Statistik Asas

| Nilai Portfolio | $ 908,515,079 |

| Kedudukan Semasa | 57 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

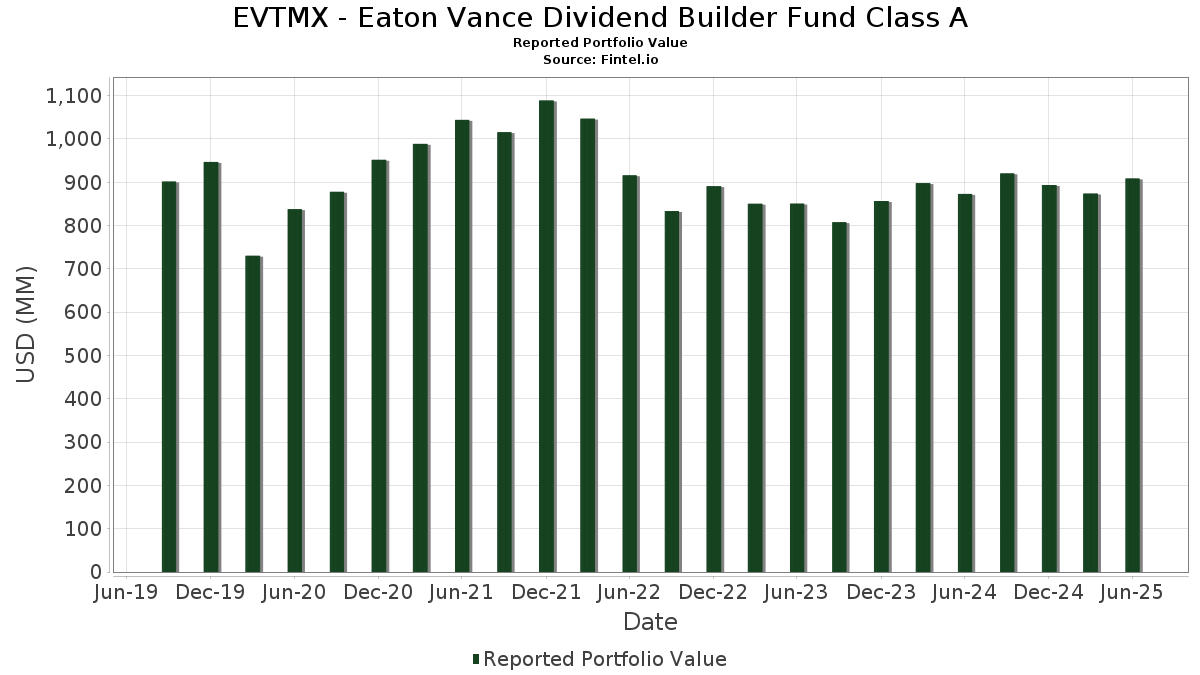

EVTMX - Eaton Vance Dividend Builder Fund Class A telah mendedahkan 57 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 908,515,079 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas EVTMX - Eaton Vance Dividend Builder Fund Class A ialah Microsoft Corporation (US:MSFT) , Broadcom Inc. (US:AVGO) , JPMorgan Chase & Co. (US:JPM) , Chevron Corporation (US:CVX) , and Johnson & Johnson (US:JNJ) . Kedudukan baharu EVTMX - Eaton Vance Dividend Builder Fund Class A termasuk The Southern Company (US:SO) , Quest Diagnostics Incorporated (US:DGX) , Iron Mountain Incorporated (US:IRM) , Zoetis Inc. (US:ZTS) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.18 | 16.99 | 1.8702 | 1.8702 | |

| 0.07 | 13.17 | 1.4495 | 1.4495 | |

| 0.13 | 36.30 | 3.9965 | 1.3570 | |

| 0.11 | 11.56 | 1.2726 | 1.2726 | |

| 0.01 | 10.63 | 1.1701 | 1.1701 | |

| 0.06 | 9.33 | 1.0267 | 1.0267 | |

| 0.03 | 8.61 | 0.9476 | 0.9476 | |

| 0.09 | 42.86 | 4.7184 | 0.8303 | |

| 0.05 | 18.38 | 2.0240 | 0.8133 | |

| 0.08 | 18.30 | 2.0145 | 0.6332 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.07 | 8.81 | 0.9698 | -1.1278 | |

| 6.77 | 6.77 | 0.7454 | -0.9987 | |

| 0.08 | 14.89 | 1.6388 | -0.9110 | |

| 0.05 | 11.06 | 1.2174 | -0.7433 | |

| 0.05 | 15.85 | 1.7447 | -0.5579 | |

| 0.59 | 11.27 | 1.2405 | -0.5268 | |

| 0.06 | 6.91 | 0.7604 | -0.5199 | |

| 0.10 | 11.84 | 1.3040 | -0.4820 | |

| 0.30 | 14.18 | 1.5616 | -0.4754 | |

| 0.02 | 11.86 | 1.3061 | -0.3518 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-25 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.09 | -4.75 | 42.86 | 26.21 | 4.7184 | 0.8303 | |||

| AVGO / Broadcom Inc. | 0.13 | -4.36 | 36.30 | 57.46 | 3.9965 | 1.3570 | |||

| JPM / JPMorgan Chase & Co. | 0.11 | 0.00 | 31.57 | 18.19 | 3.4756 | 0.4173 | |||

| CVX / Chevron Corporation | 0.18 | 13.82 | 25.36 | -2.58 | 2.7917 | -0.1885 | |||

| JNJ / Johnson & Johnson | 0.15 | 2.95 | 23.48 | -5.18 | 2.5846 | -0.2501 | |||

| KO / The Coca-Cola Company | 0.32 | -5.68 | 22.91 | -6.83 | 2.5220 | -0.2930 | |||

| PG / The Procter & Gamble Company | 0.13 | 0.00 | 20.73 | -6.51 | 2.2818 | -0.2565 | |||

| MMM / 3M Company | 0.13 | -4.50 | 20.03 | -1.00 | 2.2056 | -0.1113 | |||

| ICE / Intercontinental Exchange, Inc. | 0.11 | 8.20 | 19.85 | 15.08 | 2.1854 | 0.2105 | |||

| EOG / EOG Resources, Inc. | 0.16 | 0.00 | 19.66 | -6.73 | 2.1647 | -0.2490 | |||

| WMT / Walmart Inc. | 0.20 | 0.00 | 19.53 | 11.38 | 2.1496 | 0.1425 | |||

| ADP / Automatic Data Processing, Inc. | 0.06 | 0.00 | 18.94 | 0.94 | 2.0846 | -0.0632 | |||

| HD / The Home Depot, Inc. | 0.05 | 8.40 | 18.92 | 8.45 | 2.0827 | 0.0855 | |||

| LRCX / Lam Research Corporation | 0.19 | 0.00 | 18.57 | 33.89 | 2.0446 | 0.4565 | |||

| ETN / Eaton Corporation plc | 0.05 | 32.39 | 18.38 | 73.86 | 2.0240 | 0.8133 | |||

| ORCL / Oracle Corporation | 0.08 | -3.01 | 18.30 | 51.67 | 2.0145 | 0.6332 | |||

| SRE / Sempra | 0.24 | 16.00 | 18.13 | 23.16 | 1.9961 | 0.3106 | |||

| FIS / Fidelity National Information Services, Inc. | 0.22 | 0.00 | 18.02 | 9.02 | 1.9833 | 0.0912 | |||

| ABT / Abbott Laboratories | 0.13 | 0.00 | 17.89 | 2.53 | 1.9689 | -0.0281 | |||

| CME / CME Group Inc. | 0.06 | 18.37 | 17.58 | 22.97 | 1.9358 | 0.2988 | |||

| SO / The Southern Company | 0.18 | 16.99 | 1.8702 | 1.8702 | |||||

| APH / Amphenol Corporation | 0.16 | -9.97 | 16.06 | 35.55 | 1.7676 | 0.4115 | |||

| FNF / Fidelity National Financial, Inc. | 0.29 | 4.80 | 16.02 | -9.73 | 1.7638 | -0.2680 | |||

| UNH / UnitedHealth Group Incorporated | 0.05 | 32.29 | 15.85 | -21.20 | 1.7447 | -0.5579 | |||

| LHX / L3Harris Technologies, Inc. | 0.06 | 5.13 | 15.43 | 25.99 | 1.6983 | 0.2964 | |||

| BLK / BlackRock, Inc. | 0.01 | 0.00 | 15.32 | 10.86 | 1.6864 | 0.1044 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.06 | 12.30 | 15.31 | 12.56 | 1.6855 | 0.1283 | |||

| ABBV / AbbVie Inc. | 0.08 | -24.55 | 14.89 | -33.16 | 1.6388 | -0.9110 | |||

| ADI / Analog Devices, Inc. | 0.06 | 0.00 | 14.83 | 18.02 | 1.6324 | 0.1940 | |||

| CMCSA / Comcast Corporation | 0.41 | 22.86 | 14.48 | 18.83 | 1.5944 | 0.1990 | |||

| QCOM / QUALCOMM Incorporated | 0.09 | 0.00 | 14.48 | 3.67 | 1.5937 | -0.0049 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 0.00 | 14.47 | 25.67 | 1.5933 | 0.2747 | |||

| ALL / The Allstate Corporation | 0.07 | 0.00 | 14.45 | -2.78 | 1.5912 | -0.1110 | |||

| TXN / Texas Instruments Incorporated | 0.07 | 27.24 | 14.45 | 47.01 | 1.5908 | 0.4654 | |||

| IP / International Paper Company | 0.30 | -9.18 | 14.18 | -20.28 | 1.5616 | -0.4754 | |||

| AJG / Arthur J. Gallagher & Co. | 0.04 | 0.00 | 13.67 | -7.27 | 1.5048 | -0.1830 | |||

| TFC / Truist Financial Corporation | 0.32 | 0.00 | 13.60 | 4.48 | 1.4974 | 0.0068 | |||

| DGX / Quest Diagnostics Incorporated | 0.07 | 13.17 | 1.4495 | 1.4495 | |||||

| BAH / Booz Allen Hamilton Holding Corporation | 0.12 | 50.73 | 12.93 | 50.08 | 1.4238 | 0.4372 | |||

| WM / Waste Management, Inc. | 0.06 | 10.84 | 12.63 | 9.55 | 1.3905 | 0.0705 | |||

| CARR / Carrier Global Corporation | 0.17 | 8.78 | 12.24 | 25.58 | 1.3472 | 0.2315 | |||

| SPGI / S&P Global Inc. | 0.02 | -21.05 | 11.86 | -18.07 | 1.3061 | -0.3518 | |||

| LAMR / Lamar Advertising Company | 0.10 | -28.81 | 11.84 | -24.07 | 1.3040 | -0.4820 | |||

| AME / AMETEK, Inc. | 0.06 | 18.53 | 11.69 | 24.61 | 1.2869 | 0.2128 | |||

| IRM / Iron Mountain Incorporated | 0.11 | 11.56 | 1.2726 | 1.2726 | |||||

| OWL / Blue Owl Capital Inc. | 0.59 | -23.85 | 11.27 | -27.00 | 1.2405 | -0.5268 | |||

| AAPL / Apple Inc. | 0.05 | -30.09 | 11.06 | -35.43 | 1.2174 | -0.7433 | |||

| META / Meta Platforms, Inc. | 0.01 | 10.63 | 1.1701 | 1.1701 | |||||

| EQT / EQT Corporation | 0.18 | 0.00 | 10.60 | 9.15 | 1.1666 | 0.0551 | |||

| FAST / Fastenal Company | 0.23 | 55.46 | 9.50 | -15.80 | 1.0459 | -0.2460 | |||

| ZTS / Zoetis Inc. | 0.06 | 9.33 | 1.0267 | 1.0267 | |||||

| AFG / American Financial Group, Inc. | 0.07 | -49.96 | 8.81 | -51.92 | 0.9698 | -1.1278 | |||

| ACN / Accenture plc | 0.03 | 8.61 | 0.9476 | 0.9476 | |||||

| BBWI / Bath & Body Works, Inc. | 0.28 | 42.14 | 8.54 | 40.45 | 0.9400 | 0.2440 | |||

| NYT / The New York Times Company | 0.13 | 0.00 | 7.08 | 12.86 | 0.7796 | 0.0612 | |||

| GILD / Gilead Sciences, Inc. | 0.06 | -37.58 | 6.91 | -38.23 | 0.7604 | -0.5199 | |||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 6.77 | -55.55 | 6.77 | -55.55 | 0.7454 | -0.9987 |