Statistik Asas

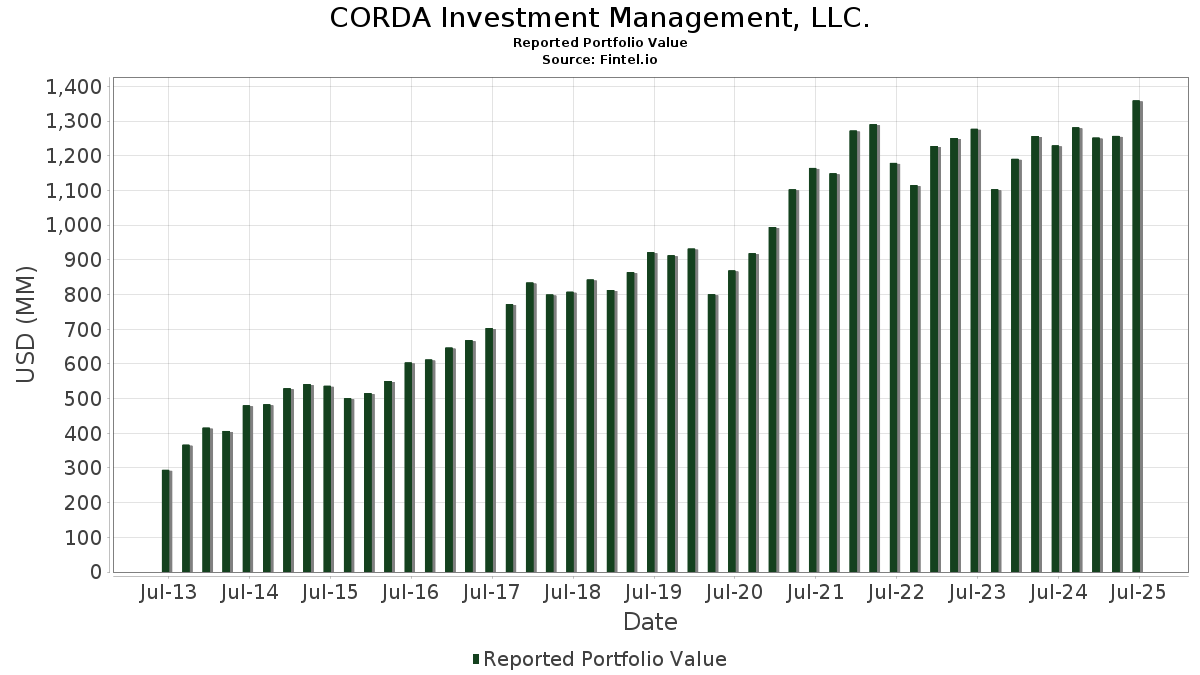

| Nilai Portfolio | $ 1,359,353,912 |

| Kedudukan Semasa | 78 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

CORDA Investment Management, LLC. telah mendedahkan 78 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 1,359,353,912 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas CORDA Investment Management, LLC. ialah CME Group Inc. (US:CME) , The Bank of New York Mellon Corporation (US:BK) , Apple Inc. (US:AAPL) , The Charles Schwab Corporation (US:SCHW) , and Deere & Company (US:DE) . Kedudukan baharu CORDA Investment Management, LLC. termasuk ASML Holding N.V. - Depositary Receipt (Common Stock) (US:ASML) , iShares Bitcoin Trust ETF (US:IBIT) , Broadcom Inc. (US:AVGO) , International Business Machines Corporation (US:IBM) , and Galaxy Digital Inc. (US:GLXY) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.11 | 19.92 | 1.4656 | 1.4656 | |

| 0.02 | 15.18 | 1.1169 | 1.1169 | |

| 0.29 | 58.96 | 4.3371 | 0.9897 | |

| 0.08 | 12.29 | 0.9042 | 0.6344 | |

| 0.21 | 46.25 | 3.4021 | 0.4002 | |

| 0.54 | 31.27 | 2.3002 | 0.2158 | |

| 0.60 | 54.44 | 4.0048 | 0.2156 | |

| 0.22 | 39.07 | 2.8741 | 0.2132 | |

| 0.02 | 12.41 | 0.9132 | 0.1783 | |

| 0.20 | 24.25 | 1.7839 | 0.1345 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.23 | 36.12 | 2.6574 | -0.4833 | |

| 1.25 | 26.17 | 1.9254 | -0.4435 | |

| 0.43 | 34.20 | 2.5159 | -0.4137 | |

| 0.30 | 39.22 | 2.8851 | -0.3802 | |

| 0.29 | 44.84 | 3.2986 | -0.3563 | |

| 0.68 | 31.87 | 2.3442 | -0.3461 | |

| 0.81 | 34.93 | 2.5696 | -0.3320 | |

| 0.09 | 25.78 | 1.8966 | -0.3312 | |

| 0.21 | 32.79 | 2.4122 | -0.3281 | |

| 0.78 | 20.03 | 1.4735 | -0.3202 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-30 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CME / CME Group Inc. | 0.22 | -2.05 | 61.17 | 1.77 | 4.4999 | -0.2807 | |||

| BK / The Bank of New York Mellon Corporation | 0.66 | -3.16 | 60.17 | 5.21 | 4.4262 | -0.1226 | |||

| AAPL / Apple Inc. | 0.29 | 51.66 | 58.96 | 40.08 | 4.3371 | 0.9897 | |||

| SCHW / The Charles Schwab Corporation | 0.60 | -1.96 | 54.44 | 14.27 | 4.0048 | 0.2156 | |||

| DE / Deere & Company | 0.10 | -1.98 | 49.38 | 6.19 | 3.6325 | -0.0659 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.80 | -1.67 | 49.13 | 1.00 | 3.6139 | -0.2546 | |||

| AMZN / Amazon.com, Inc. | 0.21 | 6.26 | 46.25 | 22.53 | 3.4021 | 0.4002 | |||

| WELL / Welltower Inc. | 0.29 | -2.75 | 44.84 | -2.42 | 3.2986 | -0.3563 | |||

| USB / U.S. Bancorp | 0.95 | 1.93 | 42.98 | 9.25 | 3.1618 | 0.0327 | |||

| PEP / PepsiCo, Inc. | 0.30 | 8.48 | 39.22 | -4.47 | 2.8851 | -0.3802 | |||

| GOOGL / Alphabet Inc. | 0.22 | 2.47 | 39.07 | 16.78 | 2.8741 | 0.2132 | |||

| MDLZ / Mondelez International, Inc. | 0.57 | -0.62 | 38.44 | -1.22 | 2.8281 | -0.2674 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.23 | -2.15 | 36.12 | -8.52 | 2.6574 | -0.4833 | |||

| VZ / Verizon Communications Inc. | 0.81 | 0.37 | 34.93 | -4.25 | 2.5696 | -0.3320 | |||

| MRK / Merck & Co., Inc. | 0.43 | 5.28 | 34.20 | -7.15 | 2.5159 | -0.4137 | |||

| SPG / Simon Property Group, Inc. | 0.21 | -0.53 | 34.00 | -3.71 | 2.5014 | -0.3073 | |||

| JNJ / Johnson & Johnson | 0.21 | 3.33 | 32.79 | -4.83 | 2.4122 | -0.3281 | |||

| HIW / Highwoods Properties, Inc. | 1.03 | 0.79 | 31.94 | 5.72 | 2.3494 | -0.0532 | |||

| CNA / CNA Financial Corporation | 0.68 | 2.83 | 31.87 | -5.79 | 2.3442 | -0.3461 | |||

| NTR / Nutrien Ltd. | 0.54 | 1.76 | 31.27 | 19.31 | 2.3002 | 0.2158 | |||

| KO / The Coca-Cola Company | 0.43 | -2.02 | 30.71 | -3.21 | 2.2589 | -0.2644 | |||

| CUZ / Cousins Properties Incorporated | 0.99 | 1.77 | 29.86 | 3.60 | 2.1969 | -0.0958 | |||

| GLW / Corning Incorporated | 0.56 | -0.04 | 29.67 | 14.83 | 2.1825 | 0.1276 | |||

| PFE / Pfizer Inc. | 1.14 | 6.37 | 27.72 | 1.75 | 2.0391 | -0.1276 | |||

| KVUE / Kenvue Inc. | 1.25 | 0.68 | 26.17 | -12.12 | 1.9254 | -0.4435 | |||

| MCD / McDonald's Corporation | 0.09 | -1.59 | 25.78 | -7.96 | 1.8966 | -0.3312 | |||

| DIS / The Walt Disney Company | 0.20 | -6.93 | 24.25 | 16.94 | 1.7839 | 0.1345 | |||

| CPT / Camden Property Trust | 0.21 | 0.87 | 23.54 | -7.05 | 1.7320 | -0.2827 | |||

| HON / Honeywell International Inc. | 0.10 | 1.83 | 22.87 | 11.99 | 1.6822 | 0.0581 | |||

| MDT / Medtronic plc | 0.26 | 3.80 | 22.76 | 0.69 | 1.6741 | -0.1235 | |||

| STZ / Constellation Brands, Inc. | 0.13 | 3.18 | 20.87 | -8.54 | 1.5354 | -0.2796 | |||

| KHC / The Kraft Heinz Company | 0.78 | 4.68 | 20.03 | -11.18 | 1.4735 | -0.3202 | |||

| AMAT / Applied Materials, Inc. | 0.11 | 19.92 | 1.4656 | 1.4656 | |||||

| HSY / The Hershey Company | 0.11 | 11.84 | 17.70 | 8.51 | 1.3024 | 0.0048 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.03 | 4.46 | 15.26 | 15.46 | 1.1226 | 0.0714 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.02 | 15.18 | 1.1169 | 1.1169 | |||||

| LEVI / Levi Strauss & Co. | 0.69 | -2.36 | 12.73 | 15.80 | 0.9364 | 0.0621 | |||

| MSFT / Microsoft Corporation | 0.02 | 1.39 | 12.41 | 34.35 | 0.9132 | 0.1783 | |||

| NVDA / NVIDIA Corporation | 0.08 | 148.57 | 12.29 | 262.35 | 0.9042 | 0.6344 | |||

| NKE / NIKE, Inc. | 0.17 | 9.18 | 12.11 | 22.18 | 0.8912 | 0.1026 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.02 | 0.46 | 10.79 | -8.37 | 0.7939 | -0.1429 | |||

| XOM / Exxon Mobil Corporation | 0.05 | 2.76 | 5.79 | -6.85 | 0.4262 | -0.0685 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.03 | -3.53 | 4.59 | -0.28 | 0.3378 | -0.0284 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.02 | -1.74 | 4.16 | 3.69 | 0.3060 | -0.0131 | |||

| CSCO / Cisco Systems, Inc. | 0.05 | -2.34 | 3.81 | 9.78 | 0.2800 | 0.0043 | |||

| QCOM / QUALCOMM Incorporated | 0.02 | 18.60 | 3.58 | 22.99 | 0.2633 | 0.0318 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 2.92 | -8.71 | 0.2145 | -0.0396 | |||

| SPYV / SPDR Series Trust - SPDR Portfolio S&P 500 Value ETF | 0.05 | 0.06 | 2.73 | 2.55 | 0.2008 | -0.0109 | |||

| META / Meta Platforms, Inc. | 0.00 | 4.72 | 2.61 | 34.12 | 0.1917 | 0.0372 | |||

| CVX / Chevron Corporation | 0.02 | 17.19 | 2.60 | 0.35 | 0.1910 | -0.0149 | |||

| GOOG / Alphabet Inc. | 0.01 | 16.82 | 2.44 | 32.65 | 0.1797 | 0.0332 | |||

| SHW / The Sherwin-Williams Company | 0.01 | 0.00 | 2.22 | -1.68 | 0.1633 | -0.0163 | |||

| V / Visa Inc. | 0.01 | 0.71 | 2.06 | 2.03 | 0.1516 | -0.0090 | |||

| ABT / Abbott Laboratories | 0.01 | -0.58 | 2.04 | 1.90 | 0.1500 | -0.0091 | |||

| VEU / Vanguard International Equity Index Funds - Vanguard FTSE All-World ex-US ETF | 0.03 | 0.73 | 2.03 | 11.63 | 0.1491 | 0.0047 | |||

| TSLA / Tesla, Inc. | 0.01 | -11.14 | 1.89 | 8.88 | 0.1390 | 0.0010 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.07 | 20.79 | 1.88 | 14.47 | 0.1386 | 0.0077 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -11.77 | 1.75 | 4.23 | 0.1289 | -0.0048 | |||

| ORCL / Oracle Corporation | 0.01 | -7.23 | 1.67 | 45.13 | 0.1228 | 0.0313 | |||

| TDG / TransDigm Group Incorporated | 0.00 | 0.10 | 1.58 | 10.00 | 0.1166 | 0.0020 | |||

| MTDR / Matador Resources Company | 0.03 | 0.00 | 1.56 | -6.63 | 0.1150 | -0.0181 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -1.45 | 1.56 | 8.88 | 0.1146 | 0.0008 | |||

| HD / The Home Depot, Inc. | 0.00 | -0.24 | 1.50 | -0.27 | 0.1107 | -0.0092 | |||

| RTX / RTX Corporation | 0.01 | -2.12 | 1.48 | 7.96 | 0.1087 | -0.0002 | |||

| IBIT / iShares Bitcoin Trust ETF | 0.02 | 1.40 | 0.1029 | 0.1029 | |||||

| CAT / Caterpillar Inc. | 0.00 | 10.15 | 1.36 | 29.66 | 0.1004 | 0.0167 | |||

| AVGO / Broadcom Inc. | 0.00 | 1.36 | 0.1003 | 0.1003 | |||||

| WMT / Walmart Inc. | 0.01 | -8.20 | 1.35 | 2.28 | 0.0992 | -0.0057 | |||

| ETR / Entergy Corporation | 0.01 | 0.00 | 1.24 | -2.74 | 0.0913 | -0.0102 | |||

| LLY / Eli Lilly and Company | 0.00 | -3.37 | 1.21 | -8.76 | 0.0889 | -0.0165 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.01 | -7.72 | 1.19 | -5.55 | 0.0876 | -0.0127 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.04 | 6.55 | 1.18 | -3.20 | 0.0868 | -0.0102 | |||

| IBM / International Business Machines Corporation | 0.00 | 1.18 | 0.0866 | 0.0866 | |||||

| EMR / Emerson Electric Co. | 0.01 | 1.17 | 0.0863 | 0.0863 | |||||

| GLXY / Galaxy Digital Inc. | 0.05 | 1.16 | 0.0852 | 0.0852 | |||||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | -8.72 | 1.11 | 0.91 | 0.0819 | -0.0058 | |||

| ABBV / AbbVie Inc. | 0.01 | -11.08 | 1.09 | -21.24 | 0.0805 | -0.0300 | |||

| SPDW / SPDR Index Shares Funds - SPDR Portfolio Developed World ex-US ETF | 0.03 | 1.09 | 0.0805 | 0.0805 |