Statistik Asas

| Nilai Portfolio | $ 268,063,000 |

| Kedudukan Semasa | 138 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

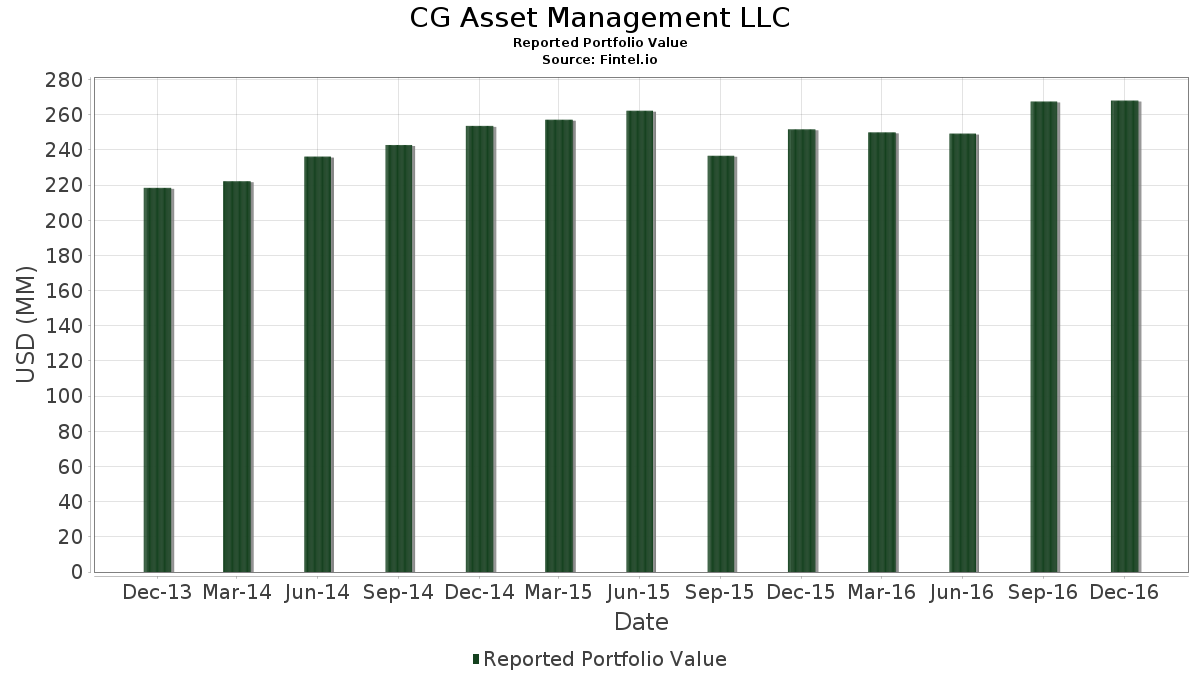

CG Asset Management LLC telah mendedahkan 138 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 268,063,000 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas CG Asset Management LLC ialah Amazon.com, Inc. (US:AMZN) , NXP Semiconductors N.V. (US:NXPI) , The Home Depot, Inc. (US:HD) , Meta Platforms, Inc. (US:META) , and Celgene Corp. (US:CELG) . Kedudukan baharu CG Asset Management LLC termasuk Ingersoll Rand Inc. (US:IR) , BorgWarner Inc. (US:BWA) , General Motors Company (US:GM) , Tiffany & Co. (US:US8865471085) , and Ralph Lauren Corporation (US:RL) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 4.32 | 1.6119 | 1.6119 | |

| 0.10 | 4.11 | 1.5340 | 1.5340 | |

| 0.05 | 2.86 | 1.0669 | 1.0669 | |

| 0.16 | 2.81 | 1.0471 | 1.0471 | |

| 0.10 | 3.59 | 1.3389 | 1.0077 | |

| 0.03 | 2.49 | 0.9296 | 0.9296 | |

| 0.06 | 2.25 | 0.8412 | 0.8412 | |

| 0.06 | 2.18 | 0.8125 | 0.8125 | |

| 0.04 | 2.01 | 0.7506 | 0.7506 | |

| 0.03 | 2.01 | 0.7491 | 0.7491 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -0.9012 | ||

| 0.02 | 14.78 | 5.5140 | -0.6219 | |

| 0.03 | 0.97 | 0.3637 | -0.5932 | |

| 0.02 | 3.68 | 1.3743 | -0.4554 | |

| 0.02 | 1.30 | 0.4835 | -0.4338 | |

| 0.09 | 9.91 | 3.6976 | -0.4085 | |

| 0.00 | 0.00 | -0.4059 | ||

| 0.02 | 2.30 | 0.8584 | -0.3572 | |

| 0.02 | 5.27 | 1.9663 | -0.3490 | |

| 0.00 | 0.00 | -0.3435 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2017-02-10 untuk tempoh pelaporan 2016-12-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AMZN / Amazon.com, Inc. | 0.02 | 0.55 | 14.78 | -9.95 | 5.5140 | -0.6219 | |||

| NXPI / NXP Semiconductors N.V. | 0.12 | -1.83 | 11.70 | -5.67 | 4.3658 | -0.2719 | |||

| HD / The Home Depot, Inc. | 0.09 | -0.70 | 11.52 | 3.47 | 4.2979 | 0.1356 | |||

| META / Meta Platforms, Inc. | 0.09 | 0.60 | 9.91 | -9.77 | 3.6976 | -0.4085 | |||

| CELG / Celgene Corp. | 0.06 | -3.12 | 6.83 | 7.27 | 2.5475 | 0.1679 | |||

| MU / Micron Technology, Inc. | 0.31 | 7.34 | 6.80 | 32.33 | 2.5360 | 0.6158 | |||

| EOG / EOG Resources, Inc. | 0.06 | 1.32 | 6.07 | 5.91 | 2.2651 | 0.1222 | |||

| GOOGL / Alphabet Inc. | 0.01 | 4.43 | 5.61 | 2.92 | 2.0917 | 0.0552 | |||

| PYPL / PayPal Holdings, Inc. | 0.13 | 3.88 | 5.29 | 0.08 | 1.9723 | -0.0025 | |||

| LMT / Lockheed Martin Corporation | 0.02 | -18.38 | 5.27 | -14.90 | 1.9663 | -0.3490 | |||

| JNJ / Johnson & Johnson | 0.04 | 3.84 | 4.80 | 1.27 | 1.7891 | 0.0188 | |||

| GE / General Electric Company | 0.15 | -8.06 | 4.72 | -1.91 | 1.7597 | -0.0379 | |||

| DIS / The Walt Disney Company | 0.04 | -5.16 | 4.55 | 6.44 | 1.6966 | 0.0994 | |||

| DOW / Dow Inc. | 0.08 | 17.17 | 4.32 | 29.33 | 1.6119 | 1.6119 | |||

| SIMO / Silicon Motion Technology Corporation - Depositary Receipt (Common Stock) | 0.10 | 0.73 | 4.11 | -17.38 | 1.5340 | 1.5340 | |||

| INTC / Intel Corporation | 0.11 | -4.01 | 4.11 | -7.79 | 1.5332 | -0.1328 | |||

| ICE / Intercontinental Exchange, Inc. | 0.07 | 403.51 | 4.04 | 5.45 | 1.5075 | 0.0751 | |||

| CMI / Cummins Inc. | 0.03 | -0.43 | 3.91 | 6.19 | 1.4594 | 0.0823 | |||

| MMM / 3M Company | 0.02 | -25.72 | 3.68 | -24.74 | 1.3743 | -0.4554 | |||

| WDC / Western Digital Corporation | 0.05 | 14.77 | 3.63 | 33.41 | 1.3542 | 0.3371 | |||

| BA / The Boeing Company | 0.02 | -2.08 | 3.60 | 15.72 | 1.3430 | 0.1801 | |||

| CSX / CSX Corporation | 0.10 | 243.80 | 3.59 | 305.08 | 1.3389 | 1.0077 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.01 | 0.01 | 3.45 | -8.68 | 1.2874 | -0.1252 | |||

| VFC / V.F. Corporation | 0.06 | -6.31 | 3.34 | -10.83 | 1.2467 | -0.1543 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.06 | -18.92 | 3.34 | -16.65 | 1.2456 | -0.2518 | |||

| XOM / Exxon Mobil Corporation | 0.04 | 5.23 | 3.32 | 8.81 | 1.2400 | 0.0981 | |||

| PH / Parker-Hannifin Corporation | 0.02 | -0.46 | 3.00 | 11.01 | 1.1206 | 0.1091 | |||

| JAZZ / Jazz Pharmaceuticals plc | 0.03 | -13.72 | 2.96 | -22.57 | 1.1031 | -0.3244 | |||

| LLL / JX Luxventure Limited | 0.02 | -18.43 | 2.96 | -17.69 | 1.1024 | -0.2396 | |||

| DHI / D.R. Horton, Inc. | 0.10 | -1.92 | 2.86 | -11.23 | 1.0673 | -0.1375 | |||

| APA / APA Corporation | 0.05 | 20.74 | 2.86 | 19.97 | 1.0669 | 1.0669 | |||

| MTCH / Match Group, Inc. | 0.16 | 14.09 | 2.81 | 9.69 | 1.0471 | 1.0471 | |||

| NKE / NIKE, Inc. | 0.05 | -15.84 | 2.75 | -18.76 | 1.0259 | -0.2394 | |||

| SLB / Schlumberger Limited | 0.03 | -1.89 | 2.72 | 4.74 | 1.0136 | 0.0439 | |||

| MSFT / Microsoft Corporation | 0.04 | 14.59 | 2.71 | 23.64 | 1.0106 | 0.1916 | |||

| ABBV / AbbVie Inc. | 0.04 | 1.70 | 2.62 | 0.96 | 0.9785 | 0.0074 | |||

| ADBE / Adobe Inc. | 0.03 | -12.18 | 2.59 | -16.68 | 0.9669 | -0.1959 | |||

| EVR / Evercore Inc. | 0.04 | -6.36 | 2.53 | 24.88 | 0.9438 | 0.1865 | |||

| IR / Ingersoll Rand Inc. | 0.03 | 2.49 | 0.9296 | 0.9296 | |||||

| MRK / Merck & Co., Inc. | 0.04 | 2.22 | 2.31 | -3.56 | 0.8599 | -0.0335 | |||

| UNP / Union Pacific Corporation | 0.02 | -33.44 | 2.30 | -29.24 | 0.8584 | -0.3572 | |||

| GILD / Gilead Sciences, Inc. | 0.03 | -2.34 | 2.26 | -11.62 | 0.8427 | -0.1127 | |||

| BWA / BorgWarner Inc. | 0.06 | 2.25 | 0.8412 | 0.8412 | |||||

| BKNG / Booking Holdings Inc. | 0.00 | 4.72 | 2.21 | 4.34 | 0.8252 | 0.0327 | |||

| GM / General Motors Company | 0.06 | 2.18 | 0.8125 | 0.8125 | |||||

| MTSI / MACOM Technology Solutions Holdings, Inc. | 0.04 | -18.58 | 2.01 | -11.01 | 0.7506 | 0.7506 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | 2.01 | 0.7491 | 0.7491 | |||||

| US8865471085 / Tiffany & Co. | 0.02 | 1.88 | 0.7006 | 0.7006 | |||||

| DAL / Delta Air Lines, Inc. | 0.04 | 4.64 | 1.88 | 30.73 | 0.6998 | 0.1634 | |||

| CB / Chubb Limited | 0.01 | -0.71 | 1.85 | 4.41 | 0.6894 | 0.0278 | |||

| PXD / Pioneer Natural Resources Company | 0.01 | 18.92 | 1.82 | 15.32 | 0.6797 | 0.6797 | |||

| CVX / Chevron Corporation | 0.01 | 5.05 | 1.72 | 20.18 | 0.6398 | 0.1064 | |||

| JBHT / J.B. Hunt Transport Services, Inc. | 0.02 | 221.15 | 1.62 | 284.12 | 0.6047 | 0.4470 | |||

| AAPL / Apple Inc. | 0.01 | 32.83 | 1.59 | 36.09 | 0.5950 | 0.1569 | |||

| RL / Ralph Lauren Corporation | 0.02 | 1.53 | 0.5696 | 0.5696 | |||||

| AXP / American Express Company | 0.02 | 1.52 | 1.48 | 17.43 | 0.5529 | 0.0811 | |||

| DOW / Dow Inc. | 0.02 | 59.63 | 1.30 | 75.03 | 0.4838 | 0.2069 | |||

| LVS / Las Vegas Sands Corp. | 0.02 | -43.11 | 1.30 | -47.19 | 0.4835 | -0.4338 | |||

| PG / The Procter & Gamble Company | 0.02 | -0.58 | 1.29 | -6.83 | 0.4831 | -0.0365 | |||

| TPR / Tapestry, Inc. | 0.04 | -21.21 | 1.28 | -24.48 | 0.4786 | 0.4786 | |||

| TJX / The TJX Companies, Inc. | 0.02 | -38.76 | 1.27 | -38.49 | 0.4734 | -0.2977 | |||

| WY / Weyerhaeuser Company | 0.04 | 2.25 | 1.23 | -3.61 | 0.4585 | -0.0181 | |||

| KO / The Coca-Cola Company | 0.03 | -8.04 | 1.22 | -9.94 | 0.4562 | -0.0514 | |||

| FDX / FedEx Corporation | 0.01 | 7.98 | 1.22 | 15.17 | 0.4559 | 0.0593 | |||

| BMY / Bristol-Myers Squibb Company | 0.02 | -12.25 | 1.22 | -4.92 | 0.4544 | -0.0245 | |||

| UPS / United Parcel Service, Inc. | 0.01 | 1.45 | 1.21 | 6.35 | 0.4499 | 0.0260 | |||

| THO / THOR Industries, Inc. | 0.01 | -30.12 | 1.20 | -17.40 | 0.4462 | 0.4462 | |||

| ROK / Rockwell Automation, Inc. | 0.01 | 0.00 | 1.19 | 9.81 | 0.4428 | 0.4428 | |||

| AOS / A. O. Smith Corporation | 0.03 | 22.22 | 1.19 | -41.43 | 0.4424 | -0.3145 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | -9.60 | 1.16 | 5.35 | 0.4331 | 0.0212 | |||

| URI / United Rentals, Inc. | 0.01 | -14.99 | 1.11 | 14.37 | 0.4156 | 0.0515 | |||

| LRCX / Lam Research Corporation | 0.01 | 10.75 | 1.09 | 23.61 | 0.4062 | 0.0769 | |||

| CHK / Chesapeake Energy Corporation | 0.15 | 1.08 | 0.4014 | 0.4014 | |||||

| KMI / Kinder Morgan, Inc. | 0.05 | -0.20 | 1.06 | -10.64 | 0.3947 | -0.0479 | |||

| KLAC / KLA Corporation | 0.01 | -2.97 | 1.03 | 9.47 | 0.3839 | 0.0325 | |||

| INFO / Harbor ETF Trust - Harbor PanAgora Dynamic Large Cap Core ETF | 0.03 | 1.02 | 0.3798 | 0.3798 | |||||

| NEE / NextEra Energy, Inc. | 0.01 | 15.75 | 1.01 | 12.99 | 0.3764 | 0.0426 | |||

| NCLH / Norwegian Cruise Line Holdings Ltd. | 0.02 | 33.27 | 1.01 | 50.37 | 0.3764 | 0.1256 | |||

| CAT / Caterpillar Inc. | 0.01 | -3.20 | 0.98 | 1.13 | 0.3660 | 0.0034 | |||

| UAA / Under Armour, Inc. | 0.03 | -49.26 | 0.97 | -61.91 | 0.3637 | -0.5932 | |||

| KITE / Kite Pharma, Inc. | 0.02 | 43.26 | 0.97 | 15.07 | 0.3619 | 0.3619 | |||

| APO / Apollo Global Management, Inc. | 0.05 | 0.96 | 0.3585 | 0.3585 | |||||

| VZ / Verizon Communications Inc. | 0.02 | -5.46 | 0.93 | -2.93 | 0.3466 | -0.0112 | |||

| AMBA / Ambarella, Inc. | 0.02 | -31.29 | 0.88 | -49.45 | 0.3283 | -0.3225 | |||

| EDU / New Oriental Education & Technology Group Inc. - Depositary Receipt (Common Stock) | 0.02 | 0.88 | 0.3275 | 0.3275 | |||||

| PII / Polaris Inc. | 0.01 | 0.86 | 0.3197 | 0.3197 | |||||

| MBLY / Mobileye Global Inc. | 0.02 | -24.62 | 0.85 | -32.54 | 0.3156 | -0.1531 | |||

| EVA / Enviva Inc. | 0.03 | -34.78 | 0.78 | -35.20 | 0.2899 | 0.2899 | |||

| MRO / Marathon Oil Corporation | 0.04 | 7.66 | 0.73 | 17.93 | 0.2723 | 0.0409 | |||

| PFE / Pfizer Inc. | 0.02 | -49.55 | 0.73 | -51.63 | 0.2708 | -0.2902 | |||

| WLK / Westlake Corporation | 0.01 | 0.69 | 0.2574 | 0.2574 | |||||

| CL / Colgate-Palmolive Company | 0.01 | -0.99 | 0.65 | -12.68 | 0.2440 | -0.0360 | |||

| WPC / W. P. Carey Inc. | 0.01 | -4.46 | 0.63 | -12.59 | 0.2358 | -0.0345 | |||

| PCAR / PACCAR Inc | 0.01 | 0.62 | 0.2305 | 0.2305 | |||||

| 018490100 / Allergan plc | 0.00 | 205.17 | 0.61 | 178.90 | 0.2268 | 0.1453 | |||

| RTX / RTX Corporation | 0.01 | -27.00 | 0.60 | -21.26 | 0.2238 | -0.0610 | |||

| HON / Honeywell International Inc. | 0.00 | -15.38 | 0.57 | -15.98 | 0.2138 | -0.0412 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 13.83 | 0.55 | 30.24 | 0.2041 | 0.0471 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 8.91 | 0.54 | 13.11 | 0.1996 | 0.0228 | |||

| PHM / PulteGroup, Inc. | 0.03 | -6.16 | 0.51 | -13.97 | 0.1906 | -0.0314 | |||

| INCY / Incyte Corporation | 0.01 | 0.51 | 0.1903 | 0.1903 | |||||

| WBA / Walgreens Boots Alliance, Inc. | 0.01 | 3.98 | 0.49 | 6.58 | 0.1813 | 0.0108 | |||

| MLM / Martin Marietta Materials, Inc. | 0.00 | -64.05 | 0.48 | -55.56 | 0.1776 | -0.2228 | |||

| LYB / LyondellBasell Industries N.V. | 0.01 | -20.52 | 0.45 | -15.56 | 0.1660 | -0.0310 | |||

| QLYS / Qualys, Inc. | 0.01 | -54.94 | 0.44 | -62.65 | 0.1641 | 0.1641 | |||

| LVMUY / LVMH Moët Hennessy - Louis Vuitton, Société Européenne - Depositary Receipt (Common Stock) | 0.01 | 0.44 | 0.1626 | 0.1626 | |||||

| AZO / AutoZone, Inc. | 0.00 | -4.43 | 0.43 | -1.62 | 0.1589 | -0.0029 | |||

| BIP / Brookfield Infrastructure Partners L.P. - Limited Partnership | 0.01 | 9.26 | 0.40 | 5.61 | 0.1474 | 0.0076 | |||

| CTAS / Cintas Corporation | 0.00 | 0.00 | 0.39 | 2.61 | 0.1466 | 0.0034 | |||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.01 | 0.38 | 0.1399 | 0.1399 | |||||

| JWN / Nordstrom, Inc. | 0.01 | 0.37 | 0.1391 | 0.1391 | |||||

| BG / Bunge Global SA | 0.00 | 0.00 | 0.35 | 6.61 | 0.1324 | 0.0080 | |||

| ALK / Alaska Air Group, Inc. | 0.00 | 0.32 | 0.1190 | 0.1190 | |||||

| VTR / Ventas, Inc. | 0.00 | 19.19 | 0.31 | 5.78 | 0.1160 | 0.0061 | |||

| LGND / Ligand Pharmaceuticals Incorporated | 0.00 | -74.25 | 0.31 | -74.40 | 0.1156 | -0.3370 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.00 | 0.30 | 4.47 | 0.1134 | 0.0046 | |||

| DUK / Duke Energy Corporation | 0.00 | 23.33 | 0.29 | 19.58 | 0.1071 | 0.0174 | |||

| 847560109 / Spectra Energy Corp. | 0.01 | 0.00 | 0.26 | -3.66 | 0.0981 | -0.0039 | |||

| WMT / Walmart Inc. | 0.00 | 0.00 | 0.25 | -4.17 | 0.0944 | -0.0043 | |||

| OXY / Occidental Petroleum Corporation | 0.00 | 0.00 | 0.25 | -2.33 | 0.0936 | -0.0024 | |||

| NLY / Annaly Capital Management, Inc. | 0.03 | -14.62 | 0.25 | -18.89 | 0.0929 | -0.0219 | |||

| AMGN / Amgen Inc. | 0.00 | -78.67 | 0.24 | -81.27 | 0.0903 | 0.0903 | |||

| ADSK / Autodesk, Inc. | 0.00 | -62.35 | 0.24 | -61.46 | 0.0884 | 0.0884 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 0.23 | 0.0869 | 0.0869 | |||||

| ASIX / AdvanSix Inc. | 0.01 | 0.23 | 0.0843 | 0.0843 | |||||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.22 | -5.93 | 0.0828 | -0.0054 | |||

| PKG / Packaging Corporation of America | 0.00 | -3.89 | 0.21 | 0.48 | 0.0783 | 0.0002 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 0.00 | 0.21 | -4.13 | 0.0780 | -0.0035 | |||

| CW / Curtiss-Wright Corporation | 0.00 | 0.21 | 0.0772 | 0.0772 | |||||

| CMCSA / Comcast Corporation | 0.00 | 0.21 | 0.0772 | 0.0772 | |||||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.21 | -9.25 | 0.0768 | 0.0768 | |||

| MA / Mastercard Incorporated | 0.00 | 0.20 | 0.0750 | 0.0750 | |||||

| KYN / Kayne Anderson Energy Infrastructure Fund, Inc. | 0.01 | -23.24 | 0.20 | -62.24 | 0.0731 | 0.0731 | |||

| CMO / Capstead Mortgage Corp. | 0.02 | -5.88 | 0.16 | 1.88 | 0.0608 | 0.0608 | |||

| FCX / Freeport-McMoRan Inc. | 0.01 | -49.58 | 0.16 | -38.85 | 0.0593 | 0.0593 | |||

| PGNX / Progenics Pharmaceuticals, Inc. | 0.02 | -46.15 | 0.15 | -26.70 | 0.0563 | 0.0563 | |||

| NRT / North European Oil Royalty Trust | 0.01 | -26.40 | 0.07 | -36.75 | 0.0276 | -0.0161 | |||

| SIRI / Sirius XM Holdings Inc. | 0.01 | 0.00 | 0.07 | 6.35 | 0.0250 | 0.0250 | |||

| TRU / TransUnion | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| AMFW / Amec Foster Wheeler Plc | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| SBUX / Starbucks Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1058 | ||||

| AGNC / AGNC Investment Corp. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| LCII / LCI Industries | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| MNST / Monster Beverage Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.9012 | ||||

| COG / Cabot Oil & Gas Corp. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| COHR / Coherent Corp. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| KORS / Michael Kors Holdings Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1260 | ||||

| EEP / Enbridge Energy Partners, L.P. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| NUVA / Nuvasive Inc | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| UA / Under Armour, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3435 | ||||

| KSU / Kansas City Southern | 0.00 | -100.00 | 0.00 | -100.00 | -0.1417 | ||||

| US0153511094 / Alexion Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1719 | ||||

| CVS / CVS Health Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1910 | ||||

| ELIN / Elot, Inc. | 0.07 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| TEAM / Atlassian Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| ICPT / Intercept Pharmaceuticals Inc | 0.00 | -100.00 | 0.00 | -100.00 | -0.4059 |