Statistik Asas

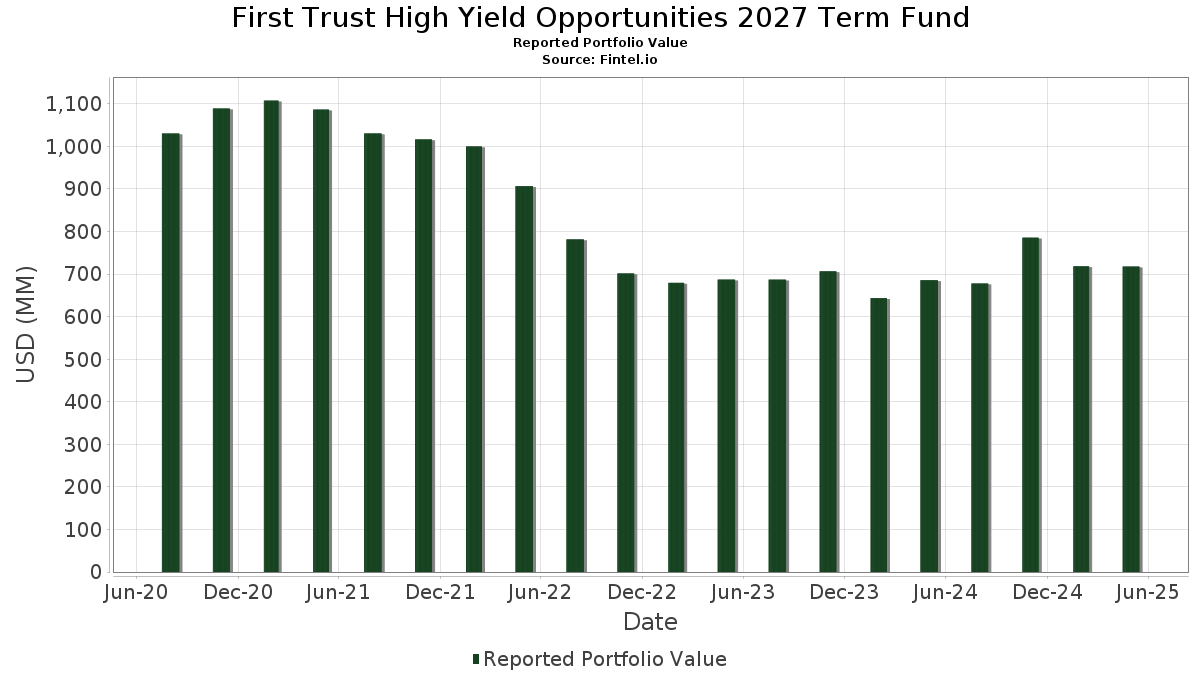

| Nilai Portfolio | $ 717,881,974 |

| Kedudukan Semasa | 280 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

First Trust High Yield Opportunities 2027 Term Fund telah mendedahkan 280 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 717,881,974 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas First Trust High Yield Opportunities 2027 Term Fund ialah SS&C Technologies Holdings Inc. (US:US78466CAC01) , Sinclair Television Group Inc (US:US829259AW02) , GPC Merger Sub Inc (US:US384701AA65) , Restaurant Brands International Inc. (US:QSR) , and Panther BF Aggregator 2 LP / Panther Finance Co Inc (XX:US69867DAC20) . Kedudukan baharu First Trust High Yield Opportunities 2027 Term Fund termasuk SS&C Technologies Holdings Inc. (US:US78466CAC01) , Sinclair Television Group Inc (US:US829259AW02) , GPC Merger Sub Inc (US:US384701AA65) , Restaurant Brands International Inc. (US:QSR) , and Panther BF Aggregator 2 LP / Panther Finance Co Inc (XX:US69867DAC20) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 8.74 | 1.5811 | 1.5811 | ||

| 6.92 | 1.2522 | 1.2522 | ||

| 6.42 | 1.1617 | 0.9605 | ||

| 4.75 | 0.8598 | 0.8598 | ||

| 5.45 | 0.9867 | 0.8584 | ||

| 8.70 | 1.5755 | 0.8313 | ||

| 4.43 | 0.8010 | 0.8010 | ||

| 3.63 | 0.6571 | 0.6571 | ||

| 3.03 | 0.5485 | 0.5485 | ||

| 2.90 | 0.5251 | 0.5251 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 15.85 | 2.8691 | -1.1943 | ||

| 2.98 | 0.5387 | -1.1523 | ||

| 3.07 | 0.5566 | -0.8523 | ||

| 4.74 | 0.8570 | -0.7910 | ||

| 1.19 | 0.2160 | -0.6668 | ||

| 6.44 | 1.1650 | -0.5720 | ||

| 0.37 | 0.0676 | -0.5183 | ||

| 1.20 | 0.2163 | -0.4269 | ||

| 1.86 | 0.3358 | -0.3821 | ||

| 2.90 | 0.5248 | -0.3577 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-23 untuk tempoh pelaporan 2025-05-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US78466CAC01 / SS&C Technologies Holdings Inc. | 15.85 | -30.40 | 2.8691 | -1.1943 | |||||

| US829259AW02 / Sinclair Television Group Inc | 13.99 | 1.06 | 2.5322 | 0.0627 | |||||

| US384701AA65 / GPC Merger Sub Inc | 13.72 | -1.27 | 2.4831 | 0.0040 | |||||

| QSR / Restaurant Brands International Inc. | 13.21 | 0.89 | 2.3908 | 0.0553 | |||||

| Panther Escrow Issuer LLC / DBT (US69867RAA59) | 9.19 | 36.71 | 1.6637 | 0.4643 | |||||

| COTIVITI INC / LON (US22164MAD92) | 9.07 | 0.34 | 1.6410 | 0.0291 | |||||

| US69867DAC20 / Panther BF Aggregator 2 LP / Panther Finance Co Inc | 8.74 | 0.05 | 1.5828 | 0.0235 | |||||

| BLDR / Builders FirstSource, Inc. | 8.74 | 1.5811 | 1.5811 | ||||||

| Lightning Power LLC / DBT (US53229KAA79) | 8.70 | 108.68 | 1.5755 | 0.8313 | |||||

| US911365BQ63 / United Rentals North America, Inc. | 8.10 | -9.37 | 1.4652 | -0.1283 | |||||

| Baldwin Insurance Group Holdings LLC / Baldwin Insurance Group Holdings Finance / DBT (US05825XAA72) | 8.01 | 6.74 | 1.4497 | 0.1110 | |||||

| Ardonagh Finco Ltd / DBT (US039853AA46) | 7.76 | 27.76 | 1.4046 | 0.3210 | |||||

| US01883LAE39 / Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer | 7.70 | 0.23 | 1.3935 | 0.0232 | |||||

| Select Medical Corp / DBT (US816196AV14) | 7.60 | -0.38 | 1.3751 | 0.0146 | |||||

| POST / Post Holdings, Inc. | 7.44 | 0.91 | 1.3465 | 0.0312 | |||||

| US59909TAC80 / Milano Acqusition/DXC State & Local HHS First-lien Term Loan 400 2027-08-03 | 7.35 | 2.64 | 1.3298 | 0.0527 | |||||

| US031921AB57 / AmWINS Group Inc | 7.22 | -3.27 | 1.3070 | -0.0247 | |||||

| US28415LAA17 / Elastic NV | 7.13 | -0.65 | 1.2908 | 0.0102 | |||||

| US01883LAA17 / Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer 6.75% 10/15/2027 144A | 7.07 | 0.24 | 1.2792 | 0.0214 | |||||

| Acrisure LLC / Acrisure Finance Inc / DBT (US00489LAL71) | 6.92 | 20.98 | 1.2525 | 0.2320 | |||||

| US073685AD12 / Beacon Roofing Supply Inc 4.875% 11/01/2025 144a Bond | 6.92 | 1.2522 | 1.2522 | ||||||

| US76680RAJ68 / CORP. NOTE | 6.83 | 57.86 | 1.2366 | 0.4645 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 6.72 | 0.39 | 1.2170 | 0.0222 | |||||

| US87901JAJ43 / TEGNA Inc | 6.44 | -33.90 | 1.1650 | -0.5720 | |||||

| ACRISURE LLC / LON (US00488PAU93) | 6.42 | 468.97 | 1.1617 | 0.9605 | |||||

| US60337JAA43 / Minerva Merger Sub Inc | 6.29 | -0.69 | 1.1393 | 0.0085 | |||||

| LEIA FINCO US LLC / LON (US52526CAD11) | 6.07 | -0.83 | 1.0980 | 0.0066 | |||||

| US04624VAB53 / AssuredPartners Inc | 5.97 | -1.09 | 1.0799 | 0.0038 | |||||

| INFA / Informatica Inc. | 5.81 | -8.15 | 1.0508 | -0.0768 | |||||

| US18064PAC32 / Clarivate Science Holdings Corp | 5.69 | 1.46 | 1.0303 | 0.0293 | |||||

| EVKG / Ever-Glory International Group, Inc. | 5.45 | 658.14 | 0.9867 | 0.8584 | |||||

| OTEX / Open Text Corporation | 5.37 | 1.17 | 0.9725 | 0.0250 | |||||

| US513075BW03 / Lamar Media Corp | 5.29 | -0.02 | 0.9583 | 0.0135 | |||||

| ONEDIGITAL BORROWER LLC / LON (US68252HAB06) | 5.25 | -2.00 | 0.9505 | -0.0054 | |||||

| IHRT / iHeartMedia, Inc. | 5.13 | -16.94 | 0.9291 | -0.1735 | |||||

| US126307BH94 / CSC Holdings LLC | 5.06 | -7.76 | 0.9151 | -0.0626 | |||||

| US90290MAE12 / US Foods Inc | 5.05 | 0.78 | 0.9146 | 0.0201 | |||||

| US65343HAA95 / Nexstar Escrow, Inc. | 5.05 | 0.68 | 0.9140 | 0.0193 | |||||

| Quikrete Holdings Inc / DBT (US74843PAB67) | 5.03 | 18.30 | 0.9104 | 0.1518 | |||||

| US44332PAG63 / HUB International Ltd | 4.90 | 1.07 | 0.8864 | 0.0220 | |||||

| US038522AQ17 / Aramark Services Inc | 4.88 | 0.66 | 0.8841 | 0.0184 | |||||

| US44332EAP16 / Hub International Ltd., Term Loan | 4.83 | 1.68 | 0.8741 | 0.0269 | |||||

| ALERA GROUP INTERMEDIATE / LON (000000000) | 4.75 | 0.8598 | 0.8598 | ||||||

| US62482BAA08 / Mozart Debt Merger Sub Inc | 4.74 | -48.74 | 0.8570 | -0.7910 | |||||

| ONEDIGITAL BORROWER LLC / LON (US68277FAN96) | 4.73 | -0.27 | 0.8559 | 0.0100 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 4.73 | -0.06 | 0.8554 | 0.0118 | |||||

| Shift4 Payments LLC / Shift4 Payments Finance Sub Inc / DBT (US82453AAB35) | 4.56 | 37.20 | 0.8245 | 0.2322 | |||||

| Miter Brands Acquisition Holdco Inc / MIWD Borrower LLC / DBT (US60672JAA79) | 4.49 | 86.31 | 0.8127 | 0.3827 | |||||

| Opal Bidco SAS / DBT (US68348BAA17) | 4.43 | 0.8010 | 0.8010 | ||||||

| US62482BAB80 / MOZART DEBT MERGER SUB INC | 4.39 | -6.38 | 0.7945 | -0.0420 | |||||

| FILTRATION GROUP CORP / LON (US31732FAV85) | 4.29 | -0.21 | 0.7760 | 0.0095 | |||||

| US38016LAA35 / Go Daddy Operating Co LLC / GD Finance Co Inc | 4.19 | -32.08 | 0.7580 | -0.3419 | |||||

| TRUIST INSURANCE HOLDING / LON (US89788VAE20) | 4.00 | 254.92 | 0.7241 | 0.5231 | |||||

| US896288AC18 / TriNet Group, Inc. | 3.87 | 0.68 | 0.7014 | 0.0148 | |||||

| US721283AA72 / PIKE CORP 5.5% 09/01/2028 144A | 3.83 | 1.40 | 0.6927 | 0.0193 | |||||

| US345370CX67 / Ford Motor Co | 3.83 | -1.29 | 0.6925 | 0.0012 | |||||

| US29272WAD11 / Energizer Holdings, Inc. | 3.77 | 0.35 | 0.6824 | 0.0121 | |||||

| AmWINS Group Inc / DBT (US031921AC31) | 3.76 | 0.27 | 0.6813 | 0.0116 | |||||

| US668771AL22 / NortonLifeLock Inc | 3.76 | 0.08 | 0.6797 | 0.0103 | |||||

| US058498AW66 / Ball Corp | 3.75 | 1.05 | 0.6787 | 0.0167 | |||||

| Ryan Specialty LLC / DBT (US78351GAA31) | 3.69 | -0.03 | 0.6680 | 0.0095 | |||||

| TransDigm Inc / DBT (US893647BY22) | 3.63 | 0.6571 | 0.6571 | ||||||

| US98980BAA17 / ZipRecruiter, Inc. | 3.55 | 46.94 | 0.6431 | 0.2116 | |||||

| US31556TAC36 / Fertitta Entertainment LLC / Fertitta Entertainment Finance Co Inc | 3.54 | -2.32 | 0.6402 | -0.0058 | |||||

| US893647BR70 / TransDigm, Inc. | 3.47 | -21.05 | 0.6274 | -0.1558 | |||||

| HRI / Herc Holdings Inc. | 3.44 | 7.88 | 0.6222 | 0.0536 | |||||

| Performance Food Group Inc / DBT (US71376LAF76) | 3.34 | 0.30 | 0.6050 | 0.0105 | |||||

| US1248EPCT83 / CCO Holdings LLC | 3.33 | 0.57 | 0.6034 | 0.0121 | |||||

| Raven Acquisition Holdings LLC / DBT (US75420NAA19) | 3.33 | 0.70 | 0.6024 | 0.0127 | |||||

| X CORP / LON (US90184NAK46) | 3.30 | 118.48 | 0.5972 | 0.3277 | |||||

| VETSTRATEGY CANADA HOLDINGS INC / LON (XAC9600DAD57) | 3.28 | -0.12 | 0.5940 | 0.0079 | |||||

| US45567YAN58 / MH Sub I, LLC 2023 Term Loan | 3.23 | -1.91 | 0.5852 | -0.0028 | |||||

| US18064PAD15 / Clarivate Science Holdings Corp | 3.12 | 9.09 | 0.5649 | 0.0545 | |||||

| SKOPIMA CONSILIO PARENT LLC / LON (US36171NAG16) | 3.10 | -0.10 | 0.5613 | 0.0076 | |||||

| Belron UK Finance PLC / DBT (US080782AA38) | 3.09 | 0.52 | 0.5586 | 0.0108 | |||||

| BCO / The Brink's Company | 3.08 | 0.10 | 0.5573 | 0.0087 | |||||

| US05352TAA79 / AVANTOR FUNDING INC 4.625% 07/15/2028 144A | 3.07 | -61.07 | 0.5566 | -0.8523 | |||||

| US810186AS55 / CORP. NOTE | 3.05 | 0.69 | 0.5517 | 0.0117 | |||||

| Waste Pro USA Inc / DBT (US94107JAC71) | 3.03 | 1.27 | 0.5486 | 0.0146 | |||||

| US05765WAA18 / TIBCO Software Inc | 3.03 | 0.5485 | 0.5485 | ||||||

| POST / Post Holdings, Inc. | 3.00 | -0.43 | 0.5436 | 0.0055 | |||||

| PROAMPAC PG BORROWER LLC / LON (US74274NAL73) | 3.00 | -27.21 | 0.5434 | -0.1923 | |||||

| US38869AAD90 / Graphic Packaging International LLC | 2.99 | 0.13 | 0.5410 | 0.0085 | |||||

| FCFS / FirstCash Holdings, Inc. | 2.98 | 0.30 | 0.5394 | 0.0093 | |||||

| US33767DAB10 / FirstCash Inc | 2.98 | 0.78 | 0.5393 | 0.0119 | |||||

| AMBP / Ardagh Metal Packaging S.A. | 2.98 | 24.64 | 0.5393 | 0.1129 | |||||

| US38016LAC90 / Go Daddy Operating Co LLC / GD Finance Co Inc | 2.98 | -68.60 | 0.5387 | -1.1523 | |||||

| HOWDEN GROUP HOLDINGS LTD / LON (XAG4712JAY82) | 2.95 | 68.34 | 0.5342 | 0.2213 | |||||

| Herc Holdings Escrow Inc / DBT (US42703NAB73) | 2.90 | 0.5251 | 0.5251 | ||||||

| BROADSTREET PARTNERS INC / LON (US11132VAY56) | 2.90 | -41.39 | 0.5248 | -0.3577 | |||||

| US73108RAB42 / Polaris Newco LLC USD Term Loan B | 2.87 | -3.04 | 0.5202 | -0.0087 | |||||

| US46266TAD00 / IQVIA Inc | 2.86 | -0.38 | 0.5184 | 0.0056 | |||||

| US36168QAQ73 / GFL Environmental Inc | 2.86 | 0.04 | 0.5169 | 0.0076 | |||||

| US92339LAA08 / VERDE PURCHASER LLC 10.5% 11/30/2030 144A | 2.85 | -2.20 | 0.5160 | -0.0040 | |||||

| US159864AG27 / Charles River Laboratories International Inc | 2.79 | -0.64 | 0.5045 | 0.0040 | |||||

| US579063AB46 / Condor Merger Sub Inc | 2.78 | -5.06 | 0.5027 | -0.0193 | |||||

| US29272WAF68 / Energizer Holdings Inc | 2.75 | -0.61 | 0.4983 | 0.0042 | |||||

| US92332YAB74 / Venture Global LNG, Inc. | 2.73 | -2.57 | 0.4943 | -0.0058 | |||||

| US92332YAD31 / Venture Global LNG Inc | 2.70 | -2.73 | 0.4894 | -0.0065 | |||||

| X CORP / LON (US90184NAG34) | 2.69 | 31.75 | 0.4860 | 0.1224 | |||||

| US131347CN48 / Calpine Corp | 2.63 | -26.35 | 0.4767 | -0.1612 | |||||

| US541056AA53 / Logan Merger Sub Inc | 2.61 | -5.44 | 0.4723 | -0.0200 | |||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 2.57 | 189.08 | 0.4647 | 0.3062 | |||||

| Wand NewCo 3 Inc / DBT (US933940AA60) | 2.54 | 89.20 | 0.4599 | 0.2202 | |||||

| US25470MAG42 / DISH Network Corp | 2.54 | 0.4593 | 0.4593 | ||||||

| US55316HAB15 / GENESEE+WYOMING INC TERM LOAN | 2.51 | 0.72 | 0.4539 | 0.0098 | |||||

| US00790RAB06 / Advanced Drainage Systems Inc | 2.48 | -0.08 | 0.4483 | 0.0061 | |||||

| US855170AA41 / Star Parent Inc | 2.40 | -1.28 | 0.4342 | 0.0008 | |||||

| US92346NAB55 / VeriFone Systems, Inc | 2.37 | 0.4295 | 0.4295 | ||||||

| XS2066744231 / Carnival PLC | 2.36 | 0.4268 | 0.4268 | ||||||

| TransDigm Inc / DBT (US893647BV82) | 2.33 | 0.21 | 0.4223 | 0.0071 | |||||

| US15963CAC01 / Chariot Buyer LLC, 1st Lien Term Loan | 2.32 | -0.51 | 0.4202 | 0.0040 | |||||

| US00184NAB38 / TRICORBRAUN HOLDINGS INC | 2.32 | -22.11 | 0.4191 | -0.1113 | |||||

| US70452AAA16 / Paysafe Finance PLC / Paysafe Holdings US Corp | 2.31 | -2.61 | 0.4184 | -0.0050 | |||||

| US44332EAP16 / Hub International Ltd., Term Loan | 2.26 | -18.03 | 0.4090 | -0.0827 | |||||

| BLDR / Builders FirstSource, Inc. | 2.24 | -1.59 | 0.4046 | -0.0005 | |||||

| US59155LAA08 / METIS MERGER SUB LLC | 2.23 | 259.77 | 0.4031 | 0.2926 | |||||

| OPAL US LLC / LON (XAF7000QAB77) | 2.23 | 0.4029 | 0.4029 | ||||||

| US857691AG41 / STATION CASINOS LLC SR UNSECURED 144A 02/28 4.5 | 2.22 | -14.82 | 0.4016 | -0.0631 | |||||

| Caesars Entertainment Inc / DBT (US12769GAD25) | 2.21 | 53.09 | 0.3994 | 0.1423 | |||||

| US410345AQ54 / Hanesbrands Inc | 2.20 | 0.3989 | 0.3989 | ||||||

| US90290MAH43 / US Foods, Inc. | 2.17 | 0.00 | 0.3936 | 0.0057 | |||||

| Avis Budget Car Rental LLC / Avis Budget Finance Inc / DBT (US053773BJ51) | 2.16 | 261.87 | 0.3917 | 0.2850 | |||||

| US655664AS97 / Nordstrom Inc. | 2.14 | -45.27 | 0.3877 | -0.3106 | |||||

| AssuredPartners Inc / DBT (US04624VAC37) | 2.14 | -0.97 | 0.3870 | 0.0018 | |||||

| Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer / DBT (US01883LAG86) | 2.13 | 0.57 | 0.3858 | 0.0077 | |||||

| PROJECT ALPHA INTERMEDIATE HOLDING INC / LON (000000000) | 2.12 | 0.3831 | 0.3831 | ||||||

| US14575EAA38 / Cars.com Inc | 2.10 | 0.43 | 0.3802 | 0.0072 | |||||

| US812127AA61 / Sealed Air Corp. | 2.09 | 0.19 | 0.3791 | 0.0062 | |||||

| US55760LAB36 / Madison IAQ LLC | 2.09 | 0.3787 | 0.3787 | ||||||

| US76774LAC19 / Ritchie Bros Holdings Inc | 2.07 | -0.53 | 0.3752 | 0.0034 | |||||

| US11135RAA32 / BroadStreet Partners Inc | 2.06 | 0.68 | 0.3731 | 0.0079 | |||||

| S1YM34 / Gen Digital Inc. - Depositary Receipt (Common Stock) | 2.05 | 0.98 | 0.3715 | 0.0089 | |||||

| US Foods Inc / DBT (US90290MAJ09) | 2.05 | -0.10 | 0.3706 | 0.0050 | |||||

| US18912UAA07 / Cloud Software Group Inc | 2.02 | 87.29 | 0.3656 | 0.1733 | |||||

| ALERA GROUP INTERMEDIATE / LON (000000000) | 2.01 | 0.3641 | 0.3641 | ||||||

| US513272AE49 / Lamb Weston Holdings Inc | 1.99 | 0.45 | 0.3599 | 0.0068 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 1.99 | 208.23 | 0.3594 | 0.2445 | |||||

| OTEX / Open Text Corporation | 1.96 | 1.24 | 0.3555 | 0.0094 | |||||

| US45763FAT57 / Inmar Inc 2023 Term Loan | 1.88 | 0.11 | 0.3403 | 0.0052 | |||||

| US12769GAA85 / Caesars Entertainment Inc | 1.87 | -1.16 | 0.3382 | 0.0009 | |||||

| US60855RAL42 / Molina Healthcare Inc | 1.86 | -53.90 | 0.3358 | -0.3821 | |||||

| US1248EPCE15 / CCO Holdings LLC / CCO Holdings Capital Corp | 1.83 | 2.46 | 0.3317 | 0.0126 | |||||

| US88632QAE35 / Picard Midco, Inc. | 1.83 | 1.55 | 0.3313 | 0.0098 | |||||

| US60855RAK68 / Molina Healthcare Inc | 1.83 | -49.25 | 0.3312 | -0.3119 | |||||

| US42704LAA26 / Herc Holdings, Inc. | 1.78 | -0.06 | 0.3226 | 0.0043 | |||||

| IRB HOLDING CORP / LON (US44988LAL18) | 1.78 | 193.40 | 0.3220 | 0.2138 | |||||

| VSTS / Vestis Corporation | 1.76 | 0.3189 | 0.3189 | ||||||

| Albion Financing 1 SARL / Aggreko Holdings Inc / DBT (US01330AAA43) | 1.75 | 0.3165 | 0.3165 | ||||||

| US48020RAB15 / Jones Deslauriers Insurance Management Inc | 1.75 | 13.46 | 0.3159 | 0.0414 | |||||

| BBD.A / Bombardier Inc. | 1.72 | 0.3115 | 0.3115 | ||||||

| EVKG / Ever-Glory International Group, Inc. | 1.72 | 468.21 | 0.3108 | 0.2568 | |||||

| US55337PAA03 / MIWD Holdco II LLC / MIWD Finance Corp | 1.70 | 0.3079 | 0.3079 | ||||||

| SS&C Technologies Inc / DBT (US78466CAD83) | 1.69 | 0.36 | 0.3056 | 0.0055 | |||||

| US29272WAC38 / Energizer Holdings Inc | 1.69 | 0.06 | 0.3050 | 0.0045 | |||||

| Standard Building Solutions Inc / DBT (US853191AA25) | 1.65 | 54.60 | 0.2984 | 0.1082 | |||||

| US45168RAS22 / Idera 2/21 2nd Lien 2/4/2029 | 1.59 | -3.46 | 0.2880 | -0.0062 | |||||

| US1248EPCS01 / CCO Holdings LLC / CCO Holdings Capital Corp. | 1.59 | 0.95 | 0.2877 | 0.0068 | |||||

| Fiesta Purchaser Inc / DBT (US31659AAB26) | 1.58 | -0.82 | 0.2858 | 0.0018 | |||||

| CAMELOT US ACQUISITION LLC / LON (XAL2000AAG57) | 1.58 | 0.2852 | 0.2852 | ||||||

| US84857HAY62 / Spirit AeroSystems Inc | 1.57 | 0.2840 | 0.2840 | ||||||

| US87169DAB10 / Syneos Health (INC Research/inVentiv Health) T/L B (09/23) | 1.56 | 0.13 | 0.2830 | 0.0045 | |||||

| EquipmentShare.com Inc / DBT (US29450YAC30) | 1.54 | 0.2795 | 0.2795 | ||||||

| STARLIGHT PARENT LLC / LON (000000000) | 1.54 | 0.2790 | 0.2790 | ||||||

| US42226AAA51 / HealthEquity Inc | 1.45 | 0.63 | 0.2622 | 0.0054 | |||||

| F2IC34 / Fair Isaac Corporation - Depositary Receipt (Common Stock) | 1.45 | 0.2619 | 0.2619 | ||||||

| Clydesdale Acquisition Holdings Inc / DBT (US18972EAD76) | 1.43 | 0.2590 | 0.2590 | ||||||

| US683720AC08 / Open Text Holdings Inc | 1.37 | 1.18 | 0.2484 | 0.0063 | |||||

| WH BORROWER LLC / LON (000000000) | 1.37 | 0.2482 | 0.2482 | ||||||

| US103304BV23 / BOYD GAMING CORP 4.75% 06/15/2031 144A | 1.35 | -0.59 | 0.2439 | 0.0021 | |||||

| US698813AA06 / Papa John's International Inc | 1.34 | -1.69 | 0.2428 | -0.0006 | |||||

| US721283AB55 / PIKE CORP 8.625% 01/31/2031 144A | 1.33 | 0.2410 | 0.2410 | ||||||

| US159864AJ65 / Charles River Laboratories International Inc | 1.33 | -0.97 | 0.2409 | 0.0012 | |||||

| US75103AAA34 / Raising Cane's Restaurants LLC | 1.33 | -0.60 | 0.2404 | 0.0020 | |||||

| Alpha Generation LLC / DBT (US02073LAA98) | 1.30 | 0.2360 | 0.2360 | ||||||

| US13806CAA09 / Canpack SA / Canpack US LLC | 1.29 | 1.26 | 0.2328 | 0.0062 | |||||

| Fiesta Purchaser Inc / DBT (US31659AAA43) | 1.26 | 1.70 | 0.2278 | 0.0069 | |||||

| Clarios Global LP / Clarios US Finance Co / DBT (US18060TAD72) | 1.24 | -0.48 | 0.2251 | 0.0022 | |||||

| Allied Universal Holdco LLC / DBT (US019576AD90) | 1.24 | 28.90 | 0.2245 | 0.0527 | |||||

| VERITIV OPERATING CO / LON (US92338TAB26) | 1.23 | 0.00 | 0.2223 | 0.0031 | |||||

| Six Flags Entertainment Corp /Six Flags Theme Parks Inc/ Canada's Wonderland Co / DBT (US83002YAA73) | 1.22 | -0.41 | 0.2203 | 0.0021 | |||||

| US758071AA21 / Redwood Star Merger Sub Inc | 1.21 | -1.22 | 0.2191 | 0.0005 | |||||

| US531968AA36 / Light & Wonder International, Inc. | 1.20 | 23.79 | 0.2177 | 0.0444 | |||||

| SCI / Service Corporation International | 1.20 | 0.17 | 0.2174 | 0.0035 | |||||

| US78351MAA09 / Ryan Specialty Group LLC | 1.20 | -66.85 | 0.2163 | -0.4269 | |||||

| US50168EAB83 / LABL, Inc. 2019 USD Term Loan | 1.19 | -75.89 | 0.2160 | -0.6668 | |||||

| US377320AA45 / Glatfelter Corp | 1.19 | -8.92 | 0.2146 | -0.0176 | |||||

| US1248EPCD32 / CCO Holdings LLC / CCO Holdings Capital Corp. | 1.13 | 2.45 | 0.2047 | 0.0078 | |||||

| 743424AA1 / Proofpoint, Inc. 1.25% Convertible Bond due 2018-12-15 | 1.13 | -11.99 | 0.2046 | -0.0246 | |||||

| US61747C5821 / Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio | 1.12 | -38.58 | 1.12 | -38.58 | 0.2029 | -0.1227 | |||

| Howden UK Refinance PLC / Howden UK Refinance 2 PLC / Howden US Refinance LLC / DBT (US44287GAA40) | 1.07 | 135.16 | 0.1938 | 0.1125 | |||||

| US75026JAC45 / Radiate Holdco LLC | 1.05 | -1.23 | 0.1897 | 0.0003 | |||||

| US655664AT70 / Nordstrom, Inc. | 1.05 | -0.67 | 0.1892 | 0.0014 | |||||

| US07831CAA18 / BellRing Brands Inc | 1.04 | 0.19 | 0.1886 | 0.0031 | |||||

| AMSPEC PARENT LLC / LON (US03218AAB52) | 1.01 | 0.60 | 0.1824 | 0.0037 | |||||

| US44332PAH47 / HUB International Ltd | 0.96 | 0.84 | 0.1745 | 0.0039 | |||||

| MTN / Vail Resorts, Inc. | 0.96 | 0.31 | 0.1738 | 0.0030 | |||||

| JUMP FINANCIAL LLC / LON (US48138UAC18) | 0.95 | 39.24 | 0.1722 | 0.0501 | |||||

| US38869AAA51 / Graphic Packaging International LLC | 0.94 | -1.26 | 0.1699 | 0.0003 | |||||

| US058498AY23 / Ball Corp | 0.93 | -0.11 | 0.1675 | 0.0022 | |||||

| US76774LAB36 / Ritchie Bros Holdings Inc | 0.92 | -0.43 | 0.1668 | 0.0017 | |||||

| US541056AA53 / Logan Merger Sub Inc | 0.91 | -24.48 | 0.1643 | -0.0500 | |||||

| Trivium Packaging Finance BV / DBT (US89686QAD88) | 0.91 | 0.1641 | 0.1641 | ||||||

| DECHRA FINANCE US / LON (US24343EAB11) | 0.90 | -0.66 | 0.1628 | 0.0012 | |||||

| Jane Street Group / JSG Finance Inc / DBT (US47077WAE84) | 0.88 | 0.1597 | 0.1597 | ||||||

| US50218KAB44 / Life Time Inc | 0.88 | -0.11 | 0.1590 | 0.0021 | |||||

| WESCO Distribution Inc / DBT (US95081QAS30) | 0.88 | 0.81 | 0.1587 | 0.0036 | |||||

| US541056AA53 / Logan Merger Sub Inc | 0.81 | -27.03 | 0.1462 | -0.0513 | |||||

| US853496AG21 / Standard Industries Inc/NJ | 0.81 | 0.37 | 0.1459 | 0.0027 | |||||

| US005095AA29 / Acushnet Co | 0.79 | -46.27 | 0.1436 | -0.1197 | |||||

| US23166MAC73 / Cushman & Wakefield US Borrower LLC | 0.79 | 0.1428 | 0.1428 | ||||||

| Gates Corp/DE / DBT (US367398AA27) | 0.77 | -0.13 | 0.1397 | 0.0018 | |||||

| TransDigm Inc / DBT (US893647BW65) | 0.75 | -0.13 | 0.1351 | 0.0019 | |||||

| APPLIED SYSTEMS INC / LON (US03827FBD24) | 0.70 | -0.43 | 0.1271 | 0.0012 | |||||

| MCAFEE CORP / LON (US57906HAF47) | 0.69 | -3.66 | 0.1241 | -0.0028 | |||||

| US92840VAP76 / Vistra Operations Co. LLC | 0.68 | 0.44 | 0.1231 | 0.0023 | |||||

| US36268NAA81 / GTCR W-2 Merger Sub LLC | 0.68 | 1.20 | 0.1223 | 0.0031 | |||||

| Ellucian Holdings Inc / DBT (US289178AA37) | 0.67 | 103.34 | 0.1211 | 0.0623 | |||||

| US34965KAA51 / Fortrea Holdings Inc | 0.66 | -17.04 | 0.1200 | -0.0224 | |||||

| Owens-Brockway Glass Container Inc / DBT (US69073TAV52) | 0.65 | 2.86 | 0.1172 | 0.0049 | |||||

| Wrangler Holdco Corp / DBT (US37441QAA94) | 0.64 | 0.63 | 0.1154 | 0.0025 | |||||

| Amer Sports Co / DBT (US02352NAA72) | 0.64 | 1.28 | 0.1151 | 0.0031 | |||||

| BCO / The Brink's Company | 0.63 | -0.47 | 0.1142 | 0.0012 | |||||

| Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer / DBT (US01883LAH69) | 0.62 | 0.65 | 0.1123 | 0.0024 | |||||

| US513272AC82 / Lamb Weston Holdings Inc | 0.62 | 0.82 | 0.1115 | 0.0025 | |||||

| Trivium Packaging Finance BV / DBT (US89686QAC06) | 0.61 | 0.1107 | 0.1107 | ||||||

| Novelis Corp / DBT (US670001AL04) | 0.61 | 0.83 | 0.1100 | 0.0025 | |||||

| US83001AAD46 / Six Flags Entertainment Corp | 0.60 | -0.83 | 0.1084 | 0.0006 | |||||

| US29450YAA73 / EquipmentShare.com, Inc. | 0.60 | 0.1080 | 0.1080 | ||||||

| US90290MAD39 / US FOODS INC 4.75% 02/15/2029 144A | 0.59 | 1.03 | 0.1068 | 0.0026 | |||||

| EZPW / EZCORP, Inc. | 0.58 | 0.1054 | 0.1054 | ||||||

| US019576AB35 / Allied Universal Holdco LLC / Allied Universal Finance Corp | 0.58 | -75.12 | 0.1041 | -0.2792 | |||||

| Ardonagh Group Finance Ltd / DBT (US039956AA59) | 0.57 | 0.1041 | 0.1041 | ||||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 0.57 | 0.1038 | 0.1038 | ||||||

| US29103CAA62 / Emerald Debt Merger Sub LLC | 0.57 | -0.18 | 0.1027 | 0.0013 | |||||

| US853496AD99 / Standard Industries Inc/NJ | 0.56 | 0.36 | 0.1021 | 0.0019 | |||||

| US81211KBA79 / Sealed Air Corp | 0.56 | 0.72 | 0.1007 | 0.0021 | |||||

| US78433BAA61 / CORP. NOTE | 0.55 | 0.1002 | 0.1002 | ||||||

| US109641AK67 / Brinker International Inc | 0.55 | -0.91 | 0.0987 | 0.0005 | |||||

| US98981BAA08 / ZoomInfo Technologies LLC/ZoomInfo Finance Corp | 0.54 | 0.55 | 0.0985 | 0.0019 | |||||

| US76133MAC55 / Restoration Hardware, Inc., Term Loan | 0.53 | -40.53 | 0.0967 | -0.0635 | |||||

| US71601HAB24 / Petco Health and Wellness Company, Inc., 1st Lien Term Loan | 0.45 | 0.22 | 0.0823 | 0.0015 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0.44 | 0.0800 | 0.0800 | ||||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0.43 | 0.0777 | 0.0777 | ||||||

| US75025KAH14 / RADIATE HOLDCO LLC | 0.40 | 0.50 | 0.0733 | 0.0016 | |||||

| US857691AH24 / Station Casinos LLC | 0.37 | -90.10 | 0.0676 | -0.5183 | |||||

| US82967NBC11 / Sirius XM Radio Inc | 0.34 | 0.30 | 0.0611 | 0.0011 | |||||

| Amentum Holdings Inc / DBT (US02352BAA35) | 0.32 | 0.00 | 0.0584 | 0.0008 | |||||

| US21871DAD57 / CoreLogic Inc | 0.32 | -1.23 | 0.0580 | 0.0002 | |||||

| Concentra Health Services Inc / DBT (US20600DAA19) | 0.32 | -0.62 | 0.0576 | 0.0004 | |||||

| US48020RAA32 / Jones Deslauriers Insurance Management Inc | 0.31 | 0.0561 | 0.0561 | ||||||

| US810186AW67 / CORPORATE BONDS | 0.30 | 0.0551 | 0.0551 | ||||||

| Jane Street Group / JSG Finance Inc / DBT (US47077WAD02) | 0.30 | -0.33 | 0.0546 | 0.0007 | |||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AB20) | 0.30 | 0.0546 | 0.0546 | ||||||

| US81728UAB08 / Sensata Technologies Inc | 0.30 | 0.34 | 0.0536 | 0.0009 | |||||

| US78433BAB45 / SCIH Salt Holdings Inc | 0.29 | 0.0533 | 0.0533 | ||||||

| NAVI / Navient Corporation | 0.29 | 0.0532 | 0.0532 | ||||||

| RHP Hotel Properties LP / RHP Finance Corp / DBT (US749571AL97) | 0.29 | 0.0523 | 0.0523 | ||||||

| Rockies Express Pipeline LLC / DBT (US77340RAU14) | 0.29 | 0.0523 | 0.0523 | ||||||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 0.29 | 0.0521 | 0.0521 | ||||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0.28 | 0.0515 | 0.0515 | ||||||

| US70451NAB29 / Paysafe Holdings (US) Corp USD Term Loan B1 | 0.28 | 0.0510 | 0.0510 | ||||||

| Williams Scotsman Inc / DBT (US96949VAN38) | 0.28 | 0.0507 | 0.0507 | ||||||

| US80874DAA46 / Scientific Games Holdings LP/Scientific Games US FinCo Inc | 0.28 | -3.82 | 0.0503 | -0.0011 | |||||

| US46205YAA91 / ION Trading Technologies Sarl | 0.28 | 2.23 | 0.0499 | 0.0018 | |||||

| US81282UAG76 / SeaWorld Parks & Entertainment Inc | 0.27 | -0.73 | 0.0493 | 0.0003 | |||||

| Howden UK Refinance PLC / Howden UK Refinance 2 PLC / Howden US Refinance LLC / DBT (US44287DAA19) | 0.22 | 0.0392 | 0.0392 | ||||||

| US01883LAD55 / Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer | 0.21 | 0.98 | 0.0374 | 0.0009 | |||||

| US126307BF39 / CSC Holdings LLC | 0.16 | -7.91 | 0.0297 | -0.0021 | |||||

| TransDigm Inc / DBT (US893647BU00) | 0.16 | -89.83 | 0.0291 | -0.2518 | |||||

| EVKG / Ever-Glory International Group, Inc. | 0.16 | -3.09 | 0.0285 | -0.0005 | |||||

| AMSPEC PARENT LLC / LON (US03218AAC36) | 0.16 | 0.65 | 0.0281 | 0.0006 | |||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 0.15 | 0.0271 | 0.0271 | ||||||

| Flutter Treasury DAC / DBT (US344045AA72) | 0.14 | 0.00 | 0.0260 | 0.0004 | |||||

| W2EX34 / WEX Inc. - Depositary Receipt (Common Stock) | 0.14 | -1.40 | 0.0256 | 0.0001 | |||||

| KASEYA INC / LON (000000000) | 0.13 | 0.0238 | 0.0238 | ||||||

| US12769GAB68 / Caesars Entertainment, Inc. | 0.08 | 0.00 | 0.0143 | 0.0002 | |||||

| US228180AB14 / Crown Americas LLC | 0.07 | 1.37 | 0.0135 | 0.0004 | |||||

| US12511VAA61 / CDI Escrow Issuer Inc | 0.07 | 0.00 | 0.0127 | 0.0002 | |||||

| Akorn Operating Company LLC / EC (000000000) | 0.22 | 0.01 | 0.0016 | 0.0016 |