Statistik Asas

| Nilai Portfolio | $ 1,257,077 |

| Kedudukan Semasa | 128 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

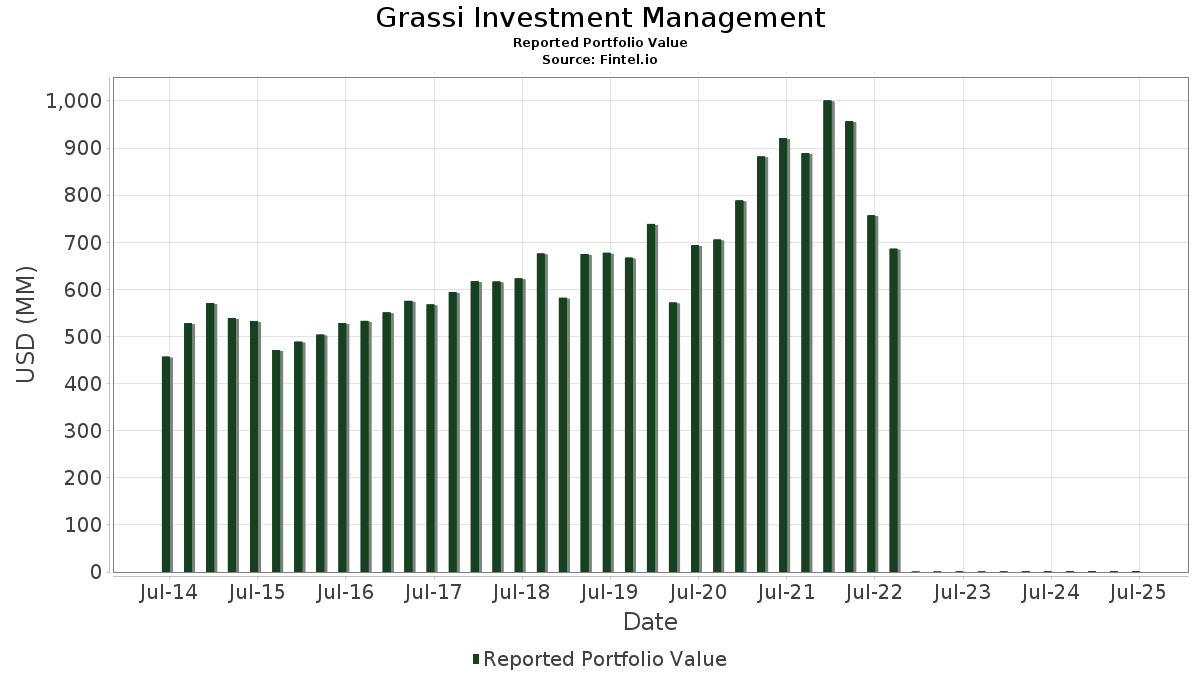

Grassi Investment Management telah mendedahkan 128 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 1,257,077 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Grassi Investment Management ialah NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Broadcom Inc. (US:AVGO) , Apple Inc. (US:AAPL) , and Eli Lilly and Company (US:LLY) . Kedudukan baharu Grassi Investment Management termasuk Lam Research Corporation (US:LRCX) , Booking Holdings Inc. (US:BKNG) , iShares Trust - iShares Russell 1000 Value ETF (US:IWD) , Element Solutions Inc (US:ESI) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.65 | 0.26 | 20.7762 | 4.1298 | |

| 0.27 | 0.07 | 5.8247 | 1.5848 | |

| 0.16 | 0.08 | 6.3169 | 0.7091 | |

| 0.10 | 0.02 | 1.6635 | 0.3938 | |

| 0.27 | 0.05 | 3.9881 | 0.2978 | |

| 0.14 | 0.02 | 1.6130 | 0.2446 | |

| 0.05 | 0.01 | 0.5254 | 0.2055 | |

| 0.05 | 0.01 | 0.7502 | 0.1079 | |

| 0.03 | 0.00 | 0.0924 | 0.0924 | |

| 0.10 | 0.00 | 0.1528 | 0.0875 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.33 | 0.07 | 5.3888 | -1.4202 | |

| 0.08 | 0.06 | 4.9563 | -1.1348 | |

| 0.26 | 0.03 | 2.1414 | -0.5067 | |

| 0.10 | 0.02 | 1.4179 | -0.4670 | |

| 0.10 | 0.04 | 2.7952 | -0.4212 | |

| 0.04 | 0.01 | 0.7735 | -0.3250 | |

| 0.10 | 0.02 | 1.3231 | -0.3227 | |

| 0.03 | 0.01 | 0.4703 | -0.3168 | |

| 0.06 | 0.01 | 0.6378 | -0.2287 | |

| 0.11 | 0.00 | 0.3962 | -0.2151 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-21 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 1.65 | -0.44 | 0.26 | 45.81 | 20.7762 | 4.1298 | |||

| MSFT / Microsoft Corporation | 0.16 | -1.14 | 0.08 | 31.67 | 6.3169 | 0.7091 | |||

| AVGO / Broadcom Inc. | 0.27 | -2.97 | 0.07 | 62.22 | 5.8247 | 1.5848 | |||

| AAPL / Apple Inc. | 0.33 | -0.36 | 0.07 | -8.22 | 5.3888 | -1.4202 | |||

| LLY / Eli Lilly and Company | 0.08 | 0.25 | 0.06 | -4.62 | 4.9563 | -1.1348 | |||

| AMAT / Applied Materials, Inc. | 0.27 | -0.38 | 0.05 | 28.21 | 3.9881 | 0.2978 | |||

| V / Visa Inc. | 0.10 | -0.25 | 0.04 | 2.94 | 2.7952 | -0.4212 | |||

| JPM / JPMorgan Chase & Co. | 0.10 | -0.57 | 0.03 | 20.00 | 2.4066 | 0.0252 | |||

| PLD / Prologis, Inc. | 0.26 | 0.00 | 0.03 | -7.14 | 2.1414 | -0.5067 | |||

| CAT / Caterpillar Inc. | 0.07 | 0.00 | 0.03 | 13.64 | 2.0661 | 0.0250 | |||

| ORCL / Oracle Corporation | 0.10 | -2.57 | 0.02 | 53.85 | 1.6635 | 0.3938 | |||

| AMD / Advanced Micro Devices, Inc. | 0.14 | -0.75 | 0.02 | 42.86 | 1.6130 | 0.2446 | |||

| 1BAC / Bank of America Corporation | 0.42 | -0.41 | 0.02 | 17.65 | 1.5923 | -0.0474 | |||

| ABBV / AbbVie Inc. | 0.10 | -1.26 | 0.02 | -15.00 | 1.4179 | -0.4670 | |||

| BX / Blackstone Inc. | 0.11 | -0.61 | 0.02 | 13.33 | 1.3535 | -0.1263 | |||

| IBM / International Business Machines Corporation | 0.06 | -1.34 | 0.02 | 14.29 | 1.3476 | 0.0077 | |||

| MS / Morgan Stanley | 0.12 | -0.58 | 0.02 | 14.29 | 1.3452 | 0.0420 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.10 | 0.00 | 0.02 | -5.88 | 1.3231 | -0.3227 | |||

| ABT / Abbott Laboratories | 0.12 | -0.79 | 0.02 | 0.00 | 1.3138 | -0.1881 | |||

| AMZN / Amazon.com, Inc. | 0.07 | -0.48 | 0.02 | 15.38 | 1.2314 | -0.0165 | |||

| WFC / Wells Fargo & Company | 0.19 | 0.00 | 0.01 | 7.69 | 1.1815 | -0.0495 | |||

| MAR / Marriott International, Inc. | 0.05 | 0.00 | 0.01 | 18.18 | 1.0866 | -0.0151 | |||

| HON / Honeywell International Inc. | 0.06 | -1.03 | 0.01 | 8.33 | 1.0680 | -0.0730 | |||

| HD / The Home Depot, Inc. | 0.04 | 0.21 | 0.01 | 0.00 | 1.0596 | -0.1695 | |||

| LMT / Lockheed Martin Corporation | 0.03 | -0.39 | 0.01 | 0.00 | 0.9482 | -0.1194 | |||

| VMC / Vulcan Materials Company | 0.04 | -0.44 | 0.01 | 10.00 | 0.9285 | -0.0416 | |||

| UNP / Union Pacific Corporation | 0.05 | 0.00 | 0.01 | 0.00 | 0.9148 | -0.1775 | |||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.19 | -0.99 | 0.01 | 0.00 | 0.8954 | -0.1878 | |||

| AMT / American Tower Corporation | 0.05 | -1.09 | 0.01 | 10.00 | 0.8785 | -0.1383 | |||

| NOW / ServiceNow, Inc. | 0.01 | -1.08 | 0.01 | 25.00 | 0.8632 | 0.0774 | |||

| SCHW / The Charles Schwab Corporation | 0.12 | -1.27 | 0.01 | 11.11 | 0.8494 | -0.0089 | |||

| UBER / Uber Technologies, Inc. | 0.11 | -2.62 | 0.01 | 25.00 | 0.8205 | 0.0554 | |||

| WMTD / Walmart Inc. | 0.10 | 0.00 | 0.01 | 12.50 | 0.7912 | -0.0349 | |||

| SNOW / Snowflake Inc. | 0.04 | -46.52 | 0.01 | -18.18 | 0.7735 | -0.3250 | |||

| BA / The Boeing Company | 0.05 | 10.56 | 0.01 | 50.00 | 0.7502 | 0.1079 | |||

| DLR / Digital Realty Trust, Inc. | 0.05 | -1.01 | 0.01 | 28.57 | 0.7453 | 0.0257 | |||

| CRM / Salesforce, Inc. | 0.03 | 0.30 | 0.01 | 12.50 | 0.7292 | -0.1028 | |||

| JNJ / Johnson & Johnson | 0.06 | -0.34 | 0.01 | -11.11 | 0.7063 | -0.1885 | |||

| MRK / Merck & Co., Inc. | 0.10 | -0.43 | 0.01 | -11.11 | 0.6576 | -0.2132 | |||

| CVX / Chevron Corporation | 0.06 | 0.00 | 0.01 | -11.11 | 0.6378 | -0.2287 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.03 | -4.64 | 0.01 | 16.67 | 0.5782 | 0.0033 | |||

| DIS / The Walt Disney Company | 0.06 | -0.43 | 0.01 | 40.00 | 0.5731 | 0.0404 | |||

| AXP / American Express Company | 0.02 | 0.00 | 0.01 | 40.00 | 0.5598 | 0.0108 | |||

| VRT / Vertiv Holdings Co | 0.05 | 7.38 | 0.01 | 100.00 | 0.5254 | 0.2055 | |||

| STZ / Constellation Brands, Inc. | 0.04 | -3.42 | 0.01 | -14.29 | 0.5123 | -0.1835 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.01 | 0.73 | 0.01 | 20.00 | 0.4979 | 0.0093 | |||

| GOOG / Alphabet Inc. | 0.03 | -39.03 | 0.01 | -37.50 | 0.4703 | -0.3168 | |||

| COST / Costco Wholesale Corporation | 0.01 | 0.00 | 0.01 | 0.00 | 0.4259 | -0.0472 | |||

| DELL INC / (24702R101) | 0.04 | 0.01 | 0.0000 | ||||||

| SHOP / Shopify Inc. | 0.05 | -0.97 | 0.01 | 25.00 | 0.4217 | 0.0118 | |||

| MO / Altria Group, Inc. | 0.09 | -3.77 | 0.01 | 0.00 | 0.4164 | -0.0987 | |||

| BMY / Bristol-Myers Squibb Company | 0.11 | -0.69 | 0.00 | -33.33 | 0.3962 | -0.2151 | |||

| PEP / PepsiCo, Inc. | 0.04 | 0.40 | 0.00 | -20.00 | 0.3923 | -0.1236 | |||

| CMCSA / Comcast Corporation | 0.13 | 0.00 | 0.00 | 0.00 | 0.3787 | -0.0766 | |||

| BSX / Boston Scientific Corporation | 0.04 | -0.91 | 0.00 | 33.33 | 0.3268 | -0.0334 | |||

| SPG / Simon Property Group, Inc. | 0.02 | -5.65 | 0.00 | 0.00 | 0.2659 | -0.0727 | |||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0.02 | -2.82 | 0.00 | 0.00 | 0.2628 | -0.0165 | |||

| WDAY / Workday, Inc. | 0.01 | -2.23 | 0.00 | 0.00 | 0.2512 | -0.0395 | |||

| GD / General Dynamics Corporation | 0.01 | -5.12 | 0.00 | 0.00 | 0.2471 | -0.0360 | |||

| VST / Vistra Corp. | 0.01 | 13.99 | 0.00 | 100.00 | 0.2192 | 0.0837 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.02 | -7.66 | 0.00 | 0.00 | 0.1899 | -0.0692 | |||

| MRVL / Marvell Technology, Inc. | 0.03 | 7.50 | 0.00 | 100.00 | 0.1809 | 0.0253 | |||

| XOM / Exxon Mobil Corporation | 0.02 | 0.00 | 0.00 | 0.00 | 0.1784 | -0.0505 | |||

| MMM / 3M Company | 0.01 | 0.00 | 0.00 | 0.00 | 0.1586 | -0.0194 | |||

| STWD / Starwood Property Trust, Inc. | 0.10 | 168.07 | 0.00 | 0.1528 | 0.0875 | ||||

| PANW / Palo Alto Networks, Inc. | 0.01 | -0.30 | 0.00 | 0.00 | 0.1363 | 0.0038 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.00 | 0.55 | 0.00 | 0.1140 | 0.0275 | ||||

| ARLP / Alliance Resource Partners, L.P. - Limited Partnership | 0.05 | 0.00 | 0.00 | 0.00 | 0.1081 | -0.0232 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.01 | -8.57 | 0.00 | 0.00 | 0.1052 | -0.0185 | |||

| TSLA / Tesla, Inc. | 0.00 | -1.65 | 0.00 | 0.00 | 0.0979 | 0.0035 | |||

| GOOGL / Alphabet Inc. | 0.01 | 0.00 | 0.00 | 0.00 | 0.0974 | -0.0024 | |||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0.01 | -6.78 | 0.00 | 0.00 | 0.0965 | -0.0128 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.00 | 0.0934 | 0.0087 | ||||

| WES / Western Midstream Partners, LP - Limited Partnership | 0.03 | 0.00 | 0.0924 | 0.0924 | |||||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.03 | -6.68 | 0.00 | 0.00 | 0.0861 | -0.0321 | |||

| RTX / RTX Corporation | 0.01 | 0.00 | 0.00 | 0.0858 | -0.0047 | ||||

| AIQ / Global X Funds - Global X Artificial Intelligence & Technology ETF | 0.02 | 3.16 | 0.00 | 0.0823 | 0.0051 | ||||

| CCI / Crown Castle Inc. | 0.01 | -6.71 | 0.00 | 0.0677 | -0.0179 | ||||

| PFE / Pfizer Inc. | 0.03 | -1.77 | 0.00 | 0.0666 | -0.0158 | ||||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 0.00 | 0.0578 | -0.0172 | ||||

| CPT / Camden Property Trust | 0.01 | 0.00 | 0.00 | 0.0574 | -0.0151 | ||||

| CLX / The Clorox Company | 0.01 | 0.00 | 0.00 | 0.0573 | -0.0244 | ||||

| AVB / AvalonBay Communities, Inc. | 0.00 | 0.00 | 0.00 | 0.0548 | -0.0123 | ||||

| XLB / The Select Sector SPDR Trust - The Materials Select Sector SPDR Fund | 0.01 | -8.70 | 0.00 | 0.0527 | -0.0130 | ||||

| CI / The Cigna Group | 0.00 | 0.00 | 0.00 | 0.0526 | -0.0083 | ||||

| HPQ / HP Inc. | 0.03 | 0.00 | 0.00 | 0.0498 | -0.0158 | ||||

| XLC / The Select Sector SPDR Trust - The Communication Services Select Sector SPDR Fund | 0.01 | 3.64 | 0.00 | 0.0479 | 0.0001 | ||||

| GAP / The Gap, Inc. | 0.03 | 0.00 | 0.00 | 0.0461 | -0.0046 | ||||

| VZ / Verizon Communications Inc. | 0.01 | 0.05 | 0.00 | 0.0439 | -0.0096 | ||||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | 2.67 | 0.00 | 0.0437 | 0.0094 | ||||

| US9229087104 / VANGUARD 500 INDEX FUND VANGUARD 500 INDEX ADM | 0.00 | 0.32 | 0.00 | 0.0435 | -0.0021 | ||||

| HACK / Amplify ETF Trust - Amplify Cybersecurity ETF | 0.01 | 2.10 | 0.00 | 0.0418 | 0.0023 | ||||

| HPE / Hewlett Packard Enterprise Company | 0.03 | 0.00 | 0.00 | 0.0417 | 0.0051 | ||||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.00 | 0.08 | 0.00 | 0.0414 | -0.0044 | ||||

| JOET / Virtus ETF Trust II - Virtus Terranova U.S. Quality Momentum ETF | 0.01 | -20.97 | 0.00 | 0.0386 | -0.0122 | ||||

| UNH / UnitedHealth Group Incorporated | 0.00 | 12.37 | 0.00 | 0.0376 | -0.0278 | ||||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.01 | -24.96 | 0.00 | 0.0356 | -0.0169 | ||||

| DVY / iShares Trust - iShares Select Dividend ETF | 0.00 | -4.84 | 0.00 | 0.0335 | -0.0079 | ||||

| IGM / iShares Trust - iShares Expanded Tech Sector ETF | 0.00 | -14.22 | 0.00 | 0.0326 | -0.0031 | ||||

| OKE / ONEOK, Inc. | 0.01 | 0.00 | 0.00 | 0.0325 | -0.0134 | ||||

| VTR / Ventas, Inc. | 0.01 | 0.00 | 0.00 | 0.0301 | -0.0081 | ||||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.00 | 0.0297 | -0.0081 | ||||

| LRCX / Lam Research Corporation | 0.00 | 0.00 | 0.0000 | ||||||

| SONY / Sony Group Corporation - Depositary Receipt (Common Stock) | 0.01 | -6.72 | 0.00 | 0.0287 | -0.0062 | ||||

| AON / Aon plc | 0.00 | -28.57 | 0.00 | 0.0284 | -0.0233 | ||||

| BEN / Franklin Resources, Inc. | 0.01 | -11.88 | 0.00 | 0.0282 | -0.0018 | ||||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.00 | 0.0268 | 0.0011 | ||||

| SCHWAB TTL STCK / (808509756) | 0.00 | 0.00 | 0.0000 | ||||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.00 | 0.0251 | -0.0043 | ||||

| KRE / SPDR Series Trust - SPDR S&P Regional Banking ETF | 0.01 | -9.48 | 0.00 | 0.0248 | -0.0057 | ||||

| WYNN / Wynn Resorts, Limited | 0.00 | -12.20 | 0.00 | 0.0241 | -0.0044 | ||||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.00 | -2.06 | 0.00 | 0.0239 | -0.0048 | ||||

| BKNG / Booking Holdings Inc. | 0.00 | 0.00 | 0.0230 | 0.0230 | |||||

| LC / LendingClub Corporation | 0.02 | -11.36 | 0.00 | 0.0224 | -0.0027 | ||||

| VWELX / Vanguard Wellington Fund - Vanguard Wellington Fund Investor Shares | 0.00 | 0.57 | 0.00 | 0.0207 | -0.0014 | ||||

| QQQM / Invesco Exchange-Traded Fund Trust II - Invesco NASDAQ 100 ETF | 0.00 | 0.00 | 0.00 | 0.0191 | 0.0002 | ||||

| MDLZ / Mondelez International, Inc. | 0.00 | 0.00 | 0.00 | 0.0188 | -0.0031 | ||||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.00 | 0.00 | 0.0186 | 0.0186 | |||||

| FBGRX / Fidelity Securities Fund - Fidelity Blue Chip Growth Fund | 0.00 | 0.00 | 0.0184 | 0.0184 | |||||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | 0.00 | 0.00 | 0.0182 | -0.0017 | ||||

| COIN / Coinbase Global, Inc. | 0.00 | 0.00 | 0.0181 | 0.0181 | |||||

| VANGUARD WELL FUND / (921935102) | 0.00 | 0.00 | 0.0000 | ||||||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 0.00 | 0.0175 | 0.0175 | |||||

| ESI / Element Solutions Inc | 0.01 | 0.00 | 0.0162 | 0.0162 | |||||

| NAC / Nuveen California Quality Municipal Income Fund | 0.01 | 0.00 | 0.00 | 0.0134 | -0.0023 | ||||

| CLNE / Clean Energy Fuels Corp. | 0.04 | 0.00 | 0.00 | 0.0060 | 0.0004 | ||||

| FATE / Fate Therapeutics, Inc. | 0.02 | 0.00 | 0.00 | 0.0016 | 0.0003 | ||||

| CLDI / Calidi Biotherapeutics, Inc. | 0.01 | 0.00 | 0.00 | 0.0002 | -0.0004 | ||||

| TRP / TC Energy Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |