Statistik Asas

| Nilai Portfolio | $ 726,663,245 |

| Kedudukan Semasa | 70 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

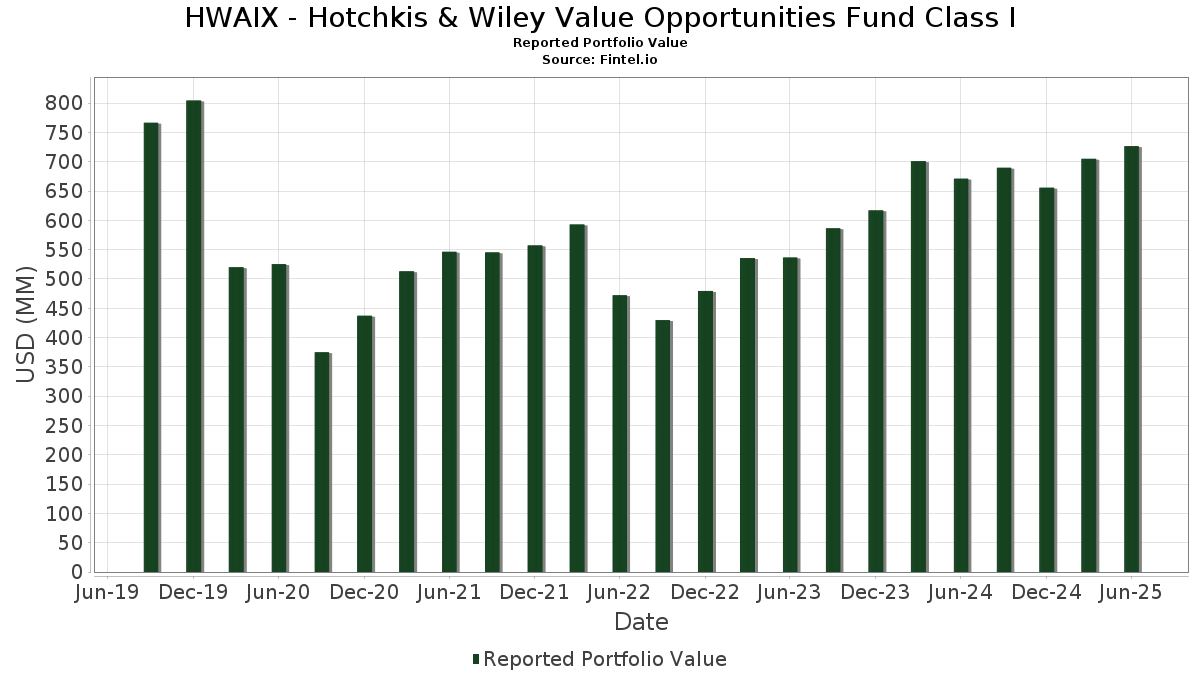

HWAIX - Hotchkis & Wiley Value Opportunities Fund Class I telah mendedahkan 70 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 726,663,245 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas HWAIX - Hotchkis & Wiley Value Opportunities Fund Class I ialah F5, Inc. (US:FFIV) , Workday, Inc. (US:WDAY) , Telefonaktiebolaget LM Ericsson (publ) - Depositary Receipt (Common Stock) (US:ERIC) , Dominion Energy, Inc. (US:D) , and Schlumberger Limited (US:SLB) . Kedudukan baharu HWAIX - Hotchkis & Wiley Value Opportunities Fund Class I termasuk Schlumberger Limited (US:SLB) , Jones Lang LaSalle Incorporated (US:JLL) , Vanguard Scottsdale Funds - Vanguard Long-Term Treasury ETF (US:VGLT) , Cummins Inc. (US:CMI) , and Constellation Brands, Inc. (US:STZ) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.77 | 26.04 | 3.5915 | 3.5915 | |

| 0.07 | 18.42 | 2.5402 | 2.5402 | |

| 16.73 | 2.3081 | 2.3081 | ||

| 0.23 | 12.91 | 1.7811 | 1.7811 | |

| 0.03 | 9.23 | 1.2737 | 1.2737 | |

| 0.03 | 7.87 | 1.0850 | 1.0850 | |

| 0.23 | 55.44 | 7.6469 | 1.0325 | |

| 0.16 | 11.60 | 1.5996 | 0.7943 | |

| 10.63 | 18.27 | 2.5197 | 0.6312 | |

| 0.01 | 3.67 | 0.5059 | 0.5059 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.96 | 1.96 | 0.2706 | -4.3163 | |

| 0.10 | 12.68 | 1.7491 | -1.9447 | |

| 0.02 | 9.34 | 1.2876 | -1.8067 | |

| 0.91 | 11.32 | 1.5609 | -1.7937 | |

| 0.15 | 10.45 | 1.4407 | -1.0593 | |

| 0.49 | 8.91 | 1.2293 | -0.8626 | |

| 0.05 | 24.38 | 3.3625 | -0.7159 | |

| 0.79 | 1.36 | 0.1871 | -0.6315 | |

| 0.03 | 7.26 | 1.0015 | -0.5801 | |

| 0.06 | 11.66 | 1.6078 | -0.5663 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-19 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FFIV / F5, Inc. | 0.21 | 0.00 | 61.27 | 10.54 | 8.4517 | 0.2698 | |||

| WDAY / Workday, Inc. | 0.23 | 20.38 | 55.44 | 23.71 | 7.6469 | 1.0325 | |||

| ERIC / Telefonaktiebolaget LM Ericsson (publ) - Depositary Receipt (Common Stock) | 4.69 | -10.15 | 39.76 | -1.81 | 5.4848 | -0.4925 | |||

| D / Dominion Energy, Inc. | 0.59 | 3.72 | 33.53 | 4.56 | 4.6245 | -0.1083 | |||

| SLB / Schlumberger Limited | 0.77 | 26.04 | 3.5915 | 3.5915 | |||||

| MSFT / Microsoft Corporation | 0.05 | -33.42 | 24.38 | -11.78 | 3.3625 | -0.7159 | |||

| UHALB / U-Haul Holding Company - Series N | 0.39 | 0.00 | 20.94 | -8.13 | 2.8887 | -0.4758 | |||

| JLL / Jones Lang LaSalle Incorporated | 0.07 | 18.42 | 2.5402 | 2.5402 | |||||

| JP70 / Havas N.V. - Depositary Receipt (Common Stock) | 10.63 | 18.30 | 18.27 | 42.77 | 2.5197 | 0.6312 | |||

| SIE / Siemens Aktiengesellschaft | 0.07 | 0.00 | 17.70 | 11.22 | 2.4410 | 0.0925 | |||

| BKR / Baker Hughes Company | 0.45 | 45.07 | 17.14 | 35.59 | 2.3644 | 0.4308 | |||

| Skandinaviska Enskilda Banken / STIV (N/A) | 16.73 | 2.3081 | 2.3081 | ||||||

| QAN / Qantas Airways Limited | 2.36 | 0.00 | 16.67 | 23.91 | 2.2993 | 0.3138 | |||

| ECVT / Ecovyst Inc. | 2.01 | 0.00 | 16.55 | 32.75 | 2.2826 | 0.4426 | |||

| 4368 / Fuso Chemical Co.,Ltd. | 0.56 | 4.26 | 15.10 | 20.85 | 2.0828 | 0.2385 | |||

| GM / General Motors Company | 0.30 | 15.29 | 14.68 | 20.63 | 2.0244 | 0.2287 | |||

| VGLT / Vanguard Scottsdale Funds - Vanguard Long-Term Treasury ETF | 0.23 | 12.91 | 1.7811 | 1.7811 | |||||

| C / Citigroup Inc. | 0.15 | 0.00 | 12.84 | 19.91 | 1.7705 | 0.1905 | |||

| SIEGY / Siemens Aktiengesellschaft - Depositary Receipt (Common Stock) | 0.10 | -60.61 | 12.68 | -47.49 | 1.7491 | -1.9447 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.17 | 0.00 | 12.55 | -8.23 | 1.7317 | -0.2874 | |||

| PM / Philip Morris International Inc. | 0.06 | -31.03 | 11.66 | -20.87 | 1.6078 | -0.5663 | |||

| HEN / Henkel AG & Co. KGaA | 0.16 | 179.55 | 11.60 | 176.03 | 1.5996 | 0.7943 | |||

| STGW / Stagwell Inc. | 2.55 | 21.50 | 11.47 | -9.63 | 1.5827 | -0.2912 | |||

| NOV / NOV Inc. | 0.91 | -39.03 | 11.32 | -50.21 | 1.5609 | -1.7937 | |||

| CMCSA / Comcast Corporation | 0.30 | 0.00 | 10.80 | -3.28 | 1.4896 | -0.1584 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | 0.00 | 10.47 | 29.55 | 1.4448 | 0.2515 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.15 | -35.82 | 10.45 | -38.33 | 1.4407 | -1.0593 | |||

| OVV / Ovintiv Inc. | 0.26 | 71.83 | 10.00 | 52.76 | 1.3798 | 0.4133 | |||

| WFC / Wells Fargo & Company | 0.12 | 0.00 | 9.49 | 11.60 | 1.3095 | 0.0539 | |||

| ELV / Elevance Health, Inc. | 0.02 | -50.21 | 9.34 | -55.47 | 1.2876 | -1.8067 | |||

| GOOGL / Alphabet Inc. | 0.05 | -2.05 | 9.27 | 11.62 | 1.2786 | 0.0529 | |||

| UNH / UnitedHealth Group Incorporated | 0.03 | 9.23 | 1.2737 | 1.2737 | |||||

| WPP / WPP plc - Depositary Receipt (Common Stock) | 0.26 | 51.51 | 9.14 | 39.73 | 1.2613 | 0.2954 | |||

| APA / APA Corporation | 0.49 | -27.73 | 8.91 | -37.12 | 1.2293 | -0.8626 | |||

| BK / The Bank of New York Mellon Corporation | 0.09 | 0.00 | 8.00 | 8.64 | 1.1034 | 0.0165 | |||

| Iracore Investments Holdings Inc / EC (N/A) | 0.03 | 7.87 | 1.0850 | 1.0850 | |||||

| AVT / Avnet, Inc. | 0.14 | -17.92 | 7.37 | -9.41 | 1.0162 | -0.1840 | |||

| HUM / Humana Inc. | 0.03 | -26.67 | 7.26 | -32.24 | 1.0015 | -0.5801 | |||

| STT / State Street Corporation | 0.07 | 0.00 | 7.11 | 18.78 | 0.9813 | 0.0972 | |||

| BPOP / Popular, Inc. | 0.06 | -1.12 | 6.83 | 17.99 | 0.9425 | 0.0877 | |||

| VAC / Marriott Vacations Worldwide Corporation | 0.09 | 0.00 | 6.28 | 12.55 | 0.8657 | 0.0427 | |||

| MDT / Medtronic plc | 0.07 | 0.00 | 6.13 | -2.99 | 0.8452 | -0.0871 | |||

| MUR / Murphy Oil Corporation | 0.24 | -4.82 | 5.29 | -24.59 | 0.7296 | -0.3057 | |||

| Aptiv PLC / EC (JE00BTDN8H13) | 0.08 | -38.91 | 5.28 | -31.09 | 0.7283 | -0.4437 | |||

| CVS / CVS Health Corporation | 0.07 | 0.00 | 4.95 | 1.81 | 0.6822 | -0.0348 | |||

| SLM / SLM Corporation | 0.14 | -22.46 | 4.58 | -13.43 | 0.6323 | -0.1493 | |||

| HEINY / Heineken N.V. - Depositary Receipt (Common Stock) | 0.10 | 0.00 | 4.35 | 7.22 | 0.6003 | 0.0012 | |||

| CFG / Citizens Financial Group, Inc. | 0.09 | -40.18 | 4.12 | -34.66 | 0.5679 | -0.3622 | |||

| CMI / Cummins Inc. | 0.01 | 3.67 | 0.5059 | 0.5059 | |||||

| STZ / Constellation Brands, Inc. | 0.02 | 3.55 | 0.4892 | 0.4892 | |||||

| COP / ConocoPhillips | 0.04 | 3.28 | 0.4530 | 0.4530 | |||||

| GBLI / Global Indemnity Group, LLC | 0.10 | 0.00 | 3.21 | -8.98 | 0.4434 | -0.0778 | |||

| LAD / Lithia Motors, Inc. | 0.01 | 0.00 | 3.18 | 15.08 | 0.4380 | 0.0307 | |||

| FLR / Fluor Corporation | 0.06 | 0.00 | 3.16 | 43.12 | 0.4363 | 0.1101 | |||

| MU / Micron Technology, Inc. | 0.02 | -62.23 | 3.01 | -46.43 | 0.4148 | -0.4137 | |||

| FMCCN / Federal Home Loan Mortgage Corporation - Preferred Stock | 0.12 | 0.00 | 2.07 | 3.25 | 0.2851 | -0.0104 | |||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 1.96 | -93.69 | 1.96 | -93.69 | 0.2706 | -4.3163 | |||

| Iracore International Inc / LON (N/A) | 1.69 | 0.2325 | 0.2325 | ||||||

| KOS / Kosmos Energy Ltd. | 0.79 | -67.58 | 1.36 | -75.55 | 0.1871 | -0.6315 | |||

| UTEX Industries Inc / EC (N/A) | 0.02 | 1.00 | 0.1374 | 0.1374 | |||||

| SRG / Seritage Growth Properties | 0.31 | 0.00 | 0.95 | -4.64 | 0.1305 | -0.0159 | |||

| XAN5200EAB73 / Lealand Finance Company BV, Term Loan | 0.79 | 21.64 | 0.1087 | 0.0130 | |||||

| FMCCK / Federal Home Loan Mortgage Corporation - Preferred Stock | 0.03 | 0.00 | 0.66 | 10.59 | 0.0908 | 0.0030 | |||

| FMCCS / Federal Home Loan Mortgage Corporation - Preferred Stock | 0.02 | 0.00 | 0.34 | 5.33 | 0.0464 | -0.0007 | |||

| XAN5200EAC56 / McDermott Technology Americas Inc 2020 Make Whole Term Loan | 0.29 | 23.93 | 0.0400 | 0.0054 | |||||

| AU0000303976 / Articore Group Ltd | 1.99 | -58.37 | 0.26 | -56.81 | 0.0360 | -0.0529 | |||

| MCDIF / Mcdermott International Ltd. | 0.01 | 0.00 | 0.07 | -33.03 | 0.0101 | -0.0061 | |||

| METALS RECOVERY HOLDINGS LLC / EC (N/A) | 0.01 | 0.00 | 0.0006 | 0.0006 | |||||

| Citigroup, Inc. / STIV (N/A) | 0.00 | 0.0001 | 0.0001 | ||||||

| Citigroup, Inc. / STIV (N/A) | 0.00 | 0.0000 | 0.0000 |