Statistik Asas

| Nilai Portfolio | $ 153,404,128 |

| Kedudukan Semasa | 45 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

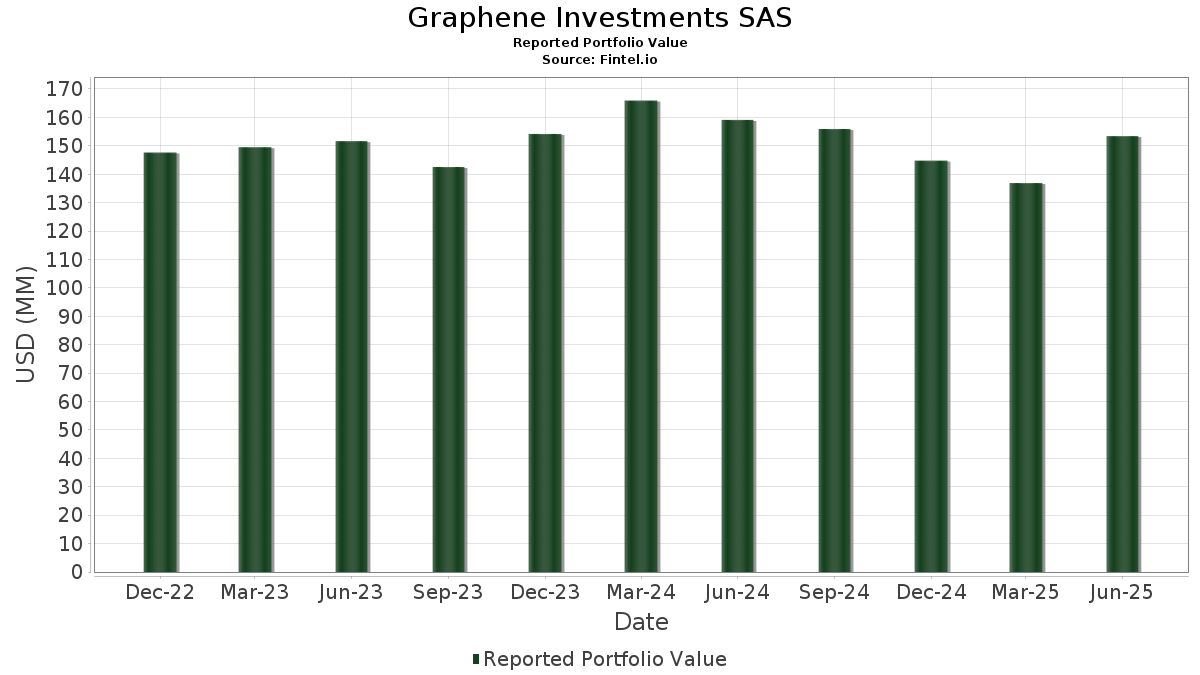

Graphene Investments SAS telah mendedahkan 45 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 153,404,128 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Graphene Investments SAS ialah Microsoft Corporation (US:MSFT) , Broadcom Inc. (US:AVGO) , NVIDIA Corporation (US:NVDA) , Alphabet Inc. (US:GOOGL) , and Apple Inc. (US:AAPL) . Kedudukan baharu Graphene Investments SAS termasuk Iridium Communications Inc. (US:IRDM) , EOG Resources, Inc. (US:EOG) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.12 | 3.48 | 2.2676 | 2.2676 | |

| 0.02 | 2.98 | 1.9415 | 1.9415 | |

| 0.02 | 6.64 | 4.3305 | 0.8691 | |

| 0.07 | 3.37 | 2.1966 | 0.4663 | |

| 0.04 | 6.29 | 4.0990 | 0.3382 | |

| 0.01 | 6.86 | 4.4746 | 0.3337 | |

| 0.05 | 2.94 | 1.9143 | 0.3070 | |

| 0.02 | 2.84 | 1.8499 | 0.2993 | |

| 0.00 | 3.27 | 2.1342 | 0.2639 | |

| 0.03 | 3.42 | 2.2310 | 0.2412 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.07 | 2.83 | 1.8420 | -0.5243 | |

| 0.01 | 3.05 | 1.9900 | -0.3537 | |

| 0.01 | 3.10 | 2.0191 | -0.3190 | |

| 0.02 | 3.02 | 1.9658 | -0.2987 | |

| 0.01 | 2.88 | 1.8805 | -0.2784 | |

| 0.01 | 2.95 | 1.9242 | -0.2575 | |

| 0.11 | 2.46 | 1.6018 | -0.2181 | |

| 0.01 | 2.84 | 1.8491 | -0.2078 | |

| 0.10 | 2.86 | 1.8651 | -0.2036 | |

| 0.01 | 2.75 | 1.7954 | -0.1847 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-06 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.01 | -8.61 | 6.86 | 21.10 | 4.4746 | 0.3337 | |||

| AVGO / Broadcom Inc. | 0.02 | -14.84 | 6.64 | 40.21 | 4.3305 | 0.8691 | |||

| NVDA / NVIDIA Corporation | 0.04 | -16.21 | 6.29 | 22.14 | 4.0990 | 0.3382 | |||

| GOOGL / Alphabet Inc. | 0.03 | 0.00 | 6.15 | 13.97 | 4.0093 | 0.0667 | |||

| AAPL / Apple Inc. | 0.03 | 19.03 | 6.03 | 9.93 | 3.9321 | -0.0760 | |||

| IRDM / Iridium Communications Inc. | 0.12 | 3.48 | 2.2676 | 2.2676 | |||||

| PFE / Pfizer Inc. | 0.14 | 23.98 | 3.47 | 18.63 | 2.2628 | 0.1247 | |||

| BK / The Bank of New York Mellon Corporation | 0.04 | 0.00 | 3.43 | 8.63 | 2.2331 | -0.0706 | |||

| ITRI / Itron, Inc. | 0.03 | 0.00 | 3.42 | 25.67 | 2.2310 | 0.2412 | |||

| FLEX / Flex Ltd. | 0.07 | -5.73 | 3.37 | 42.27 | 2.1966 | 0.4663 | |||

| DBX / Dropbox, Inc. | 0.12 | 2.38 | 3.32 | 9.63 | 2.1664 | -0.0483 | |||

| MSI / Motorola Solutions, Inc. | 0.01 | 17.91 | 3.32 | 13.23 | 2.1653 | 0.0224 | |||

| LLY / Eli Lilly and Company | 0.00 | 35.48 | 3.27 | 27.89 | 2.1342 | 0.2639 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 0.00 | 3.27 | 15.31 | 2.1309 | 0.0600 | |||

| FI / Fiserv, Inc. | 0.02 | 51.20 | 3.26 | 18.04 | 2.1242 | 0.1076 | |||

| MS / Morgan Stanley | 0.02 | 0.00 | 3.24 | 20.72 | 2.1119 | 0.1516 | |||

| ATI / ATI Inc. | 0.04 | -30.90 | 3.19 | 14.65 | 2.0768 | 0.0471 | |||

| MCK / McKesson Corporation | 0.00 | 0.00 | 3.15 | 8.88 | 2.0540 | -0.0600 | |||

| RJF / Raymond James Financial, Inc. | 0.02 | 0.00 | 3.14 | 10.43 | 2.0495 | -0.0307 | |||

| CDW / CDW Corporation | 0.02 | 0.00 | 3.11 | 11.44 | 2.0257 | -0.0114 | |||

| HCA / HCA Healthcare, Inc. | 0.01 | 0.00 | 3.10 | 10.90 | 2.0228 | -0.0219 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 8.33 | 3.10 | -3.22 | 2.0191 | -0.3190 | |||

| URI / United Rentals, Inc. | 0.00 | -12.77 | 3.09 | 4.86 | 2.0136 | -0.1381 | |||

| CPAY / Corpay, Inc. | 0.01 | 0.00 | 3.05 | -4.86 | 1.9900 | -0.3537 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | 23.64 | 3.03 | 13.54 | 1.9735 | 0.0255 | |||

| CNC / Centene Corporation | 0.06 | 21.66 | 3.02 | 8.76 | 1.9673 | -0.0595 | |||

| BFAM / Bright Horizons Family Solutions Inc. | 0.02 | 0.00 | 3.02 | -2.71 | 1.9658 | -0.2987 | |||

| TENB / Tenable Holdings, Inc. | 0.09 | 18.74 | 3.00 | 14.66 | 1.9532 | 0.0443 | |||

| EOG / EOG Resources, Inc. | 0.02 | 2.98 | 1.9415 | 1.9415 | |||||

| WM / Waste Management, Inc. | 0.01 | 0.00 | 2.95 | -1.17 | 1.9242 | -0.2575 | |||

| PINS / Pinterest, Inc. | 0.08 | -1.44 | 2.95 | 14.03 | 1.9239 | 0.0329 | |||

| PSTG / Pure Storage, Inc. | 0.05 | 2.62 | 2.94 | 33.45 | 1.9143 | 0.3070 | |||

| IQV / IQVIA Holdings Inc. | 0.02 | 22.67 | 2.90 | 9.64 | 1.8902 | -0.0417 | |||

| BURL / Burlington Stores, Inc. | 0.01 | 0.00 | 2.88 | -2.40 | 1.8805 | -0.2784 | |||

| BBWI / Bath & Body Works, Inc. | 0.10 | 2.25 | 2.86 | 1.06 | 1.8651 | -0.2036 | |||

| JAZZ / Jazz Pharmaceuticals plc | 0.03 | 30.10 | 2.84 | 11.22 | 1.8539 | -0.0144 | |||

| VRT / Vertiv Holdings Co | 0.02 | -24.83 | 2.84 | 33.69 | 1.8499 | 0.2993 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.01 | 0.00 | 2.84 | 0.75 | 1.8491 | -0.2078 | |||

| BKR / Baker Hughes Company | 0.07 | 0.00 | 2.83 | -12.78 | 1.8420 | -0.5243 | |||

| ON / ON Semiconductor Corporation | 0.05 | -10.64 | 2.77 | 15.12 | 1.8073 | 0.0476 | |||

| PATH / UiPath Inc. | 0.22 | -13.26 | 2.75 | 7.79 | 1.7956 | -0.0712 | |||

| CRM / Salesforce, Inc. | 0.01 | 0.00 | 2.75 | 1.62 | 1.7954 | -0.1847 | |||

| GAP / The Gap, Inc. | 0.12 | -4.56 | 2.55 | 0.99 | 1.6649 | -0.1825 | |||

| NXT / Nextracker Inc. | 0.05 | -22.01 | 2.48 | 0.61 | 1.6197 | -0.1842 | |||

| INTC / Intel Corporation | 0.11 | 0.00 | 2.46 | -1.36 | 1.6018 | -0.2181 | |||

| OXY / Occidental Petroleum Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| COTY / Coty Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |