Statistik Asas

| Nilai Portfolio | $ 268,066,965 |

| Kedudukan Semasa | 66 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

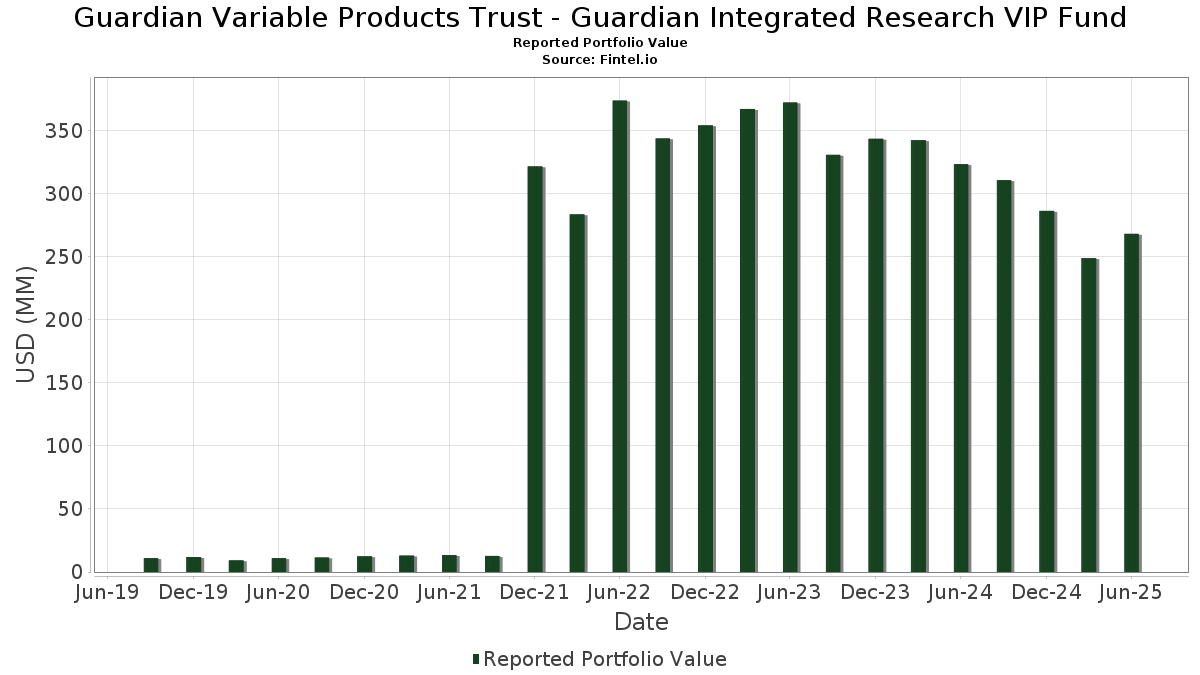

Guardian Variable Products Trust - Guardian Integrated Research VIP Fund telah mendedahkan 66 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 268,066,965 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Guardian Variable Products Trust - Guardian Integrated Research VIP Fund ialah NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Alphabet Inc. (US:GOOGL) . Kedudukan baharu Guardian Variable Products Trust - Guardian Integrated Research VIP Fund termasuk General Electric Company (US:GE) , Gilead Sciences, Inc. (US:GILD) , Linde plc (US:LIN) , Pool Corporation (US:POOL) , and BJ's Wholesale Club Holdings, Inc. (US:BJ) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.14 | 22.28 | 8.3175 | 2.3267 | |

| 0.04 | 21.32 | 7.9570 | 1.7691 | |

| 0.04 | 9.74 | 3.6348 | 1.2419 | |

| 0.01 | 3.29 | 1.2273 | 1.2273 | |

| 0.02 | 2.73 | 1.0197 | 1.0197 | |

| 0.01 | 2.72 | 1.0147 | 1.0147 | |

| 0.01 | 9.25 | 3.4531 | 0.8944 | |

| 0.01 | 2.15 | 0.8034 | 0.8034 | |

| 0.02 | 2.14 | 0.7983 | 0.7983 | |

| 0.02 | 1.86 | 0.6950 | 0.6950 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.09 | 17.49 | 6.5286 | -1.1321 | |

| 0.05 | 0.73 | 0.2743 | -0.5981 | |

| 0.02 | 3.46 | 1.2911 | -0.5743 | |

| 0.01 | 3.15 | 1.1752 | -0.3211 | |

| 0.01 | 2.40 | 0.8971 | -0.3136 | |

| 0.04 | 3.84 | 1.4328 | -0.2725 | |

| 0.02 | 1.46 | 0.5432 | -0.2573 | |

| 0.02 | 3.31 | 1.2348 | -0.2175 | |

| 0.00 | 2.78 | 1.0392 | -0.2152 | |

| 0.01 | 5.60 | 2.0903 | -0.1672 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-15 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.14 | 2.62 | 22.28 | 49.60 | 8.3175 | 2.3267 | |||

| MSFT / Microsoft Corporation | 0.04 | 4.57 | 21.32 | 38.56 | 7.9570 | 1.7691 | |||

| AAPL / Apple Inc. | 0.09 | -0.58 | 17.49 | -8.17 | 6.5286 | -1.1321 | |||

| AMZN / Amazon.com, Inc. | 0.06 | -0.58 | 13.64 | 14.64 | 5.0905 | 0.3058 | |||

| GOOGL / Alphabet Inc. | 0.06 | 2.58 | 10.92 | 16.90 | 4.0747 | 0.3189 | |||

| AVGO / Broadcom Inc. | 0.04 | -0.58 | 9.74 | 63.67 | 3.6348 | 1.2419 | |||

| META / Meta Platforms, Inc. | 0.01 | 13.55 | 9.25 | 45.43 | 3.4531 | 0.8944 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | -4.84 | 7.03 | 12.46 | 2.6255 | 0.1101 | |||

| MA / Mastercard Incorporated | 0.01 | -0.58 | 5.86 | 1.91 | 2.1888 | -0.1251 | |||

| LLY / Eli Lilly and Company | 0.01 | 5.71 | 5.60 | -0.21 | 2.0903 | -0.1672 | |||

| NFLX / Netflix, Inc. | 0.00 | -11.29 | 5.50 | 27.38 | 2.0544 | 0.3167 | |||

| WMT / Walmart Inc. | 0.05 | 10.68 | 5.06 | 23.29 | 1.8873 | 0.2376 | |||

| WFC / Wells Fargo & Company | 0.06 | -0.12 | 4.42 | 11.46 | 1.6482 | 0.0550 | |||

| AXP / American Express Company | 0.01 | -0.12 | 4.02 | 18.41 | 1.5007 | 0.1352 | |||

| BAC / Bank of America Corporation | 0.08 | -2.87 | 3.93 | 10.13 | 1.4686 | 0.0318 | |||

| XOM / Exxon Mobil Corporation | 0.04 | -0.12 | 3.84 | -9.46 | 1.4328 | -0.2725 | |||

| ABT / Abbott Laboratories | 0.03 | -6.38 | 3.64 | -4.01 | 1.3595 | -0.1665 | |||

| BSX / Boston Scientific Corporation | 0.03 | -1.21 | 3.54 | 5.21 | 1.3204 | -0.0322 | |||

| PG / The Procter & Gamble Company | 0.02 | -20.22 | 3.46 | -25.43 | 1.2911 | -0.5743 | |||

| INTU / Intuit Inc. | 0.00 | 7.02 | 3.46 | 37.31 | 1.2900 | 0.2776 | |||

| WELL / Welltower Inc. | 0.02 | -8.70 | 3.31 | -8.39 | 1.2348 | -0.2175 | |||

| GE / General Electric Company | 0.01 | 3.29 | 1.2273 | 1.2273 | |||||

| KLAC / KLA Corporation | 0.00 | -6.82 | 3.22 | 22.81 | 1.2020 | 0.1471 | |||

| PGR / The Progressive Corporation | 0.01 | -10.25 | 3.15 | -15.38 | 1.1752 | -0.3211 | |||

| MAR / Marriott International, Inc. | 0.01 | 6.58 | 3.03 | 22.25 | 1.1301 | 0.1340 | |||

| PH / Parker-Hannifin Corporation | 0.00 | -0.12 | 2.92 | 14.77 | 1.0908 | 0.0667 | |||

| RTX / RTX Corporation | 0.02 | -5.98 | 2.92 | 3.62 | 1.0887 | -0.0432 | |||

| NDAQ / Nasdaq, Inc. | 0.03 | 6.79 | 2.88 | 25.88 | 1.0768 | 0.1551 | |||

| SBUX / Starbucks Corporation | 0.03 | 17.61 | 2.87 | 9.87 | 1.0722 | 0.0206 | |||

| IR / Ingersoll Rand Inc. | 0.03 | 19.70 | 2.81 | 24.40 | 1.0488 | 0.1404 | |||

| AZO / AutoZone, Inc. | 0.00 | -8.31 | 2.78 | -10.71 | 1.0392 | -0.2152 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | 5.58 | 2.78 | -3.07 | 1.0373 | -0.1155 | |||

| KKR / KKR & Co. Inc. | 0.02 | 14.49 | 2.73 | 31.76 | 1.0206 | 0.1858 | |||

| GILD / Gilead Sciences, Inc. | 0.02 | 2.73 | 1.0197 | 1.0197 | |||||

| WEC / WEC Energy Group, Inc. | 0.03 | -0.18 | 2.73 | -4.58 | 1.0189 | -0.1314 | |||

| LIN / Linde plc | 0.01 | 2.72 | 1.0147 | 1.0147 | |||||

| SHW / The Sherwin-Williams Company | 0.01 | 8.98 | 2.70 | 7.19 | 1.0075 | -0.0055 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 21.03 | 2.64 | 8.10 | 0.9865 | 0.0033 | |||

| BA / The Boeing Company | 0.01 | 2.61 | 2.64 | 26.08 | 0.9837 | 0.1429 | |||

| GEV / GE Vernova Inc. | 0.00 | -34.27 | 2.54 | 13.93 | 0.9469 | 0.0514 | |||

| CB / Chubb Limited | 0.01 | -0.12 | 2.47 | -4.18 | 0.9234 | -0.1149 | |||

| MNST / Monster Beverage Corporation | 0.04 | 2.06 | 2.45 | 9.22 | 0.9155 | 0.0125 | |||

| CRM / Salesforce, Inc. | 0.01 | -21.42 | 2.40 | -20.17 | 0.8971 | -0.3136 | |||

| ATO / Atmos Energy Corporation | 0.01 | -0.12 | 2.27 | -0.44 | 0.8472 | -0.0696 | |||

| EMR / Emerson Electric Co. | 0.02 | -0.12 | 2.20 | 21.51 | 0.8224 | 0.0928 | |||

| POOL / Pool Corporation | 0.01 | 2.15 | 0.8034 | 0.8034 | |||||

| EW / Edwards Lifesciences Corporation | 0.03 | -1.03 | 2.15 | 6.81 | 0.8026 | -0.0072 | |||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.02 | 2.14 | 0.7983 | 0.7983 | |||||

| VEEV / Veeva Systems Inc. | 0.01 | -25.54 | 2.06 | -7.41 | 0.7702 | -0.1263 | |||

| AME / AMETEK, Inc. | 0.01 | -6.66 | 2.01 | -1.86 | 0.7500 | -0.0736 | |||

| TXN / Texas Instruments Incorporated | 0.01 | -14.94 | 1.99 | -1.73 | 0.7423 | -0.0716 | |||

| PTC / PTC Inc. | 0.01 | 7.78 | 1.89 | 19.90 | 0.7041 | 0.0712 | |||

| FWON.K / Formula One Group | 0.02 | 1.86 | 0.6950 | 0.6950 | |||||

| TYL / Tyler Technologies, Inc. | 0.00 | 1.76 | 0.6570 | 0.6570 | |||||

| ACGL / Arch Capital Group Ltd. | 0.02 | 0.00 | 1.70 | -5.34 | 0.6357 | -0.0879 | |||

| ITT / ITT Inc. | 0.01 | 1.69 | 0.6307 | 0.6307 | |||||

| WDAY / Workday, Inc. | 0.01 | -2.05 | 1.60 | 0.63 | 0.5982 | -0.0421 | |||

| TSLA / Tesla, Inc. | 0.00 | -24.37 | 1.56 | -7.31 | 0.5825 | -0.0946 | |||

| LEN / Lennar Corporation | 0.01 | 15.05 | 1.55 | 10.83 | 0.5770 | 0.0162 | |||

| RSG / Republic Services, Inc. | 0.01 | 1.50 | 0.5614 | 0.5614 | |||||

| COP / ConocoPhillips | 0.02 | -14.44 | 1.46 | -26.88 | 0.5432 | -0.2573 | |||

| EXE / Expand Energy Corporation | 0.01 | 0.00 | 1.38 | 5.01 | 0.5169 | -0.0133 | |||

| BLDR / Builders FirstSource, Inc. | 0.01 | -0.08 | 1.33 | -6.65 | 0.4976 | -0.0769 | |||

| FTAI / FTAI Aviation Ltd. | 0.01 | 8.36 | 1.20 | 12.35 | 0.4484 | 0.0181 | |||

| FANG / Diamondback Energy, Inc. | 0.01 | -9.35 | 1.15 | -22.14 | 0.4296 | -0.1646 | |||

| PCG / PG&E Corporation | 0.05 | -58.25 | 0.73 | -66.16 | 0.2743 | -0.5981 |