Statistik Asas

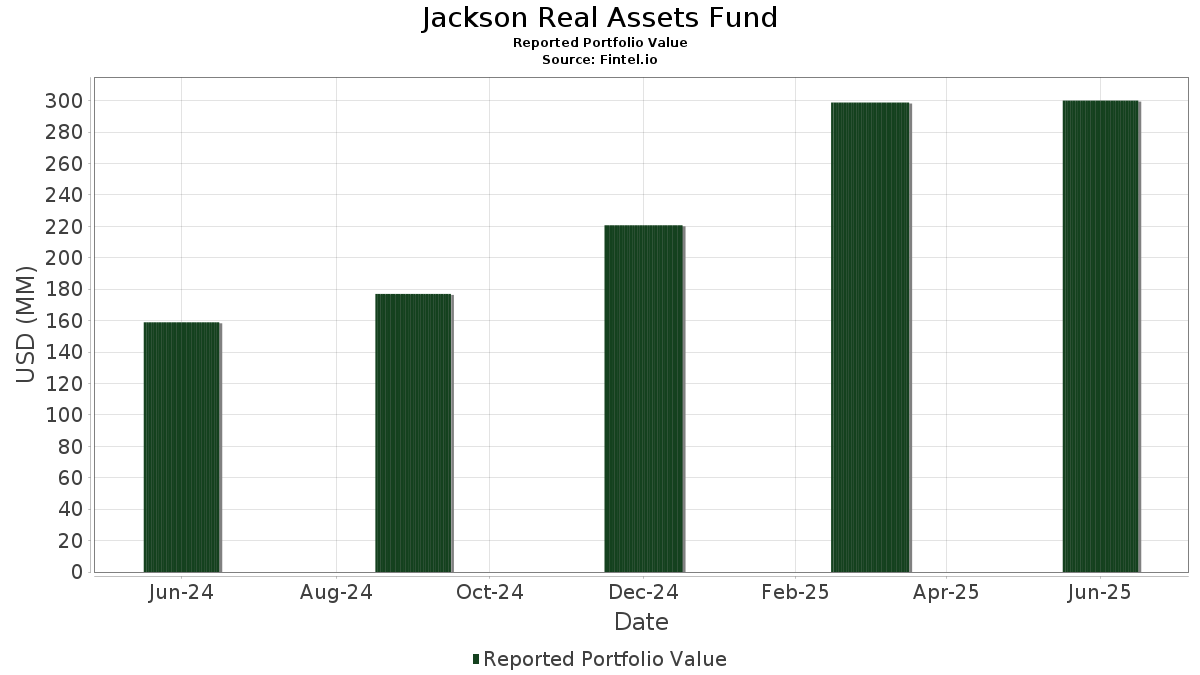

| Nilai Portfolio | $ 300,036,118 |

| Kedudukan Semasa | 91 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Jackson Real Assets Fund telah mendedahkan 91 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 300,036,118 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Jackson Real Assets Fund ialah JNL Government Money Market Fund (US:46628D437) , Welltower Inc. (US:WELL) , American Tower Corporation (US:AMT) , Crown Castle Inc. (US:CCI) , and Digital Realty Trust, Inc. (US:DLR) . Kedudukan baharu Jackson Real Assets Fund termasuk Sempra (US:SRE) , Motiva Infraestrutura de Mobilidade S.A. (BR:MOTV3) , Kite Realty Group Trust (US:KRG) , Boston Properties, Inc. (US:BXP) , and CareTrust REIT, Inc. (US:CTRE) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 20.69 | 6.4933 | 6.4933 | |

| 13.93 | 18.88 | 5.9261 | 5.9261 | |

| 18.50 | 18.78 | 5.8955 | 5.8955 | |

| 0.01 | 17.90 | 5.6184 | 5.6184 | |

| 13.60 | 15.30 | 4.8018 | 4.8018 | |

| 10.25 | 10.43 | 3.2729 | 3.2729 | |

| 0.01 | 10.26 | 3.2186 | 3.2186 | |

| 4.54 | 6.93 | 2.1743 | 2.1743 | |

| 0.00 | 6.75 | 2.1182 | 2.1182 | |

| 0.00 | 4.99 | 1.5648 | 1.5648 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 5.17 | 1.6230 | -0.7335 | |

| 35.96 | 35.96 | 11.2871 | -0.6284 | |

| 0.01 | 0.38 | 0.1201 | -0.3401 | |

| 0.03 | 0.67 | 0.2093 | -0.1808 | |

| 0.02 | 0.81 | 0.2533 | -0.1532 | |

| 0.02 | 1.30 | 0.4067 | -0.1343 | |

| 0.01 | 2.02 | 0.6348 | -0.1335 | |

| 0.09 | 0.72 | 0.2250 | -0.1253 | |

| 0.06 | 0.88 | 0.2756 | -0.1158 | |

| 0.00 | 2.02 | 0.6326 | -0.1045 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-27 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 46628D437 / JNL Government Money Market Fund | 35.96 | 0.91 | 35.96 | 0.91 | 11.2871 | -0.6284 | |||

| Harrison Street Infrastructure Fund A, L.P. / EC (N/A) | 0.01 | 20.69 | 6.4933 | 6.4933 | |||||

| CBRE U.S. Logistics Partners, L.P. / EC (N/A) | 13.93 | 18.88 | 5.9261 | 5.9261 | |||||

| Kayne Anderson Core Intermediate Fund, L.P. / EC (N/A) | 18.50 | 18.78 | 5.8955 | 5.8955 | |||||

| Harrison Street Core Property Fund, L.P. / EC (N/A) | 0.01 | 17.90 | 5.6184 | 5.6184 | |||||

| GDIF US Hedged Feeder Fund LP / EC (N/A) | 13.60 | 15.30 | 4.8018 | 4.8018 | |||||

| Kayne Commercial Real Estate Debt, L.P. / EC (N/A) | 10.25 | 10.43 | 3.2729 | 3.2729 | |||||

| Virtus Real Estate Enhanced Core, LP / EC (N/A) | 0.01 | 10.26 | 3.2186 | 3.2186 | |||||

| CBRE U.S. Core Partners, L.P. / EC (N/A) | 4.54 | 6.93 | 2.1743 | 2.1743 | |||||

| PGIM Real Estate U.S. Debt Fund, L.P. / EC (N/A) | 0.00 | 6.75 | 2.1182 | 2.1182 | |||||

| WELL / Welltower Inc. | 0.04 | 7.68 | 6.26 | 8.06 | 1.9658 | 0.0276 | |||

| AMT / American Tower Corporation | 0.02 | -27.77 | 5.17 | -26.63 | 1.6230 | -0.7335 | |||

| CCI / Crown Castle Inc. | 0.05 | 11.65 | 5.05 | 10.05 | 1.5852 | 0.0507 | |||

| Nuveen Global Timberland Fund, L.P. / EC (N/A) | 0.00 | 4.99 | 1.5648 | 1.5648 | |||||

| PRISA III Fund LP / EC (N/A) | 4.94 | 4.94 | 1.5502 | 1.5502 | |||||

| PRISA III Fund LP / EC (N/A) | 4.94 | 4.94 | 1.5502 | 1.5502 | |||||

| DLR / Digital Realty Trust, Inc. | 0.03 | 16.95 | 4.71 | 42.32 | 1.4777 | 0.3714 | |||

| Nuveen Global Farmland Fund Lux SCSp / EC (N/A) | 3.90 | 3.90 | 1.2242 | 1.2242 | |||||

| PLD / Prologis, Inc. | 0.03 | 14.19 | 3.63 | 7.39 | 1.1407 | 0.0090 | |||

| SBAC / SBA Communications Corporation | 0.01 | 69.50 | 2.97 | 80.91 | 0.9315 | 0.3830 | |||

| TCL / Transurban Group - Debt/Equity Composite Units | 0.29 | -2.07 | 2.68 | 7.08 | 0.8402 | 0.0045 | |||

| CrossHarbor Strategic Debt Fund, LP / EC (N/A) | 2.67 | 2.67 | 0.8394 | 0.8394 | |||||

| CrossHarbor Strategic Debt Fund, LP / EC (N/A) | 2.67 | 2.67 | 0.8394 | 0.8394 | |||||

| DUK / Duke Energy Corporation | 0.02 | 22.98 | 2.65 | 18.99 | 0.8322 | 0.0870 | |||

| AEP / American Electric Power Company, Inc. | 0.03 | 0.00 | 2.60 | -5.04 | 0.8167 | -0.0995 | |||

| NG. / National Grid plc | 0.17 | -3.14 | 2.52 | 8.61 | 0.7922 | 0.0152 | |||

| NSC / Norfolk Southern Corporation | 0.01 | 12.23 | 2.34 | 21.26 | 0.7360 | 0.0896 | |||

| SUI / Sun Communities, Inc. | 0.02 | 1.06 | 2.32 | -0.60 | 0.7276 | -0.0524 | |||

| EXR / Extra Space Storage Inc. | 0.02 | -1.45 | 2.25 | -2.13 | 0.7060 | -0.0626 | |||

| INVH / Invitation Homes Inc. | 0.07 | 8.16 | 2.24 | 1.82 | 0.7021 | -0.0327 | |||

| OKE / ONEOK, Inc. | 0.03 | 45.62 | 2.24 | 19.76 | 0.7020 | 0.0778 | |||

| XEL / Xcel Energy Inc. | 0.03 | 7.85 | 2.23 | 3.77 | 0.7006 | -0.0187 | |||

| LNG / Cheniere Energy, Inc. | 0.01 | 12.10 | 2.16 | 17.94 | 0.6769 | 0.0657 | |||

| SRE / Sempra | 0.03 | 2.04 | 0.6401 | 0.6401 | |||||

| SPG / Simon Property Group, Inc. | 0.01 | -9.07 | 2.02 | -11.97 | 0.6348 | -0.1335 | |||

| EQIX / Equinix, Inc. | 0.00 | -6.29 | 2.02 | -8.58 | 0.6326 | -0.1045 | |||

| GET / Compagnie Chargeurs Invest | 0.10 | -1.35 | 2.01 | 9.96 | 0.6311 | 0.0199 | |||

| WY / Weyerhaeuser Company | 0.07 | 7.73 | 1.92 | -5.48 | 0.6014 | -0.0764 | |||

| CSX / CSX Corporation | 0.06 | -5.63 | 1.91 | 4.60 | 0.5993 | -0.0109 | |||

| ESS / Essex Property Trust, Inc. | 0.01 | 18.10 | 1.80 | 9.20 | 0.5663 | 0.0137 | |||

| EVRG / Evergy, Inc. | 0.03 | 38.32 | 1.75 | 38.34 | 0.5493 | 0.1261 | |||

| FHZN / Flughafen Zürich AG | 0.01 | 0.00 | 1.74 | 20.24 | 0.5445 | 0.0619 | |||

| GAPB / Grupo Aeroportuario del Pacifico SAB de CV | 0.07 | 0.00 | 1.70 | 23.93 | 0.5351 | 0.0751 | |||

| CP / Canadian Pacific Kansas City Limited | 0.02 | 10.94 | 1.69 | 25.61 | 0.5311 | 0.0806 | |||

| IRM / Iron Mountain Incorporated | 0.02 | 16.01 | 1.63 | 38.34 | 0.5120 | 0.1176 | |||

| D / Dominion Energy, Inc. | 0.03 | 0.00 | 1.61 | 0.81 | 0.5067 | -0.0288 | |||

| PSA / Public Storage | 0.01 | -10.23 | 1.52 | -11.99 | 0.4769 | -0.1003 | |||

| ES / Eversource Energy | 0.02 | 0.00 | 1.45 | 2.40 | 0.4563 | -0.0183 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.02 | -2.63 | 1.42 | -0.42 | 0.4442 | -0.0309 | |||

| SVT1 / Severn Trent PLC | 0.04 | 29.78 | 1.35 | 48.73 | 0.4244 | 0.1202 | |||

| NEE / NextEra Energy, Inc. | 0.02 | -18.21 | 1.30 | -19.96 | 0.4067 | -0.1343 | |||

| UDR / UDR, Inc. | 0.03 | 5.59 | 1.27 | -4.59 | 0.3985 | -0.0463 | |||

| HST / Host Hotels & Resorts, Inc. | 0.08 | 51.05 | 1.25 | 63.39 | 0.3908 | 0.1358 | |||

| ALX / Atlas Arteria Limited - Debt/Equity Composite Units | 0.36 | 0.00 | 1.19 | 9.96 | 0.3743 | 0.0116 | |||

| RWE / RWE Aktiengesellschaft | 0.03 | 7.56 | 1.14 | 25.36 | 0.3571 | 0.0538 | |||

| MOTV3 / Motiva Infraestrutura de Mobilidade S.A. | 0.44 | 1.13 | 0.3541 | 0.3541 | |||||

| KIM / Kimco Realty Corporation | 0.05 | 36.16 | 1.13 | 34.73 | 0.3533 | 0.0740 | |||

| HR / Healthcare Realty Trust Incorporated | 0.07 | 29.85 | 1.05 | 21.81 | 0.3297 | 0.0415 | |||

| O / Realty Income Corporation | 0.02 | 31.62 | 1.03 | 30.67 | 0.3238 | 0.0599 | |||

| DG / Vinci SA | 0.01 | -18.25 | 1.03 | -4.38 | 0.3225 | -0.0367 | |||

| PINFRA / Promotora y Operadora de Infraestructura, S. A. B. de C. V. | 0.09 | 0.00 | 1.01 | 11.84 | 0.3176 | 0.0152 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | 625.19 | 0.96 | 794.39 | 0.3005 | 0.2647 | |||

| ADC / Agree Realty Corporation | 0.01 | 83.91 | 0.90 | 74.18 | 0.2839 | 0.1101 | |||

| HIW / Highwoods Properties, Inc. | 0.03 | 5.86 | 0.89 | 11.03 | 0.2784 | 0.0113 | |||

| TRGP / Targa Resources Corp. | 0.01 | -7.81 | 0.88 | -19.98 | 0.2767 | -0.0915 | |||

| PCG / PG&E Corporation | 0.06 | -7.56 | 0.88 | -24.96 | 0.2756 | -0.1158 | |||

| HER / Hera S.p.A. | 0.18 | 11.86 | 0.88 | 24.75 | 0.2754 | 0.0401 | |||

| 0JA / Japan Airport Terminal Co., Ltd. | 0.03 | 30.00 | 0.87 | 50.52 | 0.2733 | 0.0797 | |||

| AMH / American Homes 4 Rent | 0.02 | 9.87 | 0.83 | 4.80 | 0.2606 | -0.0043 | |||

| VICI / VICI Properties Inc. | 0.02 | -33.59 | 0.81 | -33.63 | 0.2533 | -0.1532 | |||

| 788 / China Tower Corp Ltd | 0.51 | 10.46 | 0.73 | 17.12 | 0.2301 | 0.0210 | |||

| 2688 / ENN Energy Holdings Limited | 0.09 | -29.70 | 0.72 | -31.61 | 0.2250 | -0.1253 | |||

| 9021 N / West Japan Railway Company | 0.03 | -51.17 | 0.67 | -42.88 | 0.2093 | -0.1808 | |||

| INW / Infrastrutture Wireless Italiane S.p.A. | 0.05 | 0.00 | 0.64 | 15.47 | 0.2016 | 0.0156 | |||

| CZR / Caesars Entertainment, Inc. | 0.02 | 9.43 | 0.63 | 24.26 | 0.1980 | 0.0283 | |||

| UGI / UGI Corporation | 0.02 | -33.16 | 0.63 | -26.43 | 0.1977 | -0.0884 | |||

| BYD / Boyd Gaming Corporation | 0.01 | -3.53 | 0.60 | 14.64 | 0.1870 | 0.0132 | |||

| 694 / Beijing Capital International Airport Company Limited | 1.57 | 12.27 | 0.60 | 17.36 | 0.1868 | 0.0172 | |||

| KRG / Kite Realty Group Trust | 0.02 | 0.56 | 0.1768 | 0.1768 | |||||

| BXP / Boston Properties, Inc. | 0.01 | 0.53 | 0.1653 | 0.1653 | |||||

| DTM / DT Midstream, Inc. | 0.00 | 0.00 | 0.53 | 13.85 | 0.1652 | 0.0107 | |||

| COLD / Americold Realty Trust, Inc. | 0.03 | 20.01 | 0.51 | -6.95 | 0.1598 | -0.0232 | |||

| KRC / Kilroy Realty Corporation | 0.01 | 89.27 | 0.51 | 98.82 | 0.1592 | 0.0736 | |||

| LAMR / Lamar Advertising Company | 0.00 | -39.31 | 0.41 | -35.30 | 0.1273 | -0.0822 | |||

| OHI / Omega Healthcare Investors, Inc. | 0.01 | -71.11 | 0.38 | -72.24 | 0.1201 | -0.3401 | |||

| CTRE / CareTrust REIT, Inc. | 0.01 | 0.37 | 0.1170 | 0.1170 | |||||

| Hudson Pacific Properties, Inc. / EC (N/A) | 0.10 | 0.27 | 0.0856 | 0.0856 | |||||

| AES / The AES Corporation | 0.02 | 11.28 | 0.25 | -5.70 | 0.0780 | -0.0102 | |||

| LINE / Lineage, Inc. | 0.00 | 37.82 | 0.21 | 2.49 | 0.0647 | -0.0027 | |||

| HPP / Hudson Pacific Properties, Inc. | 0.06 | 0.16 | 0.0489 | 0.0489 | |||||

| PACS / PACS Group, Inc. | 0.01 | 31.91 | 0.13 | 51.72 | 0.0414 | 0.0123 |