Statistik Asas

| Nilai Portfolio | $ 901,504,148 |

| Kedudukan Semasa | 162 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

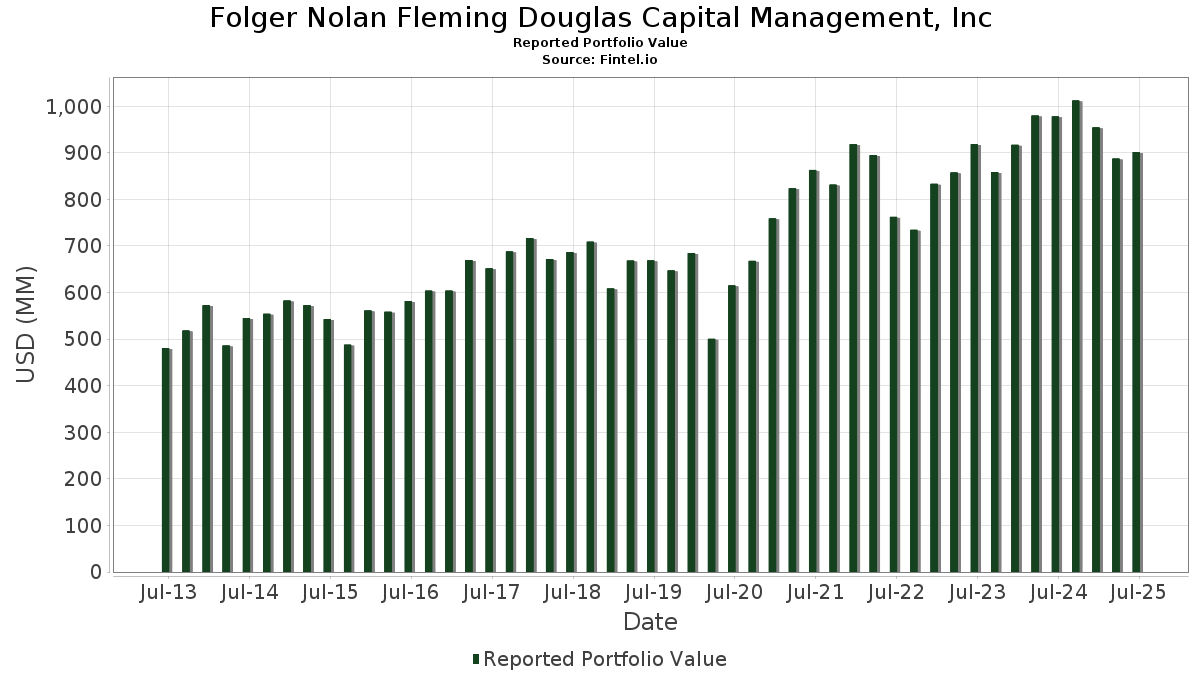

Folger Nolan Fleming Douglas Capital Management, Inc telah mendedahkan 162 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 901,504,148 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Folger Nolan Fleming Douglas Capital Management, Inc ialah Vanguard World Fund - Vanguard Information Technology ETF (US:VGT) , Corteva, Inc. (US:CTVA) , DuPont de Nemours, Inc. (US:DD) , Microsoft Corporation (US:MSFT) , and Apple Inc. (US:AAPL) . Kedudukan baharu Folger Nolan Fleming Douglas Capital Management, Inc termasuk iShares Trust - iShares Russell 1000 Growth ETF (US:IWF) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.18 | 119.23 | 13.2257 | 2.1951 | |

| 0.09 | 45.67 | 5.0658 | 1.0592 | |

| 1.01 | 75.42 | 8.3658 | 0.3255 | |

| 0.08 | 23.44 | 2.6006 | 0.3154 | |

| 0.06 | 9.35 | 1.0367 | 0.3059 | |

| 0.09 | 20.44 | 2.2677 | 0.2702 | |

| 0.01 | 9.45 | 1.0485 | 0.2419 | |

| 0.12 | 20.64 | 2.2894 | 0.2133 | |

| 0.08 | 9.92 | 1.1004 | 0.2061 | |

| 0.06 | 15.64 | 1.7349 | 0.1831 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.97 | 25.62 | 2.8414 | -1.2863 | |

| 0.81 | 55.73 | 6.1822 | -1.0868 | |

| 0.03 | 8.98 | 0.9966 | -0.4869 | |

| 0.15 | 30.39 | 3.3708 | -0.3969 | |

| 0.03 | 5.51 | 0.6113 | -0.3615 | |

| 0.13 | 12.41 | 1.3769 | -0.3235 | |

| 0.12 | 18.60 | 2.0627 | -0.2212 | |

| 0.09 | 12.22 | 1.3551 | -0.2140 | |

| 0.10 | 15.46 | 1.7148 | -0.1975 | |

| 0.05 | 15.13 | 1.6779 | -0.1736 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-24 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| VGT / Vanguard World Fund - Vanguard Information Technology ETF | 0.18 | -0.41 | 119.23 | 21.79 | 13.2257 | 2.1951 | |||

| CTVA / Corteva, Inc. | 1.01 | -10.76 | 75.42 | 5.69 | 8.3658 | 0.3255 | |||

| DD / DuPont de Nemours, Inc. | 0.81 | -5.94 | 55.73 | -13.61 | 6.1822 | -1.0868 | |||

| MSFT / Microsoft Corporation | 0.09 | -3.08 | 45.67 | 28.43 | 5.0658 | 1.0592 | |||

| AAPL / Apple Inc. | 0.15 | -1.61 | 30.39 | -9.12 | 3.3708 | -0.3969 | |||

| DOW / Dow Inc. | 0.97 | -7.79 | 25.62 | -30.08 | 2.8414 | -1.2863 | |||

| JPM / JPMorgan Chase & Co. | 0.08 | -2.19 | 23.44 | 15.60 | 2.6006 | 0.3154 | |||

| GOOG / Alphabet Inc. | 0.12 | -1.35 | 20.64 | 12.01 | 2.2894 | 0.2133 | |||

| AMZN / Amazon.com, Inc. | 0.09 | 0.00 | 20.44 | 15.31 | 2.2677 | 0.2702 | |||

| V / Visa Inc. | 0.06 | -1.23 | 19.70 | 0.06 | 2.1848 | -0.0331 | |||

| PG / The Procter & Gamble Company | 0.12 | -1.87 | 18.60 | -8.26 | 2.0627 | -0.2212 | |||

| LOW / Lowe's Companies, Inc. | 0.08 | -1.52 | 16.97 | -6.31 | 1.8823 | -0.1585 | |||

| MAR / Marriott International, Inc. | 0.06 | -0.99 | 15.64 | 13.56 | 1.7349 | 0.1831 | |||

| JNJ / Johnson & Johnson | 0.10 | -1.11 | 15.46 | -8.92 | 1.7148 | -0.1975 | |||

| MCD / McDonald's Corporation | 0.05 | -1.59 | 15.13 | -7.95 | 1.6779 | -0.1736 | |||

| ITW / Illinois Tool Works Inc. | 0.06 | -1.52 | 14.56 | -1.82 | 1.6152 | -0.0558 | |||

| RTX / RTX Corporation | 0.09 | -1.39 | 13.24 | 8.70 | 1.4687 | 0.0964 | |||

| ABT / Abbott Laboratories | 0.10 | -0.68 | 13.03 | 1.84 | 1.4453 | 0.0037 | |||

| CHD / Church & Dwight Co., Inc. | 0.13 | -5.79 | 12.41 | -17.75 | 1.3769 | -0.3235 | |||

| PEP / PepsiCo, Inc. | 0.09 | -0.38 | 12.22 | -12.27 | 1.3551 | -0.2140 | |||

| CAT / Caterpillar Inc. | 0.03 | -3.18 | 11.33 | 13.97 | 1.2567 | 0.1366 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.04 | -2.49 | 10.90 | 7.83 | 1.2095 | 0.0701 | |||

| DIS / The Walt Disney Company | 0.08 | -0.52 | 9.92 | 24.98 | 1.1004 | 0.2061 | |||

| META / Meta Platforms, Inc. | 0.01 | 3.10 | 9.45 | 32.03 | 1.0485 | 0.2419 | |||

| NVDA / NVIDIA Corporation | 0.06 | -1.16 | 9.35 | 44.09 | 1.0367 | 0.3059 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.10 | -3.31 | 9.11 | 4.54 | 1.0110 | 0.0286 | |||

| UNH / UnitedHealth Group Incorporated | 0.03 | 14.56 | 8.98 | -31.76 | 0.9966 | -0.4869 | |||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.03 | -2.07 | 8.86 | 5.97 | 0.9833 | 0.0408 | |||

| XOM / Exxon Mobil Corporation | 0.08 | -3.11 | 8.77 | -12.18 | 0.9726 | -0.1522 | |||

| TROW / T. Rowe Price Group, Inc. | 0.09 | -0.79 | 8.62 | 4.20 | 0.9557 | 0.0241 | |||

| NEE / NextEra Energy, Inc. | 0.12 | -1.50 | 8.14 | -3.54 | 0.9026 | -0.0479 | |||

| IFF / International Flavors & Fragrances Inc. | 0.11 | 0.00 | 8.05 | -5.23 | 0.8925 | -0.0641 | |||

| CSCO / Cisco Systems, Inc. | 0.12 | -2.86 | 8.01 | 9.22 | 0.8884 | 0.0622 | |||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.06 | -2.33 | 7.92 | -3.39 | 0.8787 | -0.0452 | |||

| WTRG / Essential Utilities, Inc. | 0.20 | 1.62 | 7.56 | -4.53 | 0.8388 | -0.0536 | |||

| CC / The Chemours Company | 0.66 | 0.00 | 7.50 | -15.37 | 0.8324 | -0.1667 | |||

| UNP / Union Pacific Corporation | 0.03 | -0.65 | 7.02 | -3.24 | 0.7782 | -0.0387 | |||

| AXP / American Express Company | 0.02 | -4.15 | 6.79 | 13.64 | 0.7532 | 0.0799 | |||

| CVX / Chevron Corporation | 0.05 | -2.54 | 6.69 | -16.58 | 0.7418 | -0.1614 | |||

| HON / Honeywell International Inc. | 0.03 | -2.05 | 6.32 | 7.72 | 0.7009 | 0.0400 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.03 | -1.41 | 6.08 | 5.37 | 0.6748 | 0.0242 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.03 | -2.28 | 5.72 | 5.71 | 0.6350 | 0.0248 | |||

| WFC / Wells Fargo & Company | 0.07 | -4.35 | 5.66 | 6.77 | 0.6283 | 0.0305 | |||

| BDX / Becton, Dickinson and Company | 0.03 | -15.11 | 5.51 | -36.16 | 0.6113 | -0.3615 | |||

| MRK / Merck & Co., Inc. | 0.07 | -0.69 | 5.45 | -12.41 | 0.6050 | -0.0966 | |||

| ADBE / Adobe Inc. | 0.01 | -2.58 | 5.19 | -1.72 | 0.5753 | -0.0193 | |||

| FDX / FedEx Corporation | 0.02 | -0.85 | 4.22 | -7.55 | 0.4685 | -0.0463 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -5.69 | 3.99 | -13.97 | 0.4422 | -0.0799 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 3.78 | -5.61 | 0.4196 | -0.0320 | |||

| ATO / Atmos Energy Corporation | 0.02 | -0.02 | 3.71 | -0.32 | 0.4110 | -0.0078 | |||

| SO / The Southern Company | 0.04 | -2.23 | 3.67 | -2.34 | 0.4070 | -0.0164 | |||

| IBM / International Business Machines Corporation | 0.01 | -2.60 | 3.50 | 15.48 | 0.3881 | 0.0467 | |||

| POWERSHARES QQQ TR ETF SERIES / (73935A104) | 0.01 | 3.41 | 0.0000 | ||||||

| WMT / Walmart Inc. | 0.03 | -0.54 | 3.11 | 10.81 | 0.3444 | 0.0286 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 2.92 | -8.71 | 0.3234 | -0.0365 | |||

| KO / The Coca-Cola Company | 0.04 | -0.15 | 2.59 | -1.34 | 0.2869 | -0.0085 | |||

| ABBV / AbbVie Inc. | 0.01 | -1.52 | 2.58 | -12.75 | 0.2862 | -0.0470 | |||

| GE / General Electric Company | 0.01 | -2.75 | 2.57 | 25.06 | 0.2852 | 0.0536 | |||

| MTB / M&T Bank Corporation | 0.01 | 0.81 | 2.42 | 9.39 | 0.2690 | 0.0192 | |||

| CRM / Salesforce, Inc. | 0.01 | 9.76 | 2.34 | 11.52 | 0.2600 | 0.0232 | |||

| INTU / Intuit Inc. | 0.00 | 0.00 | 2.16 | 28.30 | 0.2394 | 0.0498 | |||

| D / Dominion Energy, Inc. | 0.04 | -6.33 | 2.13 | -5.58 | 0.2366 | -0.0179 | |||

| K / Kellanova | 0.03 | -3.84 | 2.10 | -7.33 | 0.2330 | -0.0223 | |||

| HD / The Home Depot, Inc. | 0.01 | -1.21 | 2.00 | -1.19 | 0.2218 | -0.0062 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | -1.03 | 1.92 | -10.30 | 0.2125 | -0.0281 | |||

| EMR / Emerson Electric Co. | 0.01 | -4.73 | 1.77 | 15.85 | 0.1963 | 0.0242 | |||

| GOOGL / Alphabet Inc. | 0.01 | -2.77 | 1.75 | 10.82 | 0.1944 | 0.0162 | |||

| MMM / 3M Company | 0.01 | -2.91 | 1.65 | 0.61 | 0.1832 | -0.0017 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 0.00 | 1.62 | 15.54 | 0.1799 | 0.0217 | |||

| BAC / Bank of America Corporation | 0.03 | -1.38 | 1.58 | 11.79 | 0.1758 | 0.0161 | |||

| HSY / The Hershey Company | 0.01 | -0.76 | 1.57 | -3.68 | 0.1741 | -0.0095 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.02 | -10.76 | 1.41 | -12.20 | 0.1565 | -0.0246 | |||

| AMGN / Amgen Inc. | 0.00 | -1.38 | 1.40 | -11.65 | 0.1548 | -0.0231 | |||

| VZ / Verizon Communications Inc. | 0.03 | -2.54 | 1.34 | -7.00 | 0.1488 | -0.0138 | |||

| NTRS / Northern Trust Corporation | 0.01 | 0.00 | 1.32 | 28.59 | 0.1463 | 0.0307 | |||

| ORCL / Oracle Corporation | 0.01 | -0.25 | 1.31 | 55.95 | 0.1454 | 0.0507 | |||

| GEV / GE Vernova Inc. | 0.00 | -3.72 | 1.30 | 67.01 | 0.1443 | 0.0565 | |||

| DUK / Duke Energy Corporation | 0.01 | -4.62 | 1.26 | -7.71 | 0.1394 | -0.0140 | |||

| KIM / Kimco Realty Corporation | 0.06 | -2.69 | 1.21 | -3.74 | 0.1342 | -0.0073 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.02 | 1.86 | 1.12 | 14.27 | 0.1244 | 0.0138 | |||

| MS / Morgan Stanley | 0.01 | 0.00 | 1.04 | 20.72 | 0.1151 | 0.0183 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 12.93 | 1.02 | 24.79 | 0.1128 | 0.0210 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 1.01 | 3.70 | 0.1119 | 0.0023 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | -1.89 | 1.00 | 4.08 | 0.1104 | 0.0026 | |||

| ALL / The Allstate Corporation | 0.00 | 0.00 | 0.86 | -2.70 | 0.0958 | -0.0043 | |||

| SYY / Sysco Corporation | 0.01 | 0.02 | 0.86 | 1.06 | 0.0953 | -0.0006 | |||

| BK / The Bank of New York Mellon Corporation | 0.01 | -4.10 | 0.85 | 4.28 | 0.0946 | 0.0024 | |||

| EBGEF / Enbridge Inc. - Preferred Stock | 0.02 | -1.70 | 0.84 | 0.60 | 0.0930 | -0.0010 | |||

| GLW / Corning Incorporated | 0.02 | -10.68 | 0.83 | 2.61 | 0.0917 | 0.0009 | |||

| CSX / CSX Corporation | 0.02 | -1.23 | 0.79 | 9.60 | 0.0874 | 0.0063 | |||

| INTC / Intel Corporation | 0.03 | -1.83 | 0.78 | -3.10 | 0.0867 | -0.0042 | |||

| TJX / The TJX Companies, Inc. | 0.01 | 0.00 | 0.78 | 1.30 | 0.0866 | -0.0002 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | 0.00 | 0.78 | 1.17 | 0.0860 | -0.0003 | |||

| DHR / Danaher Corporation | 0.00 | -3.64 | 0.73 | -7.22 | 0.0813 | -0.0076 | |||

| UDR / UDR, Inc. | 0.02 | -1.31 | 0.72 | -10.77 | 0.0800 | -0.0111 | |||

| FRT / Federal Realty Investment Trust | 0.01 | -1.31 | 0.71 | -4.17 | 0.0792 | -0.0047 | |||

| PM / Philip Morris International Inc. | 0.00 | -10.35 | 0.67 | 2.92 | 0.0743 | 0.0009 | |||

| VMC / Vulcan Materials Company | 0.00 | 0.00 | 0.65 | 11.70 | 0.0721 | 0.0066 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.62 | 10.34 | 0.0687 | 0.0055 | |||

| GIS / General Mills, Inc. | 0.01 | -0.18 | 0.59 | -13.51 | 0.0654 | -0.0114 | |||

| CARR / Carrier Global Corporation | 0.01 | -13.45 | 0.59 | -0.17 | 0.0651 | -0.0011 | |||

| LIN / Linde plc | 0.00 | 0.00 | 0.58 | 0.87 | 0.0640 | -0.0005 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | -5.74 | 0.56 | -28.50 | 0.0619 | -0.0260 | |||

| DE / Deere & Company | 0.00 | -3.13 | 0.53 | 4.91 | 0.0593 | 0.0019 | |||

| OTIS / Otis Worldwide Corporation | 0.01 | -10.56 | 0.52 | -14.21 | 0.0576 | -0.0106 | |||

| CL / Colgate-Palmolive Company | 0.01 | -0.97 | 0.51 | -3.75 | 0.0569 | -0.0033 | |||

| ADM / Archer-Daniels-Midland Company | 0.01 | 0.00 | 0.51 | 9.87 | 0.0568 | 0.0043 | |||

| BEN / Franklin Resources, Inc. | 0.02 | 0.00 | 0.51 | 24.15 | 0.0565 | 0.0102 | |||

| FI / Fiserv, Inc. | 0.00 | 0.00 | 0.50 | -21.96 | 0.0556 | -0.0167 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.01 | 0.00 | 0.50 | 9.27 | 0.0550 | 0.0039 | |||

| COST / Costco Wholesale Corporation | 0.00 | -12.10 | 0.49 | -7.91 | 0.0542 | -0.0056 | |||

| COF / Capital One Financial Corporation | 0.00 | 0.49 | 0.0541 | 0.0541 | |||||

| T / AT&T Inc. | 0.02 | 0.00 | 0.49 | 2.32 | 0.0539 | 0.0004 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | 0.00 | 0.48 | -3.82 | 0.0530 | -0.0031 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | 0.06 | 0.47 | -0.64 | 0.0519 | -0.0011 | |||

| COP / ConocoPhillips | 0.01 | -0.02 | 0.47 | -14.63 | 0.0519 | -0.0098 | |||

| BALL / Ball Corporation | 0.01 | -3.13 | 0.47 | 4.47 | 0.0518 | 0.0014 | |||

| LH / Labcorp Holdings Inc. | 0.00 | -12.09 | 0.46 | -0.86 | 0.0510 | -0.0012 | |||

| NOC / Northrop Grumman Corporation | 0.00 | -2.69 | 0.45 | -5.04 | 0.0502 | -0.0035 | |||

| AVGO / Broadcom Inc. | 0.00 | -1.20 | 0.45 | 63.18 | 0.0501 | 0.0188 | |||

| NSC / Norfolk Southern Corporation | 0.00 | -10.24 | 0.45 | -3.03 | 0.0498 | -0.0023 | |||

| DOV / Dover Corporation | 0.00 | 0.00 | 0.44 | 4.27 | 0.0489 | 0.0013 | |||

| WM / Waste Management, Inc. | 0.00 | -1.30 | 0.44 | -2.47 | 0.0483 | -0.0020 | |||

| PFE / Pfizer Inc. | 0.02 | -21.43 | 0.42 | -24.91 | 0.0462 | -0.0162 | |||

| CVS / CVS Health Corporation | 0.01 | 0.49 | 0.38 | 2.43 | 0.0422 | 0.0003 | |||

| TFC / Truist Financial Corporation | 0.01 | -0.59 | 0.36 | 3.75 | 0.0400 | 0.0009 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -3.40 | 0.36 | -21.37 | 0.0397 | -0.0115 | |||

| WTM / White Mountains Insurance Group, Ltd. | 0.00 | 0.00 | 0.36 | -6.79 | 0.0396 | -0.0035 | |||

| HWM / Howmet Aerospace Inc. | 0.00 | 0.00 | 0.36 | 43.72 | 0.0395 | 0.0115 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.35 | 22.78 | 0.0383 | 0.0066 | |||

| MDT / Medtronic plc | 0.00 | -19.44 | 0.34 | -21.81 | 0.0374 | -0.0112 | |||

| WCN / Waste Connections, Inc. | 0.00 | 0.00 | 0.34 | -4.29 | 0.0372 | -0.0023 | |||

| NYT / The New York Times Company | 0.01 | 0.00 | 0.33 | 12.84 | 0.0371 | 0.0037 | |||

| GHC / Graham Holdings Company | 0.00 | 0.00 | 0.33 | -1.51 | 0.0363 | -0.0011 | |||

| AFL / Aflac Incorporated | 0.00 | 0.00 | 0.32 | -5.31 | 0.0357 | -0.0025 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.00 | 0.00 | 0.32 | 2.26 | 0.0352 | 0.0002 | |||

| NKE / NIKE, Inc. | 0.00 | 1.65 | 0.31 | 13.77 | 0.0349 | 0.0037 | |||

| WEC / WEC Energy Group, Inc. | 0.00 | 0.00 | 0.31 | -4.35 | 0.0342 | -0.0021 | |||

| AEP / American Electric Power Company, Inc. | 0.00 | 0.00 | 0.30 | -5.05 | 0.0334 | -0.0023 | |||

| PSX / Phillips 66 | 0.00 | 0.00 | 0.30 | -3.22 | 0.0334 | -0.0017 | |||

| SJM / The J. M. Smucker Company | 0.00 | 0.00 | 0.30 | -16.90 | 0.0327 | -0.0074 | |||

| AVAV / AeroVironment, Inc. | 0.00 | 0.28 | 0.0316 | 0.0316 | |||||

| APD / Air Products and Chemicals, Inc. | 0.00 | -25.23 | 0.28 | -28.61 | 0.0308 | -0.0129 | |||

| YUM / Yum! Brands, Inc. | 0.00 | 0.00 | 0.27 | -5.56 | 0.0302 | -0.0024 | |||

| TRMB / Trimble Inc. | 0.00 | 0.00 | 0.26 | 15.70 | 0.0287 | 0.0035 | |||

| NFG / National Fuel Gas Company | 0.00 | 0.00 | 0.26 | 7.05 | 0.0286 | 0.0014 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | -6.10 | 0.26 | -2.67 | 0.0283 | -0.0012 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.00 | 0.00 | 0.24 | 3.39 | 0.0272 | 0.0005 | |||

| BHRB / Burke & Herbert Financial Services Corp. | 0.00 | 0.10 | 0.24 | 6.19 | 0.0267 | 0.0012 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.00 | 0.00 | 0.24 | 9.59 | 0.0267 | 0.0019 | |||

| DTE / DTE Energy Company | 0.00 | -11.79 | 0.24 | -15.71 | 0.0263 | -0.0053 | |||

| TSLA / Tesla, Inc. | 0.00 | 0.23 | 0.0260 | 0.0260 | |||||

| MTD / Mettler-Toledo International Inc. | 0.00 | 0.00 | 0.23 | -0.43 | 0.0254 | -0.0005 | |||

| CI / The Cigna Group | 0.00 | 0.00 | 0.22 | 0.46 | 0.0245 | -0.0003 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.00 | 0.22 | 0.0243 | 0.0243 | |||||

| MO / Altria Group, Inc. | 0.00 | -1.34 | 0.22 | -3.59 | 0.0239 | -0.0013 | |||

| FSLR / First Solar, Inc. | 0.00 | 0.21 | 0.0237 | 0.0237 | |||||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | 0.21 | 0.0230 | 0.0230 | |||||

| LPX / Louisiana-Pacific Corporation | 0.00 | 0.00 | 0.20 | -6.39 | 0.0227 | -0.0020 | |||

| TGT / Target Corporation | 0.00 | -26.15 | 0.20 | -30.24 | 0.0226 | -0.0103 | |||

| ELME / Elme Communities | 0.01 | 0.00 | 0.19 | -8.57 | 0.0213 | -0.0024 | |||

| VWDRY / Vestas Wind Systems A/S - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.10 | 9.09 | 0.0107 | 0.0007 | |||

| BFS / Saul Centers, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CMCSA / Comcast Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HPQ / HP Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DFS / Discover Financial Services | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CADNF / Cascades Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PKG / Packaging Corporation of America | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MAN / ManpowerGroup Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |