Statistik Asas

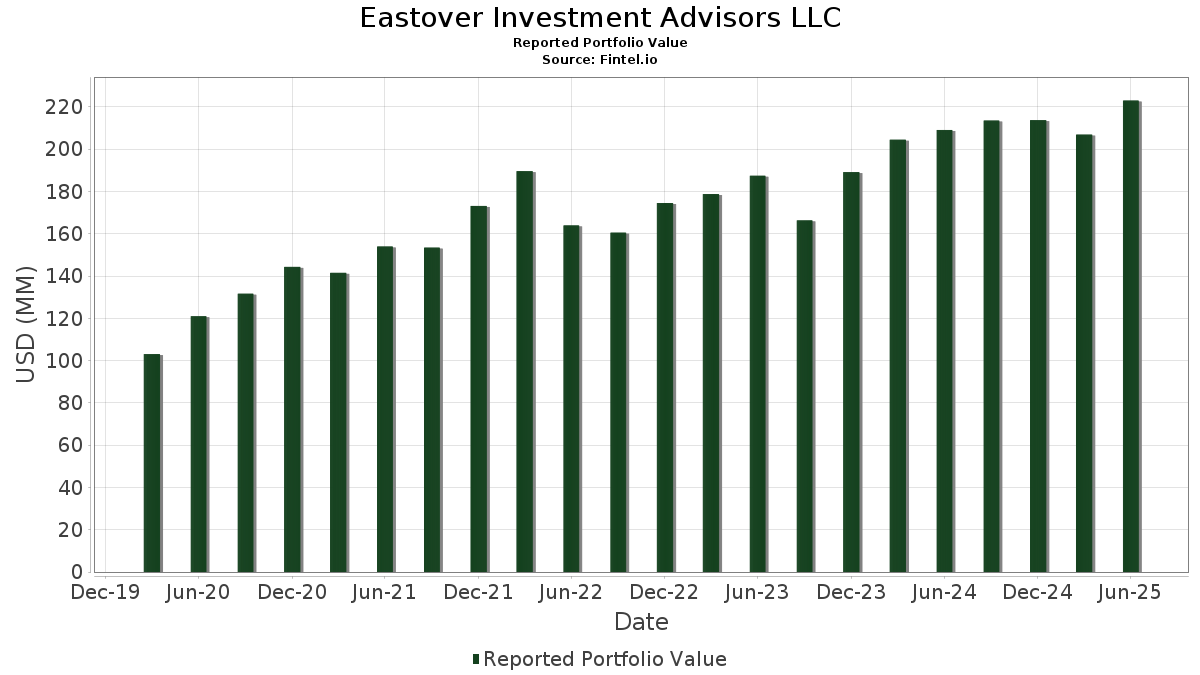

| Nilai Portfolio | $ 222,992,078 |

| Kedudukan Semasa | 44 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Eastover Investment Advisors LLC telah mendedahkan 44 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 222,992,078 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Eastover Investment Advisors LLC ialah Broadcom Inc. (US:AVGO) , Jabil Inc. (US:JBL) , NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , and Apple Inc. (US:AAPL) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 7.15 | 3.2077 | 2.1737 | |

| 0.01 | 7.30 | 3.2731 | 2.1028 | |

| 0.06 | 15.38 | 6.8965 | 1.8480 | |

| 0.06 | 13.47 | 6.0391 | 1.4952 | |

| 0.08 | 12.78 | 5.7298 | 1.4753 | |

| 0.02 | 12.00 | 5.3813 | 0.8667 | |

| 0.02 | 7.06 | 3.1677 | 0.6254 | |

| 0.01 | 7.21 | 3.2343 | 0.4180 | |

| 0.10 | 8.47 | 3.7975 | 0.3845 | |

| 0.05 | 9.94 | 4.4562 | 0.2404 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 10.93 | 4.9033 | -0.8093 | |

| 0.12 | 6.96 | 3.1229 | -0.7632 | |

| 0.04 | 6.95 | 3.1173 | -0.6346 | |

| 0.02 | 7.56 | 3.3885 | -0.5163 | |

| 0.04 | 6.62 | 2.9683 | -0.4396 | |

| 0.04 | 6.94 | 3.1133 | -0.4307 | |

| 0.07 | 7.53 | 3.3749 | -0.4100 | |

| 0.11 | 7.47 | 3.3500 | -0.3584 | |

| 0.03 | 6.51 | 2.9209 | -0.2992 | |

| 0.02 | 6.65 | 2.9843 | -0.2371 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-16 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AVGO / Broadcom Inc. | 0.06 | -10.57 | 15.38 | 47.24 | 6.8965 | 1.8480 | |||

| JBL / Jabil Inc. | 0.06 | -10.62 | 13.47 | 43.26 | 6.0391 | 1.4952 | |||

| NVDA / NVIDIA Corporation | 0.08 | -0.42 | 12.78 | 45.18 | 5.7298 | 1.4753 | |||

| MSFT / Microsoft Corporation | 0.02 | -3.04 | 12.00 | 28.47 | 5.3813 | 0.8667 | |||

| AAPL / Apple Inc. | 0.05 | 0.16 | 10.93 | -7.49 | 4.9033 | -0.8093 | |||

| AMZN / Amazon.com, Inc. | 0.05 | -1.20 | 9.94 | 13.94 | 4.4562 | 0.2404 | |||

| RTX / RTX Corporation | 0.06 | -0.42 | 8.96 | 9.78 | 4.0173 | 0.0728 | |||

| GOOG / Alphabet Inc. | 0.05 | 0.61 | 8.94 | 14.24 | 4.0070 | 0.2262 | |||

| C / Citigroup Inc. | 0.10 | 0.02 | 8.47 | 19.94 | 3.7975 | 0.3845 | |||

| RSG / Republic Services, Inc. | 0.03 | 0.32 | 8.11 | 2.15 | 3.6378 | -0.2003 | |||

| V / Visa Inc. | 0.02 | -7.67 | 7.56 | -6.46 | 3.3885 | -0.5163 | |||

| AEP / American Electric Power Company, Inc. | 0.07 | 1.21 | 7.53 | -3.90 | 3.3749 | -0.4100 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.11 | 1.34 | 7.47 | -2.63 | 3.3500 | -0.3584 | |||

| COST / Costco Wholesale Corporation | 0.01 | 188.01 | 7.30 | 201.45 | 3.2731 | 2.1028 | |||

| URI / United Rentals, Inc. | 0.01 | 2.97 | 7.21 | 23.79 | 3.2343 | 0.4180 | |||

| ISRG / Intuitive Surgical, Inc. | 0.01 | 204.77 | 7.15 | 234.36 | 3.2077 | 2.1737 | |||

| ETN / Eaton Corporation plc | 0.02 | 2.26 | 7.06 | 34.30 | 3.1677 | 0.6254 | |||

| FNF / Fidelity National Financial, Inc. | 0.12 | 0.56 | 6.96 | -13.38 | 3.1229 | -0.7632 | |||

| ABBV / AbbVie Inc. | 0.04 | 1.09 | 6.95 | -10.44 | 3.1173 | -0.6346 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.04 | 1.28 | 6.94 | -5.31 | 3.1133 | -0.4307 | |||

| PSA / Public Storage | 0.02 | 1.85 | 6.65 | -0.15 | 2.9843 | -0.2371 | |||

| JNJ / Johnson & Johnson | 0.04 | 1.93 | 6.62 | -6.13 | 2.9683 | -0.4396 | |||

| DHI / D.R. Horton, Inc. | 0.05 | 4.88 | 6.57 | 6.34 | 2.9471 | -0.0397 | |||

| LOW / Lowe's Companies, Inc. | 0.03 | 2.78 | 6.51 | -2.22 | 2.9209 | -0.2992 | |||

| CRM / Salesforce, Inc. | 0.02 | 1.35 | 6.43 | 2.98 | 2.8817 | -0.1345 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.04 | 10.22 | 1.97 | 23.26 | 0.8819 | 0.1107 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -9.56 | 0.89 | 6.48 | 0.3978 | -0.0052 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -5.46 | 0.60 | 4.36 | 0.2686 | -0.0085 | |||

| TFC / Truist Financial Corporation | 0.01 | 0.00 | 0.58 | 4.51 | 0.2599 | -0.0082 | |||

| DFAE / Dimensional ETF Trust - Dimensional Emerging Core Equity Market ETF | 0.02 | 0.00 | 0.56 | 11.71 | 0.2528 | 0.0091 | |||

| SO / The Southern Company | 0.01 | 0.00 | 0.48 | 0.00 | 0.2135 | -0.0169 | |||

| FNB / F.N.B. Corporation | 0.03 | 0.00 | 0.42 | 8.29 | 0.1878 | 0.0011 | |||

| SON / Sonoco Products Company | 0.01 | 0.00 | 0.39 | -7.82 | 0.1748 | -0.0295 | |||

| DFAI / Dimensional ETF Trust - Dimensional International Core Equity Market ETF | 0.01 | 0.05 | 0.38 | 11.01 | 0.1718 | 0.0046 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.00 | -4.61 | 0.35 | 12.78 | 0.1587 | 0.0070 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.70 | 0.35 | -8.20 | 0.1560 | -0.0271 | |||

| DGRO / iShares Trust - iShares Core Dividend Growth ETF | 0.01 | 0.00 | 0.35 | 3.58 | 0.1556 | -0.0064 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.32 | 14.86 | 0.1425 | 0.0086 | |||

| INDA / iShares Trust - iShares MSCI India ETF | 0.01 | 0.02 | 0.31 | 8.30 | 0.1406 | 0.0005 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 18.92 | 0.29 | 40.69 | 0.1291 | 0.0301 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.00 | 0.00 | 0.28 | 12.10 | 0.1250 | 0.0049 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | 0.00 | 0.28 | 17.45 | 0.1241 | 0.0103 | |||

| BAC / Bank of America Corporation | 0.00 | 0.21 | 0.0949 | 0.0949 | |||||

| AVDX / AvidXchange Holdings, Inc. | 0.01 | 0.00 | 0.10 | 15.56 | 0.0467 | 0.0031 | |||

| DHR / Danaher Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BDX / Becton, Dickinson and Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ADBE / Adobe Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PEP / PepsiCo, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |