Statistik Asas

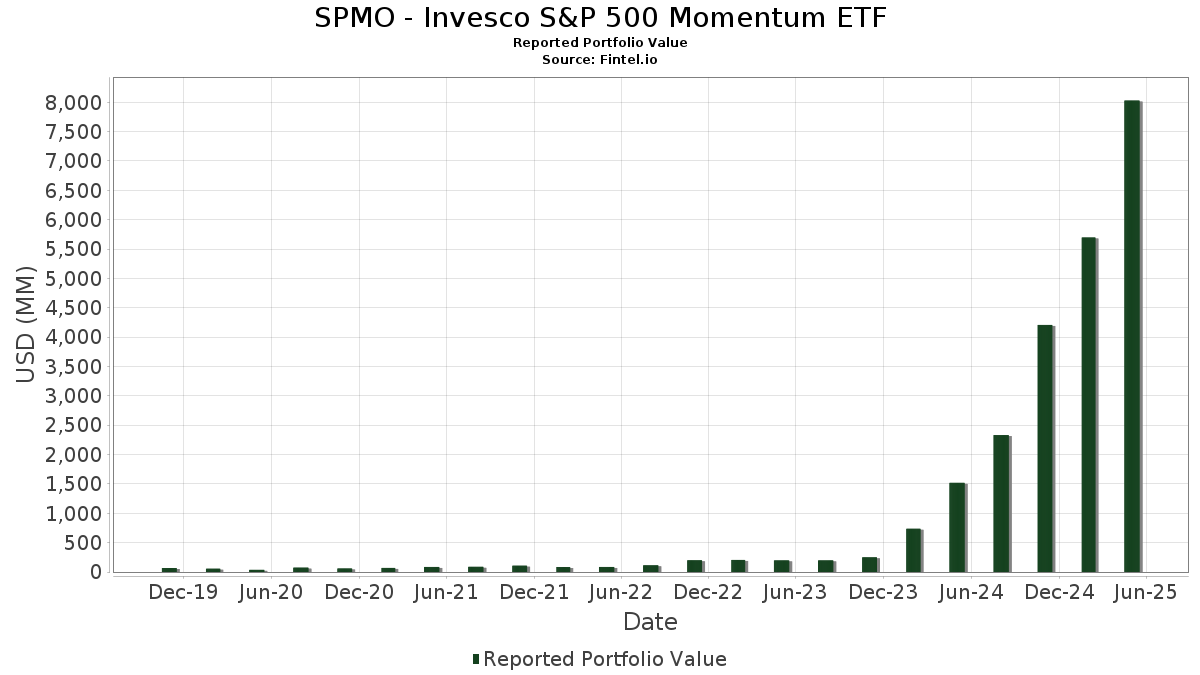

| Nilai Portfolio | $ 8,028,562,585 |

| Kedudukan Semasa | 101 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

SPMO - Invesco S&P 500 Momentum ETF telah mendedahkan 101 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 8,028,562,585 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas SPMO - Invesco S&P 500 Momentum ETF ialah NVIDIA Corporation (US:NVDA) , Meta Platforms, Inc. (US:META) , Amazon.com, Inc. (US:AMZN) , Broadcom Inc. (US:AVGO) , and Tesla, Inc. (US:TSLA) . Kedudukan baharu SPMO - Invesco S&P 500 Momentum ETF termasuk Palantir Technologies Inc. (US:PLTR) , GE Vernova Inc. (US:GEV) , BlackRock, Inc. (US:BLK) , 3M Company (US:MMM) , and Altria Group, Inc. (US:MO) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.19 | 412.59 | 5.1909 | 5.1909 | |

| 1.82 | 239.21 | 3.0096 | 3.0096 | |

| 0.24 | 289.64 | 3.6440 | 2.3645 | |

| 3.84 | 379.42 | 4.7736 | 2.1394 | |

| 1.02 | 663.07 | 8.3423 | 1.2680 | |

| 0.67 | 85.68 | 1.0780 | 1.0780 | |

| 77.71 | 77.71 | 0.9777 | 0.9777 | |

| 0.16 | 77.52 | 0.9753 | 0.9753 | |

| 0.07 | 72.22 | 0.9086 | 0.9086 | |

| 5.48 | 740.56 | 9.3172 | 0.8821 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.16 | 29.74 | 0.3742 | -1.3466 | |

| 3.23 | 661.16 | 8.3183 | -1.2680 | |

| 2.73 | 120.47 | 1.5157 | -1.2433 | |

| 0.22 | 229.80 | 2.8912 | -1.2247 | |

| 1.78 | 430.04 | 5.4104 | -0.8025 | |

| 0.27 | 76.88 | 0.9673 | -0.7003 | |

| 1.59 | 118.65 | 1.4928 | -0.6512 | |

| 1.51 | 399.64 | 5.0280 | -0.4304 | |

| 0.41 | 35.10 | 0.4416 | -0.4173 | |

| 0.43 | 51.89 | 0.6528 | -0.3956 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-28 untuk tempoh pelaporan 2025-05-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 5.48 | 43.20 | 740.56 | 54.90 | 9.3172 | 0.8821 | |||

| META / Meta Platforms, Inc. | 1.02 | 70.66 | 663.07 | 65.37 | 8.3423 | 1.2680 | |||

| AMZN / Amazon.com, Inc. | 3.23 | 26.00 | 661.16 | 21.69 | 8.3183 | -1.2680 | |||

| AVGO / Broadcom Inc. | 1.78 | 0.61 | 430.04 | 22.12 | 5.4104 | -0.8025 | |||

| TSLA / Tesla, Inc. | 1.19 | 412.59 | 5.1909 | 5.1909 | |||||

| JPM / JPMorgan Chase & Co. | 1.51 | 29.50 | 399.64 | 29.18 | 5.0280 | -0.4304 | |||

| WMT / Walmart Inc. | 3.84 | 153.85 | 379.42 | 154.14 | 4.7736 | 2.1394 | |||

| NFLX / Netflix, Inc. | 0.24 | 459.38 | 289.64 | 862.89 | 3.6440 | 2.3645 | |||

| PLTR / Palantir Technologies Inc. | 1.82 | 239.21 | 3.0096 | 3.0096 | |||||

| COST / Costco Wholesale Corporation | 0.22 | -0.69 | 229.80 | -1.49 | 2.8912 | -1.2247 | |||

| GE / General Electric Company | 0.71 | 11.87 | 173.44 | 32.91 | 2.1821 | -0.1203 | |||

| PM / Philip Morris International Inc. | 0.86 | 4,651.55 | 154.60 | 8,888.37 | 1.9451 | 0.4356 | |||

| BSX / Boston Scientific Corporation | 1.15 | 92.12 | 120.93 | 94.85 | 1.5215 | 0.4264 | |||

| BAC / Bank of America Corporation | 2.73 | 2,817.88 | 120.47 | 3,731.87 | 1.5157 | -1.2433 | |||

| WFC / Wells Fargo & Company | 1.59 | 2,738.28 | 118.65 | 4,756.90 | 1.4928 | -0.6512 | |||

| GS / The Goldman Sachs Group, Inc. | 0.19 | 40.90 | 111.59 | 35.96 | 1.4040 | -0.0442 | |||

| RTX / RTX Corporation | 0.74 | 62.00 | 100.54 | 66.26 | 1.2649 | 0.1980 | |||

| IBM / International Business Machines Corporation | 0.39 | 16.64 | 100.08 | 19.70 | 1.2591 | -0.2160 | |||

| T / AT&T Inc. | 3.41 | 26.83 | 94.90 | 28.64 | 1.1939 | -0.1077 | |||

| AXP / American Express Company | 0.32 | 21.73 | 92.76 | 18.94 | 1.1670 | -0.2090 | |||

| ISRG / Intuitive Surgical, Inc. | 0.16 | 313.18 | 88.77 | 363.28 | 1.1168 | 0.3018 | |||

| MS / Morgan Stanley | 0.67 | 85.68 | 1.0780 | 1.0780 | |||||

| Invesco Private Prime Fund / STIV (N/A) | 77.71 | 77.71 | 0.9777 | 0.9777 | |||||

| GEV / GE Vernova Inc. | 0.16 | 77.52 | 0.9753 | 0.9753 | |||||

| PGR / The Progressive Corporation | 0.27 | -19.49 | 76.88 | -18.66 | 0.9673 | -0.7003 | |||

| BLK / BlackRock, Inc. | 0.07 | 72.22 | 0.9086 | 0.9086 | |||||

| WELL / Welltower Inc. | 0.43 | 93.02 | 66.15 | 93.99 | 0.8323 | 0.2306 | |||

| TJX / The TJX Companies, Inc. | 0.51 | 15.50 | 64.72 | 17.49 | 0.8142 | -0.1577 | |||

| TMUS / T-Mobile US, Inc. | 0.26 | 18.53 | 64.06 | 6.45 | 0.8059 | -0.2558 | |||

| C / Citigroup Inc. | 0.83 | 19.99 | 62.23 | 13.04 | 0.7829 | -0.1884 | |||

| FI / Fiserv, Inc. | 0.36 | 82.43 | 58.59 | 26.00 | 0.7372 | -0.0833 | |||

| MMM / 3M Company | 0.37 | 55.38 | 0.6967 | 0.6967 | |||||

| HWM / Howmet Aerospace Inc. | 0.32 | 50.01 | 53.80 | 86.57 | 0.6769 | 0.1681 | |||

| MO / Altria Group, Inc. | 0.87 | 52.97 | 0.6664 | 0.6664 | |||||

| KKR / KKR & Co. Inc. | 0.43 | -2.52 | 51.89 | -12.68 | 0.6528 | -0.3956 | |||

| CEG / Constellation Energy Corporation | 0.16 | 18.51 | 50.03 | 44.82 | 0.6295 | 0.0199 | |||

| WMB / The Williams Companies, Inc. | 0.81 | 90.29 | 49.17 | 97.91 | 0.6186 | 0.1803 | |||

| VST / Vistra Corp. | 0.30 | 35.17 | 48.38 | 62.39 | 0.6086 | 0.0830 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.17 | 162.89 | 43.82 | 174.51 | 0.5513 | 0.2696 | |||

| MSI / Motorola Solutions, Inc. | 0.10 | 40.48 | 42.89 | 32.56 | 0.5396 | -0.0313 | |||

| BK / The Bank of New York Mellon Corporation | 0.48 | 31.91 | 42.71 | 31.41 | 0.5373 | -0.0361 | |||

| AXON / Axon Enterprise, Inc. | 0.06 | 108.04 | 41.40 | 195.40 | 0.5209 | 0.2736 | |||

| TT / Trane Technologies plc | 0.10 | -13.86 | 41.38 | 4.79 | 0.5206 | -0.1761 | |||

| PH / Parker-Hannifin Corporation | 0.06 | 51.45 | 39.93 | 50.59 | 0.5023 | 0.0345 | |||

| ICE / Intercontinental Exchange, Inc. | 0.22 | -1.43 | 39.51 | 2.31 | 0.4971 | -0.1843 | |||

| KMI / Kinder Morgan, Inc. | 1.36 | 117.57 | 38.14 | 125.12 | 0.4798 | 0.1809 | |||

| AJG / Arthur J. Gallagher & Co. | 0.11 | 33.63 | 36.58 | 37.47 | 0.4603 | -0.0093 | |||

| ANET / Arista Networks Inc | 0.41 | -22.56 | 35.10 | -27.90 | 0.4416 | -0.4173 | |||

| JCI / Johnson Controls International plc | 0.32 | 707.08 | 32.05 | 1,280.87 | 0.4032 | 0.0803 | |||

| TRGP / Targa Resources Corp. | 0.19 | 53.01 | 30.60 | 19.80 | 0.3850 | -0.0657 | |||

| COF / Capital One Financial Corporation | 0.16 | 1,541.74 | 29.74 | 1,926.09 | 0.3742 | -1.3466 | |||

| APO / Apollo Global Management, Inc. | 0.23 | 29.72 | 0.3740 | 0.3740 | |||||

| Invesco Private Government Fund / STIV (N/A) | 28.94 | 28.94 | 0.3641 | 0.3641 | |||||

| HLT / Hilton Worldwide Holdings Inc. | 0.10 | 11.44 | 25.74 | 4.49 | 0.3239 | -0.1108 | |||

| OKE / ONEOK, Inc. | 0.31 | 66.45 | 25.01 | 34.03 | 0.3146 | -0.0146 | |||

| GDDY / GoDaddy Inc. | 0.13 | 37.92 | 22.91 | 39.95 | 0.2883 | -0.0006 | |||

| RSG / Republic Services, Inc. | 0.09 | 4.77 | 22.83 | 13.73 | 0.2872 | -0.0669 | |||

| ETR / Entergy Corporation | 0.27 | 22.42 | 0.2820 | 0.2820 | |||||

| AMP / Ameriprise Financial, Inc. | 0.04 | 676.92 | 22.11 | 871.53 | 0.2782 | -0.0384 | |||

| CMI / Cummins Inc. | 0.07 | 902.01 | 21.63 | 1,099.50 | 0.2721 | 0.0213 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.27 | 62.35 | 21.55 | 62.12 | 0.2711 | 0.0366 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.11 | 73.55 | 21.38 | 89.43 | 0.2690 | 0.0699 | |||

| UAL / United Airlines Holdings, Inc. | 0.26 | 1,161.06 | 20.42 | 2,103.13 | 0.2570 | 0.1280 | |||

| CBRE / CBRE Group, Inc. | 0.16 | 3,408.11 | 20.00 | 5,455.28 | 0.2516 | -0.0643 | |||

| BKR / Baker Hughes Company | 0.54 | 791.18 | 20.00 | 1,015.96 | 0.2516 | 0.0024 | |||

| GLW / Corning Incorporated | 0.40 | 19.79 | 0.2490 | 0.2490 | |||||

| EBAY / eBay Inc. | 0.27 | 19.45 | 0.2447 | 0.2447 | |||||

| NDAQ / Nasdaq, Inc. | 0.22 | 56.09 | 18.68 | 57.53 | 0.2350 | 0.0258 | |||

| NRG / NRG Energy, Inc. | 0.11 | -15.39 | 17.24 | 24.79 | 0.2169 | -0.0269 | |||

| GRMN / Garmin Ltd. | 0.08 | 13.72 | 17.18 | 0.83 | 0.2161 | -0.0845 | |||

| FICO / Fair Isaac Corporation | 0.01 | -26.21 | 16.77 | -32.47 | 0.2110 | -0.2272 | |||

| TPL / Texas Pacific Land Corporation | 0.01 | 16.48 | 0.2074 | 0.2074 | |||||

| DAL / Delta Air Lines, Inc. | 0.34 | 683.77 | 16.24 | 797.46 | 0.2044 | -0.0474 | |||

| WTW / Willis Towers Watson Public Limited Company | 0.05 | 31.07 | 14.40 | 22.15 | 0.1811 | -0.0268 | |||

| RJF / Raymond James Financial, Inc. | 0.10 | 13.98 | 0.1758 | 0.1758 | |||||

| AEE / Ameren Corporation | 0.14 | 13.39 | 0.1685 | 0.1685 | |||||

| MTB / M&T Bank Corporation | 0.07 | 13.34 | 0.1678 | 0.1678 | |||||

| IRM / Iron Mountain Incorporated | 0.13 | -23.59 | 12.78 | -19.05 | 0.1608 | -0.1178 | |||

| BRO / Brown & Brown, Inc. | 0.11 | 10.97 | 12.67 | 5.69 | 0.1594 | -0.0521 | |||

| STT / State Street Corporation | 0.13 | 12.46 | 0.1568 | 0.1568 | |||||

| NI / NiSource Inc. | 0.31 | 12.24 | 0.1540 | 0.1540 | |||||

| SYF / Synchrony Financial | 0.20 | 50.40 | 11.76 | 42.88 | 0.1479 | 0.0027 | |||

| PPL / PPL Corporation | 0.34 | 11.75 | 0.1479 | 0.1479 | |||||

| LYV / Live Nation Entertainment, Inc. | 0.08 | 11.50 | 0.1447 | 0.1447 | |||||

| IP / International Paper Company | 0.24 | 5,113.69 | 11.47 | 5,635.50 | 0.1443 | -0.0905 | |||

| VLTO / Veralto Corporation | 0.11 | -1.28 | 10.80 | -0.03 | 0.1359 | -0.0547 | |||

| ATO / Atmos Energy Corporation | 0.07 | 10.47 | 0.1317 | 0.1317 | |||||

| DOV / Dover Corporation | 0.06 | 2,942.28 | 10.33 | 4,242.02 | 0.1300 | -0.0795 | |||

| TYL / Tyler Technologies, Inc. | 0.02 | 26.10 | 10.00 | 19.59 | 0.1258 | -0.0217 | |||

| TPR / Tapestry, Inc. | 0.13 | 9.85 | 0.1240 | 0.1240 | |||||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 9.74 | 139.33 | 9.74 | 139.37 | 0.1225 | 0.0507 | |||

| NTRS / Northern Trust Corporation | 0.09 | 9.45 | 0.1189 | 0.1189 | |||||

| FFIV / F5, Inc. | 0.03 | 5,185.56 | 8.25 | 7,332.43 | 0.1038 | -0.0225 | |||

| FOX / Fox Corporation | 0.14 | 7.71 | 0.0970 | 0.0970 | |||||

| EVRG / Evergy, Inc. | 0.11 | 7.15 | 0.0900 | 0.0900 | |||||

| ZBRA / Zebra Technologies Corporation | 0.02 | 2,989.80 | 7.11 | 2,067.07 | 0.0894 | -0.2953 | |||

| PNR / Pentair plc | 0.07 | 350.66 | 6.75 | 404.26 | 0.0849 | 0.0279 | |||

| PKG / Packaging Corporation of America | 0.03 | -0.49 | 6.19 | -9.79 | 0.0779 | -0.0432 | |||

| RL / Ralph Lauren Corporation | 0.02 | 876.74 | 5.90 | 1,354.19 | 0.0743 | 0.0178 | |||

| FOXA / Fox Corporation | 0.09 | 4.57 | 0.0575 | 0.0575 | |||||

| DVA / DaVita Inc. | 0.02 | 2.97 | 0.0373 | 0.0373 |