.0708 | -0.0104 | |||||

| USU8729TAE65 / TTAN | 0.14 | -0.72 | 0.0706 | -0.0194 | |||||

| BDS 2024-FL13 LLC / ABS-CBDO (US05555MAA71) | 0.14 | -0.72 | 0.0706 | -0.0194 | |||||

| US02209SBM44 / ALTRIA GROUP INC 3.4% 02/04/2041 | 0.14 | 13.22 | 0.0704 | -0.0089 | |||||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.14 | 0.0699 | 0.0699 | |||||

| US124857AT09 / ViacomCBS Inc | 0.14 | 32.04 | 0.0699 | 0.0026 | |||||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 0.14 | 20.35 | 0.0699 | -0.0038 | |||||

| EFMT 2024-NQM1 / ABS-MBS (US26845DAA37) | 0.14 | -4.23 | 0.0698 | -0.0227 | |||||

| US361841AK54 / GLP Capital LP / GLP Financing II Inc | 0.14 | 0.74 | 0.0697 | -0.0185 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.14 | 0.00 | 0.0693 | -0.0189 | |||||

| US11135FBL40 / Broadcom Inc | 0.13 | 88.73 | 0.0689 | 0.0222 | |||||

| Affirm Master Trust / ABS-O (US00833BAA61) | 0.13 | 0.0685 | 0.0685 | ||||||

| US92343VFL36 / Verizon Communications Inc | 0.13 | 0.0684 | 0.0684 | ||||||

| US3132DWG800 / Freddie Mac Pool | 0.13 | 0.00 | 0.0682 | -0.0186 | |||||

| US36168VAH69 / GCAT 2022-NQM1 Trust | 0.13 | 3.13 | 0.0680 | -0.0159 | |||||

| HCA Inc / DBT (US404119DC05) | 0.13 | 0.0678 | 0.0678 | ||||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0.13 | 169.39 | 0.0677 | 0.0351 | |||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust 2024-OMNI / ABS-MBS (US46593JAA25) | 0.13 | -0.76 | 0.0676 | -0.0185 | |||||

| US31418EAW03 / FN MA4520 | 0.13 | 0.77 | 0.0671 | -0.0175 | |||||

| US3133KYWE57 / Freddie Mac Pool | 0.13 | 0.78 | 0.0669 | -0.0177 | |||||

| FIGRE Trust 2024-SL1 / ABS-MBS (US31684JAA43) | 0.13 | -5.80 | 0.0667 | -0.0237 | |||||

| NYMT 2024-RR1 Trust / ABS-MBS (US62956VAA35) | 0.13 | -2.27 | 0.0663 | -0.0197 | |||||

| US3140XMMF09 / FEDERAL NATIONAL MORTGAGE ASSOCIATION | 0.13 | 0.0661 | 0.0661 | ||||||

| US78449HAB33 / SMB PRIVATE EDUCATION LOAN TRUST 2023-B SER 2023-B CL A1B V/R REGD 144A P/P 0.00000000 | 0.13 | 0.0661 | 0.0661 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.13 | -3.03 | 0.0658 | -0.0201 | |||||

| US78449XAA00 / SMB PRIVATE EDUCATION LOAN TRUST 2020-B 1.29% 07/15/2053 144A | 0.13 | -6.57 | 0.0657 | -0.0238 | |||||

| US3140QEXQ02 / Fannie Mae Pool | 0.13 | -0.78 | 0.0656 | -0.0184 | |||||

| US172967NG21 / Citigroup Inc | 0.13 | -3.79 | 0.0655 | -0.0515 | |||||

| US912810QQ40 / United States Treas Bds Bond | 0.13 | 2.42 | 0.0652 | -0.0157 | |||||

| US05526DBK00 / BAT Capital Corp. | 0.13 | 111.67 | 0.0652 | 0.0259 | |||||

| CFMT 2024-R1 LLC / ABS-MBS (US12530YAA73) | 0.13 | -4.51 | 0.0652 | -0.0219 | |||||

| US36179XND48 / Ginnie Mae II Pool | 0.13 | -0.79 | 0.0648 | -0.0184 | |||||

| US92259LAB45 / VELOCITY COMMERCIAL CAPITAL LOAN TRUST 2020-1 VCC 2020-1 AFX | 0.13 | -1.56 | 0.0647 | -0.0186 | |||||

| US46646GAA58 / J.P. MORGAN CHASE COMMERCIAL MORTGAGE SE SER 2016-NINE CL A V/R REGD 144A P/P 2.94923700 | 0.13 | 0.80 | 0.0647 | -0.0169 | |||||

| Saluda Grade Alternative Mortgage Trust 2024-RTL4 / ABS-MBS (US79584CAA99) | 0.13 | 0.00 | 0.0646 | -0.0180 | |||||

| US36179WR347 / GNMA | 0.13 | -0.79 | 0.0646 | -0.0180 | |||||

| US95002NAA54 / Wells Fargo Commercial Mortgage Trust 2019-JWDR | 0.13 | 0.00 | 0.0645 | -0.0169 | |||||

| US805564QE48 / SAST 2004-2 MF5 | 0.13 | 3.31 | 0.0643 | -0.0146 | |||||

| AT&T Reign II Multi-Property Lease-Backed Pass-Through Trust / DBT (US046912AA99) | 0.13 | 0.00 | 0.0642 | -0.0176 | |||||

| US63941BAD73 / NAVSL 2019 A B 144A | 0.12 | 0.0637 | 0.0637 | ||||||

| US52604DAA00 / Lendmark Funding Trust 2021-2 | 0.12 | 0.83 | 0.0629 | -0.0160 | |||||

| US3133L8XH38 / Freddie Mac Pool | 0.12 | -1.61 | 0.0629 | -0.0178 | |||||

| US3132DWDY66 / FHLG 30YR 2.5% 06/01/2052# | 0.12 | 0.00 | 0.0622 | -0.0167 | |||||

| FIDS / FNB, Inc. | 0.12 | -22.58 | 0.0618 | -0.0396 | |||||

| MFA 2024-RTL1 Trust / ABS-MBS (US59319NAA90) | 0.12 | 0.00 | 0.0618 | -0.0168 | |||||

| US63941KAC99 / Navient Private Education Refi Loan Trust 2020-C | 0.12 | -7.75 | 0.0614 | -0.0231 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.12 | 46.91 | 0.0613 | 0.0082 | |||||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 0.12 | 0.85 | 0.0609 | -0.0154 | |||||

| US925650AC72 / VICI Properties LP | 0.12 | 1.72 | 0.0605 | -0.0156 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 0.12 | -60.34 | 0.0604 | -0.1320 | |||||

| US 5YR NOTE (CBT) JUN25 / DIR (000000000) | 0.12 | 0.0601 | 0.0601 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.12 | 0.0601 | 0.0601 | ||||||

| US3140XA6H04 / Federal National Mortgage Association, Inc. | 0.12 | -1.68 | 0.0600 | -0.0175 | |||||

| Republic Finance Issuance Trust 2024-A / ABS-O (US76041RAA95) | 0.12 | 0.00 | 0.0598 | -0.0158 | |||||

| US17313JAM62 / CMLTI 2007-WFH4 M4 MTG | 0.12 | 0.00 | 0.0598 | -0.0161 | |||||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAA80) | 0.12 | 1.75 | 0.0595 | -0.0150 | |||||

| Republic Finance Issuance Trust 2024-B / ABS-O (US76042GAA22) | 0.12 | 0.00 | 0.0591 | -0.0157 | |||||

| US3140QC3S38 / FN 03/50 FIXED 3.5 | 0.12 | 0.00 | 0.0591 | -0.0160 | |||||

| LoanCore 2025 2025-CRE8 Issuer LLC / ABS-CBDO (US53947FAA93) | 0.11 | 0.0587 | 0.0587 | ||||||

| US912810TF57 / TREASURY BOND | 0.11 | 2.70 | 0.0587 | -0.0140 | |||||

| U.S. Treasury Bonds / DBT (US912810UF39) | 0.11 | 1.80 | 0.0583 | -0.0143 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.11 | -0.88 | 0.0582 | -0.0165 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.11 | -3.42 | 0.0582 | -0.0179 | |||||

| US77587AAC09 / Romark WM-R Ltd | 0.11 | -14.39 | 0.0579 | -0.0283 | |||||

| US69377CAA18 / PRKCM 2022-AFC1 Trust | 0.11 | -2.61 | 0.0579 | -0.0170 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.11 | 0.0577 | 0.0577 | ||||||

| JW Commercial Mortgage Trust 2024-MRCO / ABS-MBS (US46657XAA46) | 0.11 | -0.88 | 0.0576 | -0.0161 | |||||

| US133434AC43 / Cameron LNG LLC | 0.11 | 0.91 | 0.0574 | -0.0147 | |||||

| US26885BAH33 / EQM MIDSTREAM PARTNERS L SR UNSECURED 144A 07/27 6.5 | 0.11 | 3.74 | 0.0573 | -0.0124 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.11 | -5.13 | 0.0571 | -0.0195 | |||||

| US36179N5V69 / GNII II 3.5% 03/20/44#MA1760 | 0.11 | -1.80 | 0.0563 | -0.0160 | |||||

| US36179W5B07 / Government National Mortgage Association | 0.11 | -0.91 | 0.0562 | -0.0154 | |||||

| US87267TAE10 / TRK 2021-INV2 Trust | 0.11 | 1.87 | 0.0559 | -0.0141 | |||||

| WEST Trust 2025-ROSE / ABS-MBS (US955909AA47) | 0.11 | 0.0557 | 0.0557 | ||||||

| US30303M8K14 / Meta Platforms Inc | 0.11 | 21.35 | 0.0557 | -0.0026 | |||||

| NYC Trust 2024-3ELV / ABS-MBS (US62956HAE62) | 0.11 | -1.82 | 0.0555 | -0.0163 | |||||

| US12434GAA31 / BX Commercial Mortgage Trust 2023-XL3 | 0.11 | 0.00 | 0.0550 | -0.0152 | |||||

| Bear Stearns Asset Backed Securities I Trust 2006-IM1 / ABS-MBS (US07387UFW62) | 0.11 | 0.94 | 0.0549 | -0.0146 | |||||

| HCA Inc / DBT (US404119CW77) | 0.11 | 0.0548 | 0.0548 | ||||||

| US78449MAB28 / SMB Private Education Loan Trust 2021-D | 0.11 | -7.02 | 0.0547 | -0.0196 | |||||

| US77342JAA16 / Rockford Tower CLO 2018-1 Ltd | 0.11 | -19.08 | 0.0546 | -0.0308 | |||||

| US3138WD2D28 / Fannie Mae Pool | 0.11 | -1.87 | 0.0542 | -0.0157 | |||||

| GoodLeap Home Improvement Solutions Trust 2024-1 / ABS-O (US381935AA36) | 0.11 | 25.00 | 0.0540 | -0.0007 | |||||

| 30064K105 / Exacttarget, Inc. | 0.11 | -4.55 | 0.0540 | -0.0180 | |||||

| US16411QAN16 / CORPORATE BONDS | 0.11 | 23.53 | 0.0540 | -0.0013 | |||||

| BPR 2023-STON Mortgage Trust / ABS-MBS (US05593GAA40) | 0.10 | 0.00 | 0.0537 | -0.0140 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.10 | -2.80 | 0.0536 | -0.0162 | |||||

| US845467AS85 / Southwestern Energy Co | 0.10 | 593.33 | 0.0534 | 0.0432 | |||||

| US29278NAF06 / Energy Transfer Operating LP | 0.10 | 0.00 | 0.0532 | -0.0138 | |||||

| US03027XBA72 / CORPORATE BONDS | 0.10 | 472.22 | 0.0531 | 0.0290 | |||||

| GoodLeap Home Improvement Solutions Trust 2025-1 / ABS-O (US38237EAA29) | 0.10 | -9.65 | 0.0531 | -0.0215 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 0.10 | 0.0530 | 0.0530 | ||||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0.10 | 312.00 | 0.0530 | 0.0366 | |||||

| US68269HAB15 / ONEMAIN FINANCIAL ISSUANCE TRUST 2023-2 6.17% 09/15/2036 144A | 0.10 | 0.98 | 0.0529 | -0.0138 | |||||

| EQT / EQT Corporation | 0.10 | 0.0529 | 0.0529 | ||||||

| Onemain Financial Issuance Trust 2024-1 / ABS-O (US68269NAA00) | 0.10 | 0.98 | 0.0528 | -0.0140 | |||||

| US78396YAA10 / Sesac Finance LLC | 0.10 | -0.97 | 0.0526 | -0.0144 | |||||

| HTL Commercial Mortgage Trust 2024-T53 / ABS-MBS (US404300AG03) | 0.10 | -0.98 | 0.0521 | -0.0146 | |||||

| Mariner Finance issuance Trust 2024-B / ABS-O (US56847GAA13) | 0.10 | 2.02 | 0.0517 | -0.0128 | |||||

| Regional Management Issuance Trust 2025-1 / ABS-O (US75908AAB89) | 0.10 | 0.0517 | 0.0517 | ||||||

| Rain City Mortgage Trust 2024-RTL1 / ABS-MBS (US75079KAA16) | 0.10 | 1.01 | 0.0517 | -0.0132 | |||||

| A&D Mortgage Trust 2024-NQM5 / ABS-MBS (US00039KAF75) | 0.10 | 1.01 | 0.0517 | -0.0132 | |||||

| US694308KP16 / PACIFIC GAS AND ELECTRIC CO SR SEC 1ST LIEN 6.95% 03-15-34 | 0.10 | 0.0516 | 0.0516 | ||||||

| HOMES 2025-NQM1 Trust / ABS-MBS (US43761DAF78) | 0.10 | 0.0515 | 0.0515 | ||||||

| Vistra Operations Co LLC / DBT (US92840VAT98) | 0.10 | 0.00 | 0.0514 | -0.0137 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2025-NQM1 / ABS-MBS (US617932AF56) | 0.10 | 1.01 | 0.0514 | -0.0136 | |||||

| US161630AL29 / CHASE MORTGAGE FINANCE CORPORA CHASE 2007 A1 3A1 | 0.10 | -2.91 | 0.0514 | -0.0159 | |||||

| Saluda Grade Alternative Mortgage Trust 2024-RTL5 / ABS-MBS (US795935AA37) | 0.10 | -0.99 | 0.0514 | -0.0143 | |||||

| US05610DAC65 / BX Trust | 0.10 | 0.00 | 0.0514 | -0.0142 | |||||

| BRAVO Residential Funding Trust 2023-NQM6 / ABS-MBS (US10569DAE31) | 0.10 | -0.99 | 0.0514 | -0.0145 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.10 | -0.99 | 0.0513 | -0.0150 | |||||

| US05610MAC64 / BX_22-CSMO | 0.10 | 0.00 | 0.0513 | -0.0141 | |||||

| US36267CAA36 / GS Mortgage Securities Corp Trust 2023-FUN | 0.10 | 0.00 | 0.0513 | -0.0141 | |||||

| Toorak Mortgage Trust 2024-2 / ABS-MBS (US89055KAA07) | 0.10 | 1.01 | 0.0513 | -0.0135 | |||||

| US61747YEL56 / Morgan Stanley | 0.10 | -23.08 | 0.0513 | -0.0334 | |||||

| US0669224778 / BlackRock Cash Funds: Treasury, SL Agency Shares | 0.10 | -98.14 | 0.10 | -98.14 | 0.0512 | -2.6972 | |||

| GWT 2024-WLF2 / ABS-MBS (US362414AA28) | 0.10 | -1.00 | 0.0512 | -0.0142 | |||||

| US05549GAA94 / BHMS 2018-ATLS | 0.10 | 0.00 | 0.0512 | -0.0138 | |||||

| US62475WAA36 / MTN Commercial Mortgage Trust, Series 2022-LPFL, Class A | 0.10 | -1.00 | 0.0512 | -0.0139 | |||||

| SDAL Trust 2025-DAL / ABS-MBS (US78437RAA77) | 0.10 | 0.0512 | 0.0512 | ||||||

| FS Rialto 2024-FL9 Issuer LLC / ABS-CBDO (US30338WAL37) | 0.10 | 0.0511 | 0.0511 | ||||||

| US05549GAG64 / BHMS 2018 ATLS B 144A | 0.10 | 0.00 | 0.0511 | -0.0137 | |||||

| US912810SS87 / T 1 5/8 11/15/50 | 0.10 | 2.06 | 0.0510 | -0.0124 | |||||

| US25278XAT63 / Diamondback Energy Inc | 0.10 | -38.51 | 0.0510 | -0.0538 | |||||

| SHR Trust 2024-LXRY / ABS-MBS (US784234AA47) | 0.10 | -1.00 | 0.0510 | -0.0143 | |||||

| HILT COMMERCIAL MORTGAGE TRUST 2024-ORL / ABS-MBS (US403956AA32) | 0.10 | -1.00 | 0.0510 | -0.0141 | |||||

| US26442UAK07 / Duke Energy Progress LLC | 0.10 | 141.46 | 0.0509 | 0.0237 | |||||

| Foundation Finance Trust 2024-2 / ABS-O (US35040VAB53) | 0.10 | 1.02 | 0.0509 | -0.0134 | |||||

| BMP 2024-MF23 / ABS-MBS (US05593JAG58) | 0.10 | -1.00 | 0.0508 | -0.0143 | |||||

| IVW / Meta Platforms, Inc. - Depositary Receipt (Common Stock) | 0.10 | 19.28 | 0.0508 | -0.0036 | |||||

| SELF Commercial Mortgage Trust 2024-STRG / ABS-MBS (US81631WAJ53) | 0.10 | -1.00 | 0.0507 | -0.0144 | |||||

| Acrec 2025 Fl 3 LLC / ABS-CBDO (US00112HAA59) | 0.10 | 0.00 | 0.0507 | -0.0143 | |||||

| HIH Trust 2024-61P / ABS-MBS (US40444VAE11) | 0.10 | -1.00 | 0.0507 | -0.0146 | |||||

| US92840VAQ59 / Vistra Operations Co. LLC | 0.10 | 27.27 | 0.0506 | 0.0003 | |||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAE55) | 0.10 | -2.00 | 0.0506 | -0.0147 | |||||

| US715638DT64 / Peruvian Government International Bond | 0.10 | 38.03 | 0.0506 | 0.0040 | |||||

| OBX 2025-NQM3 Trust / ABS-MBS (US67448YAC84) | 0.10 | 0.0505 | 0.0505 | ||||||

| NOCG34 / Northrop Grumman Corporation - Depositary Receipt (Common Stock) | 0.10 | 127.91 | 0.0505 | 0.0222 | |||||

| FNA 8 LLC / ABS-O (US30340WAA36) | 0.10 | 0.0504 | 0.0504 | ||||||

| US76119DAF69 / Residential Mortgage Loan Trust 2019-2 | 0.10 | 2.08 | 0.0503 | -0.0124 | |||||

| US63941FAB22 / Navient Private Education Refi Loan Trust 2020-A | 0.10 | -5.77 | 0.0503 | -0.0177 | |||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust 2025-BHR5 / ABS-MBS (US46649WAA71) | 0.10 | 0.0502 | 0.0502 | ||||||

| US93935NAB01 / Washington Mutual Mortgage Pass-Through Certificates WMALT Trust, Series 2007-OA1, Class 2A | 0.10 | -2.02 | 0.0502 | -0.0143 | |||||

| Verus Securitization Trust 2024-7 / ABS-MBS (US924925AG54) | 0.10 | -2.02 | 0.0501 | -0.0145 | |||||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.00 | 0.10 | 0.0500 | 0.0500 | |||||

| US85214RAC79 / Spruce Hill Mortgage Loan Trust, Series 2020-SH2, Class B1 | 0.10 | 1.04 | 0.0498 | -0.0129 | |||||

| BX Commercial Mortgage Trust 2024-AIRC / ABS-MBS (US12433CAA36) | 0.10 | -3.00 | 0.0497 | -0.0158 | |||||

| US87303TAQ04 / TTAN 2021-MHC | 0.10 | -1.03 | 0.0497 | -0.0139 | |||||

| US61691KAG67 / Morgan Stanley Capital I Trust 2017-ASHF | 0.10 | -2.04 | 0.0496 | -0.0147 | |||||

| NYMT Loan Trust 2024-INV1 / ABS-MBS (US62956XAA90) | 0.10 | -1.03 | 0.0494 | -0.0142 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2025-NQM1 / ABS-MBS (US617932AA69) | 0.10 | -3.03 | 0.0493 | -0.0157 | |||||

| MO / Altria Group, Inc. - Depositary Receipt (Common Stock) | 0.10 | 0.0492 | 0.0492 | ||||||

| BX Commercial Mortgage Trust 2024-AIR2 / ABS-MBS (US05613QAA85) | 0.10 | -5.00 | 0.0491 | -0.0162 | |||||

| US05948XTV37 / Banc of America Alternative Loan Trust 2003-8 | 0.10 | -2.06 | 0.0491 | -0.0141 | |||||

| US912810SP49 / United States Treasury Note/Bond | 0.10 | 2.15 | 0.0490 | -0.0119 | |||||

| US07402LAC63 / Bear Stearns Structured Products Trust 2007-EMX1 | 0.10 | -5.94 | 0.0490 | -0.0168 | |||||

| MFA 2024-NPL1 Trust / ABS-MBS (US58004YAA73) | 0.10 | -2.06 | 0.0489 | -0.0148 | |||||

| Store Capital LLC / DBT (US862123AA45) | 0.09 | 0.0485 | 0.0485 | ||||||

| US92838TAF84 / Vista Point Securitization Trust 2020-2 | 0.09 | 2.17 | 0.0485 | -0.0116 | |||||

| US75907UAA79 / Regional Management Issuance Trust 2021-2 | 0.09 | 1.08 | 0.0485 | -0.0122 | |||||

| BX Commercial Mortgage Trust 2024-XL4 / ABS-MBS (US05611VAJ08) | 0.09 | -1.05 | 0.0484 | -0.0136 | |||||

| A&D Mortgage Trust 2024-NQM5 / ABS-MBS (US00039KAC45) | 0.09 | -2.08 | 0.0483 | -0.0145 | |||||

| US172967MS77 / Citigroup Inc | 0.09 | 0.0482 | 0.0482 | ||||||

| US06051GLS65 / Bank of America Corp | 0.09 | -41.51 | 0.0480 | -0.0929 | |||||

| VEGAS 2024-GCS / ABS-MBS (US92254BAC90) | 0.09 | 1.09 | 0.0479 | -0.0123 | |||||

| US30307RAE71 / FREMF Mortgage Trust, Series 2018-K80, Class B | 0.09 | 1.10 | 0.0476 | -0.0117 | |||||

| US161175CC60 / CHARTER COMMUNICATIONS OPERATING LLC / CHARTER COMMUNICATIONS OPERATING CAPITAL 4.4% 12/01/2061 | 0.09 | 19.48 | 0.0476 | -0.0030 | |||||

| PRET 2024-NPL4 LLC / ABS-O (US74143RAA14) | 0.09 | -4.17 | 0.0476 | -0.0152 | |||||

| BX Trust 2025-ROIC / ABS-MBS (US05593VAN38) | 0.09 | 0.0472 | 0.0472 | ||||||

| US3140QR3K75 / Fannie Mae Pool | 0.09 | -1.09 | 0.0468 | -0.0135 | |||||

| US3140QSUC39 / 30 YR SINGLE FAMILY MBS | 0.09 | 0.00 | 0.0467 | -0.0131 | |||||

| US161175BY99 / CHARTER COMM OPER LLC/CAP CORP 3.85% 04/01/2061 | 0.09 | 313.64 | 0.0467 | 0.0318 | |||||

| US12529AAC80 / CFK Trust 2020-MF2 | 0.09 | 1.11 | 0.0467 | -0.0124 | |||||

| EQT / EQT Corporation | 0.09 | 0.0466 | 0.0466 | ||||||

| US373334KT78 / Georgia Power Co. | 0.09 | -13.46 | 0.0465 | -0.0216 | |||||

| US05608MAA45 / BX Commercial Mortgage Trust 2020-VIV4 | 0.09 | 1.12 | 0.0464 | -0.0115 | |||||

| US031162DU18 / Amgen Inc | 0.09 | -59.09 | 0.0463 | -0.0974 | |||||

| US63941FAD87 / Navient Private Education Refi Loan Trust 2020-A | 0.09 | 2.30 | 0.0460 | -0.0107 | |||||

| US466330AN72 / JP Morgan Chase Commercial Mortgage Securities Corp | 0.09 | -1.11 | 0.0458 | -0.0128 | |||||

| US785592AZ90 / Sabine Pass Liquefaction LLC | 0.09 | 18.67 | 0.0457 | -0.0037 | |||||

| US31329PX733 / FED HM LN PC POOL ZA6102 FR 12/48 FIXED 4 | 0.09 | 0.00 | 0.0456 | -0.0128 | |||||

| Deephaven Residential Mortgage Trust 2024-1 / ABS-MBS (US24380QAC69) | 0.09 | -4.35 | 0.0455 | -0.0149 | |||||

| US32052CAA18 / First Horizon Alternative Mortgage Securities Trust 2006-AA7 | 0.09 | -2.22 | 0.0455 | -0.0135 | |||||

| US912810SU34 / United States Treasury Note/Bond | 0.09 | 1.15 | 0.0455 | -0.0112 | |||||

| US92538NAE76 / Verus Securitization Trust 2022-4 | 0.09 | 0.00 | 0.0454 | -0.0119 | |||||

| US87612BBS07 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 0.09 | 0.00 | 0.0453 | -0.0120 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.09 | 0.00 | 0.0451 | -0.0125 | |||||

| US01F0324503 / Fannie Mae or Freddie Mac | 0.09 | 222.22 | 0.0449 | 0.0095 | |||||

| SMB Private Education Loan Trust 2024-A / ABS-O (US831943AB13) | 0.09 | -5.43 | 0.0448 | -0.0154 | |||||

| US133434AB69 / Cameron LNG LLC | 0.09 | 22.54 | 0.0447 | -0.0016 | |||||

| US06051GKQ19 / Bank of America Corp | 0.09 | 1,142.86 | 0.0447 | 0.0353 | |||||

| US29444UBU97 / 3.9% 15 Apr 2032 | 0.09 | 64.15 | 0.0446 | 0.0098 | |||||

| BX Commercial Mortgage Trust 2024-XL5 / ABS-MBS (US05612GAG82) | 0.09 | -5.43 | 0.0446 | -0.0154 | |||||

| US06427DAW39 / Banc of America Commercial Mortgage Trust 2017-BNK3 | 0.09 | 0.00 | 0.0445 | -0.0115 | |||||

| US06051GHV41 / Bank of America Corp | 0.09 | 0.0445 | 0.0445 | ||||||

| US83404WAB37 / Sofi Professional Loan Program 2019-B LLC | 0.09 | -8.51 | 0.0441 | -0.0172 | |||||

| US30227FAJ93 / Extended Stay America Trust | 0.09 | -2.30 | 0.0438 | -0.0133 | |||||

| CSMC 2022-NQM6 Trust / ABS-MBS (US12663YAM03) | 0.09 | -4.49 | 0.0438 | -0.0144 | |||||

| US666807BP60 / Northrop Grumman Corp. | 0.09 | -8.60 | 0.0438 | -0.0173 | |||||

| BXMT / Blackstone Mortgage Trust, Inc. | 0.00 | 9.99 | 0.09 | 16.44 | 0.0437 | -0.0040 | |||

| Morgan Stanley Capital I Trust 2024-NSTB / ABS-MBS (US61690BAA08) | 0.09 | 0.00 | 0.0437 | -0.0121 | |||||

| US3132DWC270 / FR SD8189 | 0.09 | 0.00 | 0.0436 | -0.0117 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 0.09 | 1.19 | 0.0436 | -0.0116 | |||||

| SAIF Securitization Trust 2024-CES1 / ABS-MBS (US78436VAA98) | 0.08 | -5.62 | 0.0433 | -0.0147 | |||||

| GCAT 2023-NQM4 Trust / ABS-MBS (US36171FAA12) | 0.08 | 0.00 | 0.0432 | -0.0116 | |||||

| US92838CAE84 / VISIO 2022-1 TRUST VISIO 2022-1 B1 | 0.08 | -3.45 | 0.0432 | -0.0134 | |||||

| BAMLL Trust 2025-ASHF / ABS-MBS (US05494CAA36) | 0.08 | 0.0431 | 0.0431 | ||||||

| TRGP / Targa Resources Corp. | 0.08 | -23.15 | 0.0430 | -0.0276 | |||||

| BX Trust 2024-CNYN / ABS-MBS (US05612HAG65) | 0.08 | -1.19 | 0.0430 | -0.0122 | |||||

| D1HI34 / D.R. Horton, Inc. - Depositary Receipt (Common Stock) | 0.08 | -14.43 | 0.0428 | -0.0208 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.08 | -4.60 | 0.0427 | -0.0142 | |||||

| BX Trust 2024-CNYN / ABS-MBS (US05612HAJ05) | 0.08 | -1.19 | 0.0427 | -0.0121 | |||||

| US23245FAE34 / Alternative Loan Trust 2006-OC10 | 0.08 | -2.38 | 0.0425 | -0.0126 | |||||

| GreenSky Home Improvement Trust 2024-1 / ABS-O (US39571MAD02) | 0.08 | -22.64 | 0.0425 | -0.0269 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.08 | -4.65 | 0.0424 | -0.0137 | |||||

| US161175BV50 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.08 | 18.84 | 0.0423 | -0.0030 | |||||

| US12659YAF16 / COLT 2022-3 Mortgage Loan Trust | 0.08 | 0.0417 | 0.0417 | ||||||

| EQT / EQT Corporation | 0.08 | 0.0417 | 0.0417 | ||||||

| US01F0404537 / Uniform Mortgage-Backed Security, TBA | 0.08 | 138.24 | 0.0415 | -0.0019 | |||||

| US03465WAA99 / ANGEL OAK MORTGAGE TRUST 2023-1 SER 2023-1 CL A1 V/R REGD 144A P/P 4.75000000 | 0.08 | 0.0415 | 0.0415 | ||||||

| US072024NV09 / BAY AREA CA TOLL AUTH TOLL BRIDGE REVENUE | 0.08 | 1.27 | 0.0413 | -0.0107 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.08 | 158.06 | 0.0413 | 0.0210 | |||||

| US87612GAA94 / Targa Resources Corp | 0.08 | 40.35 | 0.0412 | -0.0209 | |||||

| MCR 2024-HTL Mortgage Trust / ABS-MBS (US55286PAE34) | 0.08 | -1.23 | 0.0411 | -0.0117 | |||||

| US35906ABF49 / Frontier Communications Corp | 0.08 | 185.71 | 0.0411 | 0.0224 | |||||

| ARES1 2024-IND2 / ABS-MBS (US04021EAA47) | 0.08 | -1.25 | 0.0410 | -0.0112 | |||||

| Navient Private Education Refi Loan Trust 2024-A / ABS-O (US63943CAA99) | 0.08 | -8.14 | 0.0409 | -0.0152 | |||||

| US12659VAA89 / CREDIT SUISSE MORTGAGE TRUST | 0.08 | 0.00 | 0.0408 | -0.0111 | |||||

| US6174468U61 / MORGAN STANLEY 1.794%/VAR 02/13/2032 | 0.08 | -33.05 | 0.0406 | -0.0366 | |||||

| US54627RAM25 / LOUISIANA ST LOCAL GOVT ENVRNMNTL FACS & CMNTY DEV AUTH | 0.08 | 2.60 | 0.0406 | -0.0099 | |||||

| US94989WAY30 / Wells Fargo Commercial Mortgage Trust 2015-C31 | 0.08 | 0.00 | 0.0404 | -0.0109 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.08 | -4.88 | 0.0404 | -0.0130 | |||||

| EQT / EQT Corporation | 0.08 | 0.0400 | 0.0400 | ||||||

| US17330VAA44 / CMLTI_22-A | 0.08 | -2.50 | 0.0400 | -0.0122 | |||||

| US87165BAP85 / SYNCHRONY FINANCIAL SR UNSECURED 03/29 5.15 | 0.08 | 0.00 | 0.0400 | -0.0109 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 0.08 | 54.00 | 0.0398 | 0.0069 | |||||

| US03027XBC39 / AMERICAN TOWER CORP SR UNSECURED 06/30 2.1 | 0.08 | 541.67 | 0.0397 | 0.0313 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 0.08 | 381.25 | 0.0395 | 0.0253 | |||||

| US26884LAQ23 / EQT Corp. | 0.08 | 1.32 | 0.0394 | -0.0102 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.08 | 0.00 | 0.0393 | -0.0108 | |||||

| US06051GLG28 / Bank of America Corp | 0.08 | -34.48 | 0.0392 | -0.1085 | |||||

| Morgan Stanley Resecuritization Trust 2015-R3 / ABS-MBS (US61690TAV52) | 0.08 | 0.0392 | 0.0392 | ||||||

| US87303TAN72 / TTAN 2021-MHC | 0.08 | 0.00 | 0.0392 | -0.0108 | |||||

| US646139W353 / NEW JERSEY ST TURNPIKE AUTH | 0.08 | 2.74 | 0.0388 | -0.0090 | |||||

| Bear Stearns Asset Backed Securities I Trust 2007-HE5 / ABS-MBS (US073859AH34) | 0.08 | 0.0388 | 0.0388 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.08 | 7.14 | 0.0387 | -0.0070 | |||||

| US361841AP42 / GLP Capital LP / GLP Financing II Inc | 0.08 | 1.35 | 0.0386 | -0.0101 | |||||

| Velocity Commercial Capital Loan Trust 2024-1 / ABS-MBS (US92261CAA27) | 0.07 | -11.90 | 0.0383 | -0.0165 | |||||

| US842587DL81 / Southern Co. (The) | 0.07 | 0.0383 | 0.0383 | ||||||

| US83401CAB00 / Sofi Professional Loan Program 2019-C LLC | 0.07 | -6.33 | 0.0381 | -0.0139 | |||||

| US92343VGN82 / Verizon Communications Inc | 0.07 | -2.63 | 0.0380 | -0.0118 | |||||

| US193938AB31 / COLLEGE AVE STUDENT LOANS 2023-A LLC SER 2023-A CL A2 REGD 144A P/P 5.33000000 | 0.07 | -3.95 | 0.0378 | -0.0122 | |||||

| US83189DAC48 / SMB PRIVATE EDUCATION LOAN TRUST 2017-B SMB 2017-B A2B | 0.07 | -23.40 | 0.0372 | -0.0244 | |||||

| EQT Trust 2024-EXTR / ABS-MBS (US29439DAA90) | 0.07 | 1.41 | 0.0371 | -0.0091 | |||||

| US87612GAB77 / Targa Resources Corp | 0.07 | 0.0371 | 0.0371 | ||||||

| US760942BA98 / Uruguay Government International Bond | 0.07 | 1.41 | 0.0369 | -0.0095 | |||||

| CNX Resources Corp / DBT (US12653CAL28) | 0.07 | 0.0369 | 0.0369 | ||||||

| US882722KF74 / TEXAS ST | 0.07 | 1.43 | 0.0367 | -0.0091 | |||||

| US842587CW55 / Southern Co/The | 0.07 | 16.39 | 0.0367 | -0.0036 | |||||

| US33767BAA70 / FirstEnergy Transmission LLC | 0.07 | 0.0366 | 0.0366 | ||||||

| US00206RKJ04 / AT&T Inc | 0.07 | -12.50 | 0.0363 | -0.0159 | |||||

| US20030NDW83 / Comcast Corp | 0.07 | 22.81 | 0.0362 | -0.0013 | |||||

| CMS USISSO01 2Y-10 OPTION @0.401BP / DIR (000000000) | 0.07 | 0.0361 | 0.0361 | ||||||

| US36179TSH94 / Ginnie Mae II Pool | 0.07 | -1.43 | 0.0357 | -0.0104 | |||||

| US07401TAA43 / Bear Stearns Mortgage Funding Trust, Series 2007-AR2, Class A1 | 0.07 | -2.82 | 0.0357 | -0.0106 | |||||

| US785592AV86 / Sabine Pass Liquefaction LLC | 0.07 | 0.00 | 0.0357 | -0.0097 | |||||

| VICI Properties LP / DBT (US925650AK98) | 0.07 | 0.0355 | 0.0355 | ||||||

| US87165BAM54 / Synchrony Financial | 0.07 | 213.64 | 0.0354 | 0.0209 | |||||

| PRM5 Trust 2025-PRM5 / ABS-MBS (US693980AG99) | 0.07 | 0.0353 | 0.0353 | ||||||

| US16412XAG07 / CHENIERE CORP CHRISTI HD SR SECURED 06/27 5.125 | 0.07 | 0.00 | 0.0352 | -0.0093 | |||||

| US90278LBC28 / UBS Commercial Mortgage Trust 2018-C15 | 0.07 | 0.0351 | 0.0351 | ||||||

| US912810QC53 / United States Treas Bds Bond | 0.07 | 3.03 | 0.0351 | -0.0083 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.07 | -5.56 | 0.0350 | -0.0118 | |||||

| US61747YFE05 / Morgan Stanley | 0.07 | 0.0348 | 0.0348 | ||||||

| US78449PAC32 / SMB PRIVATE EDUCATION LOAN TRUST 2018-A SER 2018-A CL A2B V/R REGD 144A P/P 2.56538000 | 0.07 | -15.19 | 0.0347 | -0.0169 | |||||

| Palmer Square Loan Funding 2022-3 Ltd / ABS-CBDO (US69690CAL72) | 0.07 | -37.38 | 0.0346 | -0.0356 | |||||

| US373334KP56 / Georgia Power Co | 0.07 | 36.73 | 0.0343 | 0.0020 | |||||

| US373334KQ30 / Georgia Power Co | 0.07 | 17.86 | 0.0341 | -0.0026 | |||||

| US11135FBF71 / Broadcom, Inc. | 0.07 | 25.00 | 0.0337 | -0.0335 | |||||

| US3132DNAY94 / Federal Home Loan Mortgage Corp. | 0.06 | 0.00 | 0.0333 | -0.0089 | |||||

| US92553PBB76 / Viacom, Inc. | 0.06 | 178.26 | 0.0330 | 0.0179 | |||||

| T-Mobile USA Inc / DBT (US87264ADS15) | 0.06 | 0.0326 | 0.0326 | ||||||

| US26444HAL50 / Duke Energy Florida LLC | 0.06 | 16.98 | 0.0321 | -0.0026 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.06 | 588.89 | 0.0319 | 0.0255 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 0.06 | -1.59 | 0.0319 | -0.0094 | |||||

| US124857AR43 / ViacomCBS Inc | 0.06 | 1.64 | 0.0318 | -0.0081 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.06 | -3.12 | 0.0318 | -0.0100 | |||||

| US3140XDGA86 / UMBS | 0.06 | -3.17 | 0.0315 | -0.0096 | |||||

| Florida Power & Light Co / DBT (US341081GZ45) | 0.06 | 0.0315 | 0.0315 | ||||||

| US61747YFH36 / Morgan Stanley | 0.06 | -57.04 | 0.0315 | -0.1239 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.06 | -1.64 | 0.0312 | -0.0091 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.06 | -3.23 | 0.0311 | -0.0094 | |||||

| US78445QAE17 / SLM Private Education Loan Trust 2010-C | 0.06 | -3.23 | 0.0308 | -0.0097 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.06 | -20.27 | 0.0307 | -0.0345 | |||||

| US31418CQA52 / Fannie Mae Pool | 0.06 | 0.00 | 0.0303 | -0.0082 | |||||

| US88632QAE35 / Picard Midco, Inc. | 0.06 | 3.51 | 0.0302 | -0.0075 | |||||

| US3132DWBQ50 / Freddie Mac Pool | 0.06 | 0.00 | 0.0302 | -0.0081 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.06 | 0.0301 | 0.0301 | ||||||

| US842400HY20 / Southern California Edison Co. | 0.06 | 1.75 | 0.0300 | -0.0074 | |||||

| US06051GJM24 / Bank of America Corp | 0.06 | -1.69 | 0.0300 | -0.0087 | |||||

| DK Trust 2024-SPBX / ABS-MBS (US23346LAN82) | 0.06 | -1.72 | 0.0296 | -0.0084 | |||||

| US36179UCC45 / Ginnie Mae II Pool | 0.06 | -1.72 | 0.0295 | -0.0085 | |||||

| US68389XCK90 / ORACLE CORPORATION | 0.06 | 111.11 | 0.0292 | 0.0049 | |||||

| US26442UAR59 / Duke Energy Progress LLC | 0.06 | -1.75 | 0.0292 | -0.0081 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.06 | 0.00 | 0.0291 | -0.0079 | |||||

| 30064K105 / Exacttarget, Inc. | 0.06 | -38.46 | 0.0290 | -0.0306 | |||||

| US02765UEK60 / AMERICAN MUNI PWR-OHIO INC OH REVENUE | 0.06 | 0.00 | 0.0289 | -0.0076 | |||||

| US38141GYN86 / Goldman Sachs Group Inc/The | 0.06 | -42.27 | 0.0289 | -0.0348 | |||||

| US63940YAB20 / Navient Private Education Refi Loan Trust 2019-C | 0.06 | -11.11 | 0.0288 | -0.0126 | |||||

| US03027XBZ24 / American Tower Corp | 0.06 | 0.0286 | 0.0286 | ||||||

| US912810QE10 / United States Treas Bds Bond | 0.06 | 1.85 | 0.0285 | -0.0068 | |||||

| US12666TAD81 / CWABS Asset-Backed Certificates Trust 2006-11 | 0.06 | -5.17 | 0.0284 | -0.0098 | |||||

| Duke Energy Progress LLC / DBT (US26442UAU88) | 0.05 | 0.0281 | 0.0281 | ||||||

| US36179VN306 / Ginnie Mae II Pool | 0.05 | -1.82 | 0.0280 | -0.0078 | |||||

| US626207YF57 / MUNI ELEC AUTH OF GEORGIA | 0.05 | 0.0278 | 0.0278 | ||||||

| Expedia Group Inc / DBT (US30212PBL85) | 0.05 | 0.0277 | 0.0277 | ||||||

| US92553PAU66 / Viacom, Inc. Bond | 0.05 | -3.64 | 0.0274 | -0.0087 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0.05 | -11.67 | 0.0272 | -0.0120 | |||||

| US31418DXR87 / Fannie Mae Pool | 0.05 | 0.00 | 0.0271 | -0.0070 | |||||

| US161631AK29 / CHASE MORTGAGE FINANCE CORPORA CHASE 2007 S5 1A10 | 0.05 | 0.00 | 0.0271 | -0.0073 | |||||

| US3140QQTM73 / Fannie Mae Pool | 0.05 | -1.89 | 0.0267 | -0.0078 | |||||

| US35908MAA80 / FRONTIER COMMUNICATIONS HOLDINGS LLC 5.875% 11/01/2029 | 0.05 | 0.0266 | 0.0266 | ||||||

| US694308KJ55 / Pacific Gas and Electric Co. | 0.05 | 0.0266 | 0.0266 | ||||||

| US38141GYG36 / Goldman Sachs Group Inc/The | 0.05 | -46.87 | 0.0266 | -0.0364 | |||||

| US694308KM84 / Pacific Gas and Electric Co. | 0.05 | 0.0265 | 0.0265 | ||||||

| US29450YAA73 / EquipmentShare.com, Inc. | 0.05 | 117.39 | 0.0261 | 0.0110 | |||||

| US912810QK79 / United States Treas Bds Bond | 0.05 | 2.04 | 0.0261 | -0.0062 | |||||

| Clarios Global LP / Clarios US Finance Co / DBT (US18060TAD72) | 0.05 | 0.0261 | 0.0261 | ||||||

| Amentum Holdings Inc / DBT (US02352BAA35) | 0.05 | 0.0261 | 0.0261 | ||||||

| US67059TAH86 / NuStar Logistics LP | 0.05 | 0.0260 | 0.0260 | ||||||

| US92564RAL96 / VICI Properties LP / VICI Note Co., Inc. | 0.05 | 0.00 | 0.0260 | -0.0066 | |||||

| JP Morgan Resecuritization Trust Series 2014-5 / ABS-MBS (US46642VAR96) | 0.05 | -1.96 | 0.0260 | -0.0074 | |||||

| BX Commercial Mortgage Trust 2024-BRBK / ABS-MBS (US05613NAA54) | 0.05 | -1.96 | 0.0260 | -0.0074 | |||||

| US01883LAF04 / ALLIANT HOLD / CO-ISSUER REGD 144A P/P 7.00000000 | 0.05 | 0.0260 | 0.0260 | ||||||

| US29103CAA62 / Emerald Debt Merger Sub LLC | 0.05 | 0.0260 | 0.0260 | ||||||

| US629377CL46 / NRG Energy Inc | 0.05 | 2.04 | 0.0259 | -0.0065 | |||||

| JP Morgan Chase Commercial Mortgage Securities Trust 2024-IGLG / ABS-MBS (US46593KAA97) | 0.05 | 2.04 | 0.0258 | -0.0066 | |||||

| Quikrete Holdings Inc / DBT (US74843PAA84) | 0.05 | 0.0258 | 0.0258 | ||||||

| US341081FU66 / Florida Power & Light Co. | 0.05 | 2.04 | 0.0256 | -0.0069 | |||||

| US80874YBC30 / Scientific Games International Inc | 0.05 | 0.0256 | 0.0256 | ||||||

| BAMLL Trust 2025-ASHF / ABS-MBS (US05494CAJ45) | 0.05 | 0.0255 | 0.0255 | ||||||

| US62954HAJ77 / NXP BV / NXP Funding LLC / NXP USA Inc | 0.05 | 880.00 | 0.0254 | 0.0199 | |||||

| US235825AG15 / Dana Inc | 0.05 | 0.0254 | 0.0254 | ||||||

| U.S. Treasury Notes / DBT (US91282CMT52) | 0.05 | 0.0254 | 0.0254 | ||||||

| US677415CT66 / Ohio Power Co., Series Q | 0.05 | 28.95 | 0.0254 | 0.0003 | |||||

| US31418DV668 / Fannie Mae Pool | 0.05 | 2.08 | 0.0252 | -0.0066 | |||||

| US842400FC28 / Southern California Edison 5.625% Due 2/1/36 | 0.05 | 2.08 | 0.0251 | -0.0063 | |||||

| US95000U2Z51 / Wells Fargo & Co. | 0.05 | -50.00 | 0.0250 | -0.0374 | |||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0.05 | 0.0248 | 0.0248 | ||||||

| MTDR / Matador Resources Company | 0.05 | 0.0247 | 0.0247 | ||||||