Statistik Asas

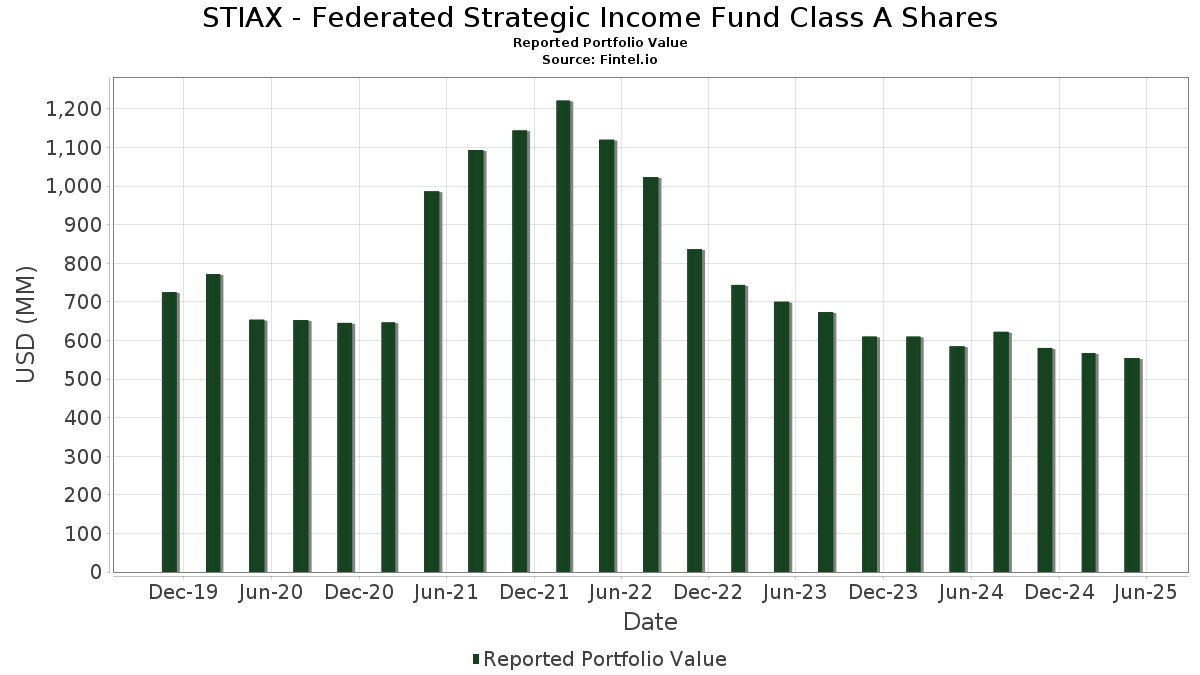

| Nilai Portfolio | $ 554,538,542 |

| Kedudukan Semasa | 250 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

STIAX - Federated Strategic Income Fund Class A Shares telah mendedahkan 250 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 554,538,542 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas STIAX - Federated Strategic Income Fund Class A Shares ialah FED HIGH YLD BOND PORT (US:US31409N1019) , FEDERATED CORE TR MUTUAL FUND (US:US31409N8873) , FEDERATED CORE TR MTG CORE PORTFOLIO (US:US31409N2009) , iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF (US:HYG) , and United States Treasury Note/Bond (US:US91282CGQ87) . Kedudukan baharu STIAX - Federated Strategic Income Fund Class A Shares termasuk United States Treasury Note/Bond (US:US91282CGQ87) , Fannie Mae Pool (US:US3140LQP957) , Freddie Mac Pool (US:US3132DWD674) , Freddie Mac Pool (US:US3132DWEQ24) , and Fannie Mae Pool (US:US31418EHJ29) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 20.51 | 3.6745 | 2.9092 | ||

| 0.16 | 12.73 | 2.2806 | 2.2806 | |

| 7.49 | 1.3414 | 1.3414 | ||

| 4.77 | 0.8544 | 0.8544 | ||

| 14.37 | 124.43 | 22.2899 | 0.6315 | |

| 3.00 | 0.5368 | 0.5368 | ||

| 9.21 | 9.21 | 1.6507 | 0.4900 | |

| 2.04 | 0.3649 | 0.3649 | ||

| 4.22 | 0.7558 | 0.0592 | ||

| 10.02 | 1.7953 | 0.0508 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 31.62 | 178.01 | 31.8880 | -3.2077 | |

| 10.19 | 83.67 | 14.9893 | -2.5041 | |

| 0.00 | 0.02 | 0.0031 | -0.0808 | |

| 0.00 | 0.10 | 0.0175 | -0.0658 | |

| 0.00 | 0.07 | 0.0129 | -0.0638 | |

| 0.00 | 0.08 | 0.0151 | -0.0563 | |

| 0.00 | 0.06 | 0.0100 | -0.0503 | |

| 0.00 | 0.08 | 0.0142 | -0.0499 | |

| 0.00 | 0.00 | -0.0499 | ||

| 0.00 | 0.08 | 0.0136 | -0.0466 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-22 untuk tempoh pelaporan 2025-05-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US31409N1019 / FED HIGH YLD BOND PORT | 31.62 | -11.01 | 178.01 | -11.48 | 31.8880 | -3.2077 | |||

| US31409N8873 / FEDERATED CORE TR MUTUAL FUND | 14.37 | 1.77 | 124.43 | 0.26 | 22.2899 | 0.6315 | |||

| US31409N2009 / FEDERATED CORE TR MTG CORE PORTFOLIO | 10.19 | -14.90 | 83.67 | -16.53 | 14.9893 | -2.5041 | |||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CLV18) | 20.51 | 357.35 | 3.6745 | 2.9092 | |||||

| U.S. Treasury Notes / DBT (US91282CLW90) | 17.82 | -1.36 | 3.1922 | 0.0393 | |||||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 0.16 | 12.73 | 2.2806 | 2.2806 | |||||

| US91282CGQ87 / United States Treasury Note/Bond | 10.02 | 0.25 | 1.7953 | 0.0508 | |||||

| GOFXX / Federated Hermes Money Market Obligations Trust - Federated Hermes Gov Oblig Fd Prem Shs USD | 9.21 | 38.54 | 9.21 | 38.54 | 1.6507 | 0.4900 | |||

| US3140LQP957 / Fannie Mae Pool | 7.72 | -3.93 | 1.3828 | -0.0195 | |||||

| U.S. Treasury Notes / DBT (US91282CMR96) | 7.49 | 1.3414 | 1.3414 | ||||||

| US3132DWD674 / Freddie Mac Pool | 6.56 | -3.83 | 1.1755 | -0.0152 | |||||

| US3132DWEQ24 / Freddie Mac Pool | 6.56 | -4.01 | 1.1749 | -0.0176 | |||||

| US31418EHJ29 / Fannie Mae Pool | 6.25 | -4.04 | 1.1205 | -0.0169 | |||||

| US46654WAC55 / J.P. Morgan Mortgage Trust 2022-1 | 4.98 | -5.33 | 0.8913 | -0.0258 | |||||

| U.S. Treasury Bonds / DBT (US912810UG12) | 4.77 | 0.8544 | 0.8544 | ||||||

| AU000XCLWAX7 / Australia Government Bond | 4.22 | 5.71 | 0.7558 | 0.0592 | |||||

| US95040QAP90 / Welltower Inc | 3.52 | 0.83 | 0.6303 | 0.0214 | |||||

| US46655DAC65 / JP Morgan Mortgage Trust 2022-2 | 3.19 | -5.79 | 0.5717 | -0.0194 | |||||

| U.S. Treasury Notes / DBT (US91282CMV09) | 3.00 | 0.5368 | 0.5368 | ||||||

| US045054AP84 / Ashtead Capital Inc | 2.87 | -1.24 | 0.5150 | 0.0070 | |||||

| BRSTNCLTN871 / Brazil Letras do Tesouro Nacional | 2.67 | 8.67 | 0.4784 | 0.0495 | |||||

| US362924AE27 / GS MORTGAGE BACKED SECURITIES GSMBS 2022 PJ3 A4 144A | 2.60 | -4.65 | 0.4661 | -0.0103 | |||||

| US46654UAC99 / JP MORGAN MORTGAGE TRUST JPMMT 2022 3 A3 144A | 2.57 | -4.63 | 0.4608 | -0.0100 | |||||

| US43730NAC02 / HOME PARTNERS OF AMERICA TRUST HPA 2022 1 B 144A | 2.15 | 0.28 | 0.3849 | 0.0110 | |||||

| U.S. Treasury Notes / DBT (US91282CMM00) | 2.04 | 0.3649 | 0.3649 | ||||||

| U.S. Treasury Notes / DBT (US91282CMD01) | 2.04 | 0.20 | 0.3646 | 0.0101 | |||||

| Southern California Gas Co / DBT (US842434DB54) | 1.97 | -0.65 | 0.3534 | 0.0068 | |||||

| ORL Trust 2024-GLKS / ABS-MBS (US67120DAC92) | 1.64 | -0.61 | 0.2943 | 0.0060 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 1.41 | -1.47 | 0.2519 | 0.0028 | |||||

| US207942AB90 / Fannie Mae Connecticut Avenue Securities | 1.30 | -0.91 | 0.2337 | 0.0040 | |||||

| US63942KAA25 / Navient Student Loan Trust | 1.04 | -4.23 | 0.1865 | -0.0033 | |||||

| US78450MAA09 / SMB Private Education Loan Trust 2021-E | 0.87 | -7.68 | 0.1550 | -0.0086 | |||||

| US36268ABB35 / GS Mortgage-Backed Securities Trust 2023-PJ5 | 0.85 | -8.60 | 0.1523 | -0.0101 | |||||

| US12629NAH89 / COMM 2015-DC1 Mortgage Trust | 0.72 | -27.17 | 0.1293 | -0.0435 | |||||

| US08162BBE11 / Benchmark 2019-B11 Mortgage Trust | 0.64 | 0.00 | 0.1141 | 0.0029 | |||||

| US3137FRUH25 / Freddie Mac Multifamily Structured Pass Through Certificates | 0.56 | -3.77 | 0.1007 | -0.0013 | |||||

| US08163EAZ88 / Benchmark 2021-B26 Mortgage Trust | 0.50 | -0.20 | 0.0894 | 0.0020 | |||||

| US06036FBC41 / BANK 2018-BNK15 | 0.49 | 0.00 | 0.0883 | 0.0023 | |||||

| US06541LBG05 / BANK 2022-BNK40 | 0.31 | 0.00 | 0.0559 | 0.0015 | |||||

| US95000U2G70 / Wells Fargo & Co | 0.25 | 0.40 | 0.0455 | 0.0014 | |||||

| US86787GAJ13 / SunTrust Banks, Inc. | 0.20 | 0.00 | 0.0354 | 0.0010 | |||||

| US20030NCA72 / Comcast Corp | 0.19 | 1.04 | 0.0348 | 0.0011 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBH79) | 0.15 | -1.33 | 0.0266 | 0.0003 | |||||

| US191241AH15 / Coca-Cola Femsa SAB de CV | 0.14 | 1.47 | 0.0248 | 0.0009 | |||||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | 0.14 | 0.0244 | 0.0244 | ||||||

| US46647PCC86 / JPMorgan Chase & Co | 0.13 | -26.86 | 0.0229 | -0.0077 | |||||

| US575767AL25 / Massachusetts Mutual Life Insurance Co | 0.12 | -5.51 | 0.0217 | -0.0006 | |||||

| US718172CX57 / PHILIP MORRIS INTERNATIONAL INC | 0.12 | 0.00 | 0.0216 | 0.0005 | |||||

| US927804FX73 / Virginia Electric & Power Co | 0.12 | 0.85 | 0.0212 | 0.0007 | |||||

| US38141GWV21 / Goldman Sachs Group Inc/The | 0.12 | 0.86 | 0.0210 | 0.0006 | |||||

| US26441CBH79 / DUKE ENERGY CORP NEW 2.45% 06/01/2030 | 0.12 | 0.87 | 0.0209 | 0.0008 | |||||

| US437076BY77 / Home Depot, Inc. (The) | 0.11 | 1.79 | 0.0204 | 0.0007 | |||||

| US015271AK55 / Alexandria Real Estate Equities Inc | 0.11 | 0.00 | 0.0194 | 0.0005 | |||||

| K1EY34 / KeyCorp - Depositary Receipt (Common Stock) | 0.10 | -1.89 | 0.0188 | 0.0002 | |||||

| US172967MY46 / Citigroup Inc | 0.10 | -31.13 | 0.0188 | -0.0077 | |||||

| TSNF34 / Tyson Foods, Inc. - Depositary Receipt (Common Stock) | 0.10 | -0.98 | 0.0183 | 0.0003 | |||||

| US15189TBB26 / CenterPoint Energy, Inc. | 0.10 | -0.99 | 0.0181 | 0.0004 | |||||

| H1BA34 / Huntington Bancshares Incorporated - Depositary Receipt (Common Stock) | 0.10 | -1.96 | 0.0180 | 0.0002 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.10 | -0.99 | 0.0180 | 0.0003 | |||||

| Bacardi-Martini BV / DBT (US05634WAB81) | 0.10 | -2.91 | 0.0180 | -0.0000 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.10 | -1.00 | 0.0179 | 0.0003 | |||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 0.10 | -1.01 | 0.0176 | 0.0003 | |||||

| CZR / Caesars Entertainment, Inc. | 0.00 | -74.68 | 0.10 | -79.66 | 0.0175 | -0.0658 | |||

| Beacon Funding Trust / DBT (US073952AB93) | 0.10 | -5.94 | 0.0172 | -0.0005 | |||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 0.10 | -5.94 | 0.0172 | -0.0005 | |||||

| Aon North America Inc / DBT (US03740MAF77) | 0.10 | -5.94 | 0.0171 | -0.0006 | |||||

| US69448FAA93 / Pacific Life Insurance Co | 0.09 | -6.12 | 0.0165 | -0.0006 | |||||

| US03522AAJ97 / Anheuser-Busch Cos LLC / Anheuser-Busch InBev Worldwide Inc | 0.09 | -31.54 | 0.0160 | -0.0067 | |||||

| US46647PCU84 / JPMorgan Chase & Co | 0.09 | 0.00 | 0.0159 | 0.0004 | |||||

| US38141GYB49 / Goldman Sachs Group Inc/The | 0.09 | 0.00 | 0.0157 | 0.0005 | |||||

| US06051GKD06 / Bank of America Corp | 0.09 | 0.00 | 0.0155 | 0.0005 | |||||

| US61747YED31 / Morgan Stanley | 0.09 | 0.00 | 0.0153 | 0.0004 | |||||

| US6174468X01 / Morgan Stanley | 0.08 | 0.00 | 0.0151 | 0.0005 | |||||

| FIDS / FNB, Inc. | 0.08 | -1.18 | 0.0151 | 0.0001 | |||||

| GPK / Graphic Packaging Holding Company | 0.00 | -75.30 | 0.08 | -79.41 | 0.0151 | -0.0563 | |||

| US775109CJ87 / Rogers Communications Inc | 0.08 | -3.49 | 0.0150 | -0.0001 | |||||

| CVS / CVS Health Corporation | 0.08 | -23.15 | 0.0149 | -0.0040 | |||||

| US37045VAJ98 / General Motors Co | 0.08 | -4.60 | 0.0149 | -0.0004 | |||||

| AMBP / Ardagh Metal Packaging SA | 0.02 | -73.22 | 0.08 | -63.72 | 0.0148 | -0.0247 | |||

| US68389XCK90 / ORACLE CORPORATION | 0.08 | -4.71 | 0.0145 | -0.0004 | |||||

| US55336VBT61 / MPLX LP | 0.08 | -6.98 | 0.0145 | -0.0006 | |||||

| US031162DR88 / Amgen Inc | 0.08 | -1.23 | 0.0145 | 0.0003 | |||||

| US665859AX29 / NTRS 6 1/8 11/02/32 | 0.08 | -1.25 | 0.0143 | 0.0002 | |||||

| US75884RAX17 / Regency Centers, L.P. | 0.08 | 1.28 | 0.0143 | 0.0005 | |||||

| NRG / NRG Energy, Inc. | 0.00 | -80.12 | 0.08 | -70.85 | 0.0142 | -0.0331 | |||

| LEA / Lear Corporation | 0.00 | -77.59 | 0.08 | -78.47 | 0.0142 | -0.0499 | |||

| DELL / Dell Technologies Inc. | 0.00 | -75.35 | 0.08 | -73.22 | 0.0142 | -0.0375 | |||

| US06051GKA66 / Bank of America Corp | 0.08 | 1.32 | 0.0138 | 0.0004 | |||||

| WCC / WESCO International, Inc. | 0.00 | -75.73 | 0.08 | -77.42 | 0.0138 | -0.0458 | |||

| US760759BB57 / Republic Services Inc | 0.08 | 1.33 | 0.0137 | 0.0004 | |||||

| US031162DT45 / Amgen Inc | 0.08 | -5.00 | 0.0137 | -0.0004 | |||||

| USFD / US Foods Holding Corp. | 0.00 | -80.06 | 0.08 | -78.26 | 0.0136 | -0.0466 | |||

| ERAC USA Finance LLC / DBT (US26884TAZ57) | 0.08 | -25.74 | 0.0135 | -0.0042 | |||||

| US06051GJT76 / Bank of America Corp | 0.08 | -39.02 | 0.0135 | -0.0081 | |||||

| US842587DF14 / Southern Co/The | 0.07 | 0.00 | 0.0133 | 0.0004 | |||||

| US512807AU29 / Lam Research Corp. | 0.07 | 0.00 | 0.0133 | 0.0004 | |||||

| US52532XAF24 / LEIDOS INC COMPANY GUAR 05/30 4.375 | 0.07 | -24.74 | 0.0131 | -0.0039 | |||||

| US25746UDJ51 / Dominion Energy, Inc. | 0.07 | 0.00 | 0.0131 | 0.0004 | |||||

| RRR / Red Rock Resorts, Inc. | 0.00 | -74.81 | 0.07 | -75.84 | 0.0130 | -0.0391 | |||

| CDW / CDW Corporation | 0.00 | 0.07 | 0.0129 | 0.0129 | |||||

| SPH / Suburban Propane Partners, L.P. - Limited Partnership | 0.00 | -81.98 | 0.07 | -83.83 | 0.0129 | -0.0638 | |||

| US337738AU25 / Fiserv Inc | 0.07 | 0.00 | 0.0128 | 0.0004 | |||||

| US55261FAS39 / M&T Bank Corp | 0.07 | 0.00 | 0.0126 | 0.0003 | |||||

| US485134BR00 / Kansas City Power & Light Co. | 0.07 | -5.41 | 0.0126 | -0.0004 | |||||

| KOP / Koppers Holdings Inc. | 0.00 | -74.57 | 0.07 | -73.46 | 0.0125 | -0.0329 | |||

| BYD / Boyd Gaming Corporation | 0.00 | -76.88 | 0.07 | -77.38 | 0.0124 | -0.0408 | |||

| WCNCN / Waste Connections Inc | 0.07 | 0.00 | 0.0124 | 0.0004 | |||||

| APA Corp / DBT (US03743QAS75) | 0.07 | -10.67 | 0.0121 | -0.0011 | |||||

| US95040QAL86 / Welltower Inc | 0.07 | 0.00 | 0.0121 | 0.0004 | |||||

| US210385AC48 / Constellation Energy Generation LLC | 0.07 | 0.00 | 0.0121 | 0.0004 | |||||

| US761713BW55 / Reynolds American Inc | 0.07 | -4.35 | 0.0120 | -0.0001 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0.07 | -1.49 | 0.0119 | 0.0002 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0.07 | 1.54 | 0.0119 | 0.0004 | |||||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 0.07 | -1.49 | 0.0118 | 0.0000 | |||||

| US682680AU71 / ONEOK Inc | 0.06 | 0.00 | 0.0116 | 0.0003 | |||||

| US65339KCP30 / NextEra Energy Capital Holdings Inc | 0.06 | 0.00 | 0.0116 | 0.0003 | |||||

| US316773CV06 / Fifth Third Bancorp | 0.06 | 1.59 | 0.0115 | 0.0004 | |||||

| US00287YBV02 / ABBVIE INC 2.95% 11/21/2026 | 0.06 | 0.00 | 0.0114 | 0.0003 | |||||

| DVN / Devon Energy Corporation | 0.00 | -65.51 | 0.06 | -71.36 | 0.0114 | -0.0271 | |||

| US00206RML32 / AT&T Inc | 0.06 | 0.00 | 0.0114 | 0.0004 | |||||

| HRI / Herc Holdings Inc. | 0.00 | 0.06 | 0.0113 | 0.0113 | |||||

| MMC / Marsh & McLennan Companies, Inc. - Depositary Receipt (Common Stock) | 0.06 | 1.69 | 0.0108 | 0.0003 | |||||

| US302520AC56 / FNB Corp/PA | 0.06 | -1.67 | 0.0107 | 0.0003 | |||||

| US92857WBY57 / Vodafone Group PLC | 0.06 | -4.84 | 0.0107 | -0.0002 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 0.06 | 0.00 | 0.0106 | 0.0003 | |||||

| VST / Vistra Corp. | 0.00 | -80.00 | 0.06 | -76.13 | 0.0105 | -0.0321 | |||

| TILE / Interface, Inc. | 0.00 | -79.92 | 0.06 | -80.28 | 0.0103 | -0.0401 | |||

| ST / Sensata Technologies Holding plc | 0.00 | 0.06 | 0.0103 | 0.0103 | |||||

| US174610AW56 / CITIZENS FINANCIAL GROUP SUBORDINATED 09/32 2.638 | 0.06 | -31.33 | 0.0103 | -0.0042 | |||||

| US00287YBX67 / CORP. NOTE | 0.06 | 0.00 | 0.0102 | 0.0003 | |||||

| US87264ACQ67 / T-Mobile USA Inc | 0.06 | 0.00 | 0.0101 | 0.0003 | |||||

| GMS / GMS Inc. | 0.00 | -77.69 | 0.06 | -78.87 | 0.0101 | -0.0363 | |||

| US025537AX91 / American Electric Power Co Inc | 0.06 | 0.00 | 0.0101 | 0.0002 | |||||

| US097023DC69 / Boeing Co/The | 0.06 | -55.65 | 0.0100 | -0.0118 | |||||

| BCO / The Brink's Company | 0.00 | -81.50 | 0.06 | -84.06 | 0.0100 | -0.0503 | |||

| US91159HJA95 / US Bancorp | 0.06 | 1.85 | 0.0099 | 0.0004 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 0.06 | 0.00 | 0.0099 | 0.0002 | |||||

| EPC / Edgewell Personal Care Company | 0.00 | -79.19 | 0.06 | -81.79 | 0.0099 | -0.0429 | |||

| US776743AL02 / ROPER TECHNOLOGIES INC 1.75% 02/15/2031 | 0.06 | 1.85 | 0.0099 | 0.0003 | |||||

| SAIC / Science Applications International Corporation | 0.00 | -83.79 | 0.05 | -81.31 | 0.0098 | -0.0407 | |||

| US871829BC08 / Sysco Corp. | 0.05 | 0.00 | 0.0097 | 0.0003 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0.05 | -32.05 | 0.0096 | -0.0041 | |||||

| US666807BN13 / Northrop Grumman Corp | 0.05 | 0.00 | 0.0096 | 0.0003 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.05 | -3.64 | 0.0096 | -0.0001 | |||||

| US09062XAH61 / Biogen Inc | 0.05 | 1.92 | 0.0095 | 0.0003 | |||||

| US11135FBL40 / Broadcom Inc | 0.05 | -1.89 | 0.0094 | 0.0002 | |||||

| US87264ACW36 / T-Mobile USA, Inc. | 0.05 | -3.70 | 0.0093 | -0.0002 | |||||

| US65473QBF90 / NiSource, Inc. | 0.05 | -5.56 | 0.0093 | -0.0002 | |||||

| SNV.PRD / Synovus Financial Corp. - Preferred Stock | 0.05 | -1.96 | 0.0091 | 0.0002 | |||||

| US46647PDR47 / JPMorgan Chase & Co | 0.05 | 0.00 | 0.0091 | 0.0002 | |||||

| Bank of America Corp / DBT (US06051GMA49) | 0.05 | 0.00 | 0.0091 | 0.0002 | |||||

| ASH / Ashland Inc. | 0.00 | 0.05 | 0.0090 | 0.0090 | |||||

| Mars Inc / DBT (US571676BA26) | 0.05 | 0.0089 | 0.0089 | ||||||

| US15135UAM18 / Cenovus Energy Inc | 0.05 | 0.00 | 0.0089 | 0.0002 | |||||

| URI / United Rentals, Inc. | 0.00 | 0.05 | 0.0089 | 0.0089 | |||||

| US90265EAS90 / UDR Inc | 0.05 | -2.00 | 0.0089 | 0.0001 | |||||

| WPC / W. P. Carey Inc. | 0.05 | -51.00 | 0.0088 | -0.0087 | |||||

| US378272BD96 / Glencore Funding LLC | 0.05 | 0.00 | 0.0087 | 0.0003 | |||||

| ENR / Energizer Holdings, Inc. | 0.00 | -76.97 | 0.05 | -82.61 | 0.0086 | -0.0396 | |||

| US22822VAM37 / Crown Castle International Corp. | 0.05 | -43.37 | 0.0086 | -0.0060 | |||||

| M1TB34 / M&T Bank Corporation - Depositary Receipt (Common Stock) | 0.05 | -2.13 | 0.0084 | 0.0002 | |||||

| US06051GHX07 / Bank of America Corp | 0.05 | 0.00 | 0.0083 | 0.0003 | |||||

| AXTA / Axalta Coating Systems Ltd. | 0.00 | 0.05 | 0.0081 | 0.0081 | |||||

| US21036PBD96 / Constellation Brands Inc | 0.04 | -4.35 | 0.0080 | -0.0001 | |||||

| US023135BZ81 / AMAZON.COM INC 2.1% 05/12/2031 | 0.04 | 2.33 | 0.0079 | 0.0003 | |||||

| US110122CR72 / Bristol-Myers Squibb Co. | 0.04 | -4.44 | 0.0078 | -0.0003 | |||||

| Charter Communications Operating LLC / Charter Communications Operating Capital / DBT (US161175CR30) | 0.04 | -46.75 | 0.0075 | -0.0061 | |||||

| US501044DG38 / Kroger Co/The | 0.04 | -4.76 | 0.0072 | -0.0002 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0.04 | 0.00 | 0.0072 | 0.0001 | |||||

| US26441CAY12 / Duke Energy Corp | 0.04 | -4.76 | 0.0072 | -0.0002 | |||||

| US71951QAA04 / Physicians Realty L.P. | 0.04 | 0.00 | 0.0071 | 0.0002 | |||||

| US38141GZM94 / Goldman Sachs Group Inc/The | 0.04 | -55.68 | 0.0071 | -0.0083 | |||||

| US12594KAB89 / CNH Industrial NV | 0.04 | 0.00 | 0.0071 | 0.0002 | |||||

| US87264ABN46 / T-MOBILE USA INC 3.3% 02/15/2051 | 0.04 | -4.88 | 0.0070 | -0.0002 | |||||

| US00206RFS67 / AT&T Inc | 0.04 | -5.00 | 0.0069 | -0.0001 | |||||

| ECVT / Ecovyst Inc. | 0.01 | -78.11 | 0.04 | -76.25 | 0.0069 | -0.0211 | |||

| US928563AL97 / VMware Inc | 0.04 | 0.00 | 0.0069 | 0.0002 | |||||

| US023608AL60 / Ameren Corp | 0.04 | 0.00 | 0.0069 | 0.0002 | |||||

| US47233JDX37 / Jefferies Group LLC | 0.04 | 0.00 | 0.0067 | 0.0001 | |||||

| US907818FH61 / Union Pacific Corp. | 0.04 | 0.00 | 0.0066 | 0.0002 | |||||

| MBC / MasterBrand, Inc. | 0.00 | 0.04 | 0.0065 | 0.0065 | |||||

| R1FC34 / Regions Financial Corporation - Depositary Receipt (Common Stock) | 0.04 | -59.77 | 0.0064 | -0.0088 | |||||

| US378272BH01 / Glencore Funding LLC | 0.04 | -5.41 | 0.0063 | -0.0002 | |||||

| Shell Finance US Inc / DBT (US822905AE56) | 0.04 | -2.78 | 0.0063 | -0.0001 | |||||

| US920253AF89 / Valmont Industries Inc. | 0.04 | -5.41 | 0.0063 | -0.0003 | |||||

| US05348EBA64 / AvalonBay Communities Inc | 0.03 | 0.00 | 0.0062 | 0.0002 | |||||

| US69047QAD43 / Ovintiv Inc | 0.03 | -55.26 | 0.0061 | -0.0073 | |||||

| US92826CAH51 / Visa, Inc. | 0.03 | 3.03 | 0.0061 | 0.0002 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0.03 | -5.88 | 0.0059 | -0.0001 | |||||

| BHC / Bausch Health Companies Inc. | 0.01 | -60.71 | 0.03 | -75.00 | 0.0058 | -0.0094 | |||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 0.0057 | 0.0001 | |||||

| US276480AB69 / Eastern Gas Transmission & Storage Inc | 0.03 | -6.06 | 0.0057 | -0.0002 | |||||

| US92343VGB45 / Verizon Communications Inc | 0.03 | -3.12 | 0.0056 | -0.0001 | |||||

| US920253AE15 / Valmont Industries Inc. | 0.03 | -9.09 | 0.0055 | -0.0004 | |||||

| Mars Inc / DBT (US571676BC81) | 0.03 | 0.0052 | 0.0052 | ||||||

| WFC000001 USD CALL CHF PUT / DFE (000000000) | 0.03 | 0.0051 | 0.0051 | ||||||

| US23291KAH86 / DHR 2.6 11/15/29 | 0.03 | 0.00 | 0.0050 | 0.0002 | |||||

| US87612GAA94 / Targa Resources Corp | 0.03 | 0.00 | 0.0049 | 0.0001 | |||||

| US832248BC11 / SMITHFIELD FOODS INC SR UNSECURED 144A 10/30 3 | 0.03 | -50.94 | 0.0048 | -0.0045 | |||||

| US00846UAM36 / AGILENT TECHNOLOGIES INC SR UNSECURED 06/30 2.1 | 0.03 | 0.00 | 0.0048 | 0.0002 | |||||

| US92343EAM49 / VeriSign Inc | 0.03 | 0.00 | 0.0047 | 0.0001 | |||||

| US682680AV54 / ONEOK Inc | 0.03 | -7.41 | 0.0045 | -0.0002 | |||||

| US78081BAH69 / Royalty Pharma PLC | 0.02 | 0.00 | 0.0044 | 0.0002 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0.02 | -8.00 | 0.0043 | -0.0002 | |||||

| US50077LAB27 / Kraft Heinz Foods Co | 0.02 | -57.41 | 0.0042 | -0.0052 | |||||

| HCA Inc / DBT (US404121AL94) | 0.02 | -4.17 | 0.0042 | -0.0001 | |||||

| US30161NBH35 / Exelon Corp | 0.02 | -4.35 | 0.0040 | -0.0001 | |||||

| US092113AT65 / BLACK HILLS CORP SR UNSECURED 06/30 2.5 | 0.02 | 0.00 | 0.0040 | 0.0001 | |||||

| US55903VBD47 / Warnermedia Holdings Inc | 0.02 | -60.38 | 0.0039 | -0.0055 | |||||

| US161175BL78 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.02 | 0.00 | 0.0038 | 0.0001 | |||||

| US33767BAC37 / FIRSTENERGY TRANSMISSION SR UNSECURED 144A 04/49 4.55 | 0.02 | 0.00 | 0.0038 | -0.0000 | |||||

| US05526DBU81 / BAT Capital Corp | 0.02 | -9.09 | 0.0038 | -0.0001 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.0036 | 0.0001 | |||||

| US20030NCZ24 / Comcast Corp. | 0.02 | -4.76 | 0.0036 | -0.0001 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.0036 | 0.0001 | |||||

| US097023CR48 / Boeing Co. | 0.02 | -5.00 | 0.0036 | -0.0001 | |||||

| US02079KAF49 / Alphabet Inc | 0.02 | -5.00 | 0.0034 | -0.0001 | |||||

| US01748TAB70 / Allegion PLC | 0.02 | 0.00 | 0.0034 | 0.0001 | |||||

| STGW / Stagwell Inc. | 0.00 | -94.84 | 0.02 | -96.46 | 0.0031 | -0.0808 | |||

| US68389XBX21 / ORACLE CORP SR UNSECURED 04/50 3.6 | 0.02 | -67.92 | 0.0030 | -0.0063 | |||||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | 0.02 | 0.0030 | 0.0030 | ||||||

| I1RP34 / Trane Technologies plc - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.0027 | 0.0000 | |||||

| I1RP34 / Trane Technologies plc - Depositary Receipt (Common Stock) | 0.01 | -6.67 | 0.0026 | -0.0001 | |||||

| PURCHASED NZD / SOLD USD / DFE (000000000) | 0.01 | 0.0021 | 0.0021 | ||||||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | 0.01 | 0.0013 | 0.0013 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0.01 | 0.0010 | 0.0010 | ||||||

| US75902AAA60 / Regional Diversified Funding 2005-1 Ltd | 0.00 | -60.00 | 0.0008 | -0.0011 | |||||

| PURCHASED USD / SOLD NZD / DFE (000000000) | 0.00 | 0.0007 | 0.0007 | ||||||

| US00206RKB77 / AT&T INC 3.850000% 06/01/2060 | 0.00 | -89.29 | 0.0006 | -0.0044 | |||||

| US11135FBQ37 / Broadcom Inc | 0.00 | 0.00 | 0.0004 | 0.0000 | |||||

| US 10YR NOTE (CBT)SEP25 / DIR (000000000) | 0.00 | 0.0004 | 0.0004 | ||||||

| 524ESC886 / LEHMAN BRTH HLD RICI ESCROW | 0.04 | 0.00 | 0.00 | 0.0001 | 0.0000 | ||||

| AXL / American Axle & Manufacturing Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0208 | ||||

| VIAV / Viavi Solutions Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0499 | ||||

| OI / O-I Glass, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0217 | ||||

| UBC002395 USD CALL CHF PUT / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| US ULTRA BOND CBT SEP25 / DIR (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| UBP002336 GBP PUT USD CALL / DFE (000000000) | -0.01 | -0.0016 | -0.0016 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.02 | -0.0028 | -0.0028 | ||||||

| WFP000016 NZD PUT USD CALL / DFE (000000000) | -0.02 | -0.0036 | -0.0036 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | -0.02 | -0.0040 | -0.0040 | ||||||

| WFC002013 EUR CALL USD PUT / DFE (000000000) | -0.03 | -0.0048 | -0.0048 | ||||||

| WFP000014 USD PUT CHF CALL / DFE (000000000) | -0.03 | -0.0050 | -0.0050 | ||||||

| MSC002396 AUD CALL USD PUT / DFE (000000000) | -0.03 | -0.0052 | -0.0052 | ||||||

| BAC002366 USD CALL NOK PUT / DFE (000000000) | -0.03 | -0.0062 | -0.0062 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.05 | -0.0087 | -0.0087 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.05 | -0.0092 | -0.0092 | ||||||

| BAP002356 USD PUT NOK CALL / DFE (000000000) | -0.06 | -0.0109 | -0.0109 | ||||||

| MSP002385 AUD PUT USD CALL / DFE (000000000) | -0.06 | -0.0110 | -0.0110 | ||||||

| BAC002365 GBP CALL USD PUT / DFE (000000000) | -0.08 | -0.0142 | -0.0142 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.09 | -0.0160 | -0.0160 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.13 | -0.0229 | -0.0229 | ||||||

| US LONG BOND(CBT) SEP25 / DIR (000000000) | -0.19 | -0.0346 | -0.0346 |