Statistik Asas

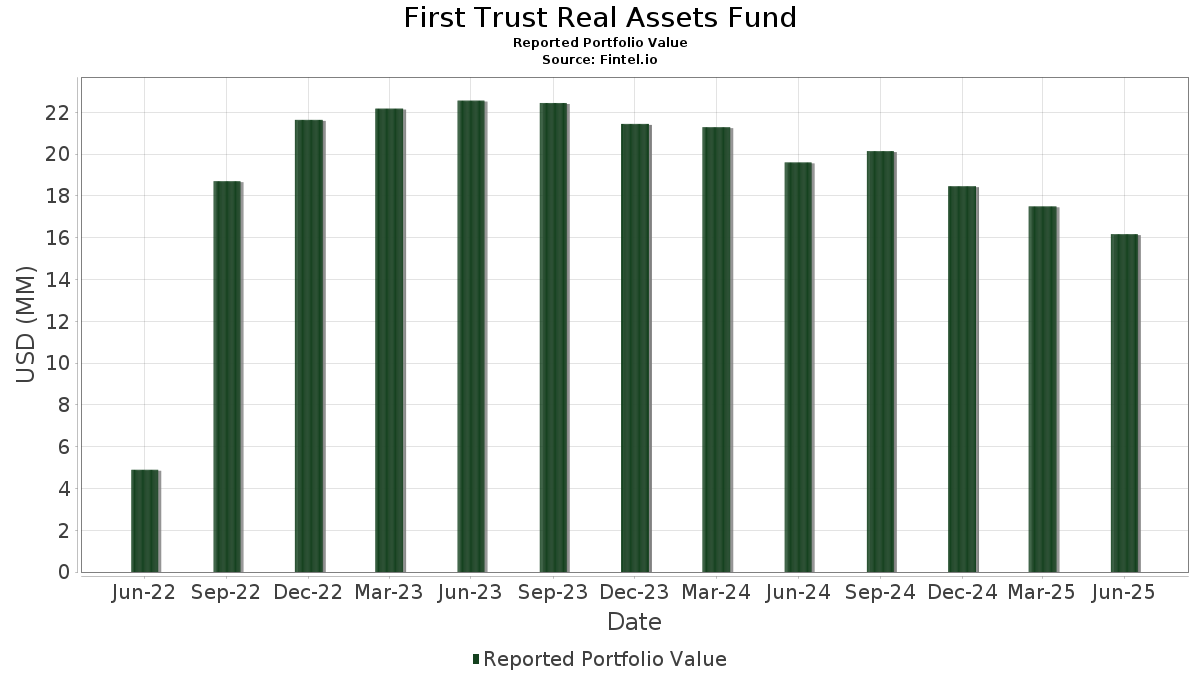

| Nilai Portfolio | $ 16,172,991 |

| Kedudukan Semasa | 34 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

First Trust Real Assets Fund telah mendedahkan 34 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 16,172,991 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas First Trust Real Assets Fund ialah RREEF PROP TR-D (US:US74972X3044) , Jones Lang LaSalle Income Property Trust, Inc. - Class M-I (US:US48021R4011) , STACR_22-HQA3 (US:US35564KE708) , GS Mortgage-Backed Securities Trust 2023-CCM1 (US:US362918AE41) , and Freddie Mac Structured Agency Credit Risk Debt Notes (US:US35564K2G38) . Kedudukan baharu First Trust Real Assets Fund termasuk STACR_22-HQA3 (US:US35564KE708) , GS Mortgage-Backed Securities Trust 2023-CCM1 (US:US362918AE41) , Freddie Mac Structured Agency Credit Risk Debt Notes (US:US35564K2G38) , Radnor RE 2022-1 Ltd (US:US75049XAB82) , and NEW RESIDENTIAL MORTGAGE LOAN NRZT 2022 NQM1 M1 144A (US:US64830JAD28) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 1.73 | 10.7526 | 10.7526 | |

| 0.00 | 1.23 | 7.6178 | 7.6178 | |

| 0.04 | 0.96 | 5.9641 | 5.9641 | |

| 0.03 | 0.82 | 5.0560 | 5.0560 | |

| 0.47 | 0.71 | 4.4060 | 4.4060 | |

| 0.00 | 0.68 | 4.2380 | 4.2380 | |

| 0.00 | 0.61 | 3.7741 | 3.7741 | |

| 0.00 | 0.35 | 2.1805 | 2.1805 | |

| 0.00 | 0.13 | 0.8136 | 0.8136 | |

| 0.00 | 0.11 | 0.6554 | 0.6554 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 3.04 | 18.8541 | -1.6970 | ||

| 0.03 | 0.55 | 3.4352 | -0.2083 | |

| 0.16 | 1.0221 | -0.0218 | ||

| 0.19 | 1.1959 | -0.0097 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-29 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| UMB MONEY MARKET II SPECIAL / / STIV (SF8888628) | 3.04 | -15.27 | 18.8541 | -1.6970 | |||||

| CIRE REAL ESTATE INVESTMENT TRUST, Inc. / / EC (999999999) | 0.00 | 1.73 | 10.7526 | 10.7526 | |||||

| OAK St (*** Please punctuate: St. or State ***) REAL EST LP / / EC (999999999) | 0.00 | 1.23 | 7.6178 | 7.6178 | |||||

| INVESCO REAL ESTATE INCOME TRUST, Inc. / / EC (999999999) | 0.04 | 0.96 | 5.9641 | 5.9641 | |||||

| BAILARD REAL ESTATE LP / / EC (999999999) | 0.03 | 0.82 | 5.0560 | 5.0560 | |||||

| US74972X3044 / RREEF PROP TR-D | 0.06 | 0.00 | 0.74 | -1.72 | 4.6178 | 0.2792 | |||

| RCKT Mortgage Trust 2024-CES3 / ABS-MBS (US74942AAD54) | 0.71 | -0.14 | 4.4126 | 0.3309 | |||||

| CBRE U.S. CORE PARTNERS LP / / EC (999999999) | 0.47 | 0.71 | 4.4060 | 4.4060 | |||||

| NUVEEN REAL ESTATE U.S. Cities Industr Fd / / EC (999999999) | 0.00 | 0.68 | 4.2380 | 4.2380 | |||||

| HILLPOINTE WORKFORCE PARTNERSHIP IV, LP / / EC (999999999) | 0.00 | 0.61 | 3.7741 | 3.7741 | |||||

| Stepstone Private Infrastructure Fund/United States - Class I / (US85914R4039) | 0.04 | 0.00 | 0.59 | 4.76 | 3.6866 | 0.4356 | |||

| STARWOOD REAL ESTATE INCOME TRUST, Inc. / / EC (85570X405) | 0.03 | -9.85 | 0.55 | -13.05 | 3.4352 | -0.2083 | |||

| US48021R4011 / Jones Lang LaSalle Income Property Trust, Inc. - Class M-I | 0.05 | 0.00 | 0.52 | -0.38 | 3.2227 | 0.2332 | |||

| Wynwood BN LLC / / EC (999999999) | 0.00 | 0.35 | 2.1805 | 2.1805 | |||||

| US35564KE708 / STACR_22-HQA3 | 0.27 | 0.00 | 1.6650 | 0.1292 | |||||

| US362918AE41 / GS Mortgage-Backed Securities Trust 2023-CCM1 | 0.23 | -0.44 | 1.4012 | 0.1017 | |||||

| US35564K2G38 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0.21 | -0.48 | 1.2934 | 0.0948 | |||||

| US75049XAB82 / Radnor RE 2022-1 Ltd | 0.19 | -8.57 | 1.1959 | -0.0097 | |||||

| US64830JAD28 / NEW RESIDENTIAL MORTGAGE LOAN NRZT 2022 NQM1 M1 144A | 0.18 | 1.10 | 1.1440 | 0.0960 | |||||

| US36167KAG31 / GCAT 2021-NQM6 Trust | 0.18 | -1.08 | 1.1365 | 0.0744 | |||||

| US79582AAB35 / Saluda Grade Alternative Mortgage Trust, Series 2023-FIG3, Class B | 0.18 | -6.25 | 1.1182 | 0.0158 | |||||

| US79582AAA51 / Saluda Grade Alternative Mortgage Trust, Series 2023-FIG3, Class A | 0.18 | -5.32 | 1.1090 | 0.0289 | |||||

| US36270XAZ78 / GS Mortgage-Backed Securities Trust 2023-PJ4 | 0.16 | -9.89 | 1.0221 | -0.0218 | |||||

| US92538QAE08 / Verus Securitization Trust 2021-7 | 0.16 | 0.65 | 0.9681 | 0.0776 | |||||

| US36170HAC43 / GCAT 2022-NQM4 Trust | 0.15 | -2.56 | 0.9456 | 0.0504 | |||||

| US46647JBB52 / JP MORGAN MORTGAGE TRUST 2016-4 SER 2016-4 CL B3 V/R REGD 144A P/P 3.89779200 | 0.14 | -2.13 | 0.8574 | 0.0477 | |||||

| NUVEEN REAL ESTATE U.S. CITIES MULTI LP / / EC (999999999) | 0.00 | 0.13 | 0.8136 | 0.8136 | |||||

| US43732VAL09 / HOME PARTNERS OF AMERICA 2021-2 TRUST HPA 2021-2 F | 0.11 | 0.00 | 0.7115 | 0.0581 | |||||

| HILLPOINTE WORKFORCE HOUSING PARTNER V LP / / EC (999999999) | 0.00 | 0.11 | 0.6554 | 0.6554 | |||||

| JP Morgan Mortgage Trust 2016-4 / ABS-MBS (US46647JBD19) | 0.09 | -1.12 | 0.5500 | 0.0363 | |||||

| JP Morgan Mortgage Trust 2016-4 / ABS-MBS (US46647JBC36) | 0.08 | -7.69 | 0.5220 | 0.0008 | |||||

| CIRE ALTO OpCo LLC TL 11/29/2024 / / LON (999999999) | 0.07 | 0.4096 | 0.4096 | ||||||

| FCP REALTY FUND VI-A LP / / EC (999999999) | 0.00 | 0.05 | 0.3031 | 0.3031 | |||||

| CORE SPACES FUND IV LP / / EC (999999999) | 0.00 | 0.04 | 0.2605 | 0.2605 |