Statistik Asas

| Nilai Portfolio | $ 218,917,678 |

| Kedudukan Semasa | 422 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

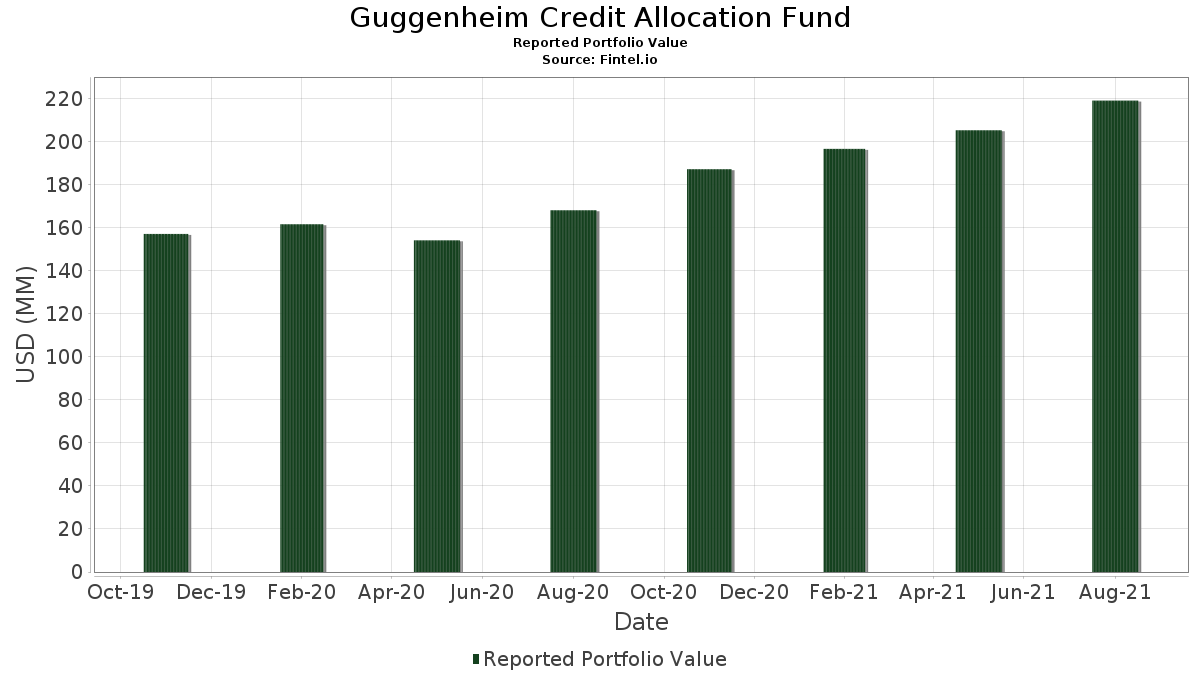

Guggenheim Credit Allocation Fund telah mendedahkan 422 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 218,917,678 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Guggenheim Credit Allocation Fund ialah FAGE International SA / FAGE USA Dairy Industry Inc (LU:US30257WAA45) , KeHE Distributors LLC / KeHE Finance Corp. (US:US487526AB19) , LBC Tank Terminals Holding Netherlands BV (NL:LBCN40) , Cengage Learning, Inc. (US:US15137NAA19) , and Accuride Corp. (US:US00439CBC73) . Kedudukan baharu Guggenheim Credit Allocation Fund termasuk FAGE International SA / FAGE USA Dairy Industry Inc (LU:US30257WAA45) , KeHE Distributors LLC / KeHE Finance Corp. (US:US487526AB19) , LBC Tank Terminals Holding Netherlands BV (NL:LBCN40) , Cengage Learning, Inc. (US:US15137NAA19) , and Accuride Corp. (US:US00439CBC73) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 3.09 | 1.4545 | 1.4545 | ||

| 3.08 | 1.4451 | 1.4451 | ||

| 2.42 | 1.1370 | 1.1370 | ||

| 2.04 | 0.9587 | 0.9587 | ||

| 1.72 | 0.8086 | 0.8086 | ||

| 1.65 | 0.7758 | 0.7758 | ||

| 2.03 | 0.9531 | 0.7348 | ||

| 1.49 | 0.7000 | 0.7000 | ||

| 1.41 | 0.6612 | 0.6612 | ||

| 1.20 | 0.5642 | 0.5642 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| -2.43 | -1.1406 | -3.0821 | ||

| -2.34 | -1.0994 | -3.0409 | ||

| -2.30 | -1.0811 | -3.0225 | ||

| -1.95 | -0.9175 | -2.8590 | ||

| -1.91 | -0.8993 | -2.8407 | ||

| -1.87 | -0.8786 | -2.8200 | ||

| -1.82 | -0.8565 | -2.7980 | ||

| -1.82 | -0.8549 | -2.7964 | ||

| -1.70 | -0.8003 | -2.7417 | ||

| -1.59 | -0.7496 | -2.6910 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2021-10-27 untuk tempoh pelaporan 2021-08-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NES Global Talent / LON (N/A) | 4.19 | 39.56 | 1.9700 | 0.0285 | |||||

| US30257WAA45 / FAGE International SA / FAGE USA Dairy Industry Inc | 4.12 | 14.17 | 1.9357 | 0.1125 | |||||

| US487526AB19 / KeHE Distributors LLC / KeHE Finance Corp. | 3.91 | -1.71 | 1.8378 | -0.1727 | |||||

| LBCN40 / LBC Tank Terminals Holding Netherlands BV | 3.74 | -0.21 | 1.7588 | -0.1364 | |||||

| US15137NAA19 / Cengage Learning, Inc. | 3.66 | 1.11 | 1.7191 | -0.1094 | |||||

| US00439CBC73 / Accuride Corp. | 3.51 | -0.14 | 1.6478 | -0.1269 | |||||

| US644274AG71 / New Enterprise Stone & Lime Co., Inc. | 3.42 | -0.23 | 1.6093 | -0.1252 | |||||

| US88033CAH25 / Teneo Holdings LLC | 3.40 | -39.25 | 1.5966 | -1.2300 | |||||

| BCLYF / Barclays PLC | 3.28 | -0.33 | 1.5421 | -0.1219 | |||||

| US88104UAC71 / Terraform Global Operating LLC | 3.16 | -0.13 | 1.4867 | -0.1140 | |||||

| US73939VAA26 / POWERTEAM SERVICES LLC REGD 144A P/P 9.03300000 | 3.11 | -0.92 | 1.4633 | -0.1247 | |||||

| US57767XAB64 / Mav Acquisition Corp. | 3.09 | 1.4545 | 1.4545 | ||||||

| US47232MAF95 / Jefferies Finance LLC | 3.08 | 1.4451 | 1.4451 | ||||||

| US398545AA16 / GRINDING MEDIA INC / MOLY-COP ALTASTEEL LTD 7.375% 12/15/2023 144A | 2.99 | -0.53 | 1.4060 | -0.1139 | |||||

| BHI Investments LLC / LON (N/A) | 2.95 | -1.86 | 1.3852 | -0.5563 | |||||

| US65342RAD26 / NFP Corp | 2.92 | -0.71 | 1.3746 | -0.1141 | |||||

| US445587AE85 / HUNTCO 5 1/4 04/15/29 | 2.92 | 8.20 | 1.3702 | 0.0086 | |||||

| US78489JAD63 / SIWF HOLDINGS INC | 2.90 | 0.38 | 1.3636 | -0.0975 | |||||

| US12598FAA75 / CPI CG Inc | 2.84 | 4.38 | 1.3329 | -0.0403 | |||||

| US185401AG14 / Cleaver-Brooks, Inc. | 2.72 | -1.49 | 1.2760 | -0.1169 | |||||

| US864486AK16 / Suburban Propane Partners Limited Partnership/Suburban Energy Finance Corp. | 2.71 | 0.11 | 1.2754 | -0.0945 | |||||

| US81220HAC07 / SeaPort Financing LLC | 2.48 | -0.28 | 1.1668 | -0.0913 | |||||

| NA Rail Hold Co. LLC / LON (N/A) | 2.47 | -17.82 | 1.1601 | -0.7814 | |||||

| US57767XAA81 / Mav Acquisition Corp | 2.42 | 1.1370 | 1.1370 | ||||||

| XAC9288BAC00 / 24-7 Intouch Inc 2018 Term Loan | 2.38 | 1.15 | 1.1183 | -0.0708 | |||||

| BHC / Bausch Health Companies Inc. | 2.34 | 11.82 | 1.0986 | 0.0420 | |||||

| US16412EAA55 / Cheplapharm Arzneimittel GmbH | 2.30 | 26.31 | 1.0788 | 0.1603 | |||||

| US33941LAE65 / TVC Albany, Inc. 2018 2nd Lien Term Loan | 2.27 | 1.11 | 1.0669 | -0.0682 | |||||

| US67059TAH86 / NuStar Logistics LP | 2.24 | 0.99 | 1.0523 | -0.0684 | |||||

| US50076QAE61 / Kraft Heinz Foods Co | 2.18 | 8.67 | 1.0250 | 0.0103 | |||||

| US415864AM90 / Harsco Corp 5.75% 07/31/2027 144A | 2.07 | -0.96 | 0.9747 | -0.0836 | |||||

| US90320BAA70 / UPC Broadband Finco BV | 2.04 | 2.25 | 0.9597 | -0.0498 | |||||

| US45074JAA25 / ITT Holdings LLC | 2.04 | 0.9587 | 0.9587 | ||||||

| US37954FAJ30 / CORP. NOTE | 2.03 | 369.44 | 0.9531 | 0.7348 | |||||

| US98432UAE55 / Yak Access, LLC 2018 2nd Lien Term Loan B | 2.02 | -5.38 | 0.9499 | -0.1300 | |||||

| US144285AL72 / Carpenter Technology Corp | 2.00 | -0.94 | 0.9421 | -0.0807 | |||||

| US50212YAD67 / LPL Holdings Inc | 1.89 | 2.78 | 0.8865 | -0.0411 | |||||

| TexGen Power LLC / EC (N/A) | 0.05 | 1.88 | -37.36 | 0.8842 | -1.0572 | ||||

| US730481AJ74 / J.B. Poindexter & Co., Inc. | 1.87 | -0.11 | 0.8801 | -0.0675 | |||||

| US893647BK28 / TransDigm Inc | 1.87 | -1.00 | 0.8800 | -0.0758 | |||||

| US23166MAA18 / DTZ US BORROWER LLC 6.75% 05/15/2028 144A | 1.79 | 27.57 | 0.8397 | 0.1318 | |||||

| US76009NAL47 / Rent-A-Center Inc/TX | 1.78 | 79.68 | 0.8355 | 0.3353 | |||||

| US12008RAP29 / Builders FirstSource Inc | 1.72 | 0.8086 | 0.8086 | ||||||

| LILAPR / LCPR Senior Secured Financing DAC | 1.71 | -0.47 | 0.8036 | -0.0648 | |||||

| US13201FAU03 / Cambrex Corporation 2021 Term Loan | 1.68 | -44.22 | 0.7874 | -1.1541 | |||||

| US384311AA42 / GrafTech Finance Inc | 1.66 | 32.24 | 0.7790 | 0.1454 | |||||

| US04683P1003 / ATD New Holdings Inc | 0.02 | 0.00 | 1.65 | 41.13 | 0.7778 | 0.1852 | |||

| US83600GAA22 / Sotheby's | 1.65 | 0.7758 | 0.7758 | ||||||

| US737446AR57 / Post Holdings, Inc. | 1.64 | -10.39 | 0.7704 | -0.1541 | |||||

| US97263CAA99 / Wilton RE Ltd. | 1.64 | 1.43 | 0.7685 | -0.0467 | |||||

| US632347AC40 / Nathan's Famous, Inc. | 1.63 | -0.24 | 0.7671 | -0.0597 | |||||

| US46284VAL53 / Iron Mountain Inc | 1.63 | 2.20 | 0.7656 | -0.0401 | |||||

| US12662PAD06 / CVR Energy Inc | 1.63 | 66.73 | 0.7656 | 0.2716 | |||||

| US103304BS93 / Boyd Gaming Corp | 1.63 | -1.39 | 0.7647 | -0.0692 | |||||

| US913229AA80 / United Wholesale Mortgage LLC | 1.59 | -0.75 | 0.7484 | -0.0626 | |||||

| US835898AH05 / SOTHEBYS 7.375% 10/15/2027 144A | 1.59 | -0.81 | 0.7475 | -0.0631 | |||||

| US59921PAB22 / MILEAGE PLUS HOLDINGS LLC | 1.59 | -0.56 | 0.7472 | -0.0613 | |||||

| US78573NAF96 / Sabre GLBL Inc | 1.59 | -1.86 | 0.7455 | -0.0714 | |||||

| Alexander Mann / LON (N/A) | 1.52 | -49.48 | 0.7130 | -1.2284 | |||||

| US489399AN56 / Kennedy-Wilson Inc | 1.49 | 0.7000 | 0.7000 | ||||||

| SP PF Buyer LLC / LON (N/A) | 1.47 | -50.92 | 0.6930 | -1.2484 | |||||

| US644274AF98 / New Enterprise Stone & Lime Co 6.25% 03/15/2026 144A | 1.46 | 26.42 | 0.6881 | 0.1025 | |||||

| US527298BS18 / Level 3 Financing Inc | 1.46 | 0.97 | 0.6841 | -0.0446 | |||||

| US45569LAC54 / INDIGO NATURAL RESOURCES LLC 5.375% 02/01/2029 144A | 1.45 | 2.99 | 0.6793 | -0.0302 | |||||

| US603158AA41 / Minerals Technologies Inc | 1.41 | 0.71 | 0.6646 | -0.0450 | |||||

| US02156LAA98 / Altice France SA/France | 1.41 | -0.35 | 0.6636 | -0.0525 | |||||

| US227046AB51 / Crocs Inc | 1.41 | 0.6612 | 0.6612 | ||||||

| US390607AF62 / GREAT LAKES DRDG and DOCK CORP NEW 5.25% 06/01/2029 144A | 1.39 | 1.31 | 0.6551 | -0.0400 | |||||

| US69888XAA72 / Par Pharmaceutical, Inc. | 1.36 | -0.73 | 0.6376 | -0.0532 | |||||

| US73900LAA98 / POWDR CORP 6% 08/01/2025 144A | 1.35 | 327.30 | 0.6329 | 0.4733 | |||||

| US432833AN19 / HILTON DOMESTIC OPERATING CO INC 3.625% 02/15/2032 144A | 1.34 | 1.67 | 0.6313 | -0.0364 | |||||

| US02156LAF85 / Altice France SA/France | 1.34 | 1.98 | 0.6296 | -0.0344 | |||||

| US70137WAG33 / Parkland Corp/Canada | 1.33 | 7.16 | 0.6262 | -0.0022 | |||||

| US92047WAG69 / Valvoline Inc | 1.32 | 2.41 | 0.6196 | -0.0313 | |||||

| US44541FAC41 / PANDA HUMMEL STATION TLB1 1L 10/27/2022 | 1.30 | -2.11 | 0.6103 | -0.0603 | |||||

| Barentz Midco BV / LON (N/A) | 1.29 | -56.94 | 0.6079 | -1.3336 | |||||

| US85172FAN96 / Springleaf Finance Corp Bond | 1.28 | 0.31 | 0.6036 | -0.0434 | |||||

| US65409QBK76 / NIELSEN FINANCE LLC/ FIN CO 4.75% 07/15/2031 144A | 1.28 | -1.16 | 0.6032 | -0.0531 | |||||

| JPM.PRK / JPMorgan Chase & Co. - Preferred Stock | 0.05 | 0.00 | 1.28 | 0.95 | 0.6015 | -0.0392 | |||

| US1248EPCL57 / CCO Holdings LLC / CCO Holdings Capital Corp | 1.27 | 3.60 | 0.5956 | -0.0227 | |||||

| WFC.PRC / Wells Fargo & Company - Preferred Stock | 0.05 | 0.00 | 1.27 | 1.12 | 0.5950 | -0.0380 | |||

| US929566AJ62 / Wabash National Corp. | 1.27 | -1.48 | 0.5948 | -0.0543 | |||||

| AEL.PRA / American National Group Inc. - Preferred Stock | 0.05 | 0.00 | 1.26 | -0.08 | 0.5943 | -0.0453 | |||

| TPGS / Vacasa Inc - Class A | 0.13 | 0.00 | 1.26 | 0.96 | 0.5904 | -0.0388 | |||

| Alexander Mann / LON (N/A) | 1.25 | -58.31 | 0.5888 | -1.3527 | |||||

| US92858RAA86 / Vmed O2 UK Financing I PLC | 1.23 | 3.79 | 0.5786 | -0.0210 | |||||

| US103186AB88 / BOXER PARENT CO INC REGD 144A P/P 7.12500000 | 1.23 | -0.16 | 0.5785 | -0.0449 | |||||

| LBTY.A / Liberty Global Ltd. | 1.22 | 1.67 | 0.5720 | -0.0329 | |||||

| US30227KAE91 / Exterran Energy Solutions LP / EES Finance Corp | 1.22 | -0.41 | 0.5710 | -0.0457 | |||||

| US443201AB48 / Howmet Aerospace Inc | 1.20 | 0.5642 | 0.5642 | ||||||

| BRE/Everbright M6 Borrower LLC / LON (N/A) | 1.19 | -60.24 | 0.5611 | -1.3803 | |||||

| US29384FAD33 / Entrans International, LLC 2018 Term Loan | 1.19 | -4.74 | 0.5574 | -0.0723 | |||||

| US43734LAA44 / Home Point Capital Inc | 1.17 | 5.32 | 0.5488 | -0.0115 | |||||

| US978097AG86 / WOLVERINE WORLD WIDE REGD 144A P/P 4.00000000 | 1.17 | 0.5486 | 0.5486 | ||||||

| US69867DAC20 / Panther BF Aggregator 2 LP / Panther Finance Co Inc | 1.12 | -1.84 | 0.5268 | -0.0503 | |||||

| US988498AP63 / Yum! Brands Inc | 1.11 | 3.55 | 0.5213 | -0.0200 | |||||

| US90290MAC55 / US Foods Inc | 1.11 | -0.54 | 0.5200 | -0.0423 | |||||

| US126307BD80 / CSC HOLDINGS LLC SR UNSECURED 144A 12/30 4.625 | 1.10 | 1.19 | 0.5184 | -0.0325 | |||||

| US019736AG29 / Allison Transmission Inc | 1.10 | 3.98 | 0.5163 | -0.0174 | |||||

| UNTC / Unit Corporation | 0.05 | 6.49 | 1.07 | 56.19 | 0.5043 | 0.1568 | |||

| US62886EAZ16 / NCR CORPORATION NEW 5.25% 10/01/2030 144A | 1.07 | 0.75 | 0.5034 | -0.0339 | |||||

| US853496AH04 / Standard Industries Inc/NJ | 1.06 | 1.25 | 0.4968 | -0.0308 | |||||

| US247361ZX93 / Delta Air Lines Inc | 1.05 | 0.48 | 0.4944 | -0.0345 | |||||

| US00109LAA17 / ADT Security Corp. | 1.05 | 0.4928 | 0.4928 | ||||||

| US18060TAA34 / Clarios Global LP | 1.05 | -11.04 | 0.4926 | -0.1029 | |||||

| US65409QBF81 / Nielsen Finance LLC / Nielsen Finance Co | 1.04 | -0.95 | 0.4903 | -0.0419 | |||||

| US031921AB57 / AmWINS Group Inc | 1.04 | 0.4895 | 0.4895 | ||||||

| US483007AJ91 / Kaiser Aluminum Corp 4.625% 03/01/2028 144A | 1.04 | -43.64 | 0.4876 | -0.4426 | |||||

| SUUIF / Superior Plus Corp. | 1.04 | 1.87 | 0.4870 | -0.0270 | |||||

| US89376VAA89 / TransMontaigne Partners Limited Partnership / TLP Finance Corp. | 1.02 | 0.4817 | 0.4817 | ||||||

| US74841CAB72 / Quicken Loans LLC / Quicken Loans Co-Issuer Inc | 1.02 | 4.61 | 0.4808 | -0.0132 | |||||

| JPM.PRM / JPMorgan Chase & Co. - Preferred Stock | 0.04 | 1.02 | 0.4796 | 0.4796 | |||||

| US22304LAA89 / Covey Park Energy LLC / Covey Park Finance Corp. | 1.00 | 0.00 | 0.4718 | -0.0356 | |||||

| US25536MAE12 / DiversiTech Holdings, Inc., Second Lien Term Loan | 1.00 | 0.00 | 0.4700 | -0.0354 | |||||

| US610333AY20 / Monroe Capital CLO Ltd. | 1.00 | 0.10 | 0.4691 | -0.0352 | |||||

| US74880TAE64 / Quirch Foods Holdings, LLC 2020 Term Loan | 1.00 | -0.50 | 0.4688 | -0.0379 | |||||

| McGraw Hill LLC / LON (N/A) | 0.99 | -66.97 | 0.4664 | -1.4750 | |||||

| / Arch Capital Group Ltd. | 0.04 | 0.99 | 0.4649 | 0.4649 | |||||

| US032177AJ66 / Amsted Industries Inc | 0.99 | 3.24 | 0.4643 | -0.0194 | |||||

| US50077LAB27 / Kraft Heinz Foods Co | 0.98 | 7.78 | 0.4627 | 0.0011 | |||||

| HAH Group Holding Co. LLC / LON (N/A) | 0.97 | -67.57 | 0.4582 | -1.4833 | |||||

| US41984LAA52 / Hawaiian Brand Intellectual Property Ltd / HawaiianMiles Loyalty Ltd | 0.97 | 46.69 | 0.4578 | 0.1222 | |||||

| KAHC / KKR Acquisition Holdings I Corp - Class A | 0.10 | 100.00 | 0.97 | 98.98 | 0.4567 | 0.2096 | |||

| US68246UAH77 / 1A Smart Start LLC | 0.97 | -0.41 | 0.4558 | -0.0362 | |||||

| US98262PAA93 / WW International, Inc. | 0.94 | 50.48 | 0.4414 | 0.1256 | |||||

| US70583GAW24 / Pelican Products, Inc. 2018 1st Lien Term Loan | 0.93 | 0.00 | 0.4369 | -0.0328 | |||||

| BAC.PRO / Bank of America Corporation - Preferred Stock | 0.04 | 0.00 | 0.91 | 2.47 | 0.4290 | -0.0208 | |||

| US03966VAB36 / Arconic Corp | 0.90 | -0.88 | 0.4229 | -0.0359 | |||||

| US82967NBM92 / Sirius XM Radio Inc | 0.89 | 0.4203 | 0.4203 | ||||||

| US72815LAA52 / Playtika Holding Corp | 0.88 | 2.44 | 0.4148 | -0.0208 | |||||

| US538034AV10 / Live Nation Entertainment Inc | 0.88 | -0.11 | 0.4145 | -0.0318 | |||||

| US84410HAC43 / Southern Veterinary Partners, LLC Term Loan | 0.88 | -0.68 | 0.4114 | -0.0572 | |||||

| US12541HAR49 / CHG Healthcare Services Inc. 2017 1st Lien Term Loan B | 0.87 | 0.00 | 0.4096 | -0.0310 | |||||

| US90290MAD39 / US FOODS INC 4.75% 02/15/2029 144A | 0.87 | 2.72 | 0.4090 | -0.0196 | |||||

| QSR / Restaurant Brands International Inc. | 0.86 | 0.4045 | 0.4045 | ||||||

| US489399AM73 / Kennedy-Wilson Inc | 0.86 | 1.78 | 0.4033 | -0.0231 | |||||

| US810186AT39 / Scotts Miracle-Gro Co. (The) | 0.85 | 1.55 | 0.4005 | -0.0237 | |||||

| US71677HAL96 / PetSmart, Inc., Term Loan B | 0.85 | 0.3998 | 0.3998 | ||||||

| US44157TAA34 / Houghton Mifflin Harcourt Publishers, Inc. | 0.85 | -0.35 | 0.3995 | -0.0320 | |||||

| US71360HAB33 / PERATON CORP | 0.85 | -0.35 | 0.3984 | -0.0316 | |||||

| US808513BJ38 / Charles Schwab Corp/The | 0.84 | 3.86 | 0.3928 | -0.0135 | |||||

| US008911BK48 / Air Canada | 0.83 | 0.3901 | 0.3901 | ||||||

| US45232TAA97 / Illuminate Buyer LLC / Illuminate Holdings IV Inc | 0.83 | -0.24 | 0.3895 | -0.0303 | |||||

| US864486AL98 / Suburban Propane Partners LP/Suburban Energy Finance Corp | 0.82 | 1.85 | 0.3872 | -0.0217 | |||||

| US62886EAV02 / NCR Corp. | 0.82 | 0.37 | 0.3842 | -0.0276 | |||||

| US92328MAB90 / Venture Global Calcasieu Pass LLC | 0.81 | 0.3824 | 0.3824 | ||||||

| US37954FAG90 / Global Partners LP / GLP Finance Corp | 0.81 | -1.71 | 0.3784 | -0.0358 | |||||

| US682691AC47 / OneMain Finance Corp | 0.80 | 0.3777 | 0.3777 | ||||||

| US00164VAF04 / AMC Networks Inc | 0.79 | 0.00 | 0.3732 | -0.0281 | |||||

| US29280BAA35 / Endo Luxembourg Finance Co I Sarl / Endo US Inc | 0.79 | 0.38 | 0.3722 | -0.0265 | |||||

| US02156LAE11 / Altice France SA/France | 0.78 | 1.69 | 0.3669 | -0.0209 | |||||

| US674599CF00 / Occidental Petroleum Corp | 0.78 | 17.58 | 0.3648 | 0.0309 | |||||

| US57763RAA59 / Mauser Packaging Solutions Holding Co. | 0.77 | 0.00 | 0.3639 | -0.0274 | |||||

| SCP Eye Care Services LLC / LON (N/A) | 0.77 | -74.53 | 0.3596 | -1.5819 | |||||

| FRC.PRK / First Republic Bank Depositary Shares, Each Representing a 1/40th Interest in a Share of 4.125% Nonc | 0.03 | 0.00 | 0.76 | 0.26 | 0.3573 | -0.0262 | |||

| US1248EPCP61 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.76 | 0.3556 | 0.3556 | ||||||

| US00175PAB94 / AMN Healthcare, Inc. | 0.76 | 0.67 | 0.3552 | -0.0240 | |||||

| US71677KAA60 / PetSmart Inc / PetSmart Finance Corp | 0.75 | 0.53 | 0.3548 | -0.0247 | |||||

| COLI / Colicity Inc - Class A | 0.08 | 0.00 | 0.75 | -0.66 | 0.3524 | -0.0289 | |||

| US78573NAC65 / Sabre GLBL Inc | 0.75 | -1.45 | 0.3521 | -0.0323 | |||||

| Polaris Newco LLC / LON (N/A) | 0.75 | -75.06 | 0.3520 | -1.5894 | |||||

| VODPF / Vodafone Group Public Limited Company | 0.75 | 0.54 | 0.3509 | -0.0245 | |||||

| US50077LAZ94 / Kraft Heinz Foods Co | 0.75 | 8.13 | 0.3502 | 0.0018 | |||||

| QSR / Restaurant Brands International Inc. | 0.72 | 2.56 | 0.3388 | -0.0161 | |||||

| FI4000507876 / PHM Group Holding Oy | 0.72 | 0.3377 | 0.3377 | ||||||

| US810186AV84 / Scotts Miracle-Gro Co/The | 0.71 | 0.3336 | 0.3336 | ||||||

| US88033GDE70 / Tenet Healthcare Corp | 0.70 | -0.14 | 0.3269 | -0.0253 | |||||

| DXP Enterprises, Inc. / LON (N/A) | 0.69 | -76.89 | 0.3263 | -1.6152 | |||||

| US20451NAG60 / Compass Minerals International, Inc. | 0.69 | -1.29 | 0.3234 | -0.0289 | |||||

| US707569AV14 / Penn National Gaming Inc | 0.67 | 0.3168 | 0.3168 | ||||||

| US50201DAD57 / LCPR Senior Secured Financing DAC | 0.67 | 0.90 | 0.3162 | -0.0209 | |||||

| BAC.PRP / Bank of America Corporation - Preferred Stock | 0.03 | 0.00 | 0.67 | 2.14 | 0.3144 | -0.0163 | |||

| US92858RAB69 / Vmed O2 UK Financing I PLC | 0.67 | 0.3139 | 0.3139 | ||||||

| US12510CAA99 / CD&R Smokey Buyer Inc | 0.67 | -0.30 | 0.3127 | -0.0245 | |||||

| Franchise Group, Inc. / LON (N/A) | 0.65 | -78.22 | 0.3075 | -1.6339 | |||||

| First Brands Group LLC / LON (N/A) | 0.65 | -78.29 | 0.3066 | -1.6349 | |||||

| Tank Holdings Corp. / LON (N/A) | 0.65 | -78.35 | 0.3057 | -1.6358 | |||||

| US03960DAB91 / Arcline FM Holdings LLC | 0.64 | 0.3024 | 0.3024 | ||||||

| US82488HAC51 / SHO Holding I Corp. | 0.64 | 1.11 | 0.2992 | -0.0191 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 0.02 | 0.00 | 0.63 | -0.48 | 0.2949 | -0.0234 | |||

| US91153LAA52 / United Shore Financial Services LLC | 0.63 | -41.31 | 0.2938 | -0.2445 | |||||

| US460919AB94 / Intertape Polymer Group Inc | 0.61 | 0.99 | 0.2877 | -0.0185 | |||||

| US81104BAC46 / ScribeAmerica Intermediate Holdco LLC (Healthchannels) | 0.59 | -1.00 | 0.2785 | -0.0237 | |||||

| US52473NAA63 / LEGENDS HOSPITALITY HOLDING CO LLC / LEGENDS HOSPITALITY CO-ISSUER INC 5% 02/01/2026 144A | 0.59 | -0.50 | 0.2783 | -0.0224 | |||||

| US50106GAF90 / Kronos Acquisition Holdings Inc / KIK Custom Products Inc | 0.59 | -56.68 | 0.2774 | -0.4111 | |||||

| Alterra Mountain Co. / LON (N/A) | 0.59 | -80.39 | 0.2772 | -1.6643 | |||||

| US527298BT90 / LEVEL 3 FINANCING INC 3.75% 07/15/2029 144A | 0.58 | 1.21 | 0.2749 | -0.0175 | |||||

| US038522AR99 / Aramark Services Inc | 0.58 | -0.34 | 0.2736 | -0.0217 | |||||

| XAC0553HAD26 / Avison Young (Canada), Inc. | 0.58 | -0.17 | 0.2731 | -0.0211 | |||||

| US143905AP21 / CSV 4 1/4 05/15/29 | 0.58 | 0.17 | 0.2707 | -0.0196 | |||||

| US97815UAH77 / Women's Care Holdings, Inc., LLC, First Lien Term Loan | 0.57 | -0.35 | 0.2690 | -0.0212 | |||||

| US50212YAF16 / LPL Holdings Inc | 0.57 | 3.45 | 0.2675 | -0.0105 | |||||

| US44332PAD33 / HUB International Ltd. | 0.57 | -0.18 | 0.2674 | -0.0207 | |||||

| US39303NAC56 / PANDA STONEWALL TERM B2 DD 11/13/21 | 0.56 | -4.24 | 0.2655 | -0.0326 | |||||

| DIRXX / Dreyfus Treasury Securities Cash Management - Dreyfus Treasury Securities Cash Management Institutional Shares | 0.55 | 6.15 | 0.55 | 6.18 | 0.2589 | -0.0034 | |||

| Provation Software Group, Inc. / LON (N/A) | 0.54 | -81.98 | 0.2546 | -1.6869 | |||||

| US483007AL48 / KAISER ALUMINUM CORP 4.5% 06/01/2031 144A | 0.52 | 1.97 | 0.2435 | -0.0136 | |||||

| Taxware Holdings (Sovos Compliance LLC) / LON (N/A) | 0.51 | -82.92 | 0.2412 | -1.7003 | |||||

| Drive Chassis (DCLI) / LON (N/A) | 0.51 | -83.18 | 0.2374 | -1.7041 | |||||

| National Mentor Holdings, Inc. / LON (N/A) | 0.50 | -83.22 | 0.2373 | -1.7042 | |||||

| US682691AA80 / OneMain Finance Corp | 0.50 | 3.73 | 0.2355 | -0.0091 | |||||

| US66981QAA40 / BRUNDAGE-BONE CONCRETE PUMPING HOLDINGS INC 6% 02/01/2026 144A | 0.50 | 74.30 | 0.2330 | 0.0892 | |||||

| AIZN / Assurant, Inc. - Corporate Bond/Note | 0.02 | 0.00 | 0.49 | 1.88 | 0.2292 | -0.0125 | |||

| SRNG / Soaring Eagle Acquisition Corp - Class A | 0.05 | 0.00 | 0.49 | 1.04 | 0.2286 | -0.0148 | |||

| US61647DAF96 / Moran Foods LLC | 0.48 | 3.71 | 0.2234 | -0.0085 | |||||

| US14856GAB68 / Castlelake Aircraft Structured Trust 2021-1 | 0.47 | 1.72 | 0.2230 | -0.0127 | |||||

| US53079EBL74 / Liberty Mutual Group, Inc. | 0.47 | 6.05 | 0.2227 | -0.0032 | |||||

| Pro Mach Group, Inc. / LON (N/A) | 0.47 | -84.25 | 0.2225 | -1.7190 | |||||

| US013817AK77 / Alcoa Inc 5.95% Notes 2/1/37 | 0.47 | 8.51 | 0.2223 | 0.0024 | |||||

| US67054KAA79 / Altice France SA/France | 0.47 | -0.21 | 0.2210 | -0.0171 | |||||

| US04621XAK46 / Assurant, Inc. | 0.47 | 1.96 | 0.2202 | -0.0121 | |||||

| Moran Foods LLC / LON (N/A) | 0.46 | -84.78 | 0.2149 | -1.7265 | |||||

| US39303NAB73 / Green Energy Partners/Stonewall LLC | 0.46 | -4.20 | 0.2146 | -0.0264 | |||||

| US15134NAF33 / BANK LOAN NOTE | 0.45 | 0.2120 | 0.2120 | ||||||

| US44541FAB67 / Hummel Station LLC Term Loan A | 0.45 | -3.23 | 0.2113 | -0.0235 | |||||

| US16280UAB61 / Checkers Drive-In Restaurants, Inc. | 0.45 | -0.44 | 0.2113 | -0.0169 | |||||

| Holding SOCOTEC / LON (N/A) | 0.45 | -85.05 | 0.2111 | -1.7304 | |||||

| US489399AL90 / KENNEDY-WILSON INC 4.75% 03/01/2029 | 0.44 | 0.46 | 0.2055 | -0.0146 | |||||

| US23345MAA53 / DT MIDSTREAM INC 4.125% 06/15/2029 144A | 0.44 | 1.87 | 0.2047 | -0.0111 | |||||

| US599191AA16 / Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd | 0.43 | -0.69 | 0.2042 | -0.0171 | |||||

| US91879QAL32 / Vail Resorts Inc | 0.43 | 0.24 | 0.2003 | -0.0145 | |||||

| Balrog Acquisition, Inc. / LON (N/A) | 0.42 | -85.91 | 0.1992 | -1.7422 | |||||

| Gibson Brands, Inc. / LON (N/A) | 0.42 | -86.01 | 0.1977 | -1.7437 | |||||

| US75419TAA16 / Rattler Midstream LP | 0.42 | 0.96 | 0.1974 | -0.0129 | |||||

| US62886EBA55 / NCR Corp | 0.41 | 0.98 | 0.1949 | -0.0125 | |||||

| US153527AP10 / Central Garden & Pet Co | 0.41 | 1.25 | 0.1908 | -0.0121 | |||||

| US89473MAD48 / Treman Park CLO Ltd. | 0.39 | -0.51 | 0.1841 | -0.0147 | |||||

| US830867AB33 / Delta Air Lines Inc / SkyMiles IP Ltd | 0.39 | 1.83 | 0.1830 | -0.0103 | |||||

| US85172FAS83 / Springleaf Finance Corp | 0.38 | -0.52 | 0.1804 | -0.0144 | |||||

| US01883LAB99 / Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer | 0.38 | 0.27 | 0.1767 | -0.0126 | |||||

| US83001WAC82 / Six Flags Theme Parks Inc | 0.37 | -0.53 | 0.1758 | -0.0144 | |||||

| PT Intermediate Holdings III LLC / LON (N/A) | 0.37 | -87.78 | 0.1727 | -1.7687 | |||||

| US71953LAA98 / Picasso Finance Sub Inc | 0.36 | -9.90 | 0.1715 | -0.0328 | |||||

| US039653AA89 / Arcosa Inc | 0.36 | 2.28 | 0.1690 | -0.0089 | |||||

| US09578EAB83 / Blue Nile, Inc. | 0.36 | 0.00 | 0.1685 | -0.0129 | |||||

| Blue Ribbon LLC / LON (N/A) | 0.35 | -88.21 | 0.1668 | -1.7747 | |||||

| US00771PAJ03 / AEGION CORPORATION TERM LOAN | 0.35 | 0.28 | 0.1657 | -0.0118 | |||||

| Permian Production Partners LLC / LON (N/A) | 0.34 | -88.54 | 0.1619 | -1.7796 | |||||

| US86614RAN70 / SUMMIT MATLS LLC / FIN CORP 5.25% 01/15/2029 144A | 0.34 | 0.58 | 0.1617 | -0.0116 | |||||

| US001877AA71 / APi Group DE Inc | 0.34 | 0.1612 | 0.1612 | ||||||

| US29275YAC66 / EnerSys | 0.34 | 1.49 | 0.1604 | -0.0095 | |||||

| US1248EPCN14 / CORPORATE BONDS | 0.34 | -80.23 | 0.1596 | -0.7072 | |||||

| US09951LAB99 / Booz Allen Hamilton Inc | 0.34 | 0.1583 | 0.1583 | ||||||

| RNR.PRG / RenaissanceRe Holdings Ltd. - Preferred Stock | 0.01 | 0.33 | 0.1552 | 0.1552 | |||||

| US78410GAE44 / SBA COMMUNICATIONS CORP 3.125% 02/01/2029 144A | 0.33 | -66.77 | 0.1538 | -0.3435 | |||||

| Apttus Corp. / LON (N/A) | 0.33 | -89.18 | 0.1530 | -1.7884 | |||||

| US57777YAB20 / MAVIS TIRE TERM 1LN 05/04/2028 | 0.32 | -0.31 | 0.1527 | -0.0119 | |||||

| US49387TAW62 / KIK CONSUMER TERM B 1LN 12/22/2026 | 0.32 | -1.87 | 0.1481 | -0.0143 | |||||

| US00175PAC77 / AMN Healthcare Inc | 0.31 | -46.26 | 0.1454 | -0.1452 | |||||

| US29273DAC48 / Endo Dac / Endo Finance LLC / Endo Finco Inc | 0.30 | -10.24 | 0.1404 | -0.0279 | |||||

| Ascend Performance Materials Operations LLC / LON (N/A) | 0.30 | -90.08 | 0.1403 | -1.8011 | |||||

| Syndigo LLC / LON (N/A) | 0.30 | -90.08 | 0.1403 | -1.8012 | |||||

| US74112BAM72 / Prestige Brands Inc | 0.30 | 2.78 | 0.1392 | -0.0063 | |||||

| US14314VAB99 / HAMILTON TERM B 1LN 06/11/2027 | 0.30 | -1.01 | 0.1390 | -0.0117 | |||||

| Eisner Advisory Group / LON (N/A) | 0.29 | -90.24 | 0.1380 | -1.8035 | |||||

| US90350DAF50 / U.S. Farathane, LLC 2021 Term Loan B | 0.29 | 0.1349 | 0.1349 | ||||||

| ACRO.U / Acropolis Infrastructure Acquisition Corp. Units, each consisting of one share of Class A Common Sto | 0.03 | 0.29 | 0.1343 | 0.1343 | |||||

| US90932LAH06 / United Airlines Inc | 0.29 | 0.35 | 0.1341 | -0.0095 | |||||

| CA86828QAK72 / Superior Plus, LP | 0.28 | -2.74 | 0.1338 | -0.0142 | |||||

| US047649AA63 / Atkore Inc | 0.28 | 4.41 | 0.1336 | -0.0042 | |||||

| US37959E3009 / Globe Life, Inc., 4.25% | 0.01 | 0.28 | 0.1333 | 0.1333 | |||||

| US76009WAV28 / Rent-A-Center Inc/TX | 0.28 | 0.1294 | 0.1294 | ||||||

| US26244LAA26 / Dryden 41 Senior Loan Fund | 0.27 | -6.85 | 0.1280 | -0.0198 | |||||

| US988498AM33 / Yum! Brands Inc | 0.27 | -0.74 | 0.1266 | -0.0108 | |||||

| US36165YAB65 / BBB Industries U.S. Holdings, Inc. - First Lien | 0.27 | -84.75 | 0.1251 | -0.7566 | |||||

| US409322AD66 / HAMPTON ROADS PPV LLC BONDS 144A 06/53 6.621 | 0.27 | 0.00 | 0.1245 | -0.0094 | |||||

| US431571AE83 / HILLENBRAND INC 3.75% 03/01/2031 | 0.25 | 1.62 | 0.1184 | -0.0067 | |||||

| Atlas CC Acquisition Corp. / LON (N/A) | 0.25 | -91.71 | 0.1174 | -1.8241 | |||||

| XAC0102MAP05 / Air Canada 2021 Term Loan B | 0.25 | 0.1173 | 0.1173 | ||||||

| US50106GAE26 / Kronos Acquisition Holdings Inc / KIK Custom Products Inc | 0.25 | -2.36 | 0.1169 | -0.0115 | |||||

| US741771AA79 / Princess Juliana International Airport Operating Company N.V. | 0.24 | -1.61 | 0.1150 | -0.0107 | |||||

| US08883CAD02 / SOTHEBYS TERM B 1LN 01/15/2027 | 0.24 | -0.42 | 0.1126 | -0.0090 | |||||

| US896945AA07 / TRIPADVISOR INC 7% 07/15/2025 144A | 0.24 | -2.07 | 0.1118 | -0.0106 | |||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 0.23 | 1.77 | 0.1085 | -0.0062 | |||||

| US03021BAJ35 / American Tire Distributors, Inc. | 0.22 | 0.90 | 0.1056 | -0.0071 | |||||

| YTPG / TPG Pace Beneficial II Corp - Class A | 0.02 | 0.00 | 0.22 | -3.11 | 0.1025 | -0.0112 | |||

| US67059TAE55 / NuStar Logistics LP | 0.21 | 0.47 | 0.1000 | -0.0068 | |||||

| US92763MAA36 / Viper Energy Partners LP 5.375% 11/01/2027 144A | 0.21 | 0.48 | 0.0986 | -0.0065 | |||||

| US18538RAJ23 / Clearwater Paper Corp | 0.21 | 4.59 | 0.0965 | -0.0026 | |||||

| US50077LAM81 / Kraft Heinz Foods Co | 0.19 | 8.47 | 0.0904 | 0.0007 | |||||

| US29273DAB64 / Endo Dac / Endo Finance LLC / Endo Finco Inc | 0.18 | -3.80 | 0.0834 | -0.0097 | |||||

| MTTR / Matterport, Inc. | 0.01 | 0.15 | 0.0704 | 0.0704 | |||||

| ATD / AMERICAN TIRE DISTRIBUTORS H. 2015 TERM LOAN | 0.15 | 0.69 | 0.0688 | -0.0048 | |||||

| Save-A-Lot / EC (N/A) | 0.02 | 0.14 | -95.37 | 0.0654 | -1.8760 | ||||

| US67059TAF21 / NuStar Logistics LP | 0.14 | 1.50 | 0.0636 | -0.0041 | |||||

| US96950GAE26 / Williams Scotsman International Inc | 0.13 | 0.78 | 0.0609 | -0.0039 | |||||

| US40467AAD19 / HAHGRO TL DD 1L USD | 0.12 | 0.0580 | 0.0580 | ||||||

| Permian Production Partners LLC / EC (N/A) | 0.10 | 0.12 | -95.97 | 0.0572 | -1.8843 | ||||

| US74045BAE74 / Pregis TopCo Corporation 2021 Incremental Term Loan | 0.12 | 0.0563 | 0.0563 | ||||||

| NCBJ / ABS-O (N/A) | 0.11 | -96.24 | 0.0534 | -1.8881 | |||||

| XAC8614YAB92 / Xplornet Communications, Inc., Term Loan | 0.10 | 0.00 | 0.0465 | -0.0038 | |||||

| QLIK / Qlik Technologies Inc. | 0.00 | -99.60 | 0.08 | 0.0371 | 0.0371 | ||||

| Targus Group International Equity, Inc. / EC (N/A) | 0.03 | 0.08 | -97.40 | 0.0367 | -1.9048 | ||||

| XS1078200430 / Mirabela Nickel Ltd. | 0.06 | 23.53 | 0.0301 | 0.0042 | |||||

| US5770961184 / Matterport, Inc. | 0.01 | 0.06 | 0.0290 | 0.0290 | |||||

| US06985PAN06 / Basic Energy Services, Inc. | 0.06 | -48.62 | 0.0263 | -0.0289 | |||||

| Atlas CC Acquisition Corp. / LON (N/A) | 0.05 | -98.33 | 0.0239 | -1.9176 | |||||

| BP Holdco LLC / EC (N/A) | 0.07 | 0.05 | -98.47 | 0.0219 | -1.9196 | ||||

| US48253T1170 / KKR Acquisition Holdings I Corp. | 0.03 | 100.00 | 0.03 | 92.31 | 0.0118 | 0.0050 | |||

| PT Intermediate Holdings III LLC / LON (N/A) | 0.02 | -99.23 | 0.0111 | -1.9304 | |||||

| SRNGW / Soaring Eagle Acquisition Corp - Warrants (23/02/2026) | 0.01 | 0.00 | 0.02 | 4.76 | 0.0105 | -0.0002 | |||

| National Mentor Holdings, Inc. / LON (N/A) | 0.02 | -99.37 | 0.0094 | -1.9321 | |||||

| Vector Phoenix Holdings, LP / EC (N/A) | 0.07 | 0.02 | -99.40 | 0.0085 | -1.9329 | ||||

| Legacy Reserves, Inc. / EC (N/A) | 0.00 | 0.01 | -99.57 | 0.0064 | -1.9351 | ||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.01 | -99.57 | 0.0062 | -1.9353 | |||||

| US1941701146 / Colicity, Inc. | 0.02 | 0.00 | 0.01 | -45.00 | 0.0053 | -0.0049 | |||

| SHO Holding I Corp. / LON (N/A) | 0.01 | -99.67 | 0.0050 | -1.9365 | |||||

| US44157YAB02 / Houghton Mifflin Co. | 0.00 | -97.76 | 0.0018 | -0.0660 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.00 | -99.93 | 0.0011 | -1.9404 | |||||

| Bruin E&P Partnership Units / EC (N/A) | 0.04 | 0.00 | -99.93 | 0.0010 | -1.9405 | ||||

| Chef Holdings, Inc. / EC (N/A) | 0.00 | 0.00 | -99.97 | 0.0005 | -1.9410 | ||||

| QLIK / Qlik Technologies Inc. | 0.01 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| Sparta Systems / EC (N/A) | 0.00 | 0.00 | -100.00 | 0.0000 | -1.9415 | ||||

| Pro Mach Group, Inc. / LON (N/A) | 0.00 | -100.00 | 0.0000 | -1.9415 | |||||

| Medline Industries, Inc. / LON (N/A) | 0.00 | -100.00 | -0.0000 | -1.9415 | |||||

| Taxware Holdings (Sovos Compliance LLC) / LON (N/A) | 0.00 | -100.00 | 0.0000 | -1.9415 | |||||

| Medline Industries, Inc. / LON (N/A) | 0.00 | -100.00 | -0.0000 | -1.9415 | |||||

| Datix Bidco Ltd. / LON (N/A) | 0.00 | -100.00 | -0.0000 | -1.9415 | |||||

| CCC Information Services, Inc. / LON (N/A) | -0.00 | -100.00 | -0.0000 | -1.9415 | |||||

| CCC Information Services, Inc. / LON (N/A) | -0.00 | -100.00 | -0.0000 | -1.9415 | |||||

| National Mentor Holdings, Inc. / LON (N/A) | -0.00 | -100.00 | -0.0000 | -1.9415 | |||||

| PT Intermediate Holdings III LLC / LON (N/A) | -0.00 | -100.00 | -0.0001 | -1.9415 | |||||

| Eisner Advisory Group / LON (N/A) | -0.00 | -100.00 | -0.0001 | -1.9416 | |||||

| SCP Eye Care Services LLC / LON (N/A) | -0.00 | -100.00 | -0.0002 | -1.9416 | |||||

| Southern Veterinary Partners LLC / LON (N/A) | -0.00 | -100.03 | -0.0005 | -1.9420 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.00 | -100.13 | -0.0019 | -1.9434 | |||||

| Matterport, Inc. / DE (N/A) | -0.01 | -100.17 | -0.0028 | -1.9443 | |||||

| US30065FAH82 / ExamWorks Group, Inc. | -0.02 | -100.77 | -0.0111 | -1.9526 | |||||

| Matterport, Inc. / DE (N/A) | -0.03 | -100.83 | -0.0120 | -1.9535 | |||||

| RBC Capital Markets LLC / RA (N/A) | -0.08 | -102.80 | -0.0395 | -1.9810 | |||||

| Alexander Mann / LON (N/A) | -0.14 | -104.76 | -0.0673 | -2.0088 | |||||

| Credit Suisse Securities (USA) LLC / RA (N/A) | -0.15 | -104.86 | -0.0687 | -2.0101 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.16 | -105.36 | -0.0758 | -2.0173 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.18 | -105.96 | -0.0845 | -2.0260 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.21 | -106.89 | -0.0973 | -2.0388 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -0.23 | -107.69 | -0.1087 | -2.0502 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.24 | -107.89 | -0.1117 | -2.0532 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -0.25 | -108.16 | -0.1154 | -2.0569 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.26 | -108.52 | -0.1203 | -2.0618 | |||||

| Polaris Newco LLC / LON (N/A) | -0.26 | -108.52 | -0.1205 | -2.0619 | |||||

| Credit Suisse Securities (USA) LLC / RA (N/A) | -0.26 | -108.56 | -0.1211 | -2.0626 | |||||

| RBC Capital Markets LLC / RA (N/A) | -0.26 | -108.66 | -0.1223 | -2.0638 | |||||

| RBC Capital Markets LLC / RA (N/A) | -0.29 | -109.52 | -0.1344 | -2.0759 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.29 | -109.66 | -0.1363 | -2.0778 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -0.30 | -110.09 | -0.1427 | -2.0841 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.32 | -110.62 | -0.1500 | -2.0915 | |||||

| Credit Suisse Securities (USA) LLC / RA (N/A) | -0.32 | -110.79 | -0.1523 | -2.0938 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.33 | -110.99 | -0.1551 | -2.0966 | |||||

| RBC Capital Markets LLC / RA (N/A) | -0.34 | -111.32 | -0.1598 | -2.1013 | |||||

| Credit Suisse Securities (USA) LLC / RA (N/A) | -0.36 | -111.92 | -0.1683 | -2.1097 | |||||

| Barclays Capital, Inc. / RA (N/A) | -0.38 | -112.52 | -0.1767 | -2.1182 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -0.38 | -112.62 | -0.1784 | -2.1198 | |||||

| RBC Capital Markets LLC / RA (N/A) | -0.39 | -113.12 | -0.1854 | -2.1269 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.41 | -113.72 | -0.1936 | -2.1351 | |||||

| RBC Capital Markets LLC / RA (N/A) | -0.42 | -113.89 | -0.1962 | -2.1377 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -0.43 | -114.25 | -0.2014 | -2.1429 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -0.47 | -115.48 | -0.2186 | -2.1601 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -0.48 | -115.92 | -0.2249 | -2.1664 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.49 | -116.28 | -0.2303 | -2.1718 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.50 | -116.65 | -0.2350 | -2.1765 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.50 | -116.72 | -0.2360 | -2.1775 | |||||

| Credit Suisse Securities (USA) LLC / RA (N/A) | -0.50 | -116.75 | -0.2368 | -2.1782 | |||||

| Barclays Capital, Inc. / RA (N/A) | -0.51 | -116.85 | -0.2379 | -2.1794 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.51 | -116.98 | -0.2397 | -2.1812 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -0.52 | -117.18 | -0.2425 | -2.1840 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -0.56 | -118.71 | -0.2643 | -2.2058 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.57 | -119.08 | -0.2693 | -2.2108 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.58 | -119.25 | -0.2721 | -2.2135 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.59 | -119.61 | -0.2770 | -2.2184 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.61 | -120.31 | -0.2867 | -2.2282 | |||||

| RBC Capital Markets LLC / RA (N/A) | -0.63 | -121.05 | -0.2972 | -2.2387 | |||||

| Credit Suisse Securities (USA) LLC / RA (N/A) | -0.66 | -122.04 | -0.3115 | -2.2530 | |||||

| Barclays Capital, Inc. / RA (N/A) | -0.67 | -122.24 | -0.3143 | -2.2558 | |||||

| Barclays Capital, Inc. / RA (N/A) | -0.67 | -122.31 | -0.3151 | -2.2565 | |||||

| RBC Capital Markets LLC / RA (N/A) | -0.69 | -122.81 | -0.3220 | -2.2635 | |||||

| Barclays Capital, Inc. / RA (N/A) | -0.69 | -122.84 | -0.3224 | -2.2639 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -0.70 | -123.28 | -0.3289 | -2.2704 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -0.71 | -123.54 | -0.3326 | -2.2741 | |||||

| RBC Capital Markets LLC / RA (N/A) | -0.74 | -124.78 | -0.3500 | -2.2915 | |||||

| Credit Suisse Securities (USA) LLC / RA (N/A) | -0.76 | -125.27 | -0.3567 | -2.2982 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.76 | -125.27 | -0.3569 | -2.2984 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -0.78 | -126.04 | -0.3675 | -2.3090 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -0.78 | -126.04 | -0.3678 | -2.3092 | |||||

| RBC Capital Markets LLC / RA (N/A) | -0.81 | -127.11 | -0.3830 | -2.3245 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.83 | -127.47 | -0.3878 | -2.3292 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.86 | -128.54 | -0.4028 | -2.3443 | |||||

| RBC Capital Markets LLC / RA (N/A) | -0.88 | -129.37 | -0.4149 | -2.3564 | |||||

| RBC Capital Markets LLC / RA (N/A) | -0.90 | -130.10 | -0.4251 | -2.3666 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.91 | -130.17 | -0.4259 | -2.3674 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.91 | -130.24 | -0.4268 | -2.3683 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.91 | -130.30 | -0.4279 | -2.3694 | |||||

| Barclays Capital, Inc. / RA (N/A) | -0.92 | -130.57 | -0.4316 | -2.3730 | |||||

| Citigroup Global Markets, Inc. / RA (N/A) | -0.93 | -130.94 | -0.4367 | -2.3782 | |||||

| Credit Suisse Securities (USA) LLC / RA (N/A) | -0.94 | -131.34 | -0.4425 | -2.3840 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -1.00 | -133.20 | -0.4687 | -2.4102 | |||||

| RBC Capital Markets LLC / RA (N/A) | -1.01 | -133.50 | -0.4731 | -2.4146 | |||||

| Barclays Capital, Inc. / RA (N/A) | -1.03 | -134.43 | -0.4862 | -2.4276 | |||||

| Barclays Capital, Inc. / RA (N/A) | -1.08 | -135.83 | -0.5060 | -2.4475 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -1.09 | -136.36 | -0.5133 | -2.4548 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -1.10 | -136.56 | -0.5161 | -2.4576 | |||||

| Barclays Capital, Inc. / RA (N/A) | -1.12 | -137.33 | -0.5272 | -2.4686 | |||||

| Barclays Capital, Inc. / RA (N/A) | -1.12 | -137.43 | -0.5286 | -2.4700 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -1.12 | -137.43 | -0.5286 | -2.4701 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -1.14 | -138.10 | -0.5380 | -2.4795 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -1.16 | -138.69 | -0.5462 | -2.4877 | |||||

| Barclays Capital, Inc. / RA (N/A) | -1.17 | -139.06 | -0.5517 | -2.4932 | |||||

| Credit Suisse Securities (USA) LLC / RA (N/A) | -1.18 | -139.33 | -0.5550 | -2.4965 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -1.21 | -140.39 | -0.5703 | -2.5118 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -1.26 | -141.99 | -0.5930 | -2.5344 | |||||

| Credit Suisse Securities (USA) LLC / RA (N/A) | -1.31 | -143.49 | -0.6142 | -2.5557 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -1.32 | -144.06 | -0.6218 | -2.5633 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -1.32 | -144.06 | -0.6220 | -2.5634 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -1.33 | -144.26 | -0.6247 | -2.5662 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -1.38 | -145.95 | -0.6486 | -2.5901 | |||||

| Barclays Capital, Inc. / RA (N/A) | -1.43 | -147.45 | -0.6700 | -2.6115 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -1.54 | -151.38 | -0.7256 | -2.6670 | |||||

| Credit Suisse Securities (USA) LLC / RA (N/A) | -1.55 | -151.65 | -0.7291 | -2.6706 | |||||

| Barclays Capital, Inc. / RA (N/A) | -1.57 | -152.41 | -0.7398 | -2.6813 | |||||

| RBC Capital Markets LLC / RA (N/A) | -1.59 | -153.08 | -0.7496 | -2.6910 | |||||

| Barclays Capital, Inc. / RA (N/A) | -1.70 | -156.68 | -0.8003 | -2.7417 | |||||

| Credit Suisse Securities (USA) LLC / RA (N/A) | -1.82 | -160.57 | -0.8549 | -2.7964 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -1.82 | -160.67 | -0.8565 | -2.7980 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -1.87 | -162.24 | -0.8786 | -2.8200 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -1.91 | -163.70 | -0.8993 | -2.8407 | |||||

| RBC Capital Markets LLC / RA (N/A) | -1.95 | -165.00 | -0.9175 | -2.8590 | |||||

| Citigroup Global Markets, Inc. / RA (N/A) | -2.30 | -176.59 | -1.0811 | -3.0225 | |||||

| BMO Capital Markets Corp. / RA (N/A) | -2.34 | -177.89 | -1.0994 | -3.0409 | |||||

| Barclays Capital, Inc. / RA (N/A) | -2.43 | -180.79 | -1.1406 | -3.0821 |