Statistik Asas

| Nilai Portfolio | $ 92,912,141 |

| Kedudukan Semasa | 42 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

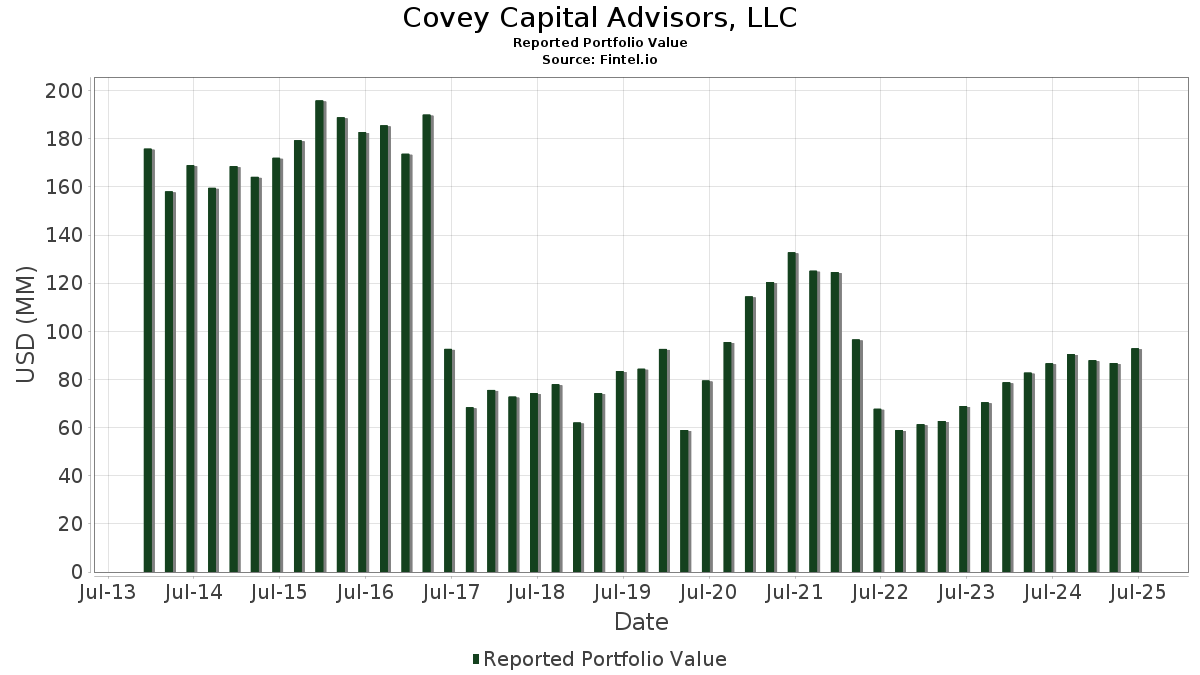

Covey Capital Advisors, LLC telah mendedahkan 42 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 92,912,141 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Covey Capital Advisors, LLC ialah Berkshire Hathaway Inc. (US:BRK.B) , KKR & Co. Inc. (US:KKR) , Visa Inc. (US:V) , Booking Holdings Inc. (US:BKNG) , and The Progressive Corporation (US:PGR) . Kedudukan baharu Covey Capital Advisors, LLC termasuk Workday, Inc. (US:WDAY) , Amrize AG (US:AMRZ) , Smith Douglas Homes Corp. (US:SDHC) , AAON, Inc. (US:AAON) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 1.32 | 1.4259 | 1.4259 | |

| 0.00 | 1.93 | 2.0741 | 1.4013 | |

| 0.02 | 1.18 | 1.2653 | 1.2653 | |

| 0.00 | 6.47 | 6.9599 | 1.0897 | |

| 0.01 | 4.85 | 5.2216 | 0.8570 | |

| 0.04 | 0.70 | 0.7587 | 0.7587 | |

| 0.01 | 0.68 | 0.7279 | 0.7279 | |

| 0.07 | 1.29 | 1.3919 | 0.6468 | |

| 0.00 | 1.30 | 1.3999 | 0.4944 | |

| 0.07 | 9.04 | 9.7310 | 0.4562 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 9.51 | 10.2364 | -3.1728 | |

| 0.03 | 2.78 | 2.9969 | -1.1819 | |

| 0.02 | 3.70 | 3.9823 | -1.0913 | |

| 0.07 | 3.54 | 3.8145 | -1.0274 | |

| 0.01 | 2.09 | 2.2496 | -0.8220 | |

| 0.02 | 5.36 | 5.7742 | -0.7808 | |

| 0.02 | 8.24 | 8.8739 | -0.5022 | |

| 0.00 | 0.86 | 0.9246 | -0.4028 | |

| 0.01 | 0.64 | 0.6909 | -0.3568 | |

| 0.01 | 2.16 | 2.3297 | -0.2627 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-04 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BRK.B / Berkshire Hathaway Inc. | 0.02 | -10.41 | 9.51 | -18.29 | 10.2364 | -3.1728 | |||

| KKR / KKR & Co. Inc. | 0.07 | -2.40 | 9.04 | 12.31 | 9.7310 | 0.4562 | |||

| V / Visa Inc. | 0.02 | 0.00 | 8.24 | 1.30 | 8.8739 | -0.5022 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 0.99 | 6.47 | 26.91 | 6.9599 | 1.0897 | |||

| PGR / The Progressive Corporation | 0.02 | 0.00 | 5.36 | -5.71 | 5.7742 | -0.7808 | |||

| META / Meta Platforms, Inc. | 0.01 | 0.00 | 4.85 | 28.06 | 5.2216 | 0.8570 | |||

| GOOGL / Alphabet Inc. | 0.02 | -4.54 | 4.00 | 8.75 | 4.3083 | 0.0684 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 0.01 | 3.75 | 15.30 | 4.0387 | 0.2898 | |||

| GOOGL / Alphabet Inc. | 0.02 | -26.00 | 3.70 | -15.97 | 3.9823 | -1.0913 | |||

| CPRT / Copart, Inc. | 0.07 | -2.75 | 3.54 | -15.66 | 3.8145 | -1.0274 | |||

| BRO / Brown & Brown, Inc. | 0.03 | -13.86 | 2.78 | -23.24 | 2.9969 | -1.1819 | |||

| IT / Gartner, Inc. | 0.01 | -0.11 | 2.16 | -3.82 | 2.3297 | -0.2627 | |||

| FI / Fiserv, Inc. | 0.01 | 0.41 | 2.09 | -21.61 | 2.2496 | -0.8220 | |||

| SCHW / The Charles Schwab Corporation | 0.02 | 0.00 | 1.98 | 16.60 | 2.1322 | 0.1740 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.00 | 212.70 | 1.93 | 229.97 | 2.0741 | 1.4013 | |||

| HGV / Hilton Grand Vacations Inc. | 0.04 | 0.39 | 1.86 | 11.45 | 2.0013 | 0.0791 | |||

| PM / Philip Morris International Inc. | 0.01 | 0.00 | 1.49 | 14.75 | 1.5999 | 0.1073 | |||

| WDAY / Workday, Inc. | 0.01 | 1.32 | 1.4259 | 1.4259 | |||||

| MEDP / Medpace Holdings, Inc. | 0.00 | 0.48 | 1.31 | 3.49 | 1.4053 | -0.0480 | |||

| KNSL / Kinsale Capital Group, Inc. | 0.00 | 66.44 | 1.30 | 65.39 | 1.3999 | 0.4944 | |||

| DRVN / Driven Brands Holdings Inc. | 0.07 | 95.19 | 1.29 | 100.15 | 1.3919 | 0.6468 | |||

| MSFT / Microsoft Corporation | 0.00 | 0.00 | 1.22 | 32.54 | 1.3116 | 0.2520 | |||

| AMRZ / Amrize AG | 0.02 | 1.18 | 1.2653 | 1.2653 | |||||

| NRP / Natural Resource Partners L.P. - Limited Partnership | 0.01 | 0.70 | 1.15 | -7.42 | 1.2356 | -0.1933 | |||

| CSX / CSX Corporation | 0.03 | 0.00 | 1.02 | 10.81 | 1.0934 | 0.0378 | |||

| NVR / NVR, Inc. | 0.00 | 0.00 | 1.01 | 1.92 | 1.0890 | -0.0544 | |||

| DHR / Danaher Corporation | 0.00 | 0.00 | 0.88 | -3.71 | 0.9502 | -0.1053 | |||

| AAPL / Apple Inc. | 0.00 | -19.28 | 0.86 | -25.43 | 0.9246 | -0.4028 | |||

| MORN / Morningstar, Inc. | 0.00 | 0.00 | 0.82 | 4.74 | 0.8798 | -0.0198 | |||

| TLN / Talen Energy Corporation | 0.00 | -2.14 | 0.73 | 42.50 | 0.7877 | 0.1960 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.00 | 0.71 | 18.33 | 0.7645 | 0.0721 | |||

| SDHC / Smith Douglas Homes Corp. | 0.04 | 0.70 | 0.7587 | 0.7587 | |||||

| AAON / AAON, Inc. | 0.01 | 0.68 | 0.7279 | 0.7279 | |||||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.01 | -22.20 | 0.64 | -29.48 | 0.6909 | -0.3568 | |||

| DIS / The Walt Disney Company | 0.00 | 0.00 | 0.61 | 25.72 | 0.6579 | 0.0974 | |||

| BX / Blackstone Inc. | 0.00 | 0.00 | 0.59 | 7.13 | 0.6311 | -0.0002 | |||

| PYPL / PayPal Holdings, Inc. | 0.01 | -30.76 | 0.44 | -21.30 | 0.4703 | -0.1680 | |||

| SHW / The Sherwin-Williams Company | 0.00 | 0.00 | 0.42 | -1.87 | 0.4531 | -0.0401 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.41 | 2.74 | 0.4445 | -0.0196 | |||

| DSGR / Distribution Solutions Group, Inc. | 0.01 | -17.19 | 0.38 | -18.76 | 0.4105 | -0.1304 | |||

| DRLL / EA Series Trust - Strive U.S. Energy ETF | 0.01 | 0.00 | 0.27 | -8.75 | 0.2921 | -0.0501 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 0.00 | 0.20 | -18.52 | 0.2138 | -0.0671 |