Statistik Asas

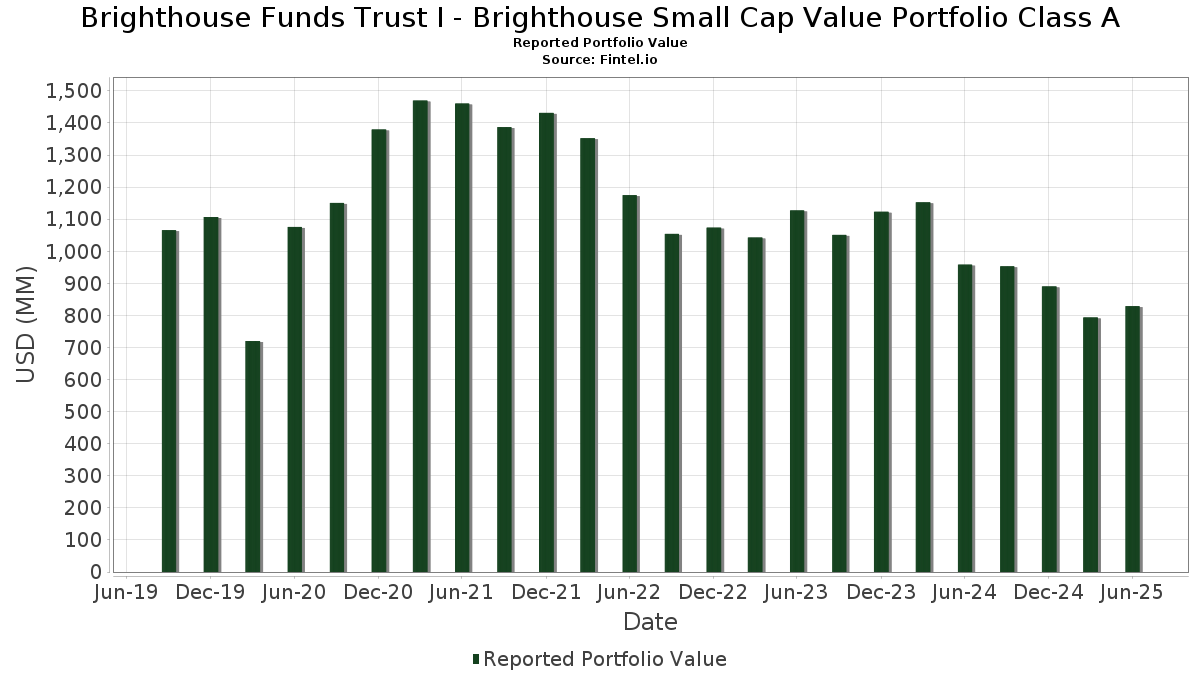

| Nilai Portfolio | $ 828,947,949 |

| Kedudukan Semasa | 145 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Brighthouse Funds Trust I - Brighthouse Small Cap Value Portfolio Class A telah mendedahkan 145 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 828,947,949 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Brighthouse Funds Trust I - Brighthouse Small Cap Value Portfolio Class A ialah UMB Financial Corporation (US:UMBF) , Franklin Electric Co., Inc. (US:FELE) , Mueller Industries, Inc. (US:MLI) , Innospec Inc. (US:IOSP) , and J&J Snack Foods Corp. (US:JJSF) . Kedudukan baharu Brighthouse Funds Trust I - Brighthouse Small Cap Value Portfolio Class A termasuk Amcor plc (US:AMCR) , Charles River Laboratories International, Inc. (US:CRL) , Standex International Corporation (US:SXI) , SmartStop Self Storage REIT, Inc. (US:SMA) , and Bit Digital, Inc. (US:BTBT) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 20.31 | 2.7631 | 2.7631 | ||

| 14.00 | 1.9048 | 1.9048 | ||

| 12.00 | 1.6327 | 1.6327 | ||

| 10.00 | 1.3606 | 1.3606 | ||

| 10.00 | 1.3606 | 1.3606 | ||

| 6.00 | 0.8163 | 0.8163 | ||

| 0.59 | 5.44 | 0.7399 | 0.7399 | |

| 5.00 | 0.6803 | 0.6803 | ||

| 5.00 | 0.6803 | 0.6803 | ||

| 4.01 | 0.5453 | 0.5453 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 4.10 | 0.5584 | -0.9062 | |

| 0.58 | 3.62 | 0.4932 | -0.8889 | |

| 0.00 | 0.00 | -0.4130 | ||

| 0.05 | 3.93 | 0.5349 | -0.3592 | |

| 0.48 | 2.82 | 0.3844 | -0.3070 | |

| 0.19 | 21.32 | 2.9011 | -0.2728 | |

| 0.11 | 6.12 | 0.8328 | -0.2717 | |

| 0.26 | 21.84 | 2.9718 | -0.2560 | |

| 0.02 | 1.03 | 0.1405 | -0.2505 | |

| 0.45 | 14.55 | 1.9791 | -0.2477 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-27 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| UMBF / UMB Financial Corporation | 0.24 | 5.40 | 24.83 | 9.64 | 3.3781 | 0.2526 | |||

| FELE / Franklin Electric Co., Inc. | 0.26 | 5.12 | 23.54 | 0.48 | 3.2029 | -0.0306 | |||

| MLI / Mueller Industries, Inc. | 0.29 | 8.20 | 22.92 | 12.93 | 3.1181 | 0.3173 | |||

| IOSP / Innospec Inc. | 0.26 | 5.23 | 21.84 | -6.61 | 2.9718 | -0.2560 | |||

| JJSF / J&J Snack Foods Corp. | 0.19 | 7.69 | 21.32 | -7.28 | 2.9011 | -0.2728 | |||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 20.31 | 2.7631 | 2.7631 | ||||||

| EXP / Eagle Materials Inc. | 0.09 | 7.21 | 18.20 | -2.36 | 2.4756 | -0.0965 | |||

| SLGN / Silgan Holdings Inc. | 0.33 | 5.40 | 18.01 | 11.70 | 2.4508 | 0.2252 | |||

| ALG / Alamo Group Inc. | 0.07 | -1.30 | 16.26 | 20.94 | 2.2121 | 0.3568 | |||

| UFPI / UFP Industries, Inc. | 0.15 | 21.50 | 14.91 | 12.79 | 2.0289 | 0.2041 | |||

| NEU / NewMarket Corporation | 0.02 | 2.18 | 14.84 | 24.63 | 2.0195 | 0.3757 | |||

| BDC / Belden Inc. | 0.13 | 5.76 | 14.75 | 22.17 | 2.0073 | 0.3405 | |||

| AVNT / Avient Corporation | 0.45 | 3.69 | 14.55 | -9.84 | 1.9791 | -0.2477 | |||

| HWC / Hancock Whitney Corporation | 0.25 | 1.57 | 14.54 | 11.16 | 1.9780 | 0.1729 | |||

| STC / Stewart Information Services Corporation | 0.22 | 7.11 | 14.31 | -2.27 | 1.9474 | -0.0740 | |||

| US63306A4114 / National Bank of Canada into Bristol-Myers Squibb Co. | 14.00 | 1.9048 | 1.9048 | ||||||

| SSB / SouthState Corporation | 0.15 | 6.49 | 13.41 | 5.58 | 1.8240 | 0.0715 | |||

| KFY / Korn Ferry | 0.18 | 5.25 | 13.21 | 13.79 | 1.7969 | 0.1950 | |||

| PBH / Prestige Consumer Healthcare Inc. | 0.16 | 3.88 | 12.98 | -3.52 | 1.7658 | -0.0907 | |||

| TD Prime Services LLC / RA (000000000) | 12.00 | 1.6327 | 1.6327 | ||||||

| THG / The Hanover Insurance Group, Inc. | 0.07 | -5.79 | 11.18 | -8.00 | 1.5212 | -0.1560 | |||

| NOMD / Nomad Foods Limited | 0.64 | 3.61 | 10.82 | -10.42 | 1.4725 | -0.1949 | |||

| TRS / TriMas Corporation | 0.37 | 0.96 | 10.69 | 23.28 | 1.4546 | 0.2577 | |||

| CF Secured LLC / RA (000000000) | 10.00 | 1.3606 | 1.3606 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 10.00 | 1.3606 | 1.3606 | ||||||

| KD / Kyndryl Holdings, Inc. | 0.23 | 0.74 | 9.76 | 34.64 | 1.3276 | 0.3272 | |||

| CHRD / Chord Energy Corporation | 0.10 | 10.97 | 9.68 | -4.66 | 1.3176 | -0.0843 | |||

| PLOW / Douglas Dynamics, Inc. | 0.31 | 4.33 | 9.22 | 32.36 | 1.2540 | 0.2929 | |||

| AGNC / AGNC Investment Corp. | 0.94 | 5.45 | 8.60 | 1.15 | 1.1705 | -0.0033 | |||

| MGY / Magnolia Oil & Gas Corporation | 0.37 | 6.48 | 8.43 | -5.24 | 1.1465 | -0.0808 | |||

| RNST / Renasant Corporation | 0.23 | 3.13 | 8.31 | 9.20 | 1.1302 | 0.0804 | |||

| AL / Air Lease Corporation | 0.14 | 6.72 | 7.90 | 29.22 | 1.0746 | 0.2309 | |||

| CENTA / Central Garden & Pet Company | 0.25 | 2.29 | 7.86 | -2.20 | 1.0688 | -0.0399 | |||

| HAE / Haemonetics Corporation | 0.10 | 1.64 | 7.30 | 19.33 | 0.9938 | 0.1490 | |||

| TWO / Two Harbors Investment Corp. | 0.67 | 7.21 | 7.24 | -13.57 | 0.9846 | -0.1711 | |||

| WTM / White Mountains Insurance Group, Ltd. | 0.00 | 24.65 | 6.95 | 16.23 | 0.9463 | 0.1204 | |||

| SSD / Simpson Manufacturing Co., Inc. | 0.04 | 18.37 | 6.94 | 17.06 | 0.9440 | 0.1258 | |||

| WERN / Werner Enterprises, Inc. | 0.25 | 5.23 | 6.92 | -1.73 | 0.9408 | -0.0304 | |||

| ONB / Old National Bancorp | 0.31 | 56.46 | 6.65 | 57.59 | 0.9044 | 0.3222 | |||

| ATKR / Atkore Inc. | 0.09 | -3.21 | 6.60 | 13.82 | 0.8980 | 0.0977 | |||

| NX / Quanex Building Products Corporation | 0.35 | 9.24 | 6.53 | 11.07 | 0.8889 | 0.0770 | |||

| HLMN / Hillman Solutions Corp. | 0.89 | 151.25 | 6.37 | 104.10 | 0.8665 | 0.4358 | |||

| WBS / Webster Financial Corporation | 0.11 | -27.79 | 6.12 | -23.52 | 0.8328 | -0.2717 | |||

| ASB / Associated Banc-Corp | 0.25 | 0.68 | 6.12 | 8.99 | 0.8327 | 0.0577 | |||

| GTES / Gates Industrial Corporation plc | 0.27 | -3.78 | 6.12 | 20.37 | 0.8323 | 0.1309 | |||

| National Bank Financial Inc / RA (000000000) | 6.00 | 0.8163 | 0.8163 | ||||||

| NOVT / Novanta Inc. | 0.05 | 45.54 | 5.97 | 46.77 | 0.8122 | 0.2507 | |||

| PRMB / Primo Brands Corporation | 0.20 | -6.41 | 5.90 | -21.89 | 0.8022 | -0.2396 | |||

| EEFT / Euronet Worldwide, Inc. | 0.06 | 8.18 | 5.65 | 2.63 | 0.7686 | 0.0090 | |||

| PRSU / Pursuit Attractions and Hospitality, Inc. | 0.19 | 8.73 | 5.49 | -11.43 | 0.7466 | -0.1085 | |||

| AMCR / Amcor plc | 0.59 | 5.44 | 0.7399 | 0.7399 | |||||

| DBD / Diebold Nixdorf, Incorporated | 0.10 | 4.79 | 5.38 | 32.80 | 0.7316 | 0.1727 | |||

| PRGS / Progress Software Corporation | 0.08 | 8.46 | 5.32 | 34.43 | 0.7242 | 0.1777 | |||

| NOG / Northern Oil and Gas, Inc. | 0.18 | 4.80 | 5.17 | -1.71 | 0.7030 | -0.0226 | |||

| ATMU / Atmus Filtration Technologies Inc. | 0.14 | 27.42 | 5.16 | 26.35 | 0.7021 | 0.1384 | |||

| CNO / CNO Financial Group, Inc. | 0.13 | 51.42 | 5.14 | 40.27 | 0.6995 | 0.1936 | |||

| TR / Tootsie Roll Industries, Inc. | 0.15 | 0.63 | 5.10 | 6.92 | 0.6936 | 0.0356 | |||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 5.00 | 0.6803 | 0.6803 | ||||||

| Barclays Capital Inc / RA (000000000) | 5.00 | 0.6803 | 0.6803 | ||||||

| ECVT / Ecovyst Inc. | 0.59 | 2.29 | 4.88 | 35.80 | 0.6638 | 0.1679 | |||

| MDU / MDU Resources Group, Inc. | 0.28 | 19.60 | 4.73 | 17.91 | 0.6440 | 0.0899 | |||

| ELME / Elme Communities | 0.26 | 4.14 | 4.21 | -4.84 | 0.5731 | -0.0378 | |||

| MYE / Myers Industries, Inc. | 0.29 | 7.49 | 4.16 | 30.56 | 0.5662 | 0.1263 | |||

| LEVI / Levi Strauss & Co. | 0.22 | 11.52 | 4.11 | 32.28 | 0.5598 | 0.1305 | |||

| SPB / Spectrum Brands Holdings, Inc. | 0.08 | -47.79 | 4.10 | -61.32 | 0.5584 | -0.9062 | |||

| MEC / Mayville Engineering Company, Inc. | 0.26 | 7.95 | 4.10 | 28.29 | 0.5578 | 0.1167 | |||

| MMS / Maximus, Inc. | 0.06 | -17.35 | 4.07 | -14.92 | 0.5533 | -0.1064 | |||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | 4.01 | 0.5453 | 0.5453 | ||||||

| CBZ / CBIZ, Inc. | 0.06 | -10.92 | 3.99 | -15.79 | 0.5435 | -0.1112 | |||

| KWR / Quaker Chemical Corporation | 0.04 | 6.07 | 3.99 | -3.95 | 0.5427 | -0.0304 | |||

| PRGO / Perrigo Company plc | 0.15 | 5.38 | 3.96 | 0.43 | 0.5389 | -0.0055 | |||

| ADC / Agree Realty Corporation | 0.05 | -35.88 | 3.93 | -39.31 | 0.5349 | -0.3592 | |||

| SHOO / Steven Madden, Ltd. | 0.16 | 0.72 | 3.90 | -9.33 | 0.5303 | -0.0630 | |||

| MATV / Mativ Holdings, Inc. | 0.56 | 11.65 | 3.79 | 22.20 | 0.5161 | 0.0878 | |||

| EBF / Ennis, Inc. | 0.21 | 2.29 | 3.74 | -7.65 | 0.5091 | -0.0500 | |||

| FIVE / Five Below, Inc. | 0.03 | 14.55 | 3.64 | 100.61 | 0.4955 | 0.2449 | |||

| CODI / Compass Diversified | 0.58 | 7.61 | 3.62 | -63.81 | 0.4932 | -0.8889 | |||

| BOKF / BOK Financial Corporation | 0.04 | 21.30 | 3.56 | 13.69 | 0.4847 | 0.0523 | |||

| MTX / Minerals Technologies Inc. | 0.06 | 6.61 | 3.46 | -7.64 | 0.4704 | -0.0463 | |||

| TTAM / Titan America SA | 0.28 | 7.11 | 3.44 | -1.12 | 0.4674 | -0.0121 | |||

| ACCO / ACCO Brands Corporation | 0.93 | 19.65 | 3.34 | 2.23 | 0.4550 | 0.0035 | |||

| NYMT / New York Mortgage Trust, Inc. | 0.50 | 8.00 | 3.32 | 11.50 | 0.4514 | 0.0407 | |||

| JBI / Janus International Group, Inc. | 0.40 | 13.60 | 3.28 | 28.45 | 0.4466 | 0.0939 | |||

| MRX / Marex Group plc | 0.08 | -9.04 | 3.17 | 1.67 | 0.4309 | 0.0009 | |||

| BYD / Boyd Gaming Corporation | 0.04 | 33.37 | 3.13 | 58.51 | 0.4259 | 0.1533 | |||

| MATW / Matthews International Corporation | 0.13 | 12.72 | 3.12 | 21.18 | 0.4243 | 0.0691 | |||

| CSW / CSW Industrials, Inc. | 0.01 | 41.10 | 3.05 | 38.81 | 0.4152 | 0.1118 | |||

| AZTA / Azenta, Inc. | 0.10 | 13.68 | 3.03 | 1.03 | 0.4128 | -0.0018 | |||

| VREX / Varex Imaging Corporation | 0.35 | 8.86 | 3.00 | -18.62 | 0.4084 | -0.1008 | |||

| Royal Bank Canada Toronto / RA (000000000) | 3.00 | 0.4082 | 0.4082 | ||||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 3.00 | 0.4082 | 0.4082 | ||||||

| GENI / Genius Sports Limited | 0.28 | 30.32 | 2.94 | 35.44 | 0.3999 | 0.1003 | |||

| LBRT / Liberty Energy Inc. | 0.25 | 0.82 | 2.88 | -26.89 | 0.3915 | -0.1517 | |||

| DENN / Denny's Corporation | 0.70 | 0.00 | 2.86 | 11.69 | 0.3887 | 0.0358 | |||

| PTEN / Patterson-UTI Energy, Inc. | 0.48 | -21.82 | 2.82 | -43.61 | 0.3844 | -0.3070 | |||

| LZB / La-Z-Boy Incorporated | 0.08 | 40.66 | 2.81 | 33.76 | 0.3818 | 0.0922 | |||

| KN / Knowles Corporation | 0.16 | 10.33 | 2.77 | 27.89 | 0.3763 | 0.0778 | |||

| CENT / Central Garden & Pet Company | 0.08 | 2.29 | 2.71 | -1.81 | 0.3691 | -0.0123 | |||

| ALIT / Alight, Inc. | 0.47 | 42.73 | 2.67 | 36.21 | 0.3630 | 0.0927 | |||

| INGM / Ingram Micro Holding Corporation | 0.13 | 3.83 | 2.64 | 21.99 | 0.3594 | 0.0605 | |||

| CROX / Crocs, Inc. | 0.03 | 6.22 | 2.54 | 1.32 | 0.3449 | -0.0005 | |||

| CRL / Charles River Laboratories International, Inc. | 0.02 | 2.48 | 0.3370 | 0.3370 | |||||

| IAC / IAC Inc. | 0.07 | 859.48 | 2.45 | 680.25 | 0.3334 | 0.2900 | |||

| SXI / Standex International Corporation | 0.01 | 2.18 | 0.2969 | 0.2969 | |||||

| ENOV / Enovis Corporation | 0.07 | 150.61 | 2.11 | 82.60 | 0.2870 | 0.1527 | |||

| ZD / Ziff Davis, Inc. | 0.07 | 25.81 | 2.09 | 1.36 | 0.2839 | -0.0003 | |||

| AHL.PRF / Aspen Insurance Holdings Limited - Preferred Security | 0.06 | 2.02 | 0.2743 | 0.2743 | |||||

| TD Prime Services LLC / RA (000000000) | 2.00 | 0.2721 | 0.2721 | ||||||

| NATL BANK CANADA / STIV (000000000) | 2.00 | 0.2721 | 0.2721 | ||||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 2.00 | 0.2721 | 0.2721 | ||||||

| ING Financial Markets LLC / RA (000000000) | 2.00 | 0.2721 | 0.2721 | ||||||

| FIRST ABU DHABI BANK USA NV / STIV (000000000) | 2.00 | 0.2721 | 0.2721 | ||||||

| BANCO SANTANDER SA NY / STIV (000000000) | 2.00 | 0.2721 | 0.2721 | ||||||

| BANK OF MONTREAL, LONDON / STIV (000000000) | 2.00 | 0.2721 | 0.2721 | ||||||

| CHESHAM FINANCE LIMITED SERIES I / STIV (000000000) | 2.00 | 0.2720 | 0.2720 | ||||||

| CTOS / Custom Truck One Source, Inc. | 0.40 | 0.00 | 2.00 | 17.07 | 0.2717 | 0.0363 | |||

| NSIT / Insight Enterprises, Inc. | 0.01 | 47.91 | 1.97 | 36.19 | 0.2684 | 0.0685 | |||

| HLLY / Holley Inc. | 0.95 | 9.25 | 1.90 | -15.00 | 0.2585 | -0.0499 | |||

| WSC / WillScot Holdings Corporation | 0.07 | 42.91 | 1.87 | 40.84 | 0.2544 | 0.0712 | |||

| VSEC / VSE Corporation | 0.01 | -40.40 | 1.78 | -34.95 | 0.2427 | -0.1357 | |||

| CNMD / CONMED Corporation | 0.03 | 2.29 | 1.74 | -11.79 | 0.2373 | -0.0356 | |||

| TKR / The Timken Company | 0.02 | 46.24 | 1.74 | 47.66 | 0.2361 | 0.0739 | |||

| THRY / Thryv Holdings, Inc. | 0.14 | 2.29 | 1.70 | -2.86 | 0.2309 | -0.0103 | |||

| EPC / Edgewell Personal Care Company | 0.07 | -5.65 | 1.57 | -29.27 | 0.2141 | -0.0928 | |||

| DIOD / Diodes Incorporated | 0.03 | -17.36 | 1.48 | 1.23 | 0.2018 | -0.0004 | |||

| SMA / SmartStop Self Storage REIT, Inc. | 0.04 | 1.46 | 0.1992 | 0.1992 | |||||

| ARDT / Ardent Health, Inc. | 0.10 | 7.37 | 1.43 | 6.64 | 0.1945 | 0.0095 | |||

| JACK / Jack in the Box Inc. | 0.07 | -24.54 | 1.18 | -51.57 | 0.1612 | -0.1763 | |||

| GMED / Globus Medical, Inc. | 0.02 | -52.78 | 1.03 | -66.32 | 0.1405 | -0.2505 | |||

| WHG / Westwood Holdings Group, Inc. | 0.06 | 2.29 | 1.01 | -1.47 | 0.1372 | -0.0041 | |||

| SOCIETE GENERALE NEW YORK / STIV (000000000) | 1.00 | 0.1361 | 0.1361 | ||||||

| ANZ NATIONAL (INTL) LTD / STIV (000000000) | 1.00 | 0.1361 | 0.1361 | ||||||

| TRUIST BANK / STIV (000000000) | 1.00 | 0.1361 | 0.1361 | ||||||

| CREDIT AGRICOLE CIB, NY / STIV (000000000) | 1.00 | 0.1361 | 0.1361 | ||||||

| BANK OF MONTREAL, LONDON / STIV (000000000) | 1.00 | 0.1361 | 0.1361 | ||||||

| CONCORD MINUTEMEN CC LLC SER C / STIV (000000000) | 1.00 | 0.1361 | 0.1361 | ||||||

| ABL / Abacus Global Management, Inc. | 0.19 | 13.33 | 0.98 | -22.23 | 0.1328 | -0.0404 | |||

| BTBT / Bit Digital, Inc. | 0.42 | 0.92 | 0.1246 | 0.1246 | |||||

| CNR / Core Natural Resources, Inc. | 0.01 | -31.21 | 0.91 | -37.75 | 0.1234 | -0.0778 | |||

| BRY / Berry Corporation | 0.31 | 2.29 | 0.86 | -11.67 | 0.1163 | -0.0174 | |||

| ANGI / Angi Inc. | 0.04 | 0.68 | 0.0930 | 0.0930 | |||||

| FET / Forum Energy Technologies, Inc. | 0.03 | 8.65 | 0.63 | 5.17 | 0.0860 | 0.0031 | |||

| SNCR / Synchronoss Technologies, Inc. | 0.06 | 0.00 | 0.42 | -37.05 | 0.0576 | -0.0353 | |||

| DALN / DallasNews Corporation | 0.03 | 0.00 | 0.13 | -5.63 | 0.0183 | -0.0014 | |||

| GLAE / GlassBridge Enterprises, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0019 | -0.0000 | |||

| IMB / Imperial Brands PLC | 0.04 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| US715ESC0184 / ESC PERSHING SQUARE | 0.14 | 0.00 | 0.00 | 0.0000 | -0.0000 | ||||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.4130 |