Statistik Asas

| Nilai Portfolio | $ 26,323,841 |

| Kedudukan Semasa | 39 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

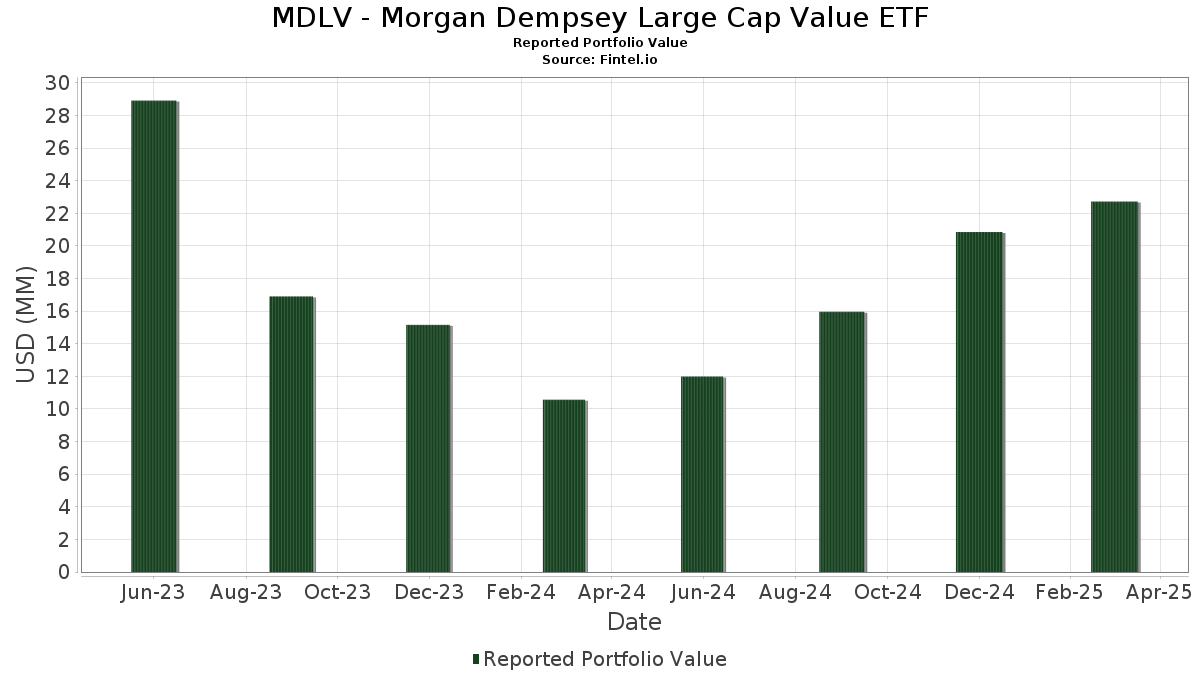

MDLV - Morgan Dempsey Large Cap Value ETF telah mendedahkan 39 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 26,323,841 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas MDLV - Morgan Dempsey Large Cap Value ETF ialah First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , AT&T Inc. (US:T) , Citigroup Inc. (US:C) , Cisco Systems, Inc. (US:CSCO) , and WEC Energy Group, Inc. (US:WEC) . Kedudukan baharu MDLV - Morgan Dempsey Large Cap Value ETF termasuk First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , ONEOK, Inc. (US:OKE) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.39 | 1.5000 | 1.5000 | |

| 0.01 | 0.82 | 3.1200 | 0.9100 | |

| 0.01 | 1.09 | 4.1500 | 0.5700 | |

| 0.00 | 0.87 | 3.3200 | 0.5000 | |

| 1.22 | 4.6700 | 0.4800 | ||

| 0.01 | 0.97 | 3.7100 | 0.3900 | |

| 0.04 | 1.16 | 4.4400 | 0.2200 | |

| 0.00 | 0.72 | 2.7500 | 0.1300 | |

| 0.00 | 0.78 | 2.9700 | 0.0800 | |

| 0.01 | 0.65 | 2.4700 | 0.0700 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.76 | 2.9200 | -1.0400 | |

| 0.01 | 0.75 | 2.8600 | -0.5100 | |

| 0.01 | 0.44 | 1.6900 | -0.4100 | |

| 0.01 | 0.90 | 3.4300 | -0.3900 | |

| 0.02 | 0.48 | 1.8200 | -0.3000 | |

| 0.02 | 0.74 | 2.8100 | -0.2800 | |

| 0.00 | 0.26 | 1.0000 | -0.2700 | |

| 0.01 | 0.45 | 1.7400 | -0.2500 | |

| 0.01 | 0.49 | 1.8700 | -0.2400 | |

| 0.00 | 0.50 | 1.9100 | -0.2100 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-29 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 1.22 | 29.07 | 4.6700 | 0.4800 | |||||

| T / AT&T Inc. | 0.04 | 19.36 | 1.16 | 22.19 | 4.4400 | 0.2200 | |||

| C / Citigroup Inc. | 0.01 | 12.13 | 1.09 | 34.57 | 4.1500 | 0.5700 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 15.18 | 0.97 | 29.55 | 3.7100 | 0.3900 | |||

| WEC / WEC Energy Group, Inc. | 0.01 | 17.24 | 0.92 | 12.18 | 3.5200 | -0.1200 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 15.01 | 0.90 | 4.30 | 3.4300 | -0.3900 | |||

| IBM / International Business Machines Corporation | 0.00 | 15.01 | 0.87 | 36.32 | 3.3200 | 0.5000 | |||

| ETR / Entergy Corporation | 0.01 | 15.73 | 0.85 | 12.60 | 3.2500 | -0.0900 | |||

| WFC / Wells Fargo & Company | 0.01 | 46.73 | 0.82 | 63.86 | 3.1200 | 0.9100 | |||

| KO / The Coca-Cola Company | 0.01 | 17.99 | 0.80 | 16.52 | 3.0500 | 0.0200 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 14.64 | 0.78 | 18.84 | 2.9700 | 0.0800 | |||

| PM / Philip Morris International Inc. | 0.00 | -25.53 | 0.76 | -14.56 | 2.9200 | -1.0400 | |||

| CVX / Chevron Corporation | 0.01 | 14.93 | 0.75 | -1.58 | 2.8600 | -0.5100 | |||

| CMI / Cummins Inc. | 0.00 | 13.36 | 0.75 | 18.57 | 2.8600 | 0.0600 | |||

| PBA / Pembina Pipeline Corporation | 0.02 | 12.74 | 0.74 | 5.60 | 2.8100 | -0.2800 | |||

| MDT / Medtronic plc | 0.01 | 16.63 | 0.73 | 13.24 | 2.7800 | -0.0700 | |||

| CCI / Crown Castle Inc. | 0.01 | 18.14 | 0.73 | 16.37 | 2.7800 | 0.0200 | |||

| VZ / Verizon Communications Inc. | 0.02 | 19.45 | 0.72 | 13.92 | 2.7500 | -0.0500 | |||

| GD / General Dynamics Corporation | 0.00 | 13.79 | 0.72 | 21.86 | 2.7500 | 0.1300 | |||

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.01 | 16.28 | 0.71 | 16.34 | 2.7200 | 0.0000 | |||

| DUK / Duke Energy Corporation | 0.01 | 16.82 | 0.67 | 13.01 | 2.5600 | -0.0600 | |||

| PRU / Prudential Financial, Inc. | 0.01 | 14.38 | 0.67 | 10.03 | 2.5600 | -0.1300 | |||

| SO / The Southern Company | 0.01 | 17.46 | 0.66 | 17.17 | 2.5100 | 0.0300 | |||

| ES / Eversource Energy | 0.01 | 16.63 | 0.65 | 19.59 | 2.4700 | 0.0700 | |||

| MAIN / Main Street Capital Corporation | 0.01 | 12.99 | 0.59 | 18.11 | 2.2500 | 0.0500 | |||

| JNJ / Johnson & Johnson | 0.00 | 17.20 | 0.54 | 7.94 | 2.0800 | -0.1500 | |||

| PFE / Pfizer Inc. | 0.02 | 14.52 | 0.51 | 9.66 | 1.9500 | -0.1200 | |||

| UPS / United Parcel Service, Inc. | 0.00 | 14.01 | 0.50 | 4.61 | 1.9100 | -0.2100 | |||

| MRK / Merck & Co., Inc. | 0.01 | 16.19 | 0.49 | 2.52 | 1.8700 | -0.2400 | |||

| KHC / The Kraft Heinz Company | 0.02 | 17.09 | 0.48 | -0.63 | 1.8200 | -0.3000 | |||

| PG / The Procter & Gamble Company | 0.00 | 18.65 | 0.47 | 11.06 | 1.8100 | -0.0800 | |||

| GIS / General Mills, Inc. | 0.01 | 16.79 | 0.45 | 1.34 | 1.7400 | -0.2500 | |||

| LYB / LyondellBasell Industries N.V. | 0.01 | 13.81 | 0.44 | -6.55 | 1.6900 | -0.4100 | |||

| MCD / McDonald's Corporation | 0.00 | 16.30 | 0.43 | 8.84 | 1.6500 | -0.1100 | |||

| SBUX / Starbucks Corporation | 0.00 | 18.18 | 0.43 | 10.39 | 1.6300 | -0.0800 | |||

| VOYA / Voya Financial, Inc. | 0.01 | 13.17 | 0.40 | 18.56 | 1.5200 | 0.0400 | |||

| OKE / ONEOK, Inc. | 0.00 | 0.39 | 1.5000 | 1.5000 | |||||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.01 | 7.99 | 0.33 | 4.73 | 1.2700 | -0.1400 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.00 | 16.10 | 0.26 | -9.09 | 1.0000 | -0.2700 |