Statistik Asas

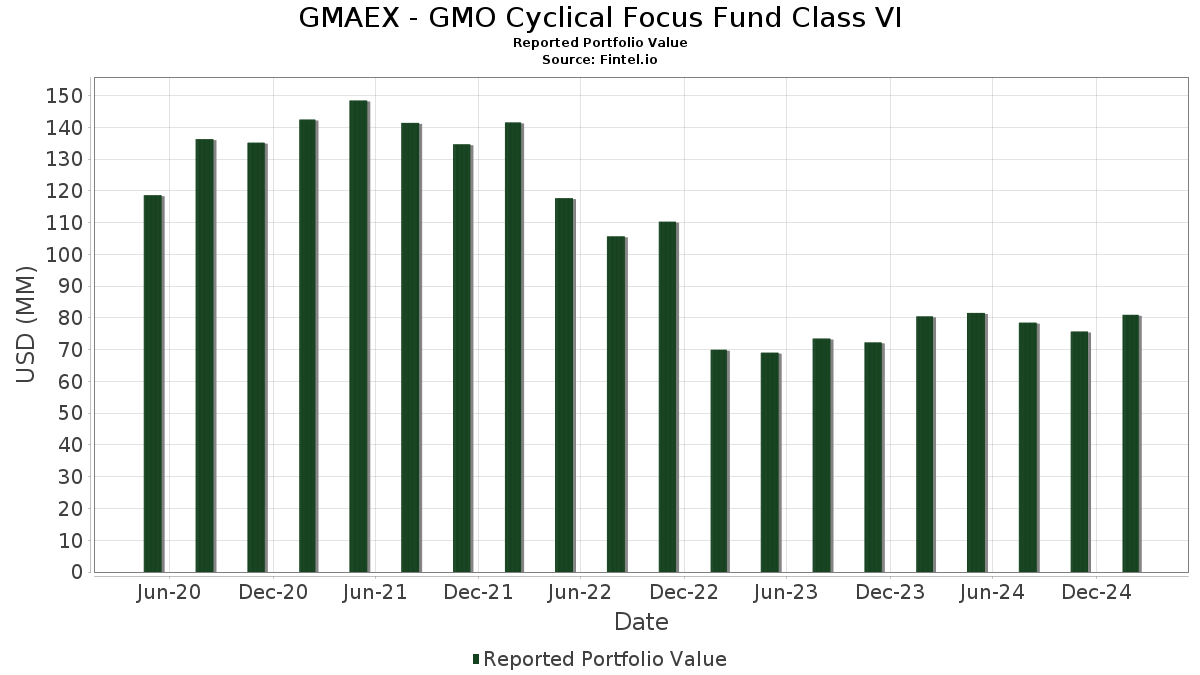

| Nilai Portfolio | $ 80,955,336 |

| Kedudukan Semasa | 64 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

GMAEX - GMO Cyclical Focus Fund Class VI telah mendedahkan 64 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 80,955,336 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas GMAEX - GMO Cyclical Focus Fund Class VI ialah Intercontinental Exchange, Inc. (US:ICE) , Safran SA - Depositary Receipt (Common Stock) (US:SAFRY) , Booking Holdings Inc. (US:BKNG) , Compass Group PLC (DE:XGR2) , and Industria de Diseño Textil, S.A. - Depositary Receipt (Common Stock) (US:IDEXY) . Kedudukan baharu GMAEX - GMO Cyclical Focus Fund Class VI termasuk Canadian Pacific Kansas City Limited (MX:CPKC N) , Norfolk Southern Corporation (US:NSC) , ConocoPhillips (US:COP) , Kinder Morgan, Inc. (US:KMI) , and Northrop Grumman Corporation (US:NOC) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 0.52 | 0.6365 | 0.6365 | |

| 0.00 | 0.50 | 0.6194 | 0.6194 | |

| 0.01 | 0.50 | 0.6172 | 0.6172 | |

| 0.02 | 0.49 | 0.5976 | 0.5976 | |

| 0.00 | 0.48 | 0.5851 | 0.5851 | |

| 0.00 | 0.47 | 0.5838 | 0.5838 | |

| 0.00 | 0.47 | 0.5793 | 0.5793 | |

| 0.00 | 0.46 | 0.5606 | 0.5606 | |

| 0.00 | 0.43 | 0.5336 | 0.5336 | |

| 0.01 | 3.40 | 4.1859 | 0.4939 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 3.31 | 4.0765 | -0.9466 | |

| 0.03 | 2.62 | 3.2253 | -0.7683 | |

| 0.07 | 0.59 | 0.7297 | -0.4909 | |

| 0.05 | 2.80 | 3.4483 | -0.4294 | |

| 0.04 | 1.91 | 2.3545 | -0.4110 | |

| 0.01 | 2.73 | 3.3661 | -0.3508 | |

| 0.02 | 0.93 | 1.1432 | -0.3449 | |

| 0.03 | 1.17 | 1.4380 | -0.2876 | |

| 0.04 | 1.87 | 2.2985 | -0.2734 | |

| 0.18 | 0.52 | 0.6368 | -0.2075 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-04-28 untuk tempoh pelaporan 2025-02-28. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ICE / Intercontinental Exchange, Inc. | 0.02 | 7.95 | 3.70 | 16.21 | 4.5563 | 0.3664 | |||

| SAFRY / Safran SA - Depositary Receipt (Common Stock) | 0.01 | 7.95 | 3.40 | 21.13 | 4.1859 | 0.4939 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -10.08 | 3.31 | -13.31 | 4.0765 | -0.9466 | |||

| XGR2 / Compass Group PLC | 0.09 | 2.16 | 3.22 | 4.38 | 3.9630 | -0.0937 | |||

| IDEXY / Industria de Diseño Textil, S.A. - Depositary Receipt (Common Stock) | 0.06 | 7.95 | 3.19 | 5.11 | 3.9280 | -0.0642 | |||

| RYAAY / Ryanair Holdings plc - Depositary Receipt (Common Stock) | 0.06 | 7.95 | 2.86 | 18.95 | 3.5243 | 0.3590 | |||

| BN / Brookfield Corporation | 0.05 | 0.66 | 2.80 | -4.99 | 3.4483 | -0.4294 | |||

| AXP / American Express Company | 0.01 | -2.05 | 2.73 | -3.26 | 3.3661 | -0.3508 | |||

| MKL / Markel Group Inc. | 0.00 | 7.97 | 2.72 | 17.11 | 3.3545 | 0.2936 | |||

| META / Meta Platforms, Inc. | 0.00 | -8.49 | 2.71 | 6.45 | 3.3356 | -0.0115 | |||

| AMADY / Amadeus IT Group, S.A. - Depositary Receipt (Common Stock) | 0.03 | 7.95 | 2.63 | 16.09 | 3.2339 | 0.2572 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.01 | 8.49 | 2.62 | 13.40 | 3.2323 | 0.1875 | |||

| WFC / Wells Fargo & Company | 0.03 | -16.09 | 2.62 | -13.71 | 3.2253 | -0.7683 | |||

| EOG / EOG Resources, Inc. | 0.02 | 7.94 | 2.37 | 2.82 | 2.9139 | -0.1137 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 7.95 | 2.16 | 5.27 | 2.6552 | -0.0403 | |||

| FEMSAUBD / Fomento Economico Mexicano SAB de CV | 0.23 | 1.46 | 2.15 | 8.36 | 2.6507 | 0.0380 | |||

| GOOGL / Alphabet Inc. | 0.01 | 2.77 | 2.09 | 3.62 | 2.5738 | -0.0809 | |||

| 4GE / Grupo México, S.A.B. de C.V. | 0.42 | 7.95 | 1.97 | 4.24 | 2.4230 | -0.0598 | |||

| LVS / Las Vegas Sands Corp. | 0.04 | 7.95 | 1.91 | -9.04 | 2.3545 | -0.4110 | |||

| USB / U.S. Bancorp | 0.04 | 8.49 | 1.87 | -4.50 | 2.2985 | -0.2734 | |||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.00 | 7.95 | 1.77 | 24.47 | 2.1736 | 0.3073 | |||

| CVX / Chevron Corporation | 0.01 | 7.94 | 1.63 | 5.78 | 2.0063 | -0.0209 | |||

| OTIS / Otis Worldwide Corporation | 0.01 | 7.95 | 1.49 | 4.55 | 1.8406 | -0.0395 | |||

| MU / Micron Technology, Inc. | 0.02 | 7.95 | 1.43 | 3.17 | 1.7618 | -0.0623 | |||

| LRCX / Lam Research Corporation | 0.02 | 7.95 | 1.37 | 12.09 | 1.6905 | 0.0797 | |||

| DAR / Darling Ingredients Inc. | 0.04 | 7.94 | 1.35 | -3.85 | 1.6600 | -0.1851 | |||

| KBX / Knorr-Bremse AG | 0.01 | 0.05 | 1.20 | 13.52 | 1.4801 | 0.0872 | |||

| Berkeley Group Holdings PLC / EC (GB00BP0RGD03) | 0.03 | 3.40 | 1.17 | -10.98 | 1.4380 | -0.2876 | |||

| PSMMF / Persimmon Plc | 0.07 | 1.48 | 1.11 | -3.56 | 1.3702 | -0.1469 | |||

| BEI / Beiersdorf Aktiengesellschaft | 0.01 | 0.18 | 0.98 | 5.95 | 1.2077 | -0.0099 | |||

| KRYAY / Kerry Group plc - Depositary Receipt (Common Stock) | 0.01 | 7.93 | 0.95 | 17.24 | 1.1732 | 0.1049 | |||

| ASHTF / Ashtead Group plc | 0.02 | 7.94 | 0.93 | -17.95 | 1.1432 | -0.3449 | |||

| IMCDY / IMCD N.V. - Depositary Receipt (Common Stock) | 0.01 | 7.95 | 0.87 | 6.78 | 1.0667 | -0.0005 | |||

| HWDJF / Howden Joinery Group Plc | 0.08 | -1.63 | 0.76 | -7.47 | 0.9321 | -0.1436 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 8.47 | 0.74 | 12.86 | 0.9082 | 0.0489 | |||

| NTOIY / Neste Oyj - Depositary Receipt (Common Stock) | 0.07 | 8.49 | 0.59 | -36.14 | 0.7297 | -0.4909 | |||

| ASAZY / ASSA ABLOY AB (publ) - Depositary Receipt (Common Stock) | 0.02 | 8.49 | 0.54 | 8.25 | 0.6635 | 0.0094 | |||

| XBRPP / Bradespar S.A. - Preferred Stock | 0.18 | -12.36 | 0.52 | -19.34 | 0.6368 | -0.2075 | |||

| CPKC N / Canadian Pacific Kansas City Limited | 0.01 | 0.52 | 0.6365 | 0.6365 | |||||

| NSC / Norfolk Southern Corporation | 0.00 | 0.50 | 0.6194 | 0.6194 | |||||

| COP / ConocoPhillips | 0.01 | 0.50 | 0.6172 | 0.6172 | |||||

| KMI / Kinder Morgan, Inc. | 0.02 | 0.49 | 0.5976 | 0.5976 | |||||

| NOC / Northrop Grumman Corporation | 0.00 | 0.48 | 0.5851 | 0.5851 | |||||

| ROK / Rockwell Automation, Inc. | 0.00 | 0.47 | 0.5838 | 0.5838 | |||||

| NUE / Nucor Corporation | 0.00 | 0.47 | 0.5793 | 0.5793 | |||||

| VMC / Vulcan Materials Company | 0.00 | 0.46 | 0.5606 | 0.5606 | |||||

| MLM / Martin Marietta Materials, Inc. | 0.00 | 0.43 | 0.5336 | 0.5336 | |||||

| J / Jacobs Solutions Inc. | 0.00 | 0.38 | 0.4655 | 0.4655 | |||||

| LMT / Lockheed Martin Corporation | 0.00 | 0.37 | 0.4564 | 0.4564 | |||||

| VMI / Valmont Industries, Inc. | 0.00 | 0.36 | 0.4478 | 0.4478 | |||||

| VLO / Valero Energy Corporation | 0.00 | 0.36 | 0.4388 | 0.4388 | |||||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.01 | 0.35 | 0.4359 | 0.4359 | |||||

| WSC / WillScot Holdings Corporation | 0.01 | 0.32 | 0.3929 | 0.3929 | |||||

| CMC / Commercial Metals Company | 0.01 | 0.31 | 0.3844 | 0.3844 | |||||

| FLR / Fluor Corporation | 0.01 | 0.30 | 0.3706 | 0.3706 | |||||

| PWR / Quanta Services, Inc. | 0.00 | 0.26 | 0.3159 | 0.3159 | |||||

| TFII N / TFI International Inc. | 0.00 | 0.24 | 0.2898 | 0.2898 | |||||

| HII / Huntington Ingalls Industries, Inc. | 0.00 | 0.23 | 0.2800 | 0.2800 | |||||

| SEDG / SolarEdge Technologies, Inc. | 0.01 | 8.49 | 0.19 | 13.10 | 0.2343 | 0.0132 | |||

| TRIXX / State Street Institutional Investment Trust - State Street Institutional Treasury Fund Institutional Class | 0.17 | 61.02 | 0.17 | 61.90 | 0.2099 | 0.0706 | |||

| ENPH / Enphase Energy, Inc. | 0.00 | 8.47 | 0.17 | -12.95 | 0.2079 | -0.0469 | |||

| GPRE / Green Plains Inc. | 0.02 | 8.49 | 0.13 | -41.12 | 0.1555 | -0.1263 | |||

| XVALO / Vale S.A. | 0.01 | 0.00 | 0.08 | -4.60 | 0.1032 | -0.0118 | |||

| US3620133690 / GMO US Treasury Fund | 0.00 | -75.73 | 0.00 | -83.33 | 0.0019 | -0.0064 | |||

| LKOH / PJSC LUKOIL | 0.03 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| NVTK / PAO NOVATEK | 0.07 | 0.00 | 0.00 | 0.0000 | 0.0000 |