Statistik Asas

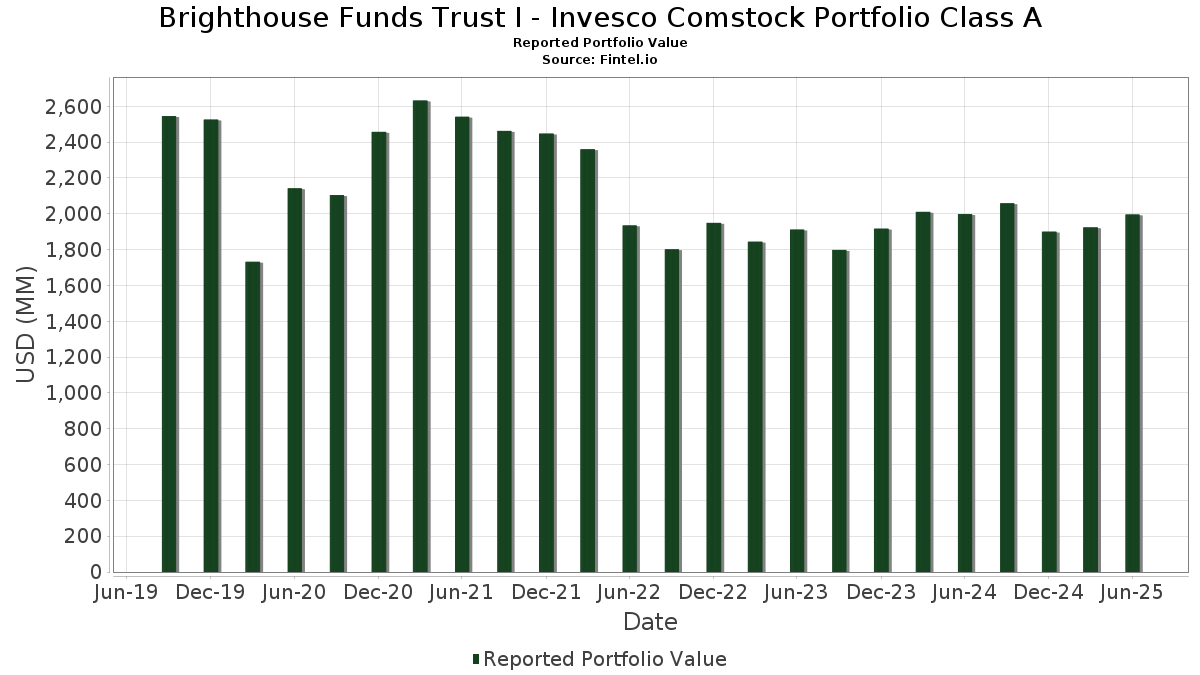

| Nilai Portfolio | $ 1,995,712,105 |

| Kedudukan Semasa | 110 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Brighthouse Funds Trust I - Invesco Comstock Portfolio Class A telah mendedahkan 110 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 1,995,712,105 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Brighthouse Funds Trust I - Invesco Comstock Portfolio Class A ialah Bank of America Corporation (US:BAC) , Microsoft Corporation (US:MSFT) , Wells Fargo & Company (US:WFC) , Cisco Systems, Inc. (US:CSCO) , and CVS Health Corporation (US:CVS) . Kedudukan baharu Brighthouse Funds Trust I - Invesco Comstock Portfolio Class A termasuk NIKE, Inc. (US:NKE) , The Clorox Company (US:CLX) , Regeneron Pharmaceuticals, Inc. (US:REGN) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 65.91 | 3.4767 | 3.4767 | ||

| 0.23 | 16.00 | 0.8437 | 0.8437 | |

| 0.12 | 14.42 | 0.7608 | 0.7608 | |

| 0.12 | 58.45 | 3.0830 | 0.6984 | |

| 12.00 | 0.6330 | 0.6330 | ||

| 10.00 | 0.5275 | 0.5275 | ||

| 10.00 | 0.5275 | 0.5275 | ||

| 10.00 | 0.5275 | 0.5275 | ||

| 10.00 | 0.5275 | 0.5275 | ||

| 0.39 | 41.04 | 2.1648 | 0.4336 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.18 | 12.81 | 0.6759 | -0.6559 | |

| 0.20 | 28.94 | 1.5267 | -0.6050 | |

| 0.10 | 9.27 | 0.4890 | -0.4837 | |

| 0.16 | 23.92 | 1.2615 | -0.4714 | |

| 0.55 | 26.74 | 1.4104 | -0.4633 | |

| 0.15 | 16.51 | 0.8708 | -0.4374 | |

| 0.22 | 16.17 | 0.8530 | -0.3962 | |

| 0.07 | 13.66 | 0.7206 | -0.3837 | |

| 0.31 | 26.88 | 1.4181 | -0.3743 | |

| 0.66 | 24.80 | 1.3081 | -0.3741 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-27 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 65.91 | 3.4767 | 3.4767 | ||||||

| BAC / Bank of America Corporation | 1.34 | 0.76 | 63.39 | 14.26 | 3.3435 | 0.3443 | |||

| MSFT / Microsoft Corporation | 0.12 | 0.00 | 58.45 | 32.51 | 3.0830 | 0.6984 | |||

| WFC / Wells Fargo & Company | 0.73 | -8.39 | 58.30 | 2.24 | 3.0753 | -0.0076 | |||

| CSCO / Cisco Systems, Inc. | 0.75 | 2.32 | 52.12 | 15.04 | 2.7491 | 0.2999 | |||

| CVS / CVS Health Corporation | 0.66 | 4.54 | 45.27 | 6.43 | 2.3880 | 0.0885 | |||

| STT / State Street Corporation | 0.39 | 7.90 | 41.04 | 28.16 | 2.1648 | 0.4336 | |||

| META / Meta Platforms, Inc. | 0.05 | -15.06 | 40.28 | 8.78 | 2.1248 | 0.1229 | |||

| GOOGL / Alphabet Inc. | 0.22 | 0.00 | 39.18 | 13.96 | 2.0669 | 0.2081 | |||

| TYIA / Johnson Controls International plc | 0.36 | -1.60 | 38.32 | 29.73 | 2.0213 | 0.4245 | |||

| PM / Philip Morris International Inc. | 0.20 | -19.14 | 35.59 | -7.22 | 1.8774 | -0.1964 | |||

| SYY / Sysco Corporation | 0.45 | 0.00 | 33.78 | 0.93 | 1.7818 | -0.0275 | |||

| C / Citigroup Inc. | 0.39 | 0.00 | 33.47 | 19.90 | 1.7656 | 0.2564 | |||

| ETN / Eaton Corporation plc | 0.09 | 0.00 | 32.39 | 31.33 | 1.7085 | 0.3752 | |||

| NXPI / NXP Semiconductors N.V. | 0.15 | 8.72 | 32.31 | 24.98 | 1.7041 | 0.3066 | |||

| HBAN / Huntington Bancshares Incorporated | 1.92 | 6.41 | 32.22 | 18.82 | 1.6995 | 0.2336 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.41 | 9.82 | 31.94 | 12.01 | 1.6849 | 0.1432 | |||

| RKT / Reckitt Benckiser Group plc | 0.46 | 8.56 | 31.46 | 9.28 | 1.6596 | 0.1032 | |||

| CFG / Citizens Financial Group, Inc. | 0.70 | 0.00 | 31.36 | 9.23 | 1.6543 | 0.1020 | |||

| EMR / Emerson Electric Co. | 0.23 | 0.00 | 30.99 | 21.61 | 1.6348 | 0.2570 | |||

| SRE / Sempra | 0.40 | 0.00 | 30.10 | 6.18 | 1.5878 | 0.0552 | |||

| FDX / FedEx Corporation | 0.13 | 8.85 | 30.06 | 1.50 | 1.5855 | -0.0155 | |||

| ELV / Elevance Health, Inc. | 0.08 | 0.00 | 29.74 | -10.58 | 1.5685 | -0.2292 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.14 | 0.00 | 29.13 | 15.44 | 1.5367 | 0.1724 | |||

| CVX / Chevron Corporation | 0.20 | -14.24 | 28.94 | -26.60 | 1.5267 | -0.6050 | |||

| KMB / Kimberly-Clark Corporation | 0.22 | 0.00 | 28.00 | -9.35 | 1.4768 | -0.1929 | |||

| AIG / American International Group, Inc. | 0.31 | -17.63 | 26.88 | -18.91 | 1.4181 | -0.3743 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.55 | -11.44 | 26.74 | -22.85 | 1.4104 | -0.4633 | |||

| FITB / Fifth Third Bancorp | 0.62 | 0.00 | 25.52 | 4.92 | 1.3463 | 0.0312 | |||

| KDP / Keurig Dr Pepper Inc. | 0.76 | 0.00 | 25.18 | -3.39 | 1.3281 | -0.0808 | |||

| EBAY / eBay Inc. | 0.34 | 0.00 | 25.03 | 9.94 | 1.3201 | 0.0894 | |||

| CAT / Caterpillar Inc. | 0.06 | 0.00 | 25.01 | 17.71 | 1.3190 | 0.1706 | |||

| SU / Suncor Energy Inc. | 0.66 | -17.60 | 24.80 | -20.30 | 1.3081 | -0.3741 | |||

| AZN / Astrazeneca plc | 0.18 | -5.18 | 24.52 | -9.52 | 1.2934 | -0.1717 | |||

| TXT / Textron Inc. | 0.30 | 19.69 | 24.14 | 33.01 | 1.2735 | 0.2922 | |||

| JNJ / Johnson & Johnson | 0.16 | -19.00 | 23.92 | -25.39 | 1.2615 | -0.4714 | |||

| D / Dominion Energy, Inc. | 0.41 | 0.00 | 23.22 | 0.80 | 1.2247 | -0.0205 | |||

| MTB / M&T Bank Corporation | 0.12 | 0.00 | 23.09 | 8.53 | 1.2180 | 0.0677 | |||

| SBUX / Starbucks Corporation | 0.25 | 22.58 | 23.06 | 14.50 | 1.2166 | 0.1276 | |||

| COP / ConocoPhillips | 0.25 | 0.00 | 22.56 | -14.55 | 1.1898 | -0.2372 | |||

| MRK / Merck & Co., Inc. | 0.26 | 0.00 | 20.95 | -11.81 | 1.1051 | -0.1792 | |||

| QSR / Restaurant Brands International Inc. | 0.31 | 22.96 | 20.54 | 22.35 | 1.0833 | 0.1759 | |||

| CHTR / Charter Communications, Inc. | 0.05 | 0.00 | 20.28 | 10.93 | 1.0697 | 0.0814 | |||

| LVS / Las Vegas Sands Corp. | 0.46 | 8.72 | 19.81 | 22.46 | 1.0449 | 0.1704 | |||

| DIS / The Walt Disney Company | 0.16 | -8.67 | 19.56 | 14.75 | 1.0319 | 0.1102 | |||

| MDT / Medtronic plc | 0.22 | 0.00 | 18.91 | -3.00 | 0.9976 | -0.0564 | |||

| ABIT / Anheuser-Busch InBev SA/NV | 0.27 | 0.00 | 18.67 | 11.65 | 0.9850 | 0.0809 | |||

| DPZ / Domino's Pizza, Inc. | 0.04 | 0.00 | 16.70 | -1.93 | 0.8810 | -0.0397 | |||

| CMCSA / Comcast Corporation | 0.47 | 0.00 | 16.68 | -3.28 | 0.8798 | -0.0525 | |||

| XOM / Exxon Mobil Corporation | 0.15 | -24.73 | 16.51 | -31.78 | 0.8708 | -0.4374 | |||

| BDX / Becton, Dickinson and Company | 0.10 | 0.00 | 16.39 | -24.80 | 0.8643 | -0.3137 | |||

| CTVA / Corteva, Inc. | 0.22 | -40.91 | 16.17 | -30.02 | 0.8530 | -0.3962 | |||

| NKE / NIKE, Inc. | 0.23 | 16.00 | 0.8437 | 0.8437 | |||||

| SBAC / SBA Communications Corporation | 0.07 | 91.29 | 15.32 | 104.19 | 0.8080 | 0.4024 | |||

| IP / International Paper Company | 0.31 | 0.00 | 14.61 | -12.22 | 0.7709 | -0.1292 | |||

| HSIC / Henry Schein, Inc. | 0.20 | -19.73 | 14.49 | -14.39 | 0.7641 | -0.1506 | |||

| CLX / The Clorox Company | 0.12 | 14.42 | 0.7608 | 0.7608 | |||||

| QCOM / QUALCOMM Incorporated | 0.09 | -4.33 | 14.33 | -0.81 | 0.7558 | -0.0251 | |||

| FFIV / F5, Inc. | 0.05 | -8.94 | 14.20 | 0.65 | 0.7488 | -0.0137 | |||

| INTC / Intel Corporation | 0.62 | 0.00 | 13.90 | -1.36 | 0.7330 | -0.0286 | |||

| ALL / The Allstate Corporation | 0.07 | -31.21 | 13.66 | -33.12 | 0.7206 | -0.3837 | |||

| BMY / Bristol-Myers Squibb Company | 0.29 | 0.00 | 13.35 | -24.10 | 0.7041 | -0.2467 | |||

| HES / Hess Corporation | 0.09 | 0.00 | 13.06 | -13.26 | 0.6888 | -0.1251 | |||

| KO / The Coca-Cola Company | 0.18 | -47.35 | 12.81 | -47.99 | 0.6759 | -0.6559 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.17 | 0.00 | 12.25 | -8.23 | 0.6459 | -0.0754 | |||

| DXC / DXC Technology Company | 0.80 | 0.00 | 12.23 | -10.33 | 0.6454 | -0.0922 | |||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 12.00 | 0.6330 | 0.6330 | ||||||

| UNH / UnitedHealth Group Incorporated | 0.04 | 14.93 | 11.85 | -31.54 | 0.6250 | -0.3107 | |||

| UMG / Universal Music Group N.V. | 0.36 | 0.00 | 11.66 | 17.73 | 0.6150 | 0.0797 | |||

| WBD / Warner Bros. Discovery, Inc. | 0.98 | 0.00 | 11.29 | 6.80 | 0.5953 | 0.0240 | |||

| EQT / EQT Corporation | 0.19 | -28.61 | 10.95 | -22.07 | 0.5774 | -0.1820 | |||

| TEN / Tenaris S.A. | 0.57 | 0.00 | 10.66 | -4.40 | 0.5620 | -0.0405 | |||

| TD Prime Services LLC / RA (000000000) | 10.00 | 0.5275 | 0.5275 | ||||||

| ING Financial Markets LLC / RA (000000000) | 10.00 | 0.5275 | 0.5275 | ||||||

| CF Secured LLC / RA (000000000) | 10.00 | 0.5275 | 0.5275 | ||||||

| Barclays Capital Inc / RA (000000000) | 10.00 | 0.5275 | 0.5275 | ||||||

| HUM / Humana Inc. | 0.04 | 0.00 | 9.71 | -7.61 | 0.5124 | -0.0560 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | 0.00 | 9.71 | 29.55 | 0.5122 | 0.1070 | |||

| CF / CF Industries Holdings, Inc. | 0.10 | -56.23 | 9.27 | -48.48 | 0.4890 | -0.4837 | |||

| IQV / IQVIA Holdings Inc. | 0.06 | 0.00 | 9.23 | -10.62 | 0.4867 | -0.0713 | |||

| IJF / ICON Public Limited Company | 0.06 | 6.76 | 8.67 | -11.27 | 0.4572 | -0.0709 | |||

| US63306A4114 / National Bank of Canada into Bristol-Myers Squibb Co. | 8.00 | 0.4220 | 0.4220 | ||||||

| BAX / Baxter International Inc. | 0.26 | 0.00 | 8.00 | -11.54 | 0.4218 | -0.0669 | |||

| COF / Capital One Financial Corporation | 0.04 | -44.87 | 7.71 | -10.66 | 0.4067 | 0.0284 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.01 | 6.87 | 0.3624 | 0.3624 | |||||

| EVRG / Evergy, Inc. | 0.10 | 0.00 | 6.65 | -0.03 | 0.3508 | -0.0088 | |||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | 5.66 | 0.2985 | 0.2985 | ||||||

| US2619081076 / DREYFUS TREASURY PRIME CASH MANAGEMENT/ CLASS A | 5.00 | 66.67 | 5.00 | 66.67 | 0.2637 | 0.1043 | |||

| TFDXX / Blackrock Liquidity Funds - BlackRock Liquidity Funds FedFund Portfolio Institutional Class | 5.00 | 3,233.33 | 5.00 | 3,233.33 | 0.2637 | 0.2556 | |||

| GSAXX / Goldman Sachs Trust - Goldman Sachs Financial Square Government Fund | 5.00 | 5.00 | 0.2637 | 0.2637 | |||||

| BANCO SANTANDER SA NY / STIV (000000000) | 4.00 | 0.2110 | 0.2110 | ||||||

| CREDIT AGRICOLE CIB, NY / STIV (000000000) | 4.00 | 0.2110 | 0.2110 | ||||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 3.00 | 0.1582 | 0.1582 | ||||||

| Nomura Securities International Inc / RA (000000000) | 3.00 | 0.1582 | 0.1582 | ||||||

| FIRST ABU DHABI BANK USA NV / STIV (000000000) | 2.00 | 0.1055 | 0.1055 | ||||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 2.00 | 0.1055 | 0.1055 | ||||||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 2.00 | 1,233.33 | 2.00 | 1,233.33 | 0.1055 | 0.0974 | |||

| RABOBANK LONDON / STIV (000000000) | 1.00 | 0.0528 | 0.0528 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0.02 | 0.0010 | 0.0010 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0.01 | 0.0005 | 0.0005 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0.01 | 0.0003 | 0.0003 | ||||||

| DGZ / DB Gold Short ETN | 0.00 | 0.0002 | 0.0002 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| DGZ / DB Gold Short ETN | -0.00 | -0.0001 | -0.0001 | ||||||

| DGZ / DB Gold Short ETN | -0.01 | -0.0003 | -0.0003 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0.01 | -0.0004 | -0.0004 | ||||||

| DGZ / DB Gold Short ETN | -0.12 | -0.0063 | -0.0063 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | -0.37 | -0.0193 | -0.0193 | ||||||

| DGZ / DB Gold Short ETN | -0.93 | -0.0491 | -0.0491 |