Statistik Asas

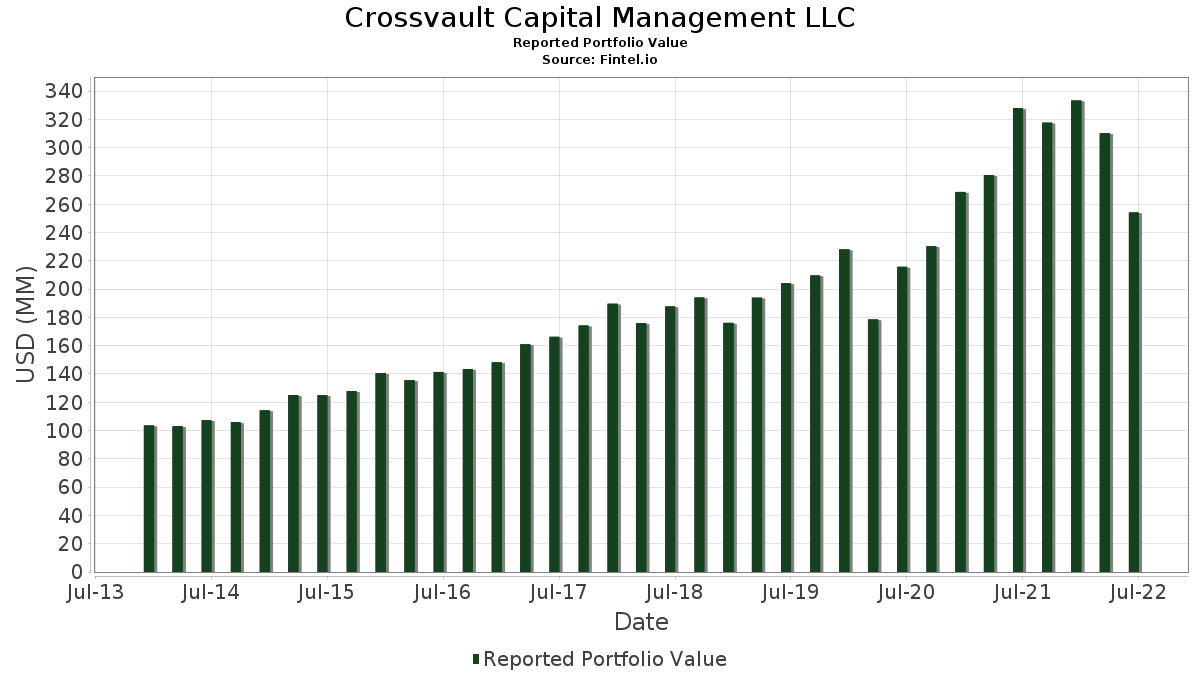

| Nilai Portfolio | $ 254,164,000 |

| Kedudukan Semasa | 74 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Crossvault Capital Management LLC telah mendedahkan 74 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 254,164,000 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Crossvault Capital Management LLC ialah Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , AbbVie Inc. (US:ABBV) , PepsiCo, Inc. (US:PEP) , and Alphabet Inc. (US:GOOGL) . Kedudukan baharu Crossvault Capital Management LLC termasuk Colgate-Palmolive Company (US:CL) , Valero Energy Corporation (US:VLO) , PPG Industries, Inc. (US:PPG) , Rani Therapeutics Holdings, Inc. (US:RANI) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 13.01 | 5.1176 | 0.8545 | |

| 0.03 | 8.97 | 3.5288 | 0.8076 | |

| 0.05 | 9.29 | 3.6555 | 0.6410 | |

| 0.18 | 9.69 | 3.8109 | 0.6269 | |

| 0.09 | 13.56 | 5.3363 | 0.4858 | |

| 0.10 | 9.62 | 3.7796 | 0.4776 | |

| 0.04 | 2.83 | 1.1146 | 0.4556 | |

| 0.08 | 5.09 | 2.0030 | 0.4084 | |

| 0.16 | 8.77 | 3.4517 | 0.4053 | |

| 0.03 | 2.61 | 1.0269 | 0.2660 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 8.87 | 3.4887 | -1.0750 | |

| 0.05 | 3.03 | 1.1910 | -0.8568 | |

| 0.05 | 4.99 | 1.9617 | -0.6790 | |

| 0.12 | 16.11 | 6.3400 | -0.5486 | |

| 0.01 | 1.69 | 0.6657 | -0.4980 | |

| 0.03 | 5.88 | 2.3087 | -0.4696 | |

| 0.03 | 5.30 | 2.0864 | -0.3973 | |

| 0.00 | 10.58 | 4.1627 | -0.3827 | |

| 0.06 | 1.31 | 0.5144 | -0.3802 | |

| 0.01 | 1.16 | 0.4551 | -0.3500 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2022-08-08 untuk tempoh pelaporan 2022-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.12 | -3.72 | 16.11 | -24.61 | 6.3400 | -0.5486 | |||

| MSFT / Microsoft Corporation | 0.05 | -4.37 | 13.83 | -20.34 | 5.4429 | -0.1536 | |||

| ABBV / AbbVie Inc. | 0.09 | -4.62 | 13.56 | -9.89 | 5.3363 | 0.4858 | |||

| PEP / PepsiCo, Inc. | 0.08 | -1.25 | 13.01 | -1.67 | 5.1176 | 0.8545 | |||

| GOOGL / Alphabet Inc. | 0.00 | -4.26 | 10.58 | -24.99 | 4.1627 | -0.3827 | |||

| PFE / Pfizer Inc. | 0.18 | -3.20 | 9.69 | -1.96 | 3.8109 | 0.6269 | |||

| RTX / RTX Corporation | 0.10 | -3.23 | 9.62 | -6.13 | 3.7796 | 0.4776 | |||

| JNJ / Johnson & Johnson | 0.05 | -0.83 | 9.29 | -0.67 | 3.6555 | 0.6410 | |||

| CVX / Chevron Corporation | 0.06 | -3.89 | 9.22 | -14.54 | 3.6260 | 0.1506 | |||

| LLY / Eli Lilly and Company | 0.03 | -6.19 | 8.97 | 6.22 | 3.5288 | 0.8076 | |||

| AMZN / Amazon.com, Inc. | 0.08 | 1,821.96 | 8.87 | -37.38 | 3.4887 | -1.0750 | |||

| DVN / Devon Energy Corporation | 0.16 | -0.42 | 8.77 | -7.19 | 3.4517 | 0.4053 | |||

| HD / The Home Depot, Inc. | 0.03 | -4.40 | 8.45 | -12.39 | 3.3231 | 0.2160 | |||

| HON / Honeywell International Inc. | 0.05 | -4.15 | 8.12 | -14.38 | 3.1960 | 0.1386 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.04 | -9.73 | 6.25 | -22.78 | 2.4575 | -0.1494 | |||

| DOW / Dow Inc. | 0.12 | 0.38 | 6.15 | -18.70 | 2.4205 | -0.0182 | |||

| ROK / Rockwell Automation, Inc. | 0.03 | -4.25 | 5.88 | -31.85 | 2.3087 | -0.4696 | |||

| CRM / Salesforce, Inc. | 0.03 | -11.48 | 5.30 | -31.19 | 2.0864 | -0.3973 | |||

| V / Visa Inc. | 0.03 | -8.18 | 5.30 | -18.49 | 2.0812 | -0.0126 | |||

| KO / The Coca-Cola Company | 0.08 | 1.40 | 5.09 | 2.89 | 2.0030 | 0.4084 | |||

| SWKS / Skyworks Solutions, Inc. | 0.05 | -12.46 | 4.99 | -39.15 | 1.9617 | -0.6790 | |||

| ADBE / Adobe Inc. | 0.01 | -2.44 | 4.76 | -21.63 | 1.8736 | -0.0845 | |||

| MGA / Magna International Inc. | 0.09 | -15.96 | 4.72 | -28.25 | 1.8586 | -0.2632 | |||

| NKE / NIKE, Inc. | 0.04 | -4.80 | 4.19 | -27.70 | 1.6454 | -0.2209 | |||

| STX / Seagate Technology Holdings plc | 0.05 | -4.37 | 3.82 | -24.00 | 1.5038 | -0.1170 | |||

| MRNA / Moderna, Inc. | 0.02 | -3.97 | 3.28 | -20.35 | 1.2917 | -0.0367 | |||

| SQ / Block, Inc. | 0.05 | 5.09 | 3.03 | -52.36 | 1.1910 | -0.8568 | |||

| GIS / General Mills, Inc. | 0.04 | 24.32 | 2.83 | 38.53 | 1.1146 | 0.4556 | |||

| D / Dominion Energy, Inc. | 0.03 | -3.69 | 2.71 | -9.53 | 1.0647 | 0.1007 | |||

| MRK / Merck & Co., Inc. | 0.03 | -0.52 | 2.61 | 10.55 | 1.0269 | 0.2660 | |||

| MCD / McDonald's Corporation | 0.01 | -4.26 | 2.55 | -4.42 | 1.0032 | 0.1425 | |||

| MMM / 3M Company | 0.02 | -0.89 | 2.53 | -13.87 | 0.9946 | 0.0488 | |||

| VZ / Verizon Communications Inc. | 0.04 | -3.17 | 2.27 | -3.53 | 0.8919 | 0.1346 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | -1.46 | 2.08 | -17.69 | 0.8199 | 0.0039 | |||

| WMT / Walmart Inc. | 0.02 | -5.47 | 1.94 | -22.80 | 0.7645 | -0.0467 | |||

| SNOW / Snowflake Inc. | 0.01 | -22.68 | 1.69 | -53.09 | 0.6657 | -0.4980 | |||

| ENPH / Enphase Energy, Inc. | 0.01 | -8.23 | 1.69 | -11.20 | 0.6641 | 0.0515 | |||

| S / SentinelOne, Inc. | 0.06 | -21.70 | 1.31 | -52.85 | 0.5144 | -0.3802 | |||

| NOW / ServiceNow, Inc. | 0.00 | -12.30 | 1.25 | -25.13 | 0.4934 | -0.0464 | |||

| GILD / Gilead Sciences, Inc. | 0.02 | -7.31 | 1.25 | -3.69 | 0.4934 | 0.0738 | |||

| WDAY / Workday, Inc. | 0.01 | -20.47 | 1.16 | -53.64 | 0.4551 | -0.3500 | |||

| MCHP / Microchip Technology Incorporated | 0.02 | 0.00 | 1.11 | -22.69 | 0.4383 | -0.0261 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 3.21 | 1.01 | -20.14 | 0.3973 | -0.0107 | |||

| TGT / Target Corporation | 0.01 | 16.72 | 1.01 | -22.32 | 0.3953 | -0.0220 | |||

| PG / The Procter & Gamble Company | 0.01 | 52.54 | 0.92 | 43.48 | 0.3635 | 0.1560 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -7.46 | 0.90 | -4.04 | 0.3553 | 0.0520 | |||

| CFR / Cullen/Frost Bankers, Inc. | 0.01 | 0.00 | 0.79 | -15.78 | 0.3104 | 0.0082 | |||

| NEE.PRN / NextEra Energy Capital Holdings, Inc. - Corporate Bond/Note | 0.01 | 5.32 | 0.74 | -3.75 | 0.2928 | 0.0433 | |||

| O / Realty Income Corporation | 0.01 | 0.00 | 0.64 | -1.53 | 0.2530 | 0.0425 | |||

| COP / ConocoPhillips | 0.01 | 4.98 | 0.58 | -5.72 | 0.2267 | 0.0295 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | 17.70 | 0.48 | 28.99 | 0.1908 | 0.0696 | |||

| UPS / United Parcel Service, Inc. | 0.00 | 5.27 | 0.46 | -10.41 | 0.1792 | 0.0152 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.01 | -4.97 | 0.44 | -21.29 | 0.1729 | -0.0072 | |||

| GD / General Dynamics Corporation | 0.00 | 0.00 | 0.43 | -8.25 | 0.1708 | 0.0183 | |||

| NOC / Northrop Grumman Corporation | 0.00 | 0.00 | 0.42 | 6.85 | 0.1656 | 0.0387 | |||

| SO / The Southern Company | 0.01 | 5.38 | 0.42 | 3.71 | 0.1649 | 0.0347 | |||

| CL / Colgate-Palmolive Company | 0.01 | 0.40 | 0.1586 | 0.1586 | |||||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.01 | -11.97 | 0.40 | -12.09 | 0.1574 | 0.0107 | |||

| FNF / Fidelity National Financial, Inc. | 0.01 | 0.00 | 0.36 | -24.43 | 0.1424 | -0.0119 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -5.47 | 0.34 | -22.02 | 0.1336 | -0.0069 | |||

| IBM / International Business Machines Corporation | 0.00 | 7.19 | 0.32 | 16.61 | 0.1243 | 0.0370 | |||

| CMI / Cummins Inc. | 0.00 | 0.00 | 0.31 | -5.49 | 0.1220 | 0.0163 | |||

| TSLA / Tesla, Inc. | 0.00 | 11.69 | 0.29 | -30.12 | 0.1141 | -0.0196 | |||

| BA / The Boeing Company | 0.00 | -2.33 | 0.29 | -30.34 | 0.1129 | -0.0199 | |||

| VLO / Valero Energy Corporation | 0.00 | 0.28 | 0.1121 | 0.1121 | |||||

| AEP / American Electric Power Company, Inc. | 0.00 | 0.00 | 0.28 | -4.07 | 0.1113 | 0.0163 | |||

| YUM / Yum! Brands, Inc. | 0.00 | 0.00 | 0.28 | -4.14 | 0.1094 | 0.0159 | |||

| PPG / PPG Industries, Inc. | 0.00 | 0.27 | 0.1078 | 0.1078 | |||||

| DVY / iShares Trust - iShares Select Dividend ETF | 0.00 | 3.06 | 0.25 | -5.30 | 0.0982 | 0.0132 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | -17.00 | 0.23 | -36.41 | 0.0893 | -0.0257 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.21 | -16.99 | 0.0846 | 0.0011 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.00 | -5.01 | 0.21 | -11.21 | 0.0810 | 0.0062 | |||

| PPL / PPL Corporation | 0.01 | 0.00 | 0.20 | -5.21 | 0.0787 | 0.0107 | |||

| RANI / Rani Therapeutics Holdings, Inc. | 0.01 | 0.15 | 0.0582 | 0.0582 | |||||

| PLTR / Palantir Technologies Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0490 | ||||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0809 | ||||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.0657 | ||||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.0854 | ||||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.0664 | ||||

| EMR / Emerson Electric Co. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0744 | ||||

| VBTX / Veritex Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0744 | ||||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.0664 | ||||

| DE / Deere & Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0802 |