Statistik Asas

| Nilai Portfolio | $ 505,511,000 |

| Kedudukan Semasa | 112 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

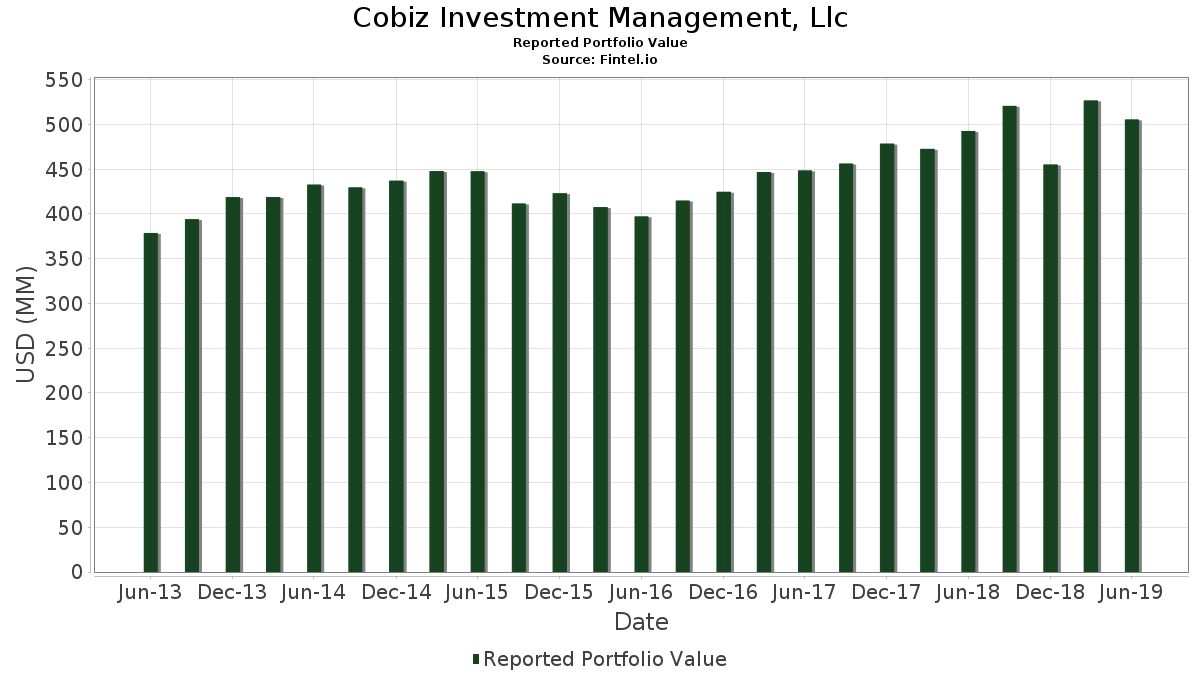

Cobiz Investment Management, Llc telah mendedahkan 112 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 505,511,000 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Cobiz Investment Management, Llc ialah Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF (US:RSP) , SPDR Series Trust - SPDR S&P Dividend ETF (US:SDY) , iShares Trust - iShares Core S&P Small-Cap ETF (US:IJR) , Amazon.com, Inc. (US:AMZN) , and iShares Trust - iShares Core S&P 500 ETF (US:IVV) . Kedudukan baharu Cobiz Investment Management, Llc termasuk Hill-Rom Holdings Inc (US:HRC) , Keysight Technologies, Inc. (US:KEYS) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 9.89 | 1.9570 | 1.9570 | |

| 0.03 | 7.31 | 1.4455 | 1.4455 | |

| 0.05 | 5.04 | 0.9968 | 0.9968 | |

| 0.07 | 4.72 | 0.9343 | 0.9343 | |

| 0.06 | 4.71 | 0.9327 | 0.9327 | |

| 0.05 | 4.33 | 0.8556 | 0.8556 | |

| 0.07 | 9.92 | 1.9618 | 0.6372 | |

| 0.05 | 15.73 | 3.1117 | 0.6367 | |

| 0.06 | 8.06 | 1.5954 | 0.5774 | |

| 0.05 | 12.64 | 2.5010 | 0.1852 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 0.31 | 0.0617 | -0.5892 | |

| 0.00 | 0.36 | 0.0706 | -0.4757 | |

| 0.01 | 0.66 | 0.1312 | -0.4336 | |

| 0.01 | 11.85 | 2.3438 | -0.2661 | |

| 0.01 | 1.38 | 0.2728 | -0.1858 | |

| 0.04 | 6.88 | 1.3608 | -0.1771 | |

| 0.04 | 0.99 | 0.1962 | -0.1514 | |

| 0.06 | 6.36 | 1.2573 | -0.1347 | |

| 0.01 | 0.27 | 0.0536 | -0.1347 | |

| 0.01 | 0.46 | 0.0906 | -0.1323 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2019-07-08 untuk tempoh pelaporan 2019-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.29 | -6.51 | 31.43 | -3.50 | 6.2179 | -0.0584 | |||

| SDY / SPDR Series Trust - SPDR S&P Dividend ETF | 0.29 | -1.22 | 29.04 | 0.24 | 5.7439 | 0.1621 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.27 | -4.44 | 21.25 | -3.04 | 4.2043 | -0.0194 | |||

| AMZN / Amazon.com, Inc. | 0.01 | -5.33 | 16.31 | 0.67 | 3.2264 | 0.1046 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.05 | 18.23 | 15.73 | 22.47 | 3.1117 | 0.6367 | |||

| AAPL / Apple Inc. | 0.08 | -3.38 | 14.99 | 0.67 | 2.9647 | 0.0961 | |||

| MA / Mastercard Incorporated | 0.05 | -6.36 | 12.64 | 5.20 | 2.5010 | 0.1852 | |||

| JPM / JPMorgan Chase & Co. | 0.11 | -4.60 | 11.91 | 5.36 | 2.3552 | 0.1778 | |||

| GOOGL / Alphabet Inc. | 0.01 | -4.92 | 11.85 | -12.52 | 2.3438 | -0.2661 | |||

| JNJ / Johnson & Johnson | 0.08 | -4.81 | 11.83 | -5.16 | 2.3400 | -0.0633 | |||

| CSCO / Cisco Systems, Inc. | 0.21 | -3.22 | 11.35 | -1.89 | 2.2453 | 0.0160 | |||

| EW / Edwards Lifesciences Corporation | 0.06 | -3.57 | 10.57 | -6.89 | 2.0919 | -0.0967 | |||

| MSFT / Microsoft Corporation | 0.07 | 27.03 | 9.92 | 44.27 | 1.9618 | 0.6372 | |||

| LII / Lennox International Inc. | 0.04 | -5.27 | 9.89 | -1.47 | 1.9570 | 1.9570 | |||

| VZ / Verizon Communications Inc. | 0.17 | -2.84 | 9.56 | -6.14 | 1.8912 | -0.0714 | |||

| COST / Costco Wholesale Corporation | 0.04 | -5.92 | 9.26 | 2.69 | 1.8308 | 0.0941 | |||

| ACN / Accenture plc | 0.05 | -5.53 | 9.12 | -0.84 | 1.8035 | 0.0319 | |||

| HON / Honeywell International Inc. | 0.05 | -5.46 | 9.03 | 3.87 | 1.7855 | 0.1110 | |||

| INTU / Intuit Inc. | 0.03 | -5.81 | 8.90 | -5.84 | 1.7610 | -0.0607 | |||

| ECL / Ecolab Inc. | 0.04 | -4.80 | 8.32 | 6.47 | 1.6461 | 0.1402 | |||

| ICE / Intercontinental Exchange, Inc. | 0.10 | -5.72 | 8.29 | 6.40 | 1.6403 | 0.1387 | |||

| BA / The Boeing Company | 0.02 | 9.86 | 8.16 | 4.84 | 1.6142 | 0.1145 | |||

| DIS / The Walt Disney Company | 0.06 | 21.37 | 8.06 | 52.66 | 1.5954 | 0.5774 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.02 | -5.32 | 7.83 | -9.95 | 1.5491 | -0.1265 | |||

| UNH / UnitedHealth Group Incorporated | 0.03 | -5.28 | 7.49 | -6.52 | 1.4825 | -0.0624 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.04 | -3.63 | 7.45 | -1.15 | 1.4730 | 0.0214 | |||

| AVGO / Broadcom Inc. | 0.03 | -4.86 | 7.31 | -8.94 | 1.4455 | 1.4455 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.17 | 9.59 | 7.24 | 11.84 | 1.4318 | 0.1847 | |||

| CI / The Cigna Group | 0.04 | -12.02 | 6.88 | -13.81 | 1.3608 | -0.1771 | |||

| SCHW / The Charles Schwab Corporation | 0.17 | -5.64 | 6.64 | -11.32 | 1.3145 | -0.1293 | |||

| APH / Amphenol Corporation | 0.07 | -5.00 | 6.62 | -3.50 | 1.3086 | -0.0123 | |||

| PEP / PepsiCo, Inc. | 0.05 | -3.43 | 6.50 | 3.32 | 1.2848 | 0.0736 | |||

| DES / WisdomTree Trust - WisdomTree U.S. SmallCap Dividend Fund | 0.24 | -3.31 | 6.43 | -4.82 | 1.2728 | -0.0298 | |||

| SYK / Stryker Corporation | 0.03 | -0.69 | 6.43 | 3.36 | 1.2720 | 0.0732 | |||

| LOW / Lowe's Companies, Inc. | 0.06 | -4.55 | 6.36 | -12.02 | 1.2573 | -0.1347 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.02 | -5.68 | 6.30 | 1.21 | 1.2459 | 0.0467 | |||

| CVX / Chevron Corporation | 0.05 | -5.49 | 6.18 | -4.53 | 1.2229 | -0.0248 | |||

| CHD / Church & Dwight Co., Inc. | 0.08 | -5.66 | 6.18 | -3.24 | 1.2223 | -0.0082 | |||

| ZTS / Zoetis Inc. | 0.05 | -4.18 | 6.12 | 8.02 | 1.2099 | 0.1188 | |||

| TRV / The Travelers Companies, Inc. | 0.04 | -5.51 | 5.55 | 3.01 | 1.0973 | 0.0596 | |||

| EOG / EOG Resources, Inc. | 0.06 | -3.13 | 5.53 | -5.18 | 1.0930 | -0.0299 | |||

| DHS / WisdomTree Trust - WisdomTree U.S. High Dividend Fund | 0.07 | -5.24 | 5.04 | -4.85 | 0.9972 | -0.0237 | |||

| HRC / Hill-Rom Holdings Inc | 0.05 | 5.04 | 0.9968 | 0.9968 | |||||

| PXD / Pioneer Natural Resources Company | 0.03 | 0.52 | 4.85 | 1.57 | 0.9590 | 0.0393 | |||

| C.WSA / Citigroup, Inc. | 0.01 | -5.41 | 4.82 | 3.88 | 0.9537 | 0.0594 | |||

| C / Citigroup Inc. | 0.07 | 3.06 | 4.72 | 15.99 | 0.9343 | 0.9343 | |||

| SBUX / Starbucks Corporation | 0.06 | 43,168.46 | 4.71 | 52,288.89 | 0.9327 | 0.9327 | |||

| KEYS / Keysight Technologies, Inc. | 0.05 | 4.33 | 0.8556 | 0.8556 | |||||

| EXPE / Expedia Group, Inc. | 0.03 | -6.02 | 4.20 | 5.08 | 0.8312 | 0.0607 | |||

| DFS / Discover Financial Services | 0.04 | -5.91 | 3.35 | 2.58 | 0.6619 | 0.0333 | |||

| STZ / Constellation Brands, Inc. | 0.02 | 0.89 | 3.18 | 13.33 | 0.6289 | 0.0884 | |||

| / Stifel Financial Corp. | 0.12 | 0.17 | 3.02 | -2.17 | 0.5980 | 0.0026 | |||

| US1729673178 / Citigroup, Inc., 6.30% Dep Shares Non-Cumulative Preferred Stock Series S | 0.09 | 29.78 | 2.41 | 29.94 | 0.4765 | 0.1193 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.05 | -8.43 | 2.34 | -8.35 | 0.4627 | -0.0291 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.01 | 17.67 | 1.89 | 22.39 | 0.3741 | 0.0764 | |||

| WFC.PRR / Wells Fargo & Company - Preferred Stock | 0.06 | -2.31 | 1.77 | 0.17 | 0.3497 | 0.0096 | |||

| NKE / NIKE, Inc. | 0.02 | -5.44 | 1.39 | -5.75 | 0.2758 | -0.0092 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.01 | -43.75 | 1.38 | -42.06 | 0.2728 | -0.1858 | |||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 0.14 | 4.69 | 1.37 | 2.86 | 0.2706 | 0.0143 | |||

| IJS / iShares Trust - iShares S&P Small-Cap 600 Value ETF | 0.01 | -10.96 | 1.36 | -10.30 | 0.2686 | -0.0231 | |||

| IWN / iShares Trust - iShares Russell 2000 Value ETF | 0.01 | -3.94 | 1.35 | -3.43 | 0.2673 | -0.0023 | |||

| IJT / iShares Trust - iShares S&P Small-Cap 600 Growth ETF | 0.01 | -8.97 | 1.23 | -6.97 | 0.2427 | -0.0114 | |||

| IVE / iShares Trust - iShares S&P 500 Value ETF | 0.01 | -6.17 | 1.14 | -2.98 | 0.2251 | -0.0009 | |||

| IJK / iShares Trust - iShares S&P Mid-Cap 400 Growth ETF | 0.00 | -11.01 | 1.11 | -8.06 | 0.2190 | -0.0130 | |||

| IJJ / iShares Trust - iShares S&P Mid-Cap 400 Value ETF | 0.01 | -11.33 | 1.05 | -9.97 | 0.2071 | -0.0170 | |||

| EL / The Estée Lauder Companies Inc. | 0.01 | -8.24 | 1.02 | 1.49 | 0.2018 | 0.0081 | |||

| UNP / Union Pacific Corporation | 0.01 | -10.50 | 1.01 | -9.47 | 0.2004 | -0.0152 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.02 | -13.17 | 1.00 | -11.94 | 0.1970 | -0.0209 | |||

| ULSGF / UBS AG | 0.04 | -44.06 | 0.99 | -45.01 | 0.1962 | -0.1514 | |||

| ABT / Abbott Laboratories | 0.01 | -0.42 | 0.99 | 4.76 | 0.1960 | 0.0138 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.95 | 5.64 | 0.1889 | 0.0147 | |||

| PFE / Pfizer Inc. | 0.02 | -0.61 | 0.88 | 1.38 | 0.1743 | 0.0068 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -2.27 | 0.87 | 3.68 | 0.1727 | 0.0104 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.01 | 3.96 | 0.80 | 4.59 | 0.1579 | 0.0108 | |||

| FENY / Fidelity Covington Trust - Fidelity MSCI Energy Index ETF | 0.04 | -42.82 | 0.75 | -45.63 | 0.1488 | 0.1488 | |||

| USB / U.S. Bancorp | 0.01 | -4.17 | 0.72 | 4.18 | 0.1428 | 0.0093 | |||

| US0325111070 / Anadarko Petroleum Corp. | 0.01 | -85.42 | 0.66 | -77.38 | 0.1312 | -0.4336 | |||

| FHLC / Fidelity Covington Trust - Fidelity MSCI Health Care Index ETF | 0.01 | -69.90 | 0.64 | -69.57 | 0.1260 | 0.1260 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -40.49 | 0.62 | -43.56 | 0.1223 | -0.0887 | |||

| ORCL / Oracle Corporation | 0.01 | 0.00 | 0.55 | 6.21 | 0.1082 | 0.0090 | |||

| ABBV / AbbVie Inc. | 0.01 | -6.37 | 0.53 | -15.64 | 0.1056 | -0.0163 | |||

| ZB.PRH / Zions Bancorporation | 0.02 | 0.00 | 0.52 | 0.00 | 0.1025 | 0.0027 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | -19.52 | 0.50 | -16.42 | 0.0987 | -0.0163 | |||

| FRC / First Republic Bank | 0.00 | -26.38 | 0.46 | -28.39 | 0.0908 | -0.0327 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.01 | -60.43 | 0.46 | -60.41 | 0.0906 | -0.1323 | |||

| CELG / Celgene Corp. | 0.00 | -87.15 | 0.36 | -87.41 | 0.0706 | -0.4757 | |||

| PG / The Procter & Gamble Company | 0.00 | 0.88 | 0.35 | 6.36 | 0.0694 | 0.0058 | |||

| CMA / Comerica Incorporated | 0.00 | -92.55 | 0.35 | -92.61 | 0.0686 | 0.0686 | |||

| IWO / iShares Trust - iShares Russell 2000 Growth ETF | 0.00 | 0.47 | 0.34 | 2.68 | 0.0682 | 0.0035 | |||

| SLB / Schlumberger Limited | 0.01 | -89.87 | 0.31 | -90.76 | 0.0617 | -0.5892 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.00 | 0.00 | 0.30 | 2.71 | 0.0599 | 0.0599 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.30 | 3.83 | 0.0590 | 0.0036 | |||

| HD / The Home Depot, Inc. | 0.00 | -1.05 | 0.29 | 7.33 | 0.0580 | 0.0054 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.01 | -2.60 | 0.29 | -4.97 | 0.0568 | -0.0014 | |||

| FDX / FedEx Corporation | 0.00 | -38.09 | 0.28 | -44.06 | 0.0550 | -0.0408 | |||

| WFC / Wells Fargo & Company | 0.01 | -71.67 | 0.27 | -72.26 | 0.0536 | -0.1347 | |||

| INTC / Intel Corporation | 0.01 | -64.26 | 0.27 | -68.11 | 0.0526 | -0.1081 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.00 | 0.26 | 0.0508 | 0.0508 | |||||

| RWR / SPDR Series Trust - SPDR Dow Jones REIT ETF | 0.00 | -18.99 | 0.25 | -19.11 | 0.0502 | -0.0103 | |||

| TROW / T. Rowe Price Group, Inc. | 0.00 | 0.00 | 0.25 | 9.78 | 0.0489 | 0.0055 | |||

| META / Meta Platforms, Inc. | 0.00 | -8.11 | 0.24 | 6.64 | 0.0477 | 0.0041 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.00 | -71.29 | 0.24 | -70.92 | 0.0469 | 0.0469 | |||

| LUV / Southwest Airlines Co. | 0.00 | -11.27 | 0.24 | -13.24 | 0.0467 | -0.0057 | |||

| EMR / Emerson Electric Co. | 0.00 | -12.04 | 0.23 | -14.02 | 0.0461 | -0.0061 | |||

| GNR / SPDR Index Shares Funds - SPDR S&P Global Natural Resources ETF | 0.00 | 0.00 | 0.23 | -0.88 | 0.0447 | 0.0447 | |||

| GOOG / Alphabet Inc. | 0.00 | -7.93 | 0.23 | -15.04 | 0.0447 | -0.0065 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -8.44 | 0.22 | -7.20 | 0.0433 | -0.0022 | |||

| DCI / Donaldson Company, Inc. | 0.00 | 0.00 | 0.22 | 1.87 | 0.0431 | 0.0019 | |||

| PKW / Invesco Exchange-Traded Fund Trust - Invesco BuyBack Achievers ETF | 0.00 | 0.00 | 0.22 | 4.83 | 0.0429 | 0.0030 | |||

| KO / The Coca-Cola Company | 0.00 | 0.21 | 0.0425 | 0.0425 | |||||

| MCD / McDonald's Corporation | 0.00 | -28.57 | 0.21 | -21.80 | 0.0411 | -0.0101 | |||

| PTY / Partway Group Plc | 0.01 | -28.57 | 0.18 | -26.12 | 0.0358 | 0.0358 | |||

| ULTI / Ultimate Software Group, Inc. (The) | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| CALYPTE BIOMEDICAL CORP / (131722605) | 0.60 | 0.00 | 0.0000 | ||||||

| FNCL / Fidelity Covington Trust - Fidelity MSCI Financials Index ETF | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| PYPL / PayPal Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0435 | ||||

| GD / General Dynamics Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0391 | ||||

| IAU / iShares Gold Trust | 0.00 | -100.00 | 0.00 | -100.00 | -0.0287 | ||||

| GE / General Electric Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0251 | ||||

| BAC / Bank of America Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0399 |