Statistik Asas

| Nilai Portfolio | $ 1,199,464,198 |

| Kedudukan Semasa | 40 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

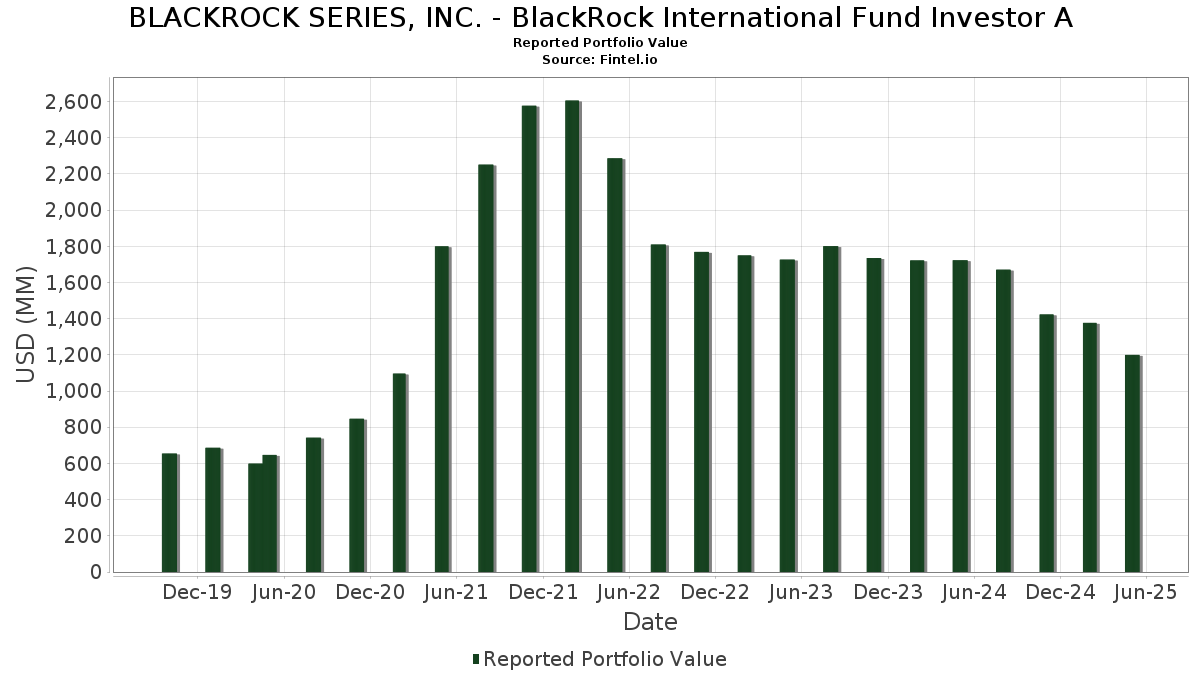

BLACKROCK SERIES, INC. - BlackRock International Fund Investor A telah mendedahkan 40 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 1,199,464,198 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas BLACKROCK SERIES, INC. - BlackRock International Fund Investor A ialah Taiwan Semiconductor Manufacturing Company Limited (TW:2330) , Shell plc (GB:SHEL) , L'Air Liquide S.A. (FR:AI) , RELX PLC - Depositary Receipt (Common Stock) (US:RELX) , and Astrazeneca plc (CH:AZN) . Kedudukan baharu BLACKROCK SERIES, INC. - BlackRock International Fund Investor A termasuk Shell plc (GB:SHEL) , Koninklijke KPN N.V. (MX:KPN N) , SAP SE (US:SAPGF) , FinecoBank Banca Fineco S.p.A. (IT:FBK) , and The Toronto-Dominion Bank (MX:TD N) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.43 | 47.43 | 3.9506 | 3.9506 | |

| 8.01 | 37.67 | 3.1381 | 3.1381 | |

| 0.35 | 36.87 | 3.0709 | 3.0709 | |

| 0.12 | 36.64 | 3.0521 | 3.0521 | |

| 1.66 | 35.92 | 2.9917 | 2.9917 | |

| 0.46 | 31.66 | 2.6370 | 2.6370 | |

| 0.05 | 29.18 | 2.4305 | 2.4305 | |

| 0.15 | 28.67 | 2.3878 | 2.3878 | |

| 0.07 | 28.59 | 2.3813 | 2.3813 | |

| 0.49 | 26.81 | 2.2335 | 2.2335 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.41 | 37.65 | 3.1358 | -3.3115 | |

| 0.05 | 28.55 | 2.3784 | -2.7414 | |

| 0.27 | 36.44 | 3.0356 | -2.4422 | |

| 0.98 | 37.09 | 3.0894 | -2.4188 | |

| 0.16 | 17.57 | 1.4632 | -1.9295 | |

| 0.45 | 32.17 | 2.6795 | -1.8830 | |

| 0.27 | 26.86 | 2.2369 | -1.1388 | |

| 0.71 | 38.42 | 3.1999 | -0.9484 | |

| 1.94 | 61.71 | 5.1406 | -0.8072 | |

| 0.26 | 38.36 | 3.1950 | -0.7854 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-24 untuk tempoh pelaporan 2025-05-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 1.94 | -25.40 | 61.71 | -22.00 | 5.1406 | -0.8072 | |||

| SHEL / Shell plc | 1.43 | 47.43 | 3.9506 | 3.9506 | |||||

| AI / L'Air Liquide S.A. | 0.20 | 1.91 | 41.39 | 15.08 | 3.4479 | 0.7438 | |||

| RELX / RELX PLC - Depositary Receipt (Common Stock) | 0.71 | -37.60 | 38.42 | -30.38 | 3.1999 | -0.9484 | |||

| AZN / Astrazeneca plc | 0.26 | -25.18 | 38.36 | -27.56 | 3.1950 | -0.7854 | |||

| KPN N / Koninklijke KPN N.V. | 8.01 | 37.67 | 3.1381 | 3.1381 | |||||

| SON1 / Sony Group Corporation | 1.41 | -58.97 | 37.65 | -56.10 | 3.1358 | -3.3115 | |||

| DTEGY / Deutsche Telekom AG - Depositary Receipt (Common Stock) | 0.98 | -51.76 | 37.09 | -49.38 | 3.0894 | -2.4188 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.35 | 36.87 | 3.0709 | 3.0709 | |||||

| SAPGF / SAP SE | 0.12 | 36.64 | 3.0521 | 3.0521 | |||||

| BEI / Beiersdorf Aktiengesellschaft | 0.27 | -49.96 | 36.44 | -49.99 | 3.0356 | -2.4422 | |||

| SMCAY / SMC Corporation - Depositary Receipt (Common Stock) | 0.10 | 30.90 | 36.37 | 35.55 | 3.0296 | 1.0124 | |||

| FBK / FinecoBank Banca Fineco S.p.A. | 1.66 | 35.92 | 2.9917 | 2.9917 | |||||

| BBVA / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 2.37 | -41.75 | 35.56 | -12.33 | 2.9620 | 0.6058 | |||

| NNND / Tencent Holdings Limited | 0.53 | 38.75 | 33.50 | 42.12 | 2.7905 | 1.0184 | |||

| NOV / Novo Nordisk A/S | 0.45 | -32.32 | 32.17 | -47.00 | 2.6795 | -1.8830 | |||

| TD N / The Toronto-Dominion Bank | 0.46 | 31.66 | 2.6370 | 2.6370 | |||||

| ASM1 N / ASM International NV | 0.05 | 29.18 | 2.4305 | 2.4305 | |||||

| WCN / Waste Connections, Inc. | 0.15 | 28.67 | 2.3878 | 2.3878 | |||||

| KEE / Keyence Corporation | 0.07 | 28.59 | 2.3813 | 2.3813 | |||||

| MA / Mastercard Incorporated | 0.05 | -58.74 | 28.55 | -58.07 | 2.3784 | -2.7414 | |||

| TECK / Teck Resources Limited | 0.76 | 17.31 | 28.13 | 8.03 | 2.3432 | 0.3857 | |||

| ADS / adidas AG | 0.11 | -6.98 | 27.21 | -9.23 | 2.2662 | 0.0129 | |||

| SAN / Santander UK plc - Preferred Stock | 0.27 | -60.72 | 26.86 | -63.65 | 2.2369 | -1.1388 | |||

| IDEXY / Industria de Diseño Textil, S.A. - Depositary Receipt (Common Stock) | 0.49 | 26.81 | 2.2335 | 2.2335 | |||||

| 0XXT / Atlas Copco AB (publ) | 1.62 | 26.04 | 2.1691 | 2.1691 | |||||

| GE / General Electric Company | 0.11 | 25.99 | 2.1651 | 2.1651 | |||||

| ZFSVF / Zurich Insurance Group AG | 0.04 | 25.09 | 2.0900 | 2.0900 | |||||

| HLN N / Haleon plc | 4.48 | 25.00 | 2.0822 | 2.0822 | |||||

| ASAZF / ASSA ABLOY AB (publ) | 0.75 | 23.66 | 1.9709 | 1.9709 | |||||

| OTIS / Otis Worldwide Corporation | 0.25 | -28.58 | 23.43 | -31.76 | 1.9513 | -0.6292 | |||

| UBSG / UBS Group AG | 0.72 | -28.69 | 22.87 | -34.35 | 1.9047 | -0.7137 | |||

| HDFCB / HDFC Bank Ltd | 0.96 | 21.81 | 1.8167 | 1.8167 | |||||

| UOVEF / United Overseas Bank Limited | 0.79 | 21.65 | 1.8037 | 1.8037 | |||||

| AXISBANK / Axis Bank Limited | 1.53 | 21.31 | 1.7751 | 1.7751 | |||||

| BATS / British American Tobacco p.l.c. | 0.43 | 19.52 | 1.6255 | 1.6255 | |||||

| TWODY / Taylor Wimpey plc - Depositary Receipt (Common Stock) | 11.86 | -35.37 | 19.12 | -27.41 | 1.5930 | -0.3876 | |||

| GOB / Compagnie de Saint-Gobain S.A. | 0.16 | -65.40 | 17.57 | -61.08 | 1.4632 | -1.9295 | |||

| 2454 / MediaTek Inc. | 0.39 | 16.09 | 1.3406 | 1.3406 | |||||

| US09248U7182 / BlackRock Liquidity Funds: T-Fund, Institutional Shares | 11.47 | 1,399.04 | 11.47 | 1,400.65 | 0.9550 | 0.8975 |