Statistik Asas

| Nilai Portfolio | $ 59,057,922 |

| Kedudukan Semasa | 75 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

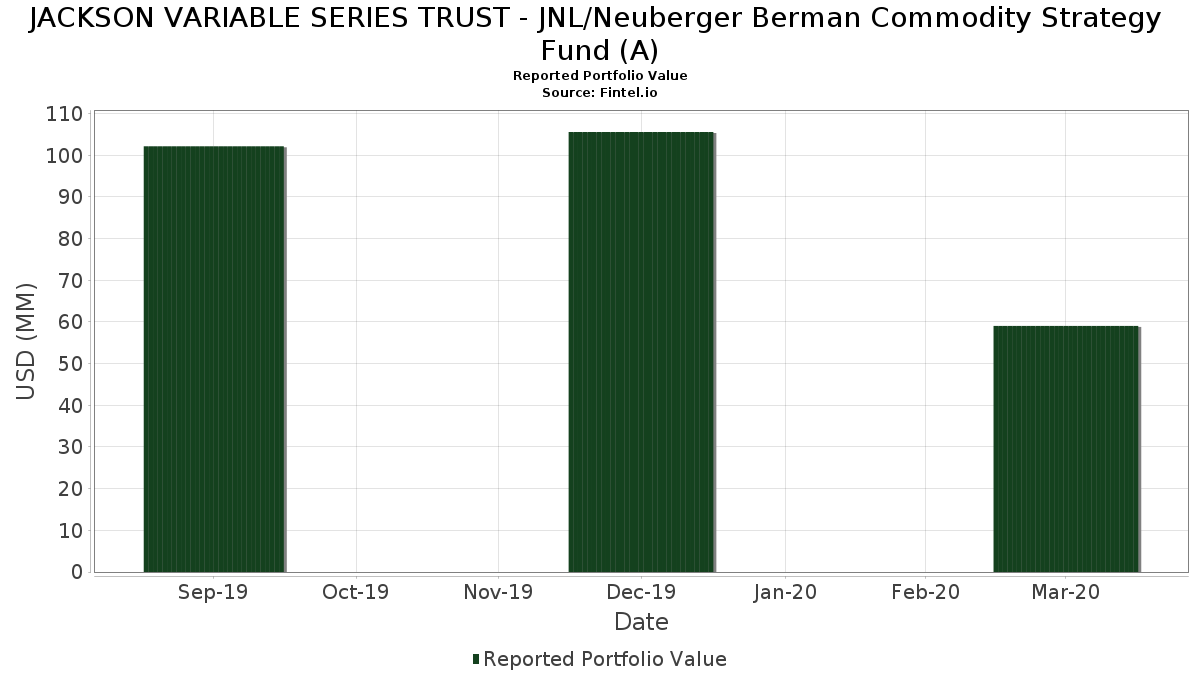

JACKSON VARIABLE SERIES TRUST - JNL/Neuberger Berman Commodity Strategy Fund (A) telah mendedahkan 75 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 59,057,922 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas JACKSON VARIABLE SERIES TRUST - JNL/Neuberger Berman Commodity Strategy Fund (A) ialah JNL Government Money Market Fund (US:46628D437) , JNL Government Money Market Fund (US:46628D437) , Morgan Stanley (US:US6174468K89) , AT&T Inc (US:US00206RDV15) , and Verizon Communications Inc (US:US92343VDX91) . Kedudukan baharu JACKSON VARIABLE SERIES TRUST - JNL/Neuberger Berman Commodity Strategy Fund (A) termasuk Morgan Stanley (US:US6174468K89) , AT&T Inc (US:US00206RDV15) , Verizon Communications Inc (US:US92343VDX91) , Cvs Health Corp (variable) Bond (US:US126650DD99) , and HSBC Holdings PLC (GB:US404280BQ12) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 18.32 | 18.32 | 24.2705 | 14.4238 | |

| 2.46 | 3.2620 | 3.2620 | ||

| 1.34 | 1.7769 | 1.7769 | ||

| 1.15 | 1.5175 | 1.5175 | ||

| 0.92 | 1.2197 | 1.2197 | ||

| 0.85 | 1.1280 | 1.1280 | ||

| 2.38 | 3.1481 | 0.8972 | ||

| 2.07 | 2.7380 | 0.7812 | ||

| 2.27 | 3.0027 | 0.7702 | ||

| 1.86 | 2.4593 | 0.7193 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| -1.48 | -1.9661 | -1.9661 | ||

| -1.18 | -1.5571 | -1.5571 | ||

| -0.89 | -1.1747 | -1.1747 | ||

| -0.87 | -1.1531 | -1.1531 | ||

| -0.78 | -1.0359 | -1.0359 | ||

| 0.38 | 0.5092 | -1.0221 | ||

| 0.34 | 0.4551 | -0.9888 | ||

| -0.65 | -0.8636 | -0.8636 | ||

| -0.60 | -0.7932 | -0.7932 | ||

| -0.56 | -0.7472 | -0.7472 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2020-05-28 untuk tempoh pelaporan 2020-03-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 46628D437 / JNL Government Money Market Fund | 18.32 | 146.48 | 18.32 | 146.47 | 24.2705 | 14.4238 | |||

| 46628D437 / JNL Government Money Market Fund | 7.43 | -31.42 | 7.43 | -31.41 | 9.8467 | -0.0783 | |||

| US6174468K89 / Morgan Stanley | 2.46 | 3.2620 | 3.2620 | ||||||

| US00206RDV15 / AT&T Inc | 2.38 | -3.30 | 3.1481 | 0.8972 | |||||

| US92343VDX91 / Verizon Communications Inc | 2.27 | -7.02 | 3.0027 | 0.7702 | |||||

| US126650DD99 / Cvs Health Corp (variable) Bond | 2.07 | -3.28 | 2.7380 | 0.7812 | |||||

| US404280BQ12 / HSBC Holdings PLC | 1.86 | -2.26 | 2.4593 | 0.7193 | |||||

| US07274NAC74 / Bayer US Finance II LLC | 1.82 | -6.18 | 2.4129 | 0.6348 | |||||

| US38141GWU48 / Goldman Sachs Group (variable) Bond | 1.82 | -31.36 | 2.4128 | -0.0173 | |||||

| US00287YBN85 / AbbVie Inc | 1.76 | -6.89 | 2.3292 | 0.5997 | |||||

| US55336VBG41 / MPLX LP | 1.63 | -4.29 | 2.1607 | 0.6005 | |||||

| US341081FW23 / Florida Power & Light Co | 1.49 | -1.52 | 1.9767 | 0.5893 | |||||

| US14042RFJ59 / Capital One NA | 1.36 | 10.67 | 1.8012 | 0.6760 | |||||

| US41284VAA08 / Harley-Davidson Financial Services, Inc. | 1.35 | 0.00 | 1.7898 | 0.5525 | |||||

| US55660CAG33 / Madison Avenue Trust 2013-650M | 1.34 | 1.7769 | 1.7769 | ||||||

| US64952WDJ99 / New York Life Global Funding | 1.30 | -4.05 | 1.7273 | 0.4828 | |||||

| US38013TAC53 / GM Financial Automobile Leasing Trust 2019-3 | 1.26 | -6.52 | 1.6717 | 0.4353 | |||||

| US80283LAU70 / Santander UK PLC | 1.19 | -0.34 | 1.5705 | 0.4813 | |||||

| US89114QCF37 / Toronto-Dominion Bank/The | 1.15 | 1.5175 | 1.5175 | ||||||

| US571748BK77 / Marsh & McLennan Cos., Inc. | 1.06 | -0.09 | 1.4036 | 0.4319 | |||||

| US92347YAB02 / Verizon Owner Trust 2019-A | 0.98 | -1.70 | 1.3025 | 0.3863 | |||||

| US233851DV31 / Daimler Finance North America LLC | 0.96 | 3.45 | 1.2706 | 0.4215 | |||||

| US125523AB67 / Cigna Corp | 0.95 | -36.14 | 1.2642 | -0.1041 | |||||

| US94988J5M53 / Wells Fargo Bank NA | 0.92 | 1.2197 | 1.2197 | ||||||

| US58989VAA26 / VAR.RT. CORP. BONDS | 0.85 | 1.1280 | 1.1280 | ||||||

| US110122CF35 / Bristol-Myers Squibb Co | 0.81 | -2.54 | 1.0666 | 0.3094 | |||||

| US64034WAA36 / Navient Student Loan Trust 2019-7 | 0.73 | -8.26 | 0.9720 | 0.2393 | |||||

| US34528DAC74 / Ford Credit Auto Lease Trust 2019-B | 0.72 | -3.74 | 0.9553 | 0.2684 | |||||

| US14040HBM60 / Capital One Financial Corp Variable Rate 03/09/2022 Bond | 0.67 | -27.91 | 0.8941 | 0.0375 | |||||

| US68902VAC19 / Otis Worldwide Corp | 0.51 | 0.6761 | 0.6761 | ||||||

| US98162YAB92 / WORLD OMNI AUTO RECEIVABLES TRUST 2019-A WOART 2019-A A2 | 0.46 | -31.86 | 0.6159 | -0.0081 | |||||

| US89231AAB70 / Toyota Auto Receivables Owner Trust, Series 2018-C, Class A2A | 0.43 | -38.23 | 0.5749 | -0.0679 | |||||

| US05565EAV74 / BMW US Capital LLC | 0.41 | 0.5484 | 0.5484 | ||||||

| US961214EK56 / Westpac Banking Corp | 0.39 | 0.5138 | 0.5138 | ||||||

| US90331HPG29 / US Bank NA/Cincinnati OH | 0.38 | -77.02 | 0.5092 | -1.0221 | |||||

| US05565QDE52 / BPLN F 09/16/21 | 0.37 | -3.69 | 0.4842 | 0.1371 | |||||

| US20030NCW92 / Comcast Corp. | 0.34 | -78.24 | 0.4551 | -0.9888 | |||||

| US36257AAC53 / GM Financial Automobile Leasing Trust 2019-2 | 0.33 | -29.22 | 0.4338 | 0.0104 | |||||

| US90290EAB56 / USAA AUTO OWNER TRUST 2019-1 USAOT 2019-1 A2 | 0.33 | -18.25 | 0.4333 | 0.0663 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | 0.32 | 9.59 | 0.4242 | 0.4242 | |||||

| US92348AAB17 / VERIZON OWNER TRUST 2019-C SER 2019-C CL A1B V/R REGD 2.14363000 | 0.29 | 0.3896 | 0.3896 | ||||||

| US31680YAC12 / Fifth Third Auto Trust 2019-1 | 0.29 | -29.95 | 0.3854 | 0.0061 | |||||

| US34533FAB76 / Ford Credit Auto Owner Trust, Series 2019-A, Class A2A | 0.27 | -29.14 | 0.3519 | 0.0093 | |||||

| US14913Q2P38 / Caterpillar Financial Services Corp | 0.22 | -71.54 | 0.2950 | -0.4195 | |||||

| US00138CAE84 / AIG Global Funding | 0.18 | -0.54 | 0.2444 | 0.0747 | |||||

| US34531EAD85 / Ford Credit Auto Owner Trust, Series 2017-A, Class A3 | 0.15 | -60.53 | 0.1997 | -0.1489 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | 0.15 | -49.32 | 0.1962 | 0.1962 | |||||

| US92348NAA54 / Verizon Owner Trust, Series 2017-1A, Class A | 0.14 | -70.13 | 0.1872 | -0.2459 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | 0.09 | -68.15 | 0.1233 | 0.1233 | |||||

| US00206RFY36 / AT&T Inc | 0.07 | -4.29 | 0.0898 | 0.0253 | |||||

| FUTURE - CASH SETTLED / DCO (N/A) | -0.03 | -109.25 | -0.0359 | -0.0359 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.03 | -109.93 | -0.0388 | -0.0388 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.03 | -111.30 | -0.0444 | -0.0444 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.04 | -111.99 | -0.0472 | -0.0472 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.04 | -113.70 | -0.0536 | -0.0536 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.04 | -114.38 | -0.0567 | -0.0567 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.08 | -126.03 | -0.1018 | -0.1018 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.08 | -128.77 | -0.1126 | -0.1126 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.14 | -146.92 | -0.1816 | -0.1816 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.19 | -164.73 | -0.2512 | -0.2512 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.19 | -166.44 | -0.2581 | -0.2581 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.30 | -202.05 | -0.3956 | -0.3956 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.32 | -209.59 | -0.4253 | -0.4253 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.32 | -210.27 | -0.4276 | -0.4276 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.33 | -214.38 | -0.4425 | -0.4425 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.38 | -229.45 | -0.5014 | -0.5014 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.43 | -247.60 | -0.5723 | -0.5723 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.56 | -292.81 | -0.7472 | -0.7472 | |||||

| FUTURE - CASH SETTLED / DCO (N/A) | -0.60 | -304.79 | -0.7932 | -0.7932 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.65 | -322.95 | -0.8636 | -0.8636 | |||||

| FUTURE - CASH SETTLED / DCO (N/A) | -0.78 | -367.47 | -1.0359 | -1.0359 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.87 | -397.95 | -1.1531 | -1.1531 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0.89 | -403.42 | -1.1747 | -1.1747 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -1.18 | -502.40 | -1.5571 | -1.5571 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -1.48 | -607.88 | -1.9661 | -1.9661 |