Statistik Asas

| Nilai Portfolio | $ 146,284,806 |

| Kedudukan Semasa | 167 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

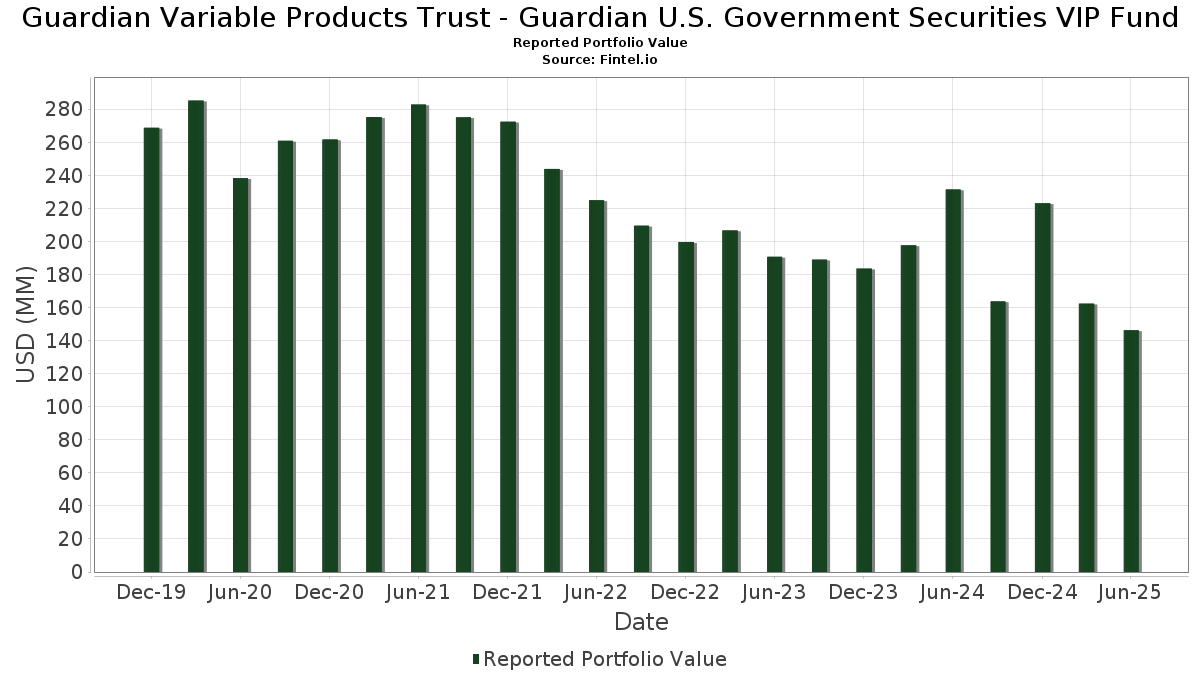

Guardian Variable Products Trust - Guardian U.S. Government Securities VIP Fund telah mendedahkan 167 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 146,284,806 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Guardian Variable Products Trust - Guardian U.S. Government Securities VIP Fund ialah U.S. Treasury Notes (US:US91282CET45) , United States Treasury Note/Bond (US:US91282CHX20) , U.S. Treasury Notes (US:US91282CJG78) , US TREASURY N/B 4.125000% 08/31/2030 (US:US91282CHW47) , and UNITED STATES TREASURY NOTE 1.50000000 (US:US91282CDL28) . Kedudukan baharu Guardian Variable Products Trust - Guardian U.S. Government Securities VIP Fund termasuk U.S. Treasury Notes (US:US91282CET45) , United States Treasury Note/Bond (US:US91282CHX20) , U.S. Treasury Notes (US:US91282CJG78) , US TREASURY N/B 4.125000% 08/31/2030 (US:US91282CHW47) , and UNITED STATES TREASURY NOTE 1.50000000 (US:US91282CDL28) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 5.36 | 3.7792 | 3.7792 | ||

| 4.85 | 3.4188 | 3.4188 | ||

| 4.32 | 3.0481 | 3.0481 | ||

| 3.26 | 2.3001 | 2.3001 | ||

| 4.12 | 2.9017 | 2.2527 | ||

| 2.65 | 1.8662 | 1.8662 | ||

| 2.61 | 1.8423 | 1.8423 | ||

| 2.18 | 1.5354 | 1.5354 | ||

| 1.77 | 1.2505 | 1.2505 | ||

| 1.66 | 1.1710 | 1.1710 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 3.79 | 2.6738 | -15.2407 | ||

| 4.82 | 3.3958 | -10.0327 | ||

| 5.23 | 3.6855 | -9.5449 | ||

| 5.58 | 3.9362 | -8.4532 | ||

| 2.52 | 1.7793 | -3.8492 | ||

| 5.02 | 3.5397 | -3.7747 | ||

| 7.69 | 5.4240 | -3.0714 | ||

| 1.64 | 1.1578 | -2.0438 | ||

| 0.18 | 0.1292 | -0.0133 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-15 untuk tempoh pelaporan 2025-06-30. Pelabur ini tidak mendedahkan sekuriti yang dikira dalam saham, jadi lajur berkaitan saham dalam jadual di bawah tidak dimasukkan. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|

| U.S. Treasury Notes / DBT (US91282CMG32) | 7.69 | -41.45 | 5.4240 | -3.0714 | ||

| U.S. Treasury Notes / DBT (US91282CMH15) | 5.58 | -70.86 | 3.9362 | -8.4532 | ||

| US91282CET45 / U.S. Treasury Notes | 5.36 | 3.7792 | 3.7792 | |||

| U.S. Treasury Notes / DBT (US91282CKD29) | 5.23 | -78.26 | 3.6855 | -9.5449 | ||

| U.S. Treasury Notes / DBT (US91282CLK52) | 5.02 | -58.30 | 3.5397 | -3.7747 | ||

| U.S. Treasury Notes / DBT (US91282CLR06) | 4.85 | 3.4188 | 3.4188 | |||

| U.S. Treasury Notes / DBT (US91282CKT70) | 4.82 | -79.38 | 3.3958 | -10.0327 | ||

| U.S. Treasury Notes / DBT (US91282CKZ31) | 4.32 | 3.0481 | 3.0481 | |||

| U.S. Treasury Notes / DBT (US91282CMP31) | 4.12 | 310.27 | 2.9017 | 2.2527 | ||

| US91282CHX20 / United States Treasury Note/Bond | 3.79 | -88.90 | 2.6738 | -15.2407 | ||

| U.S. Treasury Notes / DBT (US91282CLL36) | 3.26 | 2.3001 | 2.3001 | |||

| US91282CJG78 / U.S. Treasury Notes | 3.10 | 94.41 | 2.1828 | 1.1530 | ||

| US91282CHW47 / US TREASURY N/B 4.125000% 08/31/2030 | 2.65 | 1.8662 | 1.8662 | |||

| U.S. Treasury Notes / DBT (US91282CKX82) | 2.61 | 1.8423 | 1.8423 | |||

| U.S. Treasury Notes / DBT (US91282CLW90) | 2.52 | -71.02 | 1.7793 | -3.8492 | ||

| U.S. Treasury Notes / DBT (US91282CLF67) | 2.44 | 0.21 | 1.7215 | 0.1460 | ||

| US91282CDL28 / UNITED STATES TREASURY NOTE 1.50000000 | 2.18 | 1.5354 | 1.5354 | |||

| US01F0524748 / Uniform Mortgage-Backed Security, TBA | 1.77 | 1.2505 | 1.2505 | |||

| U.S. Treasury Notes / DBT (US91282CMM00) | 1.66 | 1.1710 | 1.1710 | |||

| US91282CGQ87 / United States Treasury Note/Bond | 1.64 | -66.83 | 1.1578 | -2.0438 | ||

| Uniform Mortgage-Backed Security, TBA / ABS-MBS (US01F0604771) | 1.32 | 0.9337 | 0.9337 | |||

| US01F0504781 / Fannie Mae or Freddie Mac | 1.32 | 0.9331 | 0.9331 | |||

| US95000U3D31 / Wells Fargo & Co | 1.25 | 0.8786 | 0.8786 | |||

| US14919LAC81 / Cathedral Lake VI Ltd | 1.20 | 0.25 | 0.8480 | 0.0725 | ||

| US172967PA33 / CITIGROUP INC | 1.20 | 0.8452 | 0.8452 | |||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1.11 | 0.7809 | 0.7809 | |||

| Mars Inc / DBT (US571676AZ85) | 1.09 | 0.7666 | 0.7666 | |||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 1.06 | 0.7454 | 0.7454 | |||

| Birch Grove CLO 8 Ltd / ABS-CBDO (US09077TAA34) | 1.00 | 0.00 | 0.7077 | 0.0591 | ||

| Voya CLO 2019-1 Ltd / ABS-CBDO (US92917NAY40) | 1.00 | 0.10 | 0.7057 | 0.0593 | ||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 0.97 | 0.6871 | 0.6871 | |||

| US07274EAK91 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.375% 11-21-30 | 0.97 | 0.6866 | 0.6866 | |||

| US902613AK44 / UBS Group AG | 0.95 | 0.6731 | 0.6731 | |||

| US46647PCU84 / JPMorgan Chase & Co | 0.95 | 0.6677 | 0.6677 | |||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0.94 | 0.6594 | 0.6594 | |||

| US64952WEZ23 / New York Life Global Funding | 0.93 | 20.00 | 0.6562 | 0.1549 | ||

| Northwestern Mutual Global Funding / DBT (US66815L2S71) | 0.91 | 0.6450 | 0.6450 | |||

| US90353TAK60 / Uber Technologies Inc | 0.91 | 0.6418 | 0.6418 | |||

| US345397C353 / Ford Motor Credit Co LLC | 0.91 | 0.6414 | 0.6414 | |||

| US29365TAH77 / Entergy Texas Inc. | 0.82 | 0.5756 | 0.5756 | |||

| US91282CDY49 / United States Treasury Note/Bond | 0.78 | 0.5519 | 0.5519 | |||

| US05401AAJ07 / Avolon Holdings Funding Ltd | 0.77 | 0.5402 | 0.5402 | |||

| US226373AT56 / Crestwood Midstream Partners LP | 0.75 | 0.5321 | 0.5321 | |||

| SOLV / Solventum Corporation | 0.75 | 0.5276 | 0.5276 | |||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.74 | 0.5222 | 0.5222 | |||

| Glencore Funding LLC / DBT (US378272BZ09) | 0.74 | 0.5183 | 0.5183 | |||

| Evergy Missouri West Inc / DBT (US30037EAB92) | 0.71 | 0.5017 | 0.5017 | |||

| US38141GYJ74 / Goldman Sachs Group Inc/The | 0.68 | 0.4815 | 0.4815 | |||

| HMC / Honda Motor Co., Ltd. - Depositary Receipt (Common Stock) | 0.66 | 0.4643 | 0.4643 | |||

| US55354GAK67 / MSCI Inc | 0.64 | 0.4538 | 0.4538 | |||

| US00928QAU58 / Aircastle Ltd | 0.64 | 0.4505 | 0.4505 | |||

| US06051GHM42 / Bank of America Corp | 0.64 | 61.01 | 0.4486 | 0.1930 | ||

| VICI / VICI Properties Inc. | 0.63 | 0.4466 | 0.4466 | |||

| US11135FBT75 / Broadcom, Inc. | 0.63 | 0.4433 | 0.4433 | |||

| US708696BY48 / Pennsylvania Electric Co. | 0.61 | 0.4301 | 0.4301 | |||

| US68785CAC55 / Oscar U.S. Funding XV LLC | 0.60 | -0.17 | 0.4259 | 0.0347 | ||

| US09626QBC06 / BlueMountain CLO 2014-2 Ltd | 0.60 | 0.34 | 0.4227 | 0.0363 | ||

| US05635JAB61 / Bacardi Ltd / Bacardi-Martini BV | 0.60 | 0.4223 | 0.4223 | |||

| R1OL34 / Rollins, Inc. - Depositary Receipt (Common Stock) | 0.58 | 0.4124 | 0.4124 | |||

| XS1040508167 / Imperial Brands Finance plc | 0.58 | 0.4120 | 0.4120 | |||

| D1TE34 / DTE Energy Company - Depositary Receipt (Common Stock) | 0.56 | 0.3963 | 0.3963 | |||

| Athene Global Funding / DBT (US04685A4D06) | 0.56 | 0.3922 | 0.3922 | |||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0.55 | 0.3887 | 0.3887 | |||

| US68389XCN30 / Oracle Corp | 0.55 | 0.3879 | 0.3879 | |||

| NVT / Nvent Finance Sarl | 0.55 | 0.3868 | 0.3868 | |||

| US62928CAA09 / NGPL PipeCo LLC | 0.54 | 0.3839 | 0.3839 | |||

| US361841AH26 / GLP Capital LP / GLP Financing II Inc | 0.54 | 0.3839 | 0.3839 | |||

| US06738EAP07 / Barclays PLC | 0.54 | 0.3836 | 0.3836 | |||

| Foundry JV Holdco LLC / DBT (US350930AF07) | 0.54 | 0.3774 | 0.3774 | |||

| US44891ACB17 / Hyundai Capital America | 0.53 | 0.3767 | 0.3767 | |||

| US25466AAN19 / Discover Bank | 0.53 | 0.3756 | 0.3756 | |||

| US91324PEV04 / UnitedHealth Group Inc | 0.53 | 0.3730 | 0.3730 | |||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.52 | 0.3697 | 0.3697 | |||

| US780153AW20 / Royal Caribbean Cruises Ltd | 0.51 | 0.3605 | 0.3605 | |||

| Palmer Square CLO 2020-3 Ltd / ABS-CBDO (US69701RAY36) | 0.50 | 0.3530 | 0.3530 | |||

| US025816DH90 / American Express Co. | 0.49 | 20.88 | 0.3473 | 0.0836 | ||

| US143658BQ44 / Carnival Corp | 0.49 | 0.3450 | 0.3450 | |||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.49 | 20.84 | 0.3438 | 0.0829 | ||

| US95000U2S19 / Wells Fargo & Co | 0.49 | 0.3431 | 0.3431 | |||

| US89788MAP77 / Truist Financial Corp | 0.48 | 0.3350 | 0.3350 | |||

| US115236AC57 / Brown & Brown, Inc. | 0.47 | 0.3326 | 0.3326 | |||

| US745310AJ12 / PUGET ENERGY INC NEW 4.1% 06/15/2030 144A | 0.47 | 0.3297 | 0.3297 | |||

| US491674BN65 / Kentucky Utilities Co | 0.47 | 0.3282 | 0.3282 | |||

| US573874AP91 / Marvell Technology Inc | 0.46 | 0.3265 | 0.3265 | |||

| US845467AR03 / CORP. NOTE | 0.46 | 0.3254 | 0.3254 | |||

| US00914AAT97 / AIR LEASE CORPORATION | 0.46 | 0.3246 | 0.3246 | |||

| BMO 2024-5C5 Mortgage Trust / ABS-MBS (US05593RAC60) | 0.46 | 0.3230 | 0.3230 | |||

| US22822VAR24 / SR UNSECURED 07/30 3.3 | 0.46 | 0.3226 | 0.3226 | |||

| NWE / NorthWestern Energy Group, Inc. | 0.46 | 0.3220 | 0.3220 | |||

| US00135TAD63 / AIB Group PLC | 0.46 | 0.3214 | 0.3214 | |||

| US609935AA97 / Monongahela Power Co. | 0.45 | 0.3201 | 0.3201 | |||

| US418751AL75 / HAT HOLDINGS I LLC/HAT REGD 144A P/P 8.00000000 | 0.45 | 0.3191 | 0.3191 | |||

| Sutter Health / DBT (US86944BAP85) | 0.45 | 0.3165 | 0.3165 | |||

| US212015AS02 / Continental Resources Inc/OK | 0.44 | 0.3080 | 0.3080 | |||

| US95000HBF82 / Wells Fargo Commercial Mortgage Trust 2016-LC24 | 0.41 | 0.99 | 0.2891 | 0.0264 | ||

| US61747YFA82 / Morgan Stanley | 0.41 | 0.25 | 0.2869 | 0.0248 | ||

| GXO / GXO Logistics, Inc. | 0.40 | 0.2836 | 0.2836 | |||

| US05369AAK79 / Aviation Capital Group LLC | 0.38 | 0.2706 | 0.2706 | |||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 0.38 | 0.2692 | 0.2692 | |||

| US366651AC11 / Gartner Inc | 0.38 | 0.2671 | 0.2671 | |||

| US46590XAU00 / JBS USA LUX SA / JBS USA Food Co / JBS USA Finance Inc | 0.38 | 0.2663 | 0.2663 | |||

| P1EG34 / Public Service Enterprise Group Incorporated - Depositary Receipt (Common Stock) | 0.38 | 0.2662 | 0.2662 | |||

| US50212YAC84 / LPL Holdings, Inc. | 0.38 | 0.2651 | 0.2651 | |||

| US469814AB34 / Jacobs Engineering Group Inc | 0.37 | 0.2639 | 0.2639 | |||

| HCA Inc / DBT (US404119CT49) | 0.37 | 0.2638 | 0.2638 | |||

| RIO TINTO FIN USA PLC / DBT (US76720AAT34) | 0.37 | 0.2632 | 0.2632 | |||

| JBS USA Holding Lux Sarl / JBS USA Foods Group Holdings Inc / JBS USA Food Co / DBT (US472140AE22) | 0.37 | 0.2628 | 0.2628 | |||

| Columbia Pipelines Holding Co LLC / DBT (US19828AAD90) | 0.37 | 0.2628 | 0.2628 | |||

| US87264ABV61 / T-Mobile USA Inc | 0.37 | 0.2621 | 0.2621 | |||

| US636180BP52 / National Fuel Gas Co | 0.37 | 0.2611 | 0.2611 | |||

| US01882YAE68 / ALLIANT ENERGY FINANCE LLC | 0.37 | 0.2608 | 0.2608 | |||

| Idaho Power Co / DBT (US45138LBK89) | 0.37 | 0.2606 | 0.2606 | |||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 0.37 | 0.2601 | 0.2601 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0.37 | 0.2600 | 0.2600 | |||

| US09951LAA17 / Booz Allen Hamilton Inc | 0.37 | 0.2599 | 0.2599 | |||

| US054989AA67 / BAT CAPITAL CORP 6.343000% 08/02/2030 | 0.37 | 0.2598 | 0.2598 | |||

| US10921U2E71 / Brighthouse Financial Global Funding | 0.37 | 0.2592 | 0.2592 | |||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 0.37 | 0.2585 | 0.2585 | |||

| US46647PBP09 / JPMORGAN CHASE and CO 2.956/VAR 05/13/2031 | 0.36 | 0.2568 | 0.2568 | |||

| Liberty Utilities Co / DBT (US531542AB48) | 0.36 | 0.2560 | 0.2560 | |||

| Parallel 2023-1 Ltd / ABS-CBDO (US69915NAJ72) | 0.36 | 0.2538 | 0.2538 | |||

| US15135BAV36 / CENTENE CORP 3.375% 02/15/2030 | 0.36 | 0.2532 | 0.2532 | |||

| US55279HAW07 / Manufacturers & Traders Trust Co | 0.32 | 0.2226 | 0.2226 | |||

| US91159HJP64 / US Bancorp | 0.32 | 0.2222 | 0.2222 | |||

| Siemens Funding BV / DBT (US82622RAD89) | 0.31 | 0.2198 | 0.2198 | |||

| GA Global Funding Trust / DBT (US36143L2T17) | 0.31 | 0.2172 | 0.2172 | |||

| Mercedes-Benz Finance North America LLC / DBT (US58769JBE64) | 0.31 | 0.2161 | 0.2161 | |||

| US314382AA01 / Fells Point Funding Trust | 0.31 | 0.2160 | 0.2160 | |||

| US452327AP42 / Illumina Inc | 0.31 | 0.2153 | 0.2153 | |||

| 2914 / Japan Tobacco Inc. | 0.30 | 0.2147 | 0.2147 | |||

| US55903VBA08 / Warnermedia Holdings Inc | 0.30 | 0.2085 | 0.2085 | |||

| Nuveen LLC / DBT (US67080LAD73) | 0.30 | 0.2084 | 0.2084 | |||

| HSY / The Hershey Company - Depositary Receipt (Common Stock) | 0.29 | 0.2076 | 0.2076 | |||

| US01F0524821 / Uniform Mortgage-Backed Security, TBA | 0.29 | 0.2074 | 0.2074 | |||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0.29 | 0.2051 | 0.2051 | |||

| US875484AL13 / Tanger Properties LP | 0.29 | 0.2022 | 0.2022 | |||

| Toyota Auto Loan Extended Note Trust 2025-1 / ABS-O (US891950AA59) | 0.28 | 0.1999 | 0.1999 | |||

| US69047QAB86 / Ovintiv Inc | 0.28 | 0.1986 | 0.1986 | |||

| US034863AW07 / Anglo American Capital PLC | 0.28 | 0.1968 | 0.1968 | |||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0.27 | 0.1930 | 0.1930 | |||

| MSBAM / ABS-MBS (US61778GAE61) | 0.25 | 0.1758 | 0.1758 | |||

| US25731VAA26 / DOMINION ENERGY SOUTH CAROLINA INC | 0.25 | 0.1744 | 0.1744 | |||

| US23345MAA53 / DT MIDSTREAM INC 4.125% 06/15/2029 144A | 0.24 | 0.1704 | 0.1704 | |||

| US517834AE74 / Las Vegas Sands Corp | 0.24 | 0.1689 | 0.1689 | |||

| Rentokil Terminix Funding LLC / DBT (US760130AB09) | 0.23 | 0.1638 | 0.1638 | |||

| LPL Holdings Inc / DBT (US50212YAL83) | 0.23 | 0.1632 | 0.1632 | |||

| P1SA34 / Public Storage - Depositary Receipt (Common Stock) | 0.23 | 0.1597 | 0.1597 | |||

| R1EG34 / Regency Centers Corporation - Depositary Receipt (Common Stock) | 0.22 | 0.1561 | 0.1561 | |||

| Uniform Mortgage-Backed Security, TBA / ABS-MBS (US01F0604854) | 0.22 | 0.1537 | 0.1537 | |||

| US030288AC89 / American Transmission Systems Inc | 0.21 | 0.1507 | 0.1507 | |||

| BBCMS Mortgage Trust 2025-5C34 / ABS-MBS (US07337BAC81) | 0.21 | 0.1469 | 0.1469 | |||

| US034863BD17 / Anglo American Capital PLC | 0.20 | 0.1433 | 0.1433 | |||

| US75886FAE79 / Regeneron Pharmaceuticals Inc | 0.20 | 0.1427 | 0.1427 | |||

| US025537AY74 / AMERICAN ELECTRIC POWER REGD 5.20000000 | 0.20 | 0.1389 | 0.1389 | |||

| Capital Power US Holdings Inc / DBT (US14041TAB44) | 0.20 | 0.1375 | 0.1375 | |||

| US95003LAA89 / WELLS FARGO COMMERCIAL MORTGAGE TRUST SER 2021-SAVE CL A V/R REGD 144A P/P 1.30000000 | 0.18 | -16.82 | 0.1292 | -0.0133 | ||

| US92840VAQ59 / Vistra Operations Co. LLC | 0.16 | 0.1163 | 0.1163 | |||

| US90931GAA76 / United Airlines 2020-1 Class A Pass Through Trust | 0.16 | 0.1158 | 0.1158 | |||

| US87612BBN10 / CORP. NOTE | 0.15 | 0.1036 | 0.1036 | |||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 0.15 | 0.1031 | 0.1031 | |||

| US35805BAE83 / FRESENIUS MEDICAL CARE US FIN III | 0.13 | 0.0930 | 0.0930 | |||

| PSEG Power LLC / DBT (US69362BBE11) | 0.12 | 0.0849 | 0.0849 | |||

| US01F0504864 / Uniform Mortgage-Backed Security, TBA | 0.11 | 0.0788 | 0.0788 | |||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 0.09 | 0.0666 | 0.0666 | |||

| BRO / Brown & Brown, Inc. | 0.07 | 0.0525 | 0.0525 | |||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | 0.04 | 0.0262 | 0.0262 | |||

| BRO / Brown & Brown, Inc. | 0.04 | 0.0259 | 0.0259 |