Statistik Asas

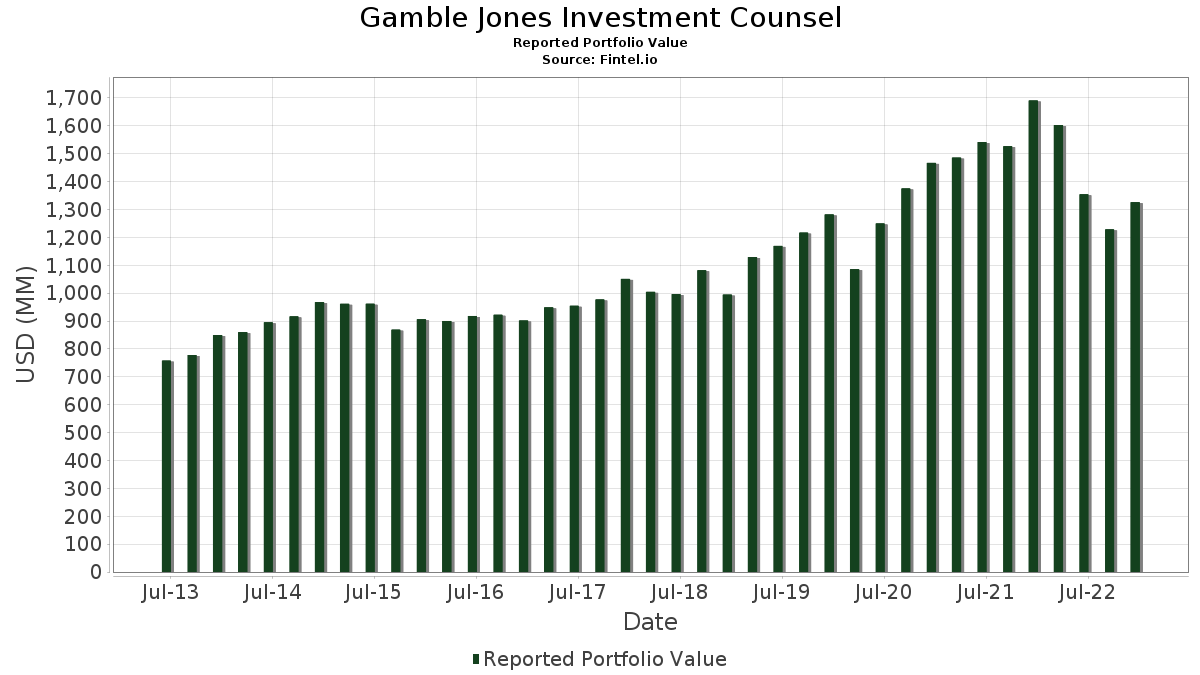

| Nilai Portfolio | $ 1,325,949,770 |

| Kedudukan Semasa | 202 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Gamble Jones Investment Counsel telah mendedahkan 202 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 1,325,949,770 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Gamble Jones Investment Counsel ialah The Procter & Gamble Company (US:PG) , Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , Texas Instruments Incorporated (US:TXN) , and Alphabet Inc. (US:GOOGL) . Kedudukan baharu Gamble Jones Investment Counsel termasuk Dow Inc. (US:DOW) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.24 | 12.25 | 0.9239 | 0.0536 | |

| 0.00 | 0.94 | 0.0707 | 0.0045 | |

| 0.00 | 0.51 | 0.0386 | 0.0027 | |

| 0.01 | 0.38 | 0.0283 | 0.0027 | |

| 0.01 | 0.81 | 0.0610 | 0.0021 | |

| 0.03 | 0.38 | 0.0284 | 0.0002 | |

| 0.00 | 0.22 | 0.0000 | 0.0000 | |

| 0.00 | 0.22 | 0.0000 | 0.0000 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.45 | 371.06 | 0.0280 | -25.1460 | |

| 0.26 | 61.49 | 0.0046 | -4.9264 | |

| 0.29 | 24.28 | 0.0018 | -2.7346 | |

| 0.34 | 29.80 | 0.0022 | -2.6570 | |

| 0.18 | 30.55 | 0.0023 | -2.3271 | |

| 0.27 | 19.72 | 0.0015 | -2.2174 | |

| 0.09 | 27.98 | 0.0021 | -2.0081 | |

| 0.13 | 23.84 | 0.0018 | -1.8063 | |

| 0.22 | 24.00 | 0.0018 | -1.7286 | |

| 0.20 | 18.11 | 0.0014 | -1.6124 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2023-02-08 untuk tempoh pelaporan 2022-12-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PG / The Procter & Gamble Company | 2.45 | -0.05 | 371.06 | 19.99 | 0.0280 | -25.1460 | |||

| AAPL / Apple Inc. | 0.51 | -1.66 | 66.16 | -7.55 | 4.9897 | -0.8357 | |||

| MSFT / Microsoft Corporation | 0.26 | -1.42 | 61.49 | 1.51 | 0.0046 | -4.9264 | |||

| TXN / Texas Instruments Incorporated | 0.18 | 0.01 | 30.55 | 6.76 | 0.0023 | -2.3271 | |||

| GOOGL / Alphabet Inc. | 0.34 | -1.12 | 29.80 | -8.79 | 0.0022 | -2.6570 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.09 | -2.05 | 27.98 | 13.31 | 0.0021 | -2.0081 | |||

| AMZN / Amazon.com, Inc. | 0.29 | -2.82 | 24.28 | -27.76 | 0.0018 | -2.7346 | |||

| ABT / Abbott Laboratories | 0.22 | -0.48 | 24.00 | 12.91 | 0.0018 | -1.7286 | |||

| JNJ / Johnson & Johnson | 0.13 | -0.76 | 23.84 | 7.31 | 0.0018 | -1.8063 | |||

| VBMFX / Vanguard Bond Index Funds - Vanguard Bond Index Fund Total Bond Market Index Fund | 0.27 | -28.17 | 19.72 | -27.65 | 0.0015 | -2.2174 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.18 | 9.73 | 19.29 | 25.15 | 0.0015 | -1.2530 | |||

| IAU / iShares Gold Trust | 0.53 | -2.86 | 18.44 | 6.56 | 0.0014 | -1.4072 | |||

| CVX / Chevron Corporation | 0.10 | -0.17 | 18.43 | 24.71 | 0.0014 | -1.2018 | |||

| GOOG / Alphabet Inc. | 0.20 | -1.01 | 18.11 | -8.65 | 0.0014 | -1.6124 | |||

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.22 | 69.80 | 17.54 | 69.72 | 0.0013 | -0.8398 | |||

| V / Visa Inc. | 0.08 | -0.03 | 17.11 | 16.91 | 0.0013 | -1.1900 | |||

| MA / Mastercard Incorporated | 0.05 | -1.25 | 16.39 | 20.76 | 0.0012 | -1.1038 | |||

| PEP / PepsiCo, Inc. | 0.09 | -5.19 | 16.04 | 4.91 | 0.0012 | -1.2435 | |||

| ABBV / AbbVie Inc. | 0.10 | -0.15 | 15.55 | 20.23 | 0.0012 | -1.0515 | |||

| MCD / McDonald's Corporation | 0.06 | -0.11 | 15.15 | 14.08 | 0.0011 | -1.0800 | |||

| CSCO / Cisco Systems, Inc. | 0.31 | -1.39 | 14.56 | 17.44 | 0.0011 | -1.0083 | |||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.15 | -6.34 | 14.52 | -6.55 | 0.0011 | -1.2635 | |||

| RTX / RTX Corporation | 0.13 | -0.19 | 13.53 | 23.04 | 0.0010 | -0.8943 | |||

| SHV / iShares Trust - iShares Short Treasury Bond ETF | 0.12 | -1.56 | 13.50 | -1.64 | 0.0010 | -1.1164 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.14 | -1.42 | 13.00 | 17.65 | 0.0010 | -0.8986 | |||

| PFE / Pfizer Inc. | 0.24 | -2.14 | 12.25 | 14.58 | 0.9239 | 0.0536 | |||

| C.WSA / Citigroup, Inc. | 0.02 | -3.02 | 11.32 | 24.88 | 0.0009 | -0.7372 | |||

| VTIAX / Vanguard Star Funds - Vanguard Total International Stock Index Fund Admiral | 0.21 | -3.90 | 10.91 | 8.59 | 0.0008 | -0.8170 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.14 | -6.28 | 10.76 | -5.14 | 0.0008 | -0.9229 | |||

| TOTL / SSGA Active Trust - SPDR DoubleLine Total Return Tactical ETF | 0.26 | -9.71 | 10.48 | -10.04 | 0.0008 | -0.9472 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.07 | 22.18 | 10.39 | 37.27 | 0.0008 | -0.6154 | |||

| KKR / KKR & Co. Inc. | 0.22 | -2.15 | 10.38 | 5.62 | 0.0008 | -0.7990 | |||

| DIS / The Walt Disney Company | 0.12 | -1.57 | 10.28 | -9.35 | 0.0008 | -0.9226 | |||

| XOM / Exxon Mobil Corporation | 0.09 | -0.15 | 10.01 | 26.13 | 0.0008 | -0.6450 | |||

| AMGN / Amgen Inc. | 0.04 | -5.60 | 9.92 | 9.99 | 0.0007 | -0.7335 | |||

| WDAY / Workday, Inc. | 0.06 | -16.60 | 9.42 | -8.33 | 0.0007 | -0.8353 | |||

| UNP / Union Pacific Corporation | 0.05 | 0.54 | 9.41 | 6.85 | 0.0007 | -0.7159 | |||

| ADSK / Autodesk, Inc. | 0.05 | -2.57 | 8.86 | -2.54 | 0.0007 | -0.7390 | |||

| DE / Deere & Company | 0.02 | 0.01 | 8.17 | 28.40 | 0.0006 | -0.5174 | |||

| VPU / Vanguard World Fund - Vanguard Utilities ETF | 0.05 | -0.56 | 7.83 | 7.19 | 0.0006 | -0.5938 | |||

| MMM / 3M Company | 0.06 | -1.80 | 7.72 | 6.56 | 0.0006 | -0.5893 | |||

| SCHW / The Charles Schwab Corporation | 0.09 | 331.82 | 7.60 | 400.33 | 0.0006 | -0.1230 | |||

| AMT / American Tower Corporation | 0.03 | -3.71 | 6.96 | -4.99 | 0.0005 | -0.5962 | |||

| CMI / Cummins Inc. | 0.03 | -0.90 | 6.65 | 17.98 | 0.0005 | -0.4586 | |||

| COST / Costco Wholesale Corporation | 0.01 | -0.09 | 6.53 | -3.44 | 0.0005 | -0.5503 | |||

| JPM / JPMorgan Chase & Co. | 0.05 | 0.82 | 6.21 | 29.37 | 0.0005 | -0.3901 | |||

| MCO / Moody's Corporation | 0.02 | -4.08 | 5.99 | 9.91 | 0.0005 | -0.4430 | |||

| CYBR / CyberArk Software Ltd. | 0.04 | -2.87 | 5.65 | -16.02 | 0.0004 | -0.5473 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.03 | -0.98 | 5.60 | 3.90 | 0.0004 | -0.4383 | |||

| ETSY / Etsy, Inc. | 0.05 | -2.80 | 5.59 | 16.27 | 0.0004 | -0.3909 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.03 | 0.52 | 5.40 | 7.07 | 0.0004 | -0.4104 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -7.40 | 5.31 | -2.80 | 0.0004 | -0.4440 | |||

| HD / The Home Depot, Inc. | 0.02 | -2.99 | 5.12 | 11.03 | 0.0004 | -0.3746 | |||

| HON / Honeywell International Inc. | 0.02 | 0.00 | 4.94 | 28.35 | 0.0004 | -0.3132 | |||

| BMY / Bristol-Myers Squibb Company | 0.07 | -0.04 | 4.90 | 1.18 | 0.0004 | -0.3939 | |||

| NSC / Norfolk Southern Corporation | 0.02 | -2.54 | 4.73 | 14.53 | 0.0004 | -0.3358 | |||

| EMR / Emerson Electric Co. | 0.05 | -0.11 | 4.54 | 31.02 | 0.0003 | -0.2817 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.02 | -4.68 | 4.43 | -5.04 | 0.0003 | -0.3792 | |||

| LLY / Eli Lilly and Company | 0.01 | -1.31 | 4.41 | 11.65 | 0.0003 | -0.3210 | |||

| NKE / NIKE, Inc. | 0.03 | -1.85 | 3.88 | 38.17 | 0.0003 | -0.2281 | |||

| SJM / The J. M. Smucker Company | 0.02 | 0.00 | 3.88 | 15.32 | 0.0003 | -0.2733 | |||

| VZ / Verizon Communications Inc. | 0.10 | -60.31 | 3.82 | -58.82 | 0.0003 | -0.7539 | |||

| WMT / Walmart Inc. | 0.03 | -0.09 | 3.80 | 9.22 | 0.0003 | -0.2832 | |||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.02 | -3.20 | 3.73 | 4.93 | 0.0003 | -0.2889 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | 3.12 | 3.69 | 10.39 | 0.0003 | -0.2717 | |||

| EPAM / EPAM Systems, Inc. | 0.01 | -2.73 | 3.61 | -11.99 | 0.0003 | -0.3332 | |||

| LIN / Linde plc | 0.01 | 0.00 | 3.39 | 20.97 | 0.0003 | -0.2280 | |||

| BDX / Becton, Dickinson and Company | 0.01 | 0.00 | 3.30 | 14.11 | 0.0002 | -0.2352 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | -9.22 | 2.84 | -3.72 | 0.0002 | -0.2403 | |||

| INTC / Intel Corporation | 0.10 | -2.29 | 2.77 | 0.18 | 0.0002 | -0.2245 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.03 | -2.67 | 2.74 | 0.11 | 0.0002 | -0.2226 | |||

| PYPL / PayPal Holdings, Inc. | 0.03 | -4.15 | 2.46 | -20.72 | 0.0002 | -0.2521 | |||

| SYY / Sysco Corporation | 0.03 | -1.58 | 2.38 | 6.36 | 0.0002 | -0.1817 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.01 | -1.60 | 2.36 | 5.40 | 0.0002 | -0.1821 | |||

| ROST / Ross Stores, Inc. | 0.02 | -2.66 | 2.33 | 34.00 | 0.0002 | -0.1415 | |||

| IBM / International Business Machines Corporation | 0.02 | 0.00 | 2.28 | 18.55 | 0.0002 | -0.1565 | |||

| META / Meta Platforms, Inc. | 0.02 | -7.56 | 2.23 | -18.03 | 0.0002 | -0.2211 | |||

| KO / The Coca-Cola Company | 0.03 | -0.29 | 2.20 | 13.17 | 0.0002 | -0.1581 | |||

| UPS / United Parcel Service, Inc. | 0.01 | 0.00 | 2.16 | 7.62 | 0.0002 | -0.1632 | |||

| FAST / Fastenal Company | 0.04 | 0.12 | 2.01 | 2.87 | 0.0002 | -0.1587 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.01 | 0.00 | 1.97 | 15.33 | 0.0001 | -0.1390 | |||

| FISV / Fiserv, Inc. | 0.02 | -1.02 | 1.97 | 6.89 | 0.0001 | -0.1500 | |||

| SPOT / Spotify Technology S.A. | 0.02 | -6.58 | 1.95 | -14.56 | 0.0001 | -0.1855 | |||

| NOC / Northrop Grumman Corporation | 0.00 | 0.00 | 1.85 | 16.01 | 0.0001 | -0.1295 | |||

| PM / Philip Morris International Inc. | 0.02 | 0.00 | 1.75 | 21.89 | 0.0001 | -0.1170 | |||

| MDLZ / Mondelez International, Inc. | 0.03 | -1.54 | 1.69 | 19.63 | 0.0001 | -0.1151 | |||

| MKL / Markel Group Inc. | 0.00 | 3.05 | 1.69 | 25.19 | 0.0001 | -0.1098 | |||

| ORCL / Oracle Corporation | 0.02 | 0.00 | 1.63 | 33.85 | 0.0001 | -0.0992 | |||

| TJX / The TJX Companies, Inc. | 0.02 | -1.73 | 1.59 | 25.81 | 0.0001 | -0.1027 | |||

| IHI / iShares Trust - iShares U.S. Medical Devices ETF | 0.03 | -0.84 | 1.58 | 10.40 | 0.0001 | -0.1165 | |||

| KCDMY / Kimberly-Clark de México, S. A. B. de C. V. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 1.50 | 20.55 | 0.0001 | -0.1013 | |||

| AXP / American Express Company | 0.01 | -0.49 | 1.49 | 8.95 | 0.0001 | -0.1108 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | 0.00 | 1.47 | 5.60 | 0.0001 | -0.1132 | |||

| CLX / The Clorox Company | 0.01 | -11.58 | 1.39 | -3.33 | 0.0001 | -0.1173 | |||

| MO / Altria Group, Inc. | 0.03 | -1.62 | 1.39 | 11.36 | 0.0001 | -0.1016 | |||

| CVBF / CVB Financial Corp. | 0.05 | 0.00 | 1.32 | 1.61 | 0.0001 | -0.1058 | |||

| HSY / The Hershey Company | 0.01 | 0.00 | 1.30 | 4.94 | 0.0001 | -0.1004 | |||

| BA / The Boeing Company | 0.01 | 0.00 | 1.27 | 57.34 | 0.0001 | -0.0654 | |||

| BSV / Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF | 0.02 | -7.10 | 1.23 | -6.60 | 0.0001 | -0.1072 | |||

| CL / Colgate-Palmolive Company | 0.02 | 0.00 | 1.22 | 12.10 | 0.0001 | -0.0887 | |||

| TIP / iShares Trust - iShares TIPS Bond ETF | 0.01 | 0.00 | 1.21 | 1.42 | 0.0001 | -0.0973 | |||

| WFC / Wells Fargo & Company | 0.03 | 0.34 | 1.21 | 2.98 | 0.0001 | -0.0954 | |||

| CAT / Caterpillar Inc. | 0.01 | 0.00 | 1.20 | 46.05 | 0.0001 | -0.0669 | |||

| TROW / T. Rowe Price Group, Inc. | 0.01 | 0.00 | 1.19 | 3.86 | 0.0001 | -0.0928 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | -0.63 | 1.18 | 21.06 | 0.0001 | -0.0795 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.01 | 0.00 | 1.17 | 7.36 | 0.0001 | -0.0884 | |||

| ROKU / Roku, Inc. | 0.03 | -6.25 | 1.15 | -32.39 | 0.0001 | -0.1384 | |||

| GPC / Genuine Parts Company | 0.01 | 0.00 | 1.11 | 16.19 | 0.0001 | -0.0773 | |||

| MRK / Merck & Co., Inc. | 0.01 | 0.00 | 1.07 | 28.78 | 0.0001 | -0.0678 | |||

| ECL / Ecolab Inc. | 0.01 | 0.00 | 1.03 | 0.78 | 0.0001 | -0.0830 | |||

| HUM / Humana Inc. | 0.00 | 0.00 | 1.02 | 5.57 | 0.0001 | -0.0789 | |||

| COP / ConocoPhillips | 0.01 | -10.58 | 1.00 | 3.10 | 0.0001 | -0.0786 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.02 | -11.11 | 0.98 | 2.07 | 0.0001 | -0.0784 | |||

| AEP / American Electric Power Company, Inc. | 0.01 | 0.00 | 0.97 | 9.77 | 0.0001 | -0.0716 | |||

| PGR / The Progressive Corporation | 0.01 | 20.61 | 0.95 | 34.47 | 0.0001 | -0.0573 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.94 | 15.25 | 0.0707 | 0.0045 | |||

| BBH / VanEck ETF Trust - VanEck Biotech ETF | 0.01 | 0.00 | 0.91 | 13.47 | 0.0001 | -0.0652 | |||

| DHR / Danaher Corporation | 0.00 | 0.00 | 0.89 | 2.76 | 0.0001 | -0.0708 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.00 | 0.00 | 0.83 | 10.33 | 0.0001 | -0.0614 | |||

| NEE.PRN / NextEra Energy Capital Holdings, Inc. - Corporate Bond/Note | 0.01 | -14.07 | 0.82 | -8.47 | 0.0001 | -0.0730 | |||

| CP / Canadian Pacific Kansas City Limited | 0.01 | 0.00 | 0.81 | 11.74 | 0.0610 | 0.0021 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 0.00 | 0.81 | 5.64 | 0.0001 | -0.0620 | |||

| BAC.PRB / Bank of America Corporation - Preferred Stock | 0.02 | 0.00 | 0.81 | 9.66 | 0.0001 | -0.0598 | |||

| AMAT / Applied Materials, Inc. | 0.01 | 3.12 | 0.80 | 22.60 | 0.0001 | -0.0533 | |||

| MDT / Medtronic plc | 0.01 | -2.90 | 0.78 | -6.58 | 0.0001 | -0.0680 | |||

| GIS / General Mills, Inc. | 0.01 | 0.00 | 0.77 | 9.34 | 0.0001 | -0.0575 | |||

| NVR / NVR, Inc. | 0.00 | 0.00 | 0.76 | 15.65 | 0.0001 | -0.0535 | |||

| WY / Weyerhaeuser Company | 0.02 | 0.00 | 0.73 | 8.43 | 0.0001 | -0.0550 | |||

| IUSV / iShares Trust - iShares Core S&P U.S. Value ETF | 0.01 | -0.84 | 0.73 | 11.79 | 0.0001 | -0.0531 | |||

| SBUX / Starbucks Corporation | 0.01 | -0.68 | 0.73 | 16.94 | 0.0001 | -0.0504 | |||

| CI / The Cigna Group | 0.00 | -4.22 | 0.72 | 14.24 | 0.0001 | -0.0514 | |||

| URI / United Rentals, Inc. | 0.00 | 0.00 | 0.71 | 31.48 | 0.0001 | -0.0439 | |||

| CPRT / Copart, Inc. | 0.01 | 100.00 | 0.69 | 14.52 | 0.0001 | -0.0493 | |||

| TGT / Target Corporation | 0.00 | 0.00 | 0.69 | 0.29 | 0.0001 | -0.0562 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 0.68 | 25.78 | 0.0001 | -0.0442 | |||

| VBR / Vanguard Index Funds - Vanguard Small-Cap Value ETF | 0.00 | -13.75 | 0.68 | -4.52 | 0.0001 | -0.0576 | |||

| SCHP / Schwab Strategic Trust - Schwab U.S. TIPS ETF | 0.01 | 0.00 | 0.64 | 0.00 | 0.0000 | -0.0519 | |||

| FDX / FedEx Corporation | 0.00 | 6.07 | 0.62 | 23.75 | 0.0000 | -0.0407 | |||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | 0.00 | 0.61 | 10.04 | 0.0000 | -0.0454 | |||

| VBK / Vanguard Index Funds - Vanguard Small-Cap Growth ETF | 0.00 | -4.07 | 0.56 | -1.42 | 0.0000 | -0.0460 | |||

| NAC / Nuveen California Quality Municipal Income Fund | 0.05 | 0.00 | 0.54 | 0.94 | 0.0405 | -0.0028 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.53 | 17.74 | 0.0000 | -0.0367 | |||

| TDY / Teledyne Technologies Incorporated | 0.00 | 0.00 | 0.53 | 18.53 | 0.0000 | -0.0364 | |||

| O / Realty Income Corporation | 0.01 | -3.05 | 0.53 | 5.59 | 0.0000 | -0.0407 | |||

| TSLA / Tesla, Inc. | 0.00 | 2.39 | 0.53 | -52.52 | 0.0398 | -0.0506 | |||

| MDYG / SPDR Series Trust - SPDR S&P 400 Mid Cap Growth ETF | 0.01 | -5.42 | 0.52 | 2.16 | 0.0000 | -0.0414 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.00 | 0.00 | 0.52 | 22.04 | 0.0000 | -0.0343 | |||

| TT / Trane Technologies plc | 0.00 | 0.00 | 0.51 | 15.87 | 0.0386 | 0.0027 | |||

| ILMN / Illumina, Inc. | 0.00 | 0.00 | 0.51 | 5.87 | 0.0000 | -0.0388 | |||

| BIV / Vanguard Bond Index Funds - Vanguard Intermediate-Term Bond ETF | 0.01 | 0.00 | 0.46 | 1.09 | 0.0000 | -0.0372 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.01 | -3.86 | 0.46 | 2.46 | 0.0000 | -0.0364 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.01 | 0.28 | 0.46 | 15.78 | 0.0000 | -0.0320 | |||

| VOE / Vanguard Index Funds - Vanguard Mid-Cap Value ETF | 0.00 | -1.02 | 0.43 | 9.67 | 0.0000 | -0.0320 | |||

| C / Citigroup Inc. | 0.01 | 0.00 | 0.41 | 8.53 | 0.0000 | -0.0305 | |||

| WTRG / Essential Utilities, Inc. | 0.01 | 0.00 | 0.39 | 15.09 | 0.0000 | -0.0275 | |||

| CSX / CSX Corporation | 0.01 | 0.00 | 0.39 | 16.27 | 0.0000 | -0.0270 | |||

| STT / State Street Corporation | 0.00 | 0.00 | 0.38 | 27.52 | 0.0000 | -0.0242 | |||

| PCQ / PIMCO California Municipal Income Fund | 0.03 | 0.00 | 0.38 | 8.67 | 0.0284 | 0.0002 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.38 | 19.05 | 0.0283 | 0.0027 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | -27.10 | 0.37 | -29.17 | 0.0000 | -0.0424 | |||

| GE / General Electric Company | 0.00 | 0.00 | 0.37 | 35.16 | 0.0000 | -0.0222 | |||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.00 | 0.00 | 0.37 | -4.94 | 0.0000 | -0.0313 | |||

| PAYX / Paychex, Inc. | 0.00 | -1.00 | 0.36 | 1.96 | 0.0000 | -0.0290 | |||

| DOW / Dow Inc. | 0.01 | -45.31 | 0.36 | -25.67 | 0.0271 | -0.0122 | |||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0.01 | 0.00 | 0.36 | -3.78 | 0.0000 | -0.0301 | |||

| PSX / Phillips 66 | 0.00 | 0.06 | 0.35 | 29.00 | 0.0000 | -0.0219 | |||

| MUB / iShares Trust - iShares National Muni Bond ETF | 0.00 | 0.20 | 0.32 | 2.93 | 0.0000 | -0.0250 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 0.00 | 0.32 | 41.26 | 0.0000 | -0.0181 | |||

| LNT / Alliant Energy Corporation | 0.01 | 0.00 | 0.31 | 4.04 | 0.0000 | -0.0242 | |||

| IJJ / iShares Trust - iShares S&P Mid-Cap 400 Value ETF | 0.00 | 0.00 | 0.30 | 11.85 | 0.0000 | -0.0220 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.00 | 0.00 | 0.30 | 8.39 | 0.0000 | -0.0223 | |||

| MTD / Mettler-Toledo International Inc. | 0.00 | 0.00 | 0.29 | 33.18 | 0.0000 | -0.0176 | |||

| NKX / Nuveen California AMT-Free Quality Municipal Income Fund | 0.02 | 0.00 | 0.27 | 4.23 | 0.0000 | -0.0211 | |||

| RYN / Rayonier Inc. | 0.01 | 0.00 | 0.25 | 10.00 | 0.0000 | -0.0187 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.00 | 0.00 | 0.24 | 22.45 | 0.0000 | -0.0159 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | 0.00 | 0.23 | 38.46 | 0.0000 | -0.0137 | |||

| NEM / Newmont Corporation | 0.00 | -3.87 | 0.23 | 7.83 | 0.0000 | -0.0176 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.01 | -14.02 | 0.23 | -6.83 | 0.0000 | -0.0203 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.00 | 0.00 | 0.23 | 0.87 | 0.0000 | -0.0187 | |||

| SO / The Southern Company | 0.00 | 0.00 | 0.23 | 4.52 | 0.0000 | -0.0180 | |||

| T.PRC / AT&T Inc. - Preferred Stock | 0.01 | 3.43 | 0.23 | 23.66 | 0.0000 | -0.0151 | |||

| DOW / Dow Inc. | 0.00 | 0.23 | 0.0000 | ||||||

| WM / Waste Management, Inc. | 0.00 | 0.00 | 0.22 | -2.18 | 0.0000 | -0.0186 | |||

| VICSX / Vanguard Scottsdale Funds - Vanguard IT Corporate Bond Index Fund Admiral | 0.00 | 0.00 | 0.22 | 2.28 | 0.0000 | -0.0178 | |||

| CB / Chubb Limited | 0.00 | 0.22 | 0.0000 | 0.0000 | |||||

| MSGS / Madison Square Garden Sports Corp. | 0.00 | 0.22 | 0.0000 | 0.0000 | |||||

| RSG / Republic Services, Inc. | 0.00 | 0.00 | 0.22 | -5.19 | 0.0000 | -0.0188 | |||

| AFL / Aflac Incorporated | 0.00 | 0.00 | 0.22 | 27.98 | 0.0000 | -0.0137 | |||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 0.01 | 0.00 | 0.21 | -3.60 | 0.0000 | -0.0181 | |||

| IOO / iShares Trust - iShares Global 100 ETF | 0.00 | 0.00 | 0.21 | 7.04 | 0.0000 | -0.0162 | |||

| KMX / CarMax, Inc. | 0.00 | 0.00 | 0.21 | -7.79 | 0.0000 | -0.0188 | |||

| DCI / Donaldson Company, Inc. | 0.00 | 0.00 | 0.21 | 19.77 | 0.0000 | -0.0140 | |||

| MMP / Magellan Midstream Partners L.P. | 0.00 | 0.00 | 0.20 | 5.73 | 0.0000 | -0.0156 | |||

| PZC / PIMCO California Municipal Income Fund III | 0.02 | 0.00 | 0.17 | 14.38 | 0.0000 | -0.0119 | |||

| VTRS / Viatris Inc. | 0.01 | -41.28 | 0.14 | -23.63 | 0.0000 | -0.0148 | |||

| PCK / PIMCO California Municipal Income Fund II | 0.02 | 0.00 | 0.14 | 5.47 | 0.0000 | -0.0104 | |||

| NCA / Nuveen California Municipal Value Fund | 0.01 | 0.00 | 0.12 | 1.75 | 0.0000 | -0.0093 | |||

| PMF / PIMCO Municipal Income Fund | 0.01 | 0.00 | 0.10 | 7.22 | 0.0000 | -0.0079 | |||

| HLNCF / Haleon plc | 0.01 | 0.00 | 0.10 | 30.67 | 0.0000 | -0.0061 | |||

| PMX / PIMCO Municipal Income Fund III | 0.01 | 0.00 | 0.09 | 12.99 | 0.0000 | -0.0063 | |||

| SNXZF / Sandstorm Gold Ltd. | 0.02 | 0.00 | 0.08 | 1.27 | 0.0000 | -0.0064 | |||

| ZIOP / Alaunos Therapeutics Inc | 0.06 | 0.00 | 0.04 | -62.86 | 0.0000 | -0.0085 | |||

| NTAP / NetApp, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0151 | ||||

| MSGE / Madison Square Garden Entertainment Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0147 | ||||

| CTVA / Corteva, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0323 | ||||

| USB / U.S. Bancorp | 0.00 | -100.00 | 0.00 | -100.00 | -0.0121 | ||||

| AVLR / Avalara Inc | 0.00 | -100.00 | 0.00 | -100.00 | -0.3730 | ||||

| OTIS / Otis Worldwide Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0112 | ||||

| COF / Capital One Financial Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0150 | ||||

| CARR / Carrier Global Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0125 | ||||

| HE / Hawaiian Electric Industries, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0087 | ||||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.0100 | ||||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.0145 | ||||

| ATI / ATI Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0068 | ||||

| VTIP / Vanguard Malvern Funds - Vanguard Short-Term Inflation-Protected Securities ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.0135 | ||||

| FTS / Fortis Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0063 | ||||

| CAG / Conagra Brands, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0106 | ||||

| MRO / Marathon Oil Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0073 | ||||

| IR / Ingersoll Rand Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0094 | ||||

| PALL / abrdn Palladium ETF Trust - abrdn Physical Palladium Shares ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.0182 | ||||

| SCZ / iShares Trust - iShares MSCI EAFE Small-Cap ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.0080 |