Statistik Asas

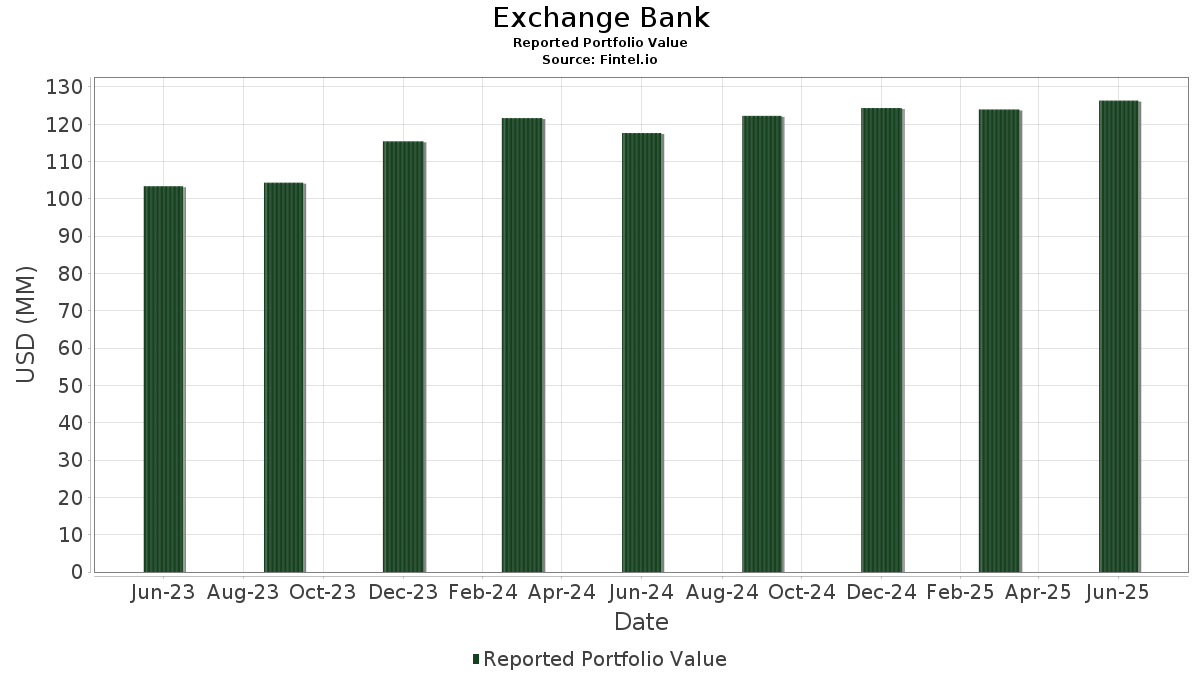

| Nilai Portfolio | $ 126,354,676 |

| Kedudukan Semasa | 120 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Exchange Bank telah mendedahkan 120 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 126,354,676 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Exchange Bank ialah Apple Inc. (US:AAPL) , iShares Trust - iShares National Muni Bond ETF (US:MUB) , Microsoft Corporation (US:MSFT) , Johnson & Johnson (US:JNJ) , and Vanguard Index Funds - Vanguard Total Stock Market ETF (US:VTI) . Kedudukan baharu Exchange Bank termasuk Capital One Financial Corporation (US:COF) , American Century ETF Trust - American Century U.S. Quality Growth ETF (US:QGRO) , Abbott Laboratories (US:ABT) , Bank of America Corporation (US:BAC) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 4.65 | 3.6803 | 0.7897 | |

| 0.01 | 2.94 | 2.3273 | 0.3123 | |

| 0.01 | 3.19 | 2.5220 | 0.2969 | |

| 0.01 | 2.31 | 1.8258 | 0.2505 | |

| 0.00 | 0.24 | 0.1877 | 0.1877 | |

| 0.00 | 0.21 | 0.1665 | 0.1665 | |

| 0.00 | 0.21 | 0.1638 | 0.1638 | |

| 0.00 | 0.20 | 0.1601 | 0.1601 | |

| 0.00 | 0.20 | 0.1588 | 0.1588 | |

| 0.01 | 1.59 | 1.2592 | 0.1380 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 5.37 | 2.6746 | -2.6183 | |

| 0.03 | 5.50 | 2.7410 | -2.2017 | |

| 0.03 | 3.40 | 1.6941 | -1.4456 | |

| 0.02 | 3.62 | 1.8030 | -1.3206 | |

| 0.04 | 3.18 | 1.5860 | -1.1403 | |

| 0.02 | 2.69 | 1.3425 | -1.0676 | |

| 0.03 | 3.04 | 1.5139 | -1.0553 | |

| 0.01 | 3.85 | 1.9168 | -0.9245 | |

| 0.03 | 1.37 | 0.6833 | -0.7863 | |

| 0.03 | 2.16 | 1.0743 | -0.6861 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-09 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.03 | -2.81 | 5.50 | -10.23 | 2.7410 | -2.2017 | |||

| MUB / iShares Trust - iShares National Muni Bond ETF | 0.05 | -17.45 | 5.37 | -18.21 | 2.6746 | -2.6183 | |||

| MSFT / Microsoft Corporation | 0.01 | -2.07 | 4.65 | 29.78 | 3.6803 | 0.7897 | |||

| JNJ / Johnson & Johnson | 0.03 | -0.58 | 3.85 | -8.41 | 3.0503 | -0.3445 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.01 | -1.25 | 3.85 | 9.20 | 1.9168 | -0.9245 | |||

| PG / The Procter & Gamble Company | 0.02 | -0.05 | 3.62 | -6.56 | 1.8030 | -1.3206 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.03 | -12.90 | 3.40 | -12.67 | 1.6941 | -1.4456 | |||

| CVX / Chevron Corporation | 0.02 | -0.53 | 3.27 | -14.84 | 2.5880 | -0.5100 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -2.26 | 3.19 | 15.52 | 2.5220 | 0.2969 | |||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.04 | -6.06 | 3.18 | -5.86 | 1.5860 | -1.1403 | |||

| WMT / Walmart Inc. | 0.03 | -14.36 | 3.04 | -4.62 | 1.5139 | -1.0553 | |||

| CAT / Caterpillar Inc. | 0.01 | 0.00 | 2.94 | 17.69 | 2.3273 | 0.3123 | |||

| XOM / Exxon Mobil Corporation | 0.02 | -0.53 | 2.69 | -9.84 | 1.3425 | -1.0676 | |||

| IBM / International Business Machines Corporation | 0.01 | -0.36 | 2.31 | 18.14 | 1.8258 | 0.2505 | |||

| UNP / Union Pacific Corporation | 0.01 | -0.85 | 2.22 | -3.44 | 1.7548 | -0.0973 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 2.19 | -8.73 | 1.7304 | -0.2017 | |||

| KO / The Coca-Cola Company | 0.03 | 0.00 | 2.16 | -1.24 | 1.0743 | -0.6861 | |||

| PM / Philip Morris International Inc. | 0.01 | -0.40 | 2.06 | 14.31 | 1.0271 | -0.4278 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.03 | -0.26 | 2.01 | 6.03 | 1.0000 | -0.5268 | |||

| NVDA / NVIDIA Corporation | 0.01 | -2.10 | 1.92 | 42.72 | 0.9576 | -0.1286 | |||

| SCHB / Schwab Strategic Trust - Schwab U.S. Broad Market ETF | 0.08 | -0.64 | 1.84 | 9.96 | 1.4588 | 0.1069 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | 0.00 | 1.79 | 0.90 | 0.8928 | -0.5390 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -0.96 | 1.78 | 9.39 | 0.8888 | -0.4264 | |||

| GOOGL / Alphabet Inc. | 0.01 | 0.43 | 1.59 | 14.46 | 1.2592 | 0.1380 | |||

| NSC / Norfolk Southern Corporation | 0.01 | -1.77 | 1.42 | 6.20 | 1.1255 | 0.0450 | |||

| TXN / Texas Instruments Incorporated | 0.01 | -4.51 | 1.41 | 10.35 | 1.1139 | 0.0849 | |||

| BMY / Bristol-Myers Squibb Company | 0.03 | -0.84 | 1.37 | -24.75 | 0.6833 | -0.7863 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.01 | -1.20 | 1.35 | -11.50 | 0.6715 | -0.5565 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 0.07 | 1.34 | 15.46 | 1.0583 | 0.1235 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.02 | -3.80 | 1.29 | -3.08 | 0.6433 | -0.4316 | |||

| MRK / Merck & Co., Inc. | 0.01 | -1.61 | 1.17 | -13.27 | 0.5834 | -0.5050 | |||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 0.02 | 0.00 | 1.17 | 0.78 | 0.5827 | -0.3535 | |||

| GOOGL / Alphabet Inc. | 0.01 | -4.54 | 1.16 | 8.40 | 0.5786 | -0.2855 | |||

| IAGG / iShares Trust - iShares Core International Aggregate Bond ETF | 0.02 | -2.29 | 1.15 | -0.09 | 0.5751 | -0.3571 | |||

| ORCL / Oracle Corporation | 0.01 | -1.11 | 1.13 | 54.72 | 0.5639 | -0.0264 | |||

| SUB / iShares Trust - iShares Short-Term National Muni Bond ETF | 0.01 | 20.57 | 1.11 | 21.47 | 0.5529 | -0.1843 | |||

| TGT / Target Corporation | 0.01 | 0.00 | 1.05 | -5.42 | 0.8296 | -0.0648 | |||

| NEE / NextEra Energy, Inc. | 0.01 | -0.18 | 0.95 | -2.26 | 0.7530 | -0.0321 | |||

| HD / The Home Depot, Inc. | 0.00 | -1.10 | 0.92 | -1.07 | 0.4598 | -0.2925 | |||

| LLY / Eli Lilly and Company | 0.00 | -3.93 | 0.91 | -9.33 | 0.4556 | -0.3578 | |||

| AXP / American Express Company | 0.00 | -5.69 | 0.90 | 11.82 | 0.7117 | 0.0630 | |||

| HON / Honeywell International Inc. | 0.00 | 0.14 | 0.85 | 10.09 | 0.4245 | -0.1994 | |||

| MO / Altria Group, Inc. | 0.01 | -0.80 | 0.84 | -3.12 | 0.6643 | -0.0344 | |||

| GL / Globe Life Inc. | 0.01 | 0.00 | 0.84 | -5.74 | 0.4180 | -0.2991 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.01 | -0.16 | 0.83 | 11.99 | 0.4144 | -0.1846 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | -0.29 | 0.83 | -9.13 | 0.4120 | -0.3213 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.61 | 0.82 | 5.30 | 0.6456 | 0.0208 | |||

| GE / General Electric Company | 0.00 | 0.00 | 0.78 | 28.71 | 0.3889 | -0.1006 | |||

| FALN / iShares Trust - iShares Fallen Angels USD Bond ETF | 0.03 | 0.00 | 0.77 | 1.32 | 0.3820 | -0.2284 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | 0.00 | 0.75 | -0.66 | 0.5948 | -0.0151 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.01 | -8.16 | 0.73 | 0.41 | 0.3656 | -0.2235 | |||

| BK / The Bank of New York Mellon Corporation | 0.01 | 0.00 | 0.69 | 8.69 | 0.3430 | -0.1681 | |||

| AVDV / American Century ETF Trust - Avantis International Small Cap Value ETF | 0.01 | 0.00 | 0.68 | 13.81 | 0.3409 | -0.1445 | |||

| PEP / PepsiCo, Inc. | 0.01 | -3.56 | 0.68 | -15.16 | 0.3407 | -0.3087 | |||

| MA / Mastercard Incorporated | 0.00 | -0.67 | 0.67 | 1.82 | 0.3343 | -0.1971 | |||

| MCD / McDonald's Corporation | 0.00 | -13.21 | 0.65 | -18.90 | 0.5136 | -0.1312 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 0.00 | 0.65 | 8.04 | 0.3218 | -0.1598 | |||

| META / Meta Platforms, Inc. | 0.00 | -3.33 | 0.64 | 23.70 | 0.3203 | -0.0985 | |||

| HBAN / Huntington Bancshares Incorporated | 0.04 | 0.00 | 0.64 | 11.75 | 0.5044 | 0.0440 | |||

| SPHY / SPDR Series Trust - SPDR Portfolio High Yield Bond ETF | 0.03 | -2.50 | 0.63 | -0.95 | 0.3127 | -0.1982 | |||

| FDX / FedEx Corporation | 0.00 | 0.00 | 0.61 | -6.69 | 0.4863 | -0.0452 | |||

| VBR / Vanguard Index Funds - Vanguard Small-Cap Value ETF | 0.00 | -0.89 | 0.61 | 3.75 | 0.3039 | -0.1702 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.01 | -0.61 | 0.61 | 3.94 | 0.3027 | -0.1690 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 1.38 | 0.59 | 13.87 | 0.2948 | -0.1239 | |||

| USMV / iShares Trust - iShares MSCI USA Min Vol Factor ETF | 0.01 | -1.56 | 0.59 | -1.34 | 0.2947 | -0.1888 | |||

| AVGO / Broadcom Inc. | 0.00 | 2.91 | 0.58 | 69.77 | 0.2911 | 0.0130 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 6.83 | 0.55 | 17.91 | 0.2760 | -0.1025 | |||

| IAU / iShares Gold Trust | 0.01 | 27.45 | 0.55 | 34.73 | 0.4336 | 0.1058 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 0.00 | 0.55 | 10.51 | 0.2729 | -0.1267 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.00 | 0.00 | 0.55 | 0.18 | 0.4328 | -0.0073 | |||

| V / Visa Inc. | 0.00 | -4.92 | 0.54 | -3.73 | 0.4294 | -0.0249 | |||

| SUSB / iShares Trust - iShares ESG Aware 1-5 Year USD Corporate Bond ETF | 0.02 | 1.58 | 0.53 | 2.31 | 0.4216 | 0.0016 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.56 | 0.52 | -4.43 | 0.4105 | -0.0268 | |||

| MMM / 3M Company | 0.00 | -1.38 | 0.51 | 2.20 | 0.2551 | -0.1488 | |||

| PFE / Pfizer Inc. | 0.02 | -12.60 | 0.51 | -16.50 | 0.4010 | -0.0878 | |||

| BLK / BlackRock, Inc. | 0.00 | -2.06 | 0.50 | 8.71 | 0.2489 | -0.1222 | |||

| BDX / Becton, Dickinson and Company | 0.00 | -0.11 | 0.49 | -24.92 | 0.2435 | -0.2812 | |||

| EMR / Emerson Electric Co. | 0.00 | -1.11 | 0.45 | 20.27 | 0.2249 | -0.0778 | |||

| DIS / The Walt Disney Company | 0.00 | 1.16 | 0.44 | 27.22 | 0.3516 | 0.0697 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | 0.00 | 0.44 | -0.23 | 0.3462 | -0.0077 | |||

| A / Agilent Technologies, Inc. | 0.00 | -1.41 | 0.41 | -0.48 | 0.2060 | -0.1293 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 0.41 | 43.55 | 0.3264 | 0.0948 | |||

| IGIB / iShares Trust - iShares 5-10 Year Investment Grade Corporate Bond ETF | 0.01 | 0.00 | 0.41 | 1.49 | 0.2037 | -0.1213 | |||

| QUAL / iShares Trust - iShares MSCI USA Quality Factor ETF | 0.00 | 0.00 | 0.41 | 6.82 | 0.2032 | -0.1043 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.01 | 0.71 | 0.40 | 10.14 | 0.2004 | -0.0944 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 0.00 | 0.40 | 25.87 | 0.1990 | -0.0574 | |||

| ADBE / Adobe Inc. | 0.00 | 0.00 | 0.40 | 1.02 | 0.1984 | -0.1200 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.00 | 0.39 | 73.54 | 0.1933 | 0.0128 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.00 | -12.01 | 0.38 | -13.57 | 0.1908 | -0.1661 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.00 | 0.37 | -11.59 | 0.1828 | -0.1512 | |||

| DUK / Duke Energy Corporation | 0.00 | 0.00 | 0.36 | -3.23 | 0.1790 | -0.1205 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.00 | -1.23 | 0.34 | 2.08 | 0.1712 | -0.1002 | |||

| RTX / RTX Corporation | 0.00 | -3.05 | 0.34 | 6.96 | 0.2681 | 0.0124 | |||

| T / AT&T Inc. | 0.01 | -1.63 | 0.31 | 0.65 | 0.2473 | -0.0031 | |||

| DD / DuPont de Nemours, Inc. | 0.00 | 0.00 | 0.30 | -8.36 | 0.2350 | -0.0258 | |||

| NOC / Northrop Grumman Corporation | 0.00 | 0.00 | 0.30 | -2.31 | 0.2346 | -0.0103 | |||

| PAVE / Global X Funds - Global X U.S. Infrastructure Development ETF | 0.01 | 0.00 | 0.29 | 15.60 | 0.1444 | -0.0580 | |||

| AON / Aon plc | 0.00 | -2.90 | 0.29 | -13.03 | 0.1431 | -0.1238 | |||

| CSX / CSX Corporation | 0.01 | 0.00 | 0.26 | 10.73 | 0.1290 | -0.0593 | |||

| MDT / Medtronic plc | 0.00 | 0.35 | 0.25 | -2.33 | 0.1995 | -0.0094 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 0.25 | 3.78 | 0.1232 | -0.0692 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | 0.24 | 0.1218 | 0.1218 | |||||

| MCHP / Microchip Technology Incorporated | 0.00 | 0.24 | 0.1203 | 0.1203 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 0.24 | -40.50 | 0.1886 | -0.1341 | |||

| COF / Capital One Financial Corporation | 0.00 | 0.24 | 0.1877 | 0.1877 | |||||

| ACN / Accenture plc | 0.00 | 2.06 | 0.24 | -2.48 | 0.1873 | -0.0080 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | 9.43 | 0.24 | 13.46 | 0.1872 | 0.0190 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | 0.00 | 0.23 | 6.02 | 0.1815 | 0.0071 | |||

| GPC / Genuine Parts Company | 0.00 | 0.00 | 0.22 | 1.84 | 0.1106 | -0.0652 | |||

| NOW / ServiceNow, Inc. | 0.00 | 0.22 | 0.1091 | 0.1091 | |||||

| TRV / The Travelers Companies, Inc. | 0.00 | 2.20 | 0.21 | 3.43 | 0.1673 | 0.0024 | |||

| QGRO / American Century ETF Trust - American Century U.S. Quality Growth ETF | 0.00 | 0.21 | 0.1665 | 0.1665 | |||||

| CRM / Salesforce, Inc. | 0.00 | 0.00 | 0.21 | 1.46 | 0.1649 | -0.0005 | |||

| FLOT / iShares Trust - iShares Floating Rate Bond ETF | 0.00 | -7.29 | 0.21 | -7.14 | 0.1037 | -0.0775 | |||

| BA / The Boeing Company | 0.00 | 0.21 | 0.1638 | 0.1638 | |||||

| TFI / SPDR Series Trust - SPDR Nuveen ICE Municipal Bond ETF | 0.00 | 0.00 | 0.21 | -0.96 | 0.1029 | -0.0651 | |||

| UPS / United Parcel Service, Inc. | 0.00 | 0.00 | 0.21 | -8.48 | 0.1629 | -0.0180 | |||

| LIN / Linde plc | 0.00 | 0.00 | 0.20 | 0.49 | 0.1019 | -0.0618 | |||

| ABT / Abbott Laboratories | 0.00 | 0.20 | 0.1601 | 0.1601 | |||||

| BAC / Bank of America Corporation | 0.00 | 0.20 | 0.1588 | 0.1588 | |||||

| PAYX / Paychex, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |