Statistik Asas

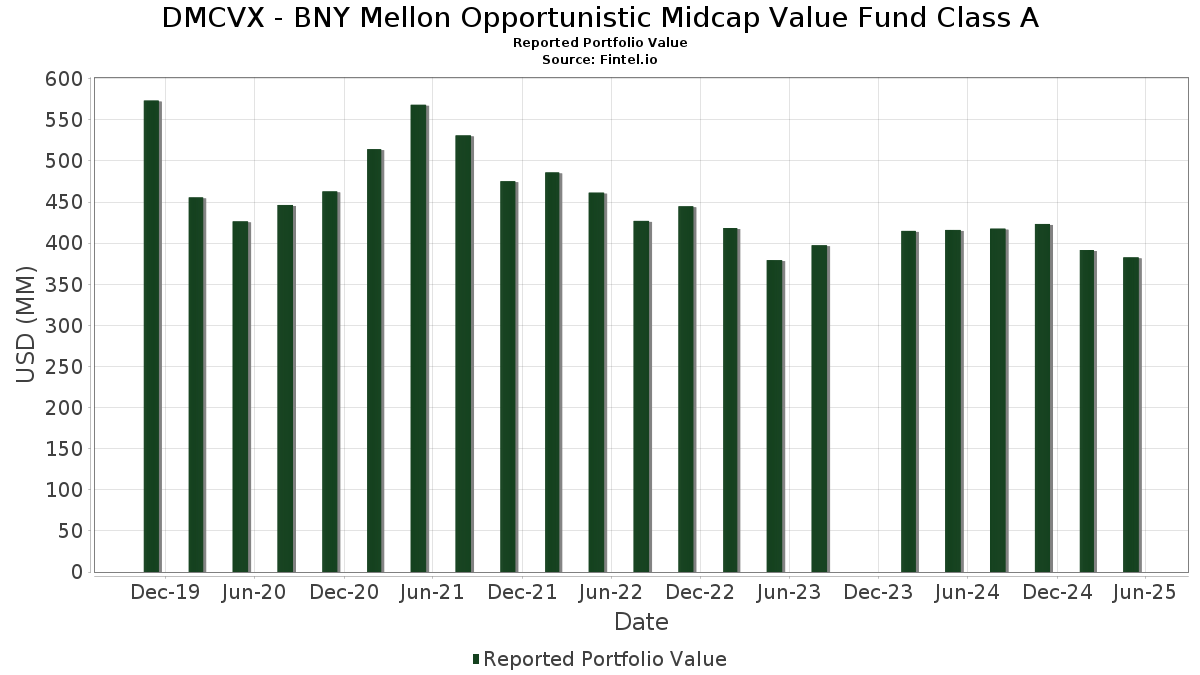

| Nilai Portfolio | $ 382,718,603 |

| Kedudukan Semasa | 69 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

DMCVX - BNY Mellon Opportunistic Midcap Value Fund Class A telah mendedahkan 69 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 382,718,603 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas DMCVX - BNY Mellon Opportunistic Midcap Value Fund Class A ialah Johnson Controls International plc (US:JCI) , Encompass Health Corporation (US:EHC) , Exelon Corporation (US:EXC) , Dominion Energy, Inc. (US:D) , and Kenvue Inc. (US:KVUE) . Kedudukan baharu DMCVX - BNY Mellon Opportunistic Midcap Value Fund Class A termasuk Block, Inc. (US:XYZ) , Healthpeak Properties, Inc. (US:PEAK) , SLM Corporation (US:SLM) , Ulta Beauty, Inc. (US:ULTA) , and Clean Harbors, Inc. (US:CLH) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 9.22 | 9.22 | 2.4501 | 2.4501 | |

| 6.53 | 6.53 | 1.7338 | 1.7338 | |

| 0.10 | 6.27 | 1.6647 | 1.6647 | |

| 0.35 | 6.17 | 1.6393 | 1.6393 | |

| 0.19 | 6.03 | 1.6015 | 1.6015 | |

| 0.01 | 6.00 | 1.5929 | 1.5929 | |

| 0.03 | 5.70 | 1.5151 | 1.5151 | |

| 0.44 | 5.58 | 1.4810 | 1.4810 | |

| 0.03 | 5.40 | 1.4354 | 1.4354 | |

| 0.04 | 3.76 | 0.9988 | 0.9988 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.11 | 4.40 | 1.1683 | -1.3965 | |

| 0.02 | 4.50 | 1.1957 | -1.1162 | |

| 0.03 | 2.89 | 0.7666 | -0.9802 | |

| 0.14 | 4.25 | 1.1278 | -0.8356 | |

| 0.03 | 5.54 | 1.4711 | -0.7829 | |

| 0.05 | 3.73 | 0.9913 | -0.6203 | |

| 0.11 | 5.63 | 1.4953 | -0.5166 | |

| 0.08 | 5.01 | 1.3313 | -0.5006 | |

| 0.23 | 2.70 | 0.7183 | -0.3803 | |

| 0.06 | 3.78 | 1.0046 | -0.3493 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-29 untuk tempoh pelaporan 2025-05-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JCI / Johnson Controls International plc | 0.11 | -3.78 | 11.14 | 13.87 | 2.9602 | 0.4625 | |||

| DREYFUS INSTITUTIONAL PREFERRED GOVERNMENT PLUS MONEY MARKET FUND / STIV (000000000) | 9.22 | 9.22 | 2.4501 | 2.4501 | |||||

| EHC / Encompass Health Corporation | 0.07 | -6.01 | 8.75 | 13.49 | 2.3249 | 0.3565 | |||

| EXC / Exelon Corporation | 0.19 | 16.92 | 8.42 | 15.92 | 2.2362 | 0.3828 | |||

| D / Dominion Energy, Inc. | 0.14 | -3.78 | 8.21 | -3.69 | 2.1821 | 0.0052 | |||

| KVUE / Kenvue Inc. | 0.34 | 0.12 | 8.20 | 1.27 | 2.1772 | 0.1116 | |||

| FHN / First Horizon Corporation | 0.40 | -3.78 | 8.00 | -11.19 | 2.1263 | -0.1741 | |||

| RNR / RenaissanceRe Holdings Ltd. | 0.03 | -3.78 | 7.99 | 1.00 | 2.1214 | 0.1033 | |||

| NEM / Newmont Corporation | 0.15 | -20.80 | 7.84 | -2.54 | 2.0815 | 0.0297 | |||

| AIZ / Assurant, Inc. | 0.04 | -3.78 | 7.82 | -6.05 | 2.0762 | -0.0471 | |||

| DLR / Digital Realty Trust, Inc. | 0.04 | -16.24 | 7.64 | -8.09 | 2.0298 | -0.0922 | |||

| LPLA / LPL Financial Holdings Inc. | 0.02 | -3.78 | 7.61 | 0.21 | 2.0207 | 0.0834 | |||

| PWR / Quanta Services, Inc. | 0.02 | -3.78 | 7.45 | 26.94 | 1.9779 | 0.4810 | |||

| EFX / Equifax Inc. | 0.03 | 16.29 | 7.28 | 25.31 | 1.9344 | 0.4512 | |||

| DLB / Dolby Laboratories, Inc. | 0.10 | 12.07 | 7.26 | 1.98 | 1.9280 | 0.1115 | |||

| CEG / Constellation Energy Corporation | 0.02 | -5.25 | 6.90 | 15.78 | 1.8324 | 0.3118 | |||

| SKX / Skechers U.S.A., Inc. | 0.11 | -4.67 | 6.69 | -3.02 | 1.7764 | 0.0165 | |||

| DREYFUS INSTITUTIONAL PREFERRED GOVERNMENT PLUS MONEY MARKET FUND / STIV (000000000) | 6.53 | 6.53 | 1.7338 | 1.7338 | |||||

| BAX / Baxter International Inc. | 0.21 | -4.36 | 6.35 | -15.47 | 1.6866 | -0.2305 | |||

| AR / Antero Resources Corporation | 0.17 | -12.91 | 6.29 | -11.13 | 1.6715 | -0.1355 | |||

| XYZ / Block, Inc. | 0.10 | 6.27 | 1.6647 | 1.6647 | |||||

| PEAK / Healthpeak Properties, Inc. | 0.35 | 6.17 | 1.6393 | 1.6393 | |||||

| CRH / CRH plc | 0.07 | 1.71 | 6.10 | -9.57 | 1.6198 | -0.1009 | |||

| VOYA / Voya Financial, Inc. | 0.09 | 7.40 | 6.06 | -1.13 | 1.6095 | 0.0455 | |||

| SLM / SLM Corporation | 0.19 | 6.03 | 1.6015 | 1.6015 | |||||

| ULTA / Ulta Beauty, Inc. | 0.01 | 6.00 | 1.5929 | 1.5929 | |||||

| WY / Weyerhaeuser Company | 0.23 | 7.43 | 5.92 | -7.53 | 1.5727 | -0.0613 | |||

| WCN / Waste Connections, Inc. | 0.03 | -3.78 | 5.84 | -0.05 | 1.5517 | 0.0600 | |||

| CCK / Crown Holdings, Inc. | 0.06 | 143.09 | 5.75 | 167.22 | 1.5269 | 0.9778 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.07 | 1.67 | 5.71 | -1.18 | 1.5155 | 0.0420 | |||

| CLH / Clean Harbors, Inc. | 0.03 | 5.70 | 1.5151 | 1.5151 | |||||

| IP / International Paper Company | 0.12 | -3.78 | 5.70 | -18.36 | 1.5147 | -0.2679 | |||

| TAP / Molson Coors Beverage Company | 0.11 | -18.34 | 5.63 | -28.59 | 1.4953 | -0.5166 | |||

| RKT / Rocket Companies, Inc. | 0.44 | 5.58 | 1.4810 | 1.4810 | |||||

| GEV / GE Vernova Inc. | 0.01 | -4.36 | 5.57 | 34.97 | 1.4794 | 0.4262 | |||

| EXPE / Expedia Group, Inc. | 0.03 | -25.56 | 5.54 | -37.30 | 1.4711 | -0.7829 | |||

| FIS / Fidelity National Information Services, Inc. | 0.07 | 4.77 | 5.46 | 17.28 | 1.4498 | 0.2621 | |||

| LOPE / Grand Canyon Education, Inc. | 0.03 | 5.40 | 1.4354 | 1.4354 | |||||

| LH / Labcorp Holdings Inc. | 0.02 | -3.78 | 5.26 | -4.57 | 1.3984 | -0.0095 | |||

| VLO / Valero Energy Corporation | 0.04 | -3.78 | 5.18 | -5.07 | 1.3769 | -0.0167 | |||

| GMED / Globus Medical, Inc. | 0.08 | -5.24 | 5.01 | -30.19 | 1.3313 | -0.5006 | |||

| ACM / AECOM | 0.05 | -19.75 | 5.01 | -11.90 | 1.3313 | -0.1204 | |||

| FCX / Freeport-McMoRan Inc. | 0.13 | 6.85 | 5.01 | 11.40 | 1.3297 | 0.1828 | |||

| NSC / Norfolk Southern Corporation | 0.02 | -23.39 | 4.77 | -22.97 | 1.2681 | -0.3134 | |||

| RMBS / Rambus Inc. | 0.09 | -4.70 | 4.76 | -8.82 | 1.2653 | -0.0680 | |||

| FERG / Ferguson Enterprises Inc. | 0.03 | -23.87 | 4.76 | -21.80 | 1.2649 | -0.2890 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.02 | -20.97 | 4.75 | -20.74 | 1.2620 | -0.2676 | |||

| CACI / CACI International Inc | 0.01 | -28.98 | 4.63 | -9.23 | 1.2312 | -0.0718 | |||

| BURL / Burlington Stores, Inc. | 0.02 | -45.73 | 4.50 | -50.31 | 1.1957 | -1.1162 | |||

| OMC / Omnicom Group Inc. | 0.06 | 69.47 | 4.46 | 50.40 | 1.1859 | 0.4283 | |||

| FANG / Diamondback Energy, Inc. | 0.03 | 25.35 | 4.40 | 6.10 | 1.1684 | 0.1104 | |||

| ARMK / Aramark | 0.11 | -59.97 | 4.40 | -56.24 | 1.1683 | -1.3965 | |||

| LVS / Las Vegas Sands Corp. | 0.11 | -5.28 | 4.40 | -12.80 | 1.1678 | -0.1189 | |||

| PINS / Pinterest, Inc. | 0.14 | -34.40 | 4.25 | -44.82 | 1.1278 | -0.8356 | |||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.10 | 22.44 | 4.23 | 7.58 | 1.1232 | 0.1202 | |||

| HUBB / Hubbell Incorporated | 0.01 | 110.20 | 4.05 | 120.46 | 1.0766 | 0.6072 | |||

| CNC / Centene Corporation | 0.07 | -3.78 | 3.93 | -6.63 | 1.0432 | -0.0302 | |||

| CF / CF Industries Holdings, Inc. | 0.04 | -31.29 | 3.92 | -23.08 | 1.0415 | -0.2592 | |||

| HAS / Hasbro, Inc. | 0.06 | -30.42 | 3.78 | -28.71 | 1.0046 | -0.3493 | |||

| FRT / Federal Realty Investment Trust | 0.04 | 3.76 | 0.9988 | 0.9988 | |||||

| AKAM / Akamai Technologies, Inc. | 0.05 | -37.21 | 3.73 | -40.91 | 0.9913 | -0.6203 | |||

| GPS / The Gap, Inc. | 0.15 | 3.43 | 0.9100 | 0.9100 | |||||

| BNTX / BioNTech SE - Depositary Receipt (Common Stock) | 0.03 | 39.42 | 3.06 | 18.28 | 0.8130 | 0.1527 | |||

| BPOP / Popular, Inc. | 0.03 | -59.10 | 2.89 | -57.83 | 0.7666 | -0.9802 | |||

| FTAI / FTAI Aviation Ltd. | 0.02 | 2.86 | 0.7602 | 0.7602 | |||||

| DATABRICKS INC / EC (000000000) | 0.03 | 2.73 | 0.7244 | 0.7244 | |||||

| NOV / NOV Inc. | 0.23 | -21.89 | 2.70 | -37.17 | 0.7183 | -0.3803 | |||

| TSN / Tyson Foods, Inc. | 0.03 | -4.41 | 1.86 | -12.49 | 0.4951 | -0.0484 | |||

| Databricks Inc Series I Preferred / EP (000000000) | 0.00 | 0.22 | 0.0597 | 0.0597 |