Statistik Asas

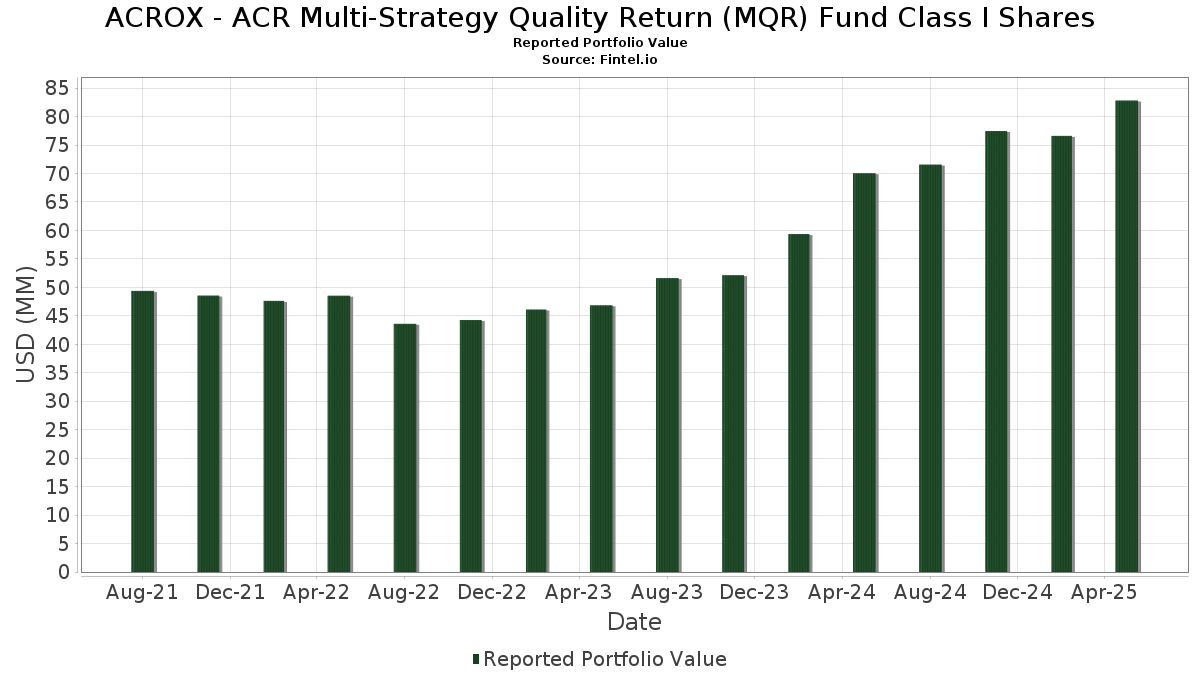

| Nilai Portfolio | $ 82,809,052 |

| Kedudukan Semasa | 39 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

ACROX - ACR Multi-Strategy Quality Return (MQR) Fund Class I Shares telah mendedahkan 39 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 82,809,052 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas ACROX - ACR Multi-Strategy Quality Return (MQR) Fund Class I Shares ialah Money Market Fiduciary (US:SF8888627) , Barclays PLC - Depositary Receipt (Common Stock) (US:BCS) , ISS A/S (DE:QJQ) , Vodafone Group Public Limited Company - Depositary Receipt (Common Stock) (US:VOD) , and General Motors Company (US:GM) . Kedudukan baharu ACROX - ACR Multi-Strategy Quality Return (MQR) Fund Class I Shares termasuk Money Market Fiduciary (US:SF8888627) , Azelis Group NV (MX:AZE N) , EUROFINS SCIENTIFIC SE COMMON STOCK EUR.1 (LU:ERF) , THOR Industries, Inc. (US:THO) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 1.66 | 1.9880 | 1.9880 | |

| 0.02 | 1.33 | 1.6009 | 1.6009 | |

| 1.30 | 2.79 | 3.3527 | 0.9940 | |

| 0.01 | 0.81 | 0.9743 | 0.9743 | |

| 0.06 | 1.77 | 2.1224 | 0.9153 | |

| 0.00 | 0.60 | 0.7183 | 0.7183 | |

| 0.28 | 2.74 | 3.2879 | 0.5106 | |

| 0.17 | 4.57 | 5.4833 | 0.5058 | |

| 0.43 | 4.45 | 5.3358 | 0.4027 | |

| 0.02 | 1.95 | 2.3342 | 0.4022 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 9.11 | 10.9298 | -1.9279 | ||

| 0.01 | 2.51 | 3.0100 | -0.9270 | |

| 0.05 | 3.54 | 4.2483 | -0.6449 | |

| 0.29 | 5.17 | 6.2053 | -0.6016 | |

| 0.03 | 1.08 | 1.2946 | -0.5110 | |

| 0.04 | 2.25 | 2.7009 | -0.4780 | |

| 0.08 | 3.86 | 4.6319 | -0.3455 | |

| 0.01 | 1.09 | 1.3124 | -0.3400 | |

| 2.20 | 2.28 | 2.7388 | -0.3333 | |

| 0.04 | 1.27 | 1.5193 | -0.2913 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-28 untuk tempoh pelaporan 2025-05-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SF8888627 / Money Market Fiduciary | 9.11 | -7.76 | 10.9298 | -1.9279 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.29 | -12.12 | 5.17 | -1.09 | 6.2053 | -0.6016 | |||

| QJQ / ISS A/S | 0.17 | 0.00 | 4.57 | 19.54 | 5.4833 | 0.5058 | |||

| VOD / Vodafone Group Public Limited Company - Depositary Receipt (Common Stock) | 0.43 | 0.00 | 4.45 | 17.37 | 5.3358 | 0.4027 | |||

| GM / General Motors Company | 0.08 | 0.00 | 3.86 | 0.97 | 4.6319 | -0.3455 | |||

| C / Citigroup Inc. | 0.05 | 0.00 | 3.54 | -5.78 | 4.2483 | -0.6449 | |||

| FRFHF / Fairfax Financial Holdings Limited | 0.00 | -10.00 | 3.05 | 5.91 | 3.6561 | -0.0898 | |||

| ECELF / Eurocell plc | 1.30 | 30.00 | 2.79 | 54.22 | 3.3527 | 0.9940 | |||

| LBTYA / Liberty Global Ltd. | 0.28 | 54.20 | 2.74 | 28.47 | 3.2879 | 0.5106 | |||

| PWCDF / Power Corporation of Canada | 0.07 | 0.00 | 2.71 | 14.02 | 3.2509 | 0.1574 | |||

| FDX / FedEx Corporation | 0.01 | 0.00 | 2.51 | -17.04 | 3.0100 | -0.9270 | |||

| 1876 / Budweiser Brewing Company APAC Limited | 2.20 | 0.00 | 2.28 | -3.26 | 2.7388 | -0.3333 | |||

| DCC / DCC PLC | 0.04 | 0.00 | 2.25 | -7.82 | 2.7009 | -0.4780 | |||

| POM / OPmobility SE | 0.18 | 0.00 | 2.25 | 13.44 | 2.6946 | 0.1174 | |||

| DELL / Dell Technologies Inc. | 0.02 | 0.00 | 2.23 | 8.27 | 2.6707 | -0.0056 | |||

| BVHMF / Vistry Group PLC | 0.26 | 0.00 | 2.21 | 9.27 | 2.6471 | 0.0188 | |||

| MGA / Magna International Inc. | 0.06 | 0.00 | 2.12 | -0.42 | 2.5470 | -0.2282 | |||

| PRBZF / Premium Brands Holdings Corporation | 0.04 | 0.00 | 2.08 | 10.37 | 2.4907 | 0.0423 | |||

| DG / Dollar General Corporation | 0.02 | 0.00 | 1.95 | 31.15 | 2.3342 | 0.4022 | |||

| BME / B&M European Value Retail S.A. | 0.40 | 0.00 | 1.85 | 31.41 | 2.2148 | 0.3861 | |||

| WIPKF / Winpak Ltd. | 0.06 | 66.67 | 1.77 | 90.93 | 2.1224 | 0.9153 | |||

| AHT / Ashtead Group plc | 0.03 | 0.00 | 1.72 | -3.91 | 2.0660 | -0.2670 | |||

| AZE N / Azelis Group NV | 0.10 | 1.66 | 1.9880 | 1.9880 | |||||

| ARW / Arrow Electronics, Inc. | 0.01 | 0.00 | 1.54 | 9.54 | 1.8469 | 0.0174 | |||

| ERF / EUROFINS SCIENTIFIC SE COMMON STOCK EUR.1 | 0.02 | 1.33 | 1.6009 | 1.6009 | |||||

| MEDX / medmix AG | 0.10 | 0.00 | 1.33 | 2.79 | 1.5924 | -0.0879 | |||

| MGM / MGM Resorts International | 0.04 | 0.00 | 1.27 | -8.92 | 1.5193 | -0.2913 | |||

| JD. / JD Sports Fashion Plc | 1.10 | 0.00 | 1.25 | 14.83 | 1.4972 | 0.0821 | |||

| TLN / Talen Energy Corporation | 0.00 | 0.00 | 1.18 | 17.35 | 1.4129 | 0.1060 | |||

| CVX / Chevron Corporation | 0.01 | 0.00 | 1.09 | -13.80 | 1.3124 | -0.3400 | |||

| IAC / IAC Inc. | 0.03 | 0.00 | 1.08 | -22.22 | 1.2946 | -0.5110 | |||

| THO / THOR Industries, Inc. | 0.01 | 0.81 | 0.9743 | 0.9743 | |||||

| FPH / Five Point Holdings, LLC | 0.13 | 0.00 | 0.73 | -2.93 | 0.8758 | -0.1024 | |||

| LENB / Lennar Corp. - Class B | 0.01 | 0.00 | 0.66 | -12.50 | 0.7902 | -0.1891 | |||

| EPI PREF HOLDINGS SERIES B / / EC (999999999) | 0.00 | 0.60 | 0.7183 | 0.7183 | |||||

| CORZ / Core Scientific, Inc. | 0.05 | 0.00 | 0.56 | -4.57 | 0.6774 | -0.0928 | |||

| VCCTF / Victoria PLC | 0.34 | 0.00 | 0.28 | -40.56 | 0.3334 | -0.2742 | |||

| NWINF / Naked Wines plc | 0.15 | 0.00 | 0.18 | 39.23 | 0.2175 | 0.0475 | |||

| LILAK / Liberty Latin America Ltd. | 0.02 | 0.00 | 0.09 | -25.21 | 0.1070 | -0.0488 |