Statistik Asas

| Nilai Portfolio | $ 212,147,450 |

| Kedudukan Semasa | 381 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

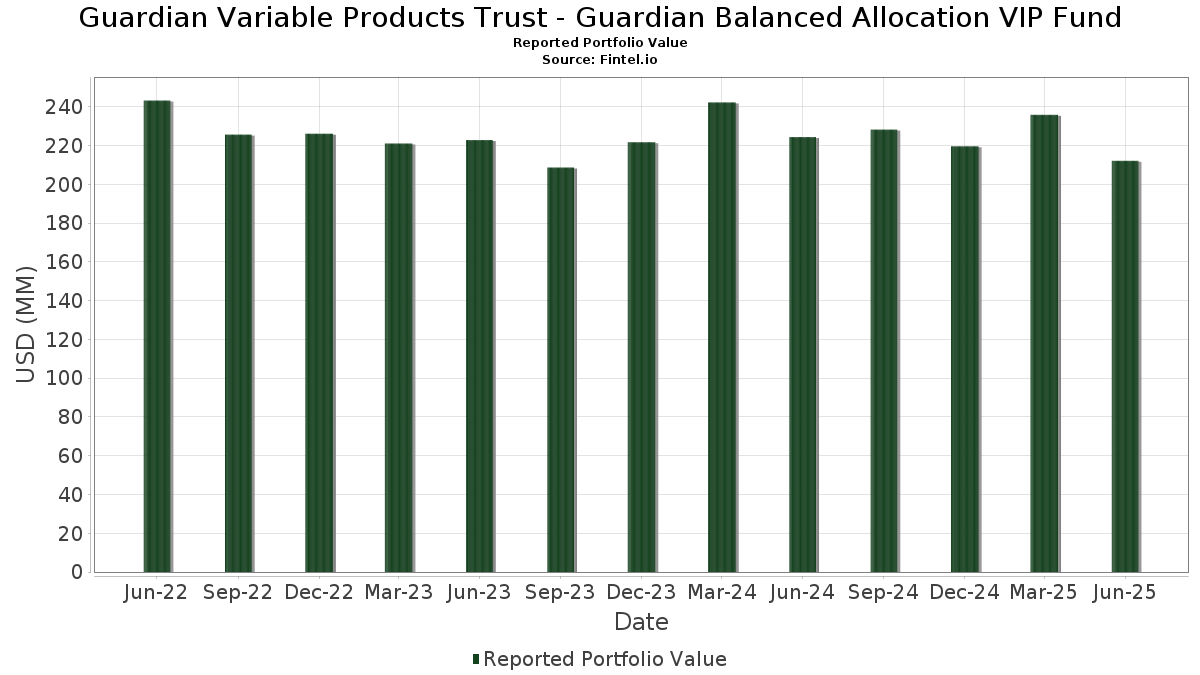

Guardian Variable Products Trust - Guardian Balanced Allocation VIP Fund telah mendedahkan 381 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 212,147,450 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Guardian Variable Products Trust - Guardian Balanced Allocation VIP Fund ialah NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Amazon.com, Inc. (US:AMZN) , Meta Platforms, Inc. (US:META) , and Wells Fargo & Company (US:WFC) . Kedudukan baharu Guardian Variable Products Trust - Guardian Balanced Allocation VIP Fund termasuk Roblox Corporation (US:RBLX) , Marriott International, Inc. (US:MAR) , Edwards Lifesciences Corporation (US:EW) , Celestica Inc. (US:CLS) , and FNMA 30YR UMBS (US:US3140QS4T57) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 5.82 | 2.7285 | 2.2596 | |

| 0.08 | 12.54 | 5.8835 | 2.0224 | |

| 0.03 | 4.56 | 2.1397 | 1.6715 | |

| 0.05 | 4.12 | 1.9322 | 1.6390 | |

| 0.02 | 10.53 | 4.9409 | 1.2600 | |

| 0.01 | 2.13 | 0.9985 | 0.9985 | |

| 0.02 | 5.26 | 2.4667 | 0.9493 | |

| 0.02 | 3.31 | 1.5528 | 0.9269 | |

| 0.04 | 8.12 | 3.8076 | 0.8560 | |

| 0.02 | 2.17 | 1.0197 | 0.8327 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 3.88 | 1.8200 | -1.8816 | |

| -0.44 | -0.2053 | -0.8828 | ||

| -0.69 | -0.3260 | -0.7663 | ||

| 0.78 | 0.3658 | -0.6800 | ||

| 0.22 | 0.1019 | -0.6339 | ||

| 0.00 | 0.83 | 0.3905 | -0.5764 | |

| 0.01 | 3.11 | 1.4599 | -0.5203 | |

| -0.11 | -0.0531 | -0.4831 | ||

| 0.02 | 1.49 | 0.6995 | -0.4700 | |

| 0.00 | 0.00 | -0.4633 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-15 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.08 | 9.08 | 12.54 | 59.01 | 5.8835 | 2.0224 | |||

| MSFT / Microsoft Corporation | 0.02 | 5.71 | 10.53 | 40.07 | 4.9409 | 1.2600 | |||

| AMZN / Amazon.com, Inc. | 0.04 | 16.74 | 8.12 | 34.62 | 3.8076 | 0.8560 | |||

| META / Meta Platforms, Inc. | 0.01 | 374.13 | 5.82 | 507.73 | 2.7285 | 2.2596 | |||

| WFC / Wells Fargo & Company | 0.07 | 28.09 | 5.72 | 42.98 | 2.6811 | 0.7240 | |||

| AVGO / Broadcom Inc. | 0.02 | 3.04 | 5.26 | 69.67 | 2.4667 | 0.9493 | |||

| GOOGL / Alphabet Inc. | 0.03 | 17.95 | 5.22 | 34.41 | 2.4506 | 0.5481 | |||

| PM / Philip Morris International Inc. | 0.03 | 315.58 | 4.56 | 377.09 | 2.1397 | 1.6715 | |||

| SRE / Sempra | 0.05 | 547.67 | 4.12 | 588.63 | 1.9322 | 1.6390 | |||

| AAPL / Apple Inc. | 0.02 | -44.45 | 3.88 | -48.70 | 1.8200 | -1.8816 | |||

| LLY / Eli Lilly and Company | 0.00 | 58.11 | 3.43 | 49.24 | 1.6069 | 0.4833 | |||

| KKR / KKR & Co. Inc. | 0.02 | 124.97 | 3.31 | 159.00 | 1.5528 | 0.9269 | |||

| MA / Mastercard Incorporated | 0.01 | -24.96 | 3.11 | -23.07 | 1.4599 | -0.5203 | |||

| XOM / Exxon Mobil Corporation | 0.03 | 23.83 | 2.99 | 12.27 | 1.4037 | 0.0987 | |||

| BSX / Boston Scientific Corporation | 0.02 | 125.26 | 2.54 | 139.79 | 1.1906 | 0.6726 | |||

| NFLX / Netflix, Inc. | 0.00 | 11.47 | 2.38 | 60.05 | 1.1170 | 0.3888 | |||

| NOW / ServiceNow, Inc. | 0.00 | 39.24 | 2.25 | 79.89 | 1.0577 | 0.4438 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.01 | 390.17 | 2.20 | 339.32 | 1.0327 | 0.7873 | |||

| ABNB / Airbnb, Inc. | 0.02 | 413.57 | 2.17 | 468.85 | 1.0197 | 0.8327 | |||

| ARES / Ares Management Corporation | 0.01 | 165.40 | 2.13 | 213.53 | 1.0004 | 0.6674 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | 2.13 | 0.9985 | 0.9985 | |||||

| MRK / Merck & Co., Inc. | 0.03 | 95.29 | 1.99 | 72.29 | 0.9337 | 0.3680 | |||

| CLH / Clean Harbors, Inc. | 0.01 | 70.93 | 1.95 | 100.62 | 0.9132 | 0.4379 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | 269.16 | 1.93 | 239.30 | 0.9075 | 0.6281 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.03 | 38.61 | 1.91 | 33.19 | 0.8945 | 0.1936 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.02 | 4,356.74 | 1.85 | 180.70 | 0.8668 | 0.5442 | |||

| KR / The Kroger Co. | 0.03 | 245.85 | 1.82 | 266.73 | 0.8534 | 0.6104 | |||

| WELL / Welltower Inc. | 0.01 | 91.16 | 1.81 | 91.75 | 0.8514 | 0.3882 | |||

| NDAQ / Nasdaq, Inc. | 0.02 | 42.98 | 1.75 | 65.50 | 0.8192 | 0.3376 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 1.66 | 0.7803 | 0.7803 | |||||

| SNPS / Synopsys, Inc. | 0.00 | 10.53 | 1.57 | 32.15 | 0.7369 | 0.1550 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | -8.30 | 1.56 | -18.08 | 0.7315 | -0.2003 | |||

| RBLX / Roblox Corporation | 0.01 | 1.51 | 0.7090 | 0.7090 | |||||

| MAR / Marriott International, Inc. | 0.01 | 1.50 | 0.7029 | 0.7029 | |||||

| UBER / Uber Technologies, Inc. | 0.02 | -51.26 | 1.49 | -37.59 | 0.6995 | -0.4700 | |||

| EW / Edwards Lifesciences Corporation | 0.02 | 48.31 | 1.44 | 1,905.56 | 0.6776 | 0.6435 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.00 | 38.19 | 1.43 | 56.59 | 0.6685 | 0.2229 | |||

| POOL / Pool Corporation | 0.00 | 181.18 | 1.39 | 157.70 | 0.6517 | 0.3875 | |||

| LIN / Linde plc | 0.00 | 14.38 | 1.37 | 15.19 | 0.6407 | 0.0606 | |||

| NOC / Northrop Grumman Corporation | 0.00 | 303.87 | 1.35 | 294.75 | 0.6356 | 0.4675 | |||

| SHOP / Shopify Inc. | 0.01 | 1.23 | 0.5776 | 0.5776 | |||||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.01 | 203.73 | 1.21 | 499.01 | 0.5680 | 0.4707 | |||

| U.S. Treasury Notes / DBT (US91282CMV09) | 1.20 | 0.5615 | 0.5615 | ||||||

| IEX / IDEX Corporation | 0.01 | 151.56 | 1.16 | 144.42 | 0.5449 | 0.3119 | |||

| CLS / Celestica Inc. | 0.01 | 1.15 | 0.5391 | 0.5391 | |||||

| TJX / The TJX Companies, Inc. | 0.01 | 66.70 | 1.14 | 68.95 | 0.5337 | 0.2042 | |||

| DIS / The Walt Disney Company | 0.01 | 1.11 | 0.5198 | 0.5198 | |||||

| JHX / James Hardie Industries plc - Depositary Receipt (Common Stock) | 0.04 | 165.34 | 1.06 | 202.85 | 0.4990 | 0.3271 | |||

| U.S. Treasury Notes / DBT (US91282CNC19) | 1.04 | 0.4877 | 0.4877 | ||||||

| US3140QS4T57 / FNMA 30YR UMBS | 1.03 | -1.63 | 0.4826 | -0.0290 | |||||

| U.S. Treasury Notes / DBT (US91282CMP31) | 1.00 | 0.10 | 0.4685 | -0.0196 | |||||

| VRSN / VeriSign, Inc. | 0.00 | 63.74 | 0.99 | 133.73 | 0.4650 | 0.2610 | |||

| U.S. Treasury Notes / DBT (US91282CMU26) | 0.95 | 0.4443 | 0.4443 | ||||||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 0.93 | 0.4386 | 0.4386 | ||||||

| US3132DNF736 / Freddie Mac Pool | 0.93 | -2.52 | 0.4365 | -0.0309 | |||||

| US91282CGQ87 / United States Treasury Note/Bond | 0.92 | 60.53 | 0.4295 | 0.1504 | |||||

| U.S. Treasury Notes / DBT (US91282CMZ13) | 0.90 | 0.4225 | 0.4225 | ||||||

| US912810TM09 / United States Treasury Note/Bond | 0.89 | -2.20 | 0.4180 | -0.0281 | |||||

| ABBV / AbbVie Inc. | 0.00 | 51.55 | 0.88 | 34.30 | 0.4137 | 0.0922 | |||

| US31418DVA70 / FNMA 30YR 2% 12/01/2050# | 0.88 | -2.01 | 0.4111 | -0.0267 | |||||

| U.S. Treasury Notes / DBT (US91282CNG23) | 0.87 | 0.4075 | 0.4075 | ||||||

| VRT / Vertiv Holdings Co | 0.01 | 42.57 | 0.84 | 154.08 | 0.3948 | 0.2323 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -29.25 | 0.83 | -57.87 | 0.3905 | -0.5764 | |||

| U.S. Treasury Bills / DBT (US912797QA86) | 0.82 | 0.3864 | 0.3864 | ||||||

| ICLR / ICON Public Limited Company | 0.01 | 324.00 | 0.82 | 253.68 | 0.3833 | 0.2698 | |||

| U.S. Treasury Notes / DBT (US91282CMM00) | 0.78 | -63.53 | 0.3658 | -0.6800 | |||||

| US3133KMFR16 / UMBS | 0.73 | -18.26 | 0.3405 | -0.0939 | |||||

| TSLA / Tesla, Inc. | 0.00 | -32.58 | 0.72 | -17.39 | 0.3392 | -0.0891 | |||

| U.S. Treasury Notes / DBT (US91282CLW90) | 0.72 | 417.27 | 0.3376 | 0.2693 | |||||

| US3133KL2U00 / FNCL UMBS 2.0 RA5287 05-01-51 | 0.70 | -25.24 | 0.3281 | -0.1300 | |||||

| U.S. Treasury Notes / DBT (US91282CMY48) | 0.70 | 0.3278 | 0.3278 | ||||||

| U.S. Treasury Notes / DBT (US91282CND91) | 0.69 | 0.3225 | 0.3225 | ||||||

| US01F0524748 / Uniform Mortgage-Backed Security, TBA | 0.68 | 0.3200 | 0.3200 | ||||||

| SNOW / Snowflake Inc. | 0.00 | 0.68 | 0.3195 | 0.3195 | |||||

| ANET / Arista Networks Inc | 0.01 | 0.66 | 0.3095 | 0.3095 | |||||

| US91282CJK80 / US TREASURY N/B 4.625% 11-15-26 | 0.65 | 0.00 | 0.3070 | -0.0135 | |||||

| U.S. Treasury Notes / DBT (US91282CNE74) | 0.61 | 0.2865 | 0.2865 | ||||||

| MU / Micron Technology, Inc. | 0.00 | -61.53 | 0.60 | -63.99 | 0.2800 | -0.4577 | |||

| U.S. Treasury Notes / DBT (US91282CKP58) | 0.57 | 0.53 | 0.2683 | -0.0102 | |||||

| US3140LVS423 / FANNIE MAE POOL FN BT6838 | 0.56 | -3.92 | 0.2641 | -0.0228 | |||||

| US3140XJ3C52 / Fannie Mae Pool | 0.56 | -2.10 | 0.2629 | -0.0173 | |||||

| U.S. Treasury Notes / DBT (US91282CKD29) | 0.56 | 0.72 | 0.2609 | -0.0097 | |||||

| U.S. Treasury Notes / DBT (US91282CLK52) | 0.55 | 0.73 | 0.2589 | -0.0092 | |||||

| US72147KAJ79 / Pilgrim's Pride Corp | 0.55 | 2.44 | 0.2561 | -0.0045 | |||||

| U.S. Treasury Notes / DBT (US91282CMG32) | 0.55 | 0.74 | 0.2560 | -0.0093 | |||||

| US91282CJR34 / United States Treasury Note/Bond - When Issued | 0.54 | -31.25 | 0.2533 | -0.1309 | |||||

| FMC / FMC Corporation | 0.01 | 113.30 | 0.53 | 111.24 | 0.2469 | 0.1248 | |||

| US36179XAA46 / Government National Mortgage Association | 0.51 | -3.02 | 0.2410 | -0.0184 | |||||

| HUBS / HubSpot, Inc. | 0.00 | -7.79 | 0.51 | -10.27 | 0.2382 | -0.0384 | |||

| U.S. Treasury Notes / DBT (US91282CKX82) | 0.50 | 0.60 | 0.2361 | -0.0087 | |||||

| U.S. Treasury Notes / DBT (US91282CLS88) | 0.49 | -29.13 | 0.2298 | -0.1081 | |||||

| US912810TQ13 / United States Treasury Note/Bond | 0.49 | -2.21 | 0.2287 | -0.0153 | |||||

| U.S. Treasury Notes / DBT (US91282CKT70) | 0.48 | 0.63 | 0.2259 | -0.0085 | |||||

| US912810TS78 / United States Treasury Note/Bond | 0.48 | -18.01 | 0.2247 | -0.0608 | |||||

| U.S. Treasury Notes / DBT (US91282CLN91) | 0.47 | 0.85 | 0.2226 | -0.0078 | |||||

| U.S. Treasury Bonds / DBT (US912810UB25) | 0.47 | -2.09 | 0.2200 | -0.0148 | |||||

| US36179XDE31 / GNMA II, 30 Year | 0.46 | -3.36 | 0.2163 | -0.0168 | |||||

| US912810TU25 / United States Treasury Note/Bond | 0.46 | -12.98 | 0.2141 | -0.0429 | |||||

| RFR Trust 2025-SGRM / ABS-MBS (US74984NAA28) | 0.46 | -20.04 | 0.2137 | -0.0653 | |||||

| US91282CJA09 / United States Treasury Note/Bond | 0.46 | -42.04 | 0.2137 | -0.1709 | |||||

| US91282CFT36 / United States Treasury Note/Bond | 0.45 | 0.90 | 0.2093 | -0.0075 | |||||

| U.S. Treasury Notes / DBT (US91282CMA61) | 0.44 | 0.69 | 0.2043 | -0.0074 | |||||

| US912810TW80 / United States Treasury Note/Bond | 0.44 | -33.99 | 0.2042 | -0.1185 | |||||

| US3140QKVB11 / Fannie Mae Pool | 0.43 | -2.70 | 0.2033 | -0.0149 | |||||

| WCN / Waste Connections, Inc. | 0.00 | 27.99 | 0.43 | 22.44 | 0.2023 | 0.0299 | |||

| U.S. Treasury Bonds / DBT (US912810UJ50) | 0.43 | -21.73 | 0.1995 | -0.0667 | |||||

| US3132D9HT40 / Freddie Mac Pool | 0.42 | -1.86 | 0.1985 | -0.0129 | |||||

| US91282CJN20 / US TREASURY N/B 4.375% 11-30-28 | 0.42 | 0.48 | 0.1964 | -0.0075 | |||||

| US3132DWHT36 / FEDERAL HOME LOAN MORTGAGE CORP | 0.41 | -2.37 | 0.1934 | -0.0135 | |||||

| U.S. Treasury Notes / DBT (US91282CLY56) | 0.41 | 0.25 | 0.1914 | -0.0083 | |||||

| US3140XGK996 / Uniform Mortgage-Backed Securities | 0.41 | -2.63 | 0.1913 | -0.0138 | |||||

| U.S. Treasury Notes / DBT (US91282CMH15) | 0.40 | 0.25 | 0.1893 | -0.0080 | |||||

| U.S. Treasury Bonds / DBT (US912810UL07) | 0.40 | 0.1874 | 0.1874 | ||||||

| US36179WLP13 / Ginnie Mae II Pool | 0.39 | -2.96 | 0.1846 | -0.0139 | |||||

| US36179WFG87 / GINNIE MAE II POOL P#MA7367 2.50000000 | 0.39 | -2.73 | 0.1841 | -0.0135 | |||||

| US36179V4W70 / GNMA | 0.38 | -3.07 | 0.1782 | -0.0134 | |||||

| U.S. Treasury Bonds / DBT (US912810TZ12) | 0.38 | -2.32 | 0.1781 | -0.0119 | |||||

| U.S. Treasury Bonds / DBT (US912810UK24) | 0.38 | 0.1775 | 0.1775 | ||||||

| US91282CFM82 / U.S. Treasury Notes | 0.38 | 0.27 | 0.1768 | -0.0071 | |||||

| US912810TV08 / US TREASURY N/B 4.75% 11-15-53 | 0.37 | -3.11 | 0.1757 | -0.0134 | |||||

| U.S. Treasury Bonds / DBT (US912810UF39) | 0.37 | -2.09 | 0.1755 | -0.0118 | |||||

| US91282CEN74 / United States Treasury Note/Bond | 0.37 | -16.06 | 0.1720 | -0.0419 | |||||

| US04685A2V22 / Athene Global Funding | 0.36 | 1.12 | 0.1696 | -0.0055 | |||||

| US36179WVW53 / Ginnie Mae II Pool | 0.35 | -3.81 | 0.1659 | -0.0139 | |||||

| US36179WXL70 / Ginnie Mae II Pool | 0.35 | -3.56 | 0.1652 | -0.0137 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.35 | -5.68 | 0.1638 | -0.0175 | |||||

| U.S. Treasury Notes / DBT (US91282CMD01) | 0.35 | 0.58 | 0.1636 | -0.0060 | |||||

| US912810TD00 / United States Treasury Note/Bond | 0.35 | -3.08 | 0.1625 | -0.0125 | |||||

| US31418ERL64 / FN MA4990 | 0.34 | -5.23 | 0.1616 | -0.0162 | |||||

| U.S. Treasury Notes / DBT (US91282CMT52) | 0.34 | 0.1615 | 0.1615 | ||||||

| US76134KAA25 / Retained Vantage Data Centers Issuer LLC | 0.34 | 0.59 | 0.1612 | -0.0061 | |||||

| U.S. Treasury Notes / DBT (US91282CJW29) | 0.34 | 0.59 | 0.1600 | -0.0059 | |||||

| US912810TL26 / TREASURY BOND | 0.34 | -3.13 | 0.1597 | -0.0121 | |||||

| US378272BP27 / Glencore Funding LLC | 0.33 | -33.53 | 0.1554 | -0.0885 | |||||

| U.S. Treasury Notes / DBT (US91282CKG59) | 0.33 | 0.61 | 0.1545 | -0.0057 | |||||

| EW / Edwards Lifesciences Corporation | 0.32 | -174.14 | 0.1522 | 0.3575 | |||||

| US03027WAM47 / American Tower Trust #1 | 0.32 | 0.31 | 0.1502 | -0.0063 | |||||

| US912810TN81 / United States Treasury Note/Bond | 0.31 | -3.09 | 0.1475 | -0.0113 | |||||

| US643821AA93 / New Economy Assets Phase 1 Sponsor LLC, Series 2021-1, Class A1 | 0.31 | 0.64 | 0.1474 | -0.0057 | |||||

| U.S. Treasury Notes / DBT (US91282CLC37) | 0.31 | 0.64 | 0.1470 | -0.0054 | |||||

| Bank of America Corp / DBT (US06051GML04) | 0.31 | 0.97 | 0.1467 | -0.0047 | |||||

| CE / Celanese Corporation | 0.01 | 65.04 | 0.31 | 60.82 | 0.1466 | 0.0515 | |||

| Extra Space Storage LP / DBT (US30225VAU17) | 0.31 | 0.98 | 0.1453 | -0.0049 | |||||

| U.S. Treasury Bonds / DBT (US912810UD80) | 0.31 | -2.24 | 0.1439 | -0.0096 | |||||

| US36179VZQ66 / Ginnie Mae II Pool | 0.30 | -2.88 | 0.1425 | -0.0103 | |||||

| U.S. Treasury Bonds / DBT (US912810UA42) | 0.30 | -3.19 | 0.1425 | -0.0111 | |||||

| US458140BL39 / Intel Corp | 0.30 | 1.68 | 0.1422 | -0.0039 | |||||

| US21H0526788 / Ginnie Mae | 0.30 | 0.1409 | 0.1409 | ||||||

| US36179XDD57 / Ginnie Mae II Pool | 0.29 | -2.97 | 0.1381 | -0.0107 | |||||

| US3133KM3Y94 / Freddie Mac Pool | 0.29 | -2.99 | 0.1371 | -0.0103 | |||||

| US3133KYVL00 / Freddie Mac Pool | 0.29 | -1.70 | 0.1357 | -0.0083 | |||||

| U.S. Treasury Notes / DBT (US91282CKZ31) | 0.28 | 0.35 | 0.1332 | -0.0055 | |||||

| U.S. Treasury Notes / DBT (US91282CMF58) | 0.28 | 0.35 | 0.1330 | -0.0053 | |||||

| U.S. Treasury Notes / DBT (US91282CLG41) | 0.28 | 0.71 | 0.1328 | -0.0053 | |||||

| US3133KPAL22 / Freddie Mac Pool | 0.28 | -2.42 | 0.1326 | -0.0093 | |||||

| U.S. Treasury Notes / DBT (US91282CNF40) | 0.28 | 0.1312 | 0.1312 | ||||||

| 4020 / Saudi Real Estate Company | 0.28 | 1.09 | 0.1310 | -0.0044 | |||||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.27 | 0.1281 | 0.1281 | |||||

| Brighthouse Financial Global Funding / DBT (US10921U2L15) | 0.27 | 0.74 | 0.1276 | -0.0047 | |||||

| US3136B9VP90 / Fannie Mae REMICS | 0.27 | -2.18 | 0.1267 | -0.0083 | |||||

| US6174467Y92 / Morgan Stanley | 0.27 | 0.38 | 0.1256 | -0.0050 | |||||

| 30064K105 / Exacttarget, Inc. | 0.27 | 1.15 | 0.1246 | -0.0041 | |||||

| Sammons Financial Group Global Funding / DBT (US79587J2C65) | 0.26 | 0.1234 | 0.1234 | ||||||

| U.S. Treasury Bonds / DBT (US912810UG12) | 0.26 | -34.99 | 0.1230 | -0.0744 | |||||

| Abu Dhabi Developmental Holding Co PJSC / DBT (US00402D2C80) | 0.26 | 0.78 | 0.1221 | -0.0042 | |||||

| AU3FN0029609 / AAI Ltd | 0.26 | 1.17 | 0.1218 | -0.0036 | |||||

| US20271AAL17 / Commonwealth Bank of Australia | 0.26 | 0.39 | 0.1208 | -0.0047 | |||||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 0.25 | -78.34 | 0.1190 | -0.4013 | |||||

| US91282CJP77 / United States Treasury Note/Bond | 0.25 | 0.00 | 0.1182 | -0.0051 | |||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 0.25 | 0.1174 | 0.1174 | ||||||

| US3140XGS916 / Fannie Mae Pool | 0.24 | -2.79 | 0.1145 | -0.0084 | |||||

| U.S. Treasury Notes / DBT (US91282CMC28) | 0.24 | 0.41 | 0.1138 | -0.0043 | |||||

| XS2262961076 / ZF Finance GmbH | 0.24 | 0.1130 | 0.1130 | ||||||

| US912810TT51 / United States Treasury Note/Bond | 0.24 | -3.24 | 0.1124 | -0.0086 | |||||

| PRET 2025-RPL2 Trust / ABS-MBS (US69392LAA26) | 0.24 | -2.06 | 0.1120 | -0.0072 | |||||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 0.24 | 1.28 | 0.1118 | -0.0037 | |||||

| US161175CA05 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.24 | 229.17 | 0.1116 | 0.0761 | |||||

| CA21037X1345 / CONSTELLATION SOFTWARE INC | 0.24 | -17.77 | 0.1110 | -0.0296 | |||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 0.23 | 0.1093 | 0.1093 | ||||||

| US95000U3G61 / Wells Fargo & Co | 0.23 | 0.43 | 0.1091 | -0.0041 | |||||

| GA Global Funding Trust / DBT (US36143L2Q77) | 0.23 | 0.88 | 0.1082 | -0.0038 | |||||

| US912810SX72 / UNITED STATES TREASURY BOND 2.375% 05/15/2051 | 0.23 | -2.99 | 0.1067 | -0.0081 | |||||

| US3132DN3S06 / Freddie Mac Pool | 0.23 | -2.60 | 0.1057 | -0.0078 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 0.22 | 0.90 | 0.1051 | -0.0034 | |||||

| US91282CGC91 / United States Treasury Note/Bond | 0.22 | 0.46 | 0.1035 | -0.0040 | |||||

| US01F0306781 / UMBS TBA | 0.22 | -86.86 | 0.1019 | -0.6339 | |||||

| US38383DY695 / Government National Mortgage Association | 0.22 | -3.57 | 0.1017 | -0.0082 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.21 | -14.06 | 0.1007 | -0.0217 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.21 | -2.29 | 0.1001 | -0.0071 | |||||

| US3137AJUU64 / Freddie Mac REMICS | 0.21 | -1.84 | 0.1001 | -0.0063 | |||||

| Foundry JV Holdco LLC / DBT (US350930AC75) | 0.21 | 1.45 | 0.0987 | -0.0030 | |||||

| US91086QAS75 / Mexico Government International Bond | 0.21 | 1.46 | 0.0976 | -0.0029 | |||||

| Foundry JV Holdco LLC / DBT (US350930AG89) | 0.21 | 1.97 | 0.0973 | -0.0025 | |||||

| JBS USA Holding Lux Sarl / JBS USA Foods Group Holdings Inc / JBS USA Food Co / DBT (US472140AJ19) | 0.21 | 0.0969 | 0.0969 | ||||||

| Greensaif Pipelines Bidco Sarl / DBT (US39541EAE32) | 0.20 | -0.49 | 0.0960 | -0.0047 | |||||

| US00206RBH49 / AT&T Inc | 0.20 | 0.00 | 0.0956 | -0.0038 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.20 | 0.50 | 0.0950 | -0.0035 | |||||

| Greensaif Pipelines Bidco Sarl / DBT (US39541EAD58) | 0.20 | -0.50 | 0.0948 | -0.0044 | |||||

| U.S. Treasury Bonds / DBT (US912810UE63) | 0.20 | -43.54 | 0.0946 | -0.0798 | |||||

| XS2262961076 / ZF Finance GmbH | 0.20 | 0.0936 | 0.0936 | ||||||

| US36179W5E46 / Government National Mortgage Association (GNMA) | 0.20 | -2.94 | 0.0929 | -0.0073 | |||||

| US36179WFH60 / Ginnie Mae II Pool | 0.20 | -2.96 | 0.0928 | -0.0068 | |||||

| U.S. Treasury Notes / DBT (US91282CJT99) | 0.20 | 0.00 | 0.0926 | -0.0039 | |||||

| Whistler Pipeline LLC / DBT (US96337RAA05) | 0.20 | 0.52 | 0.0916 | -0.0036 | |||||

| PPG / PPG Industries, Inc. | 0.00 | -69.10 | 0.19 | -67.93 | 0.0913 | -0.2052 | |||

| US3132DV3Z67 / Freddie Mac Pool | 0.19 | -2.54 | 0.0903 | -0.0062 | |||||

| Volkswagen Auto Lease Trust 2024-A / ABS-O (US92866EAD13) | 0.19 | 0.00 | 0.0899 | -0.0040 | |||||

| US21H0206753 / GINNIE MAE II POOL 30YR TBA (JULY) | 0.19 | -69.19 | 0.0898 | -0.1867 | |||||

| Protective Life Global Funding / DBT (US74368CCB81) | 0.19 | 0.53 | 0.0896 | -0.0033 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.19 | 0.53 | 0.0890 | -0.0030 | |||||

| US912810TR95 / United States Treasury Note/Bond | 0.19 | -46.31 | 0.0889 | -0.0835 | |||||

| US96328GAS66 / Wheels Fleet Lease Funding 1 LLC | 0.19 | -18.97 | 0.0886 | -0.0251 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 0.19 | 2.17 | 0.0885 | -0.0018 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.19 | -2.08 | 0.0884 | -0.0058 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.18 | -2.14 | 0.0859 | -0.0062 | |||||

| US36268DAA00 / GMREV 23-2 A 144A 5.77% 08-11-36/11-13-28 | 0.18 | 0.55 | 0.0854 | -0.0034 | |||||

| US3132DWJS35 / Freddie Mac Pool | 0.18 | -3.74 | 0.0846 | -0.0072 | |||||

| Athene Global Funding / DBT (US04685A3Q28) | 0.18 | 0.56 | 0.0844 | -0.0031 | |||||

| US88240TAA97 / Texas Electric Market Stabilization Funding N LLC | 0.18 | 0.57 | 0.0834 | -0.0031 | |||||

| US12530MAE57 / CF Hippolyta LLC | 0.18 | 1.14 | 0.0831 | -0.0029 | |||||

| Public Service Co of Oklahoma / DBT (US744533BS89) | 0.18 | 0.0827 | 0.0827 | ||||||

| Henneman Trust / DBT (US425911AA21) | 0.18 | 0.0827 | 0.0827 | ||||||

| US3137H4FG00 / FHR 5170 DP | 0.17 | -2.84 | 0.0806 | -0.0056 | |||||

| US68389XBZ78 / Oracle Corp | 0.17 | -22.48 | 0.0794 | -0.0277 | |||||

| RGA Global Funding / DBT (US76209PAG81) | 0.17 | 1.20 | 0.0794 | -0.0028 | |||||

| US254709AT53 / Discover Financial Services | 0.17 | 1.82 | 0.0791 | -0.0019 | |||||

| US92212KAD81 / Vantage Data Centers Issuer LLC | 0.17 | 0.60 | 0.0790 | -0.0029 | |||||

| US373334KT78 / Georgia Power Co. | 0.17 | 1.83 | 0.0785 | -0.0021 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0.16 | 1.25 | 0.0760 | -0.0026 | |||||

| US49338CAB90 / KeySpan Gas East Corp. | 0.16 | 0.00 | 0.0742 | -0.0031 | |||||

| US91282CHK09 / United States Treasury Note/Bond | 0.16 | 0.65 | 0.0733 | -0.0028 | |||||

| US500945AC45 / Kubota Credit Owner Trust, Series 2023-2A, Class A3 | 0.16 | 0.00 | 0.0733 | -0.0033 | |||||

| US29374LAB62 / Enterprise Fleet Financing 2023-3 LLC | 0.16 | -13.41 | 0.0731 | -0.0146 | |||||

| US626207YF57 / MUNI ELEC AUTH OF GEORGIA | 0.16 | -3.12 | 0.0730 | -0.0055 | |||||

| 30064K105 / Exacttarget, Inc. | 0.16 | -0.64 | 0.0730 | -0.0037 | |||||

| Pricoa Global Funding I / DBT (US74153WCX56) | 0.15 | 0.0715 | 0.0715 | ||||||

| US638961AA02 / Navient Private Education Refi Loan Trust 2023-A | 0.15 | -4.40 | 0.0715 | -0.0065 | |||||

| Mars Inc / DBT (US571676BC81) | 0.15 | -0.66 | 0.0711 | -0.0033 | |||||

| US36179T7L33 / Ginnie Mae II Pool | 0.15 | -3.29 | 0.0694 | -0.0052 | |||||

| US91282CGB19 / United States Treasury Note/Bond | 0.15 | 0.68 | 0.0693 | -0.0025 | |||||

| US912810RK60 / United States Treas Bds Bond | 0.15 | 0.0686 | 0.0686 | ||||||

| US91282CJF95 / United States Treasury Note/Bond | 0.15 | -81.90 | 0.0684 | -0.3241 | |||||

| U.S. Treasury Notes / DBT (US91282CLQ23) | 0.14 | 0.00 | 0.0666 | -0.0026 | |||||

| US31418EMT46 / Fannie Mae Pool | 0.14 | -2.88 | 0.0634 | -0.0047 | |||||

| Belrose Funding Trust II / DBT (US08079KAA25) | 0.13 | 0.0623 | 0.0623 | ||||||

| Whistler Pipeline LLC / DBT (US96337RAB87) | 0.13 | 0.76 | 0.0622 | -0.0022 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.13 | 0.79 | 0.0602 | -0.0020 | |||||

| Enterprise Products Operating LLC / DBT (US29379VCL53) | 0.13 | 0.0591 | 0.0591 | ||||||

| US3137FHQ630 / Freddie Mac Multifamily Structured Pass Through Certificates | 0.12 | 0.0580 | 0.0580 | ||||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 0.12 | 2.52 | 0.0573 | -0.0012 | |||||

| Chesapeake Funding II LLC / ABS-O (US165183DE19) | 0.12 | -11.11 | 0.0563 | -0.0102 | |||||

| US3132DWH220 / FHLG 30YR 5.5% 08/01/2053#SD8349 | 0.12 | -56.27 | 0.0543 | -0.0747 | |||||

| Glencore Funding LLC / DBT (US378272BS65) | 0.11 | 0.90 | 0.0529 | -0.0018 | |||||

| US3132DWF570 / FNCL UMBS 5.0 SD8288 01-01-53 | 0.11 | -2.63 | 0.0524 | -0.0037 | |||||

| US743820AC66 / Providence St Joseph Health Obligated Group | 0.11 | 0.91 | 0.0522 | -0.0022 | |||||

| US3140QQLG87 / FNMA 30YR 4% 10/01/2052#CB4826 | 0.11 | -2.68 | 0.0515 | -0.0034 | |||||

| US14040HCZ64 / Capital One Financial Corp | 0.11 | 0.93 | 0.0512 | -0.0017 | |||||

| US53079EBG89 / LIBERTY MUTUAL GROUP INC COMPANY GUAR 144A 02/29 4.569 | 0.11 | 0.93 | 0.0512 | -0.0017 | |||||

| US88258MAA36 / TEXAS NATURAL GAS SECURITIZTN FIN CORP REVENUE | 0.11 | -4.42 | 0.0508 | -0.0047 | |||||

| US46647PDH64 / JPMorgan Chase & Co. | 0.11 | 0.94 | 0.0505 | -0.0015 | |||||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 0.10 | 0.97 | 0.0492 | -0.0015 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.10 | 0.0478 | 0.0478 | ||||||

| US96328GBG10 / Wheels Fleet Lease Funding 1 LLC | 0.10 | -16.67 | 0.0474 | -0.0116 | |||||

| US3132ADVT26 / Freddie Mac Pool | 0.10 | -2.94 | 0.0468 | -0.0032 | |||||

| Beacon Funding Trust / DBT (US073952AB93) | 0.10 | -1.01 | 0.0464 | -0.0023 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0.10 | 2.08 | 0.0460 | -0.0012 | |||||

| US12530MAL90 / SORT 22-1 A1 144A 5.97% 08-15-62/02-16-27 | 0.10 | 0.00 | 0.0460 | -0.0021 | |||||

| GPJA / Georgia Power Company - Preferred Security | 0.10 | 2.11 | 0.0456 | -0.0012 | |||||

| Wheels Fleet Lease Funding 1 LLC / ABS-O (US96328GBT31) | 0.10 | -3.00 | 0.0455 | -0.0037 | |||||

| Mutual of Omaha Cos Global Funding / DBT (US62829D2F60) | 0.10 | 1.05 | 0.0454 | -0.0013 | |||||

| US19828TAE64 / COLUMBIA PIPELINES OPERATING CO LLC 144A LIFE SR UNSEC 6.497% 08-15-43 | 0.09 | -1.09 | 0.0432 | -0.0022 | |||||

| US3132D6DJ64 / Freddie Mac Pool | 0.09 | -4.21 | 0.0428 | -0.0040 | |||||

| Glencore Funding LLC / DBT (US378272BV94) | 0.09 | -52.88 | 0.0423 | -0.0512 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0.09 | 1.16 | 0.0409 | -0.0012 | |||||

| US38937LAC54 / Gray Oak Pipeline LLC | 0.08 | 1.20 | 0.0395 | -0.0014 | |||||

| US36179V4U15 / Ginnie Mae II Pool | 0.08 | -2.35 | 0.0389 | -0.0028 | |||||

| US23503CAP23 / DALLAS-FORT WORTH TX INTERNATIONAL ARPT REVENUE | 0.08 | -2.44 | 0.0379 | -0.0023 | |||||

| US913366KB56 / UNIV OF CALIFORNIA CA RGTS MED UNVHGR 05/50 FIXED 3.006 | 0.08 | -2.44 | 0.0377 | -0.0028 | |||||

| US3133KPYA01 / Freddie Mac Pool | 0.08 | -2.50 | 0.0370 | -0.0023 | |||||

| US00206RJZ64 / AT and T INC 3.5% 06/01/2041 | 0.08 | 1.30 | 0.0368 | -0.0009 | |||||

| US22822VBC46 / Crown Castle Inc | 0.08 | 1.35 | 0.0355 | -0.0008 | |||||

| Columbia Pipelines Holding Co LLC / DBT (US19828AAD90) | 0.08 | 1.35 | 0.0353 | -0.0009 | |||||

| US3137H9C983 / Federal Home Loan Mortgage Corporation Multifamily Structured Pass Through Certificates | 0.07 | 1.37 | 0.0350 | -0.0012 | |||||

| US3140QQBW48 / Fannie Mae Pool | 0.07 | -2.63 | 0.0350 | -0.0023 | |||||

| US362583AD87 / GM FINL CONSUMER AUTOMOBILE RECEIVABLES TR 2023-2 4.47% 02/16/2028 | 0.07 | -21.28 | 0.0350 | -0.0111 | |||||

| US36179V7D62 / GNII II 2% 02/20/2051#MA7192 | 0.07 | -2.67 | 0.0343 | -0.0025 | |||||

| EW / Edwards Lifesciences Corporation | 0.07 | -92.02 | 0.0341 | -0.4077 | |||||

| US36179W2X53 / GINNIE MAE II POOL G2 MA7990 | 0.07 | -4.23 | 0.0323 | -0.0026 | |||||

| US3140Q9HX49 / FNMA 30YR 4.5% 07/01/2048#CA2045 | 0.07 | -4.29 | 0.0318 | -0.0026 | |||||

| US00206RKA94 / AT&T Inc | 0.07 | 0.00 | 0.0316 | -0.0013 | |||||

| US3132DWHG15 / Freddie Mac Pool | 0.07 | -2.90 | 0.0316 | -0.0023 | |||||

| US3140XJ6L25 / FN FS3574 | 0.07 | -4.35 | 0.0312 | -0.0027 | |||||

| U.S. Treasury Notes / DBT (US91282CKN01) | 0.07 | 1.56 | 0.0305 | -0.0011 | |||||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.06 | 1.64 | 0.0291 | -0.0010 | |||||

| ATHS / Athene Holding Ltd. - Corporate Bond/Note | 0.06 | 0.0289 | 0.0289 | ||||||

| SBUX / Starbucks Corporation - Depositary Receipt (Common Stock) | 0.06 | 0.0285 | 0.0285 | ||||||

| BRO / Brown & Brown, Inc. | 0.06 | 0.0261 | 0.0261 | ||||||

| Lincoln Financial Global Funding / DBT (US53359KAB70) | 0.06 | 0.0260 | 0.0260 | ||||||

| US912810RJ97 / United States Treas Bds Bond | 0.05 | -1.82 | 0.0255 | -0.0017 | |||||

| US167725AC49 / CHICAGO IL TRANSIT AUTH SALES & TRANSFER TAX RECPTS REVENUE | 0.05 | -1.92 | 0.0244 | -0.0012 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 0.0243 | -0.0007 | |||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 0.05 | 0.0239 | 0.0239 | ||||||

| AIG / American International Group, Inc. - Depositary Receipt (Common Stock) | 0.05 | 0.0238 | 0.0238 | ||||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 0.05 | 0.0237 | 0.0237 | ||||||

| Mars Inc / DBT (US571676BB09) | 0.05 | 0.00 | 0.0235 | -0.0011 | |||||

| US3132DWG982 / FNCL UMBS 5.5 SD8324 05-01-53 | 0.05 | -3.92 | 0.0234 | -0.0018 | |||||

| US31418DW732 / FNMA 20YR 2.5% 02/01/2041#MA4269 | 0.05 | -2.00 | 0.0233 | -0.0016 | |||||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 0.05 | 2.08 | 0.0232 | -0.0007 | |||||

| US3132DWEK53 / Freddie Mac Pool | 0.05 | -2.04 | 0.0229 | -0.0015 | |||||

| US3132DQAM87 / FR SD2712 | 0.05 | -2.08 | 0.0224 | -0.0015 | |||||

| US19828TAA43 / CORP. NOTE | 0.05 | 2.17 | 0.0223 | -0.0006 | |||||

| U.S. Treasury Notes / DBT (US91282CMB45) | 0.05 | 0.00 | 0.0219 | -0.0009 | |||||

| US3132DWCJ09 / Freddie Mac Pool | 0.05 | -2.13 | 0.0218 | -0.0015 | |||||

| US92928QAF54 / WEA FINANCE LLC 144A LIFE SR UNSEC 3.5% 06-15-29 | 0.04 | 2.38 | 0.0202 | -0.0006 | |||||

| U.S. Treasury Notes / DBT (US91282CLU35) | 0.04 | 2.44 | 0.0198 | -0.0007 | |||||

| Columbia Pipelines Holding Co LLC / DBT (US19828AAC18) | 0.04 | 2.56 | 0.0190 | -0.0006 | |||||

| US22822VBB62 / CROWN CASTLE INC | 0.04 | 2.86 | 0.0170 | -0.0006 | |||||

| US373334JS15 / Georgia Power Co 4.75% Senior Notes 09/01/40 | 0.04 | 0.00 | 0.0166 | -0.0006 | |||||

| Glencore Funding LLC / DBT (US378272CB22) | 0.04 | 0.00 | 0.0166 | -0.0007 | |||||

| US88258MAB19 / Texas Natural Gas Securitization Finance Corp. | 0.04 | 0.00 | 0.0166 | -0.0007 | |||||

| U.S. Treasury Bonds / DBT (US912810TX63) | 0.04 | -2.78 | 0.0166 | -0.0013 | |||||

| US90931LAA61 / United Airlines 2016-1 Class AA Pass Through Trust | 0.03 | 0.00 | 0.0162 | -0.0006 | |||||

| US100743AK97 / Boston Gas Co | 0.03 | 3.03 | 0.0160 | -0.0006 | |||||

| US3140QST434 / Fannie Mae Pool | 0.03 | 0.00 | 0.0155 | -0.0011 | |||||

| US708696BZ13 / Pennsylvania Electric Co. | 0.03 | 0.00 | 0.0154 | -0.0005 | |||||

| US3132E0K272 / Freddie Mac Pool | 0.03 | -3.03 | 0.0154 | -0.0012 | |||||

| US3133KQWQ53 / Freddie Mac Pool | 0.03 | -5.88 | 0.0153 | -0.0015 | |||||

| US22822VAR24 / SR UNSECURED 07/30 3.3 | 0.03 | 0.00 | 0.0149 | -0.0004 | |||||

| CA21037X1345 / CONSTELLATION SOFTWARE INC | 0.03 | 0.00 | 0.0143 | -0.0005 | |||||

| US3140J9M811 / FN BM4882 | 0.03 | -3.33 | 0.0140 | -0.0008 | |||||

| US3140XJ6M08 / FN FS3575 | 0.03 | -3.33 | 0.0139 | -0.0010 | |||||

| U.S. Treasury Notes / DBT (US91282CLJ89) | 0.03 | 3.57 | 0.0137 | -0.0005 | |||||

| US22822VAL53 / Crown Castle International Corp | 0.03 | 0.00 | 0.0130 | -0.0004 | |||||

| US49803XAA19 / Kite Realty Group, L.P. | 0.03 | 0.0119 | 0.0119 | ||||||

| US912810TK43 / U.S. Treasury Bonds | 0.02 | -4.00 | 0.0117 | -0.0008 | |||||

| U.S. Treasury Notes / DBT (US91282CLR06) | 0.02 | 0.00 | 0.0116 | -0.0004 | |||||

| US3140XH4D62 / Fannie Mae Pool | 0.02 | -4.35 | 0.0107 | -0.0007 | |||||

| US86944BAG86 / Sutter Health | 0.02 | 0.00 | 0.0106 | -0.0003 | |||||

| US3140QQCC74 / Fannie Mae Pool | 0.02 | -4.35 | 0.0105 | -0.0008 | |||||

| US3132DWGH07 / Freddie Mac Pool | 0.02 | 0.00 | 0.0104 | -0.0008 | |||||

| US3140QQJ637 / Fannie Mae Pool | 0.02 | -4.55 | 0.0100 | -0.0008 | |||||

| US912810TH14 / United States Treasury Note/Bond | 0.02 | -4.76 | 0.0097 | -0.0006 | |||||

| Trans-Allegheny Interstate Line Co / DBT (US893045AF16) | 0.02 | 0.0095 | 0.0095 | ||||||

| Ohio Edison Co / DBT (US677347CJ38) | 0.02 | 0.0095 | 0.0095 | ||||||

| US3132AEUX20 / FR ZT2398 | 0.02 | 0.00 | 0.0095 | -0.0007 | |||||

| US010392FQ67 / Alabama Power Co Senior Note C Allable M/w 2.45 3/30/2022 Bond | 0.02 | 0.00 | 0.0095 | -0.0003 | |||||

| US31418EGJ38 / FN MA4700 | 0.02 | -83.33 | 0.0094 | -0.0468 | |||||

| US92928QAH11 / WEA Finance LLC | 0.02 | 0.00 | 0.0091 | -0.0003 | |||||

| US3132D6EA47 / Freddie Mac Pool | 0.02 | -5.00 | 0.0091 | -0.0008 | |||||

| US3132E0N326 / Freddie Mac Pool | 0.02 | 0.00 | 0.0075 | -0.0005 | |||||

| US010392FU79 / Alabama Power Co | 0.02 | 0.00 | 0.0073 | -0.0002 | |||||

| US097023CW33 / BOEING CO 5.805 5/50 | 0.02 | -88.19 | 0.0072 | -0.0552 | |||||

| US3140XKME77 / Fannie Mae Pool | 0.01 | -6.67 | 0.0070 | -0.0005 | |||||

| US14040HDC60 / Capital One Financial Corp | 0.01 | 0.00 | 0.0069 | -0.0002 | |||||

| US38937LAB71 / Gray Oak Pipeline LLC | 0.01 | 0.00 | 0.0069 | -0.0002 | |||||

| US3140QPXT97 / Fannie Mae Pool | 0.01 | -7.14 | 0.0065 | -0.0004 | |||||

| US3132DPZS00 / Freddie Mac Pool | 0.01 | 0.00 | 0.0063 | -0.0005 | |||||

| US00206RKB77 / AT&T INC 3.850000% 06/01/2060 | 0.01 | 0.00 | 0.0062 | -0.0002 | |||||

| US22822VAW19 / Crown Castle International Corp | 0.01 | 0.00 | 0.0060 | -0.0001 | |||||

| US29278NAF06 / Energy Transfer Operating LP | 0.01 | 0.00 | 0.0057 | -0.0002 | |||||

| US3140XJN580 / Fannie Mae Pool | 0.01 | -9.09 | 0.0050 | -0.0004 | |||||

| BRO / Brown & Brown, Inc. | 0.01 | 0.0048 | 0.0048 | ||||||

| US591894CE82 / Metropolitan Edison Co | 0.01 | 0.00 | 0.0048 | -0.0002 | |||||

| US3140XMDB95 / Fannie Mae Pool | 0.01 | -10.00 | 0.0047 | -0.0003 | |||||

| MET TRANSPRTN AUTH NY REVENUE / DBT (US59261A2P16) | 0.01 | -11.11 | 0.0042 | -0.0002 | |||||

| US3140XMW510 / Fannie Mae Pool | 0.01 | -11.11 | 0.0042 | -0.0003 | |||||

| US3140XJED14 / Fannie Mae Pool | 0.01 | 0.00 | 0.0037 | -0.0002 | |||||

| US3132DQLJ30 / Freddie Mac Pool | 0.01 | 0.00 | 0.0036 | -0.0003 | |||||

| US3140XHC629 / Fannie Mae Pool | 0.01 | 0.00 | 0.0032 | -0.0002 | |||||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | 0.01 | 0.0025 | 0.0025 | ||||||

| US708696CA52 / Pennsylvania Electric Co | 0.01 | 0.00 | 0.0024 | -0.0001 | |||||

| US22822VAT89 / CROWN CASTLE INTL CORP SR UNSECURED 01/31 2.25 | 0.00 | 0.00 | 0.0020 | -0.0001 | |||||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | 0.00 | 0.0016 | 0.0016 | ||||||

| AEP / American Electric Power Company, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4633 | ||||

| ZS / Zscaler, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4329 | ||||

| PLTR / Palantir Technologies Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0559 | ||||

| KO / The Coca-Cola Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.1860 | ||||

| COHR / Coherent Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4184 | ||||

| MTSR / Metsera, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0160 | ||||

| DECK / Deckers Outdoor Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0405 | ||||

| AKRO / Akero Therapeutics, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0152 | ||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.1099 | ||||

| BAC / Bank of America Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1769 | ||||

| PLTR / Palantir Technologies Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0559 | ||||

| US21H0306744 / Ginnie Mae | -0.11 | -111.71 | -0.0531 | -0.4831 | |||||

| EW / Edwards Lifesciences Corporation | -0.20 | -161.11 | -0.0929 | -0.2451 | |||||

| US21H0426799 / Ginnie Mae | -0.28 | -238.61 | -0.1315 | -0.2219 | |||||

| US01F0424758 / Fannie Mae or Freddie Mac | -0.36 | -0.1674 | -0.1674 | ||||||

| US21H0406734 / Ginnie Mae | -0.37 | -215.79 | -0.1757 | -0.3198 | |||||

| EW / Edwards Lifesciences Corporation | -0.44 | -130.26 | -0.2053 | -0.8828 | |||||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | -0.54 | -339.82 | -0.2546 | -0.3556 | |||||

| US01F0206791 / UMBS, 30 Year, Single Family | -0.69 | -170.24 | -0.3260 | -0.7663 |