Statistik Asas

| Nilai Portfolio | $ 632,657,000 |

| Kedudukan Semasa | 43 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

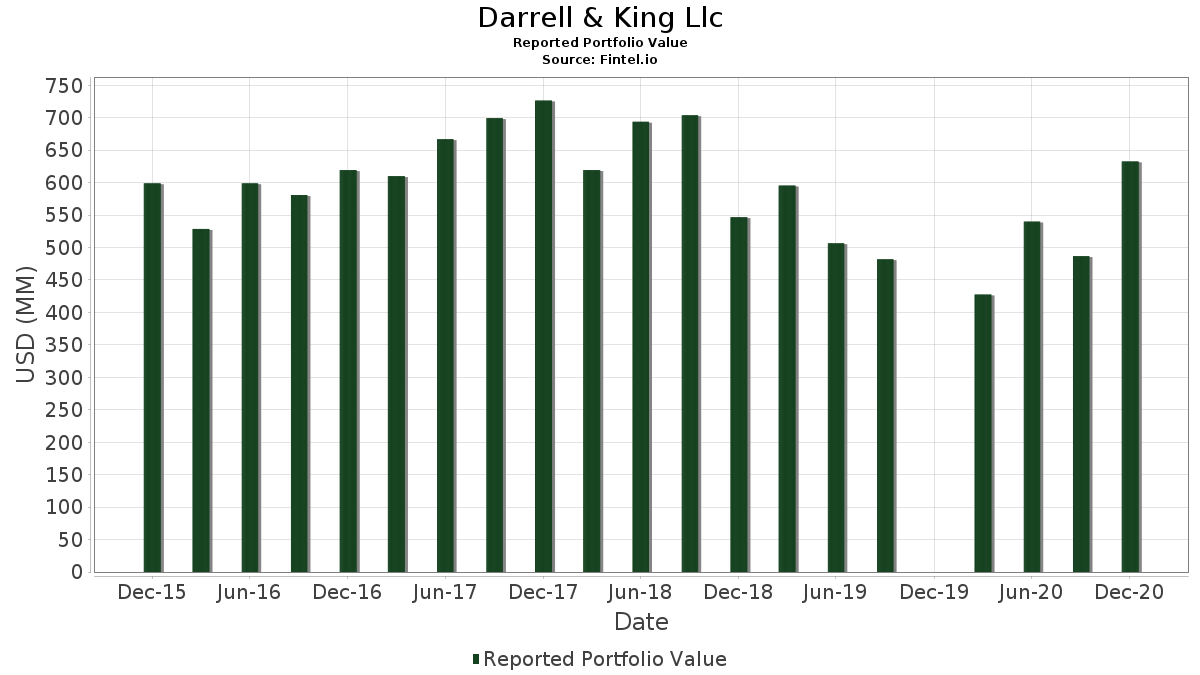

Darrell & King Llc telah mendedahkan 43 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 632,657,000 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Darrell & King Llc ialah QUALCOMM Incorporated (US:QCOM) , Palo Alto Networks, Inc. (US:PANW) , Dell Technologies Inc. (US:DELL) , Dow Inc. (US:DOW) , and W.W. Grainger, Inc. (US:GWW) . Kedudukan baharu Darrell & King Llc termasuk Ford Motor Company (US:F) , Newell Brands Inc. (US:NWL) , Simon Property Group, Inc. (US:SPG) , Tesla, Inc. (US:TSLA) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.57 | 33.22 | 5.2507 | 5.2507 | |

| 3.35 | 29.46 | 4.6573 | 4.6573 | |

| 1.29 | 27.43 | 4.3355 | 4.3355 | |

| 0.21 | 15.82 | 2.5006 | 2.5006 | |

| 0.12 | 10.42 | 1.6465 | 1.6465 | |

| 0.43 | 29.89 | 4.7253 | 1.1061 | |

| 0.52 | 24.21 | 3.8272 | 0.7169 | |

| 0.11 | 40.13 | 6.3437 | 0.4212 | |

| 0.35 | 23.85 | 3.7698 | 0.3421 | |

| 0.00 | 0.38 | 0.0593 | 0.0593 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.20 | 0.0318 | -5.4431 | |

| 0.00 | 0.00 | -2.2857 | ||

| 0.33 | 22.63 | 3.5776 | -1.6717 | |

| 0.48 | 35.20 | 5.5646 | -1.4944 | |

| 0.01 | 29.36 | 4.6414 | -1.3304 | |

| 0.09 | 25.83 | 4.0829 | -1.1409 | |

| 0.08 | 33.49 | 5.2943 | -0.9971 | |

| 0.23 | 29.96 | 4.7351 | -0.9261 | |

| 0.28 | 42.08 | 6.6515 | -0.7506 | |

| 0.02 | 32.03 | 5.0636 | -0.6691 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2021-01-15 untuk tempoh pelaporan 2020-12-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| QCOM / QUALCOMM Incorporated | 0.28 | -9.78 | 42.08 | 16.79 | 6.6515 | -0.7506 | |||

| PANW / Palo Alto Networks, Inc. | 0.11 | -4.13 | 40.13 | 39.21 | 6.3437 | 0.4212 | |||

| DELL / Dell Technologies Inc. | 0.48 | -5.37 | 35.20 | 2.46 | 5.5646 | -1.4944 | |||

| DOW / Dow Inc. | 0.49 | -3.42 | 34.92 | 23.78 | 5.5194 | -0.2759 | |||

| GWW / W.W. Grainger, Inc. | 0.08 | -4.44 | 33.49 | 9.37 | 5.2943 | -0.9971 | |||

| SFIX / Stitch Fix, Inc. | 0.57 | -1.22 | 33.22 | 113.79 | 5.2507 | 5.2507 | |||

| GOOG / Alphabet Inc. | 0.02 | -3.70 | 32.03 | 14.80 | 5.0636 | -0.6691 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.23 | -1.57 | 29.96 | 8.71 | 4.7351 | -0.9261 | |||

| PSX / Phillips 66 | 0.43 | 25.78 | 29.89 | 69.69 | 4.7253 | 1.1061 | |||

| F / Ford Motor Company | 3.35 | 29.46 | 4.6573 | 4.6573 | |||||

| AMZN / Amazon.com, Inc. | 0.01 | -2.34 | 29.36 | 1.01 | 4.6414 | -1.3304 | |||

| JPM / JPMorgan Chase & Co. | 0.23 | -1.09 | 29.12 | 30.55 | 4.6036 | 0.0205 | |||

| SYY / Sysco Corporation | 0.37 | -1.91 | 27.49 | 17.07 | 4.3455 | -0.4790 | |||

| NWL / Newell Brands Inc. | 1.29 | 27.43 | 4.3355 | 4.3355 | |||||

| DAL / Delta Air Lines, Inc. | 0.64 | -3.30 | 25.89 | 27.16 | 4.0919 | -0.0905 | |||

| META / Meta Platforms, Inc. | 0.09 | -2.61 | 25.83 | 1.58 | 4.0829 | -1.1409 | |||

| LUV / Southwest Airlines Co. | 0.52 | 28.67 | 24.21 | 59.93 | 3.8272 | 0.7169 | |||

| TJX / The TJX Companies, Inc. | 0.35 | 16.48 | 23.85 | 42.94 | 3.7698 | 0.3421 | |||

| DHI / D.R. Horton, Inc. | 0.33 | -2.80 | 22.63 | -11.42 | 3.5776 | -1.6717 | |||

| LYB / LyondellBasell Industries N.V. | 0.22 | 0.30 | 20.11 | 30.42 | 3.1794 | 0.0110 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.21 | 15.82 | 2.5006 | 2.5006 | |||||

| SPG / Simon Property Group, Inc. | 0.12 | 10.42 | 1.6465 | 1.6465 | |||||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.04 | 234.49 | 2.38 | -7.61 | 0.3762 | -0.1530 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 1.39 | 8.67 | 0.2199 | -0.0431 | |||

| SPGI / S&P Global Inc. | 0.00 | 0.00 | 1.21 | -8.87 | 0.1916 | -0.0817 | |||

| AAPL / Apple Inc. | 0.00 | -0.17 | 0.61 | 14.56 | 0.0958 | -0.0129 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -0.95 | 0.47 | 10.59 | 0.0743 | -0.0130 | |||

| TSLA / Tesla, Inc. | 0.00 | 0.38 | 0.0593 | 0.0593 | |||||

| PFE / Pfizer Inc. | 0.01 | 0.00 | 0.37 | 0.27 | 0.0582 | -0.0172 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.01 | 0.00 | 0.35 | 6.38 | 0.0553 | -0.0123 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | 0.00 | 0.34 | 2.76 | 0.0530 | -0.0140 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -2.59 | 0.30 | 16.86 | 0.0482 | -0.0054 | |||

| OEF / iShares Trust - iShares S&P 100 ETF | 0.00 | -19.21 | 0.27 | -10.86 | 0.0428 | -0.0196 | |||

| RDS.B / Shell Plc - ADR | 0.01 | 0.27 | 0.0420 | 0.0420 | |||||

| SMMF / Summit Financial Group, Inc. | 0.01 | 0.00 | 0.26 | 49.15 | 0.0417 | 0.0054 | |||

| TFC / Truist Financial Corporation | 0.01 | 0.26 | 0.0414 | 0.0414 | |||||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | 0.00 | 0.25 | 10.92 | 0.0401 | -0.0069 | |||

| IWX / iShares Trust - iShares Russell Top 200 Value ETF | 0.00 | 0.00 | 0.23 | 13.17 | 0.0367 | -0.0054 | |||

| DUK / Duke Energy Corporation | 0.00 | 0.00 | 0.23 | 3.69 | 0.0356 | -0.0090 | |||

| IWP / iShares Trust - iShares Russell Mid-Cap Growth ETF | 0.00 | 0.20 | 0.0322 | 0.0322 | |||||

| ITW / Illinois Tool Works Inc. | 0.00 | -99.29 | 0.20 | -99.25 | 0.0318 | -5.4431 | |||

| SIRI / Sirius XM Holdings Inc. | 0.01 | -27.50 | 0.09 | -14.02 | 0.0145 | -0.0074 | |||

| PWRMF / Power Metals Corp. | 0.04 | 0.00 | 0.01 | 22.22 | 0.0017 | -0.0001 | |||

| US83088V1026 / Slack Technologies Inc | 0.00 | -100.00 | 0.00 | -100.00 | -2.2857 | ||||

| MHK / Mohawk Industries, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0413 |