Statistik Asas

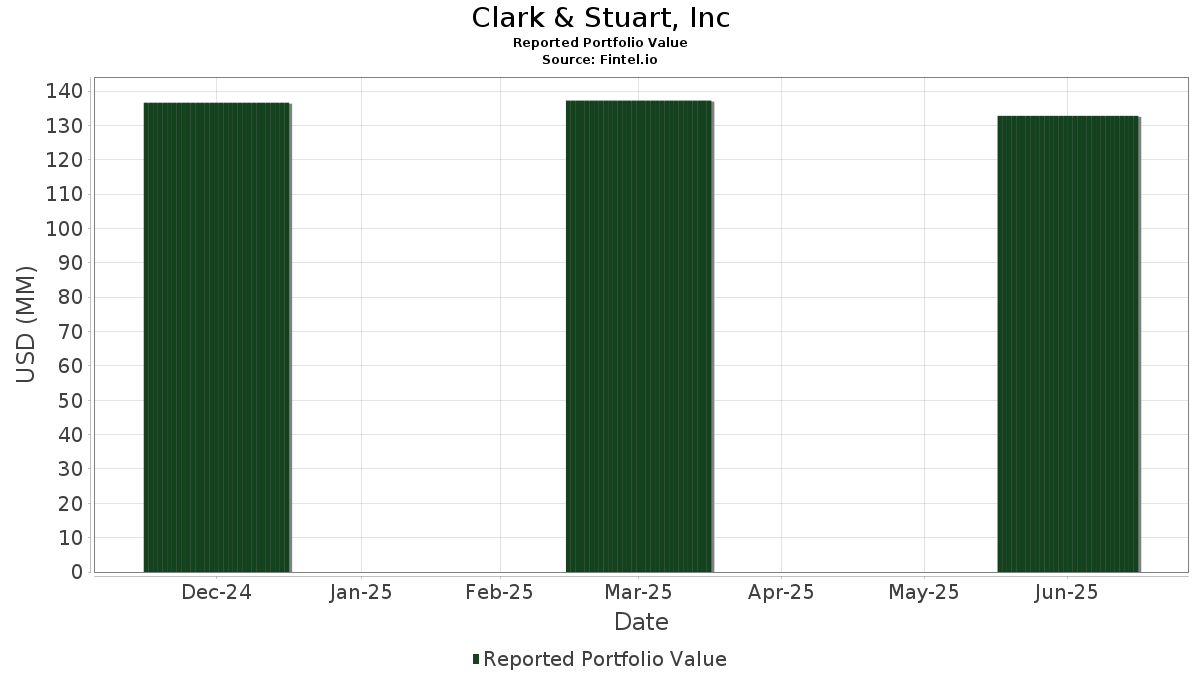

| Nilai Portfolio | $ 132,795,768 |

| Kedudukan Semasa | 48 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Clark & Stuart, Inc telah mendedahkan 48 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 132,795,768 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Clark & Stuart, Inc ialah The New York Times Company (US:NYT) , Merck & Co., Inc. (US:MRK) , 3M Company (US:MMM) , Fastenal Company (US:FAST) , and Johnson & Johnson (US:JNJ) . Kedudukan baharu Clark & Stuart, Inc termasuk JPMorgan Chase & Co. (US:JPM) , Parker-Hannifin Corporation (US:PH) , International Business Machines Corporation (US:IBM) , Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares (US:NVDD) , and The Boeing Company (US:BA) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.16 | 8.90 | 6.7036 | 0.9229 | |

| 0.00 | 1.07 | 0.8054 | 0.8054 | |

| 0.01 | 3.86 | 2.9080 | 0.5659 | |

| 0.02 | 4.82 | 3.6308 | 0.5159 | |

| 0.00 | 1.52 | 1.1432 | 0.3923 | |

| 0.06 | 8.65 | 6.5171 | 0.3796 | |

| 0.01 | 1.61 | 1.2142 | 0.2604 | |

| 0.05 | 6.18 | 4.6532 | 0.2429 | |

| 0.00 | 0.27 | 0.2009 | 0.2009 | |

| 0.00 | 0.23 | 0.1703 | 0.1703 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 3.50 | 2.6375 | -1.3617 | |

| 0.08 | 7.37 | 5.5487 | -0.7009 | |

| 0.11 | 8.69 | 6.5421 | -0.5546 | |

| 0.10 | 3.27 | 2.4627 | -0.5234 | |

| 0.00 | 1.03 | 0.7755 | -0.4064 | |

| 0.05 | 8.02 | 6.0386 | -0.3009 | |

| 0.02 | 2.09 | 1.5753 | -0.2891 | |

| 0.03 | 4.43 | 3.3356 | -0.2492 | |

| 0.02 | 2.22 | 1.6742 | -0.2063 | |

| 0.20 | 8.36 | 6.2924 | -0.1421 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-23 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NYT / The New York Times Company | 0.16 | -0.58 | 8.90 | 12.21 | 6.7036 | 0.9229 | |||

| MRK / Merck & Co., Inc. | 0.11 | 1.03 | 8.69 | -10.80 | 6.5421 | -0.5546 | |||

| MMM / 3M Company | 0.06 | -0.88 | 8.65 | 2.74 | 6.5171 | 0.3796 | |||

| FAST / Fastenal Company | 0.20 | 74.72 | 8.36 | -5.37 | 6.2924 | -0.1421 | |||

| JNJ / Johnson & Johnson | 0.05 | 0.07 | 8.02 | -7.84 | 6.0386 | -0.3009 | |||

| SYY / Sysco Corporation | 0.10 | -1.29 | 7.43 | -0.38 | 5.5942 | 0.1609 | |||

| SJM / The J. M. Smucker Company | 0.08 | 3.59 | 7.37 | -14.09 | 5.5487 | -0.7009 | |||

| UPS / United Parcel Service, Inc. | 0.06 | 5.84 | 6.31 | -2.87 | 4.7490 | 0.0183 | |||

| PEP / PepsiCo, Inc. | 0.05 | 15.93 | 6.18 | 2.10 | 4.6532 | 0.2429 | |||

| CBSH / Commerce Bancshares, Inc. | 0.09 | 0.16 | 5.30 | 0.08 | 3.9904 | 0.1316 | |||

| NDSN / Nordson Corporation | 0.02 | 6.16 | 4.82 | 12.80 | 3.6308 | 0.5159 | |||

| RPM / RPM International Inc. | 0.04 | -1.37 | 4.43 | -6.36 | 3.3379 | -0.1109 | |||

| KMB / Kimberly-Clark Corporation | 0.03 | -0.77 | 4.43 | -9.96 | 3.3356 | -0.2492 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | -0.83 | 3.99 | -5.16 | 3.0051 | -0.0606 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.01 | 2.17 | 3.86 | 20.13 | 2.9080 | 0.5659 | |||

| SYK / Stryker Corporation | 0.01 | -39.95 | 3.50 | -36.19 | 2.6375 | -1.3617 | |||

| SLB / Schlumberger Limited | 0.10 | -1.47 | 3.27 | -20.20 | 2.4627 | -0.5234 | |||

| GPC / Genuine Parts Company | 0.02 | -2.24 | 3.03 | -0.46 | 2.2842 | 0.0636 | |||

| CVX / Chevron Corporation | 0.02 | 0.65 | 2.22 | -13.84 | 1.6742 | -0.2063 | |||

| ABT / Abbott Laboratories | 0.02 | -20.26 | 2.09 | -18.26 | 1.5753 | -0.2891 | |||

| AAPL / Apple Inc. | 0.01 | 9.85 | 1.97 | 1.45 | 1.4801 | 0.0686 | |||

| XOM / Exxon Mobil Corporation | 0.02 | -0.71 | 1.68 | -10.01 | 1.2663 | -0.0951 | |||

| EMR / Emerson Electric Co. | 0.01 | 1.30 | 1.61 | 23.24 | 1.2142 | 0.2604 | |||

| KO / The Coca-Cola Company | 0.02 | -11.99 | 1.59 | -13.06 | 1.1941 | -0.1348 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | -7.62 | 1.52 | -7.86 | 1.1470 | -0.0581 | |||

| MSFT / Microsoft Corporation | 0.00 | 11.18 | 1.52 | 47.38 | 1.1432 | 0.3923 | |||

| HSY / The Hershey Company | 0.01 | -3.18 | 1.31 | -6.08 | 0.9897 | -0.0297 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.01 | -2.13 | 1.30 | -8.47 | 0.9760 | -0.0562 | |||

| K / Kellanova | 0.01 | -8.86 | 1.17 | -12.11 | 0.8796 | -0.0890 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 1.07 | 0.8054 | 0.8054 | |||||

| GWW / W.W. Grainger, Inc. | 0.00 | -39.71 | 1.03 | -36.56 | 0.7755 | -0.4064 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.03 | 0.89 | 0.91 | 0.6707 | 0.0279 | |||

| MDT / Medtronic plc | 0.01 | 0.00 | 0.56 | -2.97 | 0.4184 | 0.0012 | |||

| SBUX / Starbucks Corporation | 0.01 | 0.00 | 0.51 | -6.61 | 0.3835 | -0.0137 | |||

| GE / General Electric Company | 0.00 | -0.29 | 0.45 | 28.24 | 0.3358 | 0.0824 | |||

| CAC / Camden National Corporation | 0.01 | 0.00 | 0.41 | 0.24 | 0.3102 | 0.0109 | |||

| INTC / Intel Corporation | 0.02 | -4.23 | 0.41 | -5.52 | 0.3096 | -0.0075 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | 0.00 | 0.40 | 27.85 | 0.3046 | 0.0738 | |||

| GOOG / Alphabet Inc. | 0.00 | 29.29 | 0.34 | 47.01 | 0.2595 | 0.0884 | |||

| CI / The Cigna Group | 0.00 | 12.05 | 0.31 | 12.45 | 0.2315 | 0.0325 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.29 | -8.98 | 0.2220 | -0.0135 | |||

| PH / Parker-Hannifin Corporation | 0.00 | 0.27 | 0.2009 | 0.2009 | |||||

| CAT / Caterpillar Inc. | 0.00 | -7.26 | 0.25 | 9.25 | 0.1868 | 0.0212 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.23 | 0.1703 | 0.1703 | |||||

| VZ / Verizon Communications Inc. | 0.01 | 6.39 | 0.23 | 1.80 | 0.1703 | 0.0079 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.00 | 0.22 | 0.1654 | 0.1654 | |||||

| BA / The Boeing Company | 0.00 | 0.21 | 0.1581 | 0.1581 | |||||

| VST / Vistra Corp. | 0.00 | 0.20 | 0.1508 | 0.1508 | |||||

| OGN / Organon & Co. | 0.00 | -100.00 | 0.00 | 0.0000 |