Statistik Asas

| Nilai Portfolio | $ 115,862,000 |

| Kedudukan Semasa | 44 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

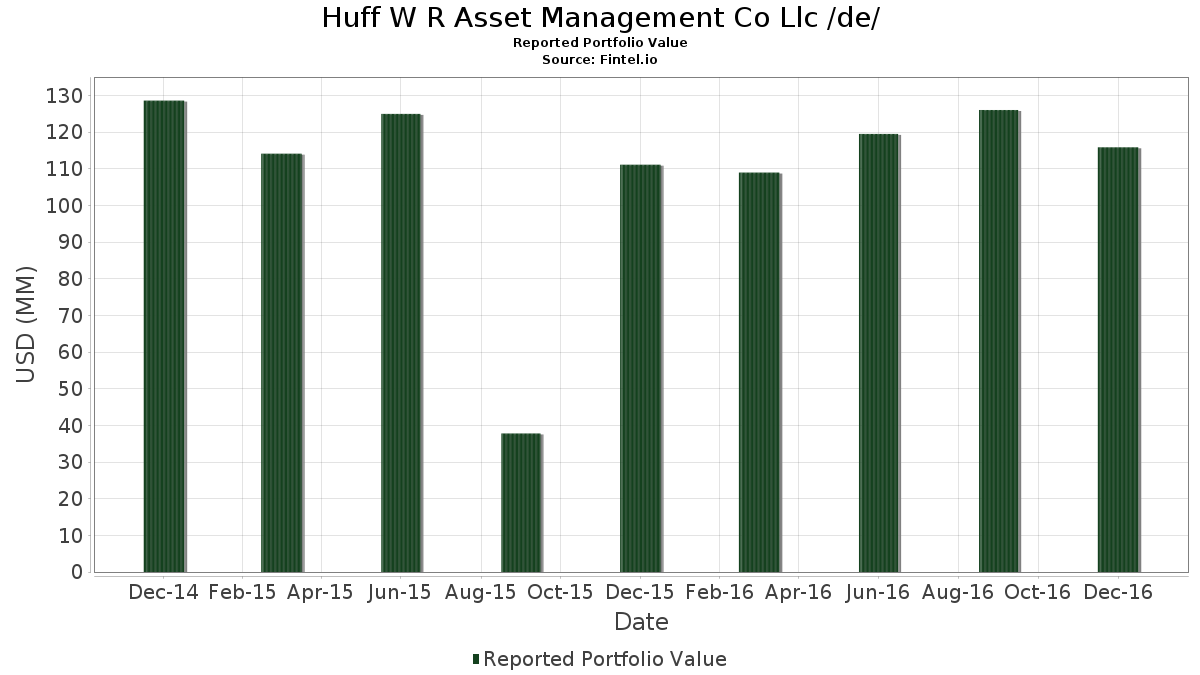

Huff W R Asset Management Co Llc /de/ telah mendedahkan 44 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 115,862,000 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Huff W R Asset Management Co Llc /de/ ialah comScore, Inc. (US:SCOR) , Exxon Mobil Corporation (US:XOM) , Potash Corp. of Saskatchewan, Inc. (US:POT) , Dow Inc. (US:DOW) , and Apple Inc. (US:AAPL) . Kedudukan baharu Huff W R Asset Management Co Llc /de/ termasuk Arch Resources, Inc. (US:ARCH) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.12 | 7.10 | 6.1254 | 6.1254 | |

| 0.19 | 2.64 | 2.2768 | 2.2768 | |

| 0.06 | 2.63 | 2.2708 | 2.2708 | |

| 0.04 | 2.34 | 2.0162 | 2.0162 | |

| 0.06 | 2.09 | 1.8056 | 1.8056 | |

| 0.05 | 1.96 | 1.6925 | 1.6925 | |

| 0.03 | 1.89 | 1.6304 | 1.6304 | |

| 0.04 | 1.50 | 1.2955 | 1.2955 | |

| 0.46 | 8.29 | 7.1525 | 1.1766 | |

| 0.03 | 1.34 | 1.1548 | 1.1548 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.65 | 20.39 | 17.5994 | -9.7687 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2017-02-14 untuk tempoh pelaporan 2016-12-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SCOR / comScore, Inc. | 0.65 | -42.61 | 20.39 | -40.89 | 17.5994 | -9.7687 | |||

| XOM / Exxon Mobil Corporation | 0.12 | -2.04 | 10.99 | 1.31 | 9.4837 | 0.8786 | |||

| POT / Potash Corp. of Saskatchewan, Inc. | 0.46 | -0.74 | 8.29 | 10.02 | 7.1525 | 1.1766 | |||

| DOW / Dow Inc. | 0.12 | -1.19 | 7.10 | 9.08 | 6.1254 | 6.1254 | |||

| AAPL / Apple Inc. | 0.05 | 4.66 | 6.16 | 7.22 | 5.3167 | 0.7586 | |||

| VZ / Verizon Communications Inc. | 0.09 | 17.52 | 4.62 | 20.69 | 3.9918 | 0.9515 | |||

| AEP / American Electric Power Company, Inc. | 0.04 | -0.07 | 2.70 | -2.00 | 2.3312 | 0.1446 | |||

| BOX / Box, Inc. | 0.19 | -0.07 | 2.64 | -12.13 | 2.2768 | 2.2768 | |||

| T / AT&T Inc. | 0.06 | 151.40 | 2.63 | 163.36 | 2.2708 | 2.2708 | |||

| DUK / Duke Energy Corporation | 0.03 | -0.06 | 2.62 | -3.11 | 2.2596 | 0.1158 | |||

| WEC / WEC Energy Group, Inc. | 0.04 | -0.09 | 2.53 | -2.13 | 2.1802 | 0.1324 | |||

| ED / Consolidated Edison, Inc. | 0.03 | -0.06 | 2.48 | -2.20 | 2.1448 | 0.1288 | |||

| PCG / PG&E Corporation | 0.04 | -0.08 | 2.35 | -0.72 | 2.0248 | 0.1500 | |||

| VVC / Vectren Corp. | 0.04 | -0.11 | 2.34 | 3.78 | 2.0162 | 2.0162 | |||

| XEL / Xcel Energy Inc. | 0.05 | -0.09 | 2.19 | -1.17 | 1.8945 | 0.1324 | |||

| SCU / Sculptor Capital Management Inc - Class A | 0.03 | -0.10 | 2.10 | 1.15 | 1.8168 | 0.1658 | |||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0.06 | 134.40 | 2.09 | 84.64 | 1.8056 | 1.8056 | |||

| PPL / PPL Corporation | 0.06 | -0.08 | 2.09 | -1.60 | 1.8056 | 0.1188 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.05 | -3.65 | 2.07 | 0.98 | 1.7857 | 0.1601 | |||

| AVA / Avista Corporation | 0.05 | -0.10 | 1.96 | -4.39 | 1.6925 | 1.6925 | |||

| D / Dominion Energy, Inc. | 0.02 | -0.08 | 1.91 | 3.08 | 1.6459 | 0.1781 | |||

| DTE / DTE Energy Company | 0.02 | -0.10 | 1.89 | 5.05 | 1.6347 | 0.2042 | |||

| WR / Westar Energy, Inc. | 0.03 | -0.15 | 1.89 | -0.89 | 1.6304 | 1.6304 | |||

| SO / The Southern Company | 0.03 | -0.09 | 1.66 | -4.17 | 1.4284 | 0.0582 | |||

| LNT / Alliant Energy Corporation | 0.04 | -0.14 | 1.65 | -1.26 | 1.4207 | 0.0981 | |||

| ES / Eversource Energy | 0.03 | -0.10 | 1.62 | 1.82 | 1.4017 | 0.1362 | |||

| BMY / Bristol-Myers Squibb Company | 0.03 | -0.02 | 1.52 | 8.35 | 1.3110 | 0.1987 | |||

| OTTR / Otter Tail Corporation | 0.04 | -0.16 | 1.50 | 17.82 | 1.2955 | 1.2955 | |||

| ETR / Entergy Corporation | 0.02 | -0.10 | 1.43 | -4.36 | 1.2299 | 0.0478 | |||

| POR / Portland General Electric Company | 0.03 | -0.16 | 1.34 | 1.59 | 1.1548 | 1.1548 | |||

| EXC / Exelon Corporation | 0.04 | -0.08 | 1.33 | 6.50 | 1.1453 | 0.1568 | |||

| CMS / CMS Energy Corporation | 0.03 | -0.20 | 1.25 | -1.19 | 1.0763 | 0.0750 | |||

| NEE / NextEra Energy, Inc. | 0.01 | -0.19 | 1.23 | -2.53 | 1.0642 | 0.0606 | |||

| SRE / Sempra | 0.01 | -0.19 | 1.06 | -6.29 | 0.9132 | 0.0174 | |||

| CVA / Covanta Holding Corporation | 0.06 | 0.00 | 1.00 | 1.42 | 0.8648 | 0.8648 | |||

| OUT / OUTFRONT Media Inc. | 0.03 | 0.00 | 0.66 | 5.08 | 0.5714 | 0.0715 | |||

| FE / FirstEnergy Corp. | 0.02 | -0.16 | 0.56 | -6.48 | 0.4859 | 0.0083 | |||

| CYH / Community Health Systems, Inc. | 0.07 | -37.10 | 0.38 | -69.50 | 0.3280 | 0.3280 | |||

| ARCH / Arch Resources, Inc. | 0.00 | 0.36 | 0.3081 | 0.3081 | |||||

| MDLZ / Mondelez International, Inc. | 0.01 | 0.00 | 0.31 | 1.30 | 0.2693 | 0.0249 | |||

| PFE / Pfizer Inc. | 0.01 | 0.00 | 0.29 | -4.26 | 0.2520 | 0.0100 | |||

| PKG / Packaging Corporation of America | 0.00 | 0.00 | 0.26 | 4.44 | 0.2235 | 0.0268 | |||

| DOW / Dow Inc. | 0.00 | 0.00 | 0.22 | 9.80 | 0.1933 | 0.0315 | |||

| KHC / The Kraft Heinz Company | 0.00 | 0.00 | 0.20 | -2.38 | 0.1769 | 0.0103 | |||

| TUBE / TubeMogul, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 |