Statistik Asas

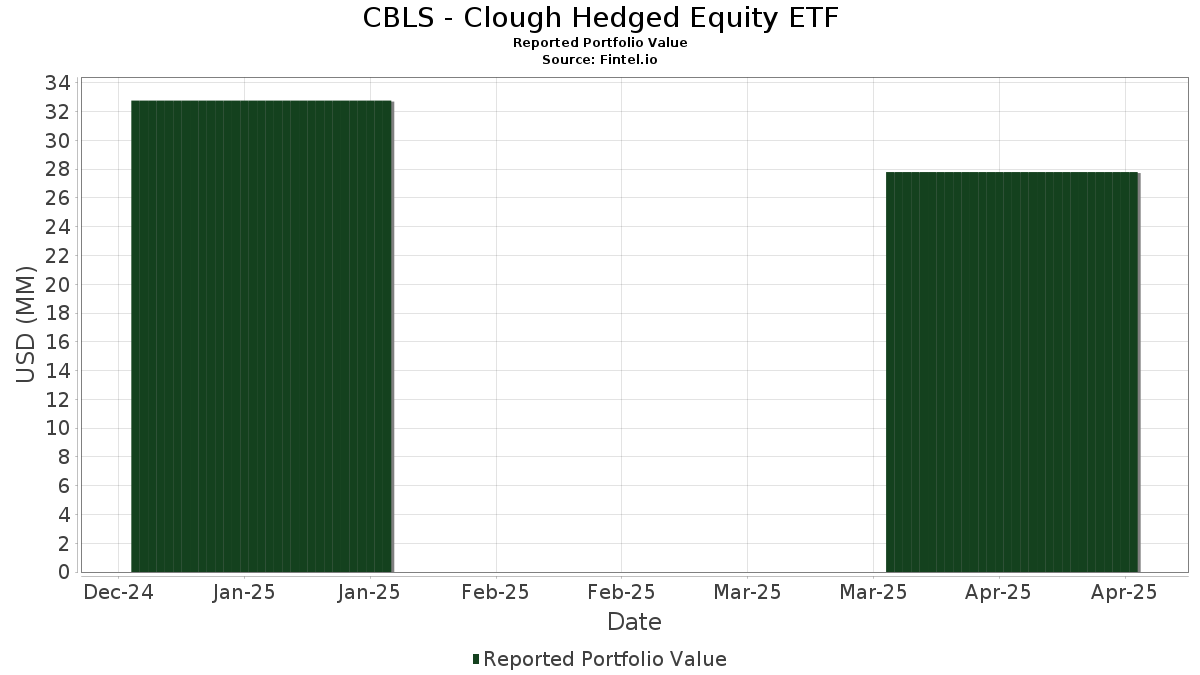

| Nilai Portfolio | $ 27,797,184 |

| Kedudukan Semasa | 73 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

CBLS - Clough Hedged Equity ETF telah mendedahkan 73 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 27,797,184 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas CBLS - Clough Hedged Equity ETF ialah BlackRock Liquidity Funds: T-Fund, Institutional Shares (US:US09248U7182) , SAP SE - Depositary Receipt (Common Stock) (US:SAP) , Magnite, Inc. (US:MGNI) , Spotify Technology S.A. (US:SPOT) , and Philip Morris International Inc. (US:PM) . Kedudukan baharu CBLS - Clough Hedged Equity ETF termasuk SAP SE - Depositary Receipt (Common Stock) (US:SAP) , Philip Morris International Inc. (US:PM) , HDFC Bank Limited - Depositary Receipt (Common Stock) (US:HDB) , Nu Holdings Ltd. (US:NU) , and ICICI Bank Limited - Depositary Receipt (Common Stock) (US:IBN) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.76 | 1.76 | 4.2584 | 2.9978 | |

| 0.00 | 1.21 | 2.9314 | 2.9314 | |

| 0.01 | 1.12 | 2.7074 | 2.7074 | |

| 0.01 | 1.08 | 2.6195 | 2.6195 | |

| 0.09 | 1.07 | 2.5998 | 2.5998 | |

| 0.03 | 1.06 | 2.5687 | 2.5687 | |

| 0.03 | 1.04 | 2.5249 | 2.5249 | |

| 0.01 | 1.04 | 2.5243 | 2.5243 | |

| 0.01 | 1.04 | 2.5139 | 2.5139 | |

| 0.00 | 1.02 | 2.4633 | 2.4633 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.7396 | ||

| 0.00 | 0.00 | -2.7275 | ||

| 0.00 | 0.00 | -2.7018 | ||

| 0.00 | 0.00 | -2.6975 | ||

| 0.00 | 0.00 | -2.6654 | ||

| 0.00 | 0.00 | -2.6458 | ||

| 0.00 | 0.00 | -2.5403 | ||

| 0.00 | 0.00 | -2.5302 | ||

| 0.00 | 0.00 | -2.4492 | ||

| 0.00 | 0.00 | -2.4426 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-06-26 untuk tempoh pelaporan 2025-04-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US09248U7182 / BlackRock Liquidity Funds: T-Fund, Institutional Shares | 1.76 | 218.48 | 1.76 | 218.48 | 4.2584 | 2.9978 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.00 | 1.21 | 2.9314 | 2.9314 | |||||

| MGNI / Magnite, Inc. | 0.10 | 107.33 | 1.21 | 43.36 | 2.9304 | 1.0027 | |||

| SPOT / Spotify Technology S.A. | 0.00 | -17.68 | 1.14 | -7.92 | 2.7618 | -0.0642 | |||

| PM / Philip Morris International Inc. | 0.01 | 1.12 | 2.7074 | 2.7074 | |||||

| HDB / HDFC Bank Limited - Depositary Receipt (Common Stock) | 0.01 | 1.08 | 2.6195 | 2.6195 | |||||

| NU / Nu Holdings Ltd. | 0.09 | 1.07 | 2.5998 | 2.5998 | |||||

| IBN / ICICI Bank Limited - Depositary Receipt (Common Stock) | 0.03 | 1.06 | 2.5687 | 2.5687 | |||||

| ADBE / Adobe Inc. | 0.00 | 46.22 | 1.06 | 25.36 | 2.5619 | 0.6348 | |||

| IFNNY / Infineon Technologies AG - Depositary Receipt (Common Stock) | 0.03 | 1.04 | 2.5249 | 2.5249 | |||||

| MU / Micron Technology, Inc. | 0.01 | 1.04 | 2.5243 | 2.5243 | |||||

| DOCU / DocuSign, Inc. | 0.01 | 1.04 | 2.5139 | 2.5139 | |||||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 1.02 | 2.4633 | 2.4633 | |||||

| GTLS / Chart Industries, Inc. | 0.01 | 27.83 | 1.02 | -18.41 | 2.4574 | -0.3838 | |||

| DELL / Dell Technologies Inc. | 0.01 | 5.50 | 1.01 | -6.55 | 2.4525 | -0.0219 | |||

| RH / RH | 0.01 | 1.01 | 2.4460 | 2.4460 | |||||

| COIN / Coinbase Global, Inc. | 0.00 | 24.68 | 1.00 | -13.13 | 2.4191 | -0.2075 | |||

| COP / ConocoPhillips | 0.01 | 0.99 | 2.3990 | 2.3990 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.01 | 0.98 | 2.3825 | 2.3825 | |||||

| MMYT / MakeMyTrip Limited | 0.01 | -21.85 | 0.98 | -24.98 | 2.3702 | -0.6105 | |||

| SEI / Solaris Energy Infrastructure, Inc. | 0.05 | 45.00 | 0.98 | 12.33 | 2.3622 | 0.3794 | |||

| SKY / Champion Homes, Inc. | 0.01 | 3.31 | 0.97 | -3.19 | 2.3524 | 0.0609 | |||

| FCX / Freeport-McMoRan Inc. | 0.03 | 0.97 | 2.3429 | 2.3429 | |||||

| SOC / Sable Offshore Corp. | 0.05 | 37.01 | 0.95 | 2.59 | 2.3029 | 0.1857 | |||

| ROL / Rollins, Inc. | 0.02 | -23.47 | 0.95 | -11.72 | 2.2996 | -0.1552 | |||

| SIEGY / Siemens Aktiengesellschaft - Depositary Receipt (Common Stock) | 0.01 | 0.95 | 2.2958 | 2.2958 | |||||

| MDLZ / Mondelez International, Inc. | 0.01 | 0.94 | 2.2764 | 2.2764 | |||||

| WMT / Walmart Inc. | 0.01 | -18.59 | 0.94 | -19.35 | 2.2720 | -0.3839 | |||

| BASFY / BASF SE - Depositary Receipt (Common Stock) | 0.07 | 0.93 | 2.2611 | 2.2611 | |||||

| SCI / Service Corporation International | 0.01 | -16.33 | 0.92 | -14.46 | 2.2367 | -0.2274 | |||

| EXE / Expand Energy Corporation | 0.01 | -8.81 | 0.91 | -6.75 | 2.2098 | -0.0244 | |||

| VG / Venture Global, Inc. | 0.11 | 0.90 | 2.1909 | 2.1909 | |||||

| ADDYY / adidas AG - Depositary Receipt (Common Stock) | 0.01 | 0.90 | 2.1801 | 2.1801 | |||||

| ARCO / Arcos Dorados Holdings Inc. | 0.12 | -20.31 | 0.89 | -21.32 | 2.1630 | -0.4296 | |||

| CCL / Carnival Corporation & plc | 0.05 | 0.88 | 2.1392 | 2.1392 | |||||

| MSTR / Strategy Inc | 0.00 | 0.87 | 2.1074 | 2.1074 | |||||

| BA / The Boeing Company | 0.00 | 0.82 | 1.9963 | 1.9963 | |||||

| TSLA / Tesla, Inc. | 0.00 | 0.72 | 1.7419 | 1.7419 | |||||

| AEP / American Electric Power Company, Inc. | 0.01 | 0.70 | 1.7049 | 1.7049 | |||||

| D / Dominion Energy, Inc. | 0.01 | 0.70 | 1.6983 | 1.6983 | |||||

| SO / The Southern Company | 0.01 | 0.70 | 1.6907 | 1.6907 | |||||

| UVIX / Vs Trust - 2x Long Vix Futures ETF | 0.01 | -13.29 | 0.55 | 28.01 | 1.3398 | 0.3524 | |||

| EME / EMCOR Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.5302 | ||||

| NVDA / NVIDIA Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -2.4392 | ||||

| TMDX / TransMedics Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.0198 | ||||

| AAPL / Apple Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.4241 | ||||

| MRVL / Marvell Technology, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.3988 | ||||

| RDFN / Redfin Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.9958 | ||||

| RDDT / Reddit, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.4154 | ||||

| AMZN / Amazon.com, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.9313 | ||||

| NEE / NextEra Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.9937 | ||||

| AEM / Agnico Eagle Mines Limited | 0.00 | -100.00 | 0.00 | -100.00 | -2.7275 | ||||

| OSW / OneSpaWorld Holdings Limited | 0.00 | -100.00 | 0.00 | -100.00 | -1.9356 | ||||

| CPRI / Capri Holdings Limited | 0.00 | -100.00 | 0.00 | -100.00 | -2.7018 | ||||

| UBER / Uber Technologies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.9989 | ||||

| ETR / Entergy Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -2.0063 | ||||

| KGC / Kinross Gold Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -2.7396 | ||||

| BWXT / BWX Technologies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.4426 | ||||

| AER / AerCap Holdings N.V. | 0.00 | -100.00 | 0.00 | -100.00 | -2.6975 | ||||

| STRL / Sterling Infrastructure, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.9814 | ||||

| VITL / Vital Farms, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.4492 | ||||

| PWR / Quanta Services, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.5403 | ||||

| ECL / Ecolab Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.6458 | ||||

| NEM / Newmont Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -2.6654 | ||||

| SEDG / SolarEdge Technologies, Inc. | Short | -0.03 | -0.39 | -0.9528 | -0.9528 | ||||

| HZO / MarineMax, Inc. | Short | -0.02 | -0.40 | -0.9620 | -0.9620 | ||||

| GM / General Motors Company | Short | -0.01 | -0.40 | -0.9655 | -0.9655 | ||||

| SOFI / SoFi Technologies, Inc. | Short | -0.03 | -0.40 | -0.9661 | -0.9661 | ||||

| SKT / Tanger Inc. | Short | -0.01 | -8.47 | -0.41 | -12.12 | -0.9845 | 0.0717 | ||

| GOGO / Gogo Inc. | Short | -0.05 | 3.36 | -0.41 | -7.31 | -0.9851 | 0.0167 | ||

| LCII / LCI Industries | Short | -0.01 | -0.41 | -0.9881 | -0.9881 | ||||

| WGO / Winnebago Industries, Inc. | Short | -0.01 | -0.41 | -0.9891 | -0.9891 | ||||

| THO / THOR Industries, Inc. | Short | -0.01 | -0.41 | -0.9927 | -0.9927 | ||||

| BC / Brunswick Corporation | Short | -0.01 | -0.41 | -0.9931 | -0.9931 | ||||

| PII / Polaris Inc. | Short | -0.01 | -0.41 | -0.9949 | -0.9949 | ||||

| VVV / Valvoline Inc. | Short | -0.01 | -17.10 | -0.41 | -23.61 | -0.9970 | 0.2312 | ||

| ICFI / ICF International, Inc. | Short | -0.00 | -0.41 | -0.9984 | -0.9984 | ||||

| F / Ford Motor Company | Short | -0.04 | -25.00 | -0.41 | -25.59 | -1.0021 | 0.2664 | ||

| TTC / The Toro Company | Short | -0.01 | 27.11 | -0.41 | 4.28 | -1.0031 | -0.0957 | ||

| DLR / Digital Realty Trust, Inc. | Short | -0.00 | -0.42 | -1.0051 | -1.0051 | ||||

| R / Ryder System, Inc. | Short | -0.00 | 8.89 | -0.42 | -6.05 | -1.0162 | 0.0026 | ||

| ORCL / Oracle Corporation | Short | -0.00 | -0.42 | -1.0163 | -1.0163 | ||||

| LULU / lululemon athletica inc. | Short | -0.00 | -0.42 | -1.0174 | -1.0174 | ||||

| AFRM / Affirm Holdings, Inc. | Short | -0.01 | -0.42 | -1.0192 | -1.0192 | ||||

| AME / AMETEK, Inc. | Short | -0.00 | -4.52 | -0.42 | -12.27 | -1.0223 | 0.0764 | ||

| MIDD / The Middleby Corporation | Short | -0.00 | 75.59 | -0.42 | 36.89 | -1.0244 | -0.3185 | ||

| FIGS / FIGS, Inc. | Short | -0.11 | -0.42 | -1.0275 | -1.0275 | ||||

| EQIX / Equinix, Inc. | Short | -0.00 | -0.43 | -1.0315 | -1.0315 | ||||

| VRTX / Vertex Pharmaceuticals Incorporated | Short | -0.00 | -0.43 | -1.0374 | -1.0374 | ||||

| ONEW / OneWater Marine Inc. | Short | -0.03 | -0.43 | -1.0378 | -1.0378 | ||||

| HCA / HCA Healthcare, Inc. | Short | -0.00 | -16.53 | -0.43 | -12.55 | -1.0460 | 0.0836 | ||

| MRNA / Moderna, Inc. | Short | -0.02 | -0.44 | -1.0572 | -1.0572 | ||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | Short | -0.01 | 55.36 | -0.44 | 22.35 | -1.0623 | -0.2430 | ||

| HELE / Helen of Troy Limited | Short | -0.02 | -0.48 | -1.1611 | -1.1611 | ||||

| CMG / Chipotle Mexican Grill, Inc. | Short | -0.01 | -0.58 | -1.4041 | -1.4041 |